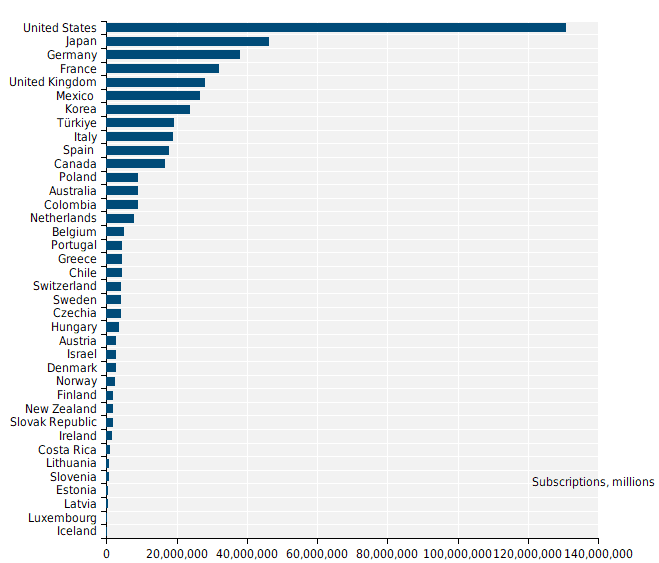

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

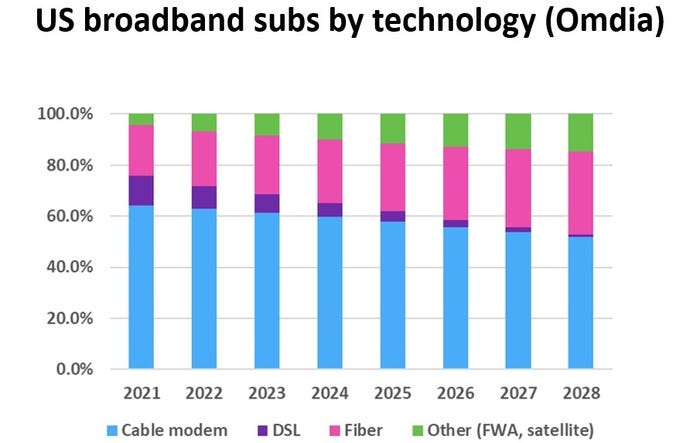

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

Nokia’s launches symmetrical 25G PON modem

Nokia today announced the launch of a new symmetrical 25G PON [1.] fiber modem. Helping to further accelerate 25G PON deployments, the compact solution can easily be installed on a wall, inside a building, or in an outdoor enclosure to immediately deliver internet speeds that are 20x faster than current gigabit solutions. Once deployed, operators can leverage their existing fiber network to offer new premium residential, business, or anyhaul services that unlock additional revenue streams.

Note 1. 25G PON, also known as 25GS PON, is a next-generation PON that offers a number of benefits. It can provide 10Gb/s services or higher, premium enterprise services, and 5G transport.

Demand for high-speed broadband access is accelerating with end-users increasingly seeking quality multi-gigabit services to power their homes and businesses. From the Metaverse and cloud gaming to cyber security, and Industry 4.0 applications, users want multi-gigabit services that can meet their evolving broadband needs.

Nokia’s new 25G PON fiber modem allows operators to establish a future-ready network that can immediately address the growing demand for more capacity and enhanced broadband services. The new 25G PON solution enables operators to quickly upgrade their existing GPON or XGS PON network to deliver true 10Gbs speeds and beyond with unprecedented ease. For enterprises, this can help significantly improve business productivity and enhance connectivity to the cloud or value-added applications located in data centers. For consumers and power users, the solution provides immediate access to additional capacity needed to support bandwidth-hungry applications such as AI, gaming, or security.

25G PON Wavelength Plan:

Image Credit: Nokia

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Geert Heyninck, General Manager of Broadband Networks at Nokia, said: “The 25G PON eco-system is growing and with it, the technology that continues to bring concrete business benefits to customers. The market for 25G PON is here and with the new fiber modem, we have a very efficient 25G solution that can support all types of services and applications in the fiber-for-everything era. 25G PON continues to be the easiest, most cost-effective and power-efficient way for services providers to upgrade and maximize the use of their existing fiber network to deliver ultra-fast broadband access.”

Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group, said: “25G PON deployments and the 25GS-PON MSA (Multi-Source Agreement) Group has grown substantially over the past year. One of the driving factors for the growing interest in 25GS-PON is its ability to coexist with GPON and XGS-PON without having to deploy additional feeder fiber, splitters, or other ODN elements. This past year we’ve seen large operators like Google indicate plans to make 25G PON service available to its customers while the MSA continues to expand, encompassing a diverse range of service providers, equipment vendors, and component suppliers.”

The new 25G PON fiber modem complements Nokia’s growing 25G PON portfolio, which includes the Lightspan FX, DF and MF fiber access platforms (OLTs) and the industry’s first 25G PON sealed fiber access node designed for cable operators.

25G PON ONT product details:

- Coexistence with GPON, XGS-PON and 50G PON on the same ODN

- Hardened and compact design for various deployment practices and environments

- Symmetrical 25 Gb/s throughput using pluggable optics

- Frequency and time-of-day synchronization functions for mobile transport

- Can be used to connect cell sites to transport mobile traffic over PON network in plug-and-play mode, delivering the required capacity, latency and synchronization required for 5G networks.

- Supports demarcation point functions for enterprise and wholesale services.

- Nokia has shipped more than one million 25G PON ready ports to date.

- 25G PON is ready to be activated in more than 150 networks worldwide.

- The eco-system for 25G PON is mature with more than 60 operators, system vendors, chipset and optical suppliers part of a MSA focused on standardizing and accelerating the technology.

- Some of the operators currently deploying 25G PON include Google Fiber, EPB, Vodafone Qatar and OGI.

- There are more than 30 operators trialing 25G PON for residential, mobile fronthaul and business connectivity applications.

References and additional information:

Nokia 25G ONT

Lightspan FX

Lightspan SF-8M sealed fiber access node

Lightspan MF fiber platform

25G PON

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Passive Optical Network (PON) technologies moving to 10G and 25G

Nokia and Proximus (Belgium) demonstrate 1st implementation of 25GS-PON

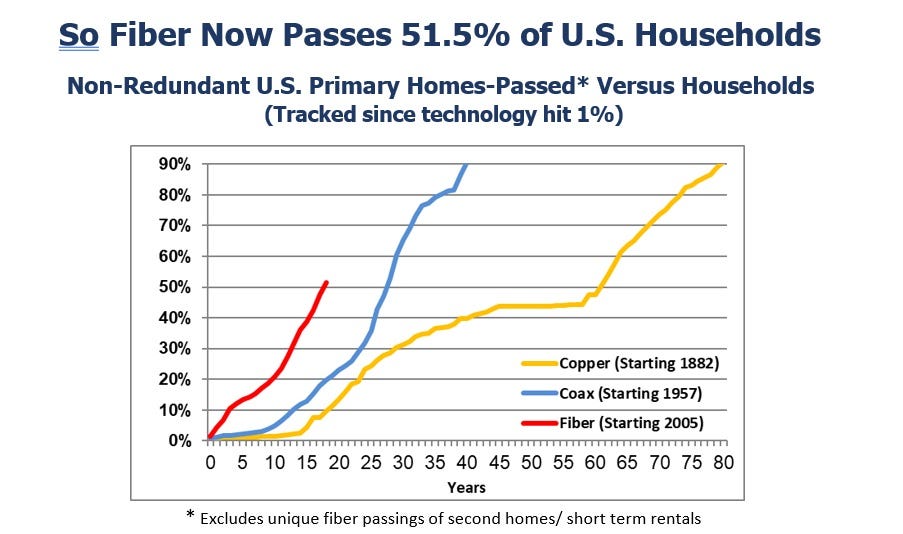

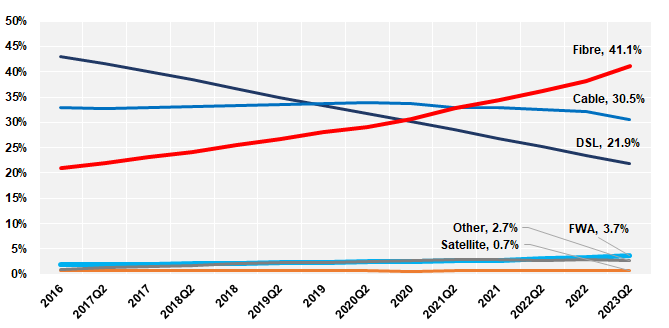

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

The latest OECD statistics show that Fiber and Fixed Wireless Access (FWA) have seen the strongest growth in fixed broadband technologies in three years. Fibre subscriptions have increased by 56% between June 2020 to June 2023, and FWA subscriptions have increased by 64%. The United States (252%), Estonia (153%), Norway (139%) and Spain (118%) led this FWA growth. The dynamism of fiber and FWA stands in stark contrasts to the decline in DSL (-24%).

Nine OECD countries have more than 70% of fibre connections over total broadband, with Korea, Japan, Iceland, Spain leading the way with the highest fibre penetration rates of 89%, 86%, 85% , and 84%, respectively. The highest fibre growth rates are in Europe, with Austria and Belgium having growth rates of 75% and 73% over the last year, closely followed by Mexico with a growth in fibre of 68%. Two other Latin American countries are in the top 7: Costa Rica and Colombia with fibre growth rates of 42% and 34%, respectively.

Mobile data usage per subscription grew substantially by 28% in one year passing from 10.2 GB to 13 GB per subscription per month in OECD countries as of June 2023. The amount of data consumed in countries vary greatly from 6 GB to 46 GB, with Latvia being the OECD leader.

Despite an already very high mobile broadband penetration in the OECD area, overall mobile subscriptions continue to grow by 4.6% over the last year, which totalled 1.8 billion as of June 2023, up from 1.74 billion a year earlier. Mobile broadband penetration is highest in Japan, Estonia, the United States and Finland, with subscriptions per 100 inhabitants at 200%, 192%, 183% and 161%, respectively.

Eighteen countries were able to provide the number of their 5G subscriptions separately from mobile broadband subscriptions. The share of 5G in total mobile broadband subscriptions is 23% on average for the OECD countries that provided this data.

Machine-to-machine (M2M) SIM cards grew 14% increase in one year. The two leading countries are Sweden with 238 M2M SIM cards per 100 inhabitants and Iceland (203), followed by Austria (179), the Netherlands (93) and Norway (76). Both Sweden and Iceland issue M2M SIM cards for international use.

Total number of fixed broadband subscriptions, by country, millions, June 2023:

……………………………………………………………………………………………………………………….

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Backgrounder:

Artificial intelligence (AI) continues both to astound and confound. AI finds patterns in data and then uses a technique called “reinforcement learning from human feedback.” Humans help train and fine-tune large language models (LLMs). Some humans, like “ethics & compliance” folks, have a heavier hand than others in tuning models to their liking.

Generative Artificial Intelligence (generative AI) is a type of AI that can create new content and ideas, including conversations, stories, images, videos, and music. AI technologies attempt to mimic human intelligence in nontraditional computing tasks like image recognition, natural language processing (NLP), and translation. Generative AI is the next step in artificial intelligence. You can train it to learn human language, programming languages, art, chemistry, biology, or any complex subject matter. It reuses training data to solve new problems. For example, it can learn English vocabulary and create a poem from the words it processes. Your organization can use generative AI for various purposes, like chatbots, media creation, and product development and design.

Review of Leading AI Company Products and Services:

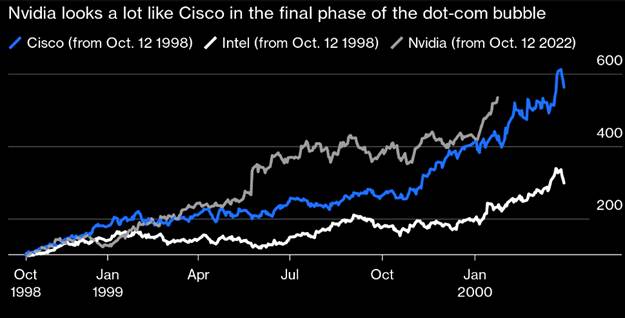

1. AI poster child Nvidia’s (NVDA) market cap is about $2.3 trillion, due mainly to momentum-obsessed investors who have driven up the stock price. Nvidia currently enjoys 75% gross profit margins and has an estimated 80% share of the Graphic Processing Unit (GPU) chip market. Microsoft and Facebook are reportedly Nvidia‘s biggest customers, buying its GPUs last year in a frenzy.

Nvidia CEO Jensen Huang talks of computing going from retrieval to generative, which investors believe will require a long-run overhaul of data centers to handle AI. All true, but a similar premise about an overhaul also was true for Cisco in 1999.

During the dot-com explosion in the late 1990s, investors believed a long-run rebuild of telecom infrastructure was imminent. Worldcom executives claimed that internet traffic doubled every 100 days, or about 3.5 months. The thinking at that time was that the whole internet would run on Cisco routers at 50% gross margins.

Cisco’s valuation at its peak of the “Dot.com” mania was at 33x sales. CSCO investors lost 85% of their money when the stock price troughed in October 2002. Over the next 16 years, as investors waited to break even, the company grew revenues by 172% and earnings per share by a staggering 681%. Over the last 24 years, CSCO buy and hold investors earned only 0.67% per year!

2. Microsoft is now a cloud computing/data-center company, more utility than innovator. Microsoft invested $13 billion in OpenAI for just under 50% of the company to help develop and roll out ChatGPT. But much of that was funny money — investment not in cash but in credits for Microsoft‘s Azure data centers. Microsoft leveraged those investments into super powering its own search engine, Bing, with generative AI which is now called “Copilot.” Microsoft spends a tremendous amount of money on Nvidia H100 processors to speed up its AI calculations. It also has designed its own AI chips.

3. Amazon masquerades as an online retailer, but is actually the world’s largest cloud computing/data-center company. The company offers several generative AI products and services which include:

- Amazon CodeWhisperer, an AI-powered coding companion.

- Amazon Bedrock, a fully managed service that makes foundational models (FMs) from AI21 Labs, Anthropic, and Stability AI, along with Amazon’s own family of FMs, Amazon Titan, accessible via an API.

- A generative AI tool for sellers to help them generate copy for product titles and listings.

- Generative AI capabilities that simplify how Amazon sellers create more thorough and captivating product descriptions, titles, and listing details.

Amazon CEO Jassy recently said the the company’s generative AI services have the potential to generate tens of billions of dollars over the next few years. CFO Brian Olsavsky told analysts that interest in Amazon Web Services’ (AWS) generative AI products, such as Amazon Q and AI chatbot for businesses, had accelerated during the quarter. In September 2023, Amazon said it plans to invest up to $4 billion in startup chatbot-maker Anthropic to take on its AI based cloud rivals (i.e. Microsoft and Google). Its security teams are currently using generative AI to increase productivity

4. Google, with 190,000 employees, controls 90% of search. Google‘s recent launch of its new Gemini AI tools was a disaster, producing images of the U.S. Founding Fathers and Nazi soldiers as people of color. When asked if Elon Musk or Adolf Hitler had a more negative effect on society, Gemini responded that it was “difficult to say.” Google pulled the product over “inaccuracies.” Yet Google is still promoting its AI product: “Gemini, a multimodal model from Google DeepMind, is capable of understanding virtually any input, combining different types of information, and generating almost any output.”

5. Facebook/Meta controls social media but has lost $42 billion investing in the still-nascent metaverse. Meta is rolling out three AI features for advertisers: background generation, image cropping and copy variation. Meta also unveiled a generative AI system called Make-A-Scene that allows artists to create scenes from text prompts . Meta’s CTO Andrew Bosworth said the company aims to use generative AI to help companies reach different audiences with tailored ads.

Conclusions:

Voracious demand has outpaced production and spurred competitors to develop rival chips. The ability to secure GPUs governs how quickly companies can develop new artificial-intelligence systems. Tech CEOs are under pressure to invest in AI, or risk investors thinking their company is falling behind the competition.

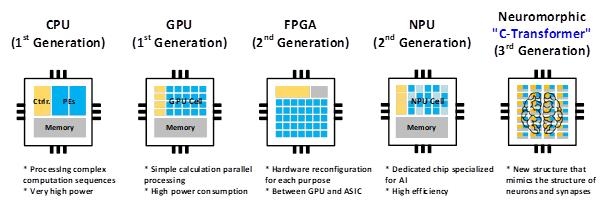

As we noted in a recent IEEE Techblog post, researchers in South Korea have developed the world’s first AI semiconductor chip that operates at ultra-high speeds with minimal power consumption for processing large language models (LLMs), based on principles that mimic the structure and function of the human brain. The research team was from the Korea Advanced Institute of Science and Technology.

While it’s impossible to predict how fast additional fabricating capacity comes on line, there certainly will be many more AI chips from cloud giants and merchant semiconductor companies like AMD and Intel. Fat profit margins Nvidia is now enjoying will surely attract many competitors.

………………………………………………………………………………….,……………………………………….

References:

https://www.zdnet.com/article/how-to-use-the-new-bing-and-how-its-different-from-chatgpt/

https://cloud.google.com/ai/generative-ai

https://aws.amazon.com/what-is/generative-ai/

https://www.wsj.com/articles/amazon-is-going-super-aggressive-on-generative-ai-7681587f

Curmudgeon: 2024 AI Fueled Stock Market Bubble vs 1999 Internet Mania? (03/11)

Korea’s KAIST develops next-gen ultra-low power Gen AI LLM accelerator

Telco and IT vendors pursue AI integrated cloud native solutions, while Nokia sells point products

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Amdocs and NVIDIA to Accelerate Adoption of Generative AI for $1.7 Trillion Telecom Industry

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Global Telco AI Alliance to progress generative AI for telcos

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Impact of Generative AI on Jobs and Workers

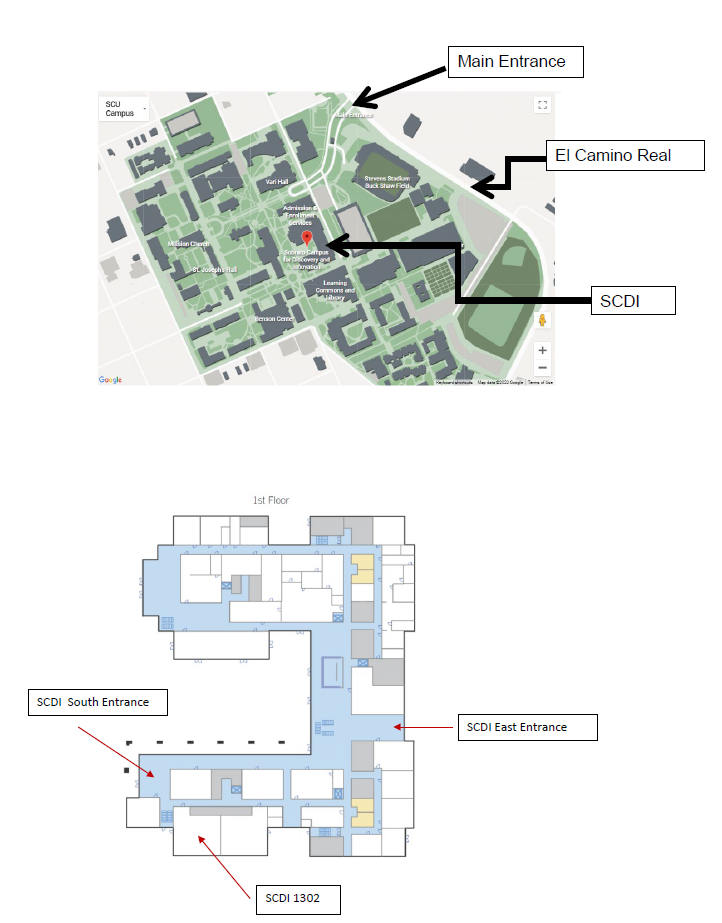

IEEE SCV March 28th Event: A Conversation with IEEE President and IEEE Region 6 Director Elect

A Conversation with IEEE President and IEEE Region 6 Director Elect

Time/Date: 5pm-7:30pm March 28, 2024

Venue: Santa Clara University Room SCDI 1302 & 1308 (see map for room location)

Register at: https://events.vtools.ieee.org/m/410534

Abstract:

Please join us for a lively and enlightening conversation with IEEE President Tom Coughlin and IEEE Region 6 Director Elect Joseph Wei, moderated by Alan J Weissberger. We will discuss and debate how to make IEEE more relevant to its members, explore volunteer opportunities, ways to elevate the awareness and perception of IEEE as the world’s largest tech non-profit organization.

In the past decade, IEEE membership has significantly declined, there are fewer volunteers, and many IEEE initiatives (e.g. 5G, cloud computing, IoT and smart grid) have fizzled. IEEE Conferences and Journals are now dominated by academia and for the most part are not of interest to industry as the content is not realizable and has little or no practical value. Many engineers, sales and marketing people think that IEEE is irrelevant and won’t help them advance their careers. Clearly, IEEE has been in a severe decline for several years.

How can we turn that around? Can IEEE provide better tools and support for the active volunteers and to grow its professional membership while encouraging student members to upgrade to full membership? How can we retain, encourage and train younger members to volunteer for officer positions and provide fresh leadership? Can we find a more equitable balance between industry and academia for IEEE conferences, publications, and local chapters? What are the important, high priority tech initiatives that IEEE should focus on to ensure success? Finally, can we orchestrate a leadership transition to ensure high priority projects are progressed?

Timeline:

5pm-5:30pm: Registration and Networking

5:30pm-7pm: Opening statements by each participant followed by a conversation/debate about IEEE key issues and initiatives.

7pm-7:25pm: Audience Q & A

7:25pm-7:30pm: Closing remarks and thanks from the participants

……………………………………………………………………………………………………………….

Addendum:

Hope everyone was satisfied with yesterday’s stimulating panel discussion and conversation at SCU. The 3 of us went back & forth discussing critical issues and needed improvements for IEEE to regain credibility & respect. Nothing was rehearsed.

We followed the mutually agreed list of discussion topics (see Comment below) and mixed them up a bit to ensure continuity of various themes.

- Thanks to Behnam, his students, Ed and Joseph for buying the refreshments.

- Thanks to Shoba for securing the SCU room for us.

- Thanks to Kim and Glenn for their cogent comments & remarks

- And many thanks to our two outstanding panelists- Tom and Joseph!!

March 28th video recording of our conversation:

References:

https://techblog.comsoc.org/2024/02/05/ieee-presidents-priorities-and-strategic-direction-for-2024/

https://events.vtools.ieee.org/m/410534

IEEE President Elect: IEEE Overview, 2024 Priorities and Strategic Plan

Téral Research: global wireless infrastructure market sank 9% YoY in 2023; will decline 6% in 2024

|

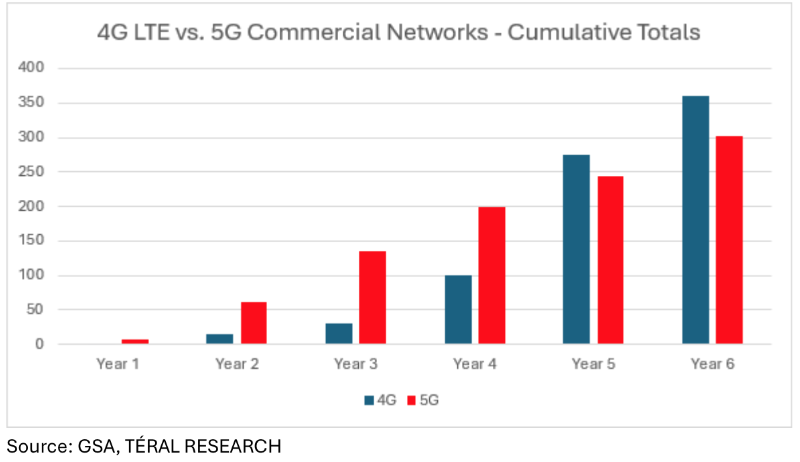

As expected, the global wireless infrastructure market comprised of all RAN and core networks sank 9% YoY despite a strong China-driven 4Q23 that was not enough to offset 3 consecutive quarters of sales declines. 2023 will be remembered by the U.S. market posting its steepest drop in history, the strong 5G rollouts in China which is way ahead of its government-set target, and India’s fast 5G rollout led by Bharti Airtel and Reliance Jio. Meanwhile, 5G core—mostly fueled by China again, and 5G RAN showed some steam in 4Q23. In this environment, for 2023, Huawei kept its lead over Ericsson in global market share, followed by Nokia and ZTE, both managed to increase their market share. Samsung remained #5 but lost shares. We are now entering the third year of this disinvestment cycle. The 5G investment cycle that started in 2019 and ended in 2021 was driven by hundreds of communications service providers (CSPs), including the ones with the world’s largest cellular footprints (i.e., China), and led to a total of 302 commercial 5G networks launched as of December 31, 2023. But the pace is quickly slowing down: by comparison, 2023 was Year 6 for 5G rollouts, at that stage, 360 4G LTE networks were live. |

|

|

At this point, the global Wireless Infrastructure market will be characterized by much smaller footprints that have yet to be upgraded to 5G as well as 5G-Advanced upgrades for the early 5G adopters, and an open RAN ramp up driven by Tier 1 CSPs. In addition, the slow 5G monetization, the normalization after the 5G surge in China and India and the rise of the secondhand equipment market are chief inhibitors that contribute to the declining pattern. Nonetheless, there is no new wave in the horizon and as a result, this year, we expect the market to decline 6% compared to 2023, despite an AT&T-induced pickup expected in 2H24 in the U.S. market. In the long run, our CSP 20-year wireless infrastructure footprint pattern analysis points to a 2023-2029 CAGR of -3% characterized by steady declines through 2026, which appears to be the bottom leading to flatness. In fact, we expect 5G to slightly pick up in 2027, driven by 5G-Advanced and other upgrades needed to prepare networks for 6G. Given the ongoing 6G activity, we believe something labeled 6G will be deployed in 2028. |

References:

Téral Research :: February 2024 Wireless Infrastructure 4Q23 & FY23 (teralresearch.com)

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

LightCounting: Wireless infrastructure market down in 2Q-23 (no surprise)

LightCounting: Wireless infrastructure market dropped both YoY and sequentially in 1Q23

IBM: 5G use cases that are transforming the world (really ?)

For many years, this author has been very skeptical about the commercial success of highly touted 5G use cases. That’s mainly because the 3GPP 5G specs and ITU-R M.2150 5G RIT/SRIT standard did not (and still do not) meet the ITU-R M.2410 minimum performance requirements for the URLLC use case for either ultra high reliability or ultra low latency.

Another reason for our skepticism is that “real 5G,” which provides 3GPP specified 5G features (like network slicing, edge computing/MEC, and 5G Security), requires a 5G SA core network, which relatively few wireless network operators have deployed.

Nonetheless, IBM has published an article citing 5G use cases that are transforming the world. Here they are:

Autonomous vehicles

From taxi cabs to drones and beyond, 5G technology underpins most of the next-generation capabilities in autonomous vehicles. Until the 5G cellular standard came along, fully autonomous vehicles were a bit of a pipe dream due to the data transmission limitations of 3G and 4G technology. Now, 5G’s lightning-fast connection speeds have made transport systems for cars, trains and more much faster than previous generations, transforming the way systems and devices connect, communicate and collaborate.

Smart factories

5G, along with AI and ML, is poised to help factories become not only smarter but more automated, efficient and resilient. Today, many mundane but necessary tasks associated with equipment repair and optimization are being turned over to machines thanks to 5G connectivity paired with AI and ML capabilities. This is one area where 5G is expected to be highly disruptive, impacting everything from fuel economy to the design of equipment lifecycles and how goods arrive at our homes.

For example, on a busy factory floor, drones and cameras connected to smart devices utilizing the IoT can help locate and transport something more efficiently than in the past and prevent theft. Not only is this better for the environment and consumers, but it also frees up employees to dedicate their time and energy to tasks that are more suited to their skill sets.

Smart cities

The idea of a hyper-connected urban environment that uses 5G network speeds to spur innovation in areas like law enforcement, waste disposal and disaster mitigation is fast becoming a reality. Some cities already use 5G-enabled sensors to track traffic patterns in real time and adjust signals, helping guide the flow of traffic, minimize congestion and improve air quality.

In another example, 5G power grids monitor supply and demand across heavily populated areas and deploy AI and ML applications to “learn” what times energy is in high or low demand. This process has been shown to significantly impact energy conservation and waste, potentially reducing carbon emissions and helping cities reach sustainability goals.

Smart healthcare

Hospitals, doctors and the healthcare industry as a whole already benefit from the speed and reliability of 5G networks every day. One example is the area of remote surgery that uses robotics and a high-definition live stream connected to the internet via a 5G network. Another is the field of mobile health, where 5G gives medical workers in the field quick access to patient data and medical history, enabling them to make smarter decisions, faster, and potentially save lives.

Lastly, as we saw during the pandemic, contact tracing and the mapping of outbreaks are critical to keeping populations safe. 5G’s ability to deliver of volumes of data swiftly and securely allows experts to make more informed decisions that have ramifications for everyone.

Better employee experiences

5G paired with new technological capabilities won’t just result in the automation of employee tasks, it will dramatically improve them and the overall employee experience. Take virtual reality (VR) and augmented reality (AR), for example. VR (digital environments that shut out the real world) and AR (digital content that augments the real world) are already used by stockroom employees, transportation drivers and many others. These employees rely on wearables connected to a 5G network capable of high-speed data transfer rates that improve several key capabilities, including the following:

- Live views: 5G connectivity provides live, real-time views of equipment, events and even people. One way in which this feature is being used in professional sports is to allow broadcasters to remotely call a sporting event from outside the stadium where the event is taking place.

- Digital overlays: IoT applications in a warehouse or industrial setting allow workers equipped with smart glasses (or even just a smartphone) to obtain real-time insights from an application, including repair instructions or the name and location of a spare part.

- Drone inspections: Right now, one of the leading causes of employee injury is inspection of equipment or project sites in remote and potentially dangerous areas. Drones, connected via 5G networks, can safely monitor equipment and project sites and even take readings from hard-to-reach gauges.

Edge computing

Edge computing, a computing framework that allows computations to be done closer to data sources, is fast becoming the standard for enterprises. According to this Gartner white paper (link resides outside ibm.com), by 2025, 75% of enterprise data will be processed at the edge (compared to only 10% today). This shift saves businesses time and money and enables better control over large volumes of data. It would be impossible without the new speed standards generated by 5G technology.

Ultra-reliable edge computing and 5G enable the enterprise to achieve faster transmission speeds, increased control and greater security over massive volumes of data. Together, these twin technologies will help reduce latency while increasing speed, reliability and bandwidth, resulting in faster, more comprehensive data analysis and insights for businesses everywhere.

5G solutions with IBM Cloud Satellite

5G presents big opportunities for the enterprise, but first, you need a platform that can handle its speed. IBM Cloud Satellite lets you deploy and run apps consistently across on-premises, edge computing and public cloud environments on a 5G network. And it’s all enabled by secure and auditable communications within the IBM Cloud. The IBM Cloud Satellite-managed distributed cloud solution delivers cloud services, APIs, access policies, security controls and compliance.

References:

https://www.ibm.com/products/satellite

Big 5 Event: wireless connectivity use cases for healthcare, network slicing, security and private networks

Qualcomm Introduces the World’s First “5G NR-Light” Modem-RF System for new 5G use cases and apps

MoffettNathanson: 5G use cases and revenue streams have not yet materialized

CELLSMART: 5G upload speeds are insufficient for industrial/enterprise applications

BofA on 5G Use Cases and Industry Vertical Applications

Korea’s KAIST develops next-gen ultra-low power Gen AI LLM accelerator

Researchers in South Korea have developed the world’s first artificial intelligence (AI) semiconductor chip that operates at ultra-high speeds with minimal power consumption for processing large language models (LLMs), based on principles that mimic the structure and function of the human brain.

The research team was from the Korea Advanced Institute of Science and Technology (KAIST) PIM Semiconductor Research Center and the Graduate School of AI Semiconductor (led by Professor Yu Hoi-jun). This ultra-low power “complementary transformer” semiconductor using Samsung Electronics’ 28 nm process as announced by Korea’s Ministry of Science and ICT on Feb. 6th. The chip is 41 times smaller in area than the Nvidia AI processor, enabling it to be used on devices like mobile phones.

The new AI chip successfully ran GPT 2 using only 1/625 of the power consumption and at 1/41 the size of Nvidia’s A100 graphics processing unit (GPU). This breakthrough is considered a key development in the escalating global AI semiconductor war.

Previously, the technology was less accurate than deep neural networks (DNNs) and mainly capable of simple image classifications, but the research team succeeded in improving the accuracy of the technology to match that of DNNs to apply it to LLMs.

The team said its new AI chip optimizes computational energy consumption while maintaining accuracy by using unique neural network architecture that fuses DNNs and SNNs, and effectively compresses the large parameters of LLMs.

A photo describing an artificial intelligence chip which processes a large language model with neuromorphic computing technology provided by the Ministry of Science and ICT on March 6, 2024.

References:

HGC Global Communications, DE-CIX & Intelsat perspectives on damaged Red Sea internet cables

Earlier this week, four underwater data cables were damaged in the Red Sea. Hong Kong telecom HGC Global Communications said about 25% of internet traffic in Asia, Europe, and the Middle East had to be rerouted.

There are more than 15 undersea internet cables in the Red Sea. To have four damaged at a single time is ”exceptionally rare,” HGC said in a separate earlier statement.

The disruption of the cables did not disconnect any country from the internet, but the Wall Street Journal reports service in India, Pakistan, and parts of East Africa was noticeably degraded.

No services have yet offered a reason for the cuts. Yemen’s telecom ministry denied speculation it was responsible for the failures, saying it was “keen to keep all telecom submarine cables…away from any possible risks.”

Underwater cables are responsible for most of the internet’s data traffic. They’re cheaper than land-based cables, but are prone to damage from ships’ anchors.

The ongoing conflict in the Middle East has experts wondering about the timing and severity of this outage, though. Iran-based Houthi has been particularly aggressive in the Red Sea, including in mid-February when a cargo ship was abandoned by its crew following an Houthi attack. The ship, which had weighed anchor, drifted for weeks before sinking.

According to U.S. officials, the anchor of the Rubymar, a UK-owned ship, likely severed three cables in the Red Sea on February 18, 2024. The Rubymar was struck by a Houthi missile on February 18, 2024, and sank after taking on water. As it was sinking, its anchor likely cut the cables that provide global telecommunications and internet data.

Houthi control of the region and the ongoing strife in Yemen makes repairing the damaged cables more complicated. One of the four companies affected said it expects to start that process early in the second quarter, though permit issues, weather, and the civil war in that country could impact that.

Statement by Dr. Thomas King, Chief Technology Officer, DE-CIX:

“As a global Internet Exchange (IX) operator, DE-CIX rents capacity on submarine cables in the Red Sea as part of its global network, which interconnects more than 50 IXs and Cloud Exchanges around the world. One of our data pathways from Asia to Europe makes use of the Asia-Africa-Europe 1 (AAE1) cable, one of three that were damaged in a recent incident. According to the information we have, the cause of the damage was the anchor of a freighter that the Houthi rebels had attacked. At some point, the crew abandoned the ship and dropped anchor so that the unmanned ship would not drift out of control. Unfortunately, the anchor did not hold, and the drifting wreck dragged the anchor across the seabed, rupturing the three affected lines before the ship finally sank.”

“From a telecommunications perspective, the Red Sea is a neuralgic point connecting Europe and Asia. DE-CIX has leased capacity on two separate submarine cables in the Red Sea, located several kilometers apart. We operate them in active-active mode, which means that the second cable is fully available if one should fail. The data is rerouted fully automatically, without manual intervention. As we monitor all of our systems automatically 24/7, we were alerted immediately to the failure of the connection. At the same time, the carrier that we rent our capacity from also informed us of the incident.”

“Given that we always work with redundant connections, the impact of the incident is not critical for DE-CIX customers. We share our capacities across multiple submarine cable routes worldwide and check the exact routes, including GPS coordinates, to ensure that these routes do not overlap at any point. We plan in such a way that we can fully compensate for the failure of at least one submarine cable, and we can always use different data pathways. We generally expect damage to submarine cables to take two to three months to repair because special ships are needed for this. In the meantime, we are also working to establish alternative redundancy channels.”

“In terms of the impact on Internet users in Europe and Asia, if Internet service providers and carriers have built their networks redundantly and therefore resiliently, Internet users should not experience any disruption. If Internet service providers choose a different risk scenario for cost reasons, for example, then even the failure of a single cable can lead to disruption for users/customers. Such a disruption is noticeable in the latency, i.e. the time it takes for the data to reach its destination. This could, for example, lead to the participants in a video conference interrupting each other because it takes too long for the spoken word to reach the other person.”

…………………………………………………………………………………………………………

Rhys Morgan, general manager and VP, media and networks, EMEA at Intelsat is seeing demand for satellite capacity as well.

“We’ve had reports from customers that they’re seeing a slowdown in some of their Internet connectivity,” he tells Capacity Media.

Morgan notes that disruption to data traffic passing through the Red Sea has been a concern for sometime due to the Houthi militants potential to target the infrastructure.

“It’s something we’ve been keeping an eye on more broadly over a long period of time,” he says. “We’ve been working with large customers to make sure that they’ve got a hybrid approach to networking.”

Morgan is keen to emphasise that a hybrid approach to networking is crucial in times of disruption, as seen this week.

Intelsat have implemented short-term services for customers that have suffered disruption in light of the cuts.

“As part of a hybrid network approach, customers will look for mission critical or highly sensitive communications to be passed through different means,” he explains. “Fibre may be their primary method, but satellite connectivity could be on standby as a backup”.

Satellite connectivity in its current form is not well enough equipped to completely replace the vast quantities of data that travel through subsea cables every day. But for certain types of data, the technology can offer a suitable alternative.

References:

https://fortune.com/2024/03/04/internet-cables-cut-red-sea/

https://www.networkcomputing.com/author/dr-thomas-king-cto-de-cix

Ericsson and ACES partner to revolutionize indoor 5G connectivity in Saudi Arabia

Ericsson and Advanced Communications and Electronics Systems (ACES) [1.] have signed a strategic three-year Neutral Host Provider (NHP) agreement, to address the surging demand for indoor 5G connectivity and 5G technology. This agreement aims to create a neutral host ecosystem, allowing service providers to share infrastructure and deliver high-performance 5G connectivity in high-traffic indoor locations in Saudi Arabia.

Note 1. Advanced Communications & Electronic Systems Company (ACES) is a leading international neutral host operator and a digital infrastructure company based in Saudi Arabia. Established in early 1990s, ACES is specialized in implementing total solutions and turn-key projects in wireless communication, network monitoring & testing and information technology systems.

……………………………………………………………………………………………………………….

Using multi-operator infrastructure sharing to address rising demand for indoor connectivity will significantly improve user experience. With the rise of high-attraction landmarks and the need for network densification, it has become crucial to provide reliable and high-performing indoor solutions for portability, agility and flexibility.

The NHP agreement allows ACES to provide Ericsson indoor 5G products to service providers, enabling them to share the same infrastructure, and ensure cost-effective coverage expansion and efficient utilization of resources.

This agreement will establish a neutral host ecosystem, supporting CSPs in enhancing their indoor 5G coverage with flexibility and ease of operation and maintenance. It will contribute to the footprint expansion of indoor 5G networks across the Kingdom.

Image Credit: Ericsson

By deploying Ericsson’s Radio Dot System, CSPs can deliver high-performing 5G connectivity to users in large locations such as airports, hotels, hospitals, stadiums, and shopping malls.

One of the key activations as a result of this agreement is enhancing the 5G indoor connectivity at an international airport in the Kingdom that welcomes millions of visitors regularly. The agreement paves the way for a resilient infrastructure in high-density locations.

Akram Aburas, Chief Executive Officer of ACES, says: “At ACES, we seek to empower businesses and individuals with a transformative digital experience, and our agreement with Ericsson is a momentous step towards that. With Ericsson’s cutting-edge indoor 5G solutions, we aim to create a neutral host ecosystem that offers seamless and high-performance connectivity in high-traffic indoor locations across the Kingdom. Our agreement with Ericsson will support and meet the surging demand for indoor connectivity across Saudi Arabia and unlock unparalleled opportunities for telecom operators to enrich their offerings and deliver exceptional user experiences.”

Ericsson’s indoor 5G solutions, powered by the Radio Dot System, will enable faster and more reliable network performance in indoor environments and will cater to the increasing need for seamless connectivity.

Håkan Cervell, Vice President and Head of Ericsson Saudi Arabia and Egypt at Ericsson Middle East and Africa, says: “By fostering a neutral host ecosystem, we are enabling communications service providers to embrace unprecedented flexibility and cost efficiency in their network expansion. Our indoor 5G solutions, powered by the Radio Dot System, will enhance how businesses and individuals experience seamless connectivity within indoor environments. We look forward to this agreement with ACES, which will ensure robust indoor 5G connectivity across the Kingdom, in line with Saudi Vision 2030, while setting new benchmarks for network performance that propel Saudi Arabia to the forefront of the global 5G revolution.”

To date, the Ericsson Radio Dot System has been deployed in more than 115 countries around the world in high-traffic indoor venues.

References:

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Ericsson expects continuing network equipment sales challenges in 2024

Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN