Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Orange-Spain has deployed a commercial 5G SA network in several cities, with more to follow this year. The network will be available in Madrid, Barcelona, Valencia and Seville. The network operator claims it is the first network operator to deploy a commercial 5G SA network in Spain which is called 5G+. 90% coverage is promised in these cities, and more locations are going to be plugged in over the course of 2023.

There will be no extra charge for Orange users to use 5G+, but initially at least they’ll need either a Samsung S22, Xiaomi 12, Xiaomi 12T, S22+, S22 Ultra or Xioami 12 Pro series handset to connect to it.

Orange says it has spent €531 million buying up 5G frequencies in all bands throughout the various auctions from 2016 to the most recent one in December 2022, and we’re told it is the operator with the most spectrum in the 3.5 GHz band.

Orange already deployed 5G services in 1,529 towns and cities in 52 provinces across Spain, surpassing its initial target for the full year. The telco has chosen the following 5G SA vendors:

- Ericsson’s 5G SA core network for Belgium, Spain, Luxembourg and Poland

- Nokia’s 5G SA core network for France and Slovakia, and Nokia’s Subscriber Data Management for all countries

- Oracle Communications for 5G core signaling and routing in all countries

Opinion:

Orange-Spain refers to its 5G SA network as 5G+, implying an enhanced form of 5G which it is not! It is true 5G because you don’t get any 5G features/functions with 5G NSA. The Orange press release describes 5G SA as a ‘standard that completes the deployment of 5G technology’ – which is only partially true, because there is no standard for 5G SA.

5G+ is also good news for business customers, as per the press release:

“In addition, for enterprises, 5G+ meets the need for flexible, scalable, reliable and secure connectivity for real-time applications. Through its network slicing capability, Orange’s network will be able to offer virtual networks that will be responsible for allocating the necessary network resources to guarantee the provision of critical services or meet specific customer needs, offering different levels of quality, availability, privacy and security.”

Orange Spain is currently offering 5G services through frequencies in the 3.5 GHz and 700 MHz bands. Last year, when Orange announced its deployment of 5G in the 700 MHz band, it said it would offer this technology progressively over the course of 2022 in more than 1,100 towns and cities, 820 of them having between 1,000 and 50,000 citizens.

In the last spectrum auction, Orange secured 2×10 megahertz in the 700 MHz band, which adds to the 110 megahertz in the 3.5 GHz band already owned by Orange. The company invested a total of 523 million euros (currently $559 million) in the acquisition of these frequencies.

Why have 5G SA rollouts been so slow?

The move from NSA to SA 5G architecture is incredibly complex – seemingly more so than initially anticipated by operators around the world. In the UK, for example, BT’s CTO Howard Watson described the shift as a “sea change in the underlying architecture” late last year, telling journalists the company would take their time to ensure a smooth transition.

Meanwhile, the global economic situation is making network rollouts more expensive and reducing customer spending, leaving operators unsure if they will be able to get a quick return on investment.

As a result, we are left with a mobile industry in no major hurry to upgrade to 5G SA, but is instead happy to bide its time and wait to learn lessons from early adopters – including Orange. For these reasons, the marketing around 5G SA and also mmWave is going to be tricky for wireless network operators who are not familiar with the inner workings of the industry and the particulars of how this roll out was executed, and who may simply assume they already bought 5G years ago.

References:

https://telecoms.com/519893/orange-spain-switches-on-5g-sa-network-dubbed-5g/

https://totaltele.com/5g-orange-launches-5g-standalone-in-spain/

Technavio: Wireless access point market to grow at a CAGR of 6% 2022-2027

According to Technavio, the global wireless access point market size is estimated to grow by USD 6,961.75 million from 2022 to 2027. The market is estimated to grow at a CAGR of 6% during the forecast period. Moreover, the growth momentum will accelerate. North America will account for 32% of the growth of the global market during the forecast period. The report includes historic market data from 2017 to 2021.

The report also provides a comprehensive analysis of growth opportunities at regional levels, new product launches, the latest trends, and the post-pandemic recovery of the global market.

Market Definition:

- A wireless access point is a computer networking device that connects a wireless device and a wired network using a wireless standard such as Wi-Fi or Bluetooth.

- As a standalone device, a wireless access point is often linked to a router through a cable

- An access point is a networking hardware device that delivers and receives data on a wireless network

- An access point links users to other users on the network and acts as the point of connection between the WLAN and a fixed wire network

- Within a given network region, each access point can serve numerous users

- When a person goes outside the range of one access point, they are unavoidably handed over to the next access point

- A single access point is needed for a tiny WLAN

- The number required grows in direct proportion to the number of network users and the structural size of the network.

Key factor driving market growth:

- The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period.

The report provides actionable insights and estimates the contribution of all regions to the growth of the global wireless access point e growth of the global market during the forecast period. This growth is attributed to factors such as the increase in the use of the Internet and smartphones. The demand for bring-your-own-device (BYOD) solutions is also increasing in the region. In addition, the rising demand for 5G network acceleration has enabled firms and telecom component providers to develop advanced telecom infrastructure and related components. These factors will fuel the growth of the wireless access point market in the region during the forecast period.

Leading trends influencing the market:

1. The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period

2. The increase in 5G investments is a key trend in the global wireless access point market.

- The rise in these investments in 5G is creating a demand for 5G network infrastructure.

- Telecom service providers and network equipment providers will have to offer routers that will enable carriers to provide 5G services.

- Thus, an increase in investments in 5G will increase the adoption of devices such as wireless routers, which, in turn, will support the growth of the market during the forecast period.

The increase in the development of smart cities is a key factor driving the growth of the global wireless access point market. Across the world, governments are investing billions of dollars in the construction of smart cities or linked cities. This necessitates the use of public Wi-Fi networks to provide customers with services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare. It also offers LBS to city planners in order to obtain insight into how its residents live and how a smart city operates in order to deliver better services to people living in smart cities. As a result, there will be a high demand for wireless access points to be deployed in smart cities.

The government of China is focusing more on urbanization and the development of smart cities in its five-year plan. The development of a smart city includes identifying an urban area and facilitating economic growth and improved quality of life with technologies such as Wi-Fi connectivity. The databases and network systems here are connected to cameras, sensors, and control systems, where technology would be used for allocating services, managing traffic, and inventory, and managing and transferring information. Hence, with the development of smart cities, the market is expected to witness growth during the forecast period

The increase in 5G investments is the primary trend in the global wireless access point market growth. 5G is the next generation of communication technology, following 4G, and on commercialization, 5G will support data download speeds of 10,000 Mbps. There have been numerous investments in 5G across the world. The increasing investments in 5G are creating demand for 5G network infrastructure.

This is expected to accelerate the growth of the market during the forecast period. Such product launches enable telecom service providers and network equipment providers to offer routers, enabling carriers to provide 5G services. Thus, an increase in investments in 5G will propel the adoption of devices, including wireless routers, which will result in the growth of the market during the forecast period.

Major challenges hindering market growth:

- Latency issues are challenging the growth of the global wireless access point market.

- In remote areas, the quality of networks is low. Hence, mobile network operators need to build solutions to offer connectivity to IoT devices.

- This can impact the consumer segment, as individual consumers do not have access to high-speed Internet everywhere.

- Moreover, in countries with low internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow.

- Hence, low internet speeds and latency issues are negatively impacting the adoption of routers and APs.

- These factors will impede the market growth during the forecast period.

The latency issues are a major challenge for the growth of the global wireless access point market. The Internet is the backbone of the IoT devices market. IoT devices require reliable, high-speed internet connectivity to function effectively. Although many countries have advanced internet infrastructure, but in suburban areas and highways, where the quality of the network is usually poor, mobile network operators need to build solutions to offer connectivity to IoT devices in these areas. This challenge has the highest impact on the consumer segment, as individual consumers cannot have access to high-speed Internet everywhere.

Low internet speeds and latency (time taken by the data packet to travel between devices in a network) are affecting the adoption of routers and APs among consumers. Singapore has the fastest average download rate at 256 Mbps, followed by Hong Kong at 254 Mbps and Romania at 232 Mbps. Hence, the adoption of wireless APs is expected to be high in these countries. However, in countries with lower internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow, which creates latency issues and is expected to hinder the growth of the market during the forecast period.

Key Wireless Access Point Market Customer Landscape:

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

………………………………………………………………………………………………………………………………………

Methodology:

Technavio categorizes the global wireless access point market as a part of the global communications equipment market within the overall global information technology sector. The parent global communications equipment market covers manufacturers of enterprise networking products, including LANs, WANs, routers, telephones, switchboards, and exchanges. Technavio also includes communications infrastructure or telecom equipment market within the scope of the communications equipment market. Our research report has extensively covered external factors influencing the parent market growth during the forecast period.

……………………………………………………………………………………………………………………………………….

References:

Huawei reinvents itself via 5G-enabled digitalized services to modernize the backbone of China’s industrial sectors

In northern China sits Tianjin port’s “Smart Hub” – a fully digitalized and automated wharf where quay cranes, gantry cranes, stackers and forklifts are all controlled by a command center miles away. Powered by Huawei Technologies’ 5G telecommunications infrastructure, the smart port can move 36 20-foot equivalent units (TEU) per hour, much faster than humans.

“Digitalization is the industry trend, a direction not just for Chinese ports, but for all global ports,” Yang Jiemin, vice- president of Tianjin Port (Group), said during a recent visit by the South China Morning Post. “Our goal is to build a digital twin to Tianjin port in the next three to five years,” he added. The benefits of automation are clear. A staff of 200 operators and engineers can manage 1 million TEU in annual throughput at Tianjin port’s Terminal C, about 25 per cent of the employees needed in a typical year during its pre-digital age. The future has more in store: artificial intelligence (AI) for predicting congestion, big data analysis for parsing traffic trends and driverless trucks – all made possible by the ultra-fast exchange of data in 5G networks.

Shenzhen-based Huawei, with 195,000 employees in 2021 and one of the world’s largest research budgets, surpassing even that of Google and Microsoft, is now promoting the advantages of 5G-enabled digitalized services to modernize the backbone of China’s industrial production in coal mines, ports and even hospitals.

As U.S. sanctions tightened around Huawei’s access to critical technology, the firm’s smartphone business, which beat Apple to become the world’s second-biggest smartphone maker in 2018, came under tremendous pressure. Deprived of Google’s Android operating system and short of vital components, it sold its Honor budget smartphone business in 2020, the biggest driver behind its spectacular success. Huawei then pivoted back to its mainstay enterprise business, opening up new data-heavy products and services for customers to increase their usage and dependence on its 5G infrastructure.

The company established “legions” to spearhead the effort, a nod to the military parlance much liked by founder Ren Zhengfei, who served in the People’s Liberation Army. These cross-departmental business units were established to help clients digitally transform their products and services in mining, customs clearance and ports, energy savings at data centres, smart highways and the photovoltaic industry.

Last June, Huawei added five legions, bringing the total to 20. While it has not disclosed details about each legion, the chief executive of its airport and road legion, Li Junfeng, said the company was hopeful about the digitalization of transport.

“Airports and roads are also key infrastructure and it is difficult to expand in the overseas market. So we do not have plans for global expansion in the short term, but we will make some changes next year,” Li said in November, according to the state-owned Securities Times financial newspaper.

For Huawei, hopes are high that such industrial infrastructure can turn into a source of steady revenue – at least domestically – although the firm has declined to divulge the financial details of its showcase applications.

Huawei’s efforts to forge deeper ties with traditional industries build on its past work with the world’s private enterprises, leveraging its 5G connectivity and computing power to automate and upgrade various verticals, says Matthew Ball, chief analyst at research firm Canalys.

“Overall, this is an extension of what Huawei has done for years, even before the US sanctions, particularly its enterprise business, which had a strong vertical focus on delivering solutions across its portfolio,” Ball said.

“It’s just that its smartphone business has received more headlines.”

The jury is still out on whether Huawei can survive US sanctions, especially given Western reluctance to allow it future access to potentially sensitive data and network infrastructure contracts on national security grounds. The company has already undergone huge change since Trump added it to a trade blacklist in May 2019, barring it from doing businesses with US partners without special permits.

Huawei’s rotating chairman, Eric Xu, said in a new year’s message that the company had exited “crisis mode” and was ready to go “back to business as usual” in 2023. The bleeding has been staunched after it reported preliminary revenue of 636.9 billion yuan (HK$736.3 billion) for 2022, little changed from the previous year.

The pressure remained on Huawei even after Trump lost his re-election bid. Reports emerged last month that Joe Biden’s administration was considering cutting off Huawei from all its US suppliers, including Intel and Qualcomm, which produce the semiconductors critical to the company’s telecoms gear.

Huawei has been reporting its annual results since 2000 even if it is not subject to public disclosure regulations, a practice from bidding for tender contracts in public telecoms networks.

The share of China revenue in its overall business has increased from about half in 2018 to around two-thirds in 2021 due to a retreat from almost all overseas markets, including the Asia-Pacific, the Americas and Europe, the Middle East and Africa, according to its results.

Its consumer business, mainly smartphones and devices, has been hobbled by a lack of access to advanced chips.

At one point, Huawei briefly surpassed Apple and Samsung Electronics to become the world’s biggest handset vendor, but it is now out of the top five. By the third quarter of 2022, it finally ran out of less advanced in-house- designed semiconductors for its handsets.

Huawei’s carrier unit, once its bread-and-butter business of selling telecoms gear, has slipped as China’s telecoms operators gradually complete network upgrades. In 2021, its carrier business revenue was 40 per cent lower than in 2019 when China began 5G infrastructure installation.

That leaves enterprise as the only segment with growth, notching up a 2.1 per cent revenue increase in 2022, although its contribution was still less than one-sixth of total sales.

At the beginning of 2021, Huawei founder Ren told employees the company must make cloud computing its priority, and personally endorsed the firm’s partnership with coal mines.

The company is developing customized 5G mobile base stations for the mining industry that are resistant to dust, dampness and even shock waves from explosions. These devices are expected to support stable and fast upload of real-time data from unstaffed machinery, sensors and high-definition cameras, which would help China’s most dangerous industry cut back on the number of people working in the pits. The mining industry would be the first to use the model where scientists and experts from different corporate departments could come together to find solutions to specific industry problems, Ren said in 2021 in the Shanxi provincial capital of Taiyuan.

Enhancing end-to-end user experience, real-time processing of massive data and the operation, maintenance and management of complex networks would all become challenges for the financial industry in the future, according to a June speech by Cao Chong, the head of Huawei’s digital finance legion, the Securities Times reported.

Huawei has also made a foray into the electric-vehicle sector, with the high-profile launch of Aito cars, a brand launched jointly with Chinese electric-car maker Seres. However, competition is cutthroat in China, and Huawei ranked only sixth among the country’s electric-vehicle start-ups with a total of 76,180 units by the end of 2022. The company has also forged ties with a series of carmakers offering smart car components.

The change in Huawei’s business is visible to consumers. On the ground floor of its Shenzhen flagship store, a three-storey building with a huge glass facade, customers approached a row of Aito cars during a recent visit, asking sales representatives about vehicle specifications and available discounts. At the other end of the showroom, Huawei’s latest smartphones and tablets were on display on long wooden tables. While analysts are generally sanguine on Huawei’s new enterprise business moves, the digitalization push is not expected to result in a short-term revolution.

“The enterprise business should be able to generate rapid growth in the next five to 10 years,” said Ivan Lam, a senior analyst at Counterpoint Research. But the threat of US sanctions remains the biggest obstacle for Huawei, according to Lam, especially for products that require advanced computing power such as smartphones, servers and car components.

“Huawei has never treated existing sanctions as the last, and it has been preparing for new restrictions in various ways, such as adoption of domestic technologies. We expect Huawei to reap the benefits of these efforts in coming years and close the gap in key technologies,” ” Lam said.

……………………………………………………………………………………………………………………………………………………………………………………………….

Separately, the South China Morning Post reported that Huawei Technologies Co chief financial officer Meng Wanzhou, daughter of company founder and chief executive Ren Zhengfei, is expected to take her turn as “rotating chairwoman” in the company from April, according to local media reports, signalling that a succession plan looks to be in place at the struggling Chinese telecommunications giant.

It would mark the first time that Meng, 50, has assumed the role since she was added as one of three rotating chairmen at Huawei in March last year, alongside Eric Xu Zhijun and Ken Hu Houkun. Xu’s current acting chairman term started on October 1 last year and will conclude on March 31.

During her six-month turn as the company’s top leader, Meng, who also serves as deputy chairwoman at Huawei, will head the company’s board of directors and its executive committee.

Meng was hailed as a national hero upon her return to China in a chartered flight in September 2021, following nearly three years under house arrest in Canada where she fought extradition to the US over a bank fraud case. Under a deal reached with US prosecutors, that case and other charges against Meng were dismissed last December.

References:

FCC grants Amazon’s Kuiper license for NGSO satellite constellation for internet services

On February 8th, the U.S. Federal Communications Commission (FCC) approved, subject to conditions, the application [1.] of Amazon’s Kuiper Systems LLC (Kuiper) for modification of its license for a non-geostationary orbit (NGSO) satellite constellation providing Fixed-Satellite Service (FSS) and Mobile Satellite Service (MSS) using Ka-band radio frequencies.

Specifically, the FCC granted Kuiper’s request for approval of its updated orbital debris mitigation plan, thereby satisfying a condition of our action in 2020 conditionally granting Kuiper’s request to deploy and operate its NGSO system. This FCC action will allow Kuiper to begin deployment of its satellite constellation in order to bring high-speed broadband connectivity to customers around the world.

Note 1. See Kuiper Systems Request for Modification of the Authorization for the Kuiper NGSO Satellite System, IBFS File No. SAT-MOD-20211207-00186 (filed Dec. 7, 2021). Kuiper is a wholly-owned subsidiary of Amazon.com Services (Amazon).

………………………………………………………………………………………………………………………………………………………………………….

In 2020, the FCC had granted Amazon’s Project Kuiper permission to deploy 3,236 satellites aimed at closing the digital divide. But the project has been delayed due to concerns about its orbital debris. This week the FCC said it is requiring Kuiper to comply with a series of orbital debris conditions.

The FCC announcement also contained reference to an apparent objection to the order by satellite rival Space X and others that seemed to want to limit an expansion of Kuiper’s constellation, but the regulator apparently wasn’t having nay of it: “When the Commission applied the 100 object-years condition in the SpaceX’s Gen2 Starlink Order, SpaceX had already launched thousands of satellites and had data reflecting its actual satellite failures, which was used to inform the Commission’s approach to satellite reliability monitoring for the Gen2 Starlink system.”

“The Commission noted that the 100 object-years metric was new and untested, but reasoned that an incremental approach based on a clear benchmark was appropriate in the context of a planned deployment that is at a scale not previously undertaken and also untested. As Kuiper has not started deploying or operating its constellation, we find it is not be necessary to impose such a condition at this time.”

Last October, Amazon switched the launch of its first Kuiper satellites – Kuipersat-1 and Kuipersat-2 -from the RS1 rocket in development by ABL Space to the debut flight of the Vulcan rocket from United Launch Alliance, the joint venture of Boeing and Lockheed Martin. That delayed the launch till 2023 (it still hasn’t happened), but with this legal hurdle now overcome it looks set to launch satellites unabated using any rocket it choses, including from Jeff Bezos owned Blue Origin.

References:

DA-23-114A1.docx – Federal Communications Commission

https://www.fcc.gov/document/international-bureau-grants-kuiper-satellite-modification

https://telecoms.com/519860/fcc-gives-nod-to-amazon-kuiper-broadband-satellite-deployment/

OpenVault: U.S. broadband users on 1-Gig tiers climbed to 26% in Q4 2022

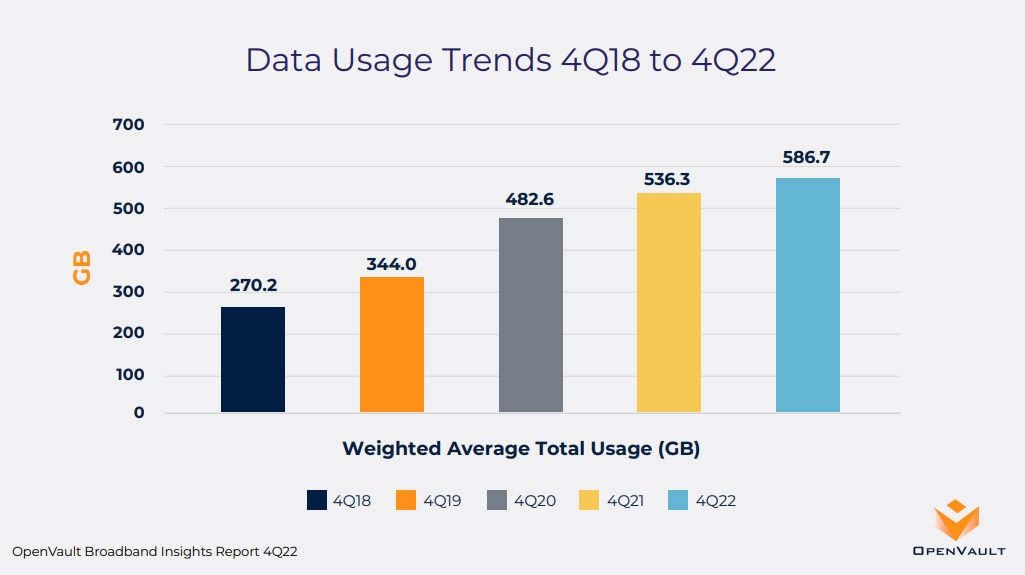

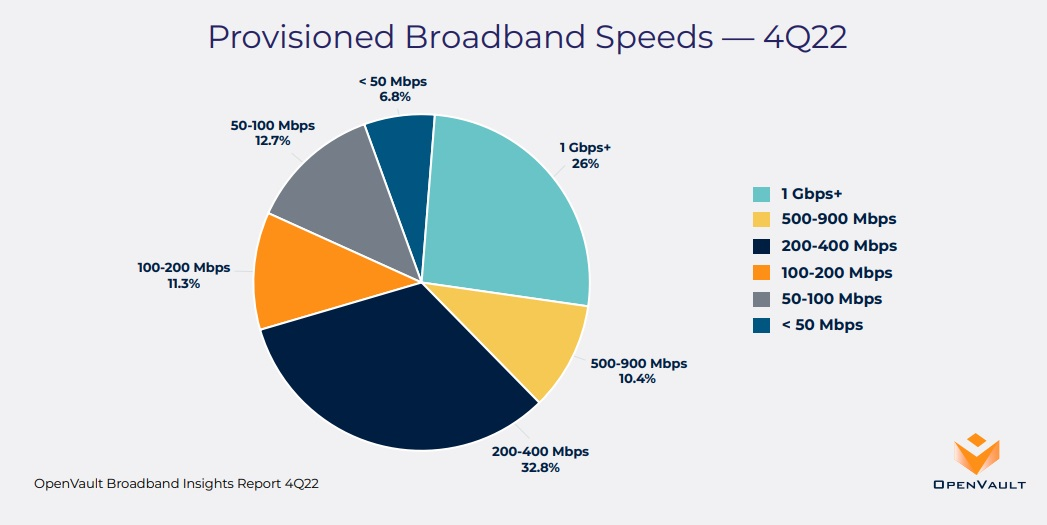

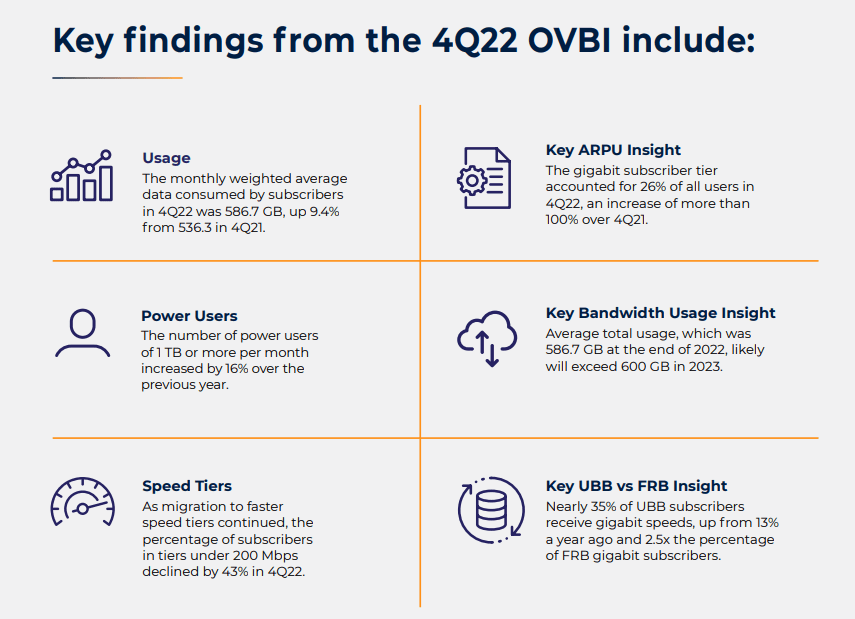

The 4Q22 edition of the OpenVault Broadband Insights (OVBI) report indicates that average household broadband consumption neared 600 GB per month, the percentage of subscribers on gigabit tiers more than doubled, and usage by participants in the FCC’s Affordable Connectivity Program (ACP) continued to outpace that of the general population. OpenVault expects household data usage to surpass 600GB by Q4 2023 and possibly reach 1 terabyte by the end of 2028.

Editor’s Note: OpenVault bases its findings on data from “millions” of individual broadband subscribers that are collected and aggregated from a software-as-a-service broadband service management tool in use by a wide range of ISPs. The data is used to pinpoint usage patterns, including the differences between two key categories: subscribers on flat-rate billing (FRB) plans that offer unlimited data usage and those on usage-based billing (UBB) plans, on which subscribers are billed based on their bandwidth consumption. OpenVault data is used for benchmarking purposes by the Federal Communications Commission (FCC) in specific comparative analyses.

…………………………………………………………………………………………………………………………………….

With broadband consumption on the rise, there’s been an increase in “power users” – households that use more than 1TB of data per month. The percentage of users at that level rose 18.7% year-over-year. “Super power users” – those consuming 2TB or more per month – climbed 25%, from 2.7% to 3.4%. That’s a nearly 30x increase within the past five years, OpenVault said.

- European average data usage (268.1 GB) grew 12.5% from a year ago, a faster pace than the North American annual growth rate of 9.4%.

- North American median data usage (396.6 GB) was more than 2.5x that of European median data usage (148.2 GB) in 4Q22, a slightly smaller difference than observed in 4Q21.

………………………………………………………………………………………………………………………………………………………………………………..

The percentage of U.S. broadband subs on 1-Gig (or higher speed) tiers climbed to 26% in Q4 2022, more than double the 12.2% observed in the year-ago period, OpenVault. As broadband speeds increase, the percentage of broadband customers provisioned for speeds of 200 Mbit/s or less is on the decline – 31% at the end of 2022, down 43% year-over-year, OpenVault found. Adoption of gigabit speeds has jumped significantly among Usage Based Billing (UBB) subscribers, increasing to almost 35% in 4Q22 from 13.4% in 4Q21.

OpenVault found that average data usage in households on the FCC’s Affordable Connectivity Plan (ACP) continues to outpace the field. In Q4, average usage in ACP households was 688.7GB, 17% higher than the broader average of 586.7GB. OpenVault has observed that some households in the ACP program use the funds to upgrade to faster speed packages.

References:

https://openvault.com/resources/ovbi/ (register to download the report)

OpenVault: Broadband data usage surges as 1-Gig adoption climbs to 15.4% of wireline subscribers

Ookla: Fixed Broadband Speeds Increasing Faster than Mobile: 28.4% vs 16.8%

MoffettNathanson: 87.4% of available U.S. homes have broadband; Leichtman Research: 90% of U.S. homes have internet

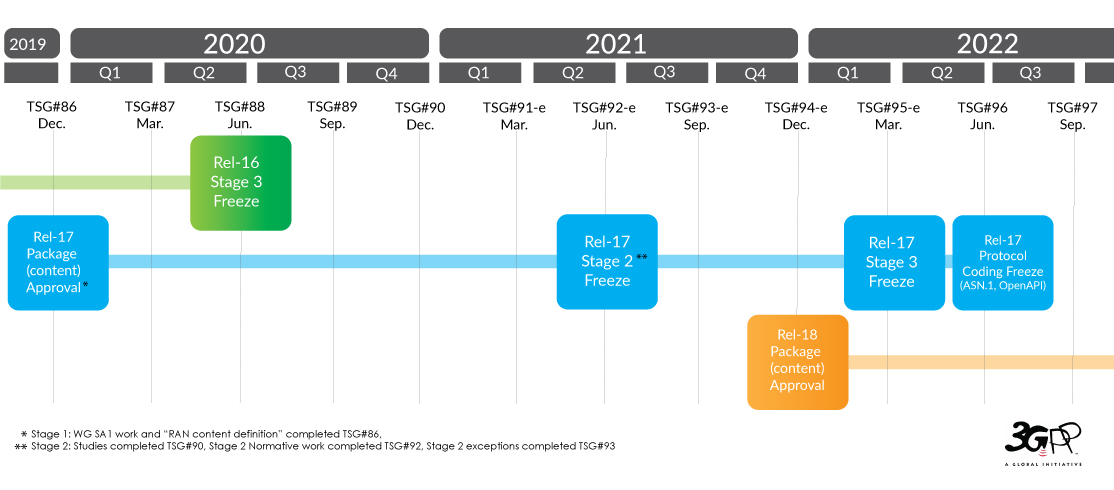

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

ITU-R Recommendation M.2150 (previously known as IMT 2020) is being updated with new features for the 3GPP and ETSI-DECT 5G radio interface specifications in Annex 1, 2 and 4. This updated recommendation has been given the temporary name “M.2150-1.”

The main changes include the addition of enhanced capabilities for 3GPP 5G-SRIT (Set of Radio Interface Technologies), 3GPP 5G-RIT (Radio Interface Technology), DECT 5G-SRIT, and some consequential changes to the overview sections of the text, as well as to the Global Core Specifications.

This M.2150-1 revision is expected to be completed at ITU-R WP 5D meeting #44 which is June 13-22, 2023 in Geneva.

Annex 1: 3GPP 5G SRIT

The main purpose of this update is to align Rec. ITU-R M.2150 to the Release 17 December 2022 version of the 3GPP Specifications of 3GPP 5G-SRIT. The main features introduced in this update are:

– Addition of new modulation schemes for NB-IoT and LTE-M (LPWANs for IoT connectivity)

– The addition of new numerologies for NR;

– New logical channels and their mapping to physical channels;

– Reduced Capability (RedCap) NR devices.

Annex 2: 3GPP 5G RIT- aka “5G-NR”

The main purpose of this update is to align Rec. ITU-R M.2150 to the Release 17 December 2022 version of the 3GPP Specifications of 3GPP 5G-RIT. The main features introduced in this update are:

– The addition of new numerologies for NR

– New logical channels and their mapping to physical channels

– Reduced Capability (RedCap) NR devices.

IMPORTANT NOTE: Since 3GPP Release 16 5G-NR URRLC in the RAN spec has not been completed yet, it was not submitted to 5D for inclusion in M.2150-1. Therefore, ITU M.2150-1 still does not meet the URLLC Minimum Performance Requirements specified in ITU-R M.2410. In particular, 3GPP Rel 16 URRLC in the RAN:

| 1335 | 830074 | Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) | NR_L1enh_URLLC | 1 | Rel-16 | R1 | 6/15/2018 | 12/22/2022 | 96% | RP-191584 |

Annex 4: DECT 5G – SRIT

The DECT 5G – SRIT consists of two components: 1.] DECT-2020 NR and 2.] 3GPP 5G-NR. The followings contain the information for each of the component RITs.

– DECT-2020 NR component RIT The original submission contained the layers up to the ‘Medium Access Control’ layer. In this update the ‘Data Link Control’ (DLC) and ‘Convergence’ (CVG) layers have been added.

– 3GPP 5G- NR component RIT. The changes are identical to those in Annex 2. The main purpose of this update is to align Rec. ITU-R M.2150 to the Release 17 December 2022 version of the 3GPP Specifications of 3GPP 5G-RIT.

• The addition of new numerologies for NR

• New logical channels and their mapping to physical channels

• Reduced Capability (RedCap) NR devices.

………………………………………………………………………………………………………………………………………..

ITU-R WP5D meeting #43 considered future revisions of Recommendations ITU-R M.2150 (and ITU-R M.2012) after year 2023 and prepared initial and preliminary revision schedules in which revisions of both Recommendations would be completed by the end of 2025. That may or may not include what pundits label “5G-Advanced,” which is coming from 3GPP Release 18.

………………………………………………………………………………………………………………………………………..

Objectives for WP5D – WG Technology Aspects at the 44th WP 5D meeting (June 12-23, 2023 in Geneva):

i) finalize preliminary draft revision “after year 2021” of Recommendation ITU-R M.2150;

ii) finalize preliminary draft revision of Recommendation ITU-R M.2012-5;

iii) finalize the Report ITU-R M.[IMT.ABOVE 100GHz];

iv) finalize preliminary draft revisions of Recommendations ITU-R M.2070-1 and ITU‑R M.2071-1 “Generic unwanted emission IMT‑Advanced”;

v) continue working on OOBE BS/MS for IMT-2020 “Generic unwanted emissions IMT‑2020.”

………………………………………………………………………………………………………………………………………………………………………….

References:

IMT 2020.SPECS approved by ITU-R but may not meet 5G performance requirements; no 5G frequencies (revision of M.1036); 5G non-radio aspects not included

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

Executive Summary: IMT-2020.SPECS defined, submission status, and 3GPP’s RIT submissions

https://www.itu.int/pub/R-REP-M.2410-2017

ETSI DECT-2020 approved by ITU-R WP5D for next revision of ITU-R M.2150 (IMT 2020)

https://www.itu.int/en/mediacentre/Pages/PR-2022-02-24-5G-Standards.aspx

https://www.3gpp.org/specifications-technologies/releases/release-17

Alaska Communications uses XGS-PON, FWA, DSL in ~5K homes including Fairbanks and North Pole

That build was funded, in part, through the Connect America Fund II (CAF II) program.

“While we consider fiber to be the gold standard, Alaska’s vast geography, weather conditions and existing middle mile network infrastructure make it hard to deploy a one-size-fits all technology,” the spokesperson said in the email.

Fixed wireless also underlies a project completed in 2022 that made gigabit service available to more than 1,200 homes at Fort Wainwright.

“Our network upgrades on Fort Wainwright use fiber-fed mesh wireless as the last mile delivery,” the spokesperson explained. “Our mesh networks use fiber and radios to create a redundant mesh of connectivity around the customer. We selected mesh because it’s fast to deploy, gives the customer a fiber-like experience and allows rapid deployment on military installations.”

The backhaul infrastructure underlying the Alaska Communications network expansion also used a wide spectrum of technologies.

On one end of the spectrum, the XGS-PON deployment is supported by the company’s core packet switched and optical transport networks. At the other end of the spectrum for lower-speed deployments, the company in “minimal cases” uses bonded copper for backhaul, the spokesperson said. For some of those lower-speed deployments, the company also relies on a combination of fixed wireless and fiber.

Interestingly, Alaska Communications fiber installations use a combination of aerial and buried cable. The use of buried cable is a bit of a surprise, recognizing that the ground in Alaska is frozen solid for a considerable portion of the year.

The company plans further expansion into the Interior in 2023 and beyond, according to a press release about the broadband expansion.

Fort Wainwright family housing equipped with an Alaska Communications receiver. Mesh networks use fiber and radios to create a redundant mesh of connectivity around the customer. (Photo: Business Wire)

Contact:

Heather Marron, Manager, Corporate Communications

[email protected]

……………………………………………………………………………………………………………………………………………….

Qualcomm Introduces the World’s First “5G NR-Light” Modem-RF System for new 5G use cases and apps

Qualcomm Technologies, Inc. today announced Snapdragon® X35 5G Modem-RF System, the world’s first “5G NR-Light” [1.] modem-RF system. NR-Light, a new class of 5G, fills the gap in between high-speed mobile broadband devices and extremely low-bandwidth NB-IoT devices. NR-Light devices, powered by Snapdragon X35, can be smaller, more cost-efficient, and provide longer battery life than traditional mobile broadband devices.

Note 1. 5G NR-Light is not an ITU-R recommendation, but rather a subset of 5G-NR in 3GPP Release 17, which was “frozen” on June 10, 2022. In 5G NR Release 17, 3GPP introduced a new tier of reduced capability (RedCap) devices, also known as NR-Light. It is a new device platform that bridges the capability and complexity gap between the extremes in 5G today with an optimized design for mid-tier use cases. When compared to 5G enhanced mobile broadband (eMBB) devices that can support gigabits per second of throughput in the downlink and uplink, NR-Light devices can efficiently support 150 Mbps and 50 Mbps in the downlink and uplink, respectively, due to the designed optimizations:

- narrower bandwidths, i.e., 20 MHz in sub-7 GHz or 100 MHz in millimeter wave (mmWave) frequency bands,

- a single transmit antenna,

- a single receive antenna, with 2 antennas being optional,

- optional support for half-duplex FDD,

- lower-order modulation, with 256-QAM being optional, and

- support for lower transmit power

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

In a briefing provided in advance to journalists, Gautam Sheoran, Qualcomm’s vice president of product management, defined the X35’s target market as “entry-level devices that may not necessarily need multi-gigabit speeds.” The X35 doesn’t support millimeter wave (mmWave) connections, even though Qualcomm continues to praise mmWave. But the X35 can support theoretical peak download speeds of 220 Mbit/s, with best-case uploads of 100 Mbit/s. “We should look at it as bringing all of the benefits of 5G at a much smaller data rate,” Sheoran said.

“The chipset is not only NR-Light, it also supports 4G fallback,” Sheoran added. “It’s really a future proof product that will last a number of years.” Sheoran emphasized that IoT gear built on its new systems was not that far off. “We expect devices to come out in the market around the first half of next year,” he said. “Sampling is actually happening as we speak.”

Snapdragon X35 offers a device platform that bridges the complexity and capability gap between the extremes in 5G today and addresses the need for mid-tier use cases. This lower cost option provides device makers with a long-term migration path to replace LTE CAT4+ devices, ultimately increasing 5G adoption and allowing for faster transition to a unified 5G network. In addition to Snapdragon X35, Qualcomm Technologies also announced Snapdragon® X32 5G Modem-RF System, a modem-to-antenna solution built to lower complexity and fuel cost-efficient NR-Light devices.

“Snapdragon X35 brings together key 5G breakthroughs expected from the world’s leading wireless innovator,” said Durga Malladi, senior vice president and general manager, cellular modems and infrastructure, Qualcomm Technologies, Inc. “The world’s first 5G NR-Light modem features a cost-effective, streamlined design with leading power efficiency, optimized thermal, and reduced footprint. Snapdragon X35 is poised to power the next wave of connected intelligent edge devices and empower a wide spectrum of uses. We look forward to working with industry leaders to unleash what’s possible with a unified 5G platform.”

World’s first 5G NR-Light modem-RF with a new streamlined architecture:

Snapdragon X35, a 3GPP Release 17 RedCap modem with optimized RFIC and PMIC modules, offers OEMs new 5G capabilities to create next-generation devices for a new era of use cases. The flexible, streamlined architecture and high-level modem-RF integration deliver superior power and thermal efficiency while enabling a small form factor design tailored to fit in compact devices.

Expansion of 5G ecosystem to new wave of use cases:

Snapdragon X35 brings a unique mix of capabilities in data rates, power consumption, complexity, and reduced footprint needed to cost-effectively enable new use cases such as entry-level industrial IoT devices, mass tier fixed wireless access consumer premise equipment, mass tier connected PCs, and first generation 5G consumer IoT devices like direct-to-cloud glasses and premium wearables.

With support for both LTE and 5G NR-Light, Snapdragon X35 is backwards compatible and future-proof enabling OEMs to develop devices which coexist with a wide range of 4G and 5G device classes helping scale 5G NR-Light services.

Breakthrough performance with advanced Modem-RF feature set:

Snapdragon X35 is equipped with advanced modem-RF technologies aimed to significantly reduce power consumption, enhance 5G coverage, lower latency, increase battery life, and improve uplink speeds:

– Qualcomm® QET5100 Envelope Tracking

– Qualcomm® Smart Transmit™ Technology

– Qualcomm® 5G Ultra-Low Latency Suite

– Qualcomm® 5G PowerSave Gen 4

In addition, Snapdragon X35 supports dual-frequency GNSS (L1+L5) to offer precise positioning suited to enable new industrial use cases and applications. With its global RF-band support, Snapdragon X35 supports all spectrum bands within Sub-6GHz, FDD, and TDD, to satisfy the needs of various markets.

These innovations and other improvements in Snapdragon X35 are designed to power a new generation of use cases and applications. Qualcomm suggested the company’s new chipset could be used in such gadgets as fixed-wireless consumer premise equipment as well as mobile hotspots, smartwatches and other upmarket wearables, connected cameras, industrial sensors, and augmented-reality glasses running what Sheoran called “glass-to-cloud” apps.

Customer sampling of Snapdragon X35 and X32 are expected to begin in the first half of 2023 and commercial mobile devices are expected to be launched by the first half of 2024. For additional details, please visit the Snapdragon X35 webpage.

…………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/iot/qualcomm-starts-connecting-dots-on-5g-nr-light-/d/d-id/783124?

https://www.3gpp.org/specifications-technologies/releases/release-17

https://portal.3gpp.org/Home.aspx?tbid=373&SubTB=373#/55934-releases

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

5G to Account for 80% of Operator Revenue by 2027:

Juniper Research has forecast that communications operators are likely to generate $625B from 5G services globally by 2027, a substantial rise from the $310bn predicted for the end of 2023. The new report, Operator revenue strategies: Business models, emerging technologies & market forecasts 2023-2027, forecasts that 80% of global operator-billed service revenue will be attributable to 5G by 2027; allowing operators to secure a return on investment into their 5G networks. However, the increasing implementation of eSIMs into new devices will drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G.

Juniper Research noted that the increasing implementation of embedded subscriber identity modules (eSIMs) into new devices would drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G. Previous Juniper studies have observed that after spending more than a decade offering a potential breakthrough in mobile communications, embedded eSIM technology has enjoyed noticeable growth in the past 12 months, making its way from smartphones to smart devices. The report also calculated that, driven by Apple’s innovation disrupting the smartphone sector, the value of the global eSIM market was expected increase from $4.7bn in 2023 to $16.3bn by 2027.

Juniper Research author Frederick Savage commented: “eSIM-capable devices will drive significant growth in cellular data, as consumers leverage cellular networks for use cases that have historically used fixed networks. Operators must ensure that networks, including 5G and upcoming 6G networks, are future‑proofed by implementing new technologies across the entirety of networks.”

6G Development Necessitates Innovative Technologies:

To prepare for this increasing demand in cellular data, the report predicts that 6G standards must adopt innovative technologies that are not currently used in 5G standards. It identified NTNs (Non‑terrestrial Networks) and sub-1THz frequency bands as key technologies that must be at the center of initial trials and tests of 6G networks, to provide increased data capabilities over existing 5G networks.

However, the research cautions that the increased cost generated by the use of satellites for NTNs and the acquisition costs of high-frequency spectrum will create longer timelines for securing return on 6G investment for operators. As a result, it urges the telecommunications industry to form partnerships with specialists in non-terrestrial connectivity; thus benefitting from lower investment costs into 6G networks.

………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.juniperresearch.com/pressreleases/operator-5g-revenue-to-reach-$625bn-by-2027

Juniper Research: CPaaS Gobal Market to Reach $29 Billion by 2025

Juniper Research: 5G connectivity opportunity for the connected car market

Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

ITU-R report in progress: Capabilities of the terrestrial component of IMT-2020 (5G) for multimedia communications

Introduction:

ITU-R WP5D is working on a preliminary draft of a report that addresses the capabilities of IMT-2020 to distribute multimedia content such as video, audio, text and graphics, including support for real-time multimedia interactive applications. The new report also addresses the capabilities of IMT-2020 user devices and base stations to support such multimedia communications with low latency and wider transmission bandwidth. It complements Report ITU-R M.2373 on “Audio-visual capabilities and applications supported by terrestrial IMT systems,” which addresses the capabilities of IMT systems for delivering audio-visual services to the consumers and also covers some aspects of production of audio-visual content.

Multimedia applications include network video, digital magazine, digital newspaper, digital radio, social media, mobile TV, digital TV, touch media, etc., that are enabled by IMT-2020 technologies. Beyond the traditional media service, the new media application not only supports accurate delivery of content, but also supports real-time interaction and real-time uploading of user-generated content. The users can be both consumers and producers of new media content.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Editor’s Note:

Ultra low latency is needed to support almost any type of multimedia applications. In particular, the URLLC performance requirements must meet those specified in ITU-R M.2410 –Key requirements related to the minimum technical performance of IMT-2020 candidate radio interface technologies. The current version of IMT 2020 (ITU-R M.2150) doesn’t meet the M.2410 ultra low latency requirement of <1ms in the data plane and <10msec in the control plane. Until 3GPP Release 16 URLLC in the RAN spec is completed and performance tested, we don’t expect any serious use of 5G for multimedia applications.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Applications for multimedia content include but are not limited to:

– audio-visual applications,

– network video applications,

– digital online magazine applications,

– digital online newspaper applications,

– internet radio applications,

– social media applications,

– mobile internet TV applications,

– touch media applications,

– online information distribution applications,

– on-demand video applications

– imaging and audio distribution applications

– content dissemination applications

– file delivery application

_ Real time uploading of multimedia content

_ Electronic classroom presentation technology

_ Full motion video conferencing

This report covers the application of IMT technology to the specific applications mentioned above. For details of applications of the Broadcasting service for multimedia, please refer to the list of ITU‑R Recommendations and ITU-R Reports below.

Relevant ITU-R Recommendations and Reports:

- Recommendation ITU-R BT.1833 – Broadcasting of multimedia and data applications for mobile reception by handheld receivers

- Recommendation ITU-R BT.2016 – Error-correction, data framing, modulation and emission methods for terrestrial multimedia broadcasting for mobile reception using handheld receivers in VHF/UHF bands

- Recommendation ITU-R M.2083 – Framework and overall objectives of the future development of IMT for 2020 and beyond

- Recommendation ITU-R M.2150 – Detailed specifications of the terrestrial radio interfaces of International Mobile Telecommunications-2020 (IMT-2020)

- Report ITU-R BT.2049 – Broadcasting of multimedia and data applications for mobile reception

- Report ITU-R BT.2295 – Digital terrestrial broadcasting systems

- Report ITU-R M.2373 – Audio-visual capabilities and applications supported by terrestrial IMT systems

Multimedia Use cases:

- Ultra-high-definition multimedia content

- Virtual reality (VR) panoramic video

- Augmented Reality (AR)

- Entertainment live streaming

- Live eCommerce (use of live webcast technology to carry out new sales methods)

- Smart venue (new viewing experiences at live events or activities)

- Live streaming production and distribution of events

IMT-2020 capabilities for real-time multimedia interaction and media content uploading:

Interactive multimedia allows the user to control, combine and manipulate a variety of media types, such as text, computer graphics audio and video materials, animation and virtual reality.

To enable interactive task completion during voice conversation, IMT-2020 is capable of supporting low-delay speech coding for interactive conversational services (refer 3GPP TS22.261, 100 ms, one-way mouth-to-ear).

Table 1. below (from 3GPP TS 22.261 Table 7.1-1.) gives a capability example of IMT-2020 to support high data rate and traffic density scenario for an interactive audio and video application in indoor hotspot.

Table 1. High data rate and traffic density scenario of IMT-2020 for an interactive audio and video application

| Scenario | Experienced data rate (DL) | Experienced data rate (UL) | Area traffic capacity (DL) | Area traffic capacity (UL) | Overall user density | Activity factor | UE speed | Coverage |

| Indoor hotspot | 1 Gbit/s | 500 Mbit/s | 15 Tbit/s/km2 | 2 Tbit/s/km2 | 250 000/km2 | Note 2 | Pedestrians | Office and residential (Note 1) |

| NOTE 1: A certain traffic mix is assumed; only some users use services that require the highest data rates. | ||||||||

Conclusions:

This report (in progress) summarizes various capabilities of terrestrial component of IMT-2020 for Multimedia communications. Multimedia is an immersive technological way of presenting information that combines audio, video, images, and animations with textual data. Multimedia applications include network video, digital magazine, digital newspaper, digital radio, social media, touch media, etc., and can be easily enabled using IMT-2020. New emerging technologies such as Virtual Reality (VR) and Augmented Reality (AR) are becoming key technologies to upgrade the traditional multimedia industries.

The IMT-2020 capabilities can support the evolving interactive multimedia communication with the capabilities not only broader bandwidth, higher data rate, but also lower latency and higher reliability.

The typical technologies are flexible and dynamic resources allocation, uplink enhancement e.g. UL MIMO, UL Carrier Aggregation and Dual connectivity, and related architecture improvement, which can connect the user to a high-definition video, real-time multimedia interaction virtual world on their mobile device.

Live events with high definition and ultra-high definition content can be streamed via IMT-2020 radio network with higher throughput. HD and UHD content (e.g. news, sport event) can be real-time produced and on demand distributed to mobile devices without any interruptions through IMT-2020 higher user experienced data rate and low latency. The entertainment industry will hugely benefit from IMT-2020 wireless networks, which are expected to enable HD virtual reality games with a better real-time interactive gaming experience, and high dynamic range video streaming without interruption. Cloud AR and Cloud VR with HD or UHD video can be supported with higher user experienced data rate and low latency supported by IMT-2020. It is foreseeable that with the support of IMT-2020 technology, it will gradually bring consumers more amazing virtual experiences.

?$QC_Responsive$&fmt=png-alpha&wid=640)