Month: September 2020

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

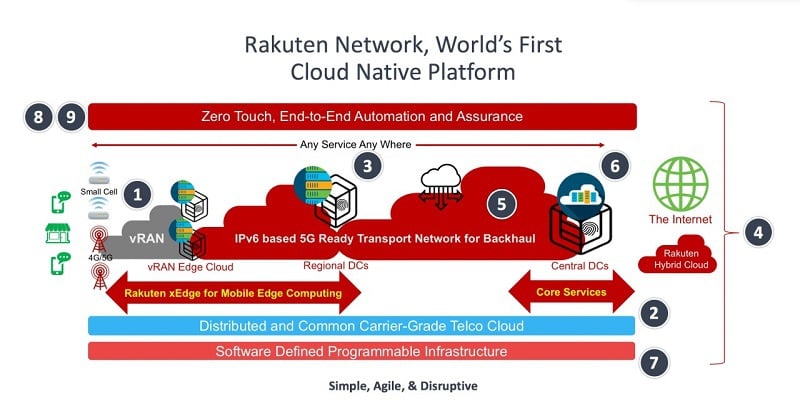

Rakuten Mobile, Inc., and Telefónica, S.A. announced today the signing of a Memorandum of Understanding (MoU) to cooperate on a shared vision to advance OpenRAN, 5G Core and OSS (operations support systems).

“We’re excited to collaborate with Telefónica on this shared vision of advancing OpenRAN,” said Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “I envision our partnership to also co-explore further development around the Rakuten Communications Platform that will enable operators around the world to take advantage of cost-effective cloud-native mobile network architecture that is secure and reliable.” (Emphasis added)

Amin emphasised the partnership is not just about opening the interfaces: “It’s about the future possibilities when these networks become fully autonomous. What makes a difference is automation, as it enables much needed operational savings. We’re going to spend a lot of energy around joint development of automation, especially what we call OSS transformation to move away from legacy systems.”

Enrique Blanco, Chief Technology & Information Officer (CTIO) at Telefónica, said: “Telefónica strongly believes that networks are evolving towards end-to-end virtualization through an open architecture, and OpenRAN is a key piece of the whole picture. Beyond the flexibility and simplicity that OpenRAN will provide, it will change the supplier ecosystem and revolutionise the current 5G industry in the medium and long term. At the same time, open and virtualized networks will lead to a new telco operating model. Telefonica and Rakuten Mobile have signed this MoU to work towards evaluating and demonstrating the capability and feasibility of OpenRAN architectures and make them a reality.”

“This is a massive opportunity for all of us. This is an inclusive approach and how we can guarantee we are building the network for the future,” Blanco added. In addition to defining the interfaces, the companies are exploring procurement of hardware and software, Blanco said.

Under the terms of the MoU, Rakuten Mobile and Telefónica plan to collaborate on the following:

- To research and conduct lab tests and trials to support OpenRAN architectures, including the role of the AI (Artificial Intelligence) in the RAN Networks.

- To jointly develop proposals for optimal 5G RAN architecture and OpenRAN models as part of industry efforts to achieve quicker time to market, new price-points, and the benefits of software-centric RAN.

- To collaborate in building an open and cost-effective 5G ecosystem, based on open interfaces, that will help accelerate the maturity of 5G with global roaming.

- To develop a joint procurement scheme of OpenRAN Hardware and Software that will help increase volumes and reach economies of scale, including CUs, DUs, RRUs, and other necessary network equipment and/or software components.

In addition, the companies will also jointly work on 4G/5G Core and OSS technology utilized by Rakuten Mobile in Japan and its Rakuten Communications Platform.

“Vendor selection typically takes a long time in the telecoms industry compared with the web-scale companies. Maybe together with Telefonica the discussions with vendors might change a bit and require us to create new business models.”

Telefonica plans to introduce open RAN in three phases, with pilots starting this year, initial rollouts in 2021 and mass deployments in 2022. “I’m extremely convinced we’ll hit these targets, but we are trying to be conservative,” Blanco said. From 2022 to 2025, up to half of Telefonica’s 5G deployments will use open RAN, he added.

Why this MOU is IMPORTANT:

- As there are no ITU recommendations or 3GPP specs detailing how to implement a 5G Core/5G SA network, the Rakuten-NEC 5G core could become a defacto standard. As we’ve stated many times, the 3GPP specs on 5G Core are network architecture specs that leave the various implementation choices to the implementer. And 3GPP is not even sending their 5G non-radio specs to ITU-T for consideration as future recommendations.

- Meanwhile, Rakuten and NEC have created a 5G “cloud native” core spec (proprietary of course) built on containers, which NEC (and likely other vendors) will implement in Rakuten’s 5G network. Rakuten and NEC plan to offer there 5G Core as a product to other 5G network operators.

- The Rakuten Communications Platform for Open RAN could similarly be sold to other carriers that want to deploy an Open RAN 4G/5G network. The catch here is that any legacy wireless carrier wanting to do so would have to support two incompatible sets of cellular infrastructure to serve its customers: 1] The traditional “closed box base stations” (from Huawei, Ericsson, Nokia, Samsung, ZTE, etc) in cell towers AND 2] The new Open RAN, multi-vendor base stations using totally different hardware/software platforms which requires a significant amount of systems integration and tech support/trouble resolution. Rakuten’s platform could, at the very least, simplify systems integration and avoid “finger pointing” when troubleshooting a failure or degraded service.

- Both the Rakuten-NEC 5G Core and Rakuten Communications Platform for Open RAN could be terrific products to sell to greenfield carriers (with no existing wireless infrastructure). Apparently, that’s too late for Dish Network and Reliance Jio, which claim they’re building their own “open 5G” network. Meanwhile, India based Tech Mahindra claims it can build a complete 5G network now, which they would surely sell to would be 5G network providers, utilities, and government agencies around the world.

- The OSS co-operation amongst these two carriers is significant, because (once again) there are no standards for 5G SA OSS’s such that the deliverable output of cooperation here could become a defacto standard.

- Co-operative work on automation of network functions and operations will also be vitally important. Otherwise, that too will be proprietary to the wireless network provider which would require different software for the SAME functions for different carriers. The work will probably start with these 2800 series 3GPP specs: TS 28.554 Management and orchestration; 5G end to end Key Performance Indicators (KPI); TS 28.555 Management and orchestration; Network policy management for 5G mobile networks; Stage 1 TS 28.556 Management and orchestration; Network policy management for 5G mobile networks; Stage 2 and stage 3. There are similar ITU-T SG 13 high level Recommendations on these subjects.

Image Credit: STL Partners

………………………………………………………………………………………………………………………………………………………………………………

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

About Telefónica

Telefónica is one of the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 342 million customers, Telefónica operates in Europe and Latin America. Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

Telefonica was a co-founder of the Open RAN Policy Coalition, and previously partnered with five companies including Altiostar and Intel to foster the approach.

For more information about Telefónica: www.telefonica.com

References:

https://stlpartners.com/research/5g-bridging-hype-reality-and-future-promises/

Synergy Research: Strong demand for Colocation with Equinix, Digital Realty and NTT top providers

New data from Synergy Research Group shows that just 25 metro areas account for 65% of worldwide retail and wholesale colocation revenues. Ranked by revenue generated in Q2 2020, the top five metros are Washington, Tokyo, London, New York and Shanghai, which in aggregate account for 27% of the worldwide market. The next 20 largest metro markets account for another 38% of the market.

Those top 25 metros include eleven in North America, nine in the APAC region, four in EMEA and one in Latin America. The world’s three largest colocation providers are Equinix, Digital Realty and NTT. One of those three is the market leader in 17 of the top 25 metros. The global footprint of Equinix is particularly notable and it is the retail colocation leader in 16 of the top 25 metros. In the wholesale segment Digital Realty is leader in seven of the metros, with NTT, Global Switch and GDS each leading in at least two metros. Other colocation operators that feature heavily in the top 25 metros include 21Vianet, @Tokyo, China Telecom, China Unicom, CoreSite, CyrusOne, Cyxtera, KDDI and QTS.

Over the last twenty quarters the top 25 metro share of the worldwide retail colocation market has been relatively constant at around the 63-65% mark, despite a push to expand data center footprints and to build out more edge locations.

->That seems to indicate that edge computing hasn’t made a wider impact beyond the 25 largest colo metro areas.

Among the top 25 metros, those with the highest colocation growth rates (measured in local currencies) are Sao Paulo, Beijing, Shanghai and Seoul, all of which grew by well over 20% in the last year. Other metros with growth rates well above the worldwide average include Phoenix, Frankfurt, Mumbai and Osaka. While not in the group of highest growth metros overall, growth in wholesale revenues was particularly strong in Washington DC/Northern Virginia and London.

“We continue to see strong demand for colocation, with the standout regional growth numbers coming from APAC. Revenue growth from hyperscale operator customers remains particularly strong, demonstrating the symbiotic nature of the relationship between cloud and colocation,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “The major economic hubs around the world are naturally the most important colocation markets, while hyperscale operators tend to focus their own data center operations in more remote areas with much lower real estate and operating costs. These cloud providers will continue to rely on colocation firms to help better serve major clients in key cities, ensuring the large metros will maintain their share of the colocation market over the coming years.”

About Synergy Research Group

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database tool, which enables easy access to complex data sets. Synergy’s CustomView ™ takes this research capability one step further, enabling our clients to receive ongoing quantitative market research that matches their internal, executive view of the market segments they compete in.

References:

https://www.srgresearch.com/articles/top-25-metros-generate-65-worldwide-colocation-revenues

AT&T Announces 5G Roaming in Japan when 5G roam-capable devices are available

AT&T 5G customers will be the first U.S. mobile customers to have the ability to access 5G in Japan through an international roaming agreement with NTT DOCOMO, Inc. and by using a 5G roam-capable device – the first of which will become available on the AT&T network this week.

The agreement delivers on AT&T’s commitment to keeping its customers connected and providing them with access to 5G – at home and around the globe – as capable devices become available. However, this agreement is only for 5G NSA which uses an LTE anchor/core for all non-RAN related functions.

“As a longtime industry leader providing global connectivity, we’re evolving the breadth and depth of our global coverage with 5G,” said Susan A. Johnson, executive vice president – Global Connections & Supply Chain, AT&T. “This marks a significant milestone for AT&T and our customers.”

AT&T customers on a wireless plan that includes access to 5G in the U.S. will be able to access 5G in Japan through NTT DOCOMO, Inc., when they use a 5G roam-capable device.

But what are those 5G roam-capable devices and when will they be available? They will surely be based on 3GPP Release 15 5GNR for the data plane, and 4G LTE for everything else, e.g. signaling, network management, security, 4G core/EPC, etc. Hence, this arrangement might be called “5G NSA roaming with a LTE core network/EPC.” 5G SA roaming will be much more complicated as there is no standard for 5G core network and all the “cloud native” functions (like network slicing and virtualization) it will support.

“We’re excited to launch 5G roaming in Japan on NTT DOCOMO, Inc.’s network because of what it means for our customers,” said JR Wilson, vice president – Tower Strategy & Roaming, AT&T. “Our teams never stop innovating, developing and deploying the latest technology to provide our customers with access to a next-generation network – at home and abroad.”

AT&T claims they have historically been a leader in global roaming. So, while the company continues innovating to enable customers with compatible devices to access 5G internationally, those with LTE devices can still expect the same great roaming coverage they’re used to while traveling.

NTT DOCOMO is the first mobile operator in Japan to offer an inbound 5G roaming service. Going forward, DOCOMO plans to expand its inbound 5G roaming service with mobile operators around the globe. Again, that will surely be for 5G NSA service.

References:

https://www.nttdocomo.co.jp/english/info/media_center/pr/2020/0914_00.html

Addendum: 5G SA roaming will be much more difficult

Roaming with a 5G SA endpoint device (smartphone, tablet, notebook PC, robot/industrial equipment, etc. won’t be achieved anytime soon. Why? There is no standard for 5G core network which have to interoperate with one another for roaming.

The 3GPP core network specs are architecture documents that do NOT specify implementation details. Therefore, every 5G network provider will have its own 5G core spec which is implemented in the core network routers/compute servers and endpoints. So each 5G endpoint (e.g. smartphone or tablet/notebook PC) will have to download a 5G SA software update from the 5G network provider. That means that unless there are bilateral 5G carrier roaming agreements, a 5G end point can only work on the 5G core network it’s subscribed to, e.g. no portability or interoperability!

3GPP Rel 16 5G Core/Architecture specs:

- TS 23.501 5G Systems Architecture, with annexes which describe 5G core deployment scenarios:

- TS 23.502 [3] contains the stage 2 procedures and flows for 5G System

- TS 23.503 [45] contains the stage 2 Policy Control and Charging architecture for 5G System

………………………………………………………………………………………………………………………………………………….

Netgear Nighthawk 5G Hotspot Pro from AT&T; Netgear’s audio video over IP (AV over IP)

“The combination of AT&T 5G technology and the NETGEAR Nighthawk 5G Mobile Hotspot Pro gives AT&T customers fast speeds, low-latency and improved bandwidth for all of their WiFi needs,” said David Christopher, executive vice president and general manager, AT&T Mobility. “The 5G addition is innovative in a hotspot and much needed during a time when many of our customers continue to work and learn from home.”

“We are delighted to team with AT&T, to release their next generation 5G hotspot. The NETGEAR Nighthawk 5G Mobile Hotspot Pro combines the best of WiFi and mobile technologies – WiFi 6 and 5G, to keep you always connected at home and on the go via the AT&T 5G network,” said Patrick Lo, chairman and chief executive officer for NETGEAR. “This new mobile hotspot with WiFi 6 provides robust WiFi connectivity to the increasing number of mobile devices and computers simultaneously with the best mobile internet speeds available over 5G.”

The introduction of this hotspot also exceeds AT&T’s commitment to offer 15 5G-capable devices to our lineup in 2020. This expansive portfolio gives our customers a wide variety to choose from, with features and price points that best serve their needs. All of these devices tap into our nationwide 5G network, offering fast, reliable and secure connectivity across the U.S. Plus, 5G access is included in all of our current consumer and business unlimited wireless plans at no extra cost to you.3

NETGEAR NIGHTHAWK 5G MOBILE HOTSPOT PRO FEATURES

The NETGEAR Nighthawk 5G Mobile Hotspot Pro is the perfect portable device. Whether you’re constantly on the move or looking for an alternative to in-home broadband, it offers the following features that will provide a steady and reliable connection wherever you are:

- Capacity: Share your connection with up to 32 WiFi devices such as smartphones, tablets, and laptops for a connection you can count on.

- 5G Compatibility: In addition to AT&T’s nationwide 5G network, this device can also access AT&T 5G+ in parts of 35 cities across the country. Together, these two flavors of 5G create the best mix of speeds and coverage, and will power new experiences coming to life.

- WiFi 6: Tap into the latest WiFi technology that will power fast surfing, downloading, and streaming for the whole family.

- Touch Screen: Set up your device and manage your usage with ease from the NETGEAR Nighthawk 5G Mobile Hotspot Pro’s touchscreen.

- Battery Life: Power through your day and night with the long-lasting, powerful 5,040 mAh rechargeable battery. It also operates without battery when connected via the quick charge power adapter.

FIRST RESPONDERS

The NETGEAR Nighthawk 5G Pro Hotspot will also be FirstNet Ready™, which means first responders can use it to tap into the power of FirstNet® – America’s public safety communications network. FirstNet Ready devices are tested and approved to operate with services using the FirstNet LTE network core. This gives public safety access to the critical capabilities that FirstNet enables, like the full power of AT&T’s LTE network, including Band 14 spectrum, which serves as a VIP lane for first responders.4

For more information on AT&T 5G, visit att.com/5G. For the latest on how we’re using this next generation of wireless technology, head to att.com/5GNews.

https://about.att.com/story/2020/netgear_nighthawk_5g_mobile_hotspot_pro.html

……………………………………………………………………………………………………………………………………………………………………………………….

- An entirely new series of switches developed and engineered for the growing audio, video over IP (AV over IP) market. These AV Line switches combine years of networking expertise with best practices from leading experts in the professional AV market.

- The new AV Line incorporates NETGEAR IGMP Plus™ for flawless video over IP (including audio and control). If you are using Dante or AVB in your audio deployment, you can trust that NETGEAR’s new AV Line switches are designed to seamlessly integrate into your solution.

- The new M4250 AV interface presents the common AV controls right up front with user-selectable profiles for common AV platforms making it a snap to ensure the settings are correct for a specific audio or video application.

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

CenturyLink has taken on a new identity — Lumen — a name it says better highlights the company’s future direction and focus on selling business services to large customers. [Note that there is already a Texas based company named Lumen Technologies Inc so there’s sure to be confusion and a possible trademark lawsuit in the near future.]

Lumen is a measure of the brightness of light, and the company’s competitive advantage this century has come from its massive fiber network, stretching 450,000 route miles. That has helped CenturyLink survive even as consumers cut their home phone lines in favor of wireless providers and switched off DSL in favor of faster alternatives.

But transporting light signals can also be a commodity service. Lumen is now pushing to offer more higher-value applications and enterprise services directly to its customers, reflected in the company’s new motto: “The Platform for Amazing Things.”

Lumen says on its website:

Lumen is an enterprise technology platform that enables companies to capitalize on emerging applications that power the 4th Industrial Revolution. Most IT leaders don’t feel ready to face the nearly century’s worth of data-driven innovation they expect in the next five years.

“Our people are dedicated to furthering human progress through technology. Lumen is all about enabling the amazing potential of our customers, by utilizing our technology platform, our people, and our relationships with customers and

partners,” said Lumen CEO Jeff Storey, in a statement on the name change.

“For the past three years we have been reinventing ourselves and repositioning the company to deliver on a brand-new promise: Furthering human progress through technology,” said Lumen CTO Andrew Dugan, who held the same title at CenturyLink. “We have been considering this change for many months. We are ideally positioned to help resolve the biggest data and application challenges of our time—this is why now is the right time to introduce Lumen.”

The CenturyLink brand will continue to be used for residential and small business customers using traditional copper based networks. “CenturyLink, with its strong heritage, will remain as a trusted brand for residential and small business customers over traditional networks,” the company said.

………………………………………………………………………………………………………………………………………………………………………………………

The number of telecom and cloud service providers that have been acquired by CenturyLink is truly astounding. That list includes: US West (which was acquired by Qwest Communications), Embarq (which included Sprint Local and US Telecom), Savvis, App Frog, Tier 3, and the big one –Level 3 Communications in a deal valued at around $25 billion. Level 3, in turn, had also acquired a boat load of telecom providers such as Global Crossing and TW Telecom and before that: WilTel Communications, Broadwing Corporation, Looking Glass Networks, Progress Telecom, and Telcove (formerly Adelphia Business Solutions) and ICG Communications.

………………………………………………………………………………………………………………………………………………………………………………….

These acquisitions, long with internal software innovations, they have given Lumen the ability to provide enterprise customers with a variety of services in a variety of areas. However, the company still does not have presence in the cellular communications business.

“Unfortunately, today’s network, cloud and IT architectures present latency, cost and security challenges that inhibit the performance of distributed applications and real-time data processing. Ultimately, the world needs a new architecture platform that has been designed to support the intensive performance requirements of next-generation applications. And that is exactly what we aim to provide with Lumen,” said Lumen’s chief marketing officer Shaun Andrews, in a video message.

Smart cities, retail and industrial robotics, real-time virtual collaboration and automated factories are some of the applications that Lumen believes it can help customers achieve in what it and others call the 4th Industrial Revolution. Steam power, electricity and then the computer chip all pushed economic progress, and now the melding of the digital and physical worlds that connectivity permits is doing the same, Andrews added.

That is the future direction, where the company sees the greatest potential for growth and new revenues. But Andrews emphasized that residential and small business consumers will still deal with CenturyLink, a brand executives believe still has value two decades into the new century. It is the name that will continue to show up on residential customers’ bills. CenturyLink Field in Seattle will retain its name.

Another new entity, Quantum Fiber, will handle the residential and small business transition to digital as the company rolls out more fiber-optic connections directly to homes and businesses (FTTH and FTTP, respectively). The company added capacity to reach about 300,000 homes and small businesses last year with gigabit service and plans to reach another 400,000 this year, according to Fierce Telecom.

Lumen says the can provide the ability to control latency, bandwidth and security for applications across cloud data centers, the market edge and on-premises, according to a blog by Dugan. Instead of putting critical applications into a centralized cloud, Lumen’s edge compute platform, which includes more than 100 active edge compute nodes across large metro markets in the U.S—puts them closer to the end user for low latency and better security.

“The Lumen brand is focused on supporting our enterprise business customers. It alludes to our network strength and to the incredible capabilities powered by our platform to help transform how businesses operate,” Dugan said.

“Quantum Fiber is an important new brand within Lumen with a focus on superior fiber connectivity and a fully enabled digital customer experience,” Dugan said. “Quantum Fiber serves residential and small business customers, and Lumen focuses on enterprise, government and global businesses.”

In 2019, CenturyLink expanded its fiber network to reach an estimated 300,000 additional homes and small businesses with its gigabit service. CenturyLink’s consumer fiber-to-the-home (FTTH) projects provide symmetrical speeds of up to 940 Mbps. The faster speeds were enabled in parts of Boulder, Colo., Spokane, Wash., and Tucson, Ariz. last year.

CenturyLink previously said it would build out its fiber network to an additional 400,000 homes and small businesses this year, including in Denver, Omaha, Neb., Phoenix, Portland, Ore., Salt Lake City, Spokane, Wash., and Springfield, MO.

MoffetNathanson analysts wrote in a note to clients (emphasis added):

The flagship Lumen brand is targeted toward larger enterprises, the likes of which would be most likely to adopt the company’s most advanced services. The CenturyLink brand is being retained for legacy copper services delivered to residential customers and some SMBs, as well as existing FTTH customers. And the new Quantum Fiber brand is being introduced for SMB services delivered via the automated platform the company has been developing and has indicated it would soon be rolling out to on-net, out-of-region locations (mostly ex-Level 3 buildings), and will include consumer FTTH sold in a similar manner. The services and capabilities Lumen delivers to each of these customer segments varies dramatically, so it’s not at all inappropriate to have separate brands for each. Innumerable examples of this phenomenon exist across other industries – automotive, consumer products, airlines, apparel, media, and so on. Within the world of telecom, carriers often have brands that target different segments or highlight different product types (Verizon with FiOS, AT&T with Cricket, T-Mobile US with MetroPCS, Altice USA with Optimum vs. Lightpath, and so on).

CenturyLink was an amalgamation of many different companies, assets, and capabilities. Management’s decision to rebrand as Lumen, Quantum Fiber, and CenturyLink acknowledges those differences and gives management an opportunity to refresh and communicate its vision for the company to customers, employees, and investors.

Andrews said the name change won’t include a relocation to Denver of the corporate headquarters, which will remain in Monroe, La., home of the original CenturyLink. Of the company’s 40,000 employees globally, 5,800 are based in Colorado, and metro Denver remains an important hub of operations, especially the ones that Lumen will emphasize.

It remains to be seen what will happen with CenturyLink’s wholesale and carriers carrier backbone services, which acquisitions such as Level 3 and Global Crossing mainly focused on, i.e. selling high bandwidth fiber optic long haul links to other carriers.

References:

https://www.lumen.com/en-us/home.html

https://news.lumen.com/CTO-Andrew-Dugan-explains-how-the-Lumen-platform-keeps-data-moving

Arthur D Little: 10 countries provide >= 95% FTTH coverage; Gigabit Fiber driving take-up of new apps and services

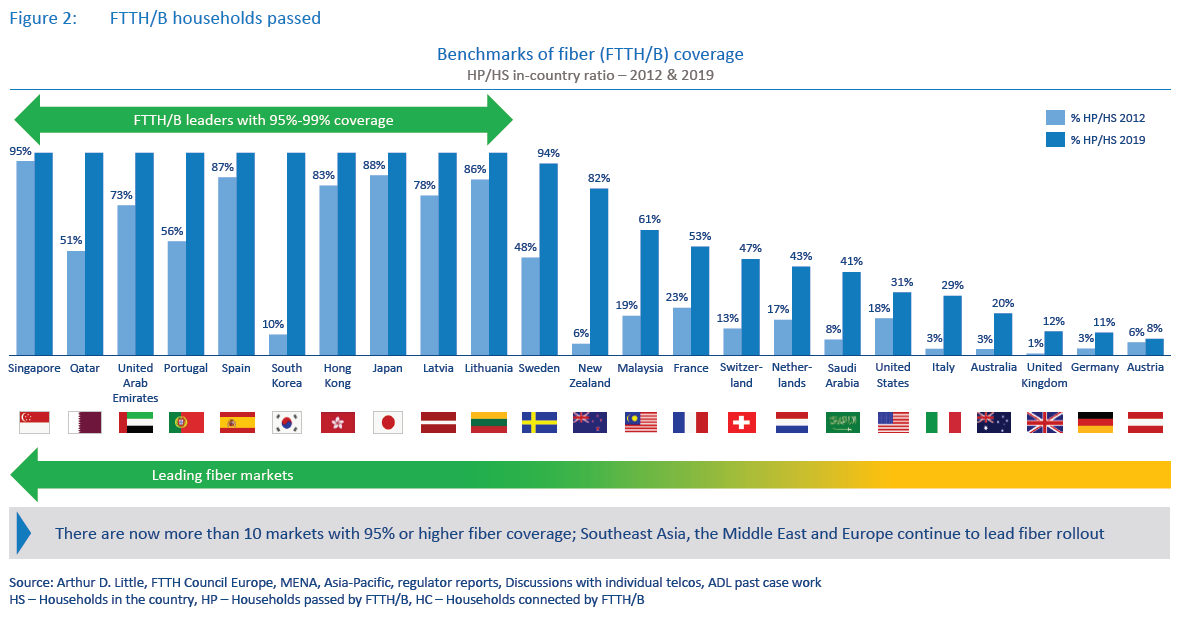

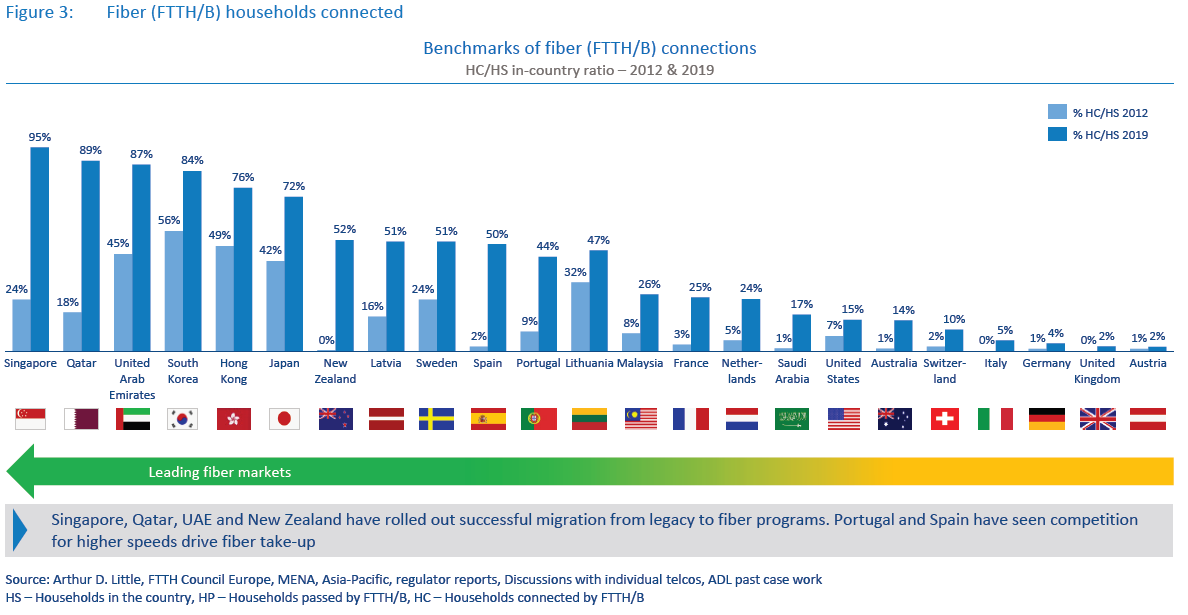

Gigabit broadband can be delivered using cable DOCSIS, fiber or other 5G-based technologies. This ADL report focuses on the rollout, take-up and services delivered with fiber -based gigabit broadband networks. ADL especially considers the developments made in fiber take-up and gigabit services enabled by fiber. See the previous edition of this study, “Race to gigabit fiber: Telecom incumbents pick up pace”4 for further details on which markets are taking the lead on fiber rollout and the deployment models used for it.

Non-telecom entities such as energy companies, railway operators and local municipalities are also entering the market, with large fiber rollout plans in fiber-lagging countries such as Italy, Germany and Austria, to bridge the gigabit broadband gap.With 5G deployment models crystallizing, operators are also considering 5G-based technologies to complement high-cost,

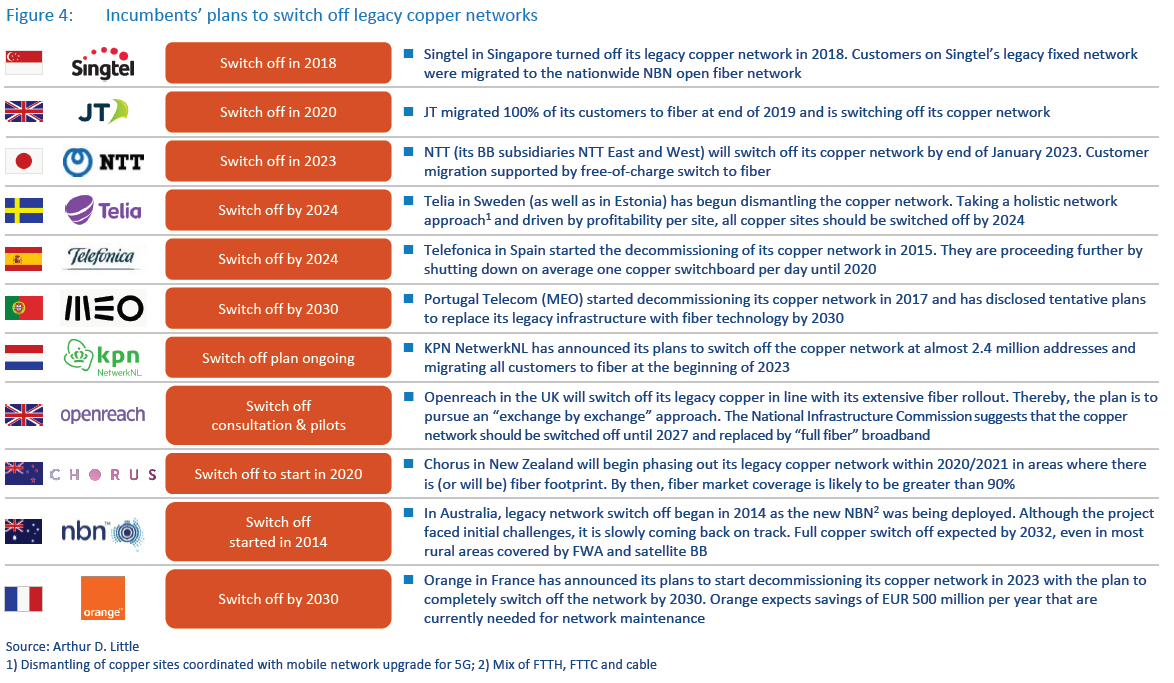

last-mile fiber access, especially in rural areas.While there were big improvements in fiber rollout from 2012 to 2017, take-up was still lagging behind, even though several markets invested large amounts of capex into nationwide fiber. However, we now see take-up rapidly improving, driven by both effective migration of legacy customers to fiber and competition driving demand for higher-speed broadband adoption at home.As the fiber coverage and take-up rates continue to grow, incumbents are increasingly announcing plans to switch off and dismantle their legacy copper networks. Singtel in Singapore turned off its copper network in 2018 and migrated its copper and cable subscribers to fiber, allowing the incumbent Singtel and cable company StarHub to switch off their copper and cable networks. Another example is JT Global in Jersey, which already migrated its entire fixed broadband customer base to fiber and will switch off the copper infrastructure in 2020. Operators in at least three other countries plan to completely migrate their customer base to fiber in the next four to five years (see Figure 4 below).

However, before decommissioning their legacy networks, telcos will need to overcome regulatory and other obstacles, such as providing an alternative to existing regulatory wholesale products and replacing some copper-specific B2B use cases with other technologies. With legacy network switch off, incumbents hope to achieve cost efficiencies especially in network operations. In recent projects, we estimate that fiber networks have up to a 15x lower fault rate and use up to 85 percent less energy compared to legacy copper-based networks.

Fiber is undoubtedly an advanced fixed broadband technology that can efficiently deliver multi-gigabit speeds to a large volume of customers in real-life conditions, especially in dense urban areas. Offering 1 Gbps plans has become the norm in the leading Asian fiber markets such as Singapore, Japan, South Korea and Hong Kong, opening the way for multi-gigabit tariffs.

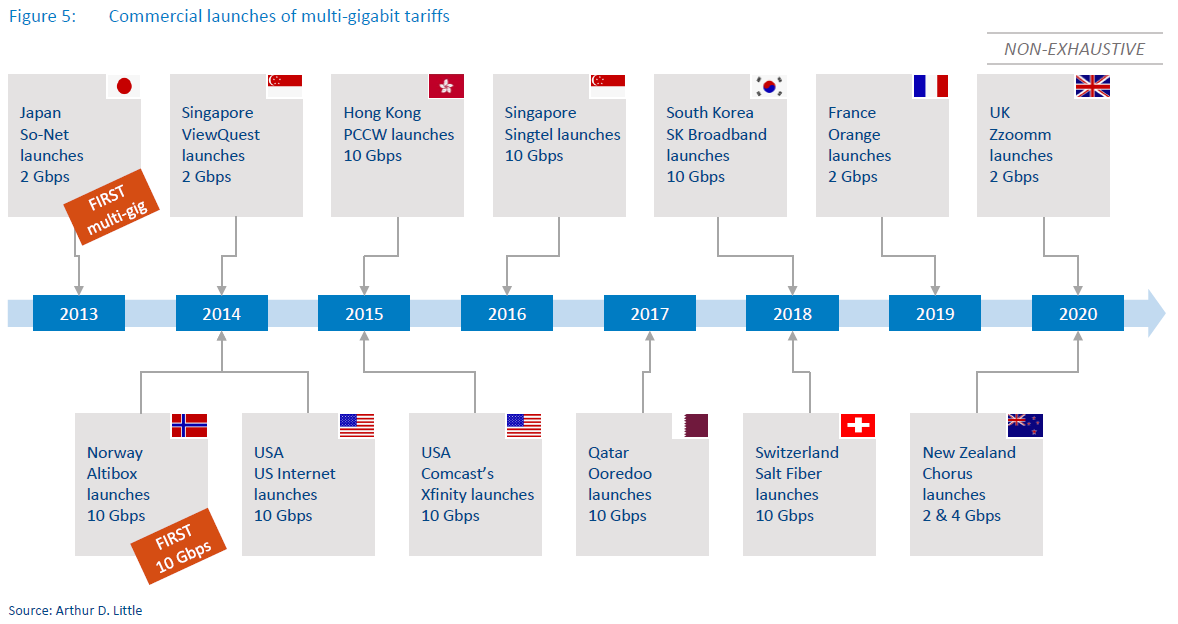

It has been more than five years since the first 10 Gbps plans were initially introduced in the US, Singapore, Hong Kong and Norway (see Figure 5. below). As of September 2020, we are not aware of any faster commercially available plan for the residential segment. Availability of multi-gigabit plans is still limited to a handful of markets and approximately 10-15 ISPs. However, just in the first half of 2020, there have been at least three ISPs that launched multi-gigabit offers: Zzoomm in the UK, Orange in France and Chorus in New Zealand.

Incumbent operator led deployments continue to play the leading role in fiber deployment today. However, we believe the importance of open access fiber providers will gain in significance, especially in important markets such as Italy, Germany, UK and Saudi Arabia, among others. Large-scale investment by non-telco entities such as energy companies and infrastructure funds, among others, will continue to expand fiber coverage in these markets. (For further details on open access fiber developments, please refer to our other report on this topic.)

An increasing number of incumbents acknowledge the inevitability of switching off and dismantling their legacy copper networks as fiber coverage becomes ubiquitous, while the cost economics of maintaining a fiber network are far superior to maintaining a legacy fixed network. Initiatives for legacy network switch off have been announced in multiple markets, and we expect to see results in larger markets such as Spain, France or Sweden soon. We also see regulators opening up to the idea that fiber-based solutions can eventually replace regulated legacy network–based products, giving a further impetus to open access fiber rollout in some regions.

Gigabit tariffs have become commonplace in developed fiber markets (mostly in Asia) and are increasingly being offered to customers worldwide. However, multi-gigabit speeds are still available only in a handful of markets. Salt in Switzerland is an example of a provider that uses its aggressively priced multigigabit offer to differentiate and disrupt the fiber market and not only as a marketing tool. We expect that, with new fiber rollouts and increasing competition on the broadband markets, the number of multi-gigabit offerings will continue to grow.

Note: This report, “The race to gigabit fiber,” is the 2020 update to Arthur D. Little’s Global FTTH study, published in 2010, 2013, 2016 and 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Ericsson: Multi-User MIMO with T-Mobile US; 5G with Telefónica; Open RAN Security WARNING

Author’s Note:

This post is actually three separate articles concerning “Ericsson in the news” today. Rather, than read all three parts, simply scroll down to the story that interests you. Let me (and others) know what you think by commenting in the box below the article.

1. Multi-User MIMO demo with T-Mobile US

T-Mobile US and Ericsson demonstrated a 16-layer multi-user multi-input multi-output (MU-MIMO) [1.] on one channel of 2.5 GHz spectrum. The peak cellular data rate was more than 5.6 Gbps.

During the test, engineers connected eight separate smartphones to the same 5G radio and resources using MU-MIMO and beamforming in a specific direction to achieve more than 700 Mbps data rate on each device.

Note 1. Multi-user MIMO (MU-MIMO) is a set of multiple-input and multiple-output (MIMO) technologies for wireless communication, in which a set of users or wireless terminals, each with one or more antennas, communicate with each other.

In contrast, single-user MIMO considers a single multi-antenna transmitter communicating with a single multi-antenna receiver. In a similar way that OFDMA adds multiple access (multi-user) capabilities to OFDM, MU-MIMO adds multiple access (multi-user) capabilities to MIMO. MU-MIMO has been investigated since the beginning of research into multi-antenna communication.

…………………………………………………………………………………….

Using MU-MIMO, T-Mobile US could potentially connect many more devices to the same cell infrastructure and still deliver very fast speeds to all of them. Using that set of technologies, wireless telcos might be able to deliver even better 5G performance to more people than was expected.

Using a commercially available massive MIMO radio with 64 antennas from Ericsson and OnePlus 8 5G smartphones T-Mobile sells today, 16 unique data streams were transmitted. Each stream was capable of transmitting/receiving at more than 350 Mbps. With two data streams for each device, that’s 700+ Mbps for each smartphone, all using the same radio resources at the same time.

With 100 MHz of total 5G spectrum used in the demonstration, T-Mobile US was able to achieve a 50+ bps/Hz in spectral efficiency. That is much higher than the single digit efficiency typically experienced today.

“This is what you get when you pair T-Mobile’s unmatched spectrum portfolio with the best damn team in wireless — innovation that changes the game for the entire industry,” said Neville Ray, President of Technology at T-Mobile. “We have a 5G network that’s second to none, and it’s getting better by the day thanks to our amazing engineers and partners. Just wait until you see what they do next for our customers!”

T-Mobile US expects to begin deploying this technology in 2021 as they continue the goal of building America’s best 5G network.

References:

https://www.t-mobile.com/news/network/t-mobile-achieves-mind-blowing-5g-speeds-with-mu-mimo

For more information about T-Mobile’s 5G vision, visit: www.t-mobile.com/5g. To see all the places you’ll get T-Mobile’s current 5G down to a neighborhood level, check out the map at www.t-mobile.com/coverage/5g-coverage-map.

https://www.telecompaper.com/news/t-mobile-us-achieves-5g-speeds-with-mu-mimo–1353491

…………………………………………………………………………………………………..

2. Ericsson partners with Telefónica on Spain 5G launch

Ericsson is providing new 3.5Ghz radio equipment and software upgrades to 5G-ready Ericsson radios in Telefónica’s network. With Ericsson Radio System products already deployed in parts of Telefónica Spain’s network, fast, flexible, and cost-efficient 5G activation is made easier.

Joaquín Mata, CTO, Telefónica Spain, says: “The launch of our 5G network constitutes a leap forward towards the hyper connectivity that will change the future of Spain. We are very pleased with the collaboration with Ericsson to build one of the best 5G networks in Europe.”

Arun Bansal, President of Ericsson Europe and Latin America, says: “With our leading technology, Telefónica will offer its customers 5G faster and support them to reach 75 percent coverage of the population by the end of the year. With our swift 5G roll-out, Spain is ready for the next digital revolution and Ericsson is proud to be powering it together with Telefónica.”

As the industry evolves towards RAN virtualization, with virtual RAN or Open RAN (O-RAN), it is important that a risk-based approach is taken to adequately address security.Virtualization throughout the network and a service-based architecture means that security needs to be handled in a new way.

5G will accelerate innovation and provide transformative use cases across multiple global sectors. However, it will also bring new security challenges for the mobile ecosystem, with broader attack surfaces, more devices and increased traffic loads. We must have networks that are trustworthy, resilient, and secure at every phase of the system lifecycle. These new security challenges are addressed by 3GPP’s SA3 security work group.Expanded threat surface

The introduction of new and additional touch points in O-RAN architecture, along with the decoupling of hardware and software, has the potential to expand the threat and attack surface of the network in numerous ways, including:

- New interfaces increase threat surface – for example, open fronthaul, A1, E2, etc.

- Near-Real-Time (RT) RIC and 3PP xApps introduces new threats that could be exploited

- Decoupling of hardware increases threat to Trust Chain

- Management interfaces may not be secured to industry best practices

- (not exclusive to O-RAN): adherence to Open Source best practices

These and other areas are explored in greater depth in Ericsson’s report, Security considerations of Open RAN. Many of these items are being studied in several O-RAN Alliance working groups, including the Security Task Group, a consensus-based standards group that will ensure that O-RAN implementations meet the levels of security expected by the industry.

Ericsson is committed to providing leadership and guidance in the O-RAN Alliance on these emerging areas of study. In the meantime, let’s take an in-depth look at just one of these new areas of risk:

Weakened Links in the Trust Chain

Virtualization and the use of cloud platforms give the possibility to utilize hardware resources better between different applications, but it will also introduce security risks as isolation between applications are only “logical” in software without physical isolation across hardware resources. Recently discovered vulnerabilities like Meltdown and Spectre reveal that there can be increased security risks when sharing hardware resources.

To establish a secure and trusted communication channel between two endpoints, one needs first to authenticate each side before a secure (confidentiality and integrity-protected) channel can be established. To authenticate each endpoint, a unique identifier and one or more credentials that shall be kept secret are needed. To protect the credentials in a computer environment, hardware security functionality such as Trusted Platform Module (TPM), Hardware Security Module (HSM), and secure enclaves, are used to establish a hardware root of trust.

In the case of virtualization and cloud environments, there are many layers that need to be considered to ensure the trust chain is maintained between applications and the underlying hardware. The authentication process is the base for establishing a secure communication channel, but it must trust the layers underneath to attest that the node, layer or data set has not been compromised. For example, a node could request a valid service, authenticate correctly to the system and be authorized to use that service yet still represent a malicious threat if it is running on compromised firmware.

As there are different layers between the hardware and its security functions and the application, one needs standardized interfaces and APIs to use the hardware security functions and allow those to attest to and validate the layers above. Together with standardized and interoperable APIs, there must also be a transparency to how the different layers use and provide the security functions in the chain, especially as different hardware vendors may have different security functions, capabilities or implementation variances.

Figure 1. O-RAN: Additional functions, interfaces and a modified architecture (Source: Ericsson)

Ericsson will continue its leadership role within the O-RAN Alliance and its Security Task Group to incorporate security best practices, ensuring that new deployments are ready to meet the level of security, resilience and performance expected by service providers and their customers.

The Open RAN Policy Coalition, a U.S. special interest (i.e. lobbying) group looking for U.S. government funding for Open RAN technology, today announced several new members (American Tower, Broadcom, GigaTera Communications, Inseego, Ligado Networks, Nvidia, RIFT, Texas Instruments and Xilinx). Ericsson is not a member, but arch rival Nokia is. Cloud giants AWS, Google and Facebook are members. Obviously, Chinese vendors aren’t welcome to join the Coalition. The complete Coalition membership list is here.

……………………………………………………………………………………………..

Coalition members believe that by standardizing or “opening” the protocols and interfaces between the various subcomponents (radios, hardware and software) in the RAN, we move to an environment where networks can be deployed with a more modular design without being dependent upon a single vendor. The Coalition will promote policies that:

- Support global development of open and interoperable wireless technologies;

- Signal government support for open and interoperable solutions;

- Use government procurement to support vendor diversity;

- Fund research and development;

- Remove barriers to 5G deployment; and

- Avoid heavy-handed or prescriptive solutions

…………………………………………………………………………………………

The FCC is scheduled to host an open RAN forum on September 14th. FCC Chairman Pai will host experts at the forefront of the development and deployment of open, interoperable, standards-based, virtualized radio access networks to discuss this innovative new approach to 5G network architecture.

Panelists include representatives from Nokia, Parallel Wireless, Mavenir, Altiostar, HP Enterprise, Dell, VM Ware, and other would be Open RAN hardware/software vendors. But Ericsson will not be among them.

SK Telecom, Samsung, HPE and Intel MOU for 5G NFV Technology Evolution; ETSI ISG-NFV?

Who needs the ETSI ISG on NFV? Apparently, no one BUILDING 5G INFRASTRUCTURE! Founded in November 2012 by seven of the world’s leading telecoms network operators, ETSI ISG NFV became the home of the definition and consolidation for Network Functions Virtualization (NFV) technologies. Yet there is very little, if any, commercial deployments based on their specifications. In particular, the greatly promoted ETSI NFV management and orchestration (NFV-MANO).

SK Telecom today announced that it signed a Memorandum of Understanding (MOU) with Samsung Electronics, Hewlett Packard Enterprise (HPE) and Intel for cooperation in the commercialization of an evolved 5G network functions virtualization (NFV) platform.

Under the MOU, the four companies will jointly develop evolved NFV technologies for 5G network infrastructure, establish a standardized process for adoption of NFV, and develop technologies that can harness the capabilities of the virtualized network. Together, the companies will be able to reduce the time required to validate and integrate technologies from various vendors as well as verify them within the network. This will result in a more rapid introduction of new innovative technologies that enhance end user experience.

Mobile operators will be able to benefit from a significantly reduced time-to-market for the latest 5G services such as augmented reality (AR) and virtual reality (VR) through the NFV platform. Previously, they had to install each new hardware equipment or upgrade existing ones to introduce a new service.

The four companies will realize an evolved 5G NFV platform by applying Samsung’s 5G solution based on technologies from Intel and HPE to SK Telecom’s 5G network. To this end, Intel will provide its latest technologies, including Intel Xeon Processors, Ethernet 800 Series Network Adapters and Solid State Drives, and HPE will provide HPE ProLiant Servers to Samsung Electronics for early development and verification purposes. SK Telecom plans to establish a process for 5G network virtualization, which includes interconnecting its 5G core network to Samsung’s virtualized 5G solutions.

“Through this global cooperation, we will secure a solid basis for commercialization of an evolved 5G NFV platform and provide more innovative services to our customers,” said Kang Jong-ryeol, Vice President and Head of ICT Infrastructure Center of SK Telecom. “Going forward, we will continue to develop new technologies for 5G NFV evolution to play a leading role in realizing communication services of the future.”

“Together with SK Telecom, HPE and Intel, Samsung will lay the groundwork for network virtualization to allow SK Telecom to swiftly apply Samsung’s virtualized solutions on partner hardware platforms. As more operators look to virtualized networks, this collaboration will serve as an exemplar of transforming legacy networks to virtual networks,” said Roh Wonil, Senior Vice President and Head of Product Strategy, Networks Business at Samsung Electronics. “With proven success in 5G commercialization, we will continue to extend our 5G leadership, allowing customers to experience immersive 5G services.”

“Industry collaboration is essential to accelerate the rollout of 5G networks,” said Dan Rodriguez, corporate vice president and general manager of the Intel Network Platforms Group. “The joint work between SK Telecom, Intel, HPE and Samsung will be instrumental in helping SK Telecom implement the latest technologies and new capabilities in a faster and more agile way, ultimately delivering new innovative services to their end users.”

“We are pleased to be providing telco optimized infrastructure for this collaboration with SK Telecom, Samsung and Intel”, said Claus Pedersen, vice president, Telco Infrastructure Solutions, HPE. “HPE believes that the future of 5G lies in open, interoperable software and hardware innovation from different vendors. This is yet another proof point that HPE is the leading open infrastructure provider for 5G, helping telcos to deploy 5G services faster, on secure telco optimized platforms.”

About SK Telecom

SK Telecom is Korea’s leading ICT company, driving innovations in the areas of mobile communications, media, security, commerce and mobility. Armed with cutting-edge ICT including AI and 5G, the company is ushering in a new level of convergence to deliver unprecedented value to customers. As the global 5G pioneer, SK Telecom is committed to realizing the full potential of 5G through ground-breaking services that can improve people’s lives, transform businesses, and lead to a better society.

SK Telecom says they have attained unrivaled leadership in the Korean mobile market with over 30 million subscribers, which account for nearly 50 percent of the market. The company now has 47 ICT subsidiaries and annual revenues approaching KRW 17.8 trillion.

References:

For more information, please contact [email protected] or visit our Linkedin page www.linkedin.com/company/sk-

Dell’Oro: Telecom equipment revenues to grow 5% through 2020; Huawei increases market share

Dell’Oro analysts say first half global telecom equipment [1.] revenues were up 4% YoY in 1st half of 2020, as 5G infrastructure investments offset declines due to the impact of the coronavirus pandemic. The market research firm forecasts a 5% advance for the entire year.

Rollouts of 5G wireless, especially in China, were a primary cause of the first half increases, which benefit the entire supply chain, including telecommunications semiconductors. China 5G spending surely helped Huawei increase its market share, despite U.S. sanctions.

Note 1. Dell’Oro includes the following types in the telecom equipment market: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch

In the first half of 2020, double digit growth in mobile infrastructure offset declining investments in broadband access, microwave and optical transport and service provider routers and ethernet switches, Dell’Oro said. Statista analysts in June said 2020 telecom equipment revenues should nearly reach $50 billion.

Rankings of the biggest telecom equipment providers remained the same in the first half of 2020, with Huawei dominating at 31%, followed by Nokia and Ericsson tied at 14% each, then ZTE at 11% and Cisco at 6%, according to Dell’Oro.

Second quarter results were stronger than expected following a 4% decline in the first quarter. The biggest driver was a strong rebound in China across 5G Radio Access Network, 5G Core and other areas. Supply chain disruptions of the first quarter also stabilized in the second quarter, Dell’Oro said.

Additional key takeaways from the 2Q20 reporting period include:

- Following the 4% Y/Y decline during 1Q20, the overall telecom equipment market returned to growth in the second quarter, with particularly strong growth in mobile infrastructure and slower but positive growth for Optical Transport and SP Routers & CES, which was more than enough to offset weaker demand for Broadband Access and Microwave Transport.

- For the 1H20 period, double-digit growth in mobile infrastructure offset declining investments in Broadband Access, Microwave and Optical Transport, and SP Routers & CES.

- The results in the quarter were stronger than expected, driven by a strong rebound in China across multiple technology segments including 5G RAN, 5G Core, GPON, SP Router & CES, and Optical Transport.

- Also helping to explain the output acceleration in the quarter was the stabilization of various supply chain disruptions that impacted the results for some of the technology segments in the first quarter.

- Shifting usage patterns both in terms of location and time and surging Internet traffic due COVID-19 has resulted in some infrastructure capacity upside, albeit still not proportional to the overall traffic surge, reflecting operators ability to address traffic increases and dimension the network for additional peak hours throughout the day using a variety of tools.

- Even though the pandemic is still inflicting high human and economic losses, the Dell’Oro analyst team believes the more upbeat trends in the second quarter will extend to the second half, propelling the overall telecom equipment market to advance 5% in 2020.

Semiconductor officials are less optimistic for the rest of the year with SIA President John Neuffer recent saying “substantial market uncertainty remains for the rest of the year.” Semiconductor sales were up 5% in July, reaching $35 billion, but dropped in early August, according to reports.

According to the Semiconductor Industry Association, about 33% of all semiconductors made (the largest category) are devoted to communications, including networking equipment and radios in smartphones.

…………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.fierceelectronics.com/electronics/telecom-equipment-revenues-to-grow-5-through-2020

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Samsung Electronics said on Monday it had won a $6.64 billion order to provide wireless communication solutions to Verizon in the United States, a major win for the South Korean firm in the next-generation 5G network market. Samsung’s local unit Samsung Electronics America signed the agreement with Verizon Sourcing, a subsidiary of Verizon Communications, to offer network products for the wireless carrier through the end of 2025. This includes providing, establishing and maintaining the company’s 5G mobile telecom equipment.

…………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Nokia on the sidelines:

Nokia’s biggest customer is Verizon, JP Morgan research said in a July note to clients. Yet Nokia didn’t win any part of the new Verizon 5G order. That was predicted by Rosenblatt analyst Ryan Koontz, who said in July “Samsung will “leapfrog Nokia to secure one of the largest new supplier telecom contracts in many years.”

Nokia wrote in an email, “We do not comment on our customers’ vendor strategy. Nokia is proud to serve Verizon, and we are committed to continuing to help them build the best, most reliable and highest performing network. Nokia and Verizon have a longstanding strategic partnership in key technologies across their network with our end-to-end solutions portfolio.”

…………………………………………………………………………………………………………………………………………………………………………….

Samsung’s global prospects for its network business have improved following U.S. sanctions on its bigger rival Huawei , analysts said. The Trump administration last month unveiled plans to auction off spectrum previously dedicated to military purposes for commercial use starting in mid-2022, to ramp up fifth-generation network coverage in the United States. In July, the UK ordered Huawei equipment to be purged completely from its 5G network by the end of 2027, adding it needs to bring in new suppliers like Samsung Electronics and Japan’s NEC Corporation.

Verizon CEO Hans Vestberg told CNBC in July last year that Verizon does not use any Huawei equipment. Verizon had already been a Samsung customer before the order. Vestberg’s statement about no Huawei gear is not true, as Light Reading and other websites noted on Friday.

The FCC requested information about “the presence or use of Huawei or ZTE equipment and/or services in their networks, or in the networks of their affiliates or subsidiaries.”

The FCC’s goal is to determine how many US companies use equipment from Huawei or ZTE – the equipment has been deemed a threat to national security – and how much it might cost to replace that gear with equipment from “trusted” suppliers.

On Friday, the FCC published a list of companies that reported they have existing Huawei or ZTE equipment and services.

Three of the nation’s five biggest wireline phone providers (Verizon, CenturyLink and Windstream) have admitted to having equipment from Huawei or ZTE, according to Leichtman Research Group.

“Verizon’s networks do not include equipment from any untrusted vendors. In addition, the company is not seeking funds from the FCC to replace equipment,” a Verizon representative wrote in response to questions from Light Reading. “Verizon has a relatively small number of devices, called VoiceLink, which were made by Huawei and are used by some customers to make voice calls. There are no data services associated with these devices. Earlier this year, Verizon started replacing these units. That effort was temporarily halted by the pandemic and is now underway again. We expect to have all Voicelink devices fully retired by the end of the year.”

“Samsung winning the order from Verizon would help the company expand its telecom equipment business abroad, potentially giving leverage to negotiate with other countries,” Park Sung-soon, an analyst at Cape Investment and Securities told Reuters.

The order is for network equipment, a Samsung spokesman said. The company declined to comment on detailed terms the contract such as the portion of 5G-capable equipment included.

Verizon joined with Samsung long before 5G made its debut in smartphones last spring. In early 2018, the two firms teamed up for trial runs of 5G-powered home internet. Verizon officials have previously pledged not to use Huawei for its next-generation rollout. Samsung has supplied some network gear for prior generations including 4G LTE.

To Samsung, the deal represents a major 5G win. The contract, valued at 7.898 trillion South Korean won over five years, compares with the roughly 5 trillion won Samsung’s network business racked up in revenue in all of 2019.

Last year, 5G represented less than half of Samsung’s network business, of which U.S. carriers accounted for 10%, said S.K. Kim, a Seoul-based analyst with Daiwa Securities.

“With this latest long-term strategic contract, we will continue to push the boundaries of 5G innovation to enhance mobile experiences for Verizon’s customers,” Samsung said in a statement.

………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar — Telecom Equipment Vendor Market Shares:

Samsung had a 3% market share of the global total telecom equipment market in 2019, behind No. 1 Huawei with 28%, Nokia’s 16%, Ericsson’s 14%, ZTE’s 10% and Cisco’s 7%, according to market research firm Dell’Oro Group.

Among 5G network sales, Samsung ranks No. 4 with about 13% of the total market, according to market research firm Dell’Oro Group. It trails the top three, which include China’s Huawei Technologies Co. and the European firms Ericsson AB and Nokia Corp.

Huawei said early this year that it had signed more than 90 5G contracts, and Ericsson last month touted its 100th 5G “commercial agreement.” Samsung hasn’t divulged how many 5G contracts it has signed. But it has high hopes, having invested more than $30 billion in the U.S. market alone.

………………………………………………………………………………………………………………………………………………………………………………………….

Separately, Samsung announced the Galaxy Book Flex 5G, an adaptable, 5G-powered addition to its premium laptop line. Galaxy Book Flex 5G is powered by the new 11th Gen Intel® Core™ processor with Intel® Iris® Xe graphics offering intelligent performance and powerful processing for impressive productivity and stunning entertainment, along with Wi-Fi 6 and 5G connectivity for an unparalleled laptop experience.

“Across the world, we’re being asked to adapt and change constantly, and it’s vital we have devices that move with us,” said Mincheol Lee, Corporate VP and Head of New Computing Biz Group at Samsung Electronics. “Thanks to our close collaboration with Intel, Galaxy Book Flex 5G provides users with a powerful performance, next-generation connectivity, effortless productivity and premium entertainment features, all in the form function of their choosing.”

……………………………………………………………………………………………………………………………………………………………………………………………..

References: