Broadband Status

Highlights of 2025 Broadband Nation Expo: Comcast, T-Mobile keynotes + selected quotes

Over 100 ISPs from across the U.S., vendors in the broadband ecosystem, organizations and more gathered in Orlando, FL November 17-19th for the TIA’s annual Broadband Nation Expo, to talk about the challenges of delivering broadband today. Keynote speakers discussed topics including Comcast’s 10G network technologies and AI, T-Mobile’s fixed wireless access strategy, AT&T’s fiber expansion, and Google’s use of AI in data center innovation.

- Future-proofing the network: Strategies for evolving existing broadband infrastructure to meet increasing demands from emerging technologies like AI, advanced streaming, and more.

- 10G technology and multigigabit speeds: Nafshi discussed progress and plans for delivering multigigabit upload and download speeds to millions of Americans using this standard.

- Network resilience: Insights into how Comcast is building a more resilient network to keep communities connected, particularly in the face of severe weather events.

- Innovation and strategy: Leading with purpose and innovation in the era of the Broadband Equity, Access, and Deployment (BEAD) program.

- Core-to-edge intelligence: The integration of artificial intelligence and a robust fiber backbone to create a smarter, faster, and more reliable connectivity experience for customers.

Comcast is using artificial intelligence (AI) to create a “smarter,” self-healing 10G network, emphasizing distributed AI at the network edge to improve customer experience and network reliability. He noted that investments in 10G technologies like DOCSIS 4.0 and next-generation amplifiers are aimed at future-proofing the network for anticipated data usage growth. In particular. Comcast applies AI at various levels of its 10G network for automation, self-healing, performance optimization, and cybersecurity. This approach is designed to create a “smarter” and more resilient network, with a focus on real-time, distributed intelligence at the network’s edge.

- Predictive maintenance: Using AI and machine learning (ML), the network can analyze performance data to identify issues before they impact customers, reducing the time needed for repairs. The network also automatically detects when a customer’s modem is offline and analyzes the data to determine the cause of the outage.

- Capacity scaling: The Octave platform uses AI to automatically increase network capacity in areas experiencing unexpected spikes in data traffic, such as during live-streamed events.

- Traffic rerouting: AI agents can perform large-scale tasks like automatically rerouting data traffic around fiber cuts to prevent service interruptions.

- Automated deployment: With its AI and ML capabilities, Comcast automates over 99.7% of all software changes on the network, which also helps prevent human-caused errors.

- In-home WiFi optimization: Every hour, AI analyzes thousands of data points from millions of network devices to enhance in-home WiFi performance. The xFi platform also uses AI to dynamically optimize home WiFi based on user behavior and signal interference.

- Outage restoration: AI helps accelerate recovery efforts during extreme weather by detecting mass outages faster, pinpointing the cause, and identifying where technicians are needed most.

- Threat mitigation: AI agents are being trialed to identify cyber threats and take proactive measures to mitigate them, providing end-to-end cybersecurity protection.

- Optimized power usage: AI agents can also optimize power usage in the network based on spikes and lulls in data consumption.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

II. T-Mobile Chief Broadband Officer Allan Samson said the “uncarrier” has gained sizable 5G FWA market share in urban markets (it’s offered in Santa Clara, CA- hometown of this author). 70% of T-Mobile’s FWA activations come from the “top 100” U.S. cities and approximately 65% of fixed wireless sales per quarter happen in suburban and urban markets.

Samson said improved quality of service is one reason more people in urban areas are drawn to FWA, touting T-Mobile’s average FWA download speed sits at 239 Mbps and latency has decreased to about 34 milliseconds. T-Mobile has now converted every fixed wireless customer to a standalone 5G core network (specified by 3GPP). “From a technology perspective, this so-called cell phone quality internet has not only made a lot of progress but has so much more room to run in terms of the innovation,” Samson added.

He admitted T-Mobile’s lack of expertise in fiber optic networks: “Our approach is real simple. We don’t build wireline networks, you’ve got to know what you’re not good at,” he said. Hence T-Mobile’s decision to acquire both Lumos and Metronet. Samson said T-Mobile expects to close 2025 with “well north of 3 million homes passed” and “hopefully about 900,000 to a million customers.”

Selected Quotes:

Dr. Dong Hao, market technology development manager, Optical Communications at Corning, told a breakfast session about Meta’s 1 million GPU data center campus in Louisiana. “It’s so gigantic that it’s going to consume 8 million miles of optical fiber in that data center, alone,” he said. “How do you manufacture that? We are dealing with the capacity crunch. It’s a high-priority issue.”

In the age of AI….Robin Olds, senior business development manager, Broadband Program Office, Americas Service Provider, from Cisco, said that service providers are getting more comfortable with AI in the network, given rising costs. “Trusting the networks to make changes on the fly – that is a really hard thing for humans to do, but providers are starting to look at that to save time and money.”

“It’s about getting smarter networks, not just faster networks,” said Jeff Brown, senior director, Segment Marketing, Calix, said during a panel on access technologies.

Mike Lubin, senior advisor and VP at ViaSat thinks LEO satellite transport will emerge as FWA backhaul “in the interim” until fiber or another optical communications technology comes along. Some combination of satellite and FWA is “going to be the paradigm” for connecting about 2.6 billion unconnected folks globally.

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Point Topic: Global Broadband Subscribers in Q2 2025: 5G FWA, DSL, satellite and FTTP

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

Broadband Forum new work areas to enable broadband services & apps

UK’s CityFibre launches 5.5Gbit/s wholesale broadband service- 3 times faster than BT Openreach

Google Fiber and Nokia demo network slicing for home broadband in GFiber Labs

Point Topic: Global Broadband Subscribers in Q2 2025: 5G FWA, DSL, satellite and FTTP

Overview:

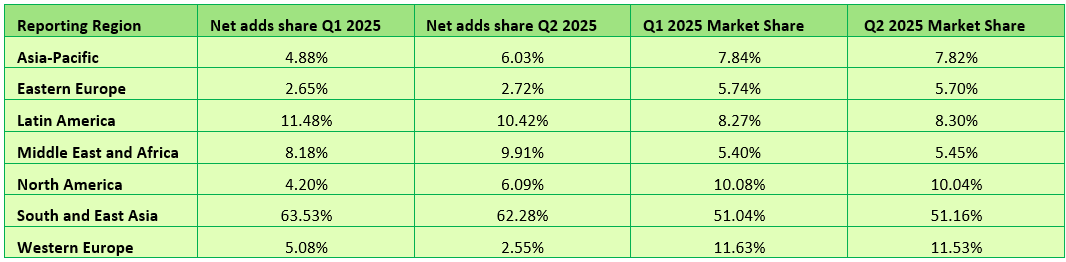

Global broadband subscribers surpassed 1.53 billion in Q2 2025, marking a 1.1% growth. Broadband subscriptions[1] declined in 24 countries[2], compared to 22 in Q1 2025. In some of these markets consumers are migrating to mobile broadband, others are experiencing economic headwinds or are already highly saturated. Some are still in the midst of conflict. Globally, the growth in Q2 2025 has increased slightly, compared to the same quarter of 2024.

Notes:

[1] Whenever Point Topic refers to ‘broadband’ in this report, they mean fixed broadband. Also, ‘subscriptions’ and ‘connections’ are used interchangeably.

[2] It is possible there will be restatements in the coming quarter/s and single period data should be viewed in that light. Decline in some markets can be due to changes in methodology used by national regulatory authorities.

Key Points:

-

In terms of growth, India remained at the top of the largest 20 fixed broadband markets with a 6.7% quarterly growth rate.

-

The share of FTTH/B in the total fixed broadband subscriptions increased further and stood at 72.68%. Broadband connections based on other technologies saw their market shares shrink again, with an exception of satellite and fixed wireless access (FWA).

-

Year-on-year, FTTH/B connections grew by 7.2%. Satellite and FWA saw an even higher annual growth (41.6% and 31% respectively).

-

Legacy copper subscriptions declined by 12.1% y-o-y, while FTTx lines (mainly VDSL) went down by 6%, with Spain becoming one of the first countries in the world and the first major European economy to shut down its copper network completely.

-

5G FWA take-up accelerated, especially in India and the US, as a result of aggressive investments by Reliance, Bharti Airtel, T-Mobile, Verizon and AT&T.

In Q2 2025, the global fixed broadband subscriber figure grew by 1.1%, exceeding 1.53 billion. In line with seasonal trends, the growth rate was slower than in the previous quarter but it was slightly higher than in the respective quarter of 2024 (Figure 1. above and Table 1. below).

Table 1. Global broadband subscribers and quarterly growth rates. Source – Point Topic

South and East Asia continues to claim the largest share of net adds in global fixed broadband subscribers, though it dropped slightly quarter-on-quarter from 63.5% to 62.3%. This was largely due to the slower quarterly growth in China, the largest broadband market of the region[3], which is inevitable due to the increasing market saturation (Table 2. below).

Other regions saw their net adds shares expand, with an exception of Latin America and Western Europe. In Western Europe, whose net adds share halved, most of the Scandinavian countries, the UK and some others saw a decline in fixed broadband subscribers, as the extent of migration to gigabit capable technologies was not sufficient to offset the decline in copper based subscriptions.

For the largest twenty broadband markets, once again all except the UK saw fixed broadband subscriber growth in Q2 2025 (Figure 5). The UK saw a -0.05% decline (compared to -0.3% in the previous quarter), as the FTTP growth was not sufficient to offset the decline in DSL, FTTx and cable broadband connections. For several quarters now India is at the top of this cohort, with a 6.7% growth, continuing to show huge growth potential due to the low fixed broadband penetration (16% of households) and the fast growing economy. Along with Canada, India also saw the largest increase in quarterly growth, compared to Q1 2025.

Globally, healthy quarterly FTTH/B growth rates were spread around the world, with the less advanced economies and more youthful fibre markets generally exhibiting higher growth. In the last 12 months to the end of Q2 2025, the number of DSL lines saw another decline (-12.1%), while FTTH/B connections grew by 7.2%. The decline in FTTx was -6%, while cable (HFC) broadband subscribers dropped by -0.9%.

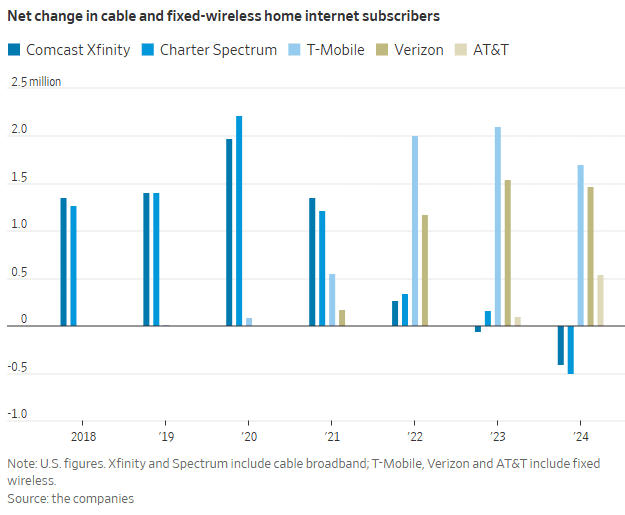

The decline in copper and FTTx (mainly VDSL) is not surprising. When it comes to cable/HFC, it is not immune to competition from other technologies either. The US is a good example, being the largest cable market globally. There the decline has continued as major players such as Comcast, Charter, Cox, Altice and others are losing customers. Competition from telcos who are rapidly expanding their fibre footprints (AT&T, Verizon, Frontier, Lumen, Consolidated Communications) and offering symmetric bandwidth, superior upload speeds and lower latency is partly to blame. At the same time, cable broadband prices have risen steadily due to promotional offer expirations, ‘network fees’, and equipment costs. Finally, 5G FWA home broadband from T-Mobile, Verizon and AT&T has exploded, with their customer numbers jumping year-on-year by 31%, 34% and 194% respectively.

Globally, wireless broadband (FWA, 5G FWA and LTE fixed) connections also continued to grow – they went up by 31% year-on-year, largely impacted by an explosive growth of 5G FWA in India (332% year-on-year) as well as the US (39%). In India, Reliance and Bharti Airtel are marching ahead with 5G FWA rollouts, capitalising on the huge potential of the enormous broadband hungry market.

Point Topic expects this trend to continue due to the fact that FWA networks are easier to scale after the initial investment, FWA broadband services being generally cheaper for consumers than the alternatives, easy to self-install, and being ‘good enough’ for streaming, remote work, and average household use, as well as the demand for connectivity in remote and underserved areas. Having said that, this applies primarily to the more advanced FWA, especially 5G based. They are also seeing a decline in subscriptions based on older FWA variants in some markets.

Point Topic: FTTP broadband subs to reach 1.12bn by 2030 in 29 largest markets

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

Point Topic Comprehensive Report: Global Fixed Broadband Connections at 1.377B as of Q1-2023

Point Topic: Global Broadband Tariff Benchmark Report- 2Q-2022

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share

Cable broadband subscriber growth slows while FTTx and FWA gain ground

U.S. Home Internet prices DECLINE amidst fierce competition between wireless carriers and cablecos

Home internet prices in the U.S. are being driven down by fierce competition between mobile carriers offering Fixed Wireless Access (FWA) and cable internet companies offering legacy Hybrid Fiber Coax connections. The increased competition has driven down the cost of home internet service, a welcome break for consumers when prices are rising for many other essential products. The price of home internet service fell 3.1% in May from a year earlier, while the overall consumer-price index rose 2.4%, according to the Labor Department.

The WSJ reports that major home-internet service providers including Verizon VZ, Comcast/Xfinity and T-Mobile launched a flurry of price-lock guarantees, promising steady rates for as long as five years. CableCos Charter, which is acquiring Cox, unveiled a three-year deal last year.

Cable companies have struggled to retain broadband internet subscribers since mobile carriers began offering more affordable 5G fixed-wireless access (FWA) internet service in 2018. FWA, which relies on over the air transmission to cell towers instead of HFC access, brought competition into markets where cable companies had long enjoyed being the only game in town. Now both types of providers are growing more aggressive to attract—and keep—customers.

“The cable companies went from gaining subscribers and raising rates every year to declining subscribers and giving people price locks,” said John Hodulik, a UBS analyst. “They’re seeing churn rise in their broadband subscriber base. And they’re trying to nip that in the bud.” Fixed wireless can sometimes cost half as much as a cable-provided internet plan. Though network congestion and other connectivity issues can be an issue for some users, the lower price point has been luring cable customers away.

T-Mobile, Verizon and AT&T added a combined 3.7 million FWA customers in 2024. In sharp contrast, Comcast’s Xfinity and Charter’s Spectrum lost more than 900,000 home internet subscribers. That’s depicted in this graph:

“Our pricing wasn’t breaking through in the marketplace,” said Steve Croney, chief operating officer for Comcast’s connectivity and platforms business. He said the company’s five-year price lock, introduced in April, competes well against the telecom companies’ offerings.

Frank Boulben, chief revenue officer at Verizon’s consumer group, said his company has been trying to address the “pain points” customers have with cable companies, such as price hikes. That’s why the telco is emphasizing FWA vs its FiOS fiber to the home based service. Boulben said his company would focus on selling fiber service to customers as it becomes available to them.

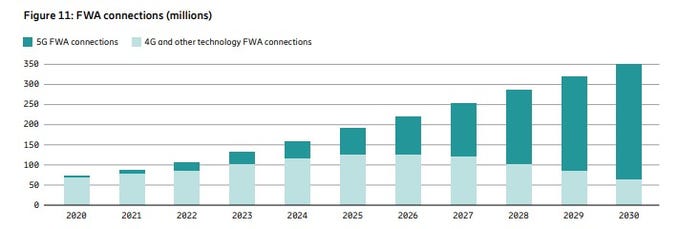

Is FWA the ONLY real killer application for 5G? Even though it was NOT one of the envisioned use cases? Ericsson’s recently released Mobility Report says FWA will account for more than 35% of all new fixed broadband connections, with an expected increase to 350 million by the end of 2030. The report states that more than half of all network service providers (wireless telcos) who offer FWA now do so with “speed-based monetization benefits enhanced by 5G.”

About 80% of the global network operators sampled by Ericsson currently offer FWA, with the most rapid area of growth among CSPs (communications service providers) offering 5G-enabled speed-based tariff plans. These opportunities are about the ability to offer a range of subscriber packages with different downlink and uplink data options with 5G FWA. As with fiber deals, “increasing monetization opportunities for CSPs compared to earlier generations of FWA.” 51% of operators with FWA offerings now include these speed-based options, which is up from 40% on the same period in June 2024 and represents a 27.5% increase. The June 2024 number had grown 50% on the June 2023 equivalent.

Source: Ericsson Mobility Report

…………………………………………………………………………………………………………………………………………………………………..

“We are at an inflection point, where 5G and the ecosystem are set to unleash a wave of innovation,” said Erik Ekudden, Ericsson Senior Vice President and Chief Technology Officer. “The recent advancements in 5G standalone (SA) networks, coupled with the progress in 5G-enabled devices, have led to an ecosystem poised to unlock transformative opportunities for connected creativity. Service providers have recognized this potential of 5G and are beginning to monetize it through innovative service offerings that extend beyond merely selling data plans. To fully realize the potential of 5G, it is essential to continue deploying 5G SA and to further build out mid-band sites. 5G SA capabilities serve as a catalyst for driving new business growth opportunities.”

Fixed-wireless doesn’t work everywhere. Besides congestion weak signals can make coverage spotty. If your cell phone doesn’t pick up 5G coverage smoothly, fixed-wireless from the same company probably won’t work either.

Verizon, AT&T and T-Mobile are winning converts to FWA at a faster pace than many anticipated, said Jonathan Chaplin, a managing partner at equity research firm New Street Research. Charter agreed to buy Cox last month for $21.9 billion in equity and assume $12 billion of its outstanding debt, in part to acquire scale to better compete with fixed wireless access. However, fixed-wireless growth can’t last indefinitely. The wireless networks on which they run will eventually hit capacity, limiting how many subscribers they can add. Chaplin estimates the networks can support around 19 million total fixed-wireless subscribers—which he predicts they will reach in about five years, accounting for planned network expansions that the companies have announced. When that limit is reached, cable companies may regain the upper hand and keep growing their fiber customer base, Chaplin said.

The big three wireless carriers (AT&T, Verizon and T-Mobile) have all been investing in fiber-based wired networks via build-outs and acquisitions. AT&T is bringing new customers in via FWA, with the long-term goal to convert them to fiber-based service, said Erin Scarborough, who runs that company’s broadband and connectivity initiatives.

References:

https://www.telecoms.com/5g-6g/ericsson-says-fwa-is-boosting-telco-monetization-opportunities

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.consumeraffairs.com/news/cable-vs-wireless-war-is-driving-prices-down-062525.html

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

FWA a bright spot in otherwise gloomy Internet access market

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

The U.S. The Commerce Department is examining changes to the NTIA’s $42.5 billion broadband funding bill (Broadband Equity Access and Deployment- BEAD), which endeavors to expand internet access in underserved/unserved areas. [BEAD was part of the 2021 Infrastructure Investment and Jobs Act (IIJA) during the Biden administration] The proposed new rules will make it much easier for Elon Musk owned Starlink satellite-internet service, to tap in to rural broadband funding, according to the Wall Street Journal. [Starlink is owned by SpaceX which is majority owned by Elon Musk).

Commerce Department Secretary Howard Lutnick said that BEAD will be revamped “to take a tech-neutral approach that is rigorously driven by outcomes, so states can provide internet access for the lowest cost.” The department is also “exploring ways to cut government red tape that slows down infrastructure construction. We will work with states and territories to quickly get rid of the delays and the waste. Thereafter, we will move quickly to implementation in order to get households connected. All Americans will receive the benefit of the bargain that Congress intended for BEAD. We’re going to deliver high-speed internet access, and we will do it efficiently and effectively at the lowest cost to taxpayers.”

By making the broadband the grant program “technology-neutral,” it will free up states to award more funds to satellite-internet providers such as Starlink, rather than mainly to companies that lay fiber-optic cables which connect the millions of U.S. households that lack high-speed internet service.

The potential new rules could greatly increase the share of funding available to Starlink. Under the BEAD program’s original rules, Starlink was expected to get up to $4.1 billion, said people familiar with the matter. With Commerce’s overhaul, Starlink, a unit of Musk’s SpaceX, could receive $10 billion to $20 billion.

“The Trump administration is committed to slashing government bureaucracy and harnessing cutting-edge technology to deliver real results for the American people, especially rural Americans who were left behind” under the Biden administration, White House spokesman Kush Desai said.

“Leave it alone; let the states do what they’ve done,” Missouri State Rep. Louis Riggs, a Republican, said in a recent interview. “The feds could not do what the states have done. In 10 or 15 years, all they basically did, they walked in and screwed everything up. God love them, they just keep throwing money at the problem, which is okay when you give it to the states and let us do our jobs, but trying to claw that funding back and stand up a new grant round is the worst idea I’ve heard in a very long time, and that’s saying a lot coming out of D.C.”

The overhaul could be announced as soon as this week, possibly without some details in place, the people said. Following any changes, states might have to rewrite their plans for how to spend their funding from the program, which could delay the implementation.

Lutnick told Commerce staff he plans to do away with other BEAD program rules, including some related to climate impact and sustainability, as well as provisions that encouraged states to fund companies with a racially diverse workforce or union participation, the people said. The program requires internet-service providers that receive funding to offer affordable plans for lower-income customers. Lutnick saids he is considering reducing those obligations.

Commerce Secretary Howard Lutnick at the White House last month. Photo: Francis Chung/Pool/Cnp/ZUMA Press

Many broadband providers worried the Musk-led Department of Government Efficiency (DOGE) would eliminate or reduce the program’s funding. Is that not a conflict of interest considering that Musk owns Starlink/SpaceX?

Given the overhaul, fiber broadband providers may not benefit from it as much as they expected because non-fiber technologies are poised to receive more funding than before.

Fiber Broadband Association CEO Gary Bolton said in a statement that all “Americans deserve fiber for their critical broadband infrastructure. Fiber provides significantly better performance on every metric, such as broadband speeds, capacity, lowest latency and jitter, highest resiliency, sustainability and provides the maximum benefit for economic development and is required for AI, Quantum Networking, smart grid modernization, public safety, 5G and the future of mobile wireless communications. We urge our policymakers to do what’s right for people and to not penalize Americans for where they live or their current income levels.”

Telecommunications and broadband consultant John Greene wrote that states that have started the sub-grantee selection process, such as Louisiana, “might be forced to rethink their process in light of potential new rules.” Other “states, like Texas, might be better served to pause their process until after Commerce has completed their review and made any necessary changes,” he said.

References:

Nokia will manufacture broadband network electronics in U.S. for BEAD program

New FCC Chairman Carr Seen Clarifying Space Rules and Streamlining Approvals Process

Highlights of FiberConnect 2024: PON-related products dominate

2021 U.S. Broadband Infrastructure law has been a colossal failure – who’s to blame?

The 2021 U.S. Investment and Jobs Act (IIJA), AKA the Bipartisan Infrastructure Law was signed into law November 15, 2021. It included $42.5 billion for states to expand broadband to “unserved,” mostly rural, communities. The White House said it would “Ensure every American has access to high-speed internet…. The Bipartisan Infrastructure Deal will deliver $65 billion to help ensure that every American has access to reliable high-speed internet through a historic investment in broadband infrastructure deployment. The legislation will also help lower prices for internet service and help close the digital divide, so that more Americans can afford internet access.”

In his speech at the Democratic National Convention, President Joe Biden trumpeted his broadband program in historic terms, calling it a national build-out “not unlike what Roosevelt did with electricity.” Democratic presidential nominee Kamala Harris helped create and promote the program as vice president, and on the campaign trail it could offer a way to show how the White House has delivered for rural Americans.

Yet almost three years later, ground hasn’t been broken on a single project! The Biden-Harris Administration recently said construction won’t start until next year at the earliest, meaning many projects won’t be up and running until the end of the decade. Who’s to blame?

- NTIA was expected to play a major role in the endeavor to connect every American to high-speed, affordable broadband. They intended to work closely with all stakeholders, including State and local governments, Tribal governments, industry, and community leaders, as well as across the Federal government to ensure that this bold investment is targeted to those who need it most. But they haven’t helped a bit!

- States must submit plans to the U.S. Commerce Department about how they’ll use the funds and their bidding process for providers. The Commerce Dept. has piled on mandates that are nowhere in the law and has rejected state plans that don’t advance progressive goals. Commerce hoped to spread the cash to small rural cooperatives, but the main beneficiaries will be large providers that can better manage the regulatory burden. Bigger businesses always win from bigger government.

- Commerce is all but refusing to fund anything other than fiber broadband, though satellite services like SpaceX’s Starlink and wireless carriers 5G FWA can expand coverage at lower cost. Extending 5G to rural communities costs a couple thousand dollars per connection. Building out fiber runs into the tens of thousands. Fiber networks will require more permits, which delay construction. But fiber will require more union labor to build. Commerce wants grant recipients to pay union-scale wages and not oppose union organizing.

- The Administration has also stipulated hiring preferences for “underrepresented” groups, including “aging individuals,” prisoners, racial, religious and ethnic minorities, “Indigenous and Native American persons,” “LGBTQI+ persons,” and “persons otherwise adversely affected by persistent poverty or inequality.”

- In Virginia, that leaves thousands of mostly rural residents stuck in a long-outdated version of the internet. According to the official state count, there are more than 100,000 homes and offices across Virginia with connection speeds slow enough to qualify for the $1.48 billion in funding. “People need to see it,” said Lynlee Thorne, a political director for Democratic campaign group Rural Ground Ggame, which helps lead campaigns for Virginia state seats. “It’s got to be a lot more concrete. We’re past the point of being able to earn people’s votes based on the status quo or just hope.”

- Last week, Cox Communications last week sued Rhode Island over the state’s plan to “build taxpayer-subsidized and duplicative high-speed broadband internet in affluent areas of Rhode Island like the Breakers Mansion in Newport and affluent areas of Westerly,” where Taylor Swift owns a $17 million vacation home. Cox says there are better ways to spend taxpayer dollars. According to the Federal Communications Commission, 99.97% of U.S. households already have access to high-speed internet.

References:

https://www.politico.com/news/2024/09/04/biden-broadband-program-swing-state-frustrations-00175845

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Apparently, there’s no place to hide in any telecom or datacom market? We all know the RAN market has been in a severe decline, but recent Dell’Oro Group reports indicate that Optical Transport, Mobile Core Network and Cable CPE shipments have also declined sharply in the 1st Quarter of 2024.

Here are a few selected quotes from Dell’Oro analysts:

“The North American broadband market is in the midst of a fundamental shift in the competitive landscape, which is having a significant impact on broadband equipment purchases,” said Jeff Heynen, Vice President with Dell’Oro Group. “In particular, cable operators are trying to navigate mounting, but predictable, broadband subscriber losses with the need to invest in their networks to keep pace with further encroachment by fiber and fixed wireless providers,” explained Heynen.

Omdia, owned by the ADVA, expects cable access equipment spending to grow later in 2024 and peak in 2026 at just over $1 billion, then drop off to $700 million in 2029.

………………………………………………………………………………………………………

“Customer’s excess inventory of DWDM systems continued to be at the center stage of the Optical Transport market decline in the first quarter of 2024,” said Jimmy Yu, Vice President at Dell’Oro Group. “However, we think the steeper-than-expected drop in optical transport revenue in 1Q 2024 may have been driven by communication service providers becoming increasingly cautious about the macroeconomic conditions, causing them to delay projects into future quarters,” added Yu.

…………………………………………………………………………………………………..

“Inflation has impacted the ability of some Mobile Network Operators (MNOs) to raise capital, and it has also impacted subscribers when it comes to upgrading their phones to 5G. Many MNOs have lowered their CAPEX plans and announced that they have fewer than expected 5G subscribers on their networks; which limits MNOs’ growth plans. As a result, we are lowering our expectations for 2024 from a positive growth rate to a negative one,” by Research Director Dave Bolan.

- As of 1Q 2024, 51 MNOs have commercially deployed 5G SA (Stand Alone) eMBB networks with two additional MNOS launching in 1Q 2024.

References:

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

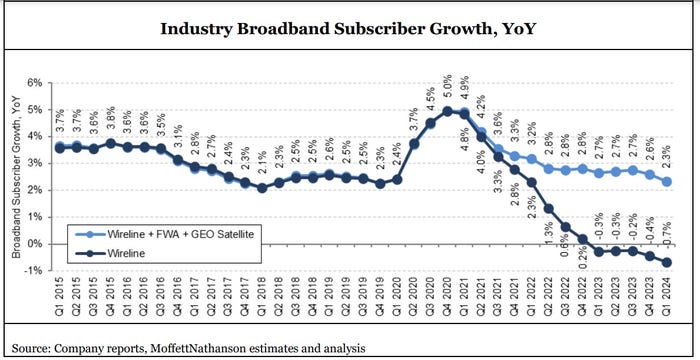

The pace of U.S. broadband subscriber growth slowed considerably in the first quarter of 2024 as fiber, fixed wireless access (FWA) and cable broadband service providers collectively turned in results that were worse than what they posted in the year-ago period.

Total industry net additions, including or excluding FWA and geosynchronous (GEO) satellite broadband providers, decelerated noticeably in Q1 2024. The total market’s growth rate decreased to just 2.3% year-over-year, the slowest since the COVID-19 pandemic, analysts at MoffettNathanson estimated in its latest broadband industry trends report (paid subscription required). When FWA and GEO satellite categories were excluded, the growth rate was much worse: -0.7%.

The overall number of U.S. broadband market subscribers decelerated by 299,000 net adds versus the year-ago quarter. “That was the most abrupt since Q2 2022,” said MoffettNathanson analyst Craig Moffett. “The bottom line is that penetration of home broadband stalled, and perhaps even declined in the quarter, particularly if one adjusts for the growth in homes passed in rural areas under RDOF [Rural Digital Opportunity Fund] subsidies and unsubsidized edgeouts,” Moffett wrote.

Here’s a breakdown of U.S. broadband subscribers by access type:

- Fixed Wireless Access (FWA) providers added 879,000 subs in Q1 2024, down from a gain of 925,000 in the year-ago period.

- Fiber net adds also slowed – from 487,000 in Q1 2024 versus a gain of 517,000 in the year-ago quarter.

- DSL losses of 560,000 in Q1 were similar to a year-ago loss of 571,000.

- MSO/cable network operators shed 169,000 broadband subs in Q1, much worse than a year-ago gain of about 71,000 subs.

“The culprit for cable’s weaker broadband net additions was a slower market growth rate,” though lower new household formation and cessation of ACP enrollments in the quarter also played a role, Moffett noted.

……………………………………………………………………………………………………………..

According to Statista, the total number of broadband subscribers in the U.S. stood at 114.7 million at the end of 2023, This was an increase of over four million subscribers compared to the previous year.

Source: Statista

…………………………………………………………………………………………………………………………

In March 2024, Leitman Research found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 96% of the market – acquired about 3,520,000 net additional broadband Internet subscribers in 2023, similar to a pro forma gain of 3,530,000 subscribers in 2022.

Leitman Research findings for 2023:

- The top cable companies lost about 65,000 subscribers in 2023 – compared to about 530,000 net adds in 2022

- The top wireline phone companies lost about 80,000 total broadband subscribers in 2023 – compared to about 180,000 net losses in 2022

- Wireline Telcos had about 1.97 million net adds via fiber in 2023, offset by about 2.05 million non-fiber net losses

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,665,000 subscribers in 2023 – compared to about 3,185,000 net adds in 2022

- Fixed wireless services accounted for 104% of the total net broadband additions in 2023, compared to 90% of the net adds in 2022, and 20% of the net adds in 2021

“Top broadband providers added about 3.5 million subscribers in 2023, similar to the number of broadband adds in 2022,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Over the past four years, top providers added about 15.9 million broadband subscribers, compared to about 10.2 million net broadband adds in the prior four (pre-pandemic) years.”

………………………………………………………………………………………………………..

References:

https://www.lightreading.com/broadband/us-broadband-subscriber-pace-slows-across-the-board

https://www.statista.com/statistics/217938/number-of-us-broadband-internet-subscribers/

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Verizon’s 2023 broadband net additions led by FWA at 375K

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

FCC increases broadband speed benchmark (x-satellites) to 100/20 Mbit/s

The U.S. FCC voted this week to implement a 4x increase to its “broadband” benchmark, from 25/3 Mbit/s to 100/20 Mbit/s (download/upload speeds). The Commission’s Report was issued pursuant to section 706 of the Telecommunications Act of 1996. The FCC concluded “that advanced telecommunications capability is not being deployed in a reasonable and timely fashion based on the total number of Americans.”

Using the agency’s Broadband Data Collection deployment data for the first time rather than FCC Form 477 data, the Report shows that, as of December 2022:

• Fixed terrestrial broadband service (excluding satellite) has not been physically deployed to approximately 24 million Americans, including almost 28% of Americans in rural areas, and more than 23% of people living on Tribal lands;

• Mobile 5G-NR (ITU-R M.2150/3GPP Release 16) coverage has not been physically deployed at minimum speeds of 35/3 Mbps to roughly 9% of all Americans, to almost 36% of Americans in rural areas, and to more than 20% of people living on Tribal lands;

• 45 million Americans lack access to both 100/20 Mbps fixed service and 35/3 Mbps mobile 5G-NR service; and

• Based on the new 1 Gbps per 1,000 students and staff short-term benchmark for schools and classrooms, 74% of school districts meet this goal.

The Report also sets a 1 Gbps/500 Mbps long-term goal for broadband speeds to give stakeholders a collective goal towards which to strive – a better, faster, more robust system of communication for American consumers.

FCC Chairwoman Jessica Rosenworcel said in a statement discussing the agency’s new 100/20 Mbit/s benchmark.

“This fix is overdue. It aligns us with pandemic legislation like the Bipartisan Infrastructure Law and the work of our colleagues at other agencies. It also helps us better identify the extent to which low-income neighborhoods and rural communities are underserved. And because doing big things is in our DNA, we also adopt a long-term goal of 1 Gigabit down and 500 Megabits up.”

“One more thing. The law requires that we assess how reasonable and timely the deployment of broadband is in this country.”

Don’t expect much change. As noted by Engadget, U.S. Internet Service Providers (ISPs) offering speeds under the new benchmark won’t be able to call their services “broadband” on the new telecom information labels the FCC will soon begin requiring. However, ISPs and network providers are not required to hit the FCC’s new 100/20 Mbit/s speeds.

Moreover, it will not impact the NTIA’s massive $42.45 billion Broadband Equity, Access, and Deployment (BEAD) program, which already requires 100/20 Mbit/s speeds on networks receiving government subsidies.

……………………………………………………………………………………………………….

The FCC’s definition of broadband excludes satellites at a time of frenzied investments in Internet services from space. Championed by Elon Musk’s Starlink, companies ranging from Amazon to OneWeb to Telesat are planning similar low-Earth orbit (LEO) satellite constellations for space-based Internet.

Starlink’s parent company – SpaceX – this week conducted another test of its massive Starlink rocket. That rocket is in part intended to launch Starlink’s second generation satellites.

However, the FCC has excluded such satellite efforts from most of its broadband programs. For example, it rejected Starlink’s application for government funding through its Rural Digital Opportunity Fund (RDOF) program.

“It is evident that fixed wireless access (FWA) offerings already compete aggressively with traditional wired broadband services, and LEO satellite-based services are poised to do the same. Accordingly, all three should be treated as robust rivals within a single ‘home Internet’ product market,” wrote the Free State Foundation, another think tank.

According to FCC Commissioner Brendan Carr, a Republican, the agency specifically excludes Starlink from its overall efforts because he thinks President Biden dislikes SpaceX chief executive Elon Musk. “The Biden Administration is choosing to prioritize its political and ideological goals at the expense of connecting Americans,” Carr alleges.

With its roughly 5,000 satellites, Starlink currently offers median speeds of around 64 Mbit/s, according to Ookla, and counts around 2.6 million customers globally.

References:

https://docs.fcc.gov/public/attachments/DOC-401205A1.pdf

https://docs.fcc.gov/public/attachments/DOC-401205A2.pdf

BroadbandNow Research: Best & Worst States for Broadband Access

FCC proposes 100 Mbps download as U.S. minimum broadband speed

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

GAO: U.S. Broadband Benchmark Speeds Too Slow; FCC Should Analyze Small Business Speed Needs

FCC Says Broadband Deployment Lacking; Redefinition (25M/3M) Has Huge Implications for AT&T, Verizon & Comcast

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

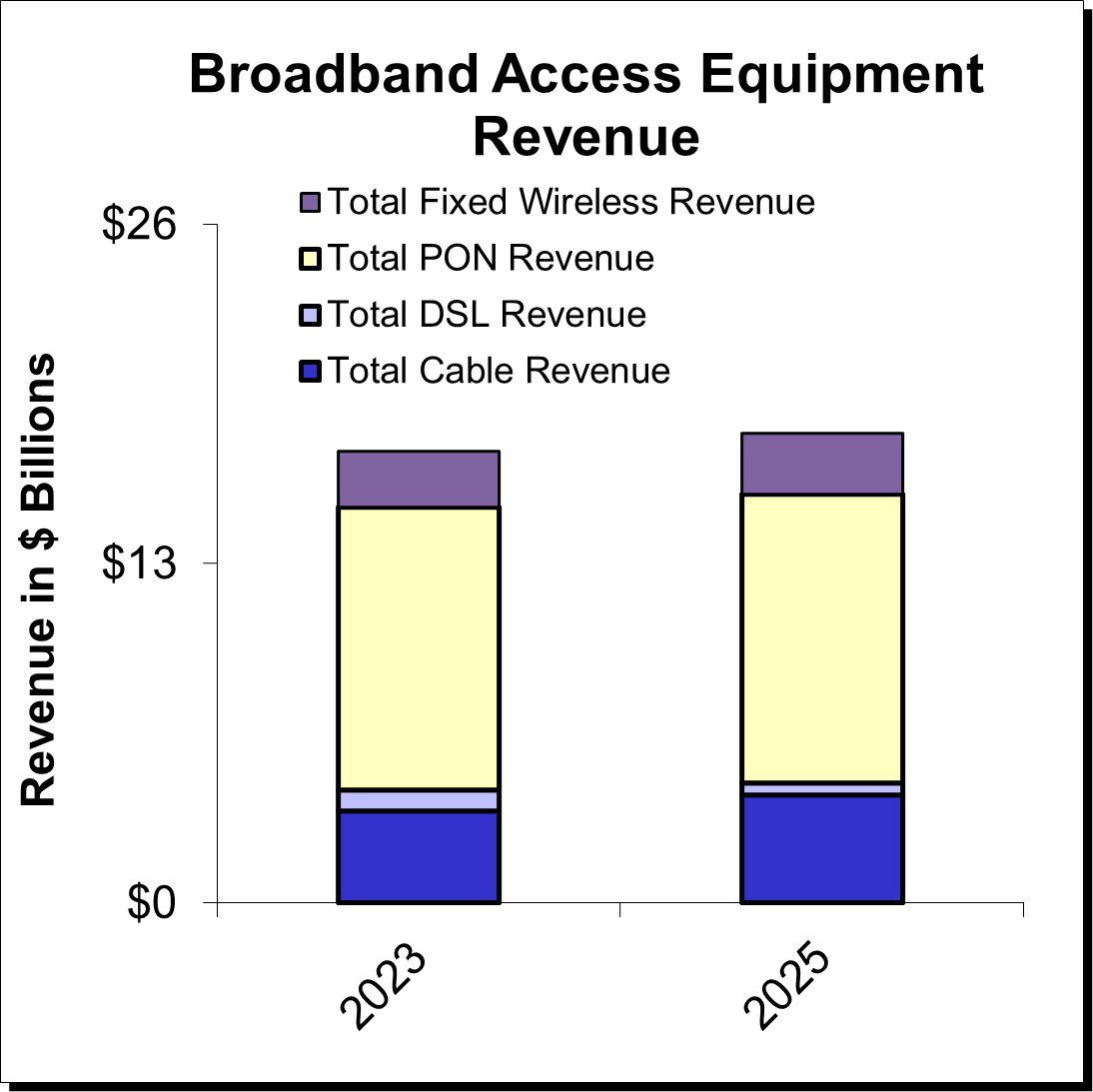

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Dell’Oro Group expects broadband access equipment sales to decline by 1% in 2024 versus 2023, with the first half of 2024 seeing continued weakness followed by a surge in spending in the second half of the year. The first half of 2024 will continue to see some of the inventory corrections that marked a tough 2023 that saw a spending decline of 8% to 10%, according to Dell’Oro VP Jeff Heynen.

“Although the inventory corrections seen in 2023 will continue through the first half of 2024, the second half of the year is expected to be the turning point towards renewed growth,” said Jeff Heynen, Vice President at Dell’Oro Group. “Service providers still have the same goals of increasing their fiber footprint, increasing the bandwidth they can offer their customers, and improving the reliability of their broadband services through the distribution of intelligence closer to subscribers,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2024 Forecast Report:

- PON equipment revenue is expected to grow from $10.8 B in 2023 to $11.8 B in 2028, driven largely by XGS-PON deployments in North America, EMEA, and CALA and early 50 Gbps deployments in China.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MAC/PHY Devices, and Remote OLTs) is expected to reach $1.3 B by 2028, as operators continue their DOCSIS 4.0 and early fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.5 B by 2028, led by shipments of 5G sub-6GHz and a growing number of 5G Millimeter Wave units.

- Revenue for Wi-Fi 7 residential routers and broadband CPE with WLAN will reach $9.3B by 2028, as the technology is rapidly adopted by consumers and service providers alike.

Source: Dell’Oro Group

About the Report:

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

References:

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Alaska Communications uses XGS-PON, FWA, DSL in ~5K homes including Fairbanks and North Pole

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications posted a surprise drop in broadband subscribers in the Q4-2023, the company announced on Friday. Charter’s internet customers decreased by 61,000 (-62,000 residential and +1,000 business) in the 4th quarter, with nearly all of the decline from residential customers. That was much worse than expectations for 17,290 additions, according to Visible Alpha and a year-ago gain of +105,000. The broadband subscriber drop was especially disappointing given Charter’s homes passed growth accelerated to 2.5% year-over-year, Craig Moffett said in a research note.

“Internet growth in our existing footprint has been challenging, driven by admittedly more persistent competition from fixed wireless and similar levels of wireline overbuild activity,” CEO Chris Winfrey said on a post-earnings call, adding that new investments will help drive growth despite the “temporary challenges.” Chief Financial Officer Jessica Fischer had warned in December that the company could lose internet customers in the quarter. At the time, speaking at an analyst conference, she said the company was facing short-term challenges and that results would be in line with the rest of the industry.

Charter was not the only cableco/MSO to report decreased broadband internet subscribers in the 4th quarter. Last week, rival Comcast reported a loss of 34,000 broadband customers, fewer than expectations, but exceeding the 18,000 broadband customers it lost in the previous quarter.

Stiff competition across broadband and wireless mobile and the decline of traditional television have been causes of concern, with Charter trying to expand its reach into rural areas in an effort to boost subscriber and earnings growth. Charter is facing heightened competition from Verizon and T-Mobile’s wireless home internet offerings, and the cable company could soon lose even more subscribers when a key government program runs out of funding in April, JPMorgan analysts say in a research note. In particular, the end of the Affordable Connectivity Program (ACP), which provided up to $30 per month to eligible customers to put toward their internet bills, could hurt Charter more than its peers. If ACP is not refunded, “we’ll work very hard to keep customers connected,” Winfrey said. Charter has more than 5 million ACP recipients, the highest in the industry. The majority of them were Charter broadband subscribers before the program began.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 142,000 broadband subs via its rural subsidy program in Q4, for a total of 420,000, and an overall penetration rate of 33.8% – up from 27.2% in the year-ago quarter. The company posted $74 million in rural revenues, up from $39 million a year earlier. Charter pulled in subsidy revenues of $29 million in Q4. Total capex for the project in Q4 was $426 million, down from $567 million in the year-ago quarter. Charter plans to activate 450,000 new subsidized rural passings in 2024. With all programs rolled up, Charter has committed to build 1.75 million subsidized rural passings.

Charter expects to complete its Rural Digital Opportunity Fund (RDOF) builds by the end of 2026 – two years ahead of schedule. Charter also intends to participate in the much larger $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Completion of Charter’s hybrid fiber/coax (HFC) network upgrade has been delayed to 2026 due in part to a lengthier certification process for distributed access architecture (DAA) technology. Charter’s original plan was to complete its HFC upgrades by the end of 2025. Charter’s HFC evolution plan consists of three steps:

- An upgrade to 15% of its network to 1.2GHz with an upstream-enhancing “high-split” using traditional integrated cable modem termination systems (CMTSs). That enables multi-gigabit downstream speeds and upstream speeds up to 1 Gbit/s.

- An upgrade to 1.2GHz with DAA and a virtual CMTS in 50% of the HFC footprint, enabling downstream speeds up to 5 Gbit/s and upstream speeds up to 1 Gbit/s.

- A full DOCSIS 4.0 upgrade by deploying 1.8GHz with DAA and a vCMTS to 35% of the HFC footprint. That’ll put Charter in position to deliver up to 10 Gbit/s downstream and at least 1 Gbit/s upstream.

Speaking on today’s Q4 2023 earnings call, Charter CEO Chris Winfrey said the operator has launched symmetrical speed tiers in two markets (Reno and Rochester, Minnesota, an official confirmed), with deployments in six additional markets underway that, once completed, will fulfill the phase one plan. Charter expects to start DAA deployments in its phase two markets later this year, Winfrey said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 546,000 mobile lines in Q4, down from a gain of +615,000 in the year-ago quarter and +594,000 in the prior quarter. Analysts were expecting Charter to add 594,000 mobile lines in the 4th quarter and +2.5 million lines for full 2023, up from 1.7 million in full 2022. The MSO ended 2023 with 7.76 million mobile lines. Charter is also expanding its deployment of CBRS spectrum to help the company offload MVNO costs in high-usage areas. Winfrey said “thousands” of CBRS units have been deployed in one “large” market (believed to be Charlotte, North Carolina). Charter expects to roll CBRS to an additional market later this year, he said.

References: