5G SA/5G Core network

Nokia to showcase agentic AI network slicing; Ericsson partners with Ookla to measure 5G network slicing performance

Executive Summary:

Today, Nokia announced a strategic collaboration with Amazon (AWS), Du, and Orange to debut an industry-first agentic AI-driven network slicing [1.] capability on a 5G SA core network. Du and Orange will deploy this new technology which uses Nokia’s 5G AirScale base stations, MantaRay SMO and Agentic AI modules in tandem with Amazon’s Bedrock Artificial Intelligence platform. Autonomous AI agents are used to ingest and process real-time telemetry—including geospatial data, event triggers, and traffic patterns—the framework enables adaptive network slicing. This architecture allows communications service providers (CSPs) to dynamically orchestrate resources in response to fluctuating demand, such as prioritizing mission-critical throughput for first responders during emergency incidents.

Note 1. There are no ITU standards for network slicing or the 5G SA Core network required to implement that capability. 3GPP specifications define end-to-end network slicing architecture, covering slice management (TS 28.552, TS 28.554), service requirements, and security (NSSAA – Network Slice Specific Authentication and Authorization). The NSA and CISA have released specific, recognized guidance on designing, deploying, and maintaining secure 5G standalone (SA) network slices. ETSI publishes and adopts 3GPP technical specifications (specifically the 28-series) as European standards for network slicing management, including 5G RAN, core network, and NFV-MANO architecture. ETSI, as a 3GPP partner, ensures these specifications cover the lifecycle of network slices.

…………………………………………………………………………………………………………………………………………………………………………………………..

- Data Ingestion & Inference: Agentic AI modules, hosted on Amazon Bedrock, ingest real-world contextual data (e.g., emergency alerts, traffic sensors, weather) alongside live network KPIs.

- Intent-Based Policy Generation: The AI agents analyze this telemetry to determine the optimal network configuration required to meet specific Service Level Agreements (SLAs) or emergency “intents'”

- NEF & SMO Integration: These high-level intents are translated into actionable policies and pushed to Nokia’s MantaRay SMO (Service Management and Orchestration).

- Dynamic RAN/Core Adjustment: The Network Exposure Function (NEF) acts as the secure gateway, allowing the AI agents to interface with the 5G Core. It exposes network capabilities so the agents can dynamically adjust RAN policies and resource allocation across the 5G AirScale base stations.

- Autonomous Feedback Loop: The system operates in an autonomous mode where agents continuously monitor the results of their adjustments, performing forensic analysis to refine slicing parameters in real-time.

Nokia will host live technical demonstrations of this AI network slicing capability at its 2026 Mobile World Congress (MWC) Barcelona exhibit.

Quotes:

“This innovation marks a major milestone in the evolution of AI-native networks,” said Pallavi Mahajan, Chief Technology and AI Officer at Nokia. “By combining Nokia’s advanced network slicing capabilities with agentic AI, we are enabling operators to deliver premium, intent-based services that adapt dynamically to real-world conditions. Nokia is advancing connectivity by unlocking new value streams for telecommunication providers and supporting next-generation applications and differentiated services for enterprises, industries and consumers.”

Amir Rao, Global Director, GTM & Telco Solutions at AWS added: “Network slicing has long promised to unlock new revenue streams for operators, but manual configuration and static policies have prevented end customers from accessing on-demand provisioning. By integrating agentic AI capabilities through Amazon Bedrock with Nokia’s application, operators can now deliver intelligent, context-aware network slicing that responds dynamically to real-world conditions from traffic surges to emergency situations. This transforms network slicing from a technical capability into a true business enabler, allowing operators to monetize their 5G investments through differentiated, premium services that adapt automatically to customer needs. Agentic Network Slicing is the beginning of an era that will enable telecommunications providers to enable real-time intent-based service provisioning for end customers.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Competitive Network Slicing Solution:

Rival wireless equipment vendor Ericsson yesterday gave a preview of a network slicing related offering which it will be demonstrating at the 2026 MWC. Together with Ookla it has developed a specialized test version of its Speedtest app designed to measure and validate 5G network slicing performance. The tool enables the Speedtest app to identify and test specific network slices, which apparently demonstrates how Service Level Agreements (SLAs) for differentiated services can be verified in real-time by consumers and service providers.

Ericsson reported in its latest Mobility report that there were 65 commercial network slicing services worldwide providing so-called “differentiated connectivity” offerings. That’s out of a total of 118 network slicing cases discovered by Ericsson’s researchers. Yet in the UK, none of the three mobile network operators have launched a commercial 5G network slicing capability yet. According to Ofcom’s latest Connected Nations report, 5G SA is available across 83% of outside areas in the country and 5G SA accounts for nearly one-third of 5G traffic. However, 4G accounts for 72% of total monthly data traffic.

“Network slicing is no longer a future concept; it is a commercial reality. However, you cannot manage what you cannot measure,” said Tibor Rathonyi, Senior Advisor at Ookla. “Our work with Ericsson is a pivotal first step in providing the transparency needed to prove the value of these premium 5G services to both consumers and enterprises.”

Philipp Bichsel, Executive Vice President Mobile Network & Services at Swisscom, said: “Swisscom has retained the title as the country’s best-performing mobile network over many years by truly prioritizing the delivery of the best possible customer experience. This has meant embarking on a journey to fully exploit automation to enhance reliability and efficiency without compromising the service quality our customers expect. As we advance towards self-learning, autonomous networks, enabling Swisscom to build smarter and more adaptive network operations, we are leveraging the SMO framework as the foundation for this evolution. Within this framework, partner solutions such as Ericsson’s Intelligent Automation Platform and its ecosystem of rApps play an important role in helping us explore the potential of AI driven automation.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecoms.com/5g-6g/nokia-and-aws-show-off-agentic-ai-powered-5g-advanced-network-slicing

https://www.telecoms.com/5g-6g/ericsson-and-ookla-launch-network-slicing-measurement-tool

https://www.lightreading.com/5g/eurobites-network-slicing-enjoying-a-moment-finds-ericsson-report

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/november-2025

https://www.lightreading.com/5g/5g-network-slicing-not-ready-for-prime-time-in-uk

https://www.awardsolutions.com/portal/resources/network-slicing

ABI Research: 5G network slicing market to hit $67.52 billion in 2030 with Asia Pacific in the lead

5G network slicing progress report with a look ahead to 2025

FCC Draft Net Neutrality Order reclassifies broadband access; leaves 5G network slicing unresolved

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Dell’Oro: Mobile Core Networks +15% in 2025; Ookla: Global Reality Check on 5G SA and 5G Advanced in 2026

A recent Dell’Oro market research report estimates that 4G/5G Mobile Core Network (MCN) revenues rose 15% YoY in 2025, which was the fastest growth since 2014. For the first time, the 5G MCN market accounted for 50% share of the total MCN market.

Editor’s Note: The 4G and 5G Non Standalone (NSA) mobile core network market (Evolved Packet Core) is experiencing long-term decline as investments are finally shifting toward 5G standalone (SA) networks.

“In 2025, the MCN market recorded its highest year-over-year revenue growth rate since 2014,” stated Dave Bolan, Research Director at Dell’Oro Group. “This was driven by record-setting growth rates in all market segments: 4G MCN (highest since 2019), 5G MCN (highest since 2022), and Voice Core (highest since 2007). 4G MCN gains came from Caribbean and Latin America (CALA) and Europe, Middle East, Africa (EMEA) regions; 5G MCN from all regions; and Voice Core, primarily from Asia Pacific and EMEA regions.

“5G MCNs led the way in 2025 growth, as 5G Standalone (5G SA) networks reached an inflection point and moved towards mass market appeal, as more 5G SA networks expand in population coverage in urban, suburban, and rural areas. Voice Core was the next major contributor to growth in 2025, driven by planned 3G MCN shutdowns, which required upgrades from Circuit Switched Core to IMS Core, and IMS Core modernization to a cloud-native IMS Core for VoNR in 5G SA networks. Meanwhile, 4G MCNs expanded due to subscriber growth in Africa and South America,” added Bolan.

Additional highlights from the 4Q 2025 Mobile Core Network and Multi-Access Edge Computing Report include:

- The top four vendors (Huawei, Ericsson, Nokia, and ZTE) posted very strong growth rates in 2025. Collectively, they accounted for about the same amount of market share as in 2024.

- The Multi-access and Edge Computing (MEC) market segment (a subsegment of the 5G MCN market) attained the highest growth rate of any MCN segment in 2025, with the China region remaining the dominant region for MEC implementations.

- Standard-setting bodies, vendors, and Mobile Network Operators (MNOs) communities are collaborating to expand the ecosystem with new products, applications, and monetization features that are expected to deliver future benefits.

- Examples include RedCap radios, which reduce the cost of IoT devices for consumer wearables and industrial applications; network slicing for both mission-critical and on-demand applications; IMS data channels to increase monetization opportunities and enhance user experience; and Open APIs that enable developers to scale their applications across all MNOs, attracting the app development community.

- Agentic AI is expected to change data traffic patterns and alter the duration that subscribers remain connected to the network as agents operate on their behalf. This could represent a paradigm shift in the future, requiring increased MCN capacity, expanded vendor opportunities, and enhanced monetization for MNOs through pricing tiers.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Traditional Packet Core, Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, Signaling, Circuit Switched Core, and IMS Core by geographic regions. To purchase this report, please contact us at [email protected].

…………………………………………………………………………………………………………………………………………………………………………………………………..

Related: The second edition of Ookla and Omdia’s report on the global state of 5G Standalone core network confirms that the technology has moved beyond launch announcements into an execution-driven phase. By the close of 2025, the “coverage gap” between major economic blocs had narrowed, but a more consequential “capability gap” has emerged, reflecting divergent spectrum strategies, investment depth, and the extent to which operators have moved beyond baseline SA deployment toward end-to-end network optimization.

For government and regulatory bodies, 5G Standalone (SA) has evolved into a high-stakes strategic imperative. The intersection of national competitiveness, digital sovereignty, and AI readiness is fundamentally reshaping Capex priorities across Tier-1 markets.

- User Equipment (UE) Performance: Impact of 5G SA on battery life and the transition to Voice over New Radio (VoNR).

- Application-Layer QoE: Benchmarking latency and jitter for cloud-native and gaming infrastructure.

- Commercial Monetization: A review of the first commercial deployments of Network Slicing, Enterprise SLAs, and 5G-Advanced (Release 18) segmentation.

- Geopolitical Drivers: Assessing how sovereign AI strategies in the GCC and legislative shifts in Europe are dictating the global SA evolutionary path.

……………………………………………………………………………………………………………………………………………………………………………………………..

5G Core network investment is accelerating as monetization transitions from concept to selective execution:

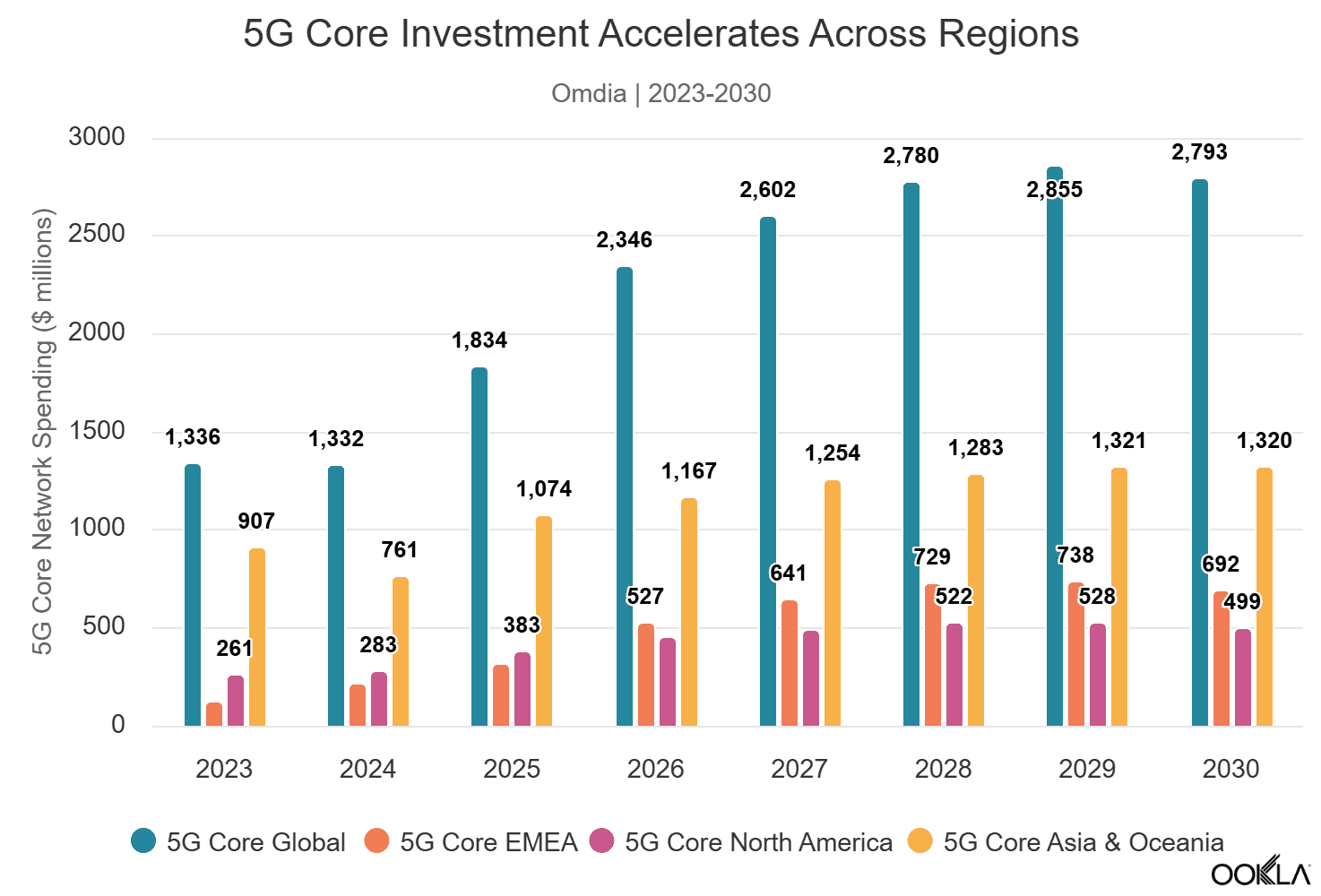

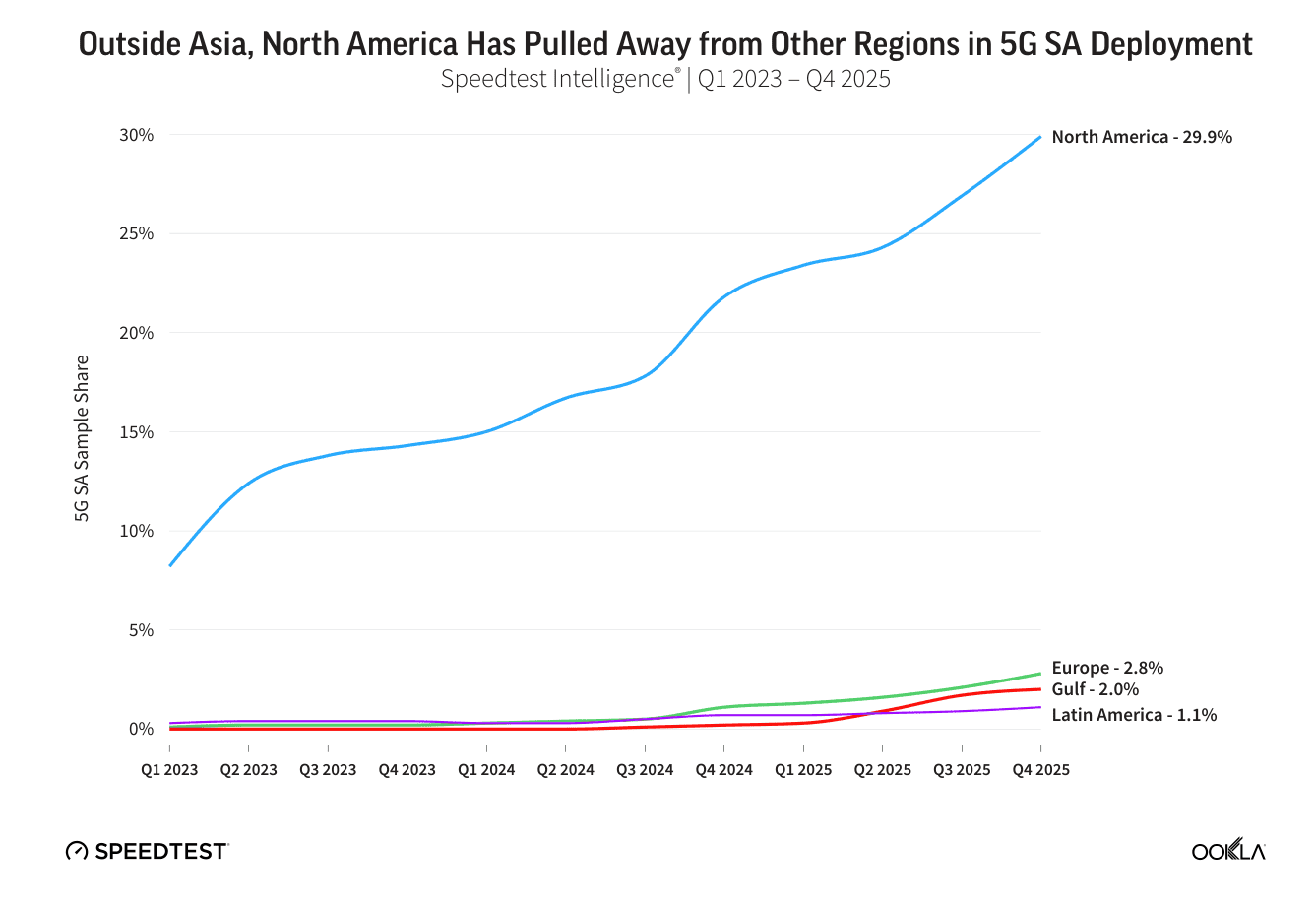

Omdia’s latest forecasts confirm the industry’s shift toward software-defined core capability as the primary driver of next-cycle investment. Global 5G SA core network software spending is projected to grow at an 8.8% CAGR between 2025 and 2030, with EMEA leading at 16.7%, significantly outpacing North America (5.5%) and Asia & Oceania (4.2%). This reflects EMEA’s later position in the deployment cycle, as the region is entering its period of peak 5G core adoption, while North America’s 5G core spending trajectory is expected to have peaked in 2025 following the commercial launches by AT&T and Verizon. By end of Q3 2025, 83 operators worldwide had deployed 5G core networks, with 5G core investment accounting for 63.6% of global core network function software spending.

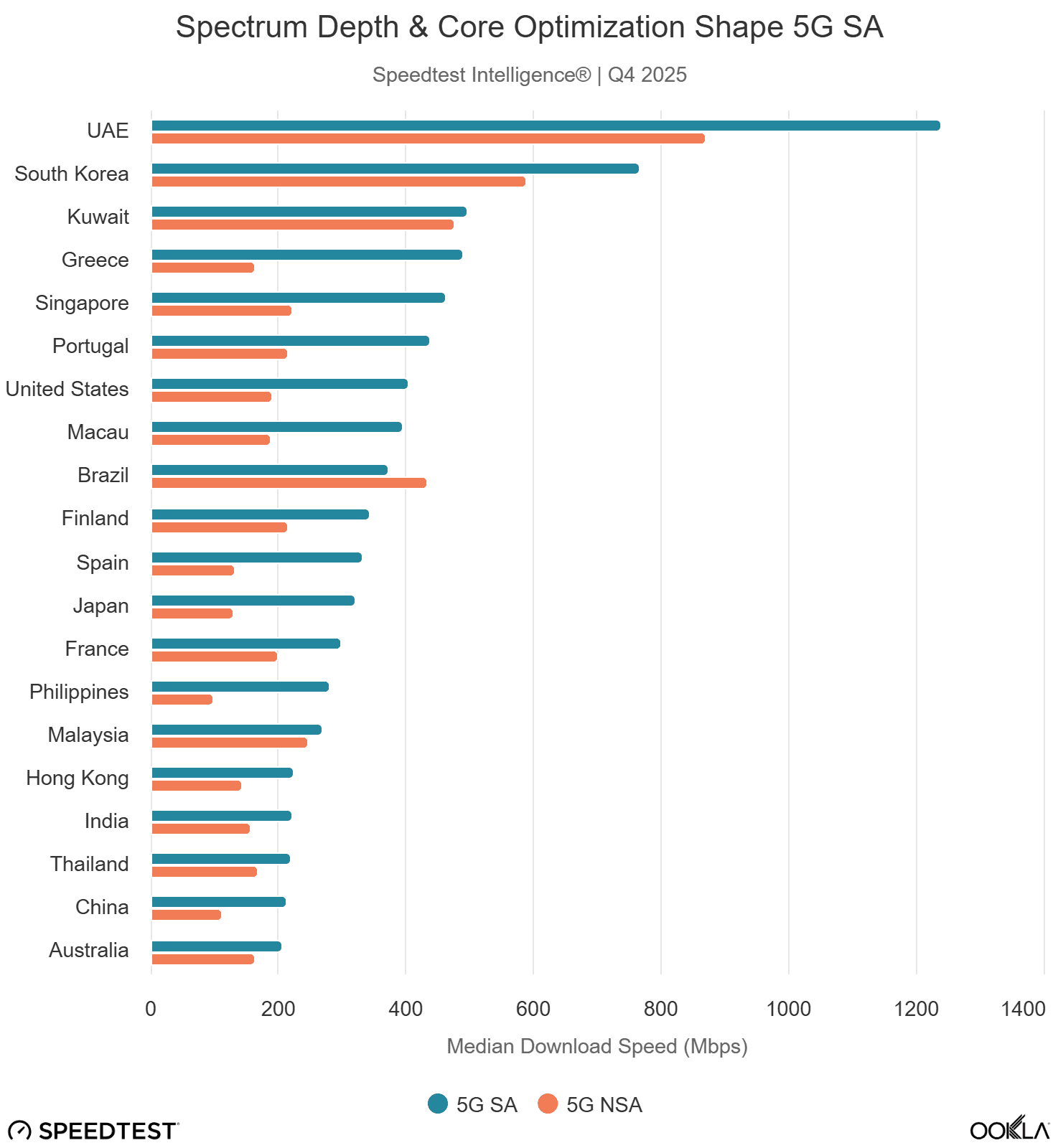

- 5G SA availability based on Speedtest® sample share reached 17.6% in Q4 2025, up modestly from 16.2% a year earlier, indicating that roughly one in six 5G Speedtests worldwide now occurs on a 5G standalone network. The headline global median SA download speed of 269.51 Mbps represents a 52% premium over non-standalone networks, though this figure masks significant regional variation driven by spectrum allocation depth, carrier aggregation maturity, and user-plane engineering.

- Asia leads in 5G availability: China continues to dominate with 80.9% 5G SA sample share and over 10 million 5G Advanced subscribers.

- Globally, 5G SA connections delivered a 52% download speed premium to 5G NSA (mostly an artifact of rich spectrum allocation and lower network load) and improved median multi-server latency by over 6% compared to NSA. However, this year’s report finds that a standalone core migration alone does not guarantee a better end-user experience. Quality of experience analysis reveals a nuanced picture: SA improves video and cloud infrastructure latency in Europe versus NSA, but underperforms NSA for gaming latency within the same region. North America records the lowest absolute SA cloud and gaming latency, consistent with dense hyperscaler adjacency and mature interconnect ecosystems.

- The Gulf Cooperation Council (GCC) was the global 5G SA performance leader, with the UAE setting the speed benchmark Led by e& and du’s aggressive 5G Advanced deployments, the delivered the world’s fastest 5G SA median download speeds in Q4 2025 at 1.13 Gbps, nearly five times that of Europe. The UAE alone reached a median of 1.24 Gbps on SA networks, a speed that would be considered exceptional even for full-fiber broadband in developed markets. The deployment of four-carrier aggregation and enhanced MIMO technology, coupled with the strategic allocation of premium mid-band spectrum to the SA network, demonstrates the performance ceiling that a fully realized 5G SA architecture can achieve.

- South Korea followed at 767 Mbps, driven by wide 3.5 GHz channel bandwidth, with the U.S. at 404 Mbps following the completion of nationwide SA deployments by all three Tier-1 operators. Europe, at 205 Mbps, trails all developed regions, though the region’s SA networks still deliver a 45% download speed premium over NSA, confirming the performance value of the SA transition where material spectrum depth is allocated.

Europe’s 5G SA sample share more than doubled from 1.1% to 2.8% between Q4 2024 and Q4 2025, driven by accelerated deployments in Austria (8.7%), Spain (8.3%), the United Kingdom (7.0%), and France (5.9%). These four markets now account for the vast majority of European SA connections. The United Kingdom and France registered the strongest year-on-year acceleration in Europe, each gaining 5.3 percentage points, reflecting the impact of investment-linked merger conditions and competition in the United Kingdom, as well as targeted R&D policy support in France.

Among European markets, France (41ms to cloud endpoints), Austria (48ms), and Finland (50ms) demonstrate what is achievable where backbone quality, peering density, and routing discipline are strong. These outcomes reflect an underappreciated end-to-end network stack optimization dividend, encompassing data-center proximity, fiber backhaul depth, and user-plane topology, rather than a pure “SA dividend” alone.

However, Europe still trails North America by 27% and emerging Asia by 30%. At the global level, the U.S. remains the largest accelerator in absolute terms over the last year, with SA sample share rising 8.2 percentage points to 31.6% year-on-year, driven by the sequential rollout of SA across all Tier-1 operators beyond T-Mobile. Firmware fragmentation, where handset OEMs gatekeep SA network access pending individual carrier certification, and tariff structures that fail to incentivize migration from NSA, remain the primary barriers to faster European adoption.

The report also presents early evidence that battery life is a tangible consumer benefit of 5G SA. In the UK, devices on EE’s 5G SA network recorded median discharge times approximately 22% longer than those on 5G NSA, with O2 showing an 11% advantage. These gains likely stem from features like SA’s unified control plane, which eliminates the dual-connectivity overhead of NSA configurations.

Consumer strategies now span speed tiers (primarily Europe), 5G network slicing (Singapore, France, and the U.S.), and 5G Advanced segmentation packages (China). Enterprise 5G network slicing presents the much larger long-term revenue opportunity, with T-Mobile’s SuperMobile representing the first nationwide commercial B2B slicing service in the U.S. Countries with coordinated regulatory frameworks, implementing clear coverage obligations, investment incentives, or infrastructure consolidation policies with deployment remedies, consistently outperform those with fragmented or reactive approaches, reinforcing the report’s finding that policy has emerged as a primary competitive differentiator in 5G SA outcomes globally.

…………………………………………………………………………………………………………………………………………………………………………………………

References:

MCN Market Roared Back in 2025 With 15 Percent Growth, According to Dell’Oro Group

https://www.ookla.com/articles/5g-sa-2026

Dell’Oro: RAN market stable, Mobile Core Network market +14% Y/Y with 72 5G SA core networks deployed

AT&T deploys nationwide 5G SA while Verizon lags and T-Mobile leads

Ericsson CEO’s strong statements on 5G SA, WRC 27, and AI in networks

Ookla: Uneven 5G deployment in Europe, 5G SA remains sluggish; Ofcom: 28% of UK connections on 5G with only 2% 5G SA

Ericsson reports ~flat 2Q-2025 results; sees potential for 5G SA and AI to drive growth

Téral Research: 5G SA core network deployments accelerate after a very slow start

Google Fiber and Nokia demo network slicing for home broadband in GFiber Labs

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

ABI Research: 5G network slicing market to hit $67.52 billion in 2030 with Asia Pacific in the lead

ABI Research forecasts that the global 5G network slicing market will surge from $6.1 billion in 2025 to $67.52 billion by 2030, reflecting a compound annual growth rate (CAGR) of 70%. This represents a sharp upward revision from its 2023 outlook, which projected a market value of $19.5 billion by 2028.

Editor’s Note: 5G network slicing, as well as ALL 5G features and functions (including 5G Security) require a 5G Standalone (SA) core network, which up until recently had not been widely deployed. Also, there are no ITU standards or recommendations for either 5G SA or 5G network slicing or any other 5G features/functions. Those are all specified by 3GPP, for example TS 23.501 5G Systems Architecture which includes network slicing.

In a recent blog post, Dimitris Mavrakis stated that the ABI’s revised forecast is driven by intensified monetization efforts from major network operators, including China Mobile, Deutsche Telekom and T-Mobile US, together with the growing installed base of 5G Standalone (SA)-capable smartphones. At the same time, he highlighted that progress is moderated by the proven complexity of integrating 5G SA cores and cloud-native tooling into existing telco network and IT environments.

ABI indicates that so-called “carpeted” industry verticals—like retail, stadiums, and financial services do not deal with mission- and safety-critical applications. Therefore, slicing deployments are more simplistic and provide a quicker Return on Investment (ROI) than in more demanding industry sectors such as oil and gas. ABI says that industrial manufacturing will remain an important vertical for network slicing, albeit at a substantially slower growth rate than carpeted verticals.

The analysis further suggests that, for certain enterprises, network slicing delivered over public 5G infrastructure is becoming a more attractive option than 5G private networks, which introduces additional headwinds for the private networking market. While B2B use cases are expected to account for 64% of total network slicing market value by 2030, consumer applications are projected to be the single largest segment, contributing approximately $24.3 billion of revenue by the end of the period.

5G network slicing progress report with a look ahead to 2025

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Dell’Oro: RAN market stable, Mobile Core Network market +14% Y/Y with 72 5G SA core networks deployed

Téral Research: 5G SA core network deployments accelerate after a very slow start

Building and Operating a Cloud Native 5G SA Core Network

Dell’Oro: RAN market stable, Mobile Core Network market +14% Y/Y with 72 5G SA core networks deployed

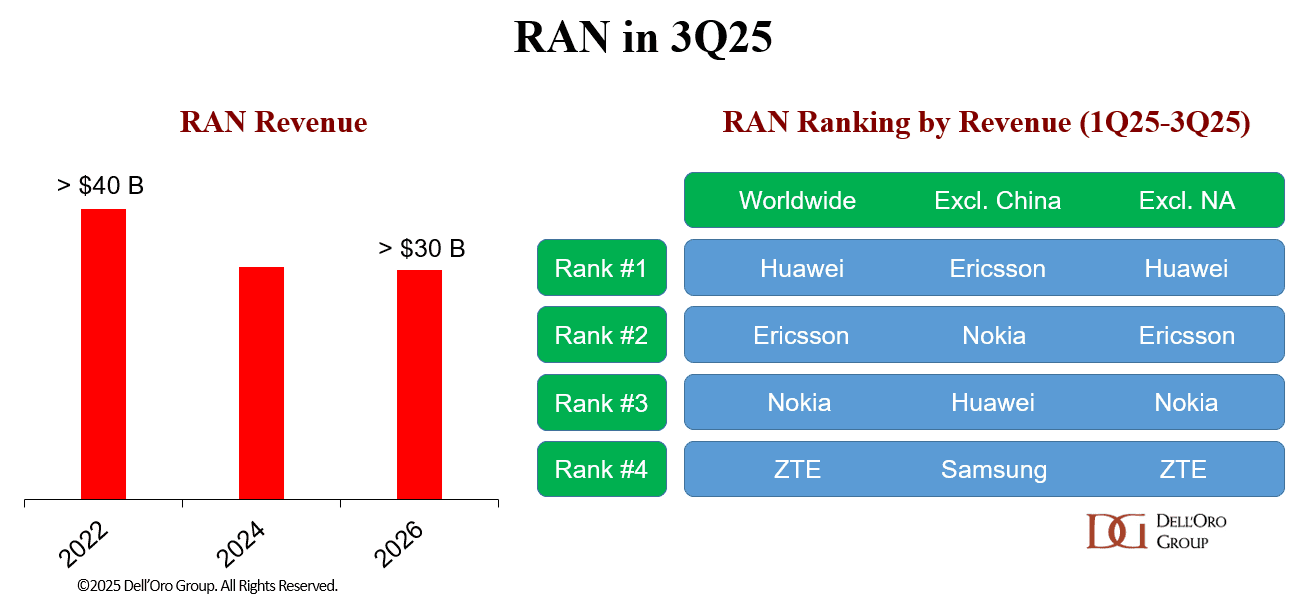

A recently published report from Dell’Oro Group notes that after two years of steep declines, initial estimates show that total Radio Access Network (RAN) revenue—including baseband, radio hardware, and software, excluding services—was flat outside of China and up when excluding North America.

“The nearly stable results for the 1Q25-3Q25 period bolster the flat growth thesis we have communicated for some time, reflecting the current state of the 5G network,” said Stefan Pongratz, Vice President of RAN market research at the Dell’Oro Group. “While near-term RAN expectations remain muted, some of the leading RAN suppliers are still cautiously optimistic that more investments are needed over the long-term to ensure the networks evolve from a connectivity pipe into an intelligence grid. Huawei and Ericsson are the clear #1 and 2 players globally – their combined share makes up nearly two-thirds of the RAN market (see table below).” Pongratz added.

Additional highlights from the 3Q 2025 RAN report:

- In the quarter, growth in EMEA was nearly enough to offset declining revenue in North America and the Asia Pacific regions.

- The top 5 RAN suppliers, based on worldwide revenues for the 1Q25-3Q25 period, are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Market is becoming more concentrated—the top five suppliers accounted for 96 percent of the 1Q25-3Q25 RAN market, up from 95 percent in 2024.

- Huawei and Ericsson’s worldwide RAN revenue share improved for the 1Q25-3Q25 period relative to 2024.

- Huawei and Nokia’s RAN revenue share outside of North America improved for the 1Q25-3Q25 period relative to 2024.

- The short-term outlook remains unchanged, with total RAN expected to remain mostly stable in 2026.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

………………………………………………………………………………………………………………………………………….

Data from Omdia, a Light Reading sister company, shows Ericsson, Huawei and Nokia were even more dominant last year than they were in 2023, growing their combined RAN market share by 2.3 percentage points over this period, to 77.4%. Besides China’s ZTE, the only other contender with more than a percentage point of market share was Samsung.

…………………………………………………………………………………………………………………………………………..

Another recent Dell’Oro Group report reveals that the Mobile Core Network (MCN) market revenue outside China surged 14% year-over-year (Y/Y) in 3Q 2025. Twelve Mobile Network Operators (MNOs) have now selected to move forward with 5G-Advanced (the marketing term used for the next phases of 3GPP’s 5G specs, which started with Release 18 and continues with Release 19 and beyond).

“The Chinese market experienced abnormally high growth in 3Q 2024. As a result, the China market revenue declined 39 percent Y/Y for 3Q 2025,” stated Dave Bolan, Research Director at Dell’Oro Group. “The revenue for all the other regions increased, between 9 percent and 17 percent Y/Y, resulting in a worldwide revenue decline of 2 percent Y/Y. As noted, revenue worldwide excluding China rose 14 percent Y/Y, continuing the trend in subscribers migrating to 5G Standalone (5G SA), and revenue worldwide excluding North America declined 5 percent Y/Y.

“MNOs are moving forward with 5G SA (72 in our last count) and moving forward to take advantage of monetization opportunities. Network Slicing announcements continued. Of note is Reliance Jio (India), which announced 10 network slices with guaranteed service level agreements (SLAs) at scale. In October, T-Mobile launched Edge Control, providing enterprises with what Dell’Oro Group refers to as an MNO-provided Mobile Private Network (MPN). This is in response to the challenges of implementing 5G SA Private Wireless networks in the shared CBRS spectrum in the US.

“We have identified 12 MNOs that have commercially launched 5G-Advanced networks (not all this quarter), to take 5G to the next level with new features and performance. MNOs include: China Mobile, China Telecom, China Unicom, CTM (Macau), Du (UAE), e& (UAE), HKT (Hong Kong), Singtel (Singapore), Telstra (Australia), T-Mobile (USA), YTL (Malaysia), and Zain (Kuwait),” added Bolan.

Additional highlights from the 3Q 2025 Mobile Core Network and Multi-Access Edge Computing Report include:

- Region rankings were: EMEA; Asia Pacific, excluding China; China and North America tied; CALA.

- Vendor rankings (with more than 5 percent share) were: Huawei, Ericsson, Nokia, and ZTE.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Traditional Packet Core, Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, Signaling, Circuit Switched Core, and IMS Core by geographic regions. To purchase this report, please contact us at [email protected].

About Dell’Oro Group:

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions.

For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

MCN Market Up 14 Percent Outside China in 3Q 2025, According to Dell’Oro Group

Market research firms Omdia and Dell’Oro: impact of 6G and AI investments on telcos

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Omdia: Huawei increases global RAN market share due to China hegemony

Dell’Oro Group: RAN Market Grows Outside of China in 2Q 2025

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Dell’Oro: Mobile Core Network Market 5 Year Forecast

Dell’Oro: AI RAN to account for 1/3 of RAN market by 2029; AI RAN Alliance membership increases but few telcos have joined

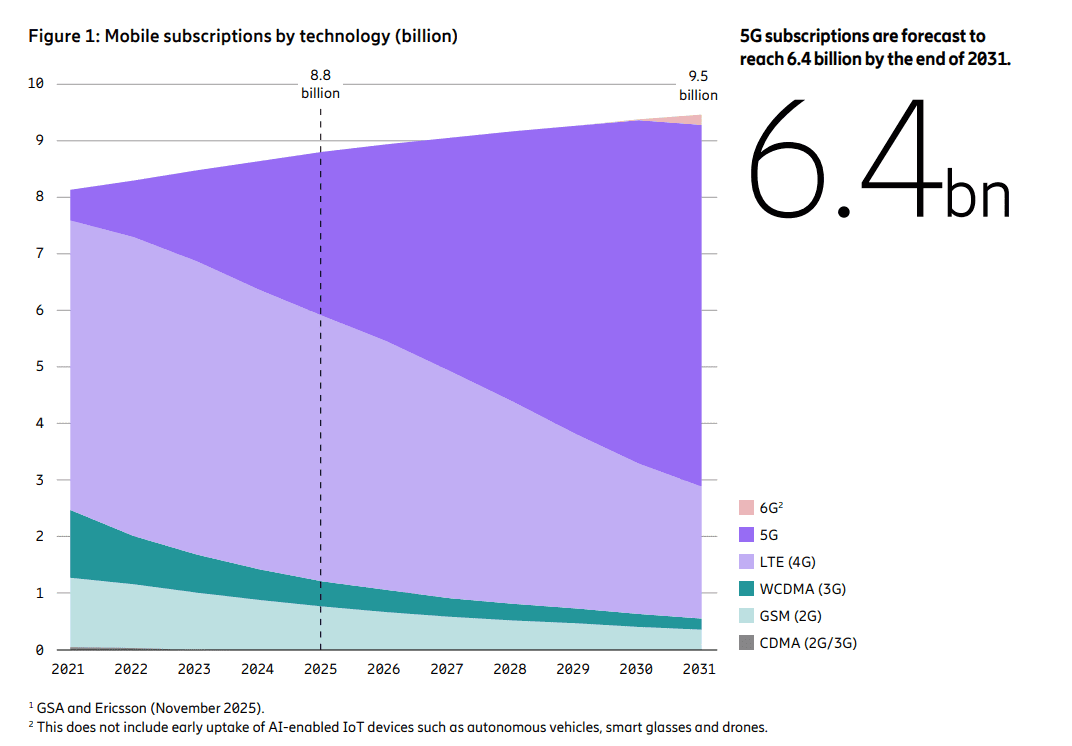

Highlights of Ericsson’s Mobility Report – November 2025

The latest issue of the Ericsson Mobility Report states that 5G subscriptions now account for one-third of total mobile subscriptions. Mobile network data traffic grew slightly more than expected – 20 percent between Q3 2024 and Q3 2025. As 5G evolves, service providers are increasingly exploring innovative use cases and new monetization opportunities such as offering differentiated connectivity services and modernizing enterprise IT with 5G.

After many years of hype, network slicing, which requires a 5G SA core network, is finally gaining market traction with 33 communications service providers now offering variations of the technology. Of the 118 network slicing cases discovered by Ericsson’s researchers, 65 have moved beyond proof of concept and into commercial services, either as standalone subscription services or as add-on packages for consumer or business customers. Ericsson attributes this growth spurt to more widespread deployment of 5G SA core networks.

Looking further ahead, the 6G RAN standardization process has begun in 3GPP and ITU-R WP5D, with the first commercial launches expected in front-runner markets.

–>However, there has been no work initiated on the 6G core network in either 3GPP or ItU-T.

Ericsson’s report says the U.S., Japan, South Korea, China, India and some Gulf Cooperation Council countries are the 6G leaders. Global 6G subscriptions are likely to reach 180 million by the end of 2031, the report predicts.

We think that forecast is highly unlikely as the IMT 2030 (6G) RIT/SRITs recommendation won’t be completed till the end of 2030 with initial deployments sometime in 2031.

…………………………………………………………………………………………………………….

Data from Omdia, a Light Reading sister company, shows Ericsson, Huawei and Nokia were even more dominant last year than they were in 2023, growing their combined market share by 2.3 percentage points over this period, to 77.4%. Besides China’s ZTE, the only other contender with more than a percentage point of market share was Samsung.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/november-2025

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Ericsson’s revenue drops, profits soar; deal with Vodafone and partnership with Export Development Canada look promising

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Ericsson Mobility Report touts “5G SA opportunities”

Ericsson Mobility Report: 5G monetization depends on network performance

Ericsson Mobility Report: 5G subscriptions in Q2 2022 are 690 million (vs. 8.3 billion total mobile users)

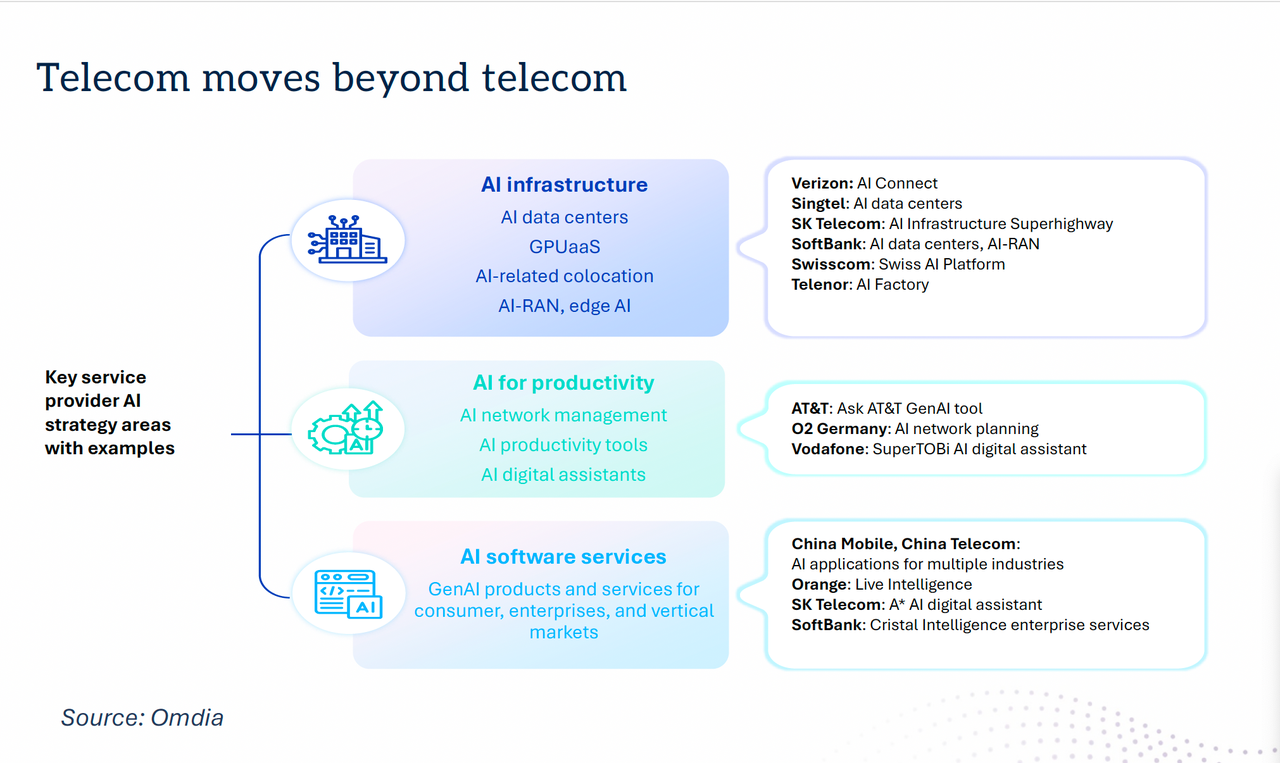

Omdia: How telcos will evolve in the AI era

Dario Talmesio, research director, service provider, strategy and regulation at market research firm Omdia (owned by Informa) sees positive signs for network operators.

“After many years of plumbing, now telecom operators are starting to see some of the benefits of their network and beyond network strategies. Furthermore, the investor community is now appreciating telecom investments, after many years of poor valuation, he said during his analyst keynote presentation at Network X, a conference organized by Light Reading and Informa in Paris, France last week.

“What has changed in the telecoms industry over the past few years is the fact that we are no longer in a market that is in contraction,” he said. Although telcos are generally not seeing double-digit percentage increases in revenue or profit, “it’s a reliable business … a business that is able to provide cash to investors.”

Omdia forecasts that global telecoms revenue will have a CAGR of 2.8% in the 2025-2030 timeframe. In addition, the industry has delivered two consecutive years of record free cash flow, above 17% of sales.

However, Omdia found that telcos have reduced capex, which is trending towards 15% of revenues. Opex fell by -0.2% in 2024 and is broadly flatlining. There was a 2.2% decline in global labor opex following the challenging trend in 2023, when labor opex increased by 4% despite notable layoffs.

“Overall, the positive momentum is continuing, but of course there is more work to be done on the efficiency side,” Talmesio said. He added that it is also still too early to say what impact AI investments will have over the longer term. “All the work that has been done so far is still largely preparatory, with visible results expected to materialize in the near(ish) future,” he added. His Network X keynote presentation addressed the following questions:

- How will telcos evolve their operating structures and shift their business focuses in the next 5 years?

- AI, cloud and more to supercharge efficiencies and operating models?

- How will big tech co-opetition evolve and impact traditional telcos?

Customer care was seen as the area first impacted by AI, building on existing GenAI implementations. In contrast, network operations are expected to ultimately see the most significant impact of agentic AI.

Talmesio said many of the building blocks are in place for telecoms services and future revenue generation, with several markets reaching 60% to 70% fiber coverage, and some even approaching 100%.

Network operators are now moving beyond monetizing pure data access and are able to charge more for different gigabit speeds, home gaming, more intelligent home routers and additional WiFi access points, smart home services such as energy, security and multi-room video, and more.

While noting that connectivity remains the most important revenue driver, when contributions from various telecoms-adjacent services are added up “it becomes a significant number,” Talmesio said.

Mobile networks are another important building block. While acknowledging that 5G has been something of a disappointment in the first five years of the deployment cycle, “this is really changing” as more operators deploy 5G standalone (5G SA core) networks, Omdia observed.

Talmesio said: “At the end of June, there were only 66 telecom operators launching or commercially using 5G SA. But those 66 operators are those operators that carry the majority of the world’s 5G subscribers. And with 5G SA, we have improved latency and more devices among other factors. Monetization is still in its infancy, perhaps, but then you can see some really positive progress in 5G Advanced, where as of June, we had 13 commercial networks available with some good monetization examples, including uplink.”

“Telecom is moving beyond telecoms,” with a number of new AI strategies in place. For example, telcos are increasingly providing AI infrastructure in their data centers, offering GPU as-a-service, AI-related colocation, AI-RAN and edge AI functionality.

Dario Talmesio, Omdia

……………………………………………………………………………………………………………………………………………………

AI is also being used for network management, with AI productivity tools and AI digital assistants, as well as AI software services including GenAI products and services for consumer, enterprises and vertical markets.

“There is an additional boost for telecom operators to move beyond connectivity, which is the sovereignty agenda,” Talmesio noted. While sovereignty in the past was largely applied to data residency, “in reality, there are more and more aspects of sovereignty that are in many ways facilitating telecom operators in retaining or entering business areas that probably ten years ago were unthinkable for them.” These include cloud and data center infrastructure, sovereign AI, cyberdefense and quantum safety, satellite communication, data protection and critical communications.

“The telecom business is definitely improving,” Talmesio concluded, noting that the market is now also being viewed more favorably by investors. “In many ways, the glass is maybe still half full, but there’s more water being poured into the telecom industry.”

References:

https://networkxevent.com/speakers/dario-talmesio/

https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/pushing-telcos-ai-envelope-on-capital-decisions

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Omdia: Huawei increases global RAN market share due to China hegemony

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Omdia: Cable network operators deploy PONs

AT&T deploys nationwide 5G SA while Verizon lags and T-Mobile leads

In a blog published today (October 8th), Yigal Elbaz, AT&T’s senior VP and network CTO, AT&T announced its 5G Standalone (SA) network is now deployed nationwide, marking an important milestone many years in the making. Elbaz described the 5G SA nationwide deployment as “another bold leap” in wireless connectivity and said the operator is moving customers onto the network “in select areas every day.”

In fact, that “bold leap” was expected to be realized years ago! In 2021, AT&T partnered with Microsoft to offload its mobile 5G Standalone (SA) core network and other network cloud operations to Microsoft Azure, acquiring AT&T’s Network Cloud technology, software, and network operations team in the process. The goal was for Microsoft to manage the software development and deployment of AT&T’s network functions on Azure, allowing AT&T to accelerate innovation, improve efficiency, and reduce operating costs. This move has provided a strategic win for Microsoft’s Azure for Operators division by integrating AT&T’s technology and offering it to other telecom companies.

AT&T said they have millions of customers already on their 5G SA network, and we’re expanding availability to more customers as device support and provisioning allow. Elbaz elaborated:

5G Standalone networks have now reached a level of maturity that enables our nationwide expansion. This growth is powered by an open and virtualized network, which enables us to scale efficiently and foster collaboration within an open ecosystem of partners. By embracing this open and virtualized network architecture, we are not only modernizing our infrastructure but also unlocking significant advantages for our customers and partners. This approach not only accelerates our ability to roll out new technologies like 5G Standalone but also helps ensure our customers benefit from a network that is robust, innovative, and designed with their needs in mind.

With 5G Standalone now nationwide, we’ve set the stage for the next wave of innovation, creativity, and connection. I couldn’t be prouder of our teams who made this possible, and we’ll continue to scale 5G Standalone over time and set the stage for next generation applications and services.

Compatible 5G SA smartphones include models released in the last several years starting with Apple’s iPhone 13, Samsung’s Galaxy S21 and Google’s Pixel 8.

AT&T also said its 5G Reduced Capability (RedCap) network, which uses the 5G SA core and supports the new Apple Watch Series 11, Apple Watch Ultra 3, and Apple Watch SE 3, has been expanded to 250 million points of presence. AT&T 5G RedCap customers can look forward to a growing portfolio of devices, Elbaz said.

……………………………………………………………………………………………………………………………………………………………………………….

Separately, Verizon is closing in on completing its 5G SA upgrade. The operator says its 5G SA is deployed nationwide but there are some places where it is still in the process of being rolled out. Although the deployment is not 100% complete, “the vast majority” of 5G SA capable phones will connect to Verizon’s network in “the vast majority of places,” according to an operator spokesperson.

Verizon has launched two network slicing services based on the 5G SA network. In April, the operator launched Frontline, a network slice for first responders that is available across the country. It also offers Enhanced Video Calling, which provides a network slice for better video communications on iPhones.

T-MobileUS launched 5G SA in 2020 and has since rolled out 5G Advanced nationwide. It also offers two network slicing propositions, T-Priority for first responders and SuperMobile for enterprise customers. Both AT&T and Verizon have implemented cloud-native 5G core networks, but T-Mobile’s implementation is more traditional. At Mobile World Congress earlier this year, T-Mobile announced its telco cloud strategy for core and edge networks that is based on Red Hat (owned by IBM).

A recent Heavy Reading (now part of Omdia) survey found 5G SA is poised to scale rapidly. Gabriel Brown noted that the results show “a critical mass is building behind 5G SA that will unlock innovation in the wider mobile network services ecosystem.”

“This matters when it comes to layering in new services because a cloud native deployment allows operators to be more agile and deploy services faster,” Brown added.

References:

https://about.att.com/blogs/2025/5g-standalone-nationwide.html

https://about.att.com/blogs/2025/5g-redcap.html

https://www.lightreading.com/5g/at-t-verizon-chase-t-mobile-with-nationwide-5g-sa

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Téral Research: 5G SA core network deployments accelerate after a very slow start

Building and Operating a Cloud Native 5G SA Core Network

Ookla: Europe severely lagging in 5G SA deployments and performance

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

GSA: More 5G SA devices, but commercial 5G SA deployments lag

GSA 5G SA Core Network Update Report

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

5G SA networks (real 5G) remain conspicuous by their absence

Nokia & Deutsche Bahn deploy world’s first 1900 MHz 5G radio network meeting FRMCS requirements

Nokia and Deutsche Bahn (Germany’s national railway company), today announced they have deployed the first commercial 1900 MHz 5G railway network with a 5G SA core. The new network meets Future Railway Mobile Communication System (FRMCS) requirements by supporting automated, resilient rail operations. The rollout marks a transition away from legacy GSM-R [1.], adding self-healing, failover, real-time monitoring, and low latency to enable smarter stations, infrastructure, and safety-critical applications. Built to support full railway automation, FRMCS integrates advanced technologies like AI and underpins a more competitive, capable and future-ready industry.

………………………………………………………………………………………………………………………………………………………………………………………

Note 1. Global System for Mobile Communications-Railway (GSM-R) is a digital, cellular telecommunications system designed specifically for railways to provide reliable voice and data services for operations, such as communication between drivers and signalers and for systems like European Train Control System (ETCS). Based on the public GSM standard, it includes railway-specific features like advanced speech services and is known for its secure and dependable performance at high speeds, supporting trains up to 500 km/hr without losing communications.

………………………………………………………………………………………………………………………………………………………………………………………

The new technology is being implemented at DB’s digital railway test field in the Ore Mountains (Erzgebirge, Germany), running on live trains. Key features include built-in failover, self-healing capabilities and real-time monitoring to ensure high availability and efficiency. The solution will also be used for the European FP2-MORANE-2 project, which evolves from earlier FRMCS initiatives to advance the digitalization of rail across Europe. The contract extends Deutsche Bahn’s ongoing test trials with Nokia’s 5G SA core and 3700 MHz (n78) radio network, while upgrading to a new solution that includes Nokia’s 1900 MHz (n101) 5G radio network equipment from its AirScale portfolio and optimized 5G SA core. Designed for a smooth migration from GSM-R to FRMCS, it delivers the high reliability and low latency needed for modern rails.

DB Test Track in Erzgebirge, Germany. Photo Credit: Copyright Deutsche Bahn

Quotes:

Rainer Fachinger, Head of Telecom Platforms at DB InfraGO, said: “Deutsche Bahn wants to benefit from modern 5G-based telecommunications to upgrade the railway communication infrastructure. Collaborating with technology experts like Nokia is key for DB to bring the latest innovations into our real-world operations. This deployment on test tracks builds on a successful pre-FRMCS 5G trial conducted with Nokia and aims to standardize our private mobile network as a foundation for further pilots and future rollout.”

Rolf Werner, Head of Europe at Nokia, said: “Nokia and DB have been frontrunners in advancing FRMCS. We are proud to deliver the first-ever commercial 5G solution that utilizes the 1900 MHz spectrum band on the rail track. This is a milestone that will unlock key benefits for DB, including automated train operations, smart maintenance, and intelligent infrastructure and stations. We believe this launch will serve as an important benchmark for FRMCS upgrades in rail networks around the world in the coming years.”

………………………………………………………………………………………………………………………………………………………….

Nokia is also working with ProRail in the Netherlands on the first cloud-native GSM-R core, building a bridge to FRMCS and lowering long-term costs across European rail networks.

………………………………………………………………………………………………………………………………………………………….

References:

Nokia, Deutsche Bahn claim world’s first 5G railway network in n101 band

Multimedia, technical information and related news

Web Page: FRMCS

Product Page: AirScale Radio Access

Product Page: Core Enterprise Solution for Railways

Blog: Laying the tracks for digital railways

Social Media Post: Nokia at EU FP2-MORANE2

Web Page: Deutsche Bahn

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

Samsung & SK Telecom offer Korea’s first LTE-Railway network

Google’s Internet Access for Emerging Markets – Managed WiFi Network for India Railways

Ericsson CEO’s strong statements on 5G SA, WRC 27, and AI in networks

At the Technology Policy Institute Forum in Aspen, Colorado this week, Ericsson CEO Börje Ekholm made many comments about “The Future of Wireless & Global Connectivity.” To begin with, he said it’s super critical for western nations, including the U.S., to increase their 5G Stand Alone (SA) network deployments. 5G network operators need 5G SA to take full advantage of the platform to support apps and services that are optimized for low latency, higher uplink prioritization and network slicing. “It’s hard to monetize something you don’t have,” Ekholm said. “The network has to be built for 5G SA.”

Ekholm’s 5G SA comments echo those of Magnus Ewerbring, Ericsson’s chief technology officer – Asia Pacific, who strongly asserted that 5G SA is the way for wireless network operators to monetize and differentiate their 5G networks.

Ekholm noted that China has prioritized 5G SA and has more than 4 million base stations deployed, estimating that this represents about ten times what’s been deployed in the US. China has been able to monetize that by supporting advanced robotics and automation in tens of thousands of factories. China is “highly competitive,” has “enormous scale, domestically,” and has made 5G SA a priority, the Ericsson CEO said. Western countries needs to take China’s 5G SA efforts “seriously” and invest more in their wireless infrastructure as it’s a competitive imperative.

Status of 5G SA network deployments:

A recent Heavy Reading (now part of Omdia) operator survey found that 35% of respondents said they have deployed 5G SA, with 20% expecting to be live by year-end. Some 41% cited “new or better services” as the primary driver for 5G core investment.

After a very slow start during the past five years, Téral Research says the migration to 5G SA has increased. Of the total 354 commercially available 5G public networks reported at the end of 1Q25, 74 are 5G SA – up from 49 one year ago. This growth is being driven by the success of fixed wireless access (FWA), a wider range of 5G SA-compatible devices, and the rise of voice over new radio (VoNR). Téral is also seeing increased adoption of private cloud for SA core deployments, with data sovereignty concerns shaping CSP strategies. Network slicing, which requires 5G SA, is moving from theory to practice—now extending to critical use cases like military applications.

3GPP URLC specifications are still not finalized and approved:

It should be noted that the 3GPP specifications for URLLC (Ultra-Reliable Low-Latency Communication) in the 5G SA core network and 5G NR access network are not considered 100% completed or finalized. URLLC relies on both the 5G NR (Radio Access Network) and the 5G Core network to achieve its goals. URLLC is vital for various industrial applications requiring real-time control and automation, such as the Industrial Internet of Things (IIoT), virtual reality, and autonomous vehicles.

3GPP Release 16 introduced significant enhancements for URLLC in the 5G New Radio (NR) access and 5G Core network. While Release 16 was “frozen” in July 2022, work on URLLC enhancements, particularly in the Radio Access Network (RAN), was not fully completed. These enhancements are crucial for 3GPP NR to meet the ITU-R M.2410 minimum performance requirements for URLLC for ultra-high reliability and ultra low latency.

3GPP Technical Specifications (TS) and Technical Reports (TR) become “official” standards when transposed into corresponding publications of the 3GPP Organizational Partner (like ETSI) or the standards body ((ITU-R)) acting as publisher for the Partner (ATIS for ITU-R). Once a Release is frozen (see definition in TR 21.900) and all work items completed, 3GPP specifications are officially transposed and published by the Organizational Partners, as a part of their standards series.

………………………………………………………………………………………………………………………………………………………………………..

Ekholm also said that strong western representation at ITU-R’s WRC-27 “is critically important.” That’s because licensed spectrum is likewise critical for the next generation of automation, self-driving vehicles and AI applications that will require a “truly reliable” and low-latency network, he added without mentioning the incomplete 3GPP URLLC specs.

“AI is the most fundamental technology we’ve seen so far,” he said. Ericsson has already been able to generate a 10% boost in spectrum efficiency using AI tools. While AI will no doubt erase some jobs, he’s also optimistic it will create new ones. Like so many analysts, Ekholm expects Gen AI to drive more traffic and new capabilities. “The criticality of the connectivity layer will become even more important,” he added.

References:

https://www.lightreading.com/5g/ericsson-ceo-calls-for-bigger-push-toward-5g-sa

https://www.tpiaspenforum.tech/agenda

Ericsson reports ~flat 2Q-2025 results; sees potential for 5G SA and AI to drive growth

Ookla: Uneven 5G deployment in Europe, 5G SA remains sluggish; Ofcom: 28% of UK connections on 5G with only 2% 5G SA

Ookla: Europe severely lagging in 5G SA deployments and performance

Téral Research: 5G SA core network deployments accelerate after a very slow start

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

3GPP Release 16 5G NR Enhancements for URLLC in the RAN & URLLC in the 5G Core network

Ookla: Uneven 5G deployment in Europe, 5G SA remains sluggish; Ofcom: 28% of UK connections on 5G with only 2% 5G SA

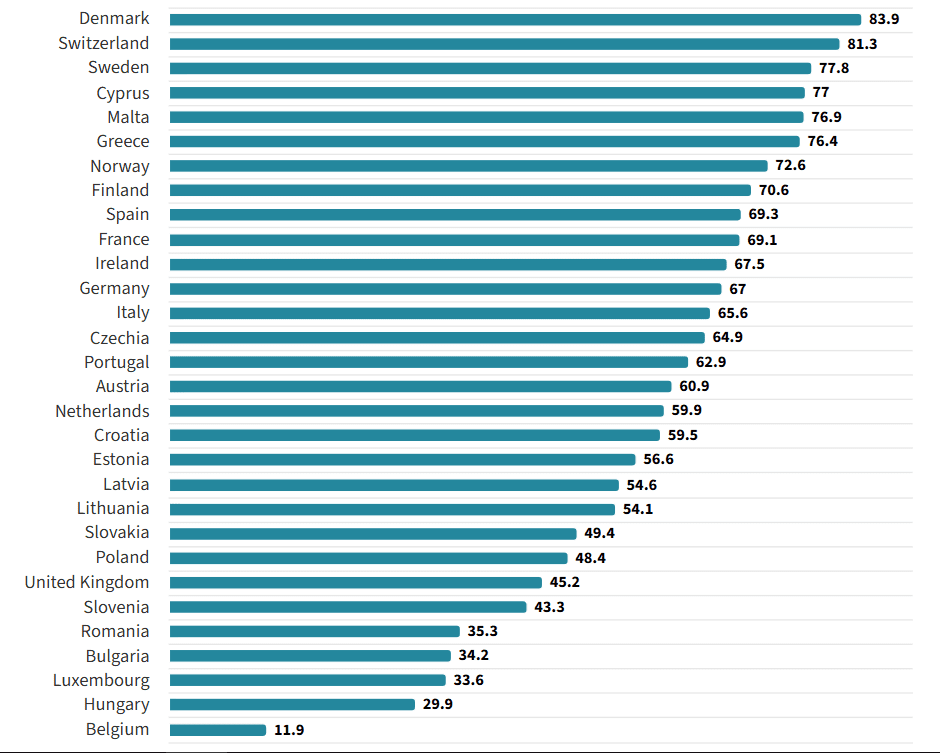

According to Ookla, Europe is a “two-speed” 5G competitiveness landscape,” with some countries surging ahead and others falling well behind, In Q2-2025, Nordic and southern Europe countries maintained a substantial lead in 5G availability, helped by recent 700MHz band deployments in countries such as Sweden and Italy. By contrast, 5G availability in central and western European laggard countries such as Belgium, the UK and Hungary remains less than half that of the 5G pacemakers, says the study. On average, mobile subscribers in the EU spent 44.5% of their time connected to 5G networks in Q2 2025, up from 32.8% a year earlier.

The deployment and adoption of 5G SA in Europe remain sluggish, increasing slowly from a very low base and further widening the region’s gap with North America and Asia. Spain stands out as a clear leader in 5G SA deployment, reaching an 8% Speedtest® sample share compared with the EU average of just 1.3% as of Q2 2025. This progress has been driven by Spain’s proactive use of EU recovery funds to subsidize 5G SA rollouts in underserved areas, with a particular focus on bridging the rural-urban digital divide. However, the U.S. and China are still far ahead, with 5G SA sample shares above 20% and 80% respectively, reflecting a much greater pace of coverage and adoption in those markets.

Northern Europe Maintains 5G Availability Lead – Speed Test Intelligence Q2-2025:

Fragmented 5G Availability across Europe is driven by a complex mix of national policies on spectrum assignment and broader economic factors, rather than by simple geographic or demographic differences. 5G Availability is more strongly correlated with policy-driven factors such as spectrum allocation timelines and costs, coverage obligations, subsidy mechanisms, and regulations for infrastructure sharing and permitting, than with structural factors like urbanization rates or the number of operators. This indicates that 5G competitiveness is shaped less by technology gaps or inherent market imbalances and more by effective policy execution.

Northern Europe Maintains 5G Availability Lead; Other Countries Lag:

Fragmentation remains a persistent theme, shaping stark 5G deployment asymmetries that cannot be explained by geography or demographics alone. Northern and Southern European countries such as Denmark (83.9%), Sweden (77.8%), and Greece (76.4%) are disproportionately represented among the countries with the highest 5G Availability in Q2 2025, with coverage rates up to twice as high as those in Western and Eastern countries like the United Kingdom (45.2%), Hungary (29.9%), and Belgium (11.9%).

Low-band deployment and DSS use continue to lift 5G availability in lagging countries:

Recent advances in 5G Availability have been driven by low-band deployments and the use of DSS, raising the average proportion of time spent on 5G networks in the EU from 32.8% in Q2 2024 to 44.5% in Q2 2025. The pace of coverage growth, and the corresponding increase in 5G usage, has primarily reflected each country’s starting point. Lagging countries like Latvia, Poland, and Slovenia have seen double-digit gains in 5G Availability from a low base. By contrast, leading countries such as Switzerland and Denmark, where 5G coverage is now nearly ubiquitous, have shifted their focus to targeted capacity upgrades through site densification and mid-band expansion.

About Ookla:

Ookla, a global leader in connectivity intelligence, brings together the trusted expertise of Speedtest®, Downdetector®, Ekahau®, and RootMetrics® to deliver unmatched network and connectivity insights. By combining multi-source data with industry-leading expertise, we transform network performance metrics into strategic, actionable insights. Solutions empower service providers, enterprises, and governments with the critical data and insights needed to optimize networks, enhance digital experiences, and help close the digital divide. At the same time, we amplify the real-world experiences of individuals and businesses that rely on connectivity to work, learn, and communicate. From measuring and analyzing connectivity to driving industry innovation, Ookla helps the world stay connected.

Ookla is a division of Ziff Davis, a vertically focused digital media and internet company whose portfolio includes leading brands in technology, entertainment, shopping, health, cybersecurity, and martech.

……………………………………………………………………………………………………………………………………………………………………………………

Mobile Matters report from communications regulator Ofcom discusses 5G’s share of network connections in UK. Ofcom’s analysis – based on crowdsourced data collected by Opensignal and covering the period October 2024 to March 2025 – showed that 28% of connections were on 5G, with 71% still on 4G, 0.7% on 3G and a holdout 0.2% on 2G. In terms of mobile network operators, BT-owned EE had the highest proportion of network connections on 5G, at 32%, while Vodafone had the lowest, at 24%. O2, which is now the mobile arm of Virgin Media, had the lowest share of 4G connections (68%) and the highest proportion on 3G (3%).

5G standalone vs 5G non-standalone performance:

• 5G standalone (SA) accounted for 2% of all 5G connection attempts in the six months to March 2025. UK MNOs have started to offer 5G SA but its use is currently low.

• Standalone 5G’s average response time (latency) was about 15% lower (better) than for 5G NSA. However, our analysis also indicated that 5G SA had a lower average connection success rate (95.9%) than 5G NSA (97.6%), although this was slightly higher than 4G’s.

• 5G SA provided significantly higher download speeds than 5G NSA. Seventy per cent of 5G SA download speeds measurements were at 100 Mbit/s or higher, compared to 46% for 5G NSA, and 2MB, 5MB and 10MB file download times, on average, were about 45% faster on 5G SA than over 5G NSA.

• The picture was more mixed for uploads. While 5G NSA had a higher proportion of low-speed connections (18% of 5G NSA upload speeds provided less than 2 Mbit/s compared to 10% on 5G SA) it also had a slightly higher share of higher-speed connections (30% of 5G NSA uploads were 20 Mbit/s or higher vs 28% on 5G SA).

References:

https://www.ookla.com/articles/europe-5g-q2-2025