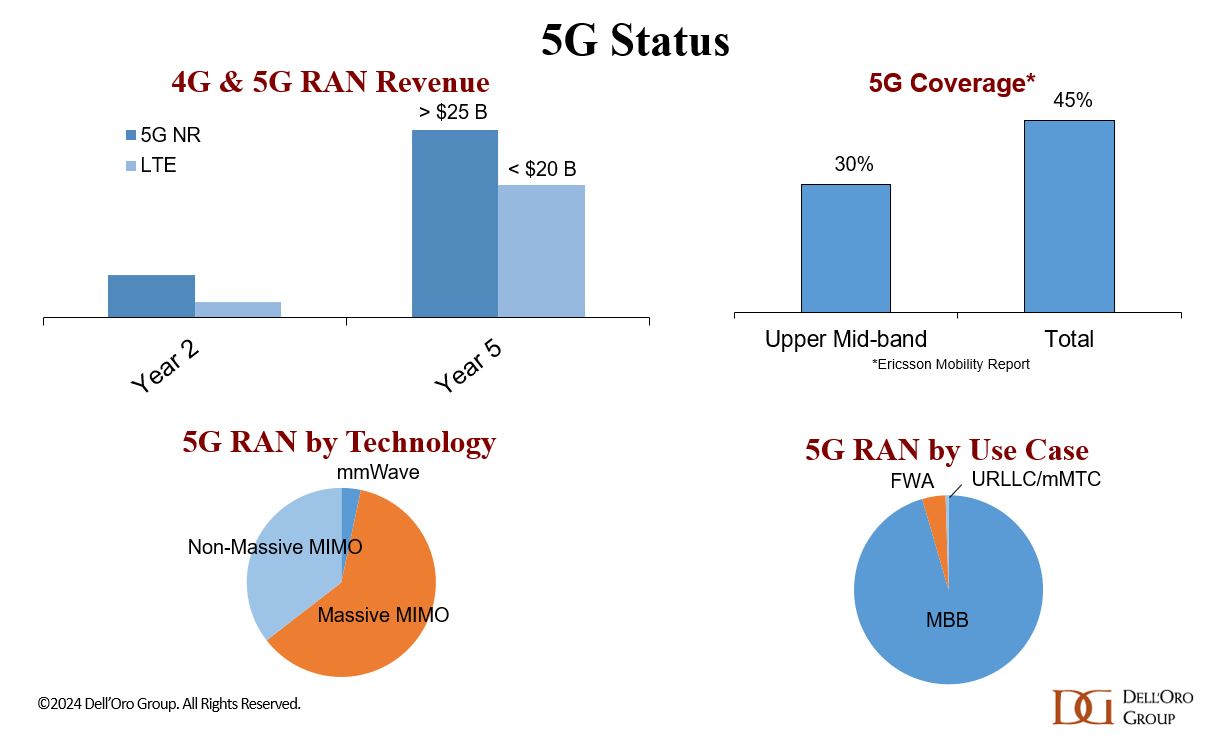

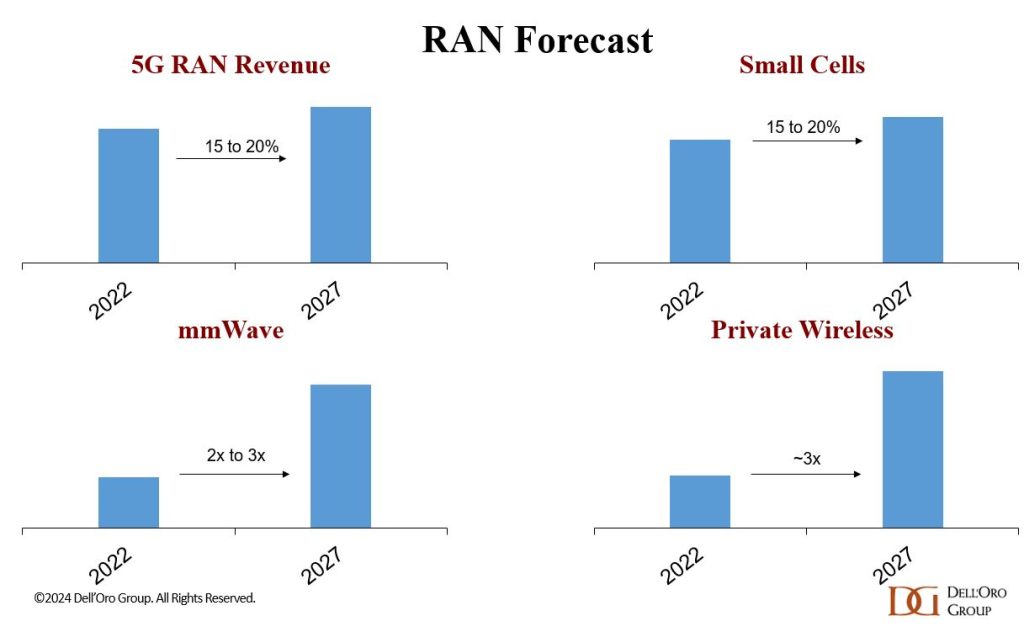

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

A new report from the Dell’Oro Group reveals that the global Radio Access Network (RAN) market concluded the year with another difficult quarter, resulting in a global decrease of nearly $4 billion in RAN revenues for the full year of 2023. However, despite these challenges, the results for the quarter exceeded expectations, partly due to robust 5G deployments in China.

“Following the intense rise between 2017 and 2021, it’s clear that the broader RAN market is now experiencing a setback, as two out of the six tracked regions are facing notable declines,” said Stefan Pongratz, Vice President for RAN market research at the Dell’Oro Group. “In addition to challenging conditions in North America and Europe, the narrowing gap between advanced and less advanced operators (e.g. India) in this first 5G wave, compared to previous technology cycles, initially had a positive impact but is now constraining global 5G and broader RAN growth prospects,” Pongratz added.

Additional highlights from the 4Q 2023 RAN report:

- Overall concentration in the RAN market showed signs of improvement in 2021 and 2022, but this progress slowed down in 2023.

- While full-year RAN rankings remained mostly unchanged for major suppliers, revenue shares within the RAN market showed more variability, with Huawei and ZTE enhancing their global revenue shares. Similarly, Huawei and Nokia saw improvements in their revenue shares outside of China.

- The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Regional projections are mostly unchanged, with market conditions expected to remain tough in 2024 due to difficult comparisons in India. Nevertheless, the base-case scenario anticipates a more moderate pace of decline this year.

…………………………………………………………………………………………………………………………

Source: Dell’Oro Group

…………………………………………………………………………………………………………………………

Separately, Rémy Pascal of Omdia says that global RAN revenues (including both hardware and software) declined by 11% last year to just over $40 billion. The worst performing region by far was North America, which almost halved, but this should be viewed in the context of a relatively strong 2022.

India and China were been the best performing countries for new RAN deployments. This partly explains why Huawei continues to be the top RAN vendor despite attempts by the U.S. and its allies to prevent that, but as the Omdia table below shows, the Chinese vendor is still doing well in many other regions too. We’re told this table looked pretty much the same last year.

Top RAN vendors by region, full year 2023:

|

North America |

Asia & Oceania |

Europe, Middle East and Africa |

Latin America & the Caribbean |

|

Ericsson |

Huawei |

Ericsson |

Huawei |

|

Nokia |

ZTE |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Nokia |

Source: Omdia

Omdia expects the RAN market size to decrease by around 5% compared to 2023. That’s an improvement on the 11% 2022-23 decline but still not good news for the RAN industry.

For all the talk of Open RAN, it clearly has yet to inspire significant capex from operators. The same goes for private 5G or programmable networks. Less than halfway through the presumed 5G cycle, spending has stalled and it’s not at all clear what will restart it.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

References:

RAN Market Shows Faint Signals of Life in 4Q 2023, According to Dell’Oro Group

https://www.telecoms.com/wireless-networking/global-ran-market-declined-by-11-in-2023

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

https://www.silverliningsinfo.com/5g/ericsson-nokia-and-state-global-ran-2024

LightCounting: Open RAN/vRAN market is pausing and regrouping

What is 5G Advanced and is it ready for deployment any time soon?

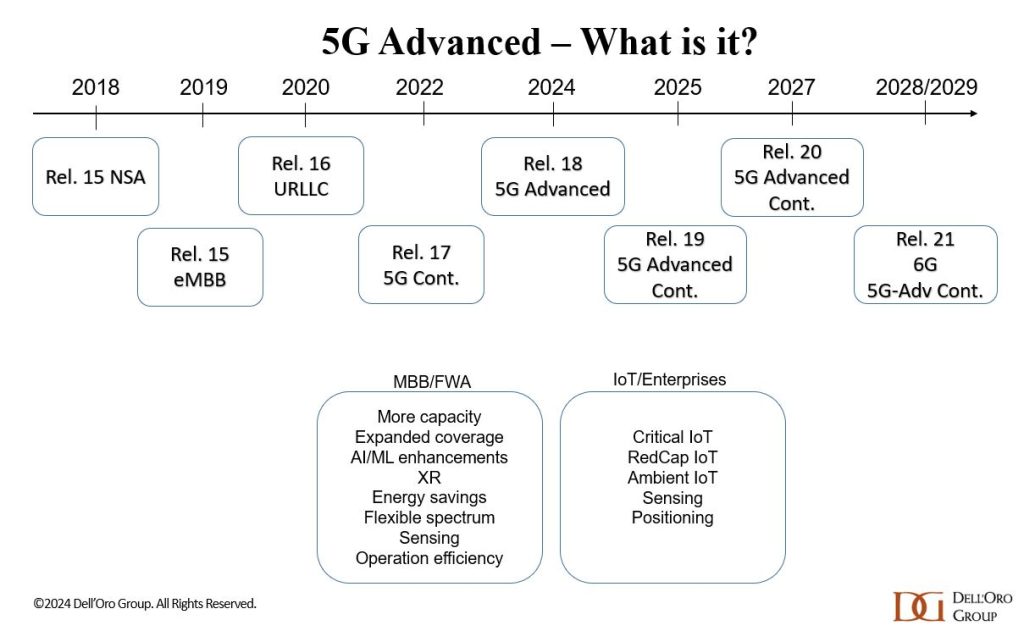

The 3GPP roadmap (see figure below) is continuously evolving to fulfill the larger 5G vision. In this initial 5G wave that began in 2018, 3GPP has completed three major releases (new releases every 1.5 to 2 years): 15, 16, and 17.

Release 17 is included in the ITU-R M.2150-1 recommendation which is the only standard for IMT 2020 RIT/SRIT (i.e. 5G RAN interface). 3GPP contributes its completed radio interface specifications to ITU-R WP5D via ATIS where they are discussed and approved for inclusion into the next version of the ITU-R M.2150 recommendation. The same procedure is likely for IMT 2030 RIT/SRIT (i.e. 6G RAN).

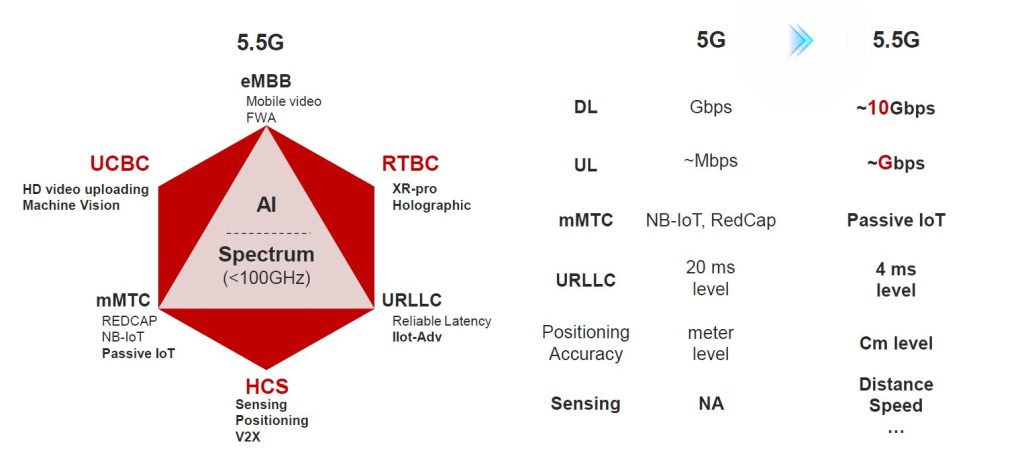

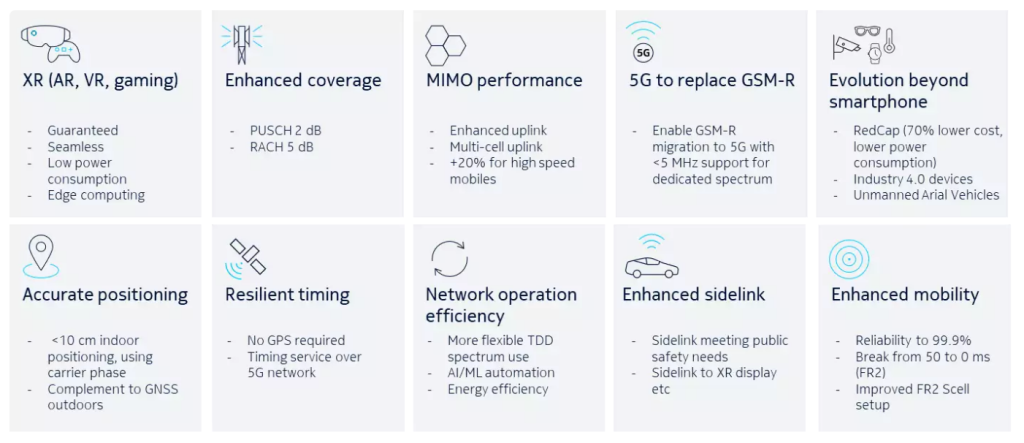

3GPP Release 18 and beyond (often referred to as 5G-Advanced or 5.5G) involve gradual technology improvements aimed at elevating 5G to the next level, creating a foundation for more demanding applications and a broader set of use cases. In addition to performance improvements and support for new applications, sustainability and intelligent network automation are also important building blocks in the broader 5G-Advanced vision (source: Ericsson).

The scope of 5G Advanced in Release 19 was approved at the December 2023 3GPP Plenary Meeting in Edinburgh, Scotland. Release 19 builds on Release 18 and focuses on enhancing 5G performance while expanding the capability of 5G across devices and deployments. In addition, it will establish the technical foundations for 6G and will include preliminary work on new 6G capabilities. Release 19 will be followed by Release 20, the first 3GPP release for 6G studies.

5G Advanced continues to push the spectral efficiency limits and coverage in both sub-7GHz and millimeter wave spectrum. In addition to continued enhancements to massive MIMO radios and mobility, 3GPP Release 19 provides advancements for new use cases such as XR and Non-Terrestrial Networks.

- Massive MIMO Radio – Release 18 introduced improvements to massive MIMO uplink and downlink throughput. Release 19 will boost capacity further by improving multi-user MIMO, which enables more UEs to share the same time and frequency resources.

Release 19 will also enable the cost-efficient realization of distributed transmitters and receivers, thus improving signal quality. This is an important step towards enabling fully distributed MIMO (D-MIMO) systems. Other enhancements include 5G beam management with UE-initiated measurement reporting, thus resulting in faster beam selection. - Mobility – 5G Advanced introduces a new handover procedure known as low-layer (i.e. L2) triggered mobility (LTM). In Release 18, LTM is supported between cells served by the same gNB. In Release 19, the LTM framework will be extended to support handover between cells served by different gNBs.

- XR and the Metaverse – Release 19 builds on the low latency and power saving features of Release 18 by enabling higher XR capacity by adding improved uplink and downlink scheduling using packet delay information.

- Non-Terrestrial Networks – 5G Advanced combines terrestrial and satellite communications under one standard for the first time. Release 19 will build on the enhancements introduced in Release 18 with a focus on increasing satellite downlink coverage, introducing UEs with higher output power and providing Redcap device support. It will also investigate whether additional support is required for regenerative payloads.

Current priorities for 5G-Advanced include:

- More capacity and better performance. Some estimates suggest that MIMO enhancements, better beam management, and full duplex technologies taken together with other advancements, including multi-band serving cell (MB-SC) and Extremely Large Antenna Array (ELAA) will deliver another 20% of efficiency improvements relative to today’s 5G. Enhanced uplink (UL) and multi-cell UL improvements could pave the way for greater data rate and latency improvements in the UL. For reference, Huawei defines 5G-Advanced as a site that can support at least 10 Gbps of cell capacity. ZTE is also targeting 10 Gbps+ with 5G-Advanced.

- Expanded coverage. In addition to MIMO and IAB coverage enhancements, 5G-Advanced includes Non-Terrestrial Network (NTN) connectivity improvements, building on the NR/LTE-based NTN support that was introduced with Release 17.

- More intelligence. Releases 15-17 already include some AI/ML features. 5G-Advanced will offer AI/ML enhancements in the RAN (including the air interface) and the management layers. In addition, Intelligent RAN and AI-powered analytics will help operators to improve the performance and proactively address network issues before they become a problem.

- Energy savings. Release 18 includes a confluence of static and dynamic power-saving enhancements for the radios and the overall RAN. Also, the specification is targeting to define a base station energy consumption model with various KPIs to better evaluate transmission and reception consumption/savings.

- Flexible spectrum (FD, DSS, CA). NR is currently based on TDD or FDD spectrum. Full duplex (FD), a 5G-Advanced contender, improves spectrum utilization by allowing UL and DL to share the same spectrum (FD should improve capacity and latency, especially in the UL). Release 18 also includes DSS capacity enhancements (increasing PDCCH capacity by allowing NR PDCCH to be transmitted in symbols overlapping with LTE CRS). Other spectrum-related upgrades with 5G-Advanced include multi-carrier enhancements and NR support for dedicated spectrum bandwidths below 5 MHz.

- Critical IoT. 5G-Advanced includes multiple industrial and IoT related advancements. Release 17 included support for Time Sensitive Networking (TSN), which will be expanded in 5G-Advanced to support Deterministic Networking (DetNet).

- RedCap IoT. 5G NR-Light or Reduced Capability (RedCap) was introduced with 3GPP NR Release 17. 5G-Advanced will introduce lower-tier RedCap devices, seeking to find a better set of tradeoffs between cost, performance, and power consumption.

- Ambient IoT. Passive IoT, sometimes referred to as Ambient IoT, will allow devices/objects to connect without a power source.

- Sensing. Harmonized communication and sensing (HCS) is a Release 19 study item.

- Positioning. Positioning is already supported in Release 16/17, though 5G-Advanced is expected to improve positioning accuracy and power consumption (Nokia has said sub-10 cm positioning is doable). In addition, Release 18 will include support for RedCap devices.

Role of AI/ML in 5G Advanced:

AI/ML will become a key feature of 5G networks with numerous applications ranging from network planning and network operations optimization to full network automation. Another important application is the use of AI/ML to improve the performance and functionality of the 5G air interface.

3GPP studied the use of AI/ML in the air interface in Release 18 and defined three use cases: channel state feedback (CSF) information, beam management and positioning. Based on the conclusions of Release 18 studies, Release 19 will specify a general AI/ML framework, i.e. actual specifications to support the above three use cases as well as specific support for each individual use case. Release 19 will also explore new areas in the AI/ML air interface such as mobility improvement and AI/ML-related model training, model management and global 5G data collection.

AI/ML is another major focus for Qualcomm. The company has dedicated significant technical resources to develop full-scale demonstrations of the three Release 18 defined use cases. For example, it recently demonstrated CSF-based cross-node machine learning involving E2E optimization between devices and the network. This reduces device communication overheads resulting in improved capacity and throughput. Qualcomm has also demonstrated the use of AI/ML to improve beam prediction on its 28GHz massive MIMO test network and is heavily involved in positioning technologies. For example, it has showcased its outdoor precise positioning technology, which uses multi-cell roundtrip (RTT) and angle-of-arrival (AoA) based technologies, as well as its RF finger printing technology operating in an indoor industrial private network.

Over the next few months, 3GPP will continue exploring the applicability of AI/ML based solutions for other use cases such as load balancing between cells, mobility optimization and network energy savings. For example, there will be support for conditional Layer 2 mobility in Release 19 and a new study item targeting new use cases designed to improve coverage and capacity optimization, such as AI-assisted dynamic cell shaping.

Enhancing Device and Network Sustainability:

5G Advanced focuses on sustainability and introduces energy-saving features for devices and networks as well as exploring end-to-end energy saving opportunities that benefit devices. There are also improved features for RedCap and the study of ambient IoT as a new device type.

- Power-optimized devices – Releases 18 and 19 build on existing energy saving features, for example, a new low-power wakeup signal (LP-WUS). A low-complexity, power-optimized receiver is specified to monitor low-power wake-up signals from the network which only wakes-up the main radio when data is available at the device. This avoids the significant power consumption required to keep the main radio monitoring control signals from the network.

- Ambient IoT – enables new use cases enabled by very-low power devices that harvest energy from the ambient environment, for example, RF waves. Release 19 will investigate new architectures for ambient IoT devices and will include the development of a harmonized specification. Numerous use cases will be studied, including smart agriculture, industrial wireless sensor networks, smart logistics, warehousing, etc.

- Network energy savings – 5G Advanced reduces network energy consumption by dynamically adjusting the network’s operation based on feedback from the device, i.e. shutting down parts of the network when idle and transmitting less power depending on the overall traffic load or using more efficient antennas.

Dell’Oro’s Stefan Pongratz says “one fundamental aspect of 5G-Advanced will be to support more demanding consumer MBB applications. The days of exponential data traffic growth are clearly in the past; however, global mobile data traffic is still projected to increase threefold over the next five years, reaching 0.5 ZB/month by 2028 (mobile plus FWA). While operators are currently in a fairly good position from a capacity perspective, especially those not aggressively pursuing FWA, some of the technology improvements with 5G-Advanced can help to address capacity limitations in hotspot areas.”

Omdia (owned by Omdia) expects leading network service providers in Asia and Oceania are expected to launch 5G-Advanced between 2024 and 2025. They aim to leverage the new capabilities and features offered by 5G-Advanced to enhance their network infrastructure and offer innovative services to their customers. These advancements include enhanced performance metrics such as higher data rates, lower latency, improved reliability, and greater network efficiency.

During the next few years, 5G Advanced will continue to evolve within 3GPP while the specification of 6G officially starts to ramp up in parallel, leading to the ITU-R IMT 2030 standard.

Setting The Stage For 6G:

Although Release 19 will be the last release focused on 5G, it will also include some longer-term technologies that will become the foundation of 6G, thus setting the direction for Release 20. For example, Integrated Sensing and Communications (ISAC), which combines wireless communications with RF sensing, will enable a raft of new position-based use cases. Release 19 will study channel characteristics suitable for the sensing of various objects, including vehicles, UAVs and humans. Full duplex, another 6G technology, allows transmitters and receivers to operate simultaneously on the same frequency, potentially resulting in a doubling of network capacity. Release 19 will study sub-band full duplex, a type of full duplex, which will improve capacity and latency, particularly for the uplink. Release 19 will also include channel model studies for the upper mid-band spectrum (7-16GHz), which will be supported by “Giga-MIMO” in the 6G timeframe, in order to enable wide-area coverage in this higher band.

Whereas AI/ML is a key pillar of 5G Advanced, it will be a core foundational technology of 6G and will underpin the key features that will make 6G revolutionary. For example, 6G will start to move away from the traditional, model-driven approach of designing communication systems and transition towards a more data-driven design. Indeed, it is likely that the 6G air-interface will be designed to be AI-native from the outset, thus signalling a paradigm change in the way communication systems are designed. An AI-native air interface could offer many benefits. For example, it could refine existing communication protocols by continuously learning and improving them, thereby enabling the air interface to be customized dynamically to suit local radio environments.

References:

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

Deutsche Telekom migrates IP-based voice telephony platform to the cloud

Deutsche Telekom has successfully transitioned its IP-based voice telephony platform to the cloud. Landline connections are now centrally controlled from cloud data centers in Germany. Over seventeen million customer connections have been migrated. Billions of voice minutes are now handled entirely through the NIMS platform (NIMS: Next Generation IP Multimedia Subsystem) with around 100 interconnect partners.

Thanks to disaggregation, services can be provided through an optimized solution portfolio of software modules from a wide ecosystem of industry partners. The near-complete automation of the Telco Cloud provides a more efficient process, leading to significantly more flexibility and speed in the introduction of new service features and capacity expansion.

Image credit: Deutsche Telekom

“This project is a game changer in the industry,” says Abdu Mudesir, Chief Technology Officer of Deutsche Telekom Deutschland. “It is the result of excellent cooperation with partners such as Juniper Networks, Mavenir, Microsoft, HPE, Red Hat, and Lenovo. Our common goal in this innovation project has always been to set a benchmark for excellence in the industry, for our customers. The success has spread, many network operators are now asking us specifically how we managed to achieve this.”

“The cloud isn’t just a technology, but rather an entirely new operating model that can yield tremendous agility, cost efficiencies and better user experiences. I am so proud that Juniper was able to play a role in bringing Deutsche Telekom’s visionary strategy for NIMS to life and even more thrilled to see this project, which I consider a blueprint for the rest of the telecom industry, now complete,” says Rami Rahim, CEO – Juniper Networks.

“With NIMS, Deutsche Telekom has leveraged the benefits of cloud native network functions, hyper scaler technology and extreme automation to deliver mission critical carrier grade performance; it’s a huge step forward in the Telecommunications industry,” says Yousef Khalidi CVP, Azure for Operators – Microsoft.

“Telekom´s vision was unique because it was not just a pure technology play. Its goal to change the old development paradigms, driving automation and interoperability into the very fabric of the Telco Cloud architecture. The NIMS platform offers a transformative lifecycle automation for all telco cloud and payload components and Mavenir is proud to be part of the multi-vendor ecosystem delivering this innovation,” says Bejoy Pankajakshan, EVP & Chief Technology and Strategy Officer of Mavenir.

“The platform is a key building block for ´Zero Touch operations´ where manual intervention and operations to handle network management and configuration are reduced in favor of a more advanced, software-based solution,” says David Stark, VP & GM, Telco Solutions – HPE.

Telekom has already established follow-up projects to consistently implement the successful model of cloudification, disaggregation, and complete automation in other voice applications, 5G Core and the access networks.

References:

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

Deutsche Telekom with AWS and VMware demonstrate a global enterprise network for seamless connectivity across geographically distributed data centers

Deutsche Telekom exec: AI poses massive challenges for telecom industry

Deutsche Telekom’s fiber optic expansion in 140 of the 179 municipalities within the Gigabit region of Stuttgart

Deutsche Telekom Global Carrier Launches New Point-of-Presence (PoP) in Miami, Florida

NEC’s new AI technology for robotics & RAN optimization designed to improve performance

NEC Corporation has developed AI technology for robotics that enables precise handling operations on unorganized and disorderly placed items. By predicting both the areas hidden by obstacles and the results of a robot’s actions, this technology makes it possible for robots to perform tasks that were previously performed manually, thereby contributing to the improvement of productivity and work-styles.

NEC has developed AI technology for robotics that consists of two technologies based on “World Models“:

“Spatiotemporal Prediction,” in which a robot precisely predicts the work environment and the results of its own actions from camera data, and

“Robot Motion Generation,” which automatically generates optimal and precise actions based on these predictions. According to NEC research, this is the world’s first technology of its kind to be applied to robot operations.

1. Autonomously executes precise actions in optimal sequences for items of various shapes and sizes:

The handling of objects performed manually at a work site are executed by a combination of various actions. For example, in packing items, people can instantly execute a combination of precise actions such as “placing and then pushing items” without hitting other objects or obstacles. In robot control that uses conventional technologies, however, actions such as “push” and “pull” are more difficult to execute with high precision than actions such as “pick up” and “place.” This is because slight differences in actions or shapes significantly influence how objects move in response to actions. In addition, as the number and types of actions to be considered increases, the combination and sequence of actions becomes more complex, which makes real-time planning a challenge.

This technology uses World Models to accurately predict the results of robot actions on objects of various shapes from video camera data, enabling robots to execute precise actions such as “push” and “pull.” Moreover, robots can autonomously and instantly execute combinations of multiple actions such as “place and push” and “pull and pick up” by generating the appropriate action sequence at real-time speed depending on the work environment.

2. Operates while predicting hidden and invisible items:

In a work environment where multiple items are closely arranged or disorderly piled up, people naturally predict the hidden areas and act accordingly, such as picking up items while avoiding interference with hidden objects. However, conventional recognition technology for robots has been difficult for practical use because it requires the preparation and learning of a large amount of teaching data showing the state of hidden objects in order to predict the hidden areas.

This new technology enables unsupervised learning that does not require labeling through the application of World Models and is able to efficiently learn prediction models of hidden object shapes. This enables robots to accurately predict a work environment from camera data and automatically generate optimal actions that do not collide with other objects or obstacles.

NEC will test this technology in logistics warehouses and other sites where much of the work is done manually by the end of 2024. By promoting social implementation of this technology in various industries with significant need for automation, NEC will contribute to improved productivity and work style reform.

………………………………………………………………………………………………………….

Separately, NEC has developed a RAN autonomous optimization technology that dynamically controls 5G Radio Access Networks (RAN) according to the status of each user terminal, dramatically improving the productivity of applications, such as the remote control of robots and vehicles. NEC will incorporate the technology into RAN Intelligent Controllers (RIC) and conduct demonstration tests using this technology by March 2025.

There is growing momentum to promote digital transformation (DX) by utilizing the latest technologies such as 5G, Artificial Intelligence (AI), and the Internet of Things (IoT) with the aim of resolving labor shortages and improving productivity.

When using these technologies for remote control of robots and vehicles, two-way communication consisting of status monitoring and control instructions for each robot/vehicle must be completed within a certain period of time.

However, if the communication latency exceeds the requirement, the operation is repeatedly suspended for safety reasons, resulting in a decrease in the operation rate and productivity. The communication delays, such as retransmission delays due to poor radio quality and queuing delays (*) due to congestion on the radio links, have been a barrier to the introduction of remote control systems.

Currently, stable communications environments have been achieved by installing high performance network equipment, providing sufficient frequency resources, increasing redundancy in coding and communication paths, and pre-configuration of RAN parameters according to the application. However, with these methods, it is difficult to widely support applications that are diversifying with the advancement of DX, and the time and cost required for implementation is also an issue.

About the RAN autonomous optimization technology:

The RAN autonomous optimization technology developed by NEC consists of AI that analyzes communication requirements and radio quality fluctuations on a per-user terminal basis, such as robots and vehicles, and AI that dynamically controls RAN parameters on a per-user terminal basis based on the results of that analysis. This AI learns from past operational records of robots and vehicles, and optimally controls RAN parameters such as modulation and coding scheme (target block error rate), radio resource allocation (resource block ratio), and maximum allowable delay (delay budget) while predicting the probability of exceeding communication latency requirements. Whereas in a typical 5G network, RAN parameters are fixed and set for the entire network, this technology dynamically controls them on a per-user terminal basis to improve application productivity.

Technology features are as follows.

1. Flexible support for a variety of applications

RAN parameters can be dynamically controlled according to the communication requirements of applications, enabling overall optimization even in environments where diverse applications are mixed.

2. O-RAN Alliance-compliant and easy to deploy

Since it can be mounted on RIC that are compliant with O-RAN Alliance standard specifications, it is easy to install or add to existing facilities.

3. Dramatic productivity gains are possible at industrial sites

Simulation results of applying this technology to a system that remotely controls multiple autonomous robots operating in factories or warehouses confirmed that the number of robot stoppages can be reduced by 98% or more compared to cases where this technology is not used.

NEC plans to incorporate the technology into RIC platforms compliant with the O-RAN Alliance standard specifications and conduct demonstration tests using this technology by March 2025.

NEC will exhibit this technology at MWC Barcelona 2024, the world’s largest mobile exhibition, which will be held from February 26 to February 29, 2024 at Fira Gran Via, Barcelona, Spain.

When using these technologies for remote control of robots and vehicles, two-way communication consisting of status monitoring and control instructions for each robot/vehicle must be completed within a certain period of time. However, if the communication latency exceeds the requirement, the operation is repeatedly suspended for safety reasons, resulting in a decrease in the operation rate and productivity. The communication delays, such as retransmission delays due to poor radio quality and queuing delays due to congestion on the radio links, have been a barrier to the introduction of remote control systems.

“SMART” undersea cable to connect New Caledonia and Vanuatu in the southwest Pacific Ocean

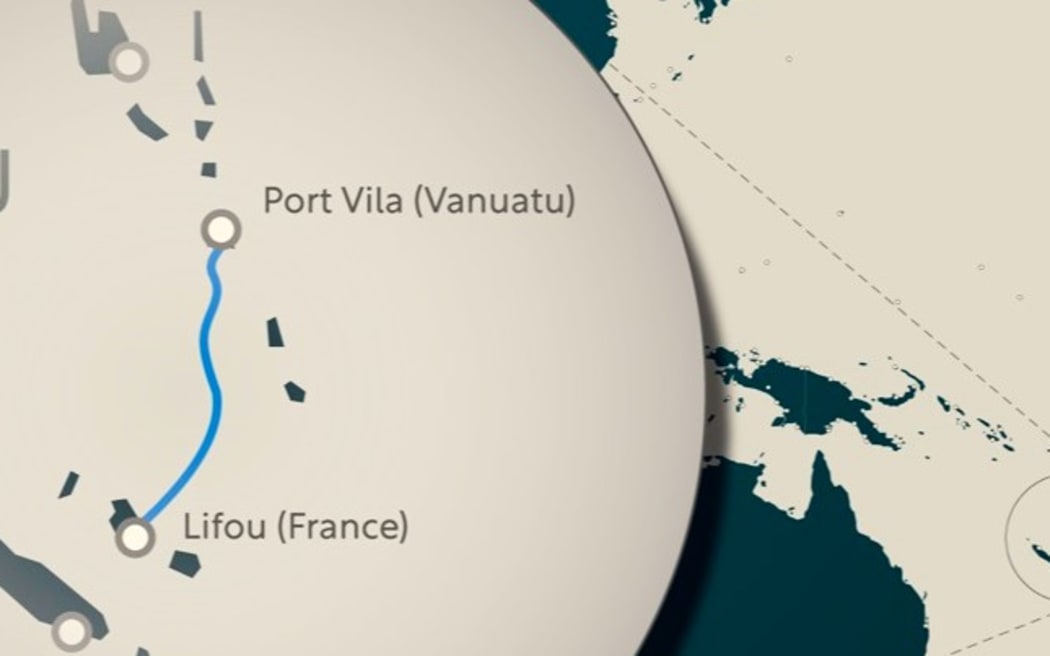

A new kind of multi-purpose “SMART” undersea cable is scheduled to connect New Caledonia (landing on Lifou Island, Loyalty Islands group) and Vanuatu (Port Vila) by 2026, a telecom joint venture has announced. The project ‘s partnership is between Vanuatu-based telecom and infrastructure company Prima and cable laying specialist Alcatel Submarine Networks, the two partners said in a release earlier this month. Other parties supporting the project are the government of Vanuatu, New Caledonia’s telecom company OPT (Office des Postes et Télécommunications) and the French government.

Described as a “world first,” the cable would provide telecommunications, but is also equipped with built-in “Climate Change Nodes”, sensors designed to feedback real-time data for tsunami and earthquakes monitoring. The “SMART” cable (for Science Monitoring And Reliable Telecommunications) is said to “symbolize the strength of international collaboration in addressing global challenges…merging telecommunications with environmental monitoring technologies…will substantially enhance the safety, connectivity, and scientific insight of the Pacific region.”

Vanuatu-New Caledonia first SMART cable system. Photo: Image Courtesy of ASN

The signing ceremony between partners took place during the recent Pacific Telecoms Council Meeting in Hawaii late January. The Pacific Peering website describes the project as follows:

“As part of the TAM TAM project, Pacific Peering will integrate the installation of a SMART cable between Port-Vila (Vanuatu) and Lifou (New Caledonia). This first world use of this technology in the New Hebrides fault will allow the study of a sensitive seismic zone and better protection of the 650,000 inhabitants directly exposed to the risks of tsunami and earthquakes. The data will be accessible without a license by the scientific community and civil protection. The data will be hosted in a data center in New Caledonia meeting the latest security and connection standards (redundancy, latency). This system of sensors integrated into telecommunications cables makes it possible to pool installation costs and thus reduce the CAPEX and OPEX of the seabed observation system. Our objective is to have all submarine cables equipped by 2030.”

“This groundbreaking project is set to provide not only a supplementary telecom cable to New Caledonia, extending to Australia and Fiji, but also a vital component in environmental monitoring. This innovative technology promises to revolutionize warning systems throughout the Pacific, enhancing security and preparedness against natural disasters,” the partners said.

References:

https://w.media/contract-signed-for-worlds-first-smart-cable-to-connect-vanuatu-and-new-caledonia/

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

NEC completes Patara-2 subsea cable system in Indonesia

SEACOM telecom services now on Equiano subsea cable surrounding Africa

China seeks to control Asian subsea cable systems; SJC2 delayed, Apricot and Echo avoid South China Sea

China plans $500 million subsea internet cable to rival US-backed project

Japan telecoms are launching satellite-to-phone services

Japanese telecom carriers are rushing to launch communication services that directly connect smartphones to satellites. In recent years, global telecom carrier interest in non-terrestrial networks, such as space-based services, has grown. Such network services not only allow for expanded coverage to places that would otherwise be difficult to reach, but also are expected to be used in natural disasters. After the January 2023 Noto Peninsula Earthquake in Japan, SpaceX owned Starlink satellite internet service was used for emergency restoration of base stations and to provide internet at disaster shelters.

- Rakuten Mobile Inc. announced Friday that it will start offering a satellite-to-smartphone service that can also be used to make voice calls as early as 2026. The service is expected to provide a connection anywhere in the country, including in mountainous regions and areas offshore, where it is difficult to build base stations. It could prove useful in a natural disaster.

- KDDI Corp. also plans to launch a satellite-to-smartphone service for text messaging. Such satellite-based services do not require a dedicated receiver, and can be accessed with just a smartphone.

For the Rakuten Mobile service, the company will use satellites from AST SpaceMobile Inc., a U.S. startup that has been invested in by the Rakuten Group.

……………………………………………………………………………………………………………….

AST SpaceMobile has launched two test satellites into low-earth orbit at an altitude of about 500 kilometers. Because these satellites orbit lower than geostationary satellites, they can provide communications with less delay. The company plans to have as many as 90 satellites operating in the future.

At a press conference on Friday, Rakuten Mobile Chairman Hiroshi Mikitani said, “Our customers will be able to enjoy mobile connectivity across Japan, even offshore or on an airplane.”

KDDI, which has gotten out ahead by providing access to Starlink, a satellite-based communication network from U.S. company SpaceX, will launch its text messaging service as early as this year.

Starlink currently requires a dedicated terminal, but last month SpaceX successfully launched six satellites that allow smartphones to connect to them directly.

NTT Docomo Inc. and SoftBank Corp. are looking to commercialize high-altitude platform stations, or HAPS. These stations are large unmanned aircraft that stay in the air at an altitude of about 20 kilometers, from where they send out radio signals.

NTT Docomo is currently testing direct links between HAPS and smartphones, and expects to launch a HAPS mobile service in fiscal 2025. However, a framework for space- and air-based services is still being defined.

The frequency bands to be used for the services are expected to be discussed at an international conference, and the Internal Affairs and Communications Ministry is considering technical requirements.

References:

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Telstra partners with Starlink for home phone service and LEO satellite broadband services

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Australian telco Telstra announced this week that it has achieved a 5G uplink speed of 350 Mbps over 5G Standalone (SA) using sub-6 GHz frequencies in a live commercial network in partnership with Ericsson and Qualcomm. Telstra claims this as a new global record for 5G uplink speed, which is 100 times faster than the average 3G uplink speed.

Telstra’s new 5G SA uplink capability combines its mid-band spectrum holdings to create a 140MHz channel for sending data from the device to the network.

The tests were completed using a mobile test device powered by Qualcomm Technologies’ latest Snapdragon® 5G modem-RF System and an existing in-market NetGear Nighthawk M6 Pro Mobile Broadband device in the live commercial network on the Gold Coast.

The latest software from Ericsson brings together different combinations of frequency ranges and types to enable a single 5G uplink and downlink data channel.

By aggregating carrier bands, it considerably increases the uplink speeds, while the ability to use low band carriers in these combinations of frequencies delivers improved coverage and performance enhancements for the 5G SA Network.

Mr Amirthalingam says: “The uplink and downlink 5G data channels work together to provide a seamless and almost symmetrical like 5G service, meeting the increasing demand for data-intensive applications such as augmented and virtual reality, or sharing photos and memorable movie moments with friends.

“The technology also includes advanced features in the base station that can prioritise different types of data and applications and can support future differentiated services, like network slicing.”

“On top of this, Telstra also has the option to use the n5 (850MHz) carrier that is currently serving its 3G Network. “

“Our latest 5G Standalone uplink speed achievement is 100 times faster than the typical 3G uplink speed, which is great news for customers. Enterprise Applications such as these are increasingly becoming more uplink heavy with things like such as high-definition video surveillance cameras and the faster speeds and coverage will all provide a much better experience.”

“The ability to use low band frequencies and repurpose our 3G low band 850 MHz frequency to deliver 5G SA coverage when the 3G network closes on 30 June 2024, has the benefit of providing improved depth of coverage and enhancing the 5G experience for customers.”

“It’s a further example of how we are leading the way in 5G innovation and investment, and how we are committed to delivering the best and most advanced network for Australia.”

To test and validate this capability, Telstra worked with long-term partners Ericsson, the global leader in 5G network equipment, and Qualcomm, one of the world’s leading wireless chipset companies.

Emilio Romeo, Head of Ericsson Australia and New Zealand, says: “Ericsson’s latest software features enables Telstra to capitalize the full spectrum portfolio for a wider coverage whilst providing far superior data rates. Customers will be empowered to explore new experiences offered with 5G Standalone such as differentiated services and a range of applications, which will in turn drive network monetization.”

Durga Malladi, Senior Vice President and General Manager, Technology Planning & Edge Solutions Qualcomm Technologies, Inc., says: This live test proves that uplink carrier aggregation on 5G Standalone network has the potential to significantly increase upload speeds and capacity, thus unlocking new experiences for consumers.”

This latest achievement takes Telstra’s World-First count to 53 since the launch of 3G. It is only through its collaboration efforts with industry and its strategic partners, like Ericsson and Qualcomm, that it can deliver the technology innovation and leadership that its customers can benefit from.

……………………………………………………………………………………………………………………

Telstra has also implemented Ericsson’s Dynamic Network Slicing software for automated network orchestration. This software gives the operator a fully automated and monetizable network slicing orchestration capability to sell slicing services to enterprise customers.

………………………………………………………………………………………………………………

References:

Telstra’s T25 to extend 5G coverage and offer enhanced customer experiences

Telstra wins most lots in Australia’s 5G mmWave auction

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

The NGMN Alliance has issued the “ITU-R Framework for IMT-2030: Review and Future Direction.” In this essential publication, NGMN welcomes the recent ITU-R report on the ‘Framework and overall objectives of the future development of IMT for 2030 and beyond.’ This ITU-R report ( Recommendation ITU-R M. 2160) sets an important framework for future technology discussions towards 6G.

“Our publication underlines the importance of investment confidence for operators in order to deliver tangible value to customers while ensuring the commercial sustainability of current and future networks,” said Luke Ibbetson, Member of the NGMN Alliance Board and Head of Group R&D at Vodafone. “The capabilities identified for IMT-2030 should be able to be deployed as and when required, without compromising existing core connectivity services, and reflect a customer need that generates new value.”

There is close alignment between NGMN’s vision for 6G and the IMT-2030 framework. This close alignment covers vision, usage scenarios and essential capabilities, particularly related to practical and sustainable deployment and emphasizing harmonised global standards for mobile networks. NGMN goes on to provide recommendations and guidance on ITU-R aspects as it moves forward in the next stage of the IMT-2030 process, including:

- New features should be able to be deployed as and when required, without compromising existing core connectivity services, which reflect customer needs and generate new values.

- Evaluation should include interworking of IMT-2030 candidates with non-IMT systems.

- Reinforcement of the importance of global standards for mobile networks within industry consensus-based standards organisations (e.g., 3GPP).

- Consideration that advanced features introduced with the IMT-2020 network and/or a new radio interface might be candidates for IMT-2030.

- Any new radio interface must demonstrate significant benefits over and above IMT-2020 in key metrics such as spectral and/or energy efficiency, overall energy consumption reduction and/or cost advantages.

- Further work would be beneficial, as input to the process and next steps, to understand the commercial imperative for any extreme requirements of IMT-2030.

- IMT-2030 should continue to evolve based on IP communications, considering cloud native solutions, disaggregation, and service-based architecture, ensuring both forward and backward compatibility. Support for self-organisation to manage complexity and emerging capabilities.

“This publication provides a realistic evaluation of IMT-2030 technologies”, said Michael Irizarry, Member of the NGMN Alliance Board and Executive Vice President and Chief Technology Officer, Engineering and Information Technology, UScellular. “For a new IMT-2030 radio technology to become widely adopted for 6G, it must demonstrate significant benefits across key metrics such as energy efficiency, traffic capacity and cost reduction”.

“We at NGMN look forward to collaborative efforts with the ITU-R and subsequent phases of activity to shape the future of IMT-2030,” said Madam Yuhong Huang, Member of the NGMN Alliance Board and General Manager China Mobile Research Institute. She added, “We hope the industry will prioritize the development needs outlined by NGMN on behalf of its operator members and actively participate in 6G research, contributing novel technologies, unlocking innovative business opportunities, and enabling the sustainable development of the society for the benefit of our customers.”

Following the NGMN publications “6G Position Statement, an Operator View”, “6G Use Cases and Analysis”, “6G Drivers and Vision” and “6G Requirements and Design Considerations”, this latest publication “Analysis of ITU-R Framework for IMT-2030” marks the next step towards guidance for E2E requirements for 6G.

The publication can be downloaded here.

About NGMN Alliance:

The NGMN Alliance (NGMN) is a forum founded by world-leading Mobile Network Operators and open to all Partners in the mobile industry. Its goal is to ensure that next generation network infrastructure, service platforms and devices will meet the requirements of operators and ultimately will satisfy end user demand and expectations. The vision of NGMN is to provide impactful industry guidance to achieve innovative, sustainable and affordable mobile telecommunication services for the end user with a particular focus on Mastering the Route to Disaggregation / Operating Disaggregated Networks, Green Future Networks and 6G, whilst continuing to support 5G’s full implementation.

NGMN seeks to incorporate the views of all interested stakeholders in the telecommunications industry and is open to three categories of participants/NGMN Partners: Mobile Network Operators (Members), vendors, software companies and other industry players (Contributors), as well as research institutes (Advisors).

Collaboration is key to driving the industry’s most important subjects such as NGMN’s Strategic Focus Topics: Mastering the Route to Disaggregation, Green Future Networks and 6G. NGMN invites all parties across the entire value chain to join the Alliance in these important endeavors.

…………………………………………………………………………………………………………….

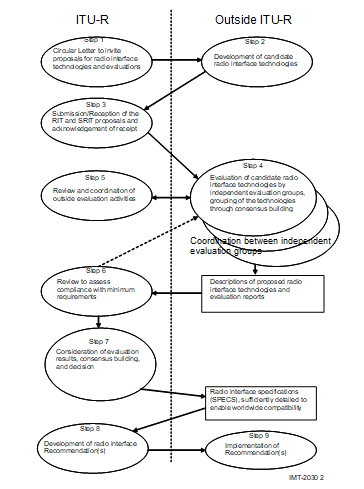

At its February 2024 meeting, ITU-R WP 5D produced a working document on the IMT-2030 process for standardization. The document describes the process and activities identified for the development of the IMT‑2030 terrestrial components radio interface Recommendations.

The time schedule for candidate RITs (Radio Interface Technologies) or SRITs (Set of Radio Interface Technologies is as follows:

Submission of proposals may begin at 54th meeting of Working Party (WP) 5D (currently planned to be 10-17 February 2027) and contribution to the meeting needs to be submitted by 1600 hours UTC, 12 calendar days prior to the start of the meeting.

The final deadline for submissions is 1600 hours Coordinated Universal Time (UTC), 12 calendar days prior to the start of the 59th meeting of WP 5D in February 2029. The evaluation of the proposed RITs and SRITs by the independent evaluation groups and the consensus-building process will be performed throughout this time period and thereafter.

…………………………………………………………………………………………………………………..

Editor’s Note: Don’t expect ITU-R M.[IMT-2030.SPECS] recommendation to be approved before sometime in 2031. The detailed specifications of each of IMT-2030 technology is scheduled for completion at ITU-R WP5D meeting #63 in June 2030. Draft revisions/spec updates are scheduled to be completed at 5D meeting #64 in October 2030.

Just as with 5G/IMT-2020, IMT-2030.SPECS will only cover the 6G RIT/SRIT (radio interfaces). 3GPP will do all the work on the 6G non-radio/systems aspects.

……………………………………………………………………………………………………………………

The seven steps in the IMT-2030 standardization process is shown in this Figure:

References:

NGMN publishes ITU-R Framework for IMT-2030: Review and Future Direction

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/Pages/default.aspx

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

IMT Vision – Framework and overall objectives of the future development of IMT for 2030 and beyond

Building and Operating a Cloud Native 5G SA Core Network

By Ajay Thakur with Alan J Weissberger

Abstract:

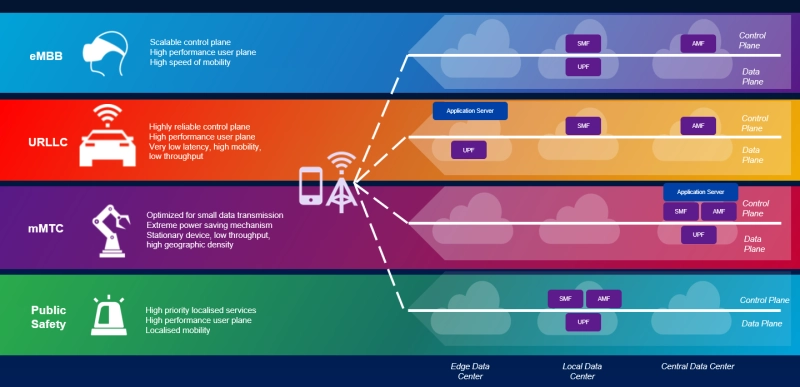

In this article, we endeavor to clarify some of the critical issues and questions related to implementing a cloud native 5G SA core network and how it differs from the traditional core network composed of hardware devices and software solutions. It’s important to note that NONE of the 3GPP defined 5G features can be realized without a 5G SA core. Those include: Network Automation, Network Function Virtualization, 5G Security, Network Slicing, Multi-Access Edge Computing (MEC), Policy Control, Network Data Analytics, etc.

Communication Service Providers (CSPs) will need to do things differently (than 4G) in order to implement and use a 5G cloud native SA core. Various cloud native 5G SA core aspects include network planning, deployment, software upgrades, network monitoring, hardware and platform upgrades.

These will be examined and contrasted with traditional implementations, such as the 4G Evolved Packet Core (EPC).

Introduction:

3GPP introduced 5G SA core network architecture in release 15. Since then numerous new features (work items) have been introduced to specifications. 3GPP’s 5G SA’s specifications use virtualization and cloud native principles as the foundation. A few key 3GPP Technical Specifications (TSs) for 5G system are the following:

- TS 22.261, “Service requirements for the 5G system”.

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)

- TS 32.240 “Charging management; Charging architecture and principles”.

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

- TS 38.300 “NR; NR and NG-RAN Overall description; Stage-2”

- TS 23.527 “5G System; Restoration procedures Stage-2”

5G SA tries to resolve the challenges faced by network operators in the EPC deployments and how those challenges can be mitigated with new design.

Several important changes in the 5G SA core are support for a Service Based Architecture and Cloud Native implementation of 5G SA core. That will enable new 5G features and functions like Network Slicing, 5G Security, and MEC, among others.

To reap the benefits of Cloud Native SA, CSPs are required to adapt to new cloud native principles of network deployment, operation and monitoring. We shall examine various aspects of Life Cycle Management of 5G SA software and also ask some open ended questions on each aspect.

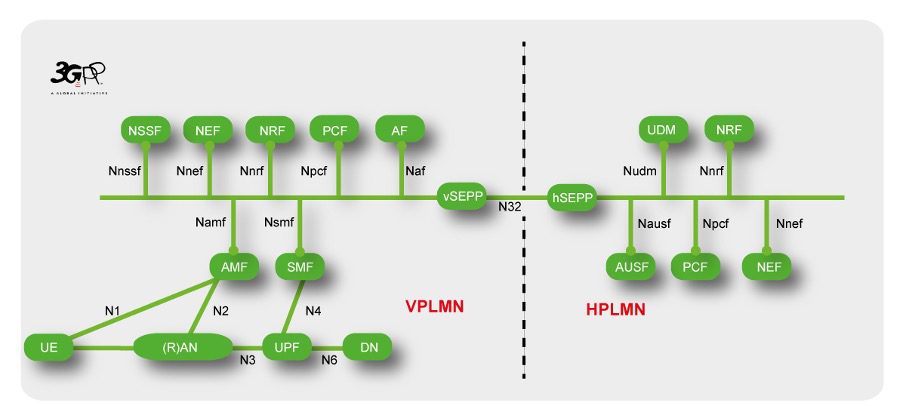

SBA architecture Diagram with multiple Interfaces:

- The Network diagram above shows the SBI interfaces in case of roaming. Each of the individual NF may be composed of one more micro-services. Each NF may come from different vendor. Since these NFs are available in containerized format, they may or may not share the same container orchestration platform.

Network Dimensioning:

- 5G SA solves the network expansion problem since the network can be scaled up/down by adding/removing commercial off the shelf hardware.

- Once we have all the NFs software releases available, operators can gather the compute, memory & network requirements for deployment.

- Operators would rely on auto scaling functionality provided by the 5G NF vendors to avoid over provisioning at the start. This is relatively much simpler compared to adding dedicated hardware for NF in case of EPC.

Deployment Options Selection/Planning

- Operators need to decide the type of deployment for the network like the 5G SA deployment on public cloud or on private cloud.

- Along with Public vs Private cloud decisions, the Operator also needs to decide on a Container orchestration engine. Container orchestration can be managed service or operator managed service. Popular container orchestration engine is Kubernetes (K8s).

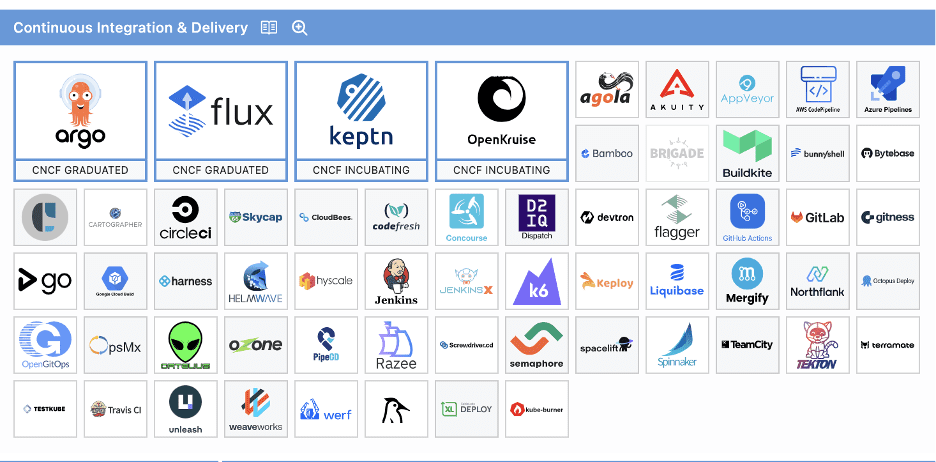

- Next step would be to finalize or select one of the CI/CD tools which works for all the vendors and integrate that with the container orchestration platform.

- Also placement of the NFs needs to be decided, e.g. User Plane Function (UPF) could be on-prem close to RAN. It’s possible that the operator may place some of the RAN virtualized components in the cloud.

- These all are important decisions to be made before getting into the real deployment of the software.

- Some of the aspects here are due to Cloud Native 5G SA and were not applicable for EPC.

CI/CD:

- CI/CD landscape (https://landscape.cncf.io/) from CNCF shown in below Figure

- It can be seen from the CNCF project that there are many projects which are available for CI/CD

- Irrespective of Public or Private cloud, operators need to follow cloud native CI/CD principles for deploying the Core Network in the Cloud environment. CI/CD involves taking the software release from the vendor and running it against existing network functions and carrying out some minimum tests and once operator is satisfied with evaluation of the release then rollout the release in the network.

- Operators can decide to have a separate staging environments where new releases can soak for a certain period of time while few subscribers use the new release.

- CI/CD gives the option of rolling back the release if the operator is not happy with the performance of the new release.

- Now the challenge here would be, will the operator have single CI/CD tools used for deploying all the vendors’ solution OR would the operator use its own CI/CD tooling and integrate NFs from vendor it in its own environment. This is the decision the operator needs to take.

- Having Automated CI/CD infrastructure which takes the software releases from the vendors and passes it through multiple environments and all the way to the production environment is key.

- Without having an appropriate CI/CD environment it would be very difficult to manage all micro-services and their deployments.

- Public Cloud may come with inbuilt CI/CD solutions and would be easy for operators to start with.

- AWS offers multiple services around CI/CD and those are listed here – https://docs.aws.amazon.com/whitepapers/latest/cicd_for_5g_networks_on_aws/cicd-on-aws.html

- Azure offering can be found here https://learn.microsoft.com/en-us/azure/devops/pipelines/apps/cd/azure/cicd-data-overview?view=azure-devops

- Google Cloud CI/CD services can be found here – https://cloud.google.com/solutions/continuous-integration

Software Upgrade:

- Cloud Native 5G SA allows operator to upgrade some of the components easily instead of complete 5G Core update in one go. CI/CD framework would help in the software upgrades with minimal human intervention.

- Note that with Cloud Native principles the operator would get multiple patch/minor releases and may be some major releases throughout the life cycle of the software. So the traditional approach of pulling down complete hardware & upgrading it with new software is not required for microservice based solutions. But this really works as long as all microservices are truly built stateless and supports live upgrade.

- As an operator, it would be required to know the impact of each upgrade package and prepare for rollback in case something goes wrong during the upgrade cycle.

Network Monitoring:

- Traditionally, operators developed their own Network Monitoring solutions to monitor the health of EPC since there was no standard mechanism to get the metrics, statistics from the NFs,

- 5G SA follows Cloud Native principles; it is easy to get the logs, statistics, alerts, alarms from all microservices in a consistent manner. There are common tooling used by most of the cloud native applications and CNCF has multiple projects in these categories.

- CNCF supported Monitoring projects are shown below figure

-

- Tracing is important aspect to find out the bottleneck in the performance.

- Logging has been a traditional approach for debugging network issues. Below are the projects offered by CNCF in the logging area

- Public Cloud providers can extend the monitoring easily by generating Texts or email alerts as per CSPs needs.

- Operators can define their policies to retain the network performance monitoring output for a long time and can take backup of this easily through use of Public Cloud Providers data backup services.

- In the case of EPC these mechanisms were product dependent.

- Challenge in case of 5G SA would be each NF vendor may end up in using different tool and operators would have some challenges to converge all NF vendors to the common tooling.

Hardware & platform upgrade:

- In the traditional approach, providing hardware with updated operating systems and platforms was the responsibility of the equipment vendor. Now this responsibility has gone into either operator’s hand or sometimes in Public Cloud Provider’s hand. It depends on if the 5G SA is deployed on on-prem or on public cloud. Operators need to carefully plan for these upgrades without causing any downtime and of course follow the rolling upgrade patterns to avoid updating multiple entities at a time.

- If managed container orchestration is used, then these upgrades are seamlessly handled by Public Cloud Providers.

Vendor Lock In:

- In the case of EPC, vendor lock in was specific to NF & Radio Vendors. The 3GPP EPC specification allows the operators to swap NFs from one vendor with another and as long as NF supports the required Services. Point to note that this is less costly replacement compared to replacing one vendor with another vendor when NF had associated hardware.

- But with cloud native SA there is a chance that the operator may end up in building the tooling (CI/CD, monitoring etc.) over the period of time and this may lead to cloud provider lock in.

Conclusions:

The 5G SA core network provides a lot of flexibility and automation via cloud native deployments. However, the 3GPP 5G core specs contain a lot of implementation options, which network operators and their vendors must select to properly deploy a 5G core network. Making those decisions will likely require solid experience with operating applications on a cloud native platform. And that may be a reason that 5G SA core network rollouts have been so slow.

In the U.S. AT&T and Verizon have taken a very cautious approach to deploying their long ago promised 5G SA core networks. During the Brooklyn 6G Summit in November 2023, Chris Sambar, EVP for technology at AT&T said, ““I would say we are not moving as quickly as some of the other operators on the 5G standalone core, but we see the use cases that are coming, we understand when they’re coming, so we’re being very purposeful about getting there when we need to get there.” That’s despite AT&T outsourcing its 5G SA core network deployment to Microsoft Azure in June 2021. Yet Microsoft is the world’s second biggest cloud services provider with tons of experience running cloud native applications.

Summing up, Dave Bolan, Research Director at Dell’Oro Group wrote, “The buildout of 5G SA networks is going slower than anticipated which is restraining growth in the marketplace. To date, we count fifty 5G SA eMBB (enhanced Mobile BroadBand) networks that have been commercially deployed worldwide by Mobile Network Operators (MNOs). We counted 18 new 5G SA networks in 2022, but only 12 were launched in 2023. On a positive note, we believe a lot of work has been done in the background, preparing for 5G SA launches by Mobile Network Operators (MNOs) and we expect 2024 to have more launches than 2022.”

Ajay Lotan Thakur, Cloud Software Architect at Intel and IEEE Techblog Editorial Team member

References:

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Ericsson Mobility Report touts “5G SA opportunities”

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

Samsung and VMware Collaborate to Advance 5G SA Core & Telco Cloud

5G SA networks (real 5G) remain conspicuous by their absence

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

Years after 5G network slicing was hyped to the sky (see References below dating from 2028), BT Group, Ericsson and Qualcomm Technologies, Inc. have successfully demonstrated end-to-end consumer and enterprise 5G differentiated connectivity enabled by 5G network slicing on Ericsson’s 5G Core and Radio Access Network technology in the UK with devices powered by the Snapdragon ® 8 Gen 2 for Galaxy Mobile Platform.

The trial, which took place at Adastral Park, BT Group’s home of research and innovation, established network slices for Gaming, Enterprise and Enhanced Mobile Broadband (eMBB), and showed how, by allocating a portion of the 5G SA network to provide dynamic partitions for specific use-cases, optimal performance can be maintained for bandwidth-heavy activities including mobile gaming and video conferencing even during peak times.

Mobile gaming is experiencing relentless growth, with traffic on EE’s network almost doubling since the beginning of 2023 to more than two petabytes of data every month. With consistent low-latency, jitter-free and immersive experiences increasingly essential to the gaming experience, network slicing is expected to be a key enabler of performance and growth in the 5G SA era.

Together, BT Group, Ericsson and Qualcomm Technologies demonstrated an optimal mobile cloud gaming experience on Nvidia’s GeForce Now, maintaining a throughput comfortably in excess of the recommended 25 Mbps at 1080p even when a background load was generated. The companies initiated a gaming session on Fortnite using the Samsung S23 Ultra device, equipped with the Snapdragon 8 Gen 2 for Galaxy Mobile Platform, and Ericsson implemented Network slicing along with the Ericsson RAN feature Radio Resource Partitioning on EE’s Network to achieve a smooth experience. The experience was simultaneously compared to a non-optimised eMBB RAN partition, which was congested by the background load, resulting in a less than optimal gaming experience.

The trial also validated the potential of network slicing for BT Group’s business customers. Using the enterprise and eMBB slices, configured via URSP rules which enables a device to connect to multiple network slices simultaneously depending on the application, it demonstrated consistent 4K video streaming and enterprise use-cases using the Samsung S23 Ultra device, powered by Snapdragon 8 Gen 2 for Galaxy. Enterprise communications platforms and video applications such as YouTube require a stable connection and low jitter to work well. The Ericsson 5G RAN Slicing feature, Radio Resource Partitioning, was enabled to ensure the enterprise traffic to achieve an optimal experience.

5G network slicing requires a 5G SA core network. It supports these diverse services and reassigns resources as needed from one virtual network slice to another, making the one-size-fits-all approach to service delivery obsolete.

Image courtesy of Viavi

Greg McCall, Chief Networks Officer, BT Group, said: “Network slicing will enable us to deliver new and improved capabilities for customers in the 5G SA era. As we work diligently towards the launch of our own 5G SA network, today’s successful demonstration of how slicing enables us to differentiate Quality of Service to guarantee performance for different segments is a significant milestone, and illustrative of the new services that will be enabled by 5G SA.”

Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA of Qualcomm Europe, Inc., said: “We are proud to collaborate with BT Group and Ericsson on the network slicing trial, which used a device powered by the Snapdragon 8 Gen 2 for Galaxy mobile platform. Together, we showcased the enhanced performance and flexibility 5G Standalone capabilities, such as network slicing, will bring to consumers and enterprise experiences.”

Katherine Ainley, CEO, Ericsson UK & Ireland, said: “5G standalone and network slicing demonstrates that leading operators like EE will be able to offer customers tailored connectivity with different requirements on speed, latency and reliability for specific applications, such as video streaming and gaming. This ultimate next step in connectivity will enable new service offerings for consumers and businesses who require premium performance, while helping to drive future market growth and innovation for the UK in a wide range of new industries.”

References:

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

https://www.viavisolutions.com/en-us/5g-network-slicing