Author: Alan Weissberger

HUAWEI CLOUD launches partner programs in LatAm and Caribbean

HUAWEI CLOUD [1.] announced today that it will launch partner programs in Latin America and the Caribbean, such as the Spark Program, which provides a fund of $10 million for startup innovation, and the Huawei Mobile Services (HMS) Ecosystem Program, which provides a fund of $10 million to enable app developers and partners to improve cloud experience.

Note 1. HUAWEI CLOUD provides a powerful computing platform and easy-to-use development platform to support Huawei’s full-stack, all-scenario AI strategy.

………………………………………………………………………………………………………………………………

From August 25 to September 3, HUAWEI CLOUD is celebrating its second anniversary in Latin America with a series of activities. HUAWEI CLOUD and its customers and partners will share experiences in digital transformation and intelligent upgrade.

The event includes a series of releases, covering distributed cloud, cloud native, big data, AI, and video service. The following cloud services are launched for the first time in Latin America: Intelligent EdgeCloud (IEC), Intelligent EdgeFabric (IEF), KYON (Keep Your Own Network), FunctionGraph 2.0, Multi-Cloud Container Platform (MCP), Application Service Mesh (ASM), Container Guard Service (CGS), GaussDB database, ModelArts Pro (AI development platform for enterprises), and Cloud-native Video Service. These powerful offerings help Latin American customers simplify connections, deployment, data analysis, AI adoption, and service rollout, facilitating their digital transformation.

Four Initiatives to Accelerate Digital Transformation and Intelligent Upgrade:

“Cloud is the core of the ICT industry and a key driving force for industry digitalization,” said Mr. Zhang Ping‘an, Senior Vice President of Huawei, CEO of Huawei Cloud BU, and President of Huawei Consumer Cloud Service. “HUAWEI CLOUD values the strategy of building a global presence within local reach. Latin America is one of the most important emerging markets for cloud computing. HUAWEI CLOUD has been investing heavily in this market and has achieved rapid growth,” Mr. Zhang Ping‘an continued. “Going forward, we will strengthen our support for the digital transformation and intelligent upgrade of our customers in Latin America through four initiatives: continuous tech innovation, joint outreach by HUAWEI CLOUD & Huawei Mobile Services, Global + Local services, and high-quality business ecosystems. We invite more partners to join. Together, we will build a robust digital ecosystem around the world and lay the cloud foundation for an intelligent world.”

Continuous tech innovation: Drawing on Huawei’s rock-solid foundation built by 80,000 R&D engineers and an annual investment of 15 billion US dollars into R&D, HUAWEI CLOUD continues to innovate in cloud native, AI, and big data, delivering global cloud services with compelling elasticity, performance, and consistency.

Joint outreach by HUAWEI CLOUD & Huawei Mobile Services (HMS): This cloud-cloud synergy initiative enables deep collaboration between HUAWEI CLOUD and Huawei Consumer Cloud for media, audio-visual, finance, industrial interconnection, and medical education. The synergy aims to deliver consistent technologies and experience for developers and partners via unified accounts, development platforms, and application distribution and operation.

Global + Local services: HUAWEI CLOUD has built 45 availability zones (AZs) in 23 regions around the world. Over the past year, HUAWEI CLOUD has continuously invested in Latin America, bringing the second region online in Mexico and adding two new AZs in Brazil and Chile. As of today, HUAWEI CLOUD operates three core regions in Chile, Brazil, and Mexico, and two country-level regions in Argentina and Peru, with eight AZs in total. HUAWEI CLOUD has the largest number of nodes in Latin America and the Caribbean. The unrelenting resource investment helps provide customers with stable, efficient, and low-latency cloud service experience.

High-quality business ecosystem: HUAWEI CLOUD has more than 20,000 partners, including consulting, SaaS, and software partners. In the process of global deployment, HUAWEI CLOUD has focused on building a multi-dimensional global ecosystem and complementing the advantages of different regions to create maximum value for customers. In the future, HUAWEI CLOUD will engage with more partners in Latin America and bring the experience in other regions of the world to create shared success for all.

Continuous Investment in Latin America and Increased Support for Partners

“We position our company not only as a provider of leading cloud infrastructure and services, but also a long-term business partner in Latin America, as well as a responsible corporate citizen,” said Fernando Liu, President of Latin America Cloud Business Dept, Huawei. “As a cloud service provider with the largest number of nodes and the fastest growth in Latin America, HUAWEI CLOUD will continue to invest more in Latin America with more local nodes, new solutions, and partner support. We are dedicated to bringing the latest technology to Latin America.”

Fernando Liu also stressed HUAWEI CLOUD’s belief in a co-created ecosystem of shared success, as HUAWEI CLOUD works with partners to take digital transformation and intelligent upgrade to new heights in Latin America. At the two-year anniversary, HUAWEI CLOUD is launching a series of support initiatives for HMS partners, SaaS partners, and start-ups.

- Spark Program: A fund of USD10 million to encourage and support innovation by start-ups in Latin America.

- HMS Ecosystem Program: A fund of USD10 million to enable developers and partners to launch applications on Huawei AppGallery. The program also helps them better experience device-cloud synergy based on the HUAWEI CLOUD platform.

- Service Partner Program: Provides additional incentives for consulting partners who pass the Service Capability Certification (SCC).

- SaaS Partner Program and Marketplace Program: Focused technical and commercial policies to support technical partners and help them develop solutions based on HUAWEI CLOUD. The Marketplace Program supports the partners throughout the sales cycle, helping them achieve greater business success.

Since 2019, HUAWEI CLOUD has worked with more than 1000 consulting partners and 200 technical partners in Latin America, covering 14 Latin American countries, propelling Latin America towards digital transformation and intelligent upgrade in logistics, manufacturing, transportation, retail, education, and telecommunications.

References:

Asia Pacific’s 5G network targets 90% coverage in Taiwan; Chunghwa Telecom leads 5G market

The Taipei Times reports that Asia Pacific Telecom Co. said it expects its 5G network to cover 90 percent of Taiwan’s population by the end of this year, as its 5G base station number reaches 9,500 units by sharing infrastructure with Far EasTone Telecommunications Co.

Through a co-build and co-share infrastructure model, Asia Pacific currently provides 5G services through 7,500 base stations utilizing the 3.5-gigahertz spectrum owned by Far EasTone, the company said.

“Asia Pacific has obtained a new opportunity to thrive, thanks to the new telecommunications regulation that allows telecoms to co-share and co-build 5G networks,” company chairman Lu Fang- ming told a media briefing following the company’s annual shareholders’ meeting in Taipei.

Asia Pacific Telecom Co chairman Lu Fang-ming speaks to reporters during a media briefing following the company’s annual shareholders’ meeting in Taipei’s Neihu District yesterday. Photo credit: Lisa Wang, Taipei Times

………………………………………………………………………………………………………………………………………….

A subsidiary of Hon Hai Precision Industry Co, Asia Pacific Telecom said it has seen a rebound in subscriber numbers after rolling out its 5G services in October last year, shaking off the adverse impact from a major price war in 2019.

The company saw a 172 percent jump in average revenue per user from 5G subscribers compared with its 4G users.

The company plans to upgrade 20 percent of its mobile subscribers — or about 400,000 users — to its new 5G services by the end of this year, despite a delayed regulatory approval, company president Huang Nan-ren told reporters.

The Fair Trade Commission approved the 5G infrastructure co-sharing proposal early this month.

The National Communications Commission yesterday gave the green light for Far EasTone to invest NT$5 billion (US$179 million) for an 11.58 percent stake in Asia Pacific, which would it give one seat on the latter’s board.

Asia Pacific said it expects its earnings before interest, taxes, depreciation and amortization to further improve, extending a positive trend over the past two years. It hopes to be profitable in three to five years.

…………………………………………………………………………………………………………………………………………

Taiwan as a whole is expected to reach a 5G penetration rate of nearly 30% by the end of this year, local news site Digitimes reported, citing industry sources.

According to the Digitimes report, Chunghwa Telecom (CHT) currently leads the Taiwanese 5G market, with nearly 1 million subscribers. The operator is expected to reach 2 million 5G customers by the end of the year.

The carrier currently operates a total of 8,000 5G base stations, with plans to expand this figure to 10,000 by the end of the year, according to the sources.

The operator was the first telco in Taiwan to receive a license for 5G services from the National Communications Commission (NCC). Chunghwa Telecom launched commercial 5G services in Taiwan based on the non-standalone (NSA) 5G architecture.

Far EasTone Telecommunications (FET) has already secured over 800,000 5G subscribers and expects 5G service users to account for 30% of its total mobile services by the end of 2021. The company has already deployed over 7,000 5G base stations, with its coverage reaching 75% of the total population in Taiwan.

Taiwan Mobile currently has 800,000 subscribers in the 5G segment and aims to increase its 5G penetration rate to 30% by the end of the year, according to the report. Taiwan Mobile had partnered with Nokia to launch its 5G network. The telco had acquired 60 megahertz of spectrum in the 3.5 GHz band and 200 megahertz of the 28 GHz frequency.

Digitimes also said that handset vendors will find it difficult to sustain the competitiveness of their 4G models while putting sales focus on 5G smartphones. If they want to achieve good business performance during the 4G to 5G transition period they must continue to sell 4G smartphones till 5G coverage in Taiwan increases.

References:

https://taipeitimes.com/News/biz/archives/2021/08/26/2003763222

https://www.rcrwireless.com/20210826/5g/apt-5g-coverage-reach-90-taiwan-population-end-2021

Emerging AI Trends In The Telecom Industry

by Harikrishna Kundariya, CEO at eSparkbiz Technologies

Introduction:

Artificial Intelligence (AI) is a technology that has the potential to shape our future. Today, almost all business verticals are utilizing AI in one way or another. AI is a large field, and there are many things yet to be researched, but it’s definitely been ground-breaking for many industries. Daily new research findings are emerging. Most of these have shown how AI can help businesses improve operations and be more productive.

AI is a black box for some, whereas it is a portal to unlocking great potential for others. Most businesses have started adopting AI as much as they can. It is predicted that by the end of 2023, companies will spend $10.83 billion on AI and automation.

Considering AI’s involvement in every business sector, the telecom industry isn’t far behind. Telecom companies are doing their individual research on AI to improve their business models. Using AI, it is easier for telecom companies to make accurate decisions. Moreover, with the right predictions from AI systems, they can get an insight into their decisions before they implement them in real life. Using AI’s predictive capabilities, telecom companies can get an edge over their competition.

To sustain the competition, businesses try to adhere to market standards and trends. Trends justify the changes that are widespread and followed by everyone to gain some benefits.

Here are some trends that are up and coming in the telecom industry.

Improve telecom network maintenance:

Telecom network maintenance is essential. When a network goes down, it is not only the users who suffer, but the telecom company also suffers a more significant loss. Loss of network shows the company’s insincerity towards its services and lack of care for its customers. The business also suffers monetary losses due to network breakdown. If there is some significant fault, the company has to get it rectified quickly, and this is costly too.

Hence AI is being used to overcome this problem. With AI, telecom companies can quickly identify the point of failure. Most of the time in network maintenance is spent behind finding the first point where maintenance is needed. With the availability of AI, it has become easy. Moreover, telecom companies are also leveraging IoT, which is a great technology.

Companies are looking forward to developing context-aware AI systems. Such AI systems are brilliant and can identify their state quickly. These systems follow the observe-orient-decide-act model to make decisions.

Using AI, downtime can be minimized. Moreover, the maintenance work can be carried out quickly by benefitting from context-aware systems and IoT processes.

Many companies are carrying out network maintenance with the help of drones. Comarch is one such company that creates solutions for telecom network maintenance with the help of AI-enabled drones.

Optimize network performance:

Network performance is vital if you want to be in the market. No user prefers a slow network. If your telephone towers are weak, you’ll face difficulty in adding new customers as well as maintaining the current ones.

There are many solutions for optimizing network performance. With the advent of AI, telecom service providers are using AI to optimize their networks.

One of the most common ways in network optimization is to predict network traffic and usage based on past conditions. AI can find out trends based on past data. These trends can then be used to create strategies to serve customers in a better way.

Telecom service providers create intelligent AI and ML systems that can accurately predict network traffic for any region. The results generated from AI systems are pretty accurate, and companies use those to optimize network performance. Usage data for any area is freely available with the service providers, so they can use this data to benefit.

Network performance can be optimized by increasing a tower’s capacity and range during certain peak hours when the area has high usage. Also, it can be decreased at a later stage to accommodate lower traffic levels.

Using AI, network performance can be controlled just like a remote-controlled device. The service providers are loving this benefit; hence AI is being used extensively. Many companies like AT&T and other telecom leaders are using self-organizing network technologies. These technologies have AI at their base and can work effectively under heavy traffic conditions.

Taking network performance a step ahead, Intel and Capgemini have tied up hands to develop a one-of-a-kind solution. These companies are already working on increasing the 5G spectrum’s capacity. Their project macaroni aims to boost a customer’s network experience by using real-time predictive analytics. Using this AI solution, every cell phone tower can handle more traffic than before, ultimately resulting in better network performance under a heavy customer base.

Improve network security/authentication:

Security is a big concern in the telecom industry. Tower Hijacking, wiretapping, and call forwarding pose a severe risk to the telecom business. To secure the user’s data from theft and cyberattacks, telecom service providers are using new and unique techniques. Many of these techniques include AI at their base.

AI can be used to authenticate users and also provide security to towers. When users sign up for a new connection, the chances of fraud are highest. They can use fake addresses, proofs, images, and any other thing. Identifying these fake things manually is nearly impossible. Hence, telecom companies are using AI to authenticate new users.

AI systems are being trained to spot fake documents. There are specific characteristics of fake documents that are well known. AI systems are trained to identify such characteristics on documents. When they reach a certain confidence level, they are used in everyday authentication work to ensure that no imposter is served.

Towers can be secured by using preventive AI technologies. These models are trained to look for defects in the towers every now and then. Sometimes the systems try to attack the towers to test the security procedure’s working. Using AI, it is easy for telecom companies to find towers in need of security. Such towers can be found by constantly monitoring and reporting if even a slight change is found in the tower’s characteristics.

End-user data protection is important because today, hackers are more active than ever before. Moreover, hackers are targeting places like telephone company’s databases where they can get a lot of personally identifiable data easily.

Many telecom service providers in the US are already using Cujo.ai’s network security solutions. Companies like Verizon, AT&T, and Charter communications rely on AI services from cujo.ai to secure their networks.

Cujo.ai has a unique offering named Sentry that can process large datasets in seconds. This AI system is well developed and it can make its own decisions regarding whether there is a security issue or not. Moreover, these systems are trained heavily with real-world data, so they can easily detect and take actions on unauthorized actions over a telecom network.

When AI is leveraged, the need for better standards increases. Hence, many telecom service providers use end-to-end encryption and other newly created security protocols and encryption standards. With suitable security systems, the data is fully secure and free from any interference.

Conclusions:

There are many trends that are seen within the telecom industry, and AI constitutes the majority of them. The telecom industry is being modernized at a large scale, and so they are trying to include AI as much as possible in their business models. Above, you’ve seen the three major trends seen in the telecom industry. These are the ones that are now becoming benchmarks for the telecom industry.

References:

https://www.esparkinfo.com/our-team.html

https://techblog.comsoc.org/2019/06/10/cisco-announces-ai-ml-and-security-software/

https://techblog.comsoc.org/2017/04/17/verizon-china-telecom-huawei-et-al-form-etsi-ai-group/

About Harikrishna Kundariya:

Mr. Harikrishna Kundariya is a serial entrepreneur leading eSparkBiz since 2010. Under his leadership the company has built its reputation as an excelling offshore development company. He values building relationships with clients rather than just focusing on the business at hand.

Dell’Oro: Total RAN market to grow 10-15% in 2021; Microwave Transmission equipment grows 11% YoY

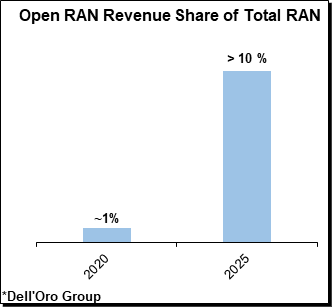

Dell’Oro Group has once again upgraded its forecast for the total RAN market, now projecting it to grow 10-15% this year. As expected, Huawei and ZTE are gaining market share in China, while Ericsson and Nokia are gaining everywhere else. Ericsson and Samsung increased their RAN revenue outside of China.

“The underlying long-term growth drivers have not changed and continue reflect the shift from 4G to 5G, new FWA (Fixed Wireless Access) and enterprise capex, and the transitions towards active antenna systems,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “At the same time, a string of indicators suggest this output acceleration is still largely driven by the shift from 4G to 5G, which continued at a torrid pace in the quarter (but only for the RAN; not for the 5G SA core network), even as LTE surprised on the upside,” continued Pongratz.

“With the improved outcome in Latin America, we estimate that four out of the six regions we track increased at a double-digit rate in the second quarter,” Stefan said via email. He was kind enough to send me these charts:

Additional highlights from Dell’Oro’s 2Q 2021 RAN report:

- RAN rankings did not change – Huawei and ZTE were the No.1 and No.2 suppliers in China while Ericsson and Nokia maintained their No.1 and No.2 positions outside of China.

- Revenue shares changed slightly – preliminary estimates suggest Ericsson and Samsung recorded revenue share gains outside of China, while Huawei and ZTE improved their positions in China.

- The combined share of the smaller RAN suppliers, excluding the top five vendors, improved by ~1% between 2020 and the first half of 2021, in part as a result of the ongoing Open RAN greenfield deployments in Japan and the U.S. “It’s all relative and it will take some time before open RAN moves the needle,” Pongrantz said.

- The RAN market remains on track for a fourth consecutive year of growth. The short-term outlook has been revised upward – total RAN is now projected to advance 10 to 15% in 2021.

………………………………………………………………………………………………………………………………………………..

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceiver, macro cell, small cell BTS shipments, and Open RAN for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, and LTE. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook.

- Segments: LTE, Sub 6 GHz 5G NR, Millimeter Wave 5G NR, Massive MIMO, Macro Cell, Small Cell, Open RAN

- Regions: North America, Europe, Middle East & Africa, Asia Pacific, China and CALA (Caribbean and Latin America)

To purchase this report, please contact: [email protected]

References:

2021 Outlook Upgraded for RAN Market, According to Dell’Oro Group

…………………………………………………………………………………………………………………………………..

Separately, Dell’Oro Group says that the demand for Microwave Transmission equipment grew 11% year-over-year in the first half of 2021, driven by LTE and 5G. In that period, microwave revenue from mobile backhaul application grew 16 percent.

“The Microwave Transmission market is recovering from the decline caused by the spread of COVID-19 as evidenced by the strong growth in the first half of 2021,” stated Jimmy Yu, Vice President at Dell’Oro Group. “Almost all of the vendors in this industry are benefiting from the improving mobile backhaul market, especially the top vendors. Since demand is rising, each vendor’s performance this year will come down to how well they navigate the supply issues created by the pandemic and semiconductor shortages,” added Yu.

Highlights from the 2Q 2021 Quarterly Report:

- All regions contributed to the positive market growth this quarter with the exception of Latin America. Latin America declined year-over-year for a ninth consecutive quarter, shrinking to its lowest quarterly revenue level that we have on record.

- The top three vendors in the quarter continued to be Huawei, Ericsson, and Nokia. In 2Q 2021, Huawei regained most of the market share lost in the previous quarter and returned to holding a 10 percentage point lead over Ericsson.

- E/V Band revenue growth remained positive for another consecutive quarter and held its double-digit year-over-year growth rate.

The Dell’Oro Group Microwave Transmission & Mobile Backhaul Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, ports/radio transceivers shipped, and average selling prices by capacities (low, high and E/V Band). The report tracks point-to-point TDM, Packet, and Hybrid Microwave as well as full indoor and full outdoor unit configurations.

The following markets are covered in the report:

- TDM, Packet, and Hybrid Microwave

- Microwave Transmission by Application: Mobile Backhaul and Verticals

- Split mount units, Full indoor units, and full outdoor units

- E/V Band systems

To purchase this report, please contact [email protected]

References:

5G and LTE Drive Mobile Backhaul Microwave Market 16 Percent in 1H 2021, According to Dell’Oro Group

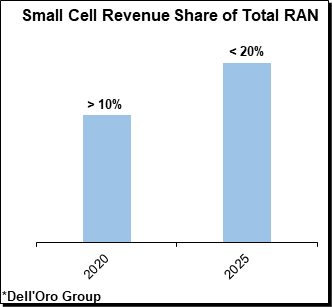

Dell’Oro: 5G SA indecisions slowing 5G Core network growth

Revenues for the Mobile Core Network (MCN) [1.] market slowed to 6% year-over-year growth in 2Q 2021 after four quarters of double-digit growth, according to a new report by Dell’Oro Group.

Communication Service Providers (CSPs) indecisions about moving forward with 5G Standalone (5G SA/core network are slowing 5G Core market growth (except in China). It is now expected to decelerate over the next four quarters dropping to 17% year-over-year in 2Q 2022.

Note 1. The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

With Network Function Virtualization (NFV) the 5G Core SBA is best served with Cloud-native Network Functions that disaggregates the hardware from the software and operates in a stateless function with the data separated from the control function among other things.

………………………………………………………………………………………………………………………………………………

“We attribute the slowdown to the slow uptake of 5G Standalone (SA) networks. CSPs need to make decisions about which direction to take for 5G SA deployments. CSPs have several options to mull over, with new choices that were not available during the switch from 3G to 4G,” stated David Bolan, Research Director at Dell’Oro Group. “One decision CSPs need to make is about the selection of Network Function Virtualization Infrastructure (NFVI). NFVI can be procured from a 5G core vendor, a third-party, the public cloud, or another platform like the Rakuten Communications Platform.”

Additional highlights from the 2Q 2021 Mobile Core Network Report:

• The Asia Pacific region accounted for 70% of the revenues for 5G Core as the Chinese SPs continue to build and Japanese SPs begin their buildouts.

• Top vendor ranking remains unchanged based on the four trailing quarters ending in 2Q 2021: Huawei, Ericsson, Nokia, ZTE, and Mavenir.

• 4G MCN (EPC) revenues are now in continual decline, but still represented 70% of the mix between 4G and 5G.

About the Report:

The Dell’Oro Group Mobile Core Network Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions.

To purchase this report, please contact at [email protected].

……………………………………………………………………………………………………………………………..

Closing Comments:

The slowdown in 5G SA/core network growth should come as no surprise to IEEE Techblog readers. We’ve pounded the table for a very long time, stating that in the absence of an ITU standard or 3GPP IMPLEMENTATION spec, the 5G SA/core network growth would be slow with many different versions implemented by CSPs. That will inhibit interoperability and portability of 5G endpoints which have 5G SA software.

Equally important is that ALL 5G services and features (e.g. network slicing, automation, MEC, etc) require a 5G Core network while almost all 5G deployments today are 5G NSA which has a 4G core (EPC) network.

References:

CSPs’ Indecisions Slow 5G Core Growth Except for China, According to Dell’Oro Group

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

RootMetrics touts 5G performance in Korea while users complain; No 5G SA in Korea!

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

T-Mobile Announces “World’s 1st Nationwide Standalone 5G Network” (without a standard)

Evaluating Gaps and Solutions to build Open 5G Core/SA networks

Ericsson Consumer Lab: Pandemic-driven online adoption habits to be future norm

- Ericsson released its largest consumer study to date, representing the opinions of 2.3 billion consumers across 31 markets

- On average, consumers will add 2.5 new services to their online activities by 2025

- Consumers’ time spent online is set to increase by ten hours per week on average by 2025

Called The Future Urban Reality, the Ericsson ConsumerLab report is Ericsson’s largest consumer study to date. It reveals key insights about what consumers believe will happen beyond the pandemic to the year 2025.

Representing the equivalent opinions of 2.3 billion consumers across 31 markets worldwide, the report predicts that consumers will not only continue to manage routine activities – such as remote work, e-learning, e-health and online grocery shopping – online but will also add an average of 2.5 new services. The report predicts that consumers will instead prioritize their leisure time to travel more, practice mindful living and spend time with friends and family.

As a result of increased online activities, consumers are predicted to spend, on average, an extra ten hours per week online when they enter the next normal. This move is also expected to close the gap between moderate and advanced online users, with the more moderate online users having introduced more online services in their daily life over the course of the pandemic.

Zeynep Ahmet, Senior Researcher, ConsumerLab, Ericsson Research, says: “Throughout the pandemic, information and communication technologies (ICT) have become the key means for consumers to manage many aspects in their everyday lives. Our latest findings suggest that this will continue well into the ‘next normal’ and beyond. This trend can support consumers to prioritize more of the important things in life, whether that is spending more time with loved ones or leading a healthier lifestyle. As an enabler of new online habits, it is clear that both mobile networks and digital inclusion efforts will play a crucial role in building tomorrow’s resilient, inclusive and equal societies.”

Key findings from the report:

- Anything routine will happen online by 2025: one in two consumers expect to use e-learning for upskilling. More than half of consumers globally believe all their entertainment activities will be online. More than one-third of consumers will order their groceries mainly online going forward.

- 64 percent of consumers expect heightened stress-levels within society: more than three-in-five consumers believe that it will be necessary to juggle multiple jobs to maintain a decent income. At the same time, seven-in-ten consumers expect to lead healthier lives.

- Convenience will come at the cost of privacy: while 75 percent of consumers predict that life will be steered by convenience in 2025, seven-in-ten also expect to pay more attention to their online security and privacy.

- Local shopping will lead the way: driven partly by environmental concerns, half of consumers globally expect to shop for more locally made products and produce as a new future norm.

- Half of consumers express a concern for climate change, yet 67 percent are looking to increase their leisure travel going forward: while most consumers believe that more sustainable travel options should be made accessible, only one in three indicate that they will refrain from flying when traveling for leisure in the future.

- Time spent online will increase by an average of 10 hours per week by 2025: the dependence on online platforms is expected to continue beyond the pandemic, with consumers predicting that they will add 2.5 more services on average to their daily online activities by 2025. This reiterates the importance of digital inclusion in ensuring an equal and resilient ‘next normal.’

China telcos add 43.71 5G subscribers in July, while capital spending declines

5G Subscriber Adds:

China’s network operators recorded a net addition of 43.71 million 5G subscribers in July, according to the carriers’ latest available reports.

- China Mobile, the world’s largest operator in terms of subscribers, added 28.91 million 5G subscribers in July. It had 279.60 million 5G subscribers at the end of July, compared to 84.05 million 5G customers in July 2020. The telco’s overall mobile subscriber base at the end of July reached 947.46 million, up compared to 945.50 million in June 2020.

- China Unicom said it added a total of 7.74 million 5G subscribers during July. During the first seven months of the year, Unicom added a total of 50.24 million 5G subscribers. The telco ended July with 121.07 million 5G subscribers. China Unicom reported an overall mobile base of with 311.61 million subscribers at the end of last month, up from 310.45 million in June.

- China Telecom added 7.06 million 5G subscribers in July to take its total 5G subscribers base to 138.21 million. The telco added 51.71 million 5G customers in the January-July period. China Telecom’s overall mobile base amounted to 364.62 million subscribers at the end of the July, after adding 2.13 million customers during the month.

China Telco CAPEX Crash:

However, total capital spending by the three state owned China telecom operators declined by 35% in the first half, with the number of new 5G base stations down 34% compared with last year. Spending on 5G by the two biggest telcos, China Mobile and China Telecom, slid 19%. China Unicom, has not disclosed its 5G spending but said it had reached only a fifth of its full-year capex target.

China Unicom revealed it had spent only RMB14 billion ($2.2 billion) of its 2021 capex budget of RMB70 billion ($10.8 billion), down 45% from 2020. It has a year-end target for 5G of RMB35 billion ($5.4 billion), the same as 2020.

China Mobile’s 5G investment of RMB50.2 billion ($7.8 billion) was 9% lower than last year, and only 46% of its full-year target of RMB110 billion ($17 billion).

China Tower reported a 28% fall in capex to 10.4 billion yuan ($1.6 billion).

China Telecom’s 5G spend plunged 45% to RMB11.1 billion ($1.71 billion), just over a quarter of its full-year forecast of RMB39.7 billion ($6.1 billion). Total capex declined 37% for the half. From the Chinese website Yicai.com:

From the data point of view, China Telecom’s capital expenditure in the first half of this year was less than one-third of the annual capital expenditure, and the investment progress was lagging behind. Liu Guiqing said that 5G was the largest investment in the first half of the year, including investment in 3.5GHz and 2.1GHz equipment. “On the whole, the investment in 3.5GHz equipment is relatively normal; for 2.1GHz investment, we make corresponding adaptations according to the current situation of the entire industry chain and the terminal ecology. At present, the purchase of 2.1GHz equipment has been completed, 3.5GHz telecom equipment is being negotiated, and there will be results soon.” He said that 87 billion yuan of investment can be completed this year, of which 5G investment is 39.7 billion yuan.

The China telcos maintain the same capex guidance for the full year of around 185 billion yuan ($28.6 billion), slightly up from last year’s 182 billion yuan ($28.1 billion). Yet for China Telecom and China Unicom, those capex numbers look quite challenging.

…………………………………………………………………………………………………………………………………….

5G Base Station Builds:

China’s three major mobile carriers have already activated 961,000 5G base stations and connected 365 million 5G-compatible devices by end-June, Chinese press reported, citing comments by press secretary for the Ministry of Industry and Information Technology (MIIT) Tian Yulong.

Unicom said it had built just 80,000 new base stations in the first half and was aiming to deploy another 240,000 in the latter half of this year.

Meanwhile, China Broadcast Network and China Mobile have recently completed a tender to deploy 400,000 5G base stations this year, as part of the companies’ efforts to launch a shared 5G network. The contracts had been won by Huawei, ZTE, Datang, Nokia and Ericsson.

China Mobile has attributed its lower 5G investment to issues around its partnership with China Broadcast Network in building a new 5G network in the 700MHz band. The main tender was set in July. China’s 5G rollout is a high priority infrastructure project closely supervised by the national government. The two carriers expect this shared 5G network to reach nationwide coverage within the next two years.

………………………………………………………………………………………………………………………………….

5G Subscriber Forecast & 5G SA Core Network:

China is forecast to reach 739 million 5G subscribers by 2025, according to a recent study by ABI Research. That would represent nearly 40% of the total global 5G subscriber market.

Earlier this year, Liu Liehong, vice minister of industry and information technology, had said that 5G Standalone (5G SA) networks covered all prefecture-level cities across China.

We wonder if all China’s telcos have implemented the same specification for 5G SA/core network and whether it is “cloud native” or not? Also, whether they use NFV (virtual machines) or containers?

Note there is no standard or implementation specification(s) that would ensure vendor interoperability on 5G SA networks from different telcos.

……………………………………………………………………………………………………………………………………………

References:

https://www.rcrwireless.com/20210824/5g/chinese-carriers-add-43-million-5g-subscribers-july

https://www.lightreading.com/5g/chip-shortage-taking-its-toll-on-china-5g-rollout/d/d-id/771681?

https://www.yicai.com/news/101136803.html

China Telcos Lose Subscribers; 5G “Co-build and Co-share” agreement to accelerate

Facebook tests voice and video calls in its main app

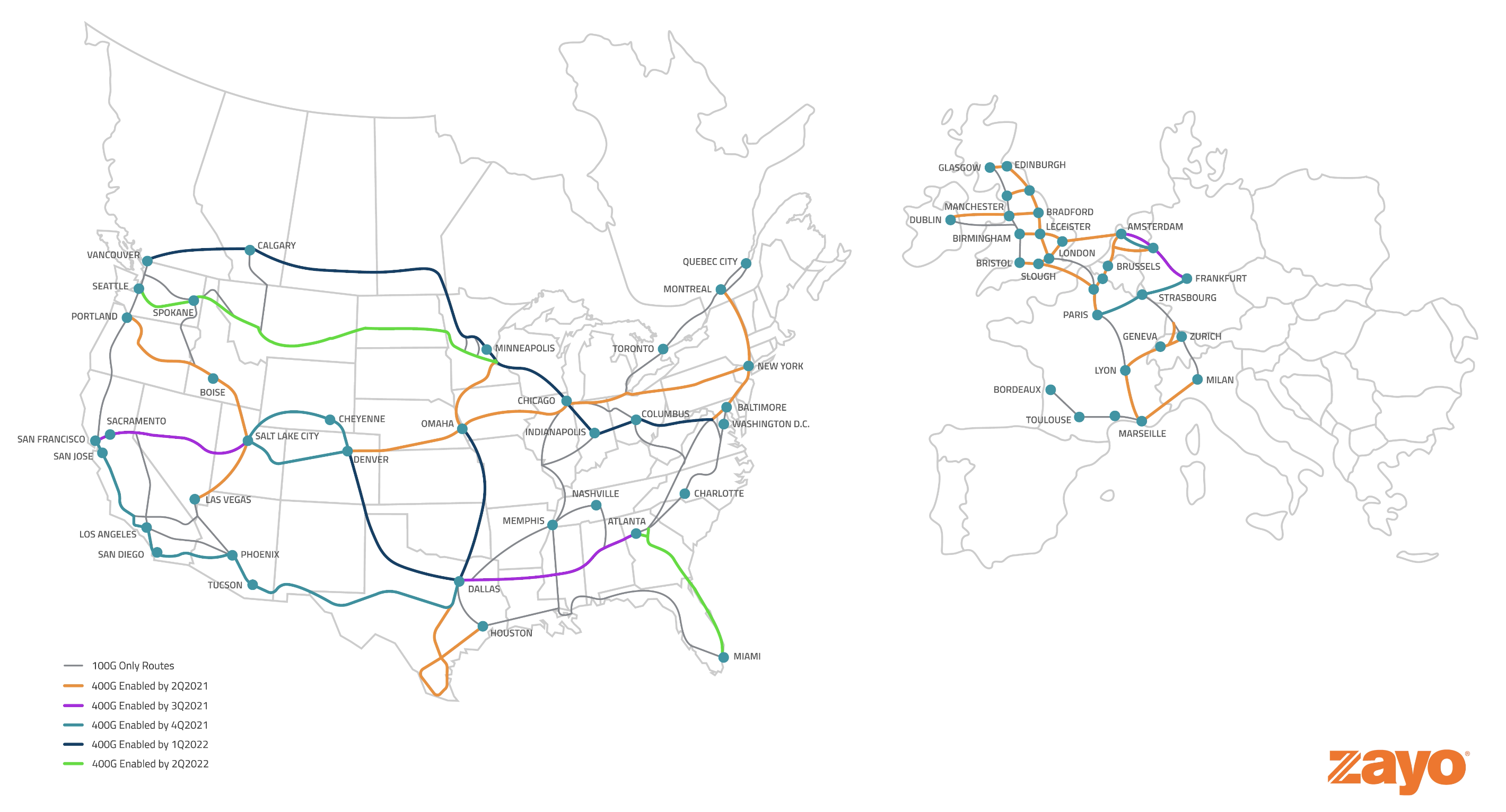

Zayo to deploy 400G b/s network across North America and Western Europe

Zayo Group Holdings today announced the planned deployment of 31 high capacity, 400G b/s enabled long haul routes across North America and Western Europe.

The availability of 400G b/s client-side wavelength capabilities will enable Zayo to deliver multi-terabit capacity across its underlying global network, enabling higher transmission rates, reduced cost per bit, increased data transfer speeds and significantly greater bandwidth capacity — key features that support enterprises on their digital transformation journeys. Up to 800G transmission will be available in select areas as Zayo deploys significant speed enhancements in anticipation of future network needs.

This optimized wavelength network is designed to provide a direct route for multi-cloud and multi-market connectivity, ideal for content providers, hyper-scalers, carriers and data centers. The upgrade will also enable reduced physical space requirements as well as reduced operation and maintenance costs resulting from a 40% reduction in power consumption.

The race to 400Gb/s has accelerated in recent years, with an increasing number of users, applications and devices driving exponential demand for increased bandwidth. Exceeding the current standard of 100G, Zayo’s new routes will provide a fourfold increase in maximum data transfer speed, supporting 5G technologies including Internet of Things, cloud-based computing, edge computing, virtual reality, high-definition video streaming and artificial intelligence.

“400G is rapidly becoming the prevailing requirement for networks and Zayo is breaking new ground with its 800G capabilities,” said Brian Lillie, Zayo Chief Product and Technology Officer. “This deployment underscores Zayo’s commitment to maintaining the leading edge of communications infrastructure and providing state-of-the art network solutions critical to our customers’ digital transformation journeys.”

C Chart courtesy of Avery Anderson of Zayo Group

Chart courtesy of Avery Anderson of Zayo Group

About Zayo Group:

Zayo’s 126,000-mile network in North America and Europe includes extensive metro connectivity to thousands of buildings and data centers. Zayo’s communications infrastructure solutions include dark fiber, private data networks, wavelengths, Ethernet, dedicated internet access and data center connectivity solutions.

Zayo owns and operates a Tier 1 IP backbone and through its CloudLink service, Zayo provides low-latency private connectivity that attaches enterprises to their public cloud environments. Zayo serves wireless and wireline carriers, media, tech, content, finance, healthcare and other large enterprises. For more information, visit https://zayo.com

References:

IDC: Global Managed Edge Services Market forecast ~$2.8B in 2025

According to IDC, Managed Edge Services [1.] will deliver worldwide revenues of about $445.3 million this year – a 43.5% increase over 2020. In addition, the IT market research firm forecasts that managed services revenues will hit nearly $2.8 billion in 2025. Over the 2021-2025 forecast period, the compound annual growth rate (CAGR) for managed edge services is expected to be 55.1%.

Note 1. Managed Edge Services seems to be a misnomer or at least a redundant term. That’s because all Multi-Access Edge Compute (MEC) services will be managed by a service provider (telco, cloud, or CDN) or network equipment vendor/managed services provider for on-premises edge computing.

“Managed edge services represent an emerging market opportunity that promises to provide a wide variety of low-latency services with the potential to enhance customer experience, drive operational efficiencies, and improve performance. It is a highly contested marketplace among key providers including communications SPs, hyper-scalers, CDN providers, and managed SPs with strategic partnerships and alliances forming to establish early commercial success and leadership,” said Ghassan Abdo, research VP, Worldwide Telecommunications at IDC.

“At the same time, service providers are keenly aware of the potential impact of the edge on their current market position and are watching closely for unforeseen competition from adjacent markets and new disruptors. Technology vendors including network equipment providers (NEPs) and software, datacenter, and networking vendors are vying to shape this market and play a significant role in delivering innovative edge services. Technical challenges abound including interoperability, open interfaces, and varying standards. The potential, however, is there to positively transform industries and user experiences,” he added.

IDC has identified three primary deployment models for managed edge services.

- On-premises deployment: This represents managed edge use cases where the edge compute infrastructure is deployed at the enterprises’ premises, also referred to as private deployment. This deployment model is intended to address the need for extra low latency and is applicable to industrial use cases, healthcare, and AR/VR applications.

- Service provider edge deployment: This represents managed edge services provided by edge compute deployed at the provider edge, both fixed and mobile. IDC expects this deployment model to spur development of a wide range of vertical use cases.

- CDN edge deployment: This represents managed edge services provided by edge compute deployed at the CDN POPs or edge locations. These use cases will enhance content delivery with personalized, high-fidelity, and interactive rich media customer experience.

IDC projects the on-premises edge to be the fastest growing segment with a five-year CAGR of 74.5%. The service provider edge will be the second-fastest growing segment with a CAGR of 59.2%, which will enable it to become the largest market segment by 2022. The CDN edge segment is expected to have a five-year CAGR of 41.9%.

The IDC report, Worldwide Managed Edge Services Forecast, 2021–2025 (IDC report #US47308121), provides a worldwide forecast for managed edge services covering 2021–2025. The forecast quantifies the revenue opportunities for service providers (SPs) that offer managed edge services on a monthly recurring revenue contractual arrangement. Service providers, in this context, comprise communications SPs, content delivery network (CDN) providers, public cloud providers or hyper-scalers, and managed service providers. This is the first forecast provided by IDC on this new and developing market.

For more information, contact:

Michael Shirer [email protected] or 508-935-4200

………………………………………………………………………………………………………………………………………

June was a busy month for managed edged compute deals:

- Vodafone outsourced its European MEC infrastructure to Amazon Web Services (AWS);

- Ericsson and Google agreed to collaborate on edge compute solutions for mutual benefit; and

- AT&T sold its Network Cloud technology to Microsoft which will also provide Azure (public cloud) based 5G SA/core network for AT&T.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48179321

https://telecoms.com/511025/managed-edge-services-revenue-expected-to-hit-2-8-billion-by-2025/

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I