Intel

Massive layoffs and cost cutting will decimate Intel’s already tiny 5G network business

Huge Loss & Restructuring:

In its August 1st press release detailing a $1.6 billion 2Q-2024 loss (mainly from it’s foundry business) [1.] Intel announced it was cutting more than 15% of its workforce by 2025 with most of those coming by year end. The company is also suspending its dividend starting in the fourth quarter of 2024.

Note 1. Intel Foundry, which reported a $2.5bn operating loss during the first quarter of 2024, lost an additional $2.8bn in Q2-2024. That business is seen as a U.S. strategic asset in a major move to bring back chip making to the U.S. from Taiwan, China and South Korea.

“Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies while accelerating our IDM 2.0 transformation,” said Pat Gelsinger, Intel CEO. “These actions, combined with the launch of Intel 18A next year to regain process technology leadership, will strengthen our position in the market, improve our profitability and create shareholder value.”

CEO/CFO Earnings Call prepared remarks:

“We are targeting a headcount reduction of greater than 15% by the end of 2025, with the majority of this action completed by the end of this year. We do not do this lightly, and we have carefully considered the impact this will have on the Intel family. These are hard but necessary decisions. Our actions will reduce OpEx (operating expenses) to approximately $20 billion in 2024, and we see a bigger impact next year, with 2025 OpEx targeted at $17.5 billion, more than 20% below prior estimates. We expect further benefits in 2026, with OpEx to decline in absolute dollars yet again. Even as we lower overall spending, we will continue to fund the investments needed to deliver our strategy.”

The company’s latest filing with the Securities and Exchange Commission (SEC) stated there were 124,800 employees as of December 2023, down from 131,900 a year before. Therefore, a 15% reduction could translate to the loss of 18,720 employees and we wouldn’t be surprised by total job cuts exceeding 20,000! In addition to layoffs, Intel is pushing older employees to retire.

CEO Pat Gelsinger wrote in a letter to Intel employees:

“Next week, we’ll announce a companywide enhanced retirement offering for eligible employees and broadly offer an application program for voluntary departures. I believe that how we implement these changes is just as important as the changes themselves, and we will adhere to Intel values throughout this process.”

The objective is to greatly reduce various operational costs (research and development plus marketing, general and administrative expenses) to about $20 billion this year and $17.5 billion in 2025, “with further reductions planned in 2026,” said Intel. That $17.5 billion would be about $4.2 billion less than Intel booked for these expenses in 2023, according to its last annual SEC filing, and a reduction of $7 billion compared with the figure for 2022.

Fitch Ratings downgraded Intel’s Long-Term Issuer Default Rating to ‘BBB+’ from “A-,” citing execution risks and potential negative rating actions. Fitch also affirmed Intel’s Short-Term IDR and commercial paper rating at ‘F2’. Fitch believes execution risk remains significant for Intel and that missteps could result in further negative rating actions.

……………………………………………………………………………………………………………………………………

Analyst Comments:

Rosenblatt Securities analyst Hans Mosesmann reiterated his sell rating on Intel stock with a price target of 17. “We anticipate that the company (Intel) will continue to lose share to AMD as its manufacturing roadmap is tepid compared to that of the leading-edge player,” Mosesmann said in a client note.

Bernstein analyst Stacy Rasgon was particularly grim about Intel’s prospects.

“The company’s issues are now approaching the existential,” he said in a client note. “In other circumstances we believe we would now be having ‘going concern’ conversations with clients.”

Impact on Intel’s 5G Business:

The company’s website states: “From Cloud to Network to Edge: 5G Is Powered by Intel Intel-powered 5G networks deliver a powerful data-centric future where compute is fluid, intelligent, and pervasive—creating an evolutionary leap in agility and scalability.”

PHOTO Credit: Intel

Intel incorrectly states, “Intel is embedded throughout the 5G value chain, offering flexible performance, Intel® Xeon® Scalable processors, custom RAN configurations, accelerators, software, and a common toolchain.” Does anyone really believe that?

Intel wants 5G network equipment vendors to switch from custom ASIC silicon they design to its general-purpose processors (GPPs). But there has been very limited adoption of those processors in the radio access network (RAN) to date. Many telco executives remain unconvinced GPPs, especially based on x86, can measure up. Arguments about using the same platforms for multiple needs look spurious when most RAN compute is at the mast site, where it cannot realistically be shared with anything else.

Of the big three 5G kit vendors, only Ericsson says Intel is a good option for Layer 1 (PHY), the category of most demanding RAN software. Huawei and Nokia remain vehemently opposed to using Intel silicon in this area. As expected, most of Ericsson’s 5G products today are based on its own custom silicon, not Intel’s GPPs.

References:

https://www.intel.com/content/www/us/en/newsroom/news/actions-accelerate-our-progress.html#gs.d2jtpn

https://download.intel.com/newsroom/2024/corporate/Earnings-Call-2Q2024-080124.pdf

https://www.intel.com/content/www/us/en/wireless-network/5g-overview.html

WSJ: China’s Telecom Carriers to Phase Out Foreign Chips; Intel & AMD will lose out

China’s largest telecom firms were ordered earlier this year to phase out foreign computer chips from their networks by 2027. That news confirms and expands on reports from recent months. It was reported in the Saturday print edition of the Wall Street Journal (WSJ). The move will hit U.S. semiconductor processor companies Intel and Advanced Micro Devices. Asia Financial reported in late March that these retaliatory bans would cost the U.S. chip firms billions.

The deadline given by China’s Ministry of Industry and Information Technology (MIIT) aims to accelerate efforts by Beijing to halt the use of such core chips in its telecom infrastructure. The regulator ordered state-owned mobile operators to inspect their networks for the prevalence of non-Chinese semiconductors and draft timelines to replace them, the people said.

In the past, efforts to get the industry to wean itself off foreign semiconductors have been hindered by the lack of good domestically made chips. Chinese telecom carriers’ procurements show they are switching more to domestic alternatives, a move made possible in part because local chips’ quality has improved and their performance has become more stable, the people said.

Such an effort will hit Intel and AMD the hardest, they said. The two chip makers have in recent years provided the bulk of the core processors used in networking equipment in China and the world.

China’s MIIT, which oversees the regulation of the wireless, broadcasting and communication industries, didn’t respond to WSJ’s request for comment. China Mobile and China Telecom , the nation’s two biggest telecom carriers by revenue, also didn’t respond.

In March 2023, the Financial Times reported China is seeking to forbid the use of Intel and AMD chips, as well as Microsoft’s operating system, from government computers and servers in favor of local hardware and software. The latest purchasing rules represent China’s most significant step yet to build up domestic substitutes for foreign technology and echo moves in the US as tensions increase between the two countries. Among the 18 approved processors were chips from Huawei and state-backed group Phytium. Both are on Washington’s export blacklist. Chinese processor makers are using a mixture of chip architectures including Intel’s x86, Arm and homegrown ones, while operating systems are derived from open-source Linux software.

Beijing’s desire to wean China off American chips where there are homemade alternatives is the latest installment of a U.S.-China technology war that is splintering the global landscape for network equipment, semiconductors and the internet. American lawmakers have banned Chinese telecom equipment over national-security concerns and have restricted U.S. chip companies including AMD and Nvidia from selling their high-end artificial-intelligence chips to China.

China has also published procurement guidelines discouraging government agencies and state-owned companies from purchasing laptops and desktop computers containing Intel and AMD chips. Requirements released in March give the Chinese entities eight options for central processing units, or CPUs, they can choose from. AMD and Intel were listed as the last two options, behind six homegrown CPUs.

Computers with the Chinese chips installed are preapproved for state buyers. Those powered by Intel and AMD chips require a security evaluation with a government agency, which hasn’t certified any foreign CPUs to date. Making chips for PCs is a significant source of sales for the two companies.

China Mobile and China Telecom are also key customers of both chip makers in China, buying thousands of servers for their data centers in the country’s mushrooming cloud-computing market. These servers are also critical to telecommunications equipment working with base stations and storing mobile subscribers’ data, often viewed as the “brains” of the network. Intel and AMD have the lion’s share of the overall global market for CPUs used in servers, according to data from industry researcher TrendForce. In 2024, Intel will likely hold 71% of the market, while AMD will have 23%, TrendForce estimates. The researcher doesn’t break out China data.

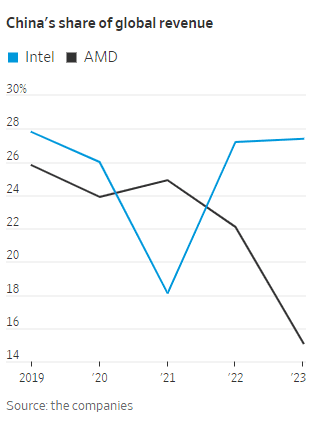

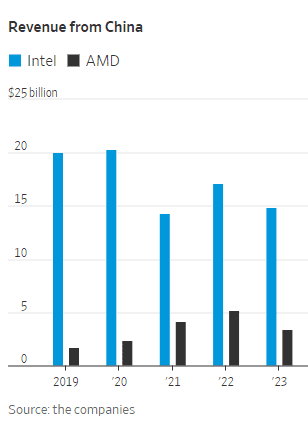

China’s localization policies could diminish Intel and AMD’s sales in the country, one of the most important markets for semiconductor firms. China is Intel’s largest market, accounting for 27% of the company’s revenue last year, Intel said in its latest annual report in January. The U.S. is its second-largest market. Its customers also include global electronics makers that manufacture in China.

In the report, Intel highlighted the geopolitical risk it faced from elevated U.S.-China tensions and China’s localization push. “We could face increased competition as a result of China’s programs to promote a domestic semiconductor industry and supply chains,” the report said.

References:

https://www.wsj.com/tech/china-telecom-intel-amd-chips-99ae99a9 (paywall)

https://www.ft.com/content/7bf0f79b-dea7-49fa-8253-f678d5acd64a

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China’s telecom industry business revenue at $218B or +6.9% YoY

Nokia utilizes Intel technology to drive greater 5G SA core network energy savings

Nokia and Intel today announced that they are targeting greater energy efficiency improvements in 5G networks by using Xeon processors and power management software from Intel that will power Nokia’s cloud-native 5G Core solutions [1.] The two companies’ advances, building on years of innovation, will give communication service providers (CSPs) more leverage in reducing electricity usage and costs in their networks.

Note 1. The Nokia packet core provides key components needed for a webscale-class evolved packet core (EPC) and 5G core system (5GC). With its virtualized, cloud-native disaggregated and state-efficient design, it is well suited for multi-cloud environments. It is also infrastructure agnostic and independent of the underlying cloud infrastructure used for orchestration, lifecycle management (LCM) and infrastructure resource management.

…………………………………………………………………………………………………………………….

In testing demonstrations, Nokia achieved approximately 40% runtime power savings using Nokia’s cloud-native 5G Core, integrated with Intel Infrastructure Power Manager (IPM) software and 4th Gen Intel Xeon Scalable Processors*, while maintaining key network performance metrics.

Such energy savings are achieved through the careful integration of Nokia’s Core with Intel’s power modulation capabilities, which result in the energy consumption of the chips being proportional to the amount of traffic on the network – which varies considerably during any 24-hour period. Nokia intends to deliver these energy savings capabilities to the market as early as the second half of 2024, starting with Nokia’s Cloud Packet Core. Nokia and Intel will demonstrate these capabilities at MWC Barcelona at Intel’s booth 3E31.

The announcement underscores Nokia’s ongoing broader efforts to help CSPs and other network-dependent industries reduce their environmental footprint, become more resource efficient, and drive increased value from their networks. Nokia has set its key greenhouse gas (GHG) emissions reduction target through the Science Based Targets (SBT) initiative, which is aligned with the goal of limiting global warming to 1.5°C. Nokia was the first telecoms equipment vendor to have a science-based target accepted by the SBT initiative in 2017.

Marcelo Madruga, Head of Technology and Platforms, Products & Engineering, Cloud and Network Services at Nokia, said: “I am very pleased with the brilliant work that Nokia and Intel are doing to deliver very meaningful reductions in the energy footprint of 5G networks. Network data and computation usage only continues to grow, with the clear implication that has for continued energy demand growth. What we are doing today demonstrates not only superior software and technology but delivering on our broader commitments to cut carbon emissions across value chains.”

Alex Quach, Vice President & GM, Wireline and Core Network Division at Intel, said: “This is another solid proof point in the long-standing Intel-Nokia collaboration that highlights the strength of our teams in empowering CSPs with innovative solutions. Integrating the Intel Infrastructure Power Manager into Nokia’s widely deployed packet core software will help deliver the power savings CSPs require and strengthens network operations through intelligent resource allocation.”

Stéphane Demartis, VP Telco Cloud Infrastructure at Orange, said: “We are delighted to start a collaboration with Nokia and Intel to optimize our power consumption. This will provide a major step forward in delivering energy efficient solutions in the core network infrastructure. Orange is looking forward to working with Nokia and Intel to explore implementation of these innovations for a sustainable 5G Core network through the #Sylva project.”

References:

https://www.nokia.com/networks/core-networks/cloud-packet-core/

https://www.intel.com/content/www/us/en/newsroom/resources/2024-mwc-barcelona.html#gs.5dbwdb

https://www.nokia.com/events/mobile-world-congress/

SK Telecom, Intel develop low-latency technology for 6G core network

In collaboration with Intel, SK Telecom (SKT) has successfully developed technology to reduce communication delays necessary for the evolution of 6G Core Network Architecture. The Core network is the gateway through which all voice and data traffic generated from a customer’s mobile device passes through to access the Internet network. It is a mobile communication service system that is responsible for security and service quality through the inter-connection of various systems.

Editor’s NOTE: Of course, 6G is currently undefined with only the features and functions being defined by ITU-R WP 5D which is meeting this week in Geneva. The 6G core network specifications will be done by 3GPP and NOT ITU-T as was the case for 5G core.

…………………………………………………………………………………………………………..

The 6G Core Architecture is required to have higher flexibility and safety than previous generations of wireless communications, and to provide stable AI service quality and technologies to customers by embedding intelligent and automation technologies.

As Core network technology continues to develop, the various systems that make up the network and the detailed functions that provide various services are also explosively increasing. As network complexity continues to increase, the process of sending and receiving messages is frequently recreated. Therefore, communication delays will increase compared to before. It is difficult to address these limitations with communication standard technologies (service communication proxies) for interconnection between unit functions within the existing Core network.

Inline Service Mesh, a low latency technology the two companies developed utilizing Intel Xeon processors with built in AI, is capable of increasing the communication speed within the Core network by reducing latency between unit function without Proxy.

Through this technology development, AI, which requires a large amount of computation, can be applied to the Core network in a wider variety of models. SKT has already commercialized a technology that reduces wireless resources by 40% and improves connectivity by analyzing movement patterns of real users in real time. Through this cooperation, the two companies will be able to reduce communication delays by 70% and increase service efficiency by 33% in the Core network through the application of the 6G Core Architecture.

SKT aims to apply the results of this study to commercial equipment next year. A technical white paper has been published by Intel that describes the technology, development process and benefits.

SKT and Intel have been continuing to cooperate for research on the development of key wired/wireless mobile communication technologies for the past 10 years. Based on the results of this study, the two companies plan to continue research and development for traffic processing improvement technologies incorporating AI technology in various areas of the Core network.

“We have made another technical achievement through continuous technology development cooperation with Intel to secure leadership in 6G,” said Yu Takki, Vice President and Head of Infra Tech at SKT. “We will continue our research and make efforts to commercialize AI-based 6G Core Architecture.”

“Our research and development efforts with SK Telecom continue to deliver innovations that have been deployed by Communications Service Providers worldwide”, said Dan Rodriguez, Corporate Vice President of Intel Network & Edge Solutions Group. “By leveraging the latest Intel Xeon processors with built in AI features, our companies are able to drive both performance and efficiency improvements that will be vital to the future Core networks.

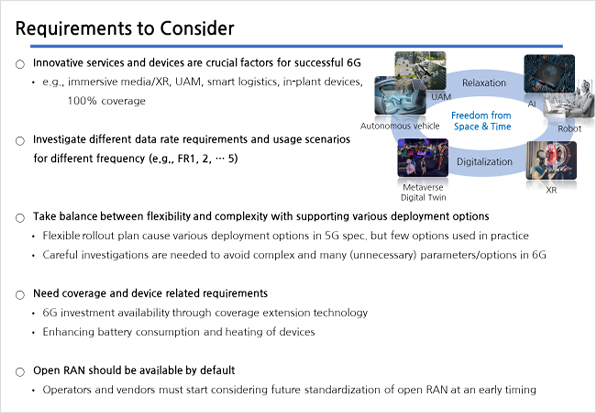

Last March, SKT and NTT DOCOMO released a white paper addressing the requirements for future 6G networks.

The South Korean carrier said the new white paper contains its views on 6G key requirements and 6G evolution methodology, along with its opinions on the latest trends in frequency standardization. The 6G white paper also provides analysis, development directions and methodologies pertaining to promising 6G use cases, technology trends as well as and candidate frequencies.

The 6G White Paper reviews the following:

- Performance requirements and implementation scenarios for each frequency band, taking into account the characteristics of each frequency

- Issues concerning coverage and devices in high-frequency bands

- Standardization for migration to 6G architecture and application of cloud-native / open architecture

References:

https://www.sktelecom.com/en/press/press_detail.do?idx=1597¤tPage=1&type=&keyword=

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

https://www.docomo.ne.jp/english/corporate/technology/rd/docomo6g/whitepaper_dcmskt.html#title02

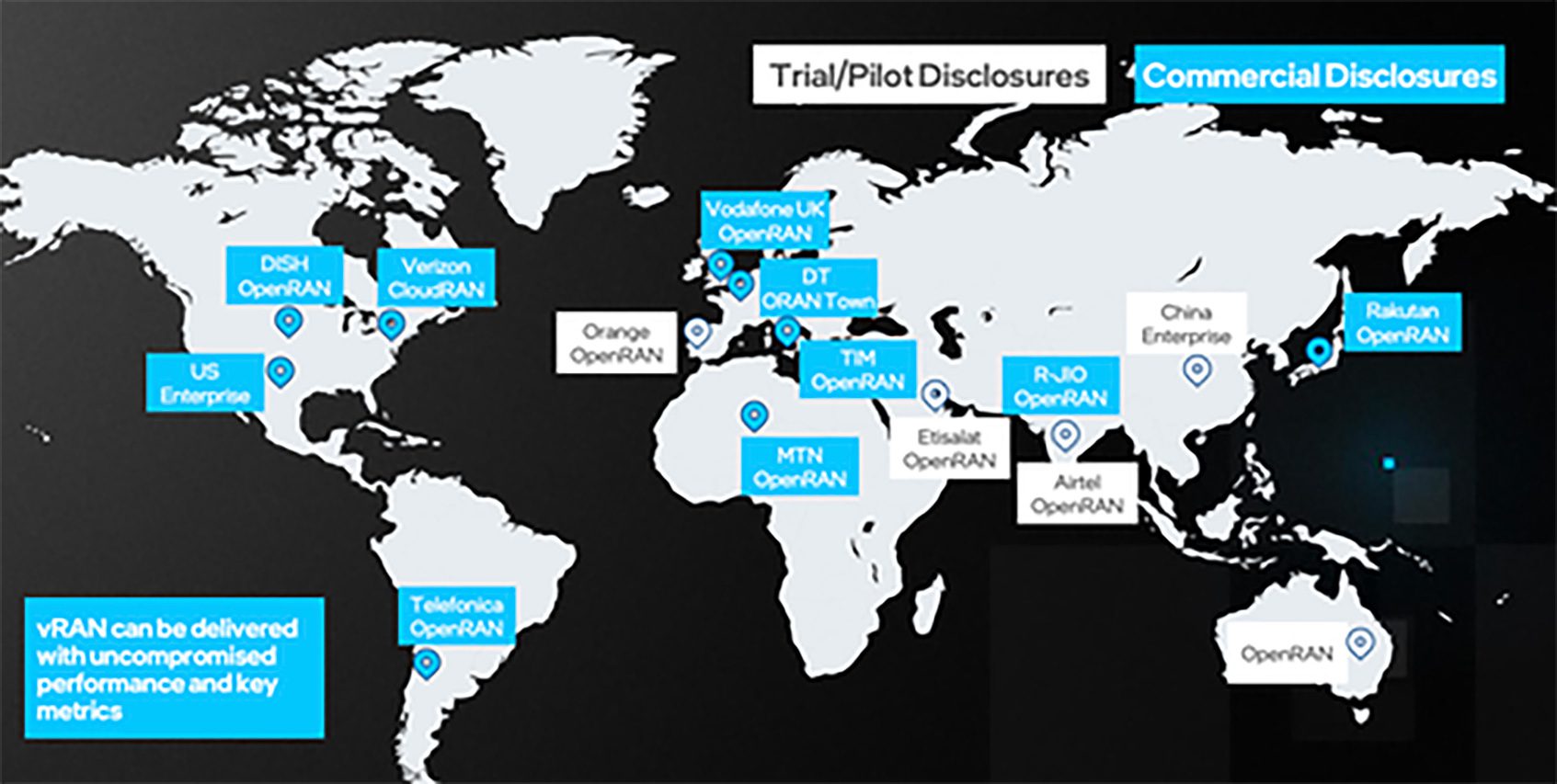

Aramco Digital and Intel establish Open RAN Development Center in Saudi Arabia

On January 15th, Aramco [1.] Digital and Intel announced their intent to establish Saudi Arabia’s inaugural Open RAN (Radio Access Network) Development Center. The facility is expected to drive innovation, foster technological advancements and contribute to the digital transformation landscape in the Kingdom.

Note 1. Aramco Digital is a subsidiary of Aramco, which made a net profit of $94.5 billion on revenues of $372.6 billion for the first nine months of 2023. Aramco spent $806 million on research and development (R&D) for the first 9 months of 2023 – all of which was likely related to its oil and gas business.

………………………………………………………………………………………………………………….

The collaborative effort aims to accelerate the development and deployment of Open RAN technologies, helping to enable the Kingdom to build robust and agile telecommunication infrastructure focused on accelerating digitization across industries. This collaboration aims to align with Saudi Arabia’s Vision 2030, which focuses on technological advancements and economic diversification.

Open RAN, an evolving paradigm in wireless network architecture, allows for greater flexibility, interoperability and innovation. Aramco Digital brings a deep understanding of the development needs and ambitions of the Kingdom and the opportunities for Open RAN technology deployment, along with a unique perspective of the Kingdom’s economic landscape. Intel, a pioneer in computing and communication technologies, brings its expertise in Open RAN technologies to the collaboration.

According to figures provided in December by analyst firm Omdia, an Informa company, the global RAN market is likely to have generated sales of about $40.2 billion last year. That would represent an 11% decline compared with revenues in 2022. Noting the reluctance of major telcos to spend money on equipment, Nokia recently announced plans to cut up to 14,000 jobs, which would equal 16% of the current total. In February last year, Ericsson, which has also recently complained of a market slowdown, said it would cut 8,500 jobs.

Highlights of the collaboration:

1. **Innovation Hub:** The Open RAN Development Center aims to serve as an innovation hub, fostering collaboration between Aramco Digital and Intel engineers, researchers and industry experts.

2. **Local Talent Development:** The Center aims to contribute to the development of local talent by providing training and hands-on experience in the rapidly evolving field of Open RAN and Edge computing technology.

3. **Economic Impact:** The collaboration aims to contribute to the local economy through technology-driven initiatives, aligning with the broader objectives of Vision 2030.

4. **Global Collaboration:** The collaboration on Open RAN between Aramco Digital and Intel is expected to extend beyond borders, connecting Saudi Arabia to the global landscape of Open RAN and Edge development and deployment.

Aramco Digital’s CEO Tareq Amin (formerly with Rakuten Symphony) said: “This collaboration is a testament to our commitment to helping drive innovation in the Kingdom. The Open RAN Development Center is expected to be a catalyst for digital evolution, providing a platform for collaboration, skill development and the creation of a vibrant technology ecosystem. At the heart of this collaboration is the creation of a vibrant pool of local capabilities for advanced 5G and future 6G technologies.”

“We are pleased to collaborate on Open RAN with Aramco Digital and to combine Intel’s technological prowess in network and edge computing and software with the local insights and industry leadership of Aramco Digital. Together, we aim to accelerate the deployment of edge-native Open RAN solutions in Saudi Arabia and beyond,” said [Sachin Katti, Intel senior vice president and general manager of the Network and Edge Group].

The Open RAN Development Center is planned to commence operations in 2024, marking a milestone in Saudi Arabia’s journey towards a technology-driven future.

……………………………………………………………………………………………………………….

Light Reading’s Iain Morris was not optimistic about this initiative. He wrote:

To the people responsible for telecom and tech in Saudi Arabia, open RAN must seem like a decent bet on diversification. After all, that is exactly how the concept is pitched in other countries. If Aramco can produce homegrown 5G goods, Saudi Arabian operators could theoretically spend their money on a local supplier instead of using only Chinese and European ones. Saudi Arabia, moreover, would gain something besides oil to sell overseas.

Aramco Digital’s chances of becoming an international RAN force – if such are its ambitions – are not great. In the west, Saudi Arabia’s dodgy image and reputation do not help. Realpolitik might have recently driven western leaders into an accommodation with Saudi rulers. But network products, in contrast to fossil fuels, can be obtained from other more likeable sources. And protectionist zeal has thrown up dozens of open RAN initiatives. If countries aren’t buying from Nordic or Chinese vendors, many would also rather buy at home. Aramco Digital is unlikely to be high on the list of preferred suppliers.

Evidence so far suggests big operators would also prefer to continue buying most of their products from a single vendor after open RAN is introduced. Doing so leaves “one throat to choke” and means avoiding the hassle and expense of systems integration. But it is prompting former specialists to develop a more comprehensive portfolio of RAN products and more thinly spread their R&D funds. Flush as Aramco Digital is with oil money, the enduring appeal of the single RAN contract will make competing in this market even harder.

Operators lauding open RAN will also appreciate how important economies of scale have been to the development of relatively low-cost but extremely sophisticated network products. Even if companies like Aramco Digital can acquire some market share, the net effect of adding players to a shrinking sector would be market fragmentation, squeezed R&D budgets and greater inefficiency.

With its resources and government backing, Aramco cannot simply be dismissed. But it may be the latest to find that telecom is stubbornly impervious to change.

About Aramco Digital:

Aramco Digital is the digital and technology subsidiary of Aramco, a global integrated energy and chemicals company. Aramco Digital aims to help drive digital transformation and technological innovation across various sectors.

About Intel:

Intel (NASDAQ: INTC) is a world leader in computing innovation. The company designs and builds the essential technologies that serve as the foundation for the world’s computing devices.

*Source: AETOSWire

References:

https://www.lightreading.com/open-ran/saudi-aramco-has-slim-open-ran-chance-in-shrinking-5g-market

Multi-G Initiative to drive Open RAN Software Interfaces and increase innovation

Cohere Technologies, Intel, Juniper Networks, Mavenir and VMware intend to collaborate to develop the industry’s first framework for a multi-generational (Multi-G), software-based Open RAN architecture. The Multi-G initiative would define frameworks, interfaces, interoperability testing, and evaluation criteria that would provide the interfaces to support full coexistence of 4G, 5G, and future waveforms.

Intel’s FlexRAN platform is used by most current virtualized RAN (vRAN) deployments; Mavenir has a strong presence in providing open RAN equipment and software; and Juniper Networks and VMware are both contributing their work with the RAN intelligent controller (RIC). Cohere’s contribution is through its Universal Spectrum Multiplier software that can be integrated by RAN vendors or as an “app” into a telco cloud platform.

Intel’s involvement in this initiative is significant from an industry perspective due to the breadth of FlexRAN adoption. It also puts the chip giant a step ahead of competitors like Qualcomm, Arm and AMD that are aggressively targeting the Open RAN silicon market.

The new Multi-G framework would disaggregate RAN intelligence and scheduling functions, enabling future code releases of Intel’s FlexRAN reference architecture to support higher capacity, software-defined deployments for 4G, 5G and next generation wireless waveforms and standards.

This effort would help drive higher performance and connectivity across satellite, private and ad-hoc networks, and autonomous vehicles, increasing new service and revenue opportunities for telecommunications and mobile operators.

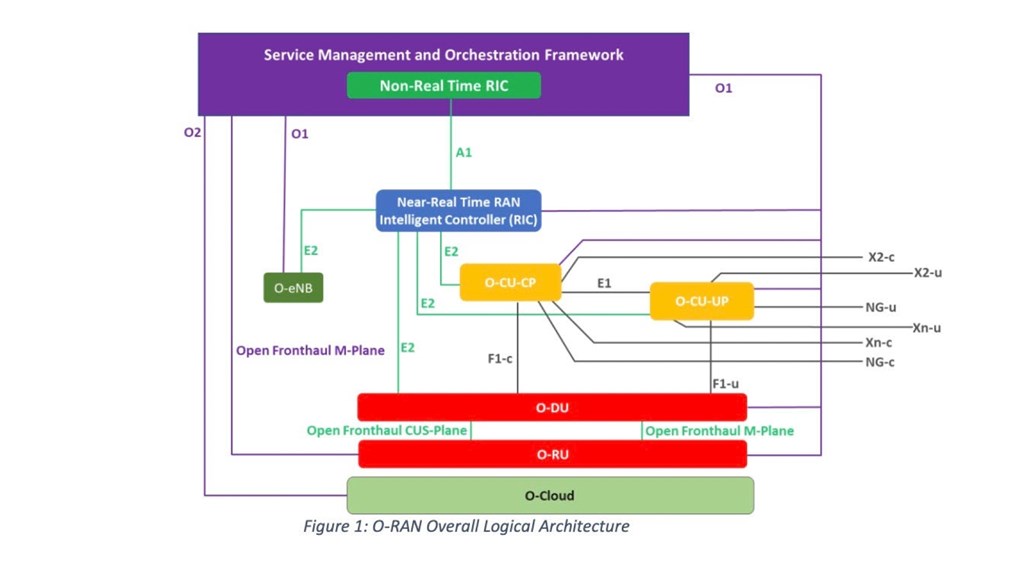

“This is going to make the network programmable all the way from layer one to the highest layers of the architecture,” said Cohere Technologies’ CEO Ray Dolan. “It’s not that open RAN is incomplete or not vibrant or not working, it is.” Right now, it has opened most of the parts that are what I’ll say are less controversial than the E2 interface. It’s opened the radio interfaces and the antenna interfaces, and so it’s established. But it hasn’t established the proper E2 interfaces completely. And that’s widely accepted as a fact. And in order for, I believe, for open RAN to really achieve its full vision, it needs to open that E2 interface because that’s where the innovation will come. Because that’s where all of the complexity in the marketplace is.”

The E2 work basically taps into the near real-time xApps running in a RIC to monitor and optimize an operator’s RAN deployment – typically either a vRAN or open RAN – and across different spectrum bands. This in turn allows an operator to support more stringent service-level agreements (SLAs) and private network deployments that can generate more revenues.

Ahead of the group’s first meeting in May 2023, telecommunications leaders worldwide are already sharing support for the collaborative initiative:

Vodafone Group

“This commitment from Intel, Mavenir, Juniper Networks, and Cohere, with a software programmable L1 stack, is fully aligned with the vision of Open RAN and will bring us one step closer to the scale deployment of software-defined RAN,” said Yago Tenorio, Vodafone Fellow and Director of Network Architecture, and Chairman of the Telecom Infra Project (TIP). “This has huge potential for significant performance and capacity benefits for all existing cellular networks. We strongly endorse this initiative, and we look forward to seeing the critical interfaces published into the relevant O-RAN Alliance and TIP Working Groups.”

Telstra

“Cohere’s Universal Spectrum Multiplier technology has the potential to unlock new architectural capabilities and opportunities for the RAN beyond today’s architecture,” said Iskra Nikolova, Network and Infrastructure Engineering Executive at Telstra. “We’re pleased to support this initiative and look forward to working with Cohere and the group to define the framework and accompanying critical interfaces.”

Bell

“A genuine Multi-G framework will enhance the benefits of Cohere’s Universal Spectrum Multiplier, strengthen Open RAN vendor flexibility down to the silicon layer, and allow old and new waveforms to coexist— beyond 5G,” said Mark McDonald, Bell’s Vice President, Wireless Access. “Bell looks forward to working with Cohere and partners later this year to further test this architecture.”

Hear from the Collaborators:

Intel Corporation

“This Multi-G framework, enabled by Intel FlexRAN – which is fully software programmable down to L1 – will enable faster O-RAN adoption and unlock new innovations,” said Sachin Katti, senior vice president and general manager of the Network and Edge Group at Intel Corporation.

Mavenir

“As the leading Open RAN partner, we’re excited to be part of the Multi-G initiative which promises to bring 4G and 5G spectral efficiencies gains not possible with incumbent solutions,” said Bejoy Pankajakshan, EVP-Chief Technology and Strategy Officer at Mavenir. “Unlike traditional DSS (Dynamic Spectrum Sharing) techniques which reduces 4G and 5G performance, with our Multi-G collaboration with Cohere and Intel, Mavenir can provide a true spectrum co-existence solution, which deploys 5G on the same spectrum assets as 4G dramatically improving the ROI per Hz on the existing 4G spectrum.”

Juniper Networks

“As more 5G deployments are underway, there is still a large installed base of 4G networks that can benefit from the intelligence, control and automation enabled by an Open RAN Intelligent Controller (RIC) architecture,” said Raj Yavatkar, CTO of Juniper Networks. “Juniper Networks has already demonstrated innovative 4G and 5G use cases with our Juniper Non-RealTime RIC and Near-RealTime RIC that can provide more flexibility to network operators. We are excited to add our expertise and join the Multi-G framework initiative, which will not only help to accelerate Open RAN adoptions but will also spur further innovation across multiple generations of mobile networks to enhance the network operator experience.”

VMware

“VMware is already paving the way for more programmable and intelligent Open RAN networks with our VMware RIC and our Service Management Orchestration Framework (SMO) for end-to-end RAN automation, assurance and optimization,” said Sanjay Uppal, GM & SVP, Service Provider Business Unit, VMware. “We are pleased to join other industry leaders to pioneer in the development of the industry’s first framework for a Multi-G, software-programmable architecture that will further encourage innovation and fast-track the adoption of Open RAN globally.”

Open RAN Policy Coalition

“Defining new interfaces that supercharge developing and future networks is critical for the success of open networks,” said Diane Rinaldo, Executive Director of the Open RAN Policy Coalition. “This will foster innovation and add flexibility, which will improve our competitiveness.”

Cohere Technologies

“We are pleased to work with world-class partners and operators to accelerate the deployment of Multi-G, open networks with significant performance improvements,” said Ray Dolan, CEO of Cohere Technologies. “Cohere is committed to a software-based, open architecture that can drive faster innovation and deliver critical revenue growth and profitability for the industry.”

………………………………………………………………………………………………………………………………………………………….

About Cohere Technologies:

Cohere is the innovator of Universal Spectrum Multiplier (USM) software for 4G, 5G, and Multi-G O-RAN. USM improves mobile networks up to 2x by MU-MIMO, enabling existing devices in any FDD and TDD spectrum band. Cohere is the creator of the Orthogonal Time Frequency Space (OTFS) wireless system, and is headquartered in San Jose, Calif. (USA). Website: www.cohere-tech.com Twitter: @Cohere_MultiG

References:

https://www.cohere-tech.com/press-releases/multi-g-initiative

LightCounting: Open RAN/vRAN market is pausing and regrouping

ATIS and O-RAN Alliance MOU may be a prelude to Open RAN standards in North America

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

NTT, VMware & Intel collaborate to launch Edge-as-a-Service and Private 5G Managed Services

Japan’s NTT Ltd. today announced the launch of Edge-as-a-Service, a managed edge compute platform that gives enterprises the ability to deploy quickly, manage and monitor applications closer to the edge.

NTT and VMware, in collaboration with Intel (whose role was not specified), are partnering to innovate on edge-focused solutions and services. NTT uses VMware’s Edge Compute Stack to power its new Edge-as-a-Service offering. Additionally, VMware is adopting NTT’s Private 5G technologies as part of its edge solution. The companies will jointly market the offering through coordinated co-innovation, sales, and business development.

NTT’s Edge-as-a-Service offering is a globally available integrated solution that accelerates business process automation. It delivers near-zero latency for enterprise applications at the network edge, optimizing costs and boosting end-user experiences in a secure environment.

NTT’s Edge-as-a-Service offering, powered by VMware’s Edge Compute Stack, includes Private 5G connectivity and will be delivered by NTT across its global footprint running on Intel network and edge technology. This work is an extension of NTT’s current membership in VMware’s Cloud Partner Program. VMware and NTT will each market their corresponding new services to their respective customer bases.

“Combining Edge and Private 5G is a game changer for our customers and the entire industry, and we are making it available today,” said Shahid Ahmed, Group EVP, New Ventures and Innovation CEO, NTT.

“The combination of NTT and VMware’s Edge Compute Stack and Private 5G delivers a unique solution that will drive powerful outcomes for enterprises eager to optimize the performance and cost efficiencies of critical applications at the network edge. Minimum latency, maximum processing power, and global coverage are exactly what enterprises need to accelerate their unique digital transformation journeys.”

“The whole premise behind it is that many of our customers are looking for an end-to-end solution when they’re buying either edge or private 5G architectures as opposed to buying edge compute from XYZ and then a private 5G from somebody else and an IoT solution from someone else. So we thought we would do a full one-stop solution for our customers, particularly those that are in manufacturing and industrial sectors.” Ahmed also said that NTT will also be able to break these services apart for customers that just want one of the services, but they will all be managed by NTT.

Ahmed added: “We have a very simple pricing structure, which is predictable and tier-based so the customer doesn’t have to put up upfront capex, it’s all opex based. Obviously, some verticals like to purchase or acquire technology as a capex, so we can do that as well.”

As factories increase their reliance on robotics, vehicles become autonomous, and manufacturers move to omnichannel models, there is a greater need for distributed compute processing power and data storage with near-instantaneous response times. VMware’s secure application development, resource management automation, and real-time processing capabilities combined with NTT’s multi-cloud and edge platforms, creates a fully integrated Edge+Private 5G managed service. VMware and NTT’s innovative offering resides closer to where the data is generated or collected, enabling enterprises to access and react to information instantaneously.

This solution, which leverages seamless multi-cloud and multi-tenant connectivity, combined with NTT’s capabilities in network segmentation, and expertise with movement from private to public 5G, provides critical benefits for multiple industries, including manufacturing, retail, logistics, and entertainment.

“Enterprises are increasingly distributed — from the digital architecture they rely on to the human workforce that powers their business daily. This has spurred a sea change across every industry, altering where data is produced, delivered, and consumed,” said Sanjay Uppal, senior vice president and general manager, service provider, and edge business unit, VMware. “Bringing VMware’s Edge Compute Stack to NTT’s Edge-as-a-Service will enable our mutual customers to build, run, manage, connect and better protect edge-native applications at the Near and Far Edge while leveraging consistent infrastructure and operations with the power of edge computing.”

NTT’s Edge-as-a-Service platform was developed to help secure, optimize and simplify organizations’ digital transformation journeys. Edge-as-a-Service is part of NTT’s Managed Service portfolio, which includes Network-as-a-Service and Multi-Cloud-as-a-Service, all designed for enterprises to focus on their core business.

References:

https://www.sdxcentral.com/articles/news/ntt-vmware-intel-team-for-private-5g-edge-tasks/2022/08/

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Dell’Oro Group estimates the RAN market is currently generating between $40 billion and $45 billion in annual revenues. The market research firm forecasts that Open RAN will account for 15% of sales in 2026. Research & Markets is more optimistic. They say the Open RAN Market will hit $32 billion in revenues by 2030 with a growth rate of 42% for the forecast period between 2022 and 2030.

As the undisputed leader of microprocessors for compute servers, it’s no surprise that most of the new Open RAN and virtual RAN (vRAN) deployments use Intel Xeon processors and FlexRAN™ software stack inside the baseband processing modules. FlexRAN™ is a vRAN reference architecture for virtualized cloud-enabled radio access networks.

The hardware for FlexRAN™ includes: Intel® Xeon® CPUs 3rd generation Intel® Xeon® Scalable processor (formerly code named Ice Lake scalable processor), Intel® Forward Error Correction Device (Intel® FEC Device), Mount Bryce (FEC accelerator), Network Interface Cards – Intel® Ethernet Controller E810 (code name Columbiaville). Intel says there are now over 100 FlexRAN™ licensees worldwide as per these charts:

Source: Intel

A short video on the FlexRAN™ reference architecture is here.

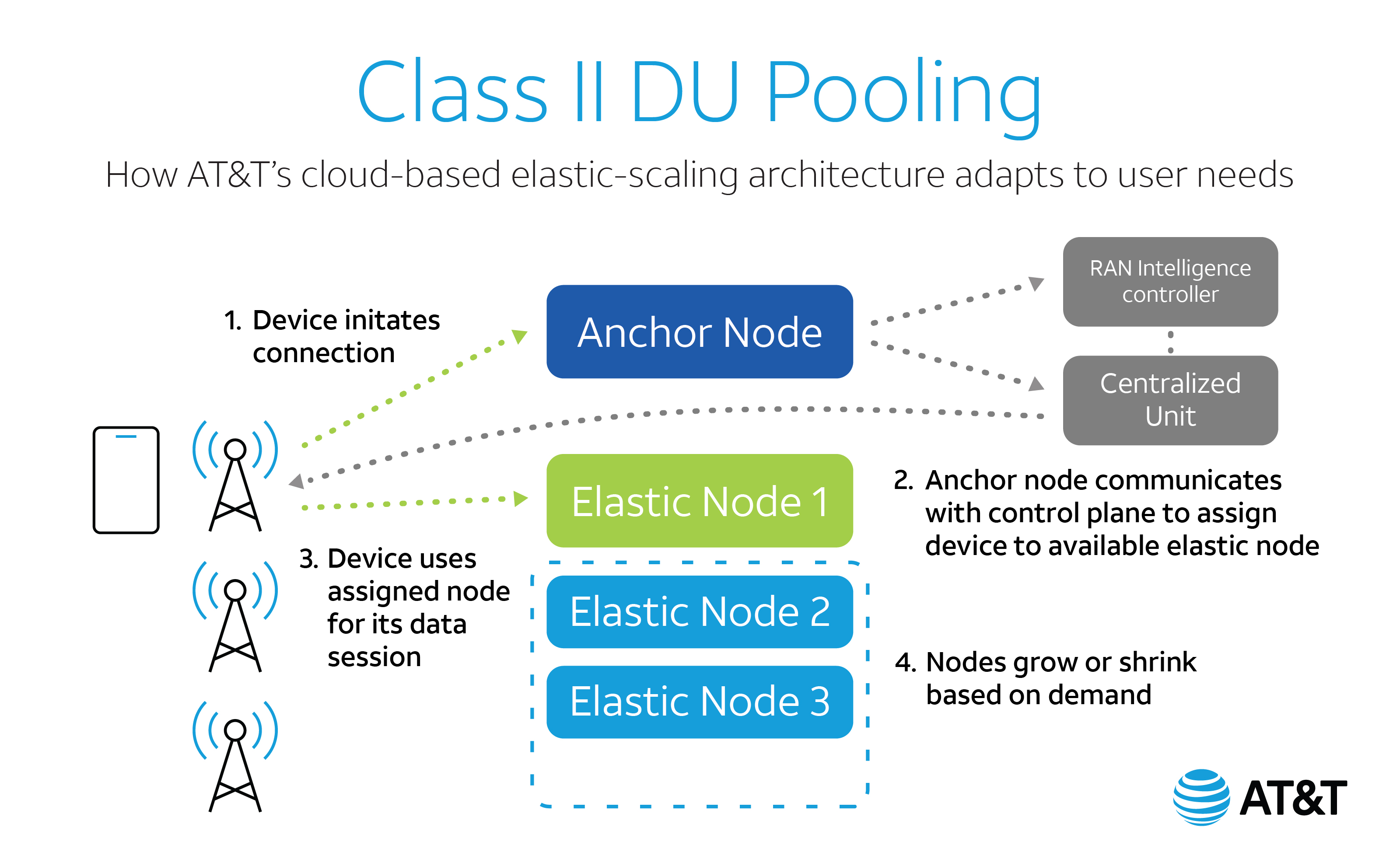

FlexRAN™ got a big boost this week from AT&T. In a February 24, 2022 blog post titled “Cloudifying 5G with an Elastic RAN,” Gordon Mansfield, AT&T VP Mobility Access & Architecture said that “AT&T and Intel had co-developed an industry-leading advanced RAN pooling technology freeing 5G radios from the limitations of dedicated base stations, while enabling more efficient, resilient, and green 5G networks. DU-pooling will eventually be usable by the entire 5G operator community to drive the telecom industry’s goals of green and efficient wireless networks forward.”

DU pooling technology was made possible by combining AT&T’s deep knowledge of Open RAN technologies as one of the co-founders of the O-RAN Alliance with Intel’s expertise in general purpose processors and software-based RAN through its FlexRAN™ software stack running on Intel 3rd generation Intel® Xeon® Scalable processors. The open standards for communications between radios and DUs that were published by O-RAN enabled its development, and the result is a technology demonstrator implemented on FlexRAN™ software.

………………………………………………………………………………………………………………………………………………………………………………..

Intel is now facing new Open RAN competition from several semiconductor companies.

Marvell has just unveiled a new accelerator card that will slot into a Dell compute server (which uses x86 processors). Based on a system called “inline” acceleration, it is designed to do baseband PHY layer processing and do it more efficiently than x86 processors. A Marvell representative claims it will boost open RAN performance and support a move “away from Intel.” Heavy Reading’s Simon Stanley (see below) was impressed. “This is a significant investment by Dell in open RAN and vRAN and a great boost for Marvell and the inline approach,” he said.

Qualcomm, which licenses RISC processors designed by UK-based ARM, has teamed up with Hewlett Packard Enterprise (HPE) on the X100 5G RAN accelerator card. Like Marvel’s offering, it also uses inline acceleration and works – by “offloading server CPUs [central processing units] from compute-intensive 5G baseband processing.”

There is also EdgeQ which is sampling a “Base Station on a Chip” which is targeted at Open RAN and private 5G markets. Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

The anticipated product launches will be welcomed by network operators backing Open RAN. Several of them have held off making investments in the technology, partly out of concern about energy efficiency and performance in busy urban areas. Scott Petty, Vodafone’s chief digital officer, has complained that Open RAN vendors will not look competitive equipped with only x86 processors. “Now they need to deliver, but it will require some dedicated silicon. It won’t be Intel chips,” he told Light Reading in late 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Inline vs Lookaside Acceleration:

While Marvell and Qualcomm are promoting the “inline” acceleration concept, Intel is using an alternative form of acceleration called “lookaside,” which continues to rely heavily on the x86 processor, offloading some but not all PHY layer functions. This week, Intel announced its own product refresh based on Sapphire Rapids, the codename for its next-generation server processors.

Simon Stanley, an analyst at large for Heavy Reading (owned by Informa), said there are two key innovations. The first involves making signal-processing tweaks to the Sapphire Rapids core to speed up the performance of FlexRAN™, Intel’s baseband software stack. Speaking on a video call with reporters, Dan Rodriguez, the general manager of Intel’s network platforms group, claimed a two-fold capacity gain from the changes. “In the virtual RAN and open RAN world, the control, packet and signal processing are all done on Xeon and that is what FlexRAN enables,” he said.

The other innovation is the promise of integrated acceleration in future Sapphire Rapids processors. Sachin Katti, who works as chief technology officer for Intel’s network and edge group, said this would combine the benefits of inline acceleration with the flexibility of x86. That is preferable, he insisted, to any solution “that shoves an entire PHY layer into an inflexible hardware accelerator,” a clear knock at inline rivals such as Marvell and Qualcomm. Despite Katti’s reference to inline acceleration, Stanley does not think it is Intel’s focus. “None of this rules out an inline acceleration solution, but it does not seem to be part of the core approach,” he told Light Reading. “The key strategy is to add maximum value to Xeon Scalable processors and enable external acceleration where needed to achieve performance goals.”

Both inline and lookaside involve trade-offs. Inline’s backers have promised PHY layer software alternatives, but Intel has a major head start with FlexRAN™, which it began developing in 2010. That means lookaside may be a lot more straightforward. “The processor is in control of everything that goes on,” said Stanley during a previous conversation with Light Reading. “It is essentially the same software and makes life very easy.”

Larger network operators seemed more enthusiastic about inline during a Heavy Reading survey last year. By cutting out the processor, it would reduce latency, a measure of the delay that occurs when signals are sent over the network. That could also weaken Intel, reducing power needs and allowing companies to use less costly CPUs. “If you use inline, you probably need a less powerful processor and less expensive server platform, which is not necessarily something Intel wants to promote,” Stanley said last year.

References:

https://www.intel.com/content/www/us/en/communications/virtualizing-radio-access-network.html

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

WBA field trial of Low Power Indoor Wi-Fi 6E with CableLabs, Intel and Asus

The Wireless Broadband Alliance (WBA) today announced results from a new field trial using technology from CableLabs®, Intel, and Asus. The purpose was to highlight the benefits of using Low Power Indoor Wi-Fi 6E for a wide variety of demanding residential applications, including video collaboration for telecommuting, multiplayer gaming, augmented and virtual reality, streaming video and more.

Since the 6 GHz band is higher frequency range than 2.4 GHz or 5 GHz typically used for Wi-Fi, signals have more of a challenge with obstruction the trial took place in a 3,600-square-foot, two-story home with a basement and the drywall, wood and other building materials typically found in a suburban residence. The Wi-Fi 6E enabled laptops with Intel® Wi-Fi 6E AX210 wireless cards were placed in various locations throughout the home and tests were conducted using a Wi-Fi 6E enabled access point from Asus.

The trial featured a range of tests on the downlink and uplink comparing throughput achieved on the 5 GHz and 6 GHz bands for wide channels (80 MHz and 160 MHz). CableLabs and Intel also analyzed the Wi-Fi 6E performance compared to Wi-Fi 6 on the 5 GHz band in the presence of overlapping neighbouring access points.

The trial’s key results include 1.7 TCP Gbps downlink and 1.2 TCP Gbps uplink speeds when using 160 MHz channels on Wi-Fi 6E in locations close to the access point. The larger channel bandwidth and the associated increase in total EIRP transmit power based on the channel bandwidth helped maximize both coverage and speed throughout the home.

These results clearly demonstrate the real-world benefits of using Wi-Fi 6E enabled devices over 6 GHz rather than 5 GHz. It is important to note that although Wi-Fi 6 devices perform better than Wi-Fi 5 devices over 5 GHz, next-level user experiences are possible with Wi-Fi 6E and the additional bandwidth available in the 6 GHz spectrum.

Tiago Rodrigues, CEO of the Wireless Broadband Alliance, said: “This field trial by CableLabs and Intel shows how Wi-Fi 6E and 6 GHz spectrum maximize coverage, capacity, throughput and the user experience in one of the most demanding real-world environments: people’s homes. Between HD and 4K streaming video, multiplayer gaming, dozens of smart home devices and videoconferencing for remote work, today’s home Wi-Fi networks are the foundation for how people live, work and play. This trial highlights that Wi-Fi 6E is more than capable of shouldering that load, especially when paired with 6 GHz spectrum.”

Lili Hervieu, Lead Architect of Wireless Access Technology at CableLabs, said: “CableLabs has been a proponent of making the 6 GHz band available for unlicensed use, and we were honored to conduct the Wi-Fi 6E trial in one of our employee’s homes for a truly real-world experience. The results confirmed the benefit of Wi-Fi 6E for increased capacity and data rate that will support the growing demand we are seeing for a large variety of applications and for new emerging technologies.”

Eric A. McLaughlin, VP Client Computing Group, GM Wireless Solutions Group, Intel Corporation, said: “Intel’s mission is to enable great PC experiences with industry leading platform capabilities like Wi-fi 6E. The wireless trial, in collaboration with CableLabs and the Wireless Broadband Alliance, helps demonstrate the versatility of Wi-fi 6E on Intel platforms. The speed, latency, and reliability improvements enabled by the new 6 GHz spectrum, with larger channels and freedom from legacy Wi-Fi interference, will help dramatically enhance user communication, entertainment, and productivity.”

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the Wireless Broadband Alliance (WBA) is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. WBA’s mission is to enable collaboration between service providers, technology companies, cities, regulators and organizations to achieve that vision. WBA’s membership is comprised of major operators, identity providers and leading technology companies across the Wi-Fi ecosystem with the shared vision.

WBA undertakes programs and activities to address business and technical issues, as well as opportunities, for member companies. WBA work areas include standards development, industry guidelines, trials, certification and advocacy. Its key programs include NextGen Wi-Fi, OpenRoaming, 5G, IoT, Testing & Interoperability and Policy & Regulatory Affairs, with member-led Work Groups dedicated to resolving standards and technical issues to promote end-to-end services and accelerate business opportunities.

The WBA Board includes Airties, AT&T, Boingo Wireless, Broadcom, BT, Cisco Systems, Comcast, Deutsche Telekom AG, GlobalReach Technology, Google, Intel, Reliance Jio, SK Telecom and Viasat. For the complete list of current WBA members, click here.

Juniper to integrate RAN Intelligent Controller with Intel’s FlexRAN platform for Open RAN

Juniper Networks today announced plans to integrate its radio access network (RAN) intelligent controller (RIC) with Intel’s FlexRAN platform for Open RAN development.

This joint initiative between two companies is part of Juniper’s continuing efforts to bring openness and innovation to a traditionally closed-off part of the network, providing a faster route-to-market for service providers and enterprises to deliver 5G, edge computing and AI. Juniper views open RAN as an opportunistic endeavor and claims it’s currently testing the RIC integration in labs and trials with some tier-one operators. Juniper’s RIC takes direction from the O-RAN Alliance and adheres to open interfaces and APIs, but the specialized features it adds on top are proprietary.

Juniper has made major investments to lead the shift to Open RAN, beginning with the exclusive IP licensing agreement with Netsia (a subsidiary of Turk Telekom Group), and continuing with significant involvement in the O-RAN Alliance. Juniper is heavily engaged in expanding integrations with key partners and is part of the innovation team building joint customer solutions in Intel’s 5G Lab.

Spending on Radio Access Networks (RAN) is a significant amount of service providers’ CapEx, primarily due to limited vendor choice and closed architectures which lead to lock-in. Juniper recognizes that the RAN is a domain that demands openness and best-of-breed innovation to ensure the best experience for network operators and their customers, and is determined to lead the industry toward that vision.

Juniper’s collaboration with Intel includes the following:

- Juniper RAN Intelligent Controller (RIC) and Intel FlexRAN platform are pre-integrated and pre-validated to enhance usability of a full ORAN-compliant Intelligent RAN system

- Collaborative R&D work with Intel Labs for RIC platform-specific apps to improve customer experience, maximize ROI and drive rapid ORAN ecosystem innovation

- Joint customer testbeds with Intel to validate performance-improving implementation and speed of time-to-market

Juniper is an active member of the O-RAN Alliance, contributing to six working groups and serving as chair and co-chair of the slicing and use-case task groups, respectively. Juniper is also an editor of RIC specifications within the alliance.

Quotes:

“Juniper has always been committed to open infrastructures, which is why we are excited to support the work that Intel has undertaken with their FlexRAN ecosystem. By collaborating with Intel, we are able to deliver cloud-native routing, automation, intelligence and assurance solutions and services that are optimized for our customers’ needs, speeding time-to-market and enabling them to monetize faster.”

– Constantine Polychronopoulos, VP of 5G and Telco Cloud at Juniper Networks

“RIC is like the brain for open RAN, and we also call it essentially the operating system of the RAN,” said Jai Thattil, director of strategic technology marketing at Juniper Networks. Juniper intends to differentiate its RIC from others by pre-integrating and validating the technology so operators can adopt it as part of a more comprehensive offering combined with other services. “Juniper is kind of in a unique position, compared to a lot of other vendors” because of its experience in 5G transport, network cores, service management and orchestration, according to Thattil.

“The virtualization of the RAN continues to gain momentum across the industry as operators take advantage of cloud economics and the delivery of new services. This collaboration with Juniper and the validation of FlexRAN and RIC solutions will assist service providers to overcome integration challenges and accelerate time-to-market for future deployments.”

– Caroline Chan, VP Intel Corporation, GM of Network Business Incubator Division

O-RAN Alliance Threatened:

The O-RAN Alliance is in a crisis because of U.S. sanctions against Chinese vendors in the group has troubled Nokia and Ericsson. In particular, the recent addition to the American “entity list” of three Chinese members of the Alliance. Kindroid, a semiconductor company, Phytium, a supercomputing company, and Inspur, a compute server vendor, have been accused of working with the Chinese military, and have joined 260 other Chinese companies, including, Huawei, on the entity list.

A few days after Nokia decided to suspend its technical activity with the O-RAN Alliance, in fear of American punishment over its engagement at the forum with companies recently put on the American “entity list,” Ericsson expressed similar concerns.

It should not be a surprise that, given O-RAN Alliance’s legacy (born out of a merger of the American-led xRAN Forum and the Chinese-led C-RAN Alliance), there are a strong Chinese contingency. According to Strand Consult, by the end of 2020, 44 of the 200 odd Alliance members are companies from China. Also of concern is this post by Mr. Strand, What NTIA won’t tell the FCC about OpenRAN.

………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/juniper-nudges-open-ran-ric-into-intel-flexran/2021/09/

Additional Resources:

Media Relations:

Lori Langona

Juniper Networks

+1 (831) 818-8758

[email protected]