Year: 2023

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Ever since Generative (Gen) AI burst into the mainstream through public-facing platforms (e.g. ChatGPT) late last year, its promising capabilities have caught the attention of many. Not surprisingly, telecom industry execs are among the curious observers wanting to try Gen AI even as it continues to evolve at a rapid pace.

MTN Consulting says the telecom industry’s bond with AI is not new though. Many telcos have deployed conventional AI tools and applications in the past several years, but Gen AI presents opportunities for telcos to deliver significant incremental value over existing AI. A few large telcos have kickstarted their quest for Gen AI by focusing on “localization.” Through localization of processes using Gen AI, telcos vow to eliminate language barriers and improve customer engagement in their respective operating markets, especially where English as a spoken language is not dominant.

Telcos can harness the power of Gen AI across a wide range of different functions, but the two vital telco domains likely to witness transformative potential of Gen AI are networks and customer service. Both these domains are crucial: network demands are rising at an unprecedented pace with increased complexity, and delivering differentiated customer experiences remains an unrealized ambition for telcos.

Several Gen AI use cases are emerging within these two telco domains to address these challenges. In the network domain, these include topology optimization, network capacity planning, and predictive maintenance, for example. In the customer support domain, they include localized virtual assistants, personalized support, and contact center documentation.

Most of the use cases leveraging Gen AI applications involve dealing with sensitive data, be it network-related or customer-related. This will have major implications from the regulatory point of view, and regulatory concerns will constrain telcos’ Gen AI adoption and deployment strategies. The big challenge is the mosaic of complex and strict regulations prevalent in different markets that telcos will have to understand and adhere to when implementing Gen AI use cases in such markets. This is an area where third-party vendors will try to cash in by offering Gen AI solutions that are compliant with regulations in the respective markets.

Vendors will also play a key role for small- and medium-sized telcos in Gen AI implementation, by eliminating constraints due to the lack of technical expertise and HW/SW resources, skilled manpower, along with opex costs burden. Key vendors to watch out for in the Gen AI space are webscale providers who possess the ideal combination of providing cloud computing resources required to train large language models (LLM) coupled with their Gen AI expertise offered through pre-trained models.

Other key points from MTN Consulting on Gen AI in the telecom industry:

- Network operations and customer support will be key transformative areas.

- Telco workforce will become leaner but smarter in the Gen AI era.

- Strict regulations will be a major barrier for telcos.

- Vendors key to Gen AI integration; webscale providers set for more telco gains.

- Lock-in risks and rising software costs are key considerations in choosing vendors.

………………………………………………………………………………………………………………………………

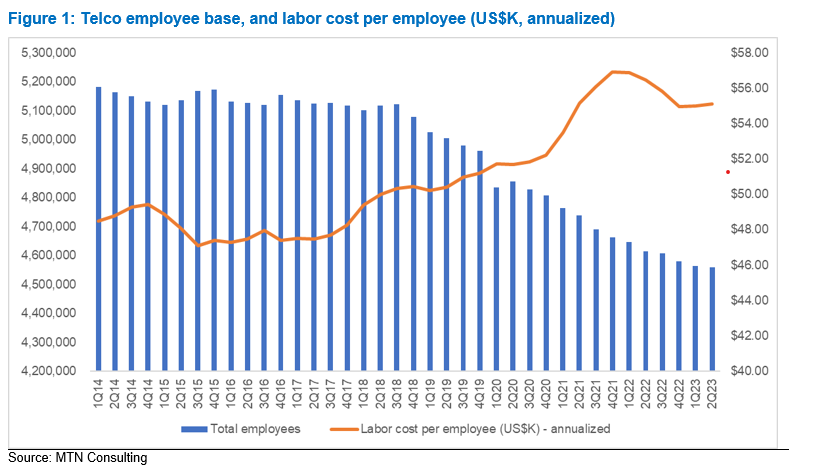

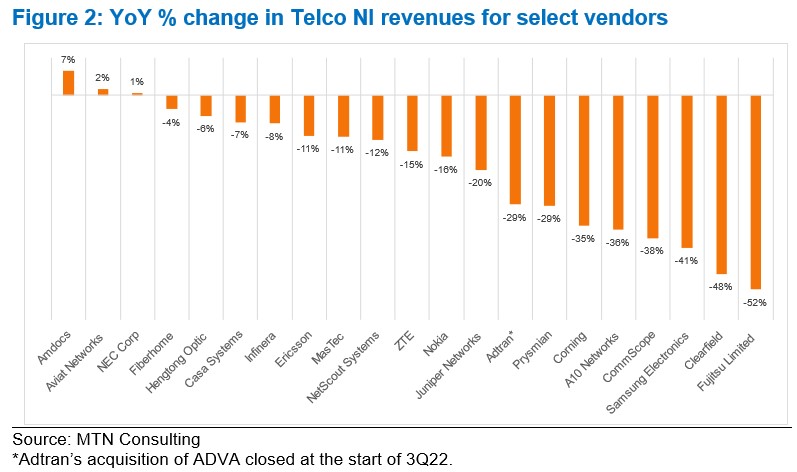

Separately, MTN Consulting’s latest forecast called for $320B of telco capex in 2023, down only slightly from the $328B recorded in 2022. Early 3Q23 revenue reports from vendors selling into the telco market call this forecast into question. The dip in the Americas is worse than expected, and Asia’s expected 2023 growth has not materialized.

Key vendors are reporting significant YoY drops in revenue, pointing to inventory corrections, macroeconomic uncertainty (interest rates, in particular), and weaker telco spending. Network infrastructure sales to telcos (Telco NI) for key vendors Ericsson and Nokia dropped 11% and 16% YoY in 3Q23, respectively, measured in US dollars. By the same metric, NEC, Fujitsu and Samsung saw +1%, -52%, and -41% YoY growth; Adtran, Casa, and Juniper declined 29%, 7%, and 20%; fiber-centric vendors Clearfield, Corning, CommScope, and Prysmian all saw double digit declines.

MTN Consulting will update its operator forecast formally next month. In advance, this comment flags a weaker spending outlook than expected. Telco capex for 2023 is likely to come in around $300-$310B.

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Global Telco AI Alliance to progress generative AI for telcos

Amdocs and NVIDIA to Accelerate Adoption of Generative AI for $1.7 Trillion Telecom Industry

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

MTN Consulting: Satellite network operators to focus on Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

MTN Consulting: : 4Q2021 review of Telco & Webscale Network Operators Capex

Vodafone Germany deploys Ericsson 5G radio to cut energy use up to 40%

Vodafone Germany has partnered with Ericsson to deploy new power-saving radio technology on its 5G network. The radio unit 6646 bundles three different frequencies (900, 800 and 700 MHz) and radio cells in one system in the control center located at the bottom of a mobile base station. By bundling the active technology, 5G base stations function with 32-40% less power.

The advantage of mobile radio stations with area frequencies is that they provide particularly large areas with stable and reliable mobile radio coverage. By bundling the active technology of different frequency ranges and several radio cells in one unit, they now require between 32 and 40 percent less energy, according to trials on the Vodafone network. Following successful tests in the North Rhine-Westphalia (NRW) region, the telecommunications group is now successively activating the technology in the live network together with its technology partner Ericsson.

The new energy-saving radio from Ericsson has been intensively tested in the live network in Wachtendonk in the Lower Rhine region over the past few weeks. The positive test results demonstrate an energy-saving potential of up to 40 percent per 5G base station and are the reason for today’s large-scale rollout. The new technology will be installed and automatically activated in NRW, Rhineland-Palatinate, Hesse, Saarland and Baden-Württemberg during routine maintenance and modernization work.

Test results on the Vodafone network show that energy requirements can be reduced by more than 2,500 kilowatt hours (kWh) per mobile phone site per year by bundling the active technology. This is roughly equivalent to the annual energy requirement of a two-person household per mobile phone station. If the technology is activated on a large scale in the network, significantly more than 30 million kilowatt hours of electricity can be saved each year. At the same time, stable and reliable network coverage will also be strengthened in rural regions.

Vodafone Germany CEO Philippe Rogge, says: “For the first time, we are bundling the active antenna technology of different area frequencies in mobile communications. This is good for smartphone users in rural areas and good for our planet. Because with the new technology, we are bringing fast and reliable 5G networks even better to people in rural areas and deep into buildings. At the same time, we are reducing the energy requirements of our mobile phone antennas. We expect to be able to save more than 30 million kilowatt hours of electricity per year with large-scale activation in our network.”

Daniel Leimbach, Head of Western Europe at Ericsson, says: “Energy consumption reduced by up to 40 percent, weight reduced by 60 percent – around a year ago, we celebrated a world premiere at the launch of the Radio 6646 at the Eurolab in Aachen. At the Imagine Live Innovation Day in the research and development center, our experts presented the innovative 5G technology for the first time. We are all the more pleased that Vodafone is convinced of its performance and energy efficiency and is installing the technology in the area. Because only innovations that are scalable, economical and powerful at the same time deliver the full benefits for mobile customers and sustainability.

The technology in Ericsson’s new radio:

Ericsson’s new remote radio combines the different 5G area frequencies 900, 800 and 700 MHz as well as the components of several radio cells into one compact system in a more sustainable way. By bundling three frequencies and several radio cells, the transmission technology consumes significantly less energy for each individual frequency range at full power. In addition, the new radio is 60 percent lighter and therefore requires less energy and material in the manufacturing process.

On the way to CO2 neutrality:

The new antenna product is another building block on Vodafone’s path to becoming more sustainable step by step. The Düsseldorf-based company has set itself specific targets to be CO2-neutral by 2025. The network is the biggest and most important lever here. Vodafone Germany has therefore been sourcing 100 percent of its electricity from renewable sources since 2020. It is also constantly testing new technologies and solutions to make the German mobile network more sustainable and conserve resources. For example, the dynamic energy-saving mode in the mobile network has already been ensuring an intelligent adjustment between actual energy demand and consumption around the clock for over a year.

………………………………………………………………………………………………………………………………..

References:

Ericsson and Vodafone deploy new energy-efficient, light 5G radio in London

Ericsson and U.S. PAWR 5G SA network for rural agricultural research

TDC NET with Ericsson launch first 5G Standalone network in Denmark

Ericsson powers Singtel 5G SA core network; lightest and smallest Massive MIMO radio

Ericsson announces 5G standalone NR software and 2 new Massive MIMO radios

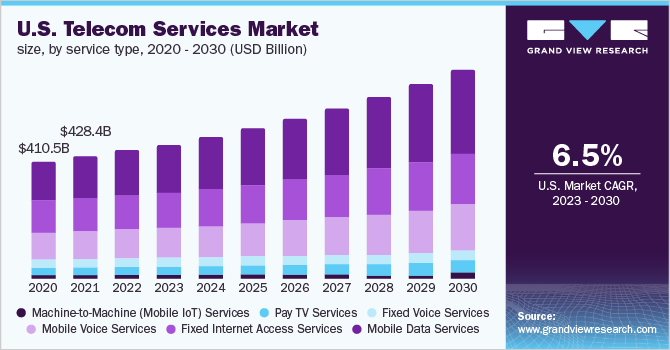

Grandview Research: global telecom services market to compound at 6.2% from 2023 to 2030

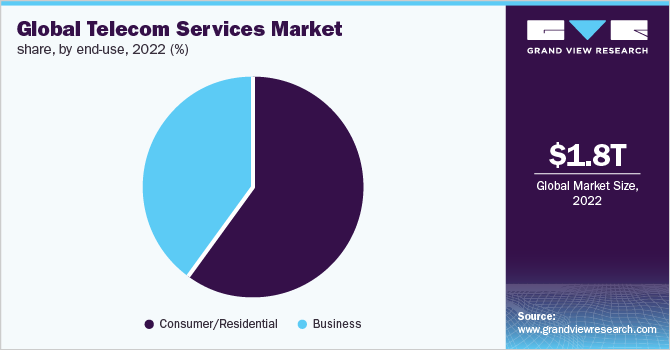

According to Grandview Research, the global telecom services market size was valued at USD 1,805.61 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030.

Rising spending on the deployment of 5G infrastructures due to the shift in customer inclination toward next-generation technologies and smartphone devices is one of the key factors driving this industry. An increasing number of mobile subscribers, soaring demand for high-speed data connectivity, and the growing demand for value-added managed services are the other potential factors fueling the market growth. The global communication network has undoubtedly been one of the prominent areas for continued technological advancements over the past few decades.

In 2022, the wireless networks accounted for a market share of more than 76.0% in the global market. The advent of cloud-computing technologies, artificial intelligence, and IoT is presumed to majorly contribute to the growth of wireless communication channels worldwide. Over the years, there has been a rapid deployment of systems for Wireless Local Area Networks (WLANs) that has enabled internet access to cellular devices in private homes, public spaces, airports, office buildings, cafeterias, and other areas. Such wireless densification to simplify work processes and automate routine test actions is presumed to prove beneficial, hence registering a robust CAGR in the forthcoming years.

In 2022, the consumer/residential segment accounted for the largest revenue share of more than 59.0% and is projected to maintain its lead over the forecast period. The significant growth is ascribed to the proliferation of smartphones worldwide. There were more than 8 billion mobile subscribers recorded globally in 2020, wherein more than 60% of the population was using smartphones. The private telecom operators account for a larger subscriber base as compared to government-owned companies. In addition, the growing demand for OTT applications is contemplating the users to subscribe to wireless internet offerings, thereby significantly contributing to the deployment of communication networks at a broader level. Additionally, the growing trend of using ultra-high-definition videos and online gaming is expected to boost the segment growth over the forecast period.

In 2022, the Asia Pacific captured more than 33.0% of share and is expected to grow at a CAGR of 7.0% from 2023 to 2030. The region is likely to attract more than half of the new mobile subscribers by 2030. The regional market is primarily driven by e-commerce and retailer buy-in platforms, smartphone ubiquity, and investments in 5G networks. China, Japan, and India have emerged as significant contributors to regional market growth. According to industry expert analysis, in February 2022, China recorded 1.02 billion internet users, which is more than three times the number of the third-placed United States, which had just over 307 million. India recorded the second highest internet users in February 2022.

Some prominent players in the global telecom services market include:

- AT&T Inc.

- Verizon Communications Inc.

- Nippon Telegraph and Telephone Corporation (NTT)

- China Mobile Ltd.

- Deutsche Telekom AG

- SoftBank Group Corp.

- China Telecom Corp Ltd.

- Telefonica SA

- Vodafone Group

- KT Corporation

- Bharati Airtel Limited

- Reliance Jio Infocomm Limited

- KDDI Corporation

- Orange SA

- BT Group plc

- Comcast Corporation

Telecom Services Market Report Scope

| Report Attribute | Details |

| Market size value in 2023 | USD 1,885.41 billion |

| Revenue forecast in 2030 | USD 2,874.76 billion |

| Growth Rate | CAGR of 6.2% from 2023 to 2030 |

| Base year for estimation | 2022 |

| Historical period | 2017 – 2021 |

| Forecast period | 2023 – 2030 |

| Quantitative units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Service type, transmission, end-use, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Mexico |

| Key companies profiled | AT&T Inc.; Verizon Communications Inc.; NTT; China Mobile Ltd.; Deutsche Telekom AG; SoftBank Group Corp.; China Telecom Corp Ltd.; Telefonica SA; Vodafone Group; KT Corporation; Bharati Airtel Limited; Reliance Jio Infocomm Limited; KDDI Corporation; Orange SA; BT Group plc; Comcast Corporation |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

References:

https://www.grandviewresearch.com/industry-analysis/global-telecom-services-market

Technavio: APAC region leads global telecom services market with 33% growth

Canalys: Global cloud infrastructure services spending up 16% in Q3-2023

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

Canalys: Global cloud infrastructure services spending up 16% in Q3-2023

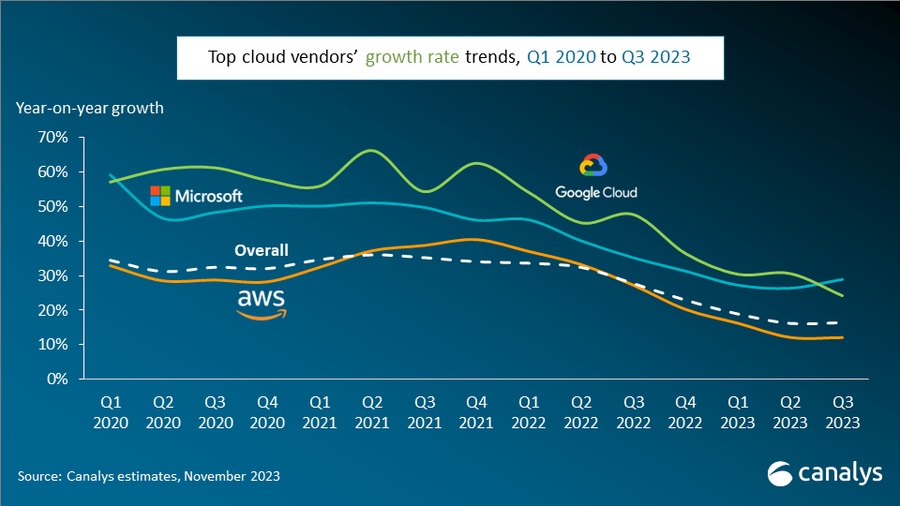

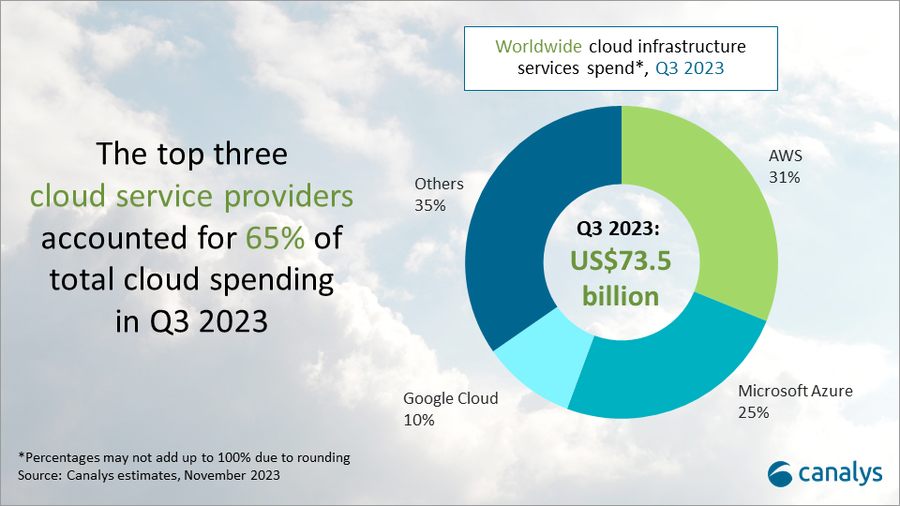

Global spending on cloud infrastructure services reached US$73.5 billion in Q3 2023, a 16% year-on-year increase. Q3 growth remained consistent with the previous quarter, showing we are entering a stable phase. The impact of enterprise IT spending cuts on the cloud services market is slowly easing. In Q3 2023, the top three cloud providers – AWS, Microsoft Azure and Google Cloud – jointly grew by 20%, slightly outpacing the overall market and accounting for 65% of total spending. AWS mirrored its performance in the previous quarter, while Microsoft saw an uptick in its growth rate. Google Cloud, however, saw a drop in its rate in Q3 2023.

In August, Canalys said that AI would be a major driver of cloud service provider investments.

Cloud market showing signs of resilience – helped by growing interest in AI

Despite enterprises continuing to optimize overall IT spending, the cloud market is beginning to show signs of resilience, helped in part by a growing interest in AI. While the broader market continues to grapple with the repercussions of cost-cutting behavior, the performance of the leading cloud vendors hints at a shift in the market dynamic. Growing demand for AI solutions is gradually offsetting the impact of reduced IT spending as enterprises begin to invest in cloud computing to support AI strategies.

Top three vendors launch AI-focused partner programs

Microsoft’s efforts to commercialize its AI products are gaining momentum, with the recent introduction of Copilot driving significant customer and partner interest. Looking ahead to next year and beyond, discussions around GenAI will take center stage, and it will become a key growth driver for the channel. Following AWS’ and Microsoft’s recent AI-focused partner program launches, Google Cloud introduced the Generative AI Partner Initiative in Q3, as it seeks to work with partners to drive enterprise adoption of its AI solutions, including Duet AI.

“Generative AI unlocks a wealth of opportunities for channel partners to venture into new areas of business growth,” said Alex Smith, VP at Canalys. “The big cloud players and their partners can seize this exponential growth opportunity by identifying customers with an appetite for AI solutions, while simultaneously strengthening their AI capabilities and offering comprehensive portfolios of AI-related products and services to address these evolving needs.”

“Apart from capitalizing on new business opportunities arising from GenAI, channel partners can incorporate GenAI internally to boost productivity,” said Yi Zhang, Analyst at Canalys. “To succeed in this rapidly evolving landscape, channel partners must stay ahead of the game by establishing robust AI strategies and investing in strategic AI partnerships.”

AWS continues to reign supreme with 31% market share

Amazon Web Services (AWS) continued to dominate the cloud infrastructure services market in Q3 2023, with a stable market share of 31%. Year-on-year growth of 12% was in line with the previous quarter but still below the overall market’s growth rate. The company’s efforts to cut costs and enhance efficiency resulted in substantial profit improvements in Q3 2023. AWS unveiled plans to open new data centers in South Korea and Malaysia, responding to the increasing demand for cloud computing in these regions. It also enhanced its cloud marketplace, as growing numbers of ISVs are seeing transactions accelerate via AWS Marketplace. AWS has committed to improving the AWS Marketplace and Partner Central in the coming months, aiming to empower partners to use AWS Marketplace to accelerate sales.

Microsoft Azure bounces back with 25% market share and rising growth rate

Microsoft Azure held second place in the cloud infrastructure services market in Q3 with a 25% market share. Following seven consecutive quarters of slowing year-on-year growth, it saw an uptick in its growth rate, which was up 29% compared with Q3 last year. The impact of the AI surge is palpable – marked by increased demand for cloud following the launch of Microsoft Copilot for Windows in September. Business performance is expected to remain steady, given the 18% increase in its cloud order backlog, which reached US$212 billion in Q3 2023. Since August, partners have had access to the new Microsoft AI Cloud Partner Program, designed to support partners in harnessing the advantages of incorporating AI capabilities into their organizations and capitalizing on the business opportunities presented by Microsoft AI-related products and Microsoft Azure.

Google Cloud takes 10% market share with growth below expectations

Google Cloud reached a market share of 10% in Q3 2023 after growing 24% year on year, securing third place in the cloud infrastructure services market. Growth was below expectations, and this was the first time that Google Cloud’s growth rate dipped below that of Microsoft Azure’s in the last three years. The dip was primarily due to the delayed impact of enterprises’ IT cost-cutting measures. Emphasizing its partner-first vision, Google Cloud is highlighting the Google Cloud partner ecosystem, particularly in the context of AI. It also committed to an open approach to GenAI development, facilitating the integration of partner-developed AI models into the Google Cloud Platform.

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

…………………………………………………………………………………………………………………………………..

According to Nick Wood at telecoms.com, the overall cloud infrastructure services market – which for Canalys encompasses infrastructure-as-a-service (IaaS) and platform-as-a-service (IaaS) – is on course to fall short of Canalys’ full-year expectations. In February, Canalys predicted that cloud spending in 2023 would grow 23% on last year, when it reached $247.1 billion. That makes for a projected total of around $304 billion.

However, since then, macroeconomic conditions have taken their toll on spending, tempering expectations for this year. The year to date total for 2023 is $212.3 billion, which means there is $91.7 billion worth of ground to make up in Q4 if spending is going to meet that target.

Achieving this looks like a tall order, because it would mean the year-on-year growth rate in Q4 would need to be 39.7%. Given the market grew by 19% in Q1, and 16% in both Q2 and Q3, a sudden surge in spending is unlikely.

References:

https://canalys.com/newsroom/global-cloud-services-q3-2023

https://telecoms.com/524974/cloud-spending-set-to-miss-full-year-forecast-despite-solid-q3-growth/

Cloud infrastructure services market grows; AI will be a major driver of future cloud service provider investments

Canalys: Cloud marketplace sales to be > $45 billion by 2025

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

Gartner Forecast: Worldwide Public Cloud End-User Spending ~$679 Billion in 2024; GenAI to Support Industry Cloud Platforms

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

Synergy: Q3 Cloud Spending Up Over $11 Billion YoY; Google Cloud gained market share in 3Q-2022

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

Ericsson, Vodafone and Qualcomm: 1st Reduced Capability 5G data call in Europe

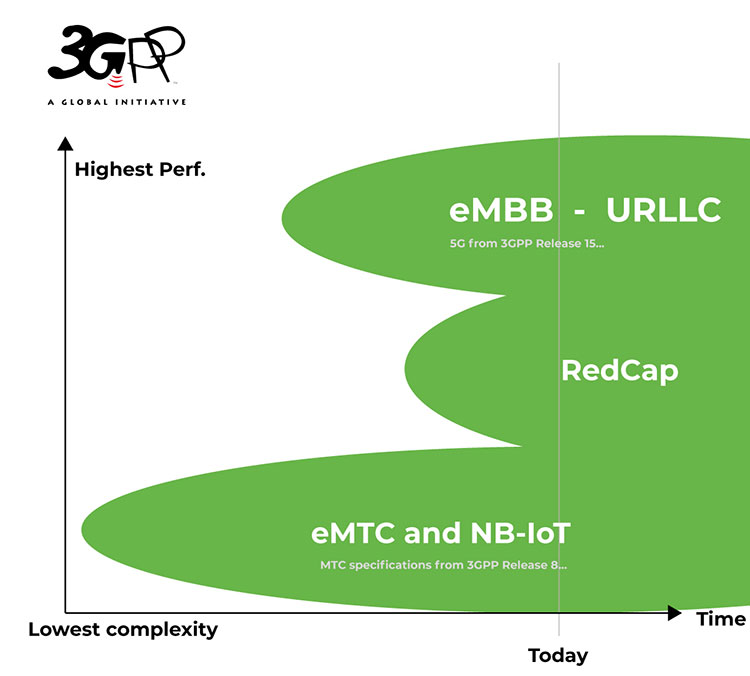

Ericsson, Vodafone and Qualcomm have demonstrated the first RAN Reduced Capability (RedCap) [1.] 5G data sessions on a European network, paving the way for a multitude of IoT and other connected devices to transmit data more simply and efficiently.

Note 1. 3GPP RedCap is a variation of 5G technology that was introduced in 3GPP Release 17 in mid-2022 and will be included in ITU-R M.2150-1. It provides reduced capability 5G New Radio (NR) devices for the mid-range segment. RedCap NR features include: Reduced UE complexity Fewer RX/TX antennas Reduced UE bandwidth use Lower UE power consumption Relaxed data rates Relaxed UE processing time and processing capability RedCap’s speeds, latency, and spectrum use are similar to advanced LTE capabilities. It’s considered the 5G heir to LTE Cat-4, with speeds of tens to hundreds of Mbps.

……………………………………………………………………………………………………………………………

The successful demo took place on 21 September 2023 in the Spanish city of Ciudad Real, running on Ericsson’s RedCap RAN software using Vodafone Spain’s live testing 5G network ‘CREATE’ (Ciudad Real España Advanced Testing Environment).

RedCap enables connectivity for simpler device types, allowing many more devices to connect to 5G networks and transmit data at low power and lower cost, enhancing existing 5G use cases and unlocking new ones. These advantages apply to many different devices, from consumer wearables such as smartwatches to a wide range of IoT devices like smart water meters.

The technology, called New Radio Light (NR-Light), works with less complex devices that can be smaller, more cost-efficient, and enjoy longer battery life than traditional mobile broadband devices. NR-Light can also complement the network APIs developed by Vodafone for its customers to extend the battery life of their devices.

The joint demonstration in Spain leveraged the Qualcomm Snapdragon® X35 platform, the world’s first NR-Light modem RF. The Snapdragon X35 platform bridges the complexity gap between high-speed mobile broadband devices, and low-bandwidth, low-power devices. The demo is part of preparations for the introduction of Snapdragon-based commercial devices which are expected in 2024.

“This successful demonstration is an exciting moment for OEMs, network operators and network users, because it highlights a clear path to new devices and commercial use cases,” said Dino Flore, Vice President, Technology, Qualcomm Europe Inc. “The use of commercial 5G networks for lower-bandwidth applications is an important milestone, not least because this offers a migratory path for low-power devices with a 5G architecture, which also draws on the current and future benefits offered by 5G standalone (5G SA). We will continue to work with customers, industry and our partners to accelerate the creation of 5G devices which present exciting new use cases for enterprises and consumers.”

“Vodafone is able to continually evolve and improve its network for customers by being first to test the latest technologies. We are delighted that our unique multi-vendor 5G network, CREATE, was able to host and validate such an innovative trial in collaboration with Qualcomm and Ericsson,” said Francisco Martín, Head of Open RAN, Vodafone. “The results show that networks will be able to support many more energy efficient connected devices in the future.”

“We are very happy to be partnering with Vodafone and Qualcomm to perform Europe’s first 5G Reduced Capability data call,” said Isidro Nieto, Global Customer Unit Vodafone, Head of Technology Networks, Ericsson. “5G Redcap opens up new use cases for both enterprise and consumer segments such as industrial sensors, lower cost 5G routers as well as wearables. Ericsson embraces new ways to fully realize the value of 5G services and this joint demo shows that that the support for RedCap is gaining market momentum.”

…………………………………………………………………………………………………………………………..

Earlier this year, Juniper Research said the number of 5G IoT roaming connections will reach 142 million by 2027, up from just 15 million this year. IoT will account for 27% of all 5G roaming connections in four years time.

References:

https://www.3gpp.org/technologies/redcap

https://www.techradar.com/pro/iot-is-set-to-push-5g-connections-into-the-billions

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

Viasat launches 2nd satellite for its Arctic Satellite Broadband Mission

Viasat, a global leader in satellite communications, believes that the Arctic has rapidly growing connectivity needs to serve governments, shipping companies, commercial airlines, and scientists. The company has announced the second satellite in the upcoming Arctic Satellite Broadband Mission has completed thermal vacuum testing at Northrop Grumman’s Dulles, VA, site: a significant milestone as the project looks to connect the Arctic region with high speed broadband in the second half of 2024.

ASBM-1 during its vibration testing stage, at Northrop Grumman’s satellite manufacturing facility in Dulles, Virginia. Photo credit: Northrop Grumman

………………………………………………………………………………………………………………………………………..

The mission, led by the Space Norway subsidiary Heosat, will see two satellites deployed in a highly elliptical orbit (HEO) in the world’s first HEO mission carrying a broadband commercial service payload. The two satellites – ASBM-1 and ASBM-2 – will host Viasat’s GX-10a and GX-10b Ka-band payloads, extending Viasat’s high-speed global network across the Arctic region.

The spacecraft are designed to integrate as part of Viasat’s wider satellite fleet and extend the coverage of its Ka-band network beyond that available from geostationary satellites. The payloads will be Viasat’s first in non-geostationary orbit and will become a key element of its co-operative hybrid network. Once launched, these new payloads will increase Viasat’s fleet size to 20, with an additional eight under development.

The Arctic has rapidly growing connectivity needs to serve governments, shipping companies, commercial airlines, and scientists. In October 2023, the UK Government’s Environmental Audit Committee called for a greater political focus on the region and further research into the potential for environmental and economic impacts of changing weather patterns. Alongside GX10a and b, the spacecraft will host payloads for the Norwegian Armed Forces and the US Space Force.

Mark Dickinson, Head of Space Systems, Viasat, said “We have been talking with our customers, partners, and shareholders about how the combination with Inmarsat has given us a new scale and scope to deliver new solutions to meet our customers’ requirements. This is an example of what that means in practice. The investment we’ve made in our network is creating the flexibility, coverage, and interoperability to meaningfully connect the world wherever and whenever our customers need it – even if they happen to be standing on the North Pole.”

Space Norway Program Director, Kjell-Ove Skare, said “With both satellites through the thermal vacuum test we are really closing in on making this strategically important capability real. We have seen an unprecedented collaborative effort with Viasat, the US Space Force, our Norwegian Armed Forces and with Northrop Grumman, and are all looking forward to providing the first dedicated broadband services to users in the real Arctic.”

The ASBM-1 and ASBM-2 spacecraft will now undergo their final testing and readiness activities. Once complete, they will be transferred to Vandenberg Space Force Base, California and launched together on a SpaceX Falcon 9 rocket in mid-2024. The company will share further details on the launch schedule once confirmed.

In October 2023, the United Kingdom’s environmental audit committee called for a greater political focus on the Arctic and further research into the potential for environmental and economic impacts of changing weather patterns, Viasat’s announcement said.

Once testing is complete, Viasat’s announcement said the satellites will be transferred to Vandenberg Space Force Base in California, where they’ll be launched together on a SpaceX Falcon 9 rocket in mid-2024.

Viasat, Inc. Contacts:

Press Contact – [email protected]

Paul Froelich/Peter Lopez, Investor Relations, +1 (760) 476-2633, [email protected]

References:

Viasat reports record quarterly revenues; launch of ViaSat-3 satellites in late summer 2022

Viasat realizes major milestone for its global satellite broadband plan

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

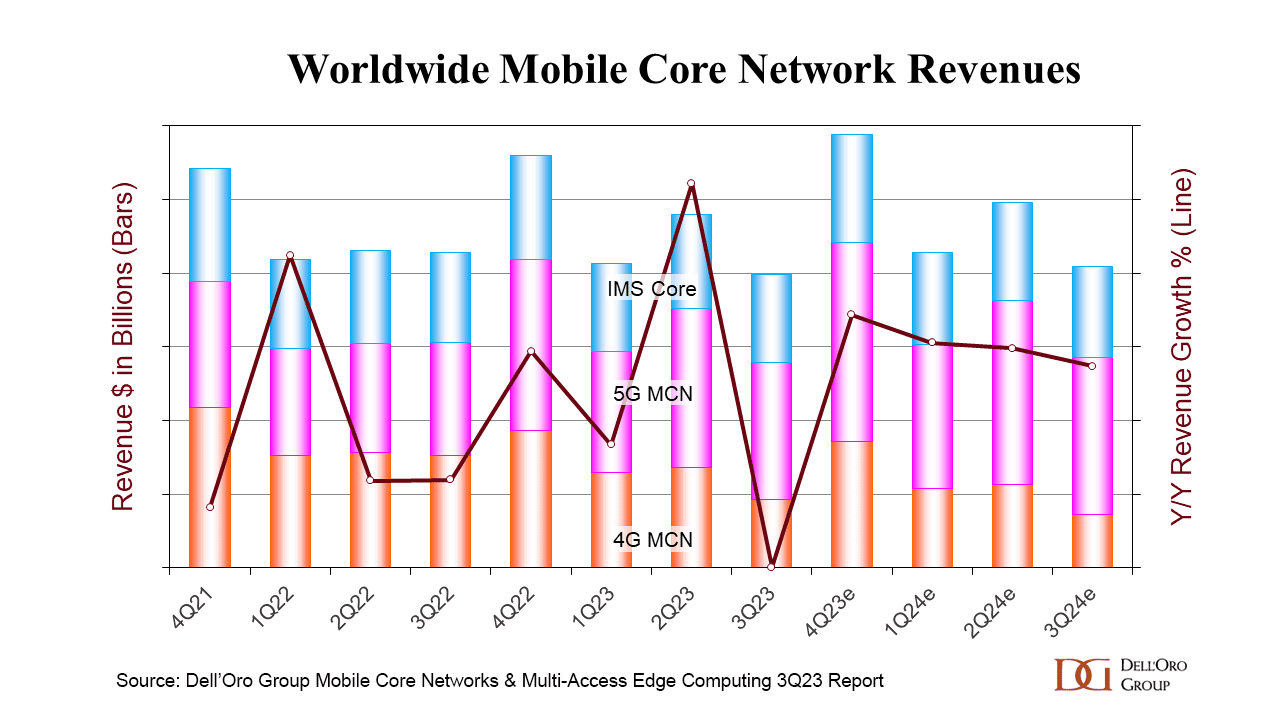

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

The global mobile core network (MCN) market has just turned in its lowest quarterly growth rate for almost six years, hit by a difficult political and economic climate, as well as by slow rollouts of 5G standalone core networks. Dell’Oro Group reports that the MCN market has become erratic, with the lowest growth rate since 4Q 2017. Europe, Middle East, and Africa (EMEA), and China were the weakest performing regions in 3rdQ 2023.

“It has become quite obvious the MCN market has entered into a very unpredictable phase after breaking the highest growth rate in 2ndQ 2023 since 1stQ 2021, and now hitting the lowest performing growth rate in 3rdQ 2023 since 4thQ 2017. Last quarter, EMEA and China were the strongest performing regions and flipped this quarter, becoming the weakest performing regions,” stated Dave Bolan, Research Director at Dell’Oro Group.

“Many vendors state that the market is volatile, attributing this phenomenon to macroeconomic conditions such as the fear of higher inflation rates, unfavorable currency foreign exchange rates, and the geopolitical climate.

“Besides subscriber growth, the growth engine for the MCN market is the transition to 5G Standalone (5G SA), which employs the 5G Core. But after five years into the 5G era, we are still seeing more 5G Non-Standalone (5G NSA) networks being launched than 5G SA, and the pace of 5G SA networks has slowed from 17 launched in 2022 to only seven so far in 2023. However, we expect more 5G SA networks to be deployed in 2024 than in 2023, and we expect 2024’s market performance to be better than 2023,” continued Bolan.

Additional highlights from the 3Q 2023 Mobile Core Network and Multi-Access Edge Computing Report include:

- Two new MNOs launched commercial 5G SA networks in 3Q23: Telefónica O2 in Germany and Etisalat in the UAE.

- Ericsson is the vendor of record for the 5G packet core for all seven 5G SA networks launched in 2023.

- As of 3Q 2023, 45 MNOs have commercially deployed 5G SA eMBB networks.

- The top MCN vendors worldwide for 3Q 2023 [1.] were: Huawei, Ericsson, Nokia, and ZTE.

- The top 5G MCN vendors worldwide for 3Q 2023 were Huawei, Ericsson, ZTE, and Nokia.

Note 1. Dell’Oro did not supply any actual MCN market share percentages or numbers.

……………………………………………………………………………………………………………………………….

In August the Global mobile Suppliers Association (GSA) released Q2 figures that showed just 36 operators worldwide has launched public 5G SA networks, including two soft launches, by the end of June, an increase of just one on the previous quarter.

In total, the GSA said that 115 operators in 52 countries had invested in public 5G SA networks – that includes actual deployments as well as planned rollouts and trials – by the end of Q2, with no new names added during the quarter, and an increase of just three on the end of 2022.

About the Report:

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

About Dell’Oro Group:

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Dell’Oro: RAN market declines at very fast pace while

Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

GSA 5G SA Core Network Update Report

5G SA networks (real 5G) remain conspicuous by their absence

Dell’Oro: Market Forecasts Decreased fo

r Mobile Core Network and Private Wireless RANs

Omdia: Cable network operators deploy PONs

In addition to the traditional hybrid fiber/coax (HFC) topology, several cable network operators (MSOs) are also deploying Passive Optical Network (PON) technologies for targeted fiber-to-the-premises (FTTP) buildouts in rural areas and other greenfield environments. Others, like Altice USA and Virgin Media O2, are moving aggressively with PON overlays of their legacy HFC networks.

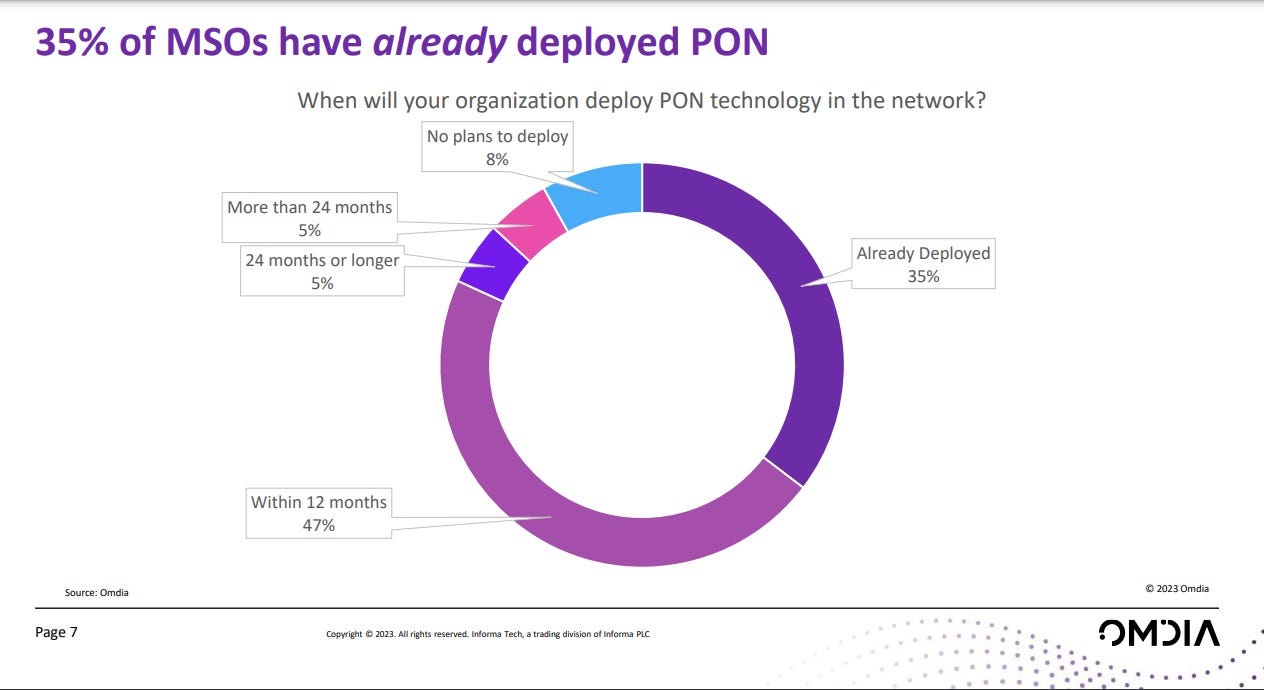

A recent Omdia (an Informa company) survey reveals that PON activity is rising among cable operators. Omdia found that about 35% of cable operators surveyed have already deployed PON in their networks, with another 47% expected to do so within the next year. Just 8% said they have no plans to deploy PON at this time. Collectively, about 80% of operators, as surveyed by Omdia, will be deploying PON in some form or fashion by next spring.

CableLabs recently launched a pair of fiber-oriented working groups focused on optical operations and maintenance and on specifying a DOCSIS framework for the provisioning of ITU-T based PON technology, including 10-Gig-capable XGS-PON. 10G-PON technology, first standardized in 2009 and first deployed in 2012, 10G-PON allows for 10 G symmetric capacity. The emerging 25G-PON and 50G-PON technology will allow cable operators to deploy cost-effective all-fiber solutions over the same optical distribution network far into the future to meet high-speed data trends.

While today’s PON deployments are largely focused on 10-Gig technologies, there’s already some action focused on next-gen 25-Gig technologies.

- Google Fiber (not a MSO) is starting to head in that direction with Nokia’s 25G PON technology (see pic below), as per this IEEE Techblog post.

- EPB (a municipal network operator in Chattanooga, Tennessee) has already introduced symmetrical 25 Gbit/s services across a footprint that passes about 180,000 homes and businesses. Katie Espeseth, VP of new products at EPB, notes that 25G PON lowers costs while also delivering the kind of bandwidth required by hospitals, universities and other local institutions. “It [25G PON] has opened a whole new world for us,” she said.

“The real issue here probably isn’t the speed,” but how operators manage these new networks and make the required upgrades to their back-office systems, Richard Loveland, director of product line management, PON for FTTP products, Vecima Networks told Light Reading. Cable operators, he said, will have to decide to focus on DOCSIS-style technologies or consider changing over to new systems and platforms. Loveland said merchant silicon is not available to support widespread PON deployment, and likewise isn’t convinced if the next big play will be for 25G or 50G PON.

References:

https://www.lightreading.com/fttx/cable-s-in-hot-pursuit-of-pon

https://www.lightreading.com/fttx/cablelabs-gets-laser-focused-on-fttp

https://www.cablelabs.com/technologies/pon

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Omdia Surveys: PON will be a key part of network operator energy reduction strategies

Ooredoo Qatar is first operator in the world to deploy 50G PON

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

ETSI Integrated Sensing and Communications ISG targets 6G

The new ETSI Industry Specification Group for Integrated Sensing and Communications (ISG ISAC). This group will establish the technical foundations for ISAC technology development and standardization of 6G.

87 participants from both the industrial sphere and the academic sphere took an active part in the kick-off meeting, which was held at ETSI premises in Sophia Antipolis, France, on 17 November 2023.

“Integrated Sensing and Communications add a new element of capability to the wireless network, enabling new innovative use cases in transport, urban environments, homes, and factories, ranging from object and intruder detection in predefined secure areas around critical infrastructures to fall detection and rain/pollution monitoring” explains Dr. Alain Mourad, Chair of the ISAC ISG.

The ETSI ISAC ISG’s mission is to enable ETSI members to coordinate their 6G pre-standard research efforts on ISAC, particularly across various European/National-funded collaborative projects, extended through relevant global initiatives, paving the way for the 6G standardization of the technology.

The ISG will target systematic outputs on ISAC into international standards organizations, namely future 3GPP 6G releases (e.g., R20+) and ITU-R IMT-2030 deliverables, related to ISAC requirements and evaluation methodologies.

Within this context, sensing refers to the use of radio signals to detect and estimate characteristics of target objects in the environment. By integrating sensing into the communications network, the network acts as a “radar” sensor, using its own radio signals to sense and comprehend the physical world in which it operates. This allows the network to collect data on the range, velocity, position, orientation, size, shape, image, materials of objects and devices.

The sensing data collected and processed by the network can then be leveraged to enhance the network’s own operations, augment existing services such as XR and digital twinning, and enable new services, such as gesture and activity recognition, object detection and tracking, along with imaging and environment reconstruction.

The ETSI ISAC ISG will define a prioritized set of 6G use cases and sensing types, along with a roadmap for their analysis and evaluation. It will focus on advanced 6G use cases and sensing types which are not expected to be covered by 3GPP Release 19. These advancements may potentially be included in future 6G releases of 3GPP. The group also aims to develop advanced channel models for ISAC use cases and sensing types, with validation through extensive measurement campaigns, addressing gaps in existing communications-based channel models (e.g., 3GPP, IEEE 802. ITU-R).

Output for architectures and deployment considerations, KPIs, and evaluation assumptions will also be provided. In parallel, the group will undertake two studies, with a first analysis of the privacy and security aspects associated with sensing data within the ISAC 6G framework, and a second analysis of the impact of widespread deployment of ISAC on the UN sustainable development goals. To get involved with this new activity, please contact [email protected]

………………………………………………………………………………………………………………………

The idea of using a network to sense objects was also offered up by Nokia at MWC this year as a potential 6G use case. Head of Europe Rolf Werner told Telecoms.com:

“Temperature, wavelength, infrared, you can do stuff which goes all around. You can tune an airport [so you] don’t have to show a passport… you walk through because the network is able to gain information from everything you have… there’s a lot of stuff coming around. 6G in 2030 is our visionary year, or that’s when we think it will kick in. Of course a lot of things have to happen before that.”

ETSI’s ISG ISAC group will be producing a study around the privacy and security aspects around sensing which seems prudent, since there are bound to be some concerns raised about the potential implications of a network sensing all sorts of data points on people and objects if that becomes a key facet of the future 6G marketing machine.

About ETSI:

ETSI provides members with an open and inclusive environment to support the development, ratification, and testing of globally applicable standards for ICT systems and services across all sectors of industry and society. We are a non-profit body, with more than 900 member organizations worldwide, drawn from over 60 countries and five continents. Our members constitute a diverse pool of large and small private companies, research entities, academia, government, and public organizations. ETSI is officially recognized by the EU as a European Standardization Organization (ESO).

For more information, please visit us at https://www.etsi.org/

References:

ETSI NFV evolution, containers, kubernetes, and cloud-native virtualization initiatives

ETSI Telemetry Standard for Optical Access Networks to enhance FTTP QoE

ETSI Experiential Networked Intelligence – Release 2 Explained

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

ETSI MEC Standard Explained – Part II

ETSI DECT-2020 approved by ITU-R WP5D for next revision of ITU-R M.2150 (IMT 2020)

SK Telecom, Samsung, HPE and Intel MOU for 5G NFV Technology Evolution; ETSI ISG-NFV?

ITU World Radiocommunication Conference 2023 opens in Dubai, UAE

The World Radiocommunication Conference 2023 (WRC-23) opened today in Dubai, United Arab Emirates (UAE), bringing governments together for negotiations on the allocation of radio-frequency spectrum. Overall, 4,000 participants are expected for WRC-23, including delegates from ITU Member States and ITU Radiocommunication Sector Members representing international organizations, equipment manufacturers, network operators and industry forums attending as observers.

The conference, organized every three to four years by the ITU, will review and update the Radio Regulations, the international treaty governing the use of spectrum and geostationary and non-geostationary satellite orbits.

Much of the technology in everyday life uses radio-frequency spectrum allocated by ITU’s world radiocommunication conferences. Ensuring that the Radio Regulations reflect the changing demand for spectrum use is critical for the efficient operation of existing and future radiocommunication services and equipment.

“We are at an inflection point in tech history, and radiocommunications are at the top of the global agenda,” said Doreen Bogdan-Martin, ITU Secretary-General. “Equitably managed spectrum and the associated satellite orbits are among the best tools in our toolbox to make good on our commitment to build a digital future that works for everyone and for our planet.”

“While today’s world is full of challenges, this conference comes to set the course and direct the compass toward sustainable human development by updating the Radio Regulations and establishing international consensus on the frequencies necessary for the coming era,” said H.E. Eng. Majed Sultan Al Mesmar, Director General of the UAE Telecommunications and Digital Government Regulatory Authority (TDRA). “With the broad horizons it brings in the fields of smart cities, digital economy, knowledge society, space and others, we are confident that this conference will achieve the results that meet the expectations and aspirations of our peoples.”

“This conference will revise and update the Radio Regulations to support the introduction of new radio-based technologies, systems, technologies and services and their growing spectrum requirements while continuing to protect the vital radio services we rely on today,” said Mario Maniewicz, Director of ITU’s Radiocommunication Bureau. “Newer innovative technologies will allow us to better monitor our changing planet, and better connect communities and people everywhere: on land, at sea, in the air, and in space. I count on the spirit of cooperation of the ITU Membership and your technical expertise to make WRC-23 a resounding success and leave a legacy of prosperity for billions of people across the globe.”

The WRC-23 agenda items include:

- Identifying additional frequency bands for the continued development of International Mobile Telecommunications (IMT), including the use of high-altitude platform stations as IMT base stations for the universal deployment of wireless networks. This work will include the integration of satellites into 5G and 6G services. As noted by Via Satellite, there’s a WRC-23 agenda item to consider adding spectrum bands for phone-to-satellite communications.

- Improvements to the international regulatory framework for geostationary orbit (GSO) and non-geostationary orbit (NGSO) satellites while promoting equitable access for all countries.

- Use of satellite technologies for broadband services to improve connectivity, particularly in remote areas.

- New spectrum to enhance radiocommunications in the aeronautical mobile service, including by satellite, and to facilitate the use of the space research and Earth exploration-satellite services for climate monitoring, weather prediction and other scientific missions.

- The modernization of the Global Maritime Distress and Safety System (GMDSS).

- The regulatory framework for the use of earth stations in motion on board aircraft and ships for communication with GSO and NGSO satellites.

- The future of the ultra-high frequency (UHF) broadcasting band which has implications for television broadcast, programme-making and special events, as well as public protection and disaster relief.

- ITU-R Resolution 65 paves the way for “studies on the compatibility of current regulations with potential 6th generation IMT radio interface technologies for 2030 and beyond.”

A complete list of matters to be considered at WRC 23 is available here.

The Radio Regulations ensure that the use of the radio-frequency spectrum is rational, equitable, efficient, and economical – all while aiming to prevent harmful interference between different radiocommunication services.

The international treaty on radiocommunications dates back to 1906, when the International Radiotelegraph Convention was signed. In the 117 years since, the Radio Regulations have undergone 38 revisions and expanded to a four-volume agreement of more than 2,000 pages.

WRC-23 was preceded by the ITU Radiocommunication Assembly (RA-23) which met in Dubai from 13-17 November to establish the structure, working methods and program of the ITU Radiocommunication Sector.

Discussion highlights during RA-23:

- Agreement on “IMT-2030″ as the technical reference for the 6th generation of International Mobile Telecommunications;

- Revision of ITU-R Resolution 65, paving the way for studies on the compatibility of current regulations with potential 6th generation IMT radio interface technologies for 2030 and beyond;

- Adoption of the new Recommendation ITU-R M. 2160 on the “IMT-2030 Framework,” setting the basis for the development of IMT-2030. The next phase will be the definition of relevant requirements and evaluation criteria for potential radio interface technologies (RIT);

- Adoption of a new resolution on the use of IMT technologies for fixed wireless broadband;

- In accordance with Resolution 219 (Bucharest, 2022), adoption of a new resolution on space sustainability to facilitate the long-term sustainable use of radio-frequency spectrum and associated satellite orbit resources used by space services. This will be supportive of further cooperation with other United Nations organisations and beneficial to the satellite industry;

- Conclusion of a new ITU-R Recommendation on the protection of the radio navigation-satellite service and amateur satellite services;

- Revision of Resolution ITU-R 8-3 to promote the participation of engineers and scientists from developing countries in propagation campaigns in tropical and subtropical regions of the world for which there is limited data monitoring.

………………………………………………………………………………………………………………………………

About ITU:

The International Telecommunication Union (ITU) is the United Nations specialized agency for information and communication technologies (ICTs), driving innovation in ICTs together with 193 Member States and a membership of over 900 companies, universities, and international and regional organizations. Established over 150 years ago, ITU is the intergovernmental body responsible for coordinating the shared global use of the radio spectrum, promoting international cooperation in assigning frequencies and, if necessary, associated satellite orbits, improving communication infrastructure in the developing world, and establishing the worldwide standards that foster seamless interconnection of a vast range of communications systems. From broadband networks to cutting-edge wireless technologies, aeronautical and maritime navigation, radio astronomy, oceanographic and satellite-based earth and oceanographic monitoring as well as converging fixed and mobile phone, Internet and broadcasting technologies, ITU is committed to connecting the world.

For more information, visit: www.itu.int

…………………………………………………………………………………………………………………………………

References:

https://www.itu.int/en/mediacentre/Pages/PR-2023-11-20-WRC23-opening-ceremony.aspx

https://www.itu.int/dms_pub/itu-r/opb/act/R-ACT-CPM-2023-PDF-E.pdf

https://techchannel.news/itu-sets-the-stage-for-the-development-of-6g/