4G

SNS Telecom & IT: Private LTE & 5G Network Ecosystem – CAGR 22% from 2025-2030

SNS Telecom & IT’s latest research report, “Private LTE & 5G Network Ecosystem: 2025 – 2030” indicates that the private LTE and 5G network market is estimated to be worth $7.2 billion by the end of 2028 and continues to grow as private 5G deployments overtake LTE across many vertical industries. This steady, strong growth stands in contrast to the tepid pace of infrastructure spending in the much larger but relatively stagnant public mobile network market, where standalone 5G core investments are growing but RAN (Radio Access Network) sales remain flat following a sharp decline last year.

Against this backdrop, the real-world impact of private networks – spanning both facility/campus-based and wide area deployments – is clearly visible across a diverse range of customers, from manufacturers, port operators, and airlines to sports clubs and public sector organizations.

Among many other impactful examples, Tesla, LG Electronics, and Hyundai have eliminated connection-related AGV (Automated Guided Vehicle) stoppages at their production facilities; Peel Ports Group has experienced a tenfold increase in network performance at the Port of Liverpool’s metal-heavy environment, which previously hindered Wi-Fi connectivity; Lufthansa has achieved a 75% improvement in operational process speed at its LAX cargo facility; partially sighted fans are able to experience football matches in exceptional detail using private 5G-connected headsets at Crystal Palace Football Club’s Selhurst Park stadium; and police forces in Ontario’s Peel-Halton Region have had uninterrupted in-vehicle data access – especially during outages affecting public mobile operator services – since adopting their independent public safety broadband network, which has recently undergone a 5G core upgrade.

While these practical and tangible benefits are already compelling, another sign of the market’s positive momentum is how customers are increasingly incorporating private 5G networks as a key component of their new facilities. A recent case in point is GDC’s (Georgia Department of Corrections) new state prison project, which also involves the implementation of a secure and physically isolated private 5G network using Band n48 (3.5 GHz) CBRS spectrum to provide indoor and outdoor coverage at a greenfield prison campus with 13 buildings covering 800,000 square feet across 200 acres. Examples of other facilities where private 5G networks have been or are being deployed from the outset include Hitachi Rail’s Hagerstown factory, Hyundai Motor’s HMGMA electrified vehicle plant, Los Angeles Chargers’ El Segundo training facility, Formula 1’s Las Vegas complex, Cleveland Clinic’s Mentor Hospital, CHI’s (Children’s Health Ireland) New Children’s Hospital, Port of Aberdeen’s South Harbour, NEC’s Kakegawa plant; Pegatron’s Batam smart factory, PATTA’s low-carbon Renwu factory, and Jacto’s Paulópolis production facility.

SNS Telecom & IT’s “Private LTE & 5G Network Ecosystem: 2025 – 2030” report projects that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 22% between 2025 and 2028, eventually exceeding $7.2 billion by the end of 2028. More than 70% of these investments – an estimated $5.1 billion – will be directed towards the buildout of standalone private 5G networks, which are well-positioned to become the predominant wireless connectivity medium for Industry 4.0 applications in manufacturing and process industries, as well as critical communications over mission-critical broadband networks for sectors such as public safety, defense, utilities, and transportation. This unprecedented level of growth is likely to transform the private RAN, mobile core, and transport network segments into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s. By 2030, private networks could account for as much as a fourth of all mobile network infrastructure spending.

About SNS Telecom & IT:

SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 6G, 5G, LTE, Open RAN, vRAN, small cells, mobile core, xHaul transport, network automation, mobile operator services, FWA, neutral host networks, private 4G/5G cellular networks, public safety broadband, critical communications, MCX, IIoT, V2X communications, and vertical applications.

………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.snstelecom.com/private-lte

Private 5G networks move to include automation, autonomous systems, edge computing & AI operations

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector are a $1.5B opportunity

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

Dell’Oro Group: RAN Market Grows Outside of China in 2Q 2025

Following two years of steep declines, initial estimates by Dell’Oro Group reveal that total RAN revenues—including baseband, radio hardware, and software, excluding services—advanced for a third consecutive quarter outside of China in 2Q 2025.

“Our initial assessment confirms that the narrative we’ve been discussing for some time is now coming to fruition. Market conditions have continued to stabilize, resulting in growth for three consecutive quarters outside of China,” said Stefan Pongratz, Vice President of RAN market research at the Dell’Oro Group. “However, broader market sentiment remains subdued, and a rapid rebound is not anticipated. The industry acknowledges that short-term fluctuations are unlikely to alter the market’s generally flat long-term trajectory,” Pongratz added.

Additional highlights from the 2Q 2025 RAN report:

- Growth in Europe, as well as the Middle East and Africa, nearly offset declines in the Caribbean and Latin America, as well as the Asia Pacific region.

- RAN vendor dynamics are gradually shifting, driven by three major trends: the strong are getting stronger, laggards are not improving, and the market is becoming increasingly divided.

- Ericsson and Huawei together accounted for more than 60 percent of the 1H25 market in North America and China, respectively.

- The top 5 RAN suppliers, based on worldwide revenues for the trailing four quarters, are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- The short-term outlook remains unchanged, with total RAN expected to stabilize in 2025.

For sure, RAN is not a growth market (+1% CAGR between 2000 and 2023). However, underneath that flattish topline over time, RAN revenues fluctuate significantly as new spectrum/technologies become available. After a massive RAN surge between 2017 and 2021, RAN revenues declined sharply in 2023 and the fundamental question now is fairly straightforward – how will the slowdown in mobile data traffic impact the RAN market over the next five years? The constantly changing and increasingly demanding end-user expectations in combination with the search for growth present opportunities and challenges for incumbent RAN suppliers and new entrants.

………………………………………………………………………………………………………………………………………………………………………………………………

Huawei’s ability to sustain growth during a period of industry volatility can be attributed to several key factors:

- Strong Presence in China: Huawei maintains a commanding position in its home market, which remains one of the largest and most competitive globally. Despite external pressures and restrictions, its domestic strength provides stability and scale.

- Expanding Global Footprint: Growth in regions such as Europe, the Middle East, and Africa helped Huawei offset weaker performance in Asia Pacific, the Caribbean, and Latin America. These markets have been central to Huawei’s strategy of diversifying its global presence.

- Technological Advancements in 5G: Huawei has continued to invest heavily in 5G RAN innovation, leveraging advanced radio hardware, AI-driven network optimization, and energy-efficient base stations. These capabilities strengthen its competitive edge in delivering cost-effective and high-performance solutions.

- Resilient Business Strategy: Despite global challenges, including regulatory restrictions in certain markets, Huawei has adapted by strengthening local partnerships, investing in regional ecosystems, and optimizing supply chain resilience.

………………………………………………………………………………………………………………………………………………………………………………………………….

According to the recent Omdia report, Ericsson is the top RAN vendor in both business performance and portfolio strength in 2025, thanks in part to its energy-efficient products, comprehensive support across radio technologies, and Open RAN–ready offerings.

Ericsson also continues expanding its enterprise solutions, with integrated strategies that include private 5G, Cradlepoint, and cloud-native cores. In India, Ericsson signed a multi-billion-dollar 4G/5G equipment deal with Bharti Airtel to enhance network coverage using Open RAN-ready solutions.

Nokia is actively replacing Huawei in key European deployments—securing a major Open RAN contract to supply Deutsche Telekom across 3,000 German sites. In the U.S., Nokia signed a multi-year deal with AT&T to provide cloud-based voice core and 5G network automation solutions powered by AI/ML. Nokia is gaining ground in Europe and the U.S. through modernization and automation contracts. Samsung is leveraging Open RAN partnerships for a comeback, and overall vendor competition is shaped by technology shifts toward cloud-native, AI-enabled, and multi-vendor architectures.

Samsung is stepping up in the Open RAN ecosystem — as illustrated by a successful joint demonstration between Samsung, Vodafone, and AMD showcasing a full Open RAN voice call using AMD processors and Samsung’s O-RAN vRAN software. Despite its RAN equipment revenues falling 25% in 2024, Samsung remains well positioned in Europe and Africa, particularly in Vodafone tenders for replacing Huawei, which may drive recovery through expanded vRAN/Open RAN adoption.

In summary, the global RAN market is stabilizing after a steep downturn in 2024. Huawei holds steady in core markets like China and parts of Europe, while Ericsson leads globally on portfolio strength and new deals — particularly Open RAN and enterprise solutions.

………………………………………………………………………………………………………………………………………………………………………………………………………

References:

RAN Market Grows Outside of China, According to Dell’Oro Group

https://telecomlead.com/telecom-equipment/huawei-achieves-growth-in-global-ran-market-amid-industry-stabilization-122275

https://www.ericsson.com/en/ran/omdia-2025

Dell’Oro: AI RAN to account for 1/3 of RAN market by 2029; AI RAN Alliance membership increases but few telcos have joined

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

Omdia: Huawei increases global RAN market share due to China hegemony

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Nokia’s Bell Labs to use adapted 4G and 5G access technologies for Indian space missions

Nokia’s Bell Labs is receptive to collaborating with the Indian Space Research Organization (ISRO), government agencies, and private players in India’s space sector to support future lunar missions with 4G, 5G and other advanced wireless networking technologies. Thierry Klein, President of Bell Labs Solutions Research, visited India in late June to explore potential partnerships and deepen engagement with the country’s growing space ecosystem. In an interview with Moneycontrol, Klein said India’s space ambitions present a compelling opportunity for collaboration.

“We are in a lot of conversations globally, working with government agencies and private companies to see how we can support their missions from a communications perspective. This is really the reason why I came to India—because it is a great opportunity for me to learn more about the space ecosystem and build relations and explore collaboration opportunities with the Indian space sector,” Klein said. He emphasized that while these space networks make use of existing 3GPP 4G and 5G cellular specifications, they must be drastically reengineered to withstand extreme temperatures, mechanical stress, radiation, and power constraints.

With India opening its space sector to private participation and international collaboration, Nokia’s proposed engagement could bring advanced telecom capabilities to future Indian lunar missions. Klein affirmed the company’s openness to working with both public and private entities in India to advance lunar and deep space communications.

India plans to launch the Chandrayaan-4 mission in 2027, aiming to bring back samples of moon rocks to Earth. Chandrayaan-4 will involve at least two separate launches of the heavy-lift LVM-3 rocket, which will carry five different components of the mission that will be assembled in orbit.

Asked if Nokia Bell Labs is engaging with ISRO, which is the primary agency in India for space exploration and research, Klein said, “Yeah, we definitely want to engage with them [ISRO]. I met people from both the government and private companies. They are very interested in continuing the conversations on both sides, the private sector as well as the public sector. I have had lots of conversations and lots of interest in exploring working together.”

Nokia Bell Labs has been developing cutting-edge communication systems for future lunar missions, with the aim of supporting the growing global interest from governments, such as India, and private space enterprises in establishing a permanent presence on the Moon and, eventually, Mars.

“Unlike the Apollo era, which relied on basic voice and low-resolution imagery, future lunar missions will demand high-definition video, data-rich applications, and low-latency networks to support scientific research, mining, transportation, and habitation on the Moon,” said Klein.

To meet those demands, Bell Labs is adapting commercial-grade 4G and 5G cellular technologies, currently used globally on Earth, for use in space. The first real-world test of this technology was conducted during the Intuitive Machines IM-2 mission, which landed on the moon on March 6, 2024, and successfully demonstrated a functioning 4G LTE network on the lunar surface.

“So that’s been our vision for seven or eight years, and that’s what we’ve really done with the Intuitive Machines 2 mission…We built the first cellular network and wanted to prove that we could do this. It was a technology demonstration to show that we can take something based on the networks we use on Earth, make all the necessary adaptations I mentioned, deploy the network, operate it successfully, and prove that cellular technology is a viable solution for space operations,” Klein said.

Klein said Bell Labs envisions the Moon’s communication infrastructure developing similarly to Earth’s surface networks, supporting permanent lunar bases, while satellites in lunar orbit provide 5G-based backhaul or coverage for remote regions. “We think of 5G as both providing surface capabilities as well as orbit-to-surface capabilities,” he said, likening it to non-terrestrial networks (NTNs) on Earth.

The company initially opted for 4G due to its maturity at the time the project began in 2020. Looking ahead, the migration to 5G is on the horizon, likely coinciding with the shift to 6G on Earth in 2030. “We would expect that we have 5G on the lunar surface by 2030,” Klein said, explaining that staying one generation behind Earth networks allows lunar missions to benefit from economies of scale, mature ecosystems, and deployment experience.

Nokia and Intuitive Machines successfully delivered a 4G LTE network to the Moon. However, a planned wireless call couldn’t be made because the Athena lander tipped over, limiting its ability to recharge. Still, Nokia’s Lunar Surface Communications System (LSCS), including its base station, radio, and core, ran flawlessly during the 25-minute power window.

Klein also revealed that Nokia is working with Axiom Space to integrate 4G LTE into next-generation space suits, which are slated for NASA’s Artemis III mission in 2027. Nokia continues to engage with governments and commercial partners globally. “Everybody realizes there is a need for communication. We are really open to working with anybody that we could support,” Klein said.

References:

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

U.S. military sees great potential in space based 5G (which has yet to be standardized)

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Key Objectives of WG Technology Aspects at ITU-R WP 5D meeting June 24-July 3, 2025

ITU-R WP 5D is responsible for the overall radio system aspects of the terrestrial component of International Mobile Telecommunications (IMT) systems, comprising the current IMT-2000, IMT-Advanced and IMT-2020 as well as IMT for 2030 and beyond. Note that 5D’s work is only for terrestrial radio access network interfaces. It does not include 5G or 6G Core network or satellite network access.

ITU-R WP5D Technology Aspects Working Group (WG) consists of several Sub Working Groups (SWGs):

SWG IMT SPECIFICATIONS, SWG EVALUATION, SWG RADIO ASPECTS, SWG IMT UNWANTED EMISSIONS, SWG IMT COORDINATION

Key objectives of WG Technology Aspects at their June 24-July 3, 2025 meeting include:

- Continue revising Recommendation ITU-R M.2150-2 (5G) and Recommendation ITU‑R M.2012-6 (IMT Advanced aka 4G), including consideration of further revision based on contribution;

- Continue working on revision of Document IMT-2030/2 “Process” – submission, evaluation process and consensus building process for IMT-2030;

- Start to work on candidate technology submission template for IMT-2030 (6G);

- Continue working on Report ITU-R M.[IMT-2030.TECH PERF REQ] – minimum requirements related to technical performance for IMT-2030 radio interface(s);

- Continue working on Report ITU-R M.[IMT-2030.EVAL] – Guidelines for evaluation of radio interface technologies for IMT-2030;

- Continue working on Report ITU-R M.[IMT-TROPO DUCT MITIGATION] – Mitigation of interference for IMT network under tropospheric ducting effect;

- Continue working on the documents of unwanted emission characteristics of base/mobile stations using the terrestrial radio interfaces of IMT-2020.

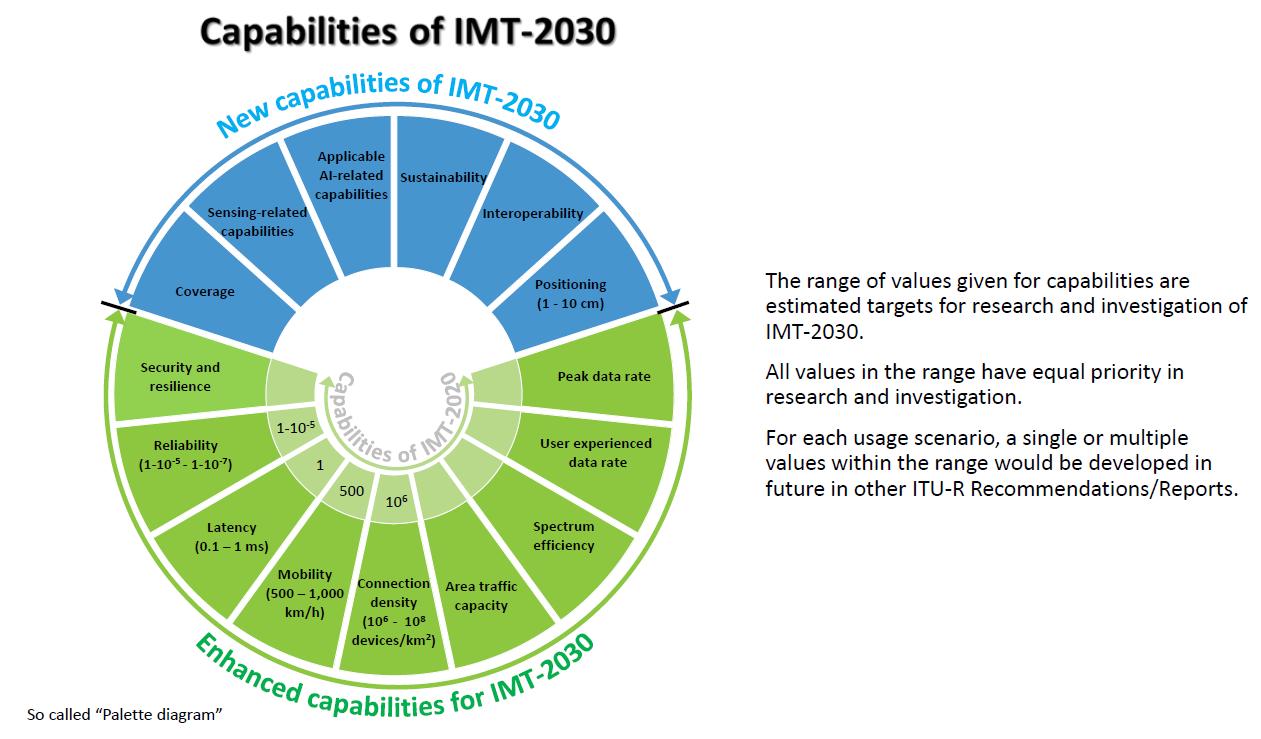

Backgrounder on IMT 2030 (6G):

Recommendation ITU R M.2160 ‒ “Framework and overall objectives of the future development of IMT for 2030 and Beyond” identifies IMT-2030 capabilities which aim to make IMT-2030 (6G) more capable, flexible, reliable and secure than previous IMT systems when providing diverse and novel services in the intended six usage scenarios, including immersive communication, hyper reliable and low latency communication (HRLLC), massive communication, ubiquitous connectivity, artificial intelligence and communication, and integrated sensing and communication (ISAC).

IMT-2030 can be considered from multiple perspectives, including users, manufacturers, application developers, network operators, verticals, and service and content providers. Therefore, it is recognized that technologies for IMT-2030 can be applied in a variety of deployment scenarios and can support a range of environments, service capabilities, and technology options.

IMT-2030 is also expected to be built on overarching aspects which act as design principles commonly applicable to all usage scenarios. These distinguishing design principles of the IMT‑2030 are including, but are not limited to sustainability, security and resilience, connecting the unconnected for providing universal and affordable access to all users independent of the location, and ubiquitous intelligence for improving overall system performance.

………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

Highlights of 3GPP Stage 1 Workshop on IMT 2030 (6G) Use Cases

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

Ericsson and e& (UAE) sign MoU for 6G collaboration vs ITU-R IMT-2030 framework

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

ITU-R WP5D invites IMT-2030 RIT/SRIT contributions

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

NGMN: 6G Key Messages from a network operator point of view

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

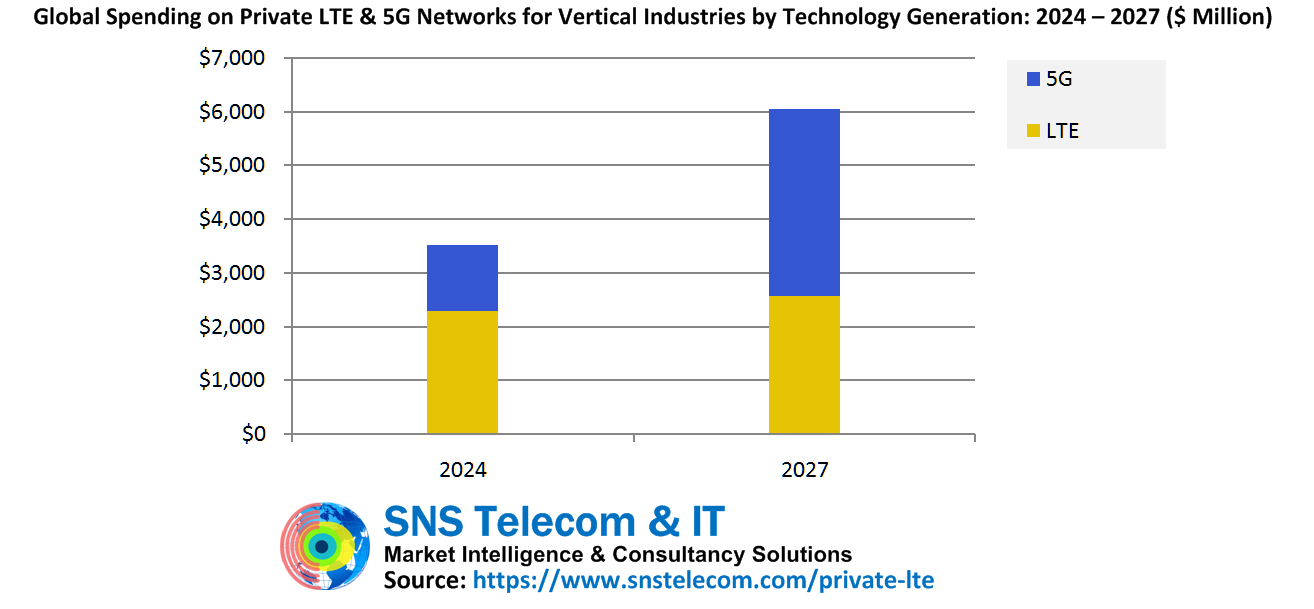

SNS Telecom & IT’s latest research report estimates that the private LTE and 5G network market revenues will be $6 Billion by the end of 2027. It’s one of the few bright spots in the otherwise gloomy wireless telecommunications industry, which is marked by a slowdown in public mobile network infrastructure spending and service providers struggling to monetize their existing 5G investments, particularly in the consumer segment.

Historically a niche segment of the wider wireless telecommunications industry, private 4G-LTE and 5G networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – have rapidly gained popularity in recent years due to privacy, security, reliability and performance advantages over public mobile networks and competing wireless technologies as well as their potential to replace hardwired connections with non-obstructive wireless links.

Their expanding influence is evident from the recent use of rapidly deployable private cellular network-in-a-box systems for professional TV broadcasting, enhanced fan engagement and gameplay operations at major sports events, including Paris 2024 Olympics, 2024 UEFA European Football Championship, North West 200 Motorcycle Race, 2024 World Rowing Cup III, New York Sail Grand Prix, 2024 PGA Championship, 2024 UFL Championship Game and 2024 NFL International Games, as well as the Republican and Democratic national conventions in the run up to the 2024 United States presidential election.

Other examples of high-impact private LTE/5G engagements include but are not limited to multi-site, multi-national private cellular deployments at the industrial facilities of Airbus, BMW, Chevron, John Deere, LG Electronics, Midea, Tesla, Toyota, Volkswagen, Walmart and several other household brand names; Aramco’s 450 MHz 3GPP network project in Saudi Arabia and ADNOCS’ 11,000-square kilometer private 5G network for connecting thousands of remote wells and pipelines in the UAE; defense sector 5G programs for the adoption of tactical cellular systems and permanent private 5G networks at military bases in the United States, Germany, Spain, Norway, Japan and South Korea; service territory-wide private wireless projects of 450connect, Ameren, CPFL Energia, ESB Networks, Evergy, Neoenergia, PGE (Polish Energy Group), SDG&E (San Diego Gas & Electric), Tampa Electric, Xcel Energy and other utility companies; and the recent implementation of a private 5G network at Belgium’s Nobelwind offshore wind farm as part of a broader European effort to secure critical infrastructure in the North Sea.

There has also been a surge in the adoption of private wireless small cells as a cost-effective alternative to DAS (Distributed Antenna Systems) for delivering neutral host public cellular coverage in carpeted enterprise spaces, public venues, hospitals, hotels, higher education campuses and schools. This trend is particularly prevalent in the United States due to the open accessibility of the license-exempt GAA (General Authorized Access) tier of 3.5 GHz CBRS spectrum. Some examples of private network deployments supporting neutral host connectivity to one or more national mobile operators include Meta’s corporate offices, City of Hope Hospital, SHC (Stanford Health Care), Sound Hotel, Gale South Beach Hotel, Nobu Hotel, ASU (Arizona State University), Cal Poly (California Polytechnic State University), University of Virginia, Duke University and Parkside Elementary School.

SNS Telecom & IT estimates that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 20% between 2024 and 2027, eventually accounting for more than $6 Billion by the end of 2027. Close to 60% of these investments – an estimated $3.5 Billion – will be directed towards the buildout of standalone private 5G networks, which will become the predominant wireless communications medium to support the ongoing Industry 4.0 revolution for the digitization and automation of manufacturing and process industries. This unprecedented level of growth is likely to transform private LTE and 5G networks into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s. By 2030, private networks could account for as much as a fifth of all mobile network infrastructure spending.

The “Private LTE & 5G Network Ecosystem: 2024 – 2030 – Opportunities, Challenges, Strategies, Industry Verticals & Forecasts” report presents an in-depth assessment of the private LTE and 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, four spectrum licensing models, 16 vertical industries and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,300 global private LTE/5G engagements – as of Q4’2024.

The report will be of value to current and future potential investors into the private LTE and 5G market, as well as LTE/5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “Private LTE & 5G Network Ecosystem: 2024 – 2030 – Opportunities, Challenges, Strategies, Industry Verticals & Forecasts” please visit: https://www.snstelecom.com/private-lte

About SNS Telecom & IT:

SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 6G, 5G, LTE, Open RAN, vRAN (Virtualized RAN), small cells, mobile core, xHaul (Fronthaul, Midhaul & Backhaul) transport, network automation, mobile operator services, FWA (Fixed Wireless Access), neutral host networks, private 4G/5G cellular networks, public safety broadband, critical communications, MCX (Mission-Critical PTT, Video & Data), IIoT (Industrial IoT), V2X (Vehicle-to-Everything) communications and vertical applications.

References:

https://www.snstelecom.com/private-lte

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Wipro and Cisco Launch Managed Private 5G Network-as-a-Service Solution

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

A Mobile World Live webinar on 5G-advanced upgrades identified new opportunities for network operator revenue streams, mostly due to improved network efficiencies and reduced costs. 5G Advanced, the next step in 5G evolution, will be specified in 3GPP Release 18 and 19. There is no work on it in ITU-R which is now focused on IMT-2030 (6G).

Egil Gronstad, T-Mobile senior director-technology development and strategy, said 5G Advanced will present opportunities for new revenue streams: 5G IoT will have lower cost and lower power consumption of endpoint devices (Redcap). Another 5G Advanced capability will be Ambient IoT (coming in Rel 19) which has a lot of opportunities via lower cost and no battery required in IoT devices. A bit further out is Integrated sensing and communications -using the network as a radar system to detect objects of interest. Improved spectrum efficiency will be improved using AI/ML for beam management.

Egil said 3GPP should develop specs for fixed wireless access (FWA). He’s disappointed with 3GPP not pursuing 5G FWA. “We haven’t really done anything in the 3GPP specs to specifically address fixed wireless,” he said. Neither has ITU-R WP 5D, which is responsible for developing all ITU-R recommendations for IMT (3G, 4G, 5G, 6G). FWA was not identified as an ITU use case for 5G and that hasn’t changed with 5G Advanced.

References:

https://www.nokia.com/about-us/newsroom/articles/5g-advanced-explained/

What is 5G Advanced and is it ready for deployment any time soon?

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Telenor installs base station in Antarctica; reports strong growth in Q4 and full year 2023

Nordic network operator Telenor yesterday announced the opening of the world’s southernmost commercial base station in Antarctica, setting a new benchmark for connectivity in the harshest of environments. The Norwegian Polar Institute’s research station in Antarctica,

The base station has extended reach, connecting a vast area to the outside world with mobile connectivity. The base station was put into operation in February. What makes this base station truly unique, aside from being the southernmost in the world, is that it’s operated from the world’s northernmost base station at Ny Ålesund which is located on the Svalbard archipelago (formerly known as Spitsbergen). Should the mobile signal fail, a satellite link from Troll to the KSAT-owned TrollSat satellite can also be used to provide wireless connectivity.

Head of Telenor Svalbard, Christian Skottun, emphasizes that a strong collaboration with the Norwegian Polar Institute is the foundation for establishing mobile coverage in Antarctica. “There has been a fruitful dialogue with the Norwegian Polar Institute regarding the possibilities offered by a base station in Antarctica. Telenor, with its presence in Svalbard, has extensive experience in building and operating mobile networks in Arctic regions. Mobile coverage is crucial for both Arctic poles. For research communities, the ability to utilize mobile IoT in gathering data from fieldwork is particularly attractive. Additionally, mobile coverage opens up new possibilities for research and environmental monitoring in the Antarctic oceanic area.”

The primary motivation behind this audacious project is to provide essential mobile coverage to the Norwegian Polar Institute’s research station, Troll, located in Antarctica. Troll serves as a hub for scientific exploration and environmental research, making reliable communication crucial for the success of ongoing projects and the safety of researchers working in the region.

This base station also provides a new dimension of safety as we now are able to offer mobile coverage in the area where the polar research station is located.

Telenor’s base station in Antarctica is claimed to be the world’s most southern commercial base station. (SOURCE: TELENOR)

……………………………………………………………………………………………………………………………………………………………………………

“Mobile coverage is a step forward for technological development at Troll. In addition, it provides new opportunities for research and monitoring in Queen Maud Land,” says the Director of the Polar Institute, Camilla Brekke.

In addition to close collaboration with the Norwegian Polar Institute, Telenor Svalbard also collaborates with Kongsberg Satellite Services (KSAT), which is responsible for the communication service from the Troll station. KSAT owns and operates TrollSat, one of the world’s most important ground stations for collecting data from climate and environmental monitoring satellites, co-located with the research station at Troll. KSAT is responsible for transmitting satellite-based information from Troll to users worldwide.

“Full mobile coverage at Troll also helps our users and simplifies communication with the outside world. We are therefore pleased that the satellite link from Troll also can be used for mobile phone traffic,” says Rolf Skatteboe, CEO of KSAT.

Birgitte Engebretsen, CEO of Telenor Norway, is proud and delighted that Telenor has contributed to establishing mobile connectivity between the poles.

“Our societal mission includes providing technology that makes research work easier. We see that the emergence of our new technological solutions opens up new possibilities for research,” says Engebretsen.

……………………………………………………………………………………………………………………………………………………………………………………………..

Telenor today announced that it ended 2023 strongly with solid top-line growth and strong cash flow both in the fourth quarter and for the full year. Service revenues for the full year 2023 ended up at NOK 62.5 billion, corresponding to an organic increase of 4.0 per cent compared to last year. EBITDA ended at NOK 34.6 billion, corresponding to organic growth of 2.8 per cent compared to the year before. Total free cash flow amounted to NOK 15 billion.

Service revenues for the fourth quarter were NOK 16.1 billion, up 4.9 per cent compared with the same period last year. EBITDA ended at NOK 8.5 billion, corresponding to an organic increase of 3.9 per cent. Free cash flow for the quarter was NOK 4.9 billion before M&A.

“I am very pleased that we continue to deliver growth with new and better products to our customers, at the same time as customer surveys show that we have Norway’s best and fastest network,” says Sigve Brekke, CEO of Telenor. “The fourth quarter was yet another strong quarter for Telenor,” Brekke added.

Telenor Nordics and Telenor Asia delivered four and seven per cent growth in service revenues, respectively, in the final quarter of the year, while organic EBITDA growth ended at five and four per cent.

Fraud is on the rise. In the fourth quarter, Telenor stopped around 300 million attempts at digital crime against Norwegian customers, which is an increase of around 30 percent compared to the previous quarter. In 2023, Telenor stopped 280 million fraud calls globally, out of which 31 million in Norway and 63 million in the Nordic region.

With artificial intelligence, criminal groups have gained access to a new toolbox that creates increased unpredictability. “Whether you’re an individual or a business owner, we are all targets. Therefore, we must adapt, be vigilant and take action to protect our digital lives and values”, says Brekke.

Telenor’s Financial outlook for 2024:

- Low single-digit organic growth in Nordic service revenues.

- Medium single-digit organic growth in both Nordic and Group EBITDA.

- Nordic capex to sales ratio of around 17 per cent.

- Free cash flow of between NOK 9-10 billion before M&A and potential items related to prior years’ activities.

References:

https://www.telenor.com/media/newsroom/press-releases/solid-year-and-fourth-quarter-for-telenor/

Telenor expands cloud-based core network with AWS to deliver 5G and edge services for customers

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

Telenor trial of multi-vendor 5G Standalone (SA) core network on vendor neutral platform

Telenor deploys first commercial 5G network in Norway

Cellsmart: 5G download performance improves but upload performance lags

UK market research firm Cellsmart finds that 5G network performance has greatly improved over the last 12 months. Real-world testing shows new peak download and upload speeds on 5G

networks. The industry is on the cusp of the gigabit era in cellular networks with these speeds moving from the lab to field in 2023.

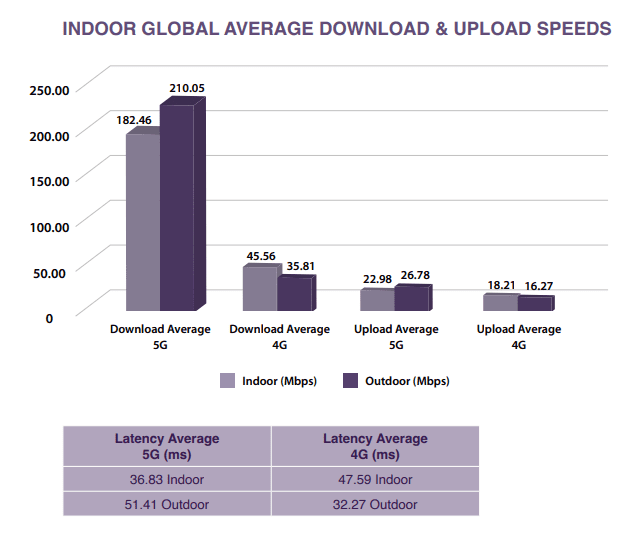

Cellsmart survey results revealed the global average outdoor download speed for 5G is 210.05 Mbps, compared to 182.46 Mbps indoors. 5G download speeds show a significant improvement over 4G with an increase of 486.57% (outdoor) and 694% (indoor).

Average upload speeds continue to lag behind download speeds with almost no improvement from 4G to 5G in indoor tests. Both 4G and 5G upload speeds remain significantly lower than download speeds. 5G upload speeds as a percentage of download speeds is 17%, compared to 74% on 4G. Download and upload speeds remain hyper-asymmetrical in 5G, which needs to improve to support enterprise use cases.

Source: Cellsmart

……………………………………………………………………………………………………………………

The survey results also revealed how latency is negatively impacted in indoor settings, with average 5G latency being 14.58ms lower indoors than outdoors. Tests run in Norway and the Philippines had outdoor speed tests that showed latency of less than 10ms, followed closely by US (10ms), China (11ms) and France (11ms). Average latency indoors was 15.32 higher on 4G than outdoors.

At the city level, Norway’s Oslo leads the way, while Spain’s Cerdanyola del Vallès and Bilbao come in second and third, while fourth placed Munich also recorded a 5G download speed in excess of 1 Gbps.

“Europe is ready for fixed wireless access,” declared Toby Forman, CEO at SmartCIC, owner of Cellsmart.

“Our test results show that 5G is beginning to mature into a justifiable investment that is ready to serve as an alternative to wired broadband and LEOs in multiple countries throughout Europe,” Forman said. “With performance rates that rival those of broadband and LEO, cellular should be considered when connecting enterprise locations. It’s a viable option.”

Cellsmart earlier this month reported that 5G upload speeds are insufficient for industrial applications.

As Cellsmart’s mission is, in its own words, “liberating enterprise from the constraints of fixed line connectivity,” it clearly has a vested interest in the results of its own study. It helps enterprises hook up to Fixed Wireless Access (FWA) solutions, essentially. However, the data still makes interesting reading against a backdrop of mobile network operators spending billions on the rollout of 5G networks.

……………………………………………………………………………………………………………………

References:

https://cellsmart.io/whitepaper/

https://telecoms.com/521982/5g-ready-to-support-fwa-in-europe/

CELLSMART: 5G upload speeds are insufficient for industrial/enterprise applications

Paradise Mobile’s Open RAN 4G/5G core network to run on AWS cloud

Paradise Mobile, a new Mobile Network Operator (MNO) building a greenfield, cloud-native, Open RAN (oRAN) 4G/5G mobile network from the ground up in Bermuda, today announced the selection of Amazon Web Services, Inc. (AWS) as its preferred cloud provider to help build an Open RAN 4G/5G network and bring innovative services to Bermuda for the first time.

Paradise Mobile will leverage AWS for digital platform workloads, with agreements to roll out AWS edge services on island to host the wireless core and Open RAN DU and CU workloads. Paradise Mobile is also working to bring AWS services to the island, which will provide local businesses and innovators in the IoT industry the necessary tools and infrastructure to rapidly develop, test and deploy cutting edge products and services. The new environment will provide the ability for a secure, scalable, and high-performance network, optimized for businesses to develop and launch their next big thing.

Sam Tabbara, Co-Founder and CEO, Paradise Mobile, said: “We see Amazon as a strategic long-term collaborator who shares our vision and values, and has the ability to significantly accelerate our roadmap of innovative new products and services we want to launch in Bermuda. This relationship will allow us to provide our customers with the best possible experience and create a hub for IoT innovation in Bermuda and beyond.”

Tabbara said Paradise plans to run its 5G network operations – including management software from Mavenir – directly inside a Kubernetes stack running on AWS. To do so, Tabbara explained that Paradise will install an instance of AWS inside a LinkBermuda data center and will run AWS at the base of each of its roughly two dozen planned cell towers. “The opportunity for us with AWS is to accelerate that [5G] future,” Tabbara told Light Reading.

The new IoT environment will also provide businesses with access to a wide range of AWS services. These services will give businesses the ability to process and analyze vast amounts of data in real-time, enabling them to create new and innovative products and services.

Sameer Vuyyuru, head of worldwide business development at AWS, said: “Leveraging AWS helps reduce time-to-market as well as create a new path to deliver innovation to customers. Our work with Paradise Mobile will not only help Paradise Mobile rapidly build, scale, and manage its mobile network but also offer secure solutions to accelerate innovation across Bermuda.”

Paradise intends to build specific network-based applications and services that can be used by other operators. Drone operations is one of the first 5G use cases that Paradise plans to support. Tabbara said that the company is in discussions with an unnamed drone startup that may use the Paradise 5G network for testing.

AWS will play a key role in that strategy, according to Tabbara. He explained that enterprise developers are already familiar with AWS’ cloud computing platform and therefore will be able to add networking into the mix as Paradise lights up its 5G operations. “Anyone who knows how to code applications … if you are able to code within that [AWS] ecosystem, then there’s value add for us to be in that same ecosystem,” Tabbara said. The drone startup plans to do its development work inside the relatively familiar confines of Amazon’s cloud computing platform. “We’re already co-developing some of these solutions,” Tabbara said.

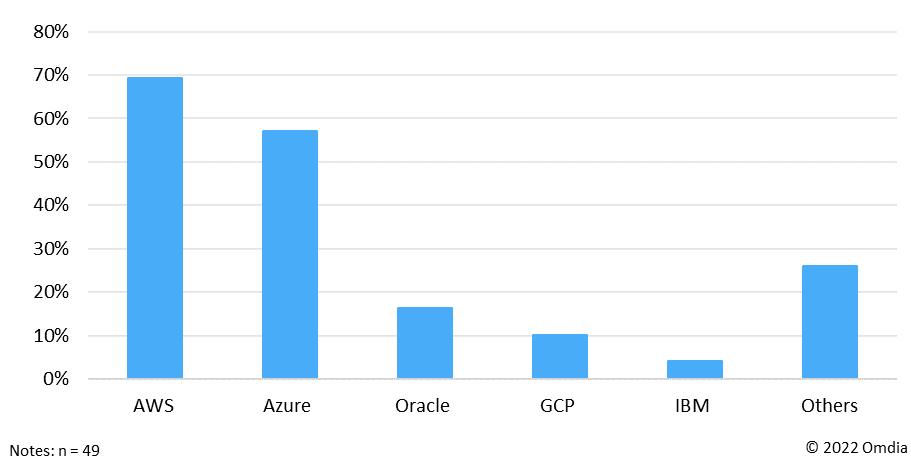

The announcement is yet another win for AWS as the hyperscaler competes against Oracle, Microsoft and Google Cloud for the telecom business. Omdia asked 49 telecom executives to list which public cloud or clouds their company is currently using to run any network functions, and respondents could select all that apply. Here was their response:

Note: Azure is Microsoft’s cloud offering, Google Cloud Platform is Google/Alphabet’s

…………………………………………………………………………………………………………………………………

Paradise Mobile is building a next generation wireless net network in Bermuda, followed by other CARICOM markets to be announced in the near future.

About Paradise Mobile:

Paradise Mobile is building a world of effortless connection with a next generation wireless network launching in multiple markets and countries, starting with Bermuda in 2023. Visit www.paradisemobile.com to learn more.

References:

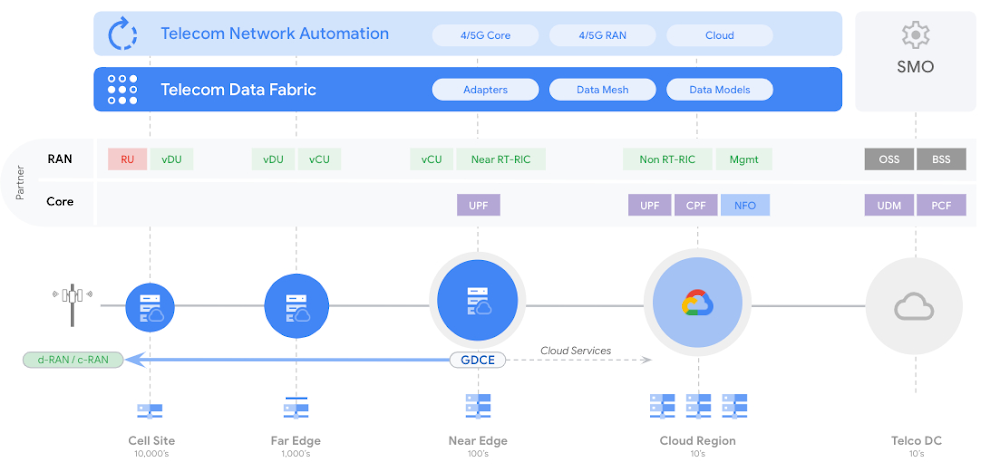

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

At MWC 2023 Barcelona, Google Cloud announced that they can now run the radio access network (RAN) functions as software on Google Distributed Cloud Edge, providing communications service providers (CSPs- AKA telcos) with a common and agile operating model that extends from the core of the network to the edge, for a high degree of programmability, flexibility, and low operating expenses. CSPs have already embraced open architecture, open-source software, disaggregation, automation, cloud, AI and machine learning, and new operational models, to name a few. The journey started in the last decade with Network Functions Virtualization, primarily with value added services and then deeper with core network applications, and in the past few years, that evolved into a push towards cloud-native. With significant progress in the core, the time for Cloud RAN is now, according to Google. However, whether for industry or region-specific compliance reasons, data sovereignty needs, or latency or local data-processing requirements, most of the network functions deployed in a mobile or wireline network may have to follow a hybrid deployment model where network functions are placed flexibly in a combination of both on-premises and cloud regions. RAN, which is traditionally implemented with proprietary hardware, falls into that camp as well.

In 2021,the company launched Google Distributed Cloud Edge (GDC Edge), an on-premises offering that extends a consistent operating model from our public Google Cloud regions to the customer’s premises. For CSPs, this hybrid approach makes it possible to modernize the network, while enabling easy development, fast innovation, efficient scale and operational efficiency; all while simultaneously helping to reduce technology risk and operational costs. GDC Edge became generally available in 2022.

Google Cloud does not plan to develop its own private wireless networking services to sell to enterprise customers, nor does the company plan to develop its own networking software functions, according to Gabriele Di Piazza, an executive with Google Cloud who spoke at MWC 2023 in Barcelona. Instead, Google Cloud would like to host the networking software functions of other vendors like Ericsson and Mavenir in its cloud. It would also like to resell private networking services from operators and others.

Rather than develop its own cloud native 5G SA core network or other cloud networking software (like Microsoft and AWS are doing), Google Cloud wants to “avoid partner conflict,” Di Piazza said. Google has been building its telecom cloud story around its Anthos platform. That platform is directly competing against the likes of AWS and Microsoft for telecom customers. According to a number of analysts, AWS appears to enjoy an early lead in the telecom industry – but its rivals, like Google, are looking for ways to gain a competitive advantage. One of Google’s competitive arguments is that it doesn’t have aspirations to sell network functions. Therefore, according to Di Piazza, the company can remain a trusted, unbiased partner.

Image Credit: Google Cloud

Last year, the executive said that moving to a cloud-native architecture is mandatory, not optional for telcos, adding that telecom operators are facing lots of challenges right now due to declining revenue growth, exploding data consumption and increasing capital requirements for 5G. Cloud-native networks have significant challenges. For example, there is a lack of standardization among the various open-source groups and there’s fragmentation among parts of the cloud-native ecosystem, particularly among OSS vendors, cloud providers and startups.

In recent years, Google, Microsoft, Amazon, Oracle and other cloud computing service providers have been working to develop products and services that are specifically designed to allow telecom network operator’s to run their network functions inside a third-party cloud environment. For example, AT&T and Dish Network are running their 5G SA core networks on Microsoft Azure and AWS, respectively.

Matt Beal, a senior VP of software development for Oracle Communications, said his company offers both a substantial cloud computing service as well as a lengthy list of network functions. He maintains that Oracle is a better partner for telecom network operators because of it. Beal said Oracle has long offered a wide range of networking functions, from policy control to network slice management, that can be run inside its cloud or inside the cloud of other companies. He said that, because Oracle developed those functions itself, the company has more experience in running them in a cloud environment compared with a company that hasn’t done that kind of work. Beal’s inference is that network operators ought to partner with the best and most experienced companies in the market. That position runs directly counter to Google’s competitive stance on the topic. “When you know how these things work in real life … you can optimize your cloud to run these workloads,” he said.

While a number of other telecom network operators have put things like customer support or IT into the cloud, they have been reluctant to release critical network functions like policy control to a cloud service provider.

References:

https://cloud.google.com/solutions/telecommunications

https://cloud.google.com/blog/topics/telecommunications