Author: Alan Weissberger

Major technology companies form AI-Enabled Information and Communication Technology (ICT) Workforce Consortium

A consortium of major tech companies, including Cisco, Accenture, Eightfold, Google, IBM, Indeed, Intel, Microsoft and SAP have formed the AI-Enabled Information and Communication Technology (ICT) Workforce Consortium with the aim of assessing “AI’s impact on technology jobs” and identifying “skills development pathways for the roles most likely to be affected by artificial intelligence.”

Francine Katsoudas, executive VP and chief people, policy and purpose officer at Cisco, stated:

“AI is accelerating the pace of change for the global workforce, presenting a powerful opportunity for the private sector to help upskill and re-skill workers for the future. The mission of our newly unveiled AI-Enabled Workforce Consortium is to provide organisations with knowledge about the impact of AI on the workforce and equip workers with relevant skills. We look forward to engaging other stakeholders – including governments, NGOs, and the academic community – as we take this important first step toward ensuring that the AI revolution leaves no one behind.”

The formation of the Consortium is catalyzed by the work of the U.S.-EU Trade and Technology Council Talent for Growth Task Force, Cisco Chair and CEO Chuck Robbins’ participation in the Task Force, and input from the U.S. Department of Commerce.

Advisors include the American Federation of Labor and Congress of Industrial Organizations, CHAIN5, Communications Workers of America, DIGITALEUROPE, the European Vocational Training Association, Khan Academy, and SMEUnited.

Working as a private sector collaborative, the Consortium is evaluating how AI is changing the jobs and skills workers need to be successful. The first phase of work will culminate in a report with actionable insights for business leaders and workers. Further details will be shared in the coming months. Findings will be intended to offer practical insights and recommendations to employers that seek ways to reskill and upskill their workers in preparation for AI-enabled environments.

……………………………………………………………………………………………………….

Author’s Note: The consortium was likely formed to retrain workers to use AI technology, else they would be laid off or fired. In a recent survey from McKinsey, 25% of business professionals said that they expect their employer to lay off staff as a result of AI adoption. Their pessimism isn’t misplaced. According to one estimate, around 4,000 workers have lost their jobs to AI since May. And in a poll from Beautiful.ai, which makes AI-powered presentation software, nearly half of managers said that they’re hoping to replace workers with AI.

……………………………………………………………………………………………………….

Consortium members represent a cross section of companies innovating on the cutting edge of AI that also understand the current and impending impact of AI on the workforce. Individually, Consortium members have documented opportunities and challenges presented by AI. The collaborative effort enables their organizations to coalesce insights, recommend action plans, and activate findings within their respective broad spheres of influence.

The Consortium’s work is inspired by the TTC’s Talent for Growth Task Force and Cisco Chair and CEO Chuck Robbins’ leadership of its skills training workstream, and input from the U.S. Department of Commerce. The TTC was established in June 2021 by U.S. President Biden, European Commission President von der Leyen, and European Council President Michel to promote U.S. and EU competitiveness and prosperity through cooperation and democratic approaches to trade, technology, and security.

“At the U.S. Department of Commerce, we’re focused on fueling advanced technology and deepening trade and investment relationships with partners and allies around the world. This work is helping us build a strong and competitive economy, propelled by a talented workforce that’s enabling workers to get into the good quality, high-paying, family-sustaining jobs of the future. We recognize that economic security and national security are inextricably linked. That’s why I’m proud to see the efforts of the Talent for Growth Task Force continue with the creation of the AI-Enabled ICT Workforce Consortium,” said U.S. Secretary of Commerce Gina Raimondo.

“I am grateful to the consortium members for joining in this effort to confront the new workforce needs that are arising in the wake of AI’s rapid development. This work will help provide unprecedented insight on the specific skill needs for these jobs. I hope that this Consortium is just the beginning, and that the private sector sees this as a call to action to ensure our workforces can reap the benefits of AI.”

The AI-Enabled ICT Workforce Consortium’s efforts address a business critical and growing need for a proficient workforce that is trained in various aspects of AI, including the skills to implement AI applications across business processes. The Consortium will leverage its members and advisors to recommend and amplify reskilling and upskilling training programs that are inclusive and can benefit multiple stakeholders – students, career changers, current IT workers, employers, and educators – in order to skill workers at scale to engage in the AI era.

In its first phase of work, the Consortium will evaluate the impact of AI on 56 ICT job roles and provide training recommendations for impacted jobs. These job roles include 80% of the top 45 ICT job titles garnering the highest volume of job postings for the period February 2023-2024 in the United States and five of the largest European countries by ICT workforce numbers (France, Germany, Italy, Spain, and the Netherlands) according to Indeed Hiring Lab. Collectively, these countries account for a significant segment of the ICT sector, with a combined total of 10 million ICT workers.

Consortium members universally recognize the urgency and importance of their combined efforts with the acceleration of AI in all facets of business and the need to build an inclusive workforce with family-sustaining opportunities. Consortium members commit to developing worker pathways particularly in job sectors that will increasingly integrate artificial intelligence technology. To that end, Consortium members have established forward thinking goals with skills development and training programs to positively impact over 95 million individuals around the world over the next 10 years.

Consortium member goals include:

- Cisco to train 25 million people with cybersecurity and digital skills by 2032.

- IBM to skill 30 million individuals by 2030 in digital skills, including 2 million in AI.

- Intel to empower more than 30 million people with AI skills for current and future jobs by 2030.

- Microsoft to train and certify 10 million people from underserved communities with in-demand digital skills for jobs and livelihood opportunities in the digital economy by 2025.

- SAP to upskill two million people worldwide by 2025.

- Google has recently announced EUR 25 million in funding to support AI training and skills for people across Europe.

Accenture

“Helping organizations identify skills gaps and train people at speed and scale is a major priority for Accenture, and this consortium brings together an impressive ecosystem of industry partners committed to growing leading-edge technology, data and AI skills within our communities. Reskilling people to work with AI is paramount in every industry. Organizations that invest as much in learning as they do in the technology not only create career pathways, they are well positioned to lead in the market.” – Ellyn Shook, Chief Leadership & Human Resources Officer, Accenture

Eightfold

“The dynamics of work and the very essence of work are evolving at an unprecedented pace. Eightfold examines the most sought-after job roles, delving into the needs for reskilling and upskilling. Through its Talent Intelligence Platform, it empowers business leaders to adapt swiftly to the changing business environment. We take pride in contributing to the creation of a knowledgeable and responsible resource that assists organizations in preparing for the future of work.” – Ashutosh Garg, CEO and Co-Founder, Eightfold AI

“Google believes the opportunities created by technology should truly be available to everyone. We’re proud to join the AI-Enabled Workforce Consortium, which will advance our work to make AI skills training universally accessible. We’re committed to collaborating across sectors to ensure workers of all backgrounds can use AI effectively and develop the skills needed to prepare for future-focused jobs, qualify for new opportunities, and thrive in the economy.” – Lisa Gevelber, Founder, Grow with Google

IBM

“IBM is proud to join this timely business-led initiative, which brings together our shared expertise and resources to prepare the workforce for the AI era. Our collective responsibility as industry leaders is to develop trustworthy technologies and help provide workers—from all backgrounds and experience levels—access to opportunities to reskill and upskill as AI adoption changes ways of working and creates new jobs.” – Gian Luigi Cattaneo, Vice President, Human Resources, IBM EMEA

Indeed

“Indeed’s mission is to help people get jobs. Our research shows that virtually every job posted on Indeed today, from truck driver to physician to software engineer, will face some level of exposure to GenAI-driven change. We look forward to contributing to the Workforce Consortium’s important work. The companies who empower their employees to learn new skills and gain on-the-job experience with evolving AI tools will deepen their bench of experts, boost retention and expand their pool of qualified candidates.” – Hannah Calhoon, Head of AI Innovation at Indeed

Intel

“At Intel, our purpose is to create world-changing technology that improves the lives of every person on the planet, and we believe bringing AI everywhere is key for businesses and society to flourish. To do so, we must provide access to AI skills for everyone. Intel is committed to expanding digital readiness by collaborating with 30 countries, empowering 30,000 institutions, and training 30 million people for current and future jobs by 2030. Working alongside industry leaders as part of this AI-enabled ICT workforce consortium will help upskill and reskill the workforce for the digital economy ahead.” – Christy Pambianchi, Executive Vice President and Chief People Officer at Intel Corporation

Microsoft

“As a global leader in AI innovation, Microsoft is proud to join the ICT Workforce Consortium and continue our efforts to shape an inclusive and equitable technology future for all. As a member of the consortium, we will work with industry leaders to share best practices, create accessible learning opportunities, and collaborate with stakeholders to ensure that workers are equipped with the technology skills of tomorrow,” – Amy Pannoni, Vice President and Deputy General Counsel, HR Legal at Microsoft

SAP

“SAP is proud to join this effort to help prepare our workforce for the jobs of the future and ensure AI is relevant, reliable, and responsible across businesses and roles. As we navigate the complexities of our ever-evolving world, AI has the potential to reshape industries, revolutionize problem-solving, and unlock unprecedented levels of human potential, enabling us to create a more intelligent, efficient, and inclusive workforce. Over the years, SAP has supported many skills building programs, and we look forward to driving additional learning opportunities, innovation, and positive change as part of the consortium.” – Nicole Helmer, Vice President & Global Head of Development Learning at SAP

About Cisco

Cisco (NASDAQ: CSCO) is the worldwide technology leader that securely connects everything to make anything possible. Our purpose is to power an inclusive future for all by helping our customers reimagine their applications, power hybrid work, secure their enterprise, transform their infrastructure, and meet their sustainability goals. Discover more on The Newsroom and follow us on X at @Cisco.

Cisco and the Cisco logo are trademarks or registered trademarks of Cisco and/or its affiliates in the U.S. and other countries. A listing of Cisco’s trademarks can be found at www.cisco.com/go/trademarks. Third-party trademarks mentioned are the property of their respective owners. The use of the word partner does not imply a partnership relationship between Cisco and any other company.

Big tech companies form new consortium to allay fears of AI job takeovers

New ETSI Reports: 1.] Use cases for THz communications & 2.] Frequency bands of interest in the sub-THz and THz range

The European Telecommunications Standards Institute (ETSI) released a pair of reports from its relatively new Terahertz Industry Specification Group (ISG THz), created in December 2022. The reports envision how 6G technology might develop and what it will do. Importantly, the reports dive into more than a dozen 6G use cases – from remote surgery to real-time industrial control – as well as the terahertz spectrum bands where that might happen.

“The role of ETSI ISG THz is to develop an environment where various actors from the academia, research centres, industry can share, in a consensus-driven way, their pre-standardization efforts on THz technology resulting from various collaborative research projects and global initiatives, paving the way towards future standardization,” the organization wrote in a press release.

The first Report ETSI GR THz 001 identifies and describes use cases either enabled by or highly benefiting from the use of THz communications. Aspects addressed in the document include deployment scenarios, potential requirements, relevant operational environments and their associated propagation characteristics and/or measurements.

With the large amount of bandwidth available in THz bands, it is possible to achieve extremely high data rates and ease spectrum scarcity problems. Moreover, specific propagation properties of THz signals unlock new features such as accurate sensing and imaging capabilities. The above properties of THz communications open the way to enabling new use cases and could provide an answer to new societal challenges that need to be addressed by the future 6G communications systems. Some of these challenges relate to new functionalities that are not currently supported by cellular systems (e.g. accurate sensing, mapping, and localization), while others relate to new use cases that were not supported by previous communications systems.

The report defines the new use cases that the THz communications and sensing systems can support, along with summarizing the requirements of those use cases. For each identified use case, the report provides description of the deployment scenario, pre‑conditions required for the use case deployment, an example of service flows through a communication system supporting the use case, post-conditions enabled by the use case, identified potential requirements, and description of the physical environment, including propagation aspects, range, and mobility.

“The concept of remote surgery with support of THz communications comes with the promise of allowing people to be treated at anytime and anywhere, so that medical interventions could be done through the use of medical robots remotely controlled by a surgeon (away from the physical location where the actual surgery is performed),” according to the ETSI report.

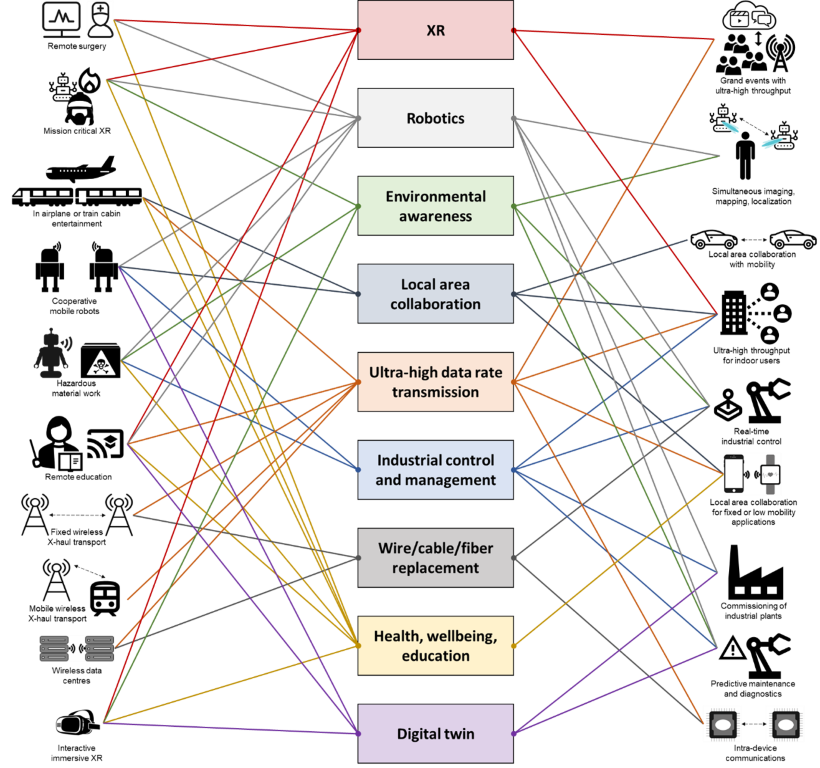

Figure 1: Use case mapping to application areas

Here’s the full list of 6G use cases in the ETSI report:

-

remote surgery

-

in-airplane or train cabin entertainment

-

cooperative mobile robots

-

hazardous material work

-

remote education

-

fixed point to point wireless applications

-

mobile wireless X-haul transport

-

wireless data centres

-

interactive immersive XR

-

mission critical XR

-

real-time industrial control

-

simultaneous imaging, mapping, and localization

-

commissioning of industrial plants

-

grand events with ultra-high throughput

-

ultra-high throughput for indoor users

-

intra-device communications

-

local area collaboration for fixed or low mobility applications

-

local area collaboration for vehicular applications

-

predictive maintenance and diagnostics

The 75-page report also offers a lengthy look at the kinds of technologies that might be involved in operating 6G networks, including AI, advanced MIMO, Reflective Intelligent Surfaces (RIS) and edge computing.

……………………………………………………………………………………………………………………………………………………………………………………………………………………….

The second Report ETSI GR THz 002 identifies frequency bands of interest in the sub-THz and THz range, describes the current regulatory situation and identifies the incumbent services to be considered for coexistence studies.

Figure 2: Frequency ranges within the THz band with different regulatory status

The frequency range 100 GHz – 10 THz is referred to as the ‘THz range’. The corresponding wavelengths are from 0,03 mm to 3 mm. Below this range, the mm-wave and microwave frequency ranges are found, already heavily utilized for communications and non-communications applications. Above 10 THz the near- and mid-infrared spectrum starts.

The interest for higher frequency bands increases with the increasing demand for higher bandwidths and lower latencies to serve critical applications. This is most pronounced in the research towards 6G technologies, which are expected to be ready for early deployments around 2030. The frequency ranges from 100 GHz and upwards is already utilized for non‑communications purposes, and therefore there is a need to understand the regulatory landscape and identify the most interesting frequency bands for THz communications.

“Between 100 GHz and 275 GHz, 8 bands with sufficient contiguous bandwidths are allocated to fixed and mobile services on a co-primary basis,” according to the report. “Above 275 GHz, interesting bands have been identified for THz communications purposes based on a combination of regulatory status and favourable propagation conditions.”

To be clear, most 5G vendors don’t expect 6G to run primarily in those terahertz spectrum bands. Companies like Ericsson and Nokia have said 6G will mainly run in the so-called “centimetric” spectrum bands that sit between 7GHz and 20GHz

Webinar:

Another way of discovering more about those two deliverables will be webinar scheduled for 11 April 2024, 15h CEST:

https://www.etsi.org/events/upcoming-events/2338-webinar-use-cases-and-spectrum-key-starting-points-for-terahertz-standards.

About ETSI:

ETSI provides members with an open and inclusive environment to support the development, ratification and testing of globally applicable standards for ICT systems and services across all sectors of industry and society. We are a non-profit body, with more than 900 member organizations worldwide, drawn from 64 countries and five continents. The members comprise a diversified pool of large and small private companies, research entities, academia, government, and public organizations. ETSI is officially recognized by the EU as a European Standards Organization (ESO). For more information, please visit https://www.etsi.org/

References:

https://www.etsi.org/deliver/etsi_gr/THz/001_099/001/01.01.01_60/gr_THz001v010101p.pdf

https://www.etsi.org/deliver/etsi_gr/THz/001_099/002/01.01.01_60/gr_THz002v010101p.pdf

https://www.lightreading.com/6g/etsi-s-new-6g-report-dives-into-thz-use-cases

mmWave Coalition on the need for very high frequency spectrum; DSA on dynamic spectrum sharing in response to NSF RFI

New ITU report in progress: Technical feasibility of IMT in bands above 100 GHz (92 GHz and 400 GHz)

ITU-R Report in Progress: Use of IMT (likely 5G and 6G) above 100 GHz (even >800 GHz)

Keysight and partners make UK’s first 100 Gbps “6G” Sub-THz connection

ETSI Integrated Sensing and Communications ISG targets 6G

ETSI NFV evolution, containers, kubernetes, and cloud-native virtualization initiatives

ETSI Experiential Networked Intelligence – Release 2 Explained

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

ETSI MEC Standard Explained – Part II

FCC Draft Net Neutrality Order reclassifies broadband access; leaves 5G network slicing unresolved

Introduction:

The FCC will take a series of steps to reestablish the commission’s net neutrality framework and reclassify broadband internet access service (BIAS) as a Communications Act Title II telecom service in a 434 page declaratory ruling and order which doesn’t resolve the issue of network slicing as a paid priority 5G service.

A draft of the items to be considered during the agency’s April meeting, released Thursday, would establish “broad” and “tailored” forbearance for ISPs. “Access to broadband Internet is now an unquestionable necessity. We also exercise broad forbearance for broadband providers as part of the Title II reclassification. Since the Commission’s abdication of authority over broadband in 2017, there has been no federal oversight over this vital service. This item would reestablish the Commission’s authority to protect consumers and safeguard the fair and open Internet, which protects free expression, encourages competition and innovation, and is critical to public safety and national security.”

Network Slicing:

The draft doesn’t make a final determination on how network slicing should be treated under the rules. Network slicing, which requires a 5G SA core network, enables 5G network operators to create multiple virtual networks on top of a shared network. How slicing should be treated has been hotly contested.

“To the extent network slicing falls outside of BIAS, we will closely monitor these uses to evaluate if they are providing the functional equivalent of BIAS, being used to evade our open Internet rules, or otherwise undermining investment, innovation, competition, or end-user benefits in the Internet ecosystem,” the draft said.

“The record reflects that the potential use cases for network slicing are still under development” and that carriers “are in the early stages of adopting the technique, with some moving more quickly than others. Given the nascent nature of network slicing, we conclude that it is not appropriate at this time to make a categorical determination regarding all network slicing and the services delivered through the use of network slicing.”

Yet the document also says it agrees with NCTA “that we ‘should not allow network slicing to be used to evade [the] Open Internet rules.’”

“The FCC declined to do what either side wanted” on slicing, New Street’s Blair Levin stated in a note to investors. “While this was not the clear, decisive win the wireless providers may have hoped for, we don’t believe this or a future FCC is likely to crack down on the primary uses of network slicing, which we understand to be network management techniques that better match wireless services to specific needs in ways that increase spectrum utilization.”

“The text left me rather confused more than reassured,” Digital Progress Institute President Joel Thayer said Friday. The commission seems interested in addressing slicing case by case, he said: “This does not bode well for consumer-facing uses of slicing as that tech starts to develop.”

One implication is the FCC might crack down on slicing if the agency sees it as a form of paid prioritization of network traffic, said Jonathan Cannon, R Street Institute policy counsel-technology and innovation and former aide to FCC Commissioner Nathan Simington.

The report and order would: “Reinstate straightforward, clear rules that prohibit blocking, throttling, or engaging in paid or affiliated prioritization arrangements, and adopt certain enhancements to the transparency rule.”

………………………………………………………………………………………………………………

The new FCC order would adopt “conduct-based rules” in the commission’s net neutrality framework, establishing “bright-line rules to prohibit blocking, throttling, and paid prioritization” by ISPs. An accompanying draft report and order would also reinstate a general conduct standard and establish a “multi-faceted enforcement framework.”

The draft declaratory ruling would officially reclassify broadband as a Title II service, saying the step would allow the commission to “more effectively safeguard the open internet” and establish a nationwide framework. The draft would largely adopt the commission’s 2015 rules on forbearance, making clear that the record “does not convincingly show that imposing universal service contribution requirements on BIAS is necessary at this time.”

The commission in the draft defended reclassification as a national security matter, noting it has previously taken action under Title II to address national security threats against voice services. “The nation’s communications networks are critical infrastructure, and therefore too important to leave entirely to market forces that may sometimes, but not always, align with necessary national security measures,” the item said.

The draft declaratory ruling also addresses the impact of reclassification on the commission’s universal service goals under section 254 of the Communications Act. Reclassification “will put the commission on the firmest legal ground to promote the universal service goals of section 254 by enabling the commission and states to designate BIAS-only providers” as eligible telecom carriers, the draft said, adding that BIAS-only providers would be allowed to participate in the high-cost and Lifeline programs.

The draft elaborates on the importance of reclassifying broadband to the agency’s authorities under Section 214 of the Communications Act, another issue raised by industry (see 2403070040). Reclassification “enhances the Commission’s ability to protect the nation’s communications networks from entities that pose threats to national security and law enforcement.”

“We find that reclassification will significantly bolster the Commission’s ability to carry out its statutory responsibilities to safeguard national security and law enforcement,” the draft said: “There can be no question about the importance to our national security of maintaining the integrity of our critical infrastructure, including communications networks.” It noted that Congress created the FCC “for the purpose of the national defense.”

The agency dismissed arguments that reclassification isn’t justified for national security purposes: “The nation’s communications networks are critical infrastructure, and therefore too important to leave entirely to market forces that may sometimes, but not always, align with necessary national security measures.” Arguments about potential costs “are unpersuasive given that, at this point, they represent only speculation about hypothetical costs and burdens.”

A draft order on reconsideration included with Thursday’s item said the net neutrality order would resolve four outstanding petitions for reconsideration filed against the FCC’s 2020 net neutrality remand order by Incompas, California’s Santa Clara County, Public Knowledge, and jointly several public interest groups including Common Cause. “As a procedural matter, we find that we have effectively provided the relief sought by each of the Petitions through a combination of the 2023 Open Internet NPRM and today’s actions,” the draft order said. “In light of the Commission’s actions today, we grant in large part and otherwise dismiss as moot” all four petitions for reconsideration. “We agree with the petitioners that the Commission’s analysis in the [Restoring Internet Freedom] Order and RIF Remand Order was insufficient in addressing the public safety, pole attachment, and Lifeline-related repercussions of classifying BIAS as a Title I service,” the draft said.

House Commerce Committee ranking member Frank Pallone, D-N.J., and Communications Subcommittee ranking member Doris Matsui, D-Calif., praised Rosenworcel “for moving to finalize rules that reflect reality: broadband internet service is critical infrastructure and an indispensable part of American life, and it must be treated that way.” The FCC’s move for Title II reclassification shows the commission is “recognizing this reality and asserting its rightful authority over broadband providers in order to protect this vital service and the hundreds of millions who rely on it each day,” Pallone and Matsui said. The two lawmakers “have confidence that a court reviewing this action will uphold it, just as courts have done in the past.” Sens. Ed Markey, D-Mass., and Ron Wyden, D-Ore., also lauded the proposal Thursday after earlier urging Rosenworcel to prevent loopholes in the rules.

The House Commerce GOP majority was tight-lipped after the draft’s release Thursday. Republican members tweeted Wednesday that the net neutrality proposal showed the commission “continues pushing Biden’s Broadband Takeover by imposing unnecessary heavy-handed regulations.”

References:

https://docs.fcc.gov/public/attachments/DOC-401676A1.pdf

https://communicationsdaily.com/reference/2404040064?BC=bc_661167bc293cd

https://communicationsdaily.com/article/view?search_id=847526&id=1928175

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

LightCounting: Optical Ethernet Transceiver sales will increase by 40% in 2024

LightCounting expected sales of Ethernet optical transceivers to decline by 5-10% in 2023, but surging demand from Google and Nvidia kept the market growing, albeit at single digits.

Sales of Optical Ethernet transceivers declined in 2019 as a result of lower spending by the Cloud companies, which now dominate demand for those parts. Cloud companies reduced their spending again in the end of 2022 and the market outlook was dire in early 2023. Yet, one year later the market has bounced back.

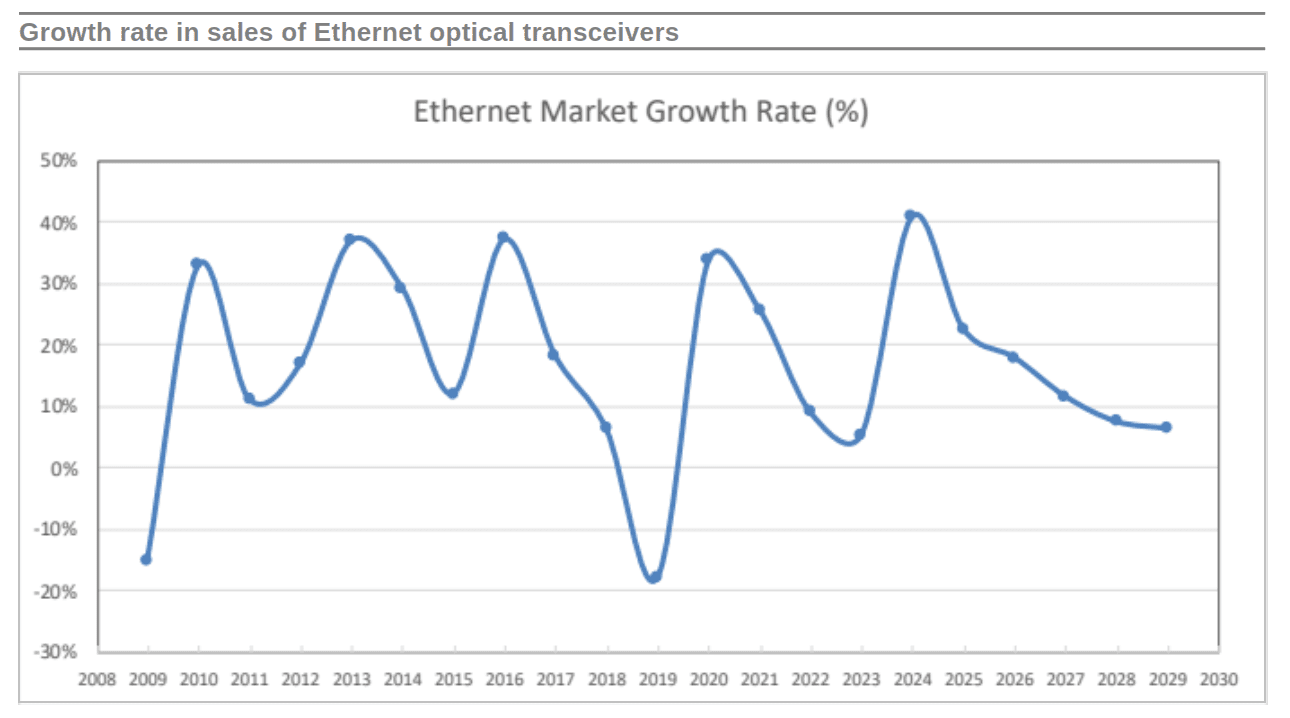

The market research firm has sharply increased their forecast for sales of 400G/800G transceivers and now expect: 40% growth in 2024, more than 20% in 2025 and double digit growth in 2026-2027, as illustrated in the figure below.

Source: LightCounting

………………………………………………………………………………………………………………….

The growth will not continue indefinitely. Any slowdown in purchases of optics by Nvidia or Cloud companies can reverse the market dynamics. Timing of such a decline is unpredictable. All we know, it will happen at some point. Our model suggests a soft landing with single digit growth rates in 2028-2029, but it is more likely that we will see another sharp drop followed by a recovery, conforming to the rocky history of the past 15 years.

Fears of an economic recession have subsided, but they continue to weigh on spending of telecom operators, which see no revenue growth. Yet, we will not know for sure if a recession is coming until it actually starts and it will take another half a year after that for the economists to formally declare it. By that time, we will be busy discussing the timing of a recovery.

What remains certain is that optics are critical for data centers and for the rest of the global networking infrastructure. Recent progress in generative AI makes the future even more exciting. Keep this in mind, while navigating the markets volatility as shown in the above graph.

……………………………………………………………………………………………………………….

About LightCounting:

The market research firm was established in 2004 with an objective of providing in-depth coverage of market and technologies for high speed optoelectronic interfaces employed in communications. By now, the company employs a team of industry experts and offers comprehensive coverage of optical communications supply chain.

……………………………………………………………………………………………………………….

References:

https://www.lightcounting.com/report/march-2024-ethernet-optics-287

https://www.lightcounting.com/report/march-2024-quarterly-market-update-288

Highlights of LightCounting’s December 2023 Quarterly Market Update on Optical Networking

LightCounting: Sales of Optical Transceivers will decline in 2023

LightCounting: Optical components market to hit $20 billion by 2027+ Ethernet Switch ASIC Market Booms

ITU Journal: NexGen Computer Communications & Networks

These solutions can include network optimization, effective data management, cognitive computing, block-chain solutions, and unconventional hardware and software design and implementation.

-

Network optimization:This can involve using techniques such as traffic engineering, load balancing, and caching to improve the performance of networks.

-

Effective data management:This can involve using techniques such as data compression, data encryption, and data analytics to improve the efficiency and security of data storage and transmission.

-

Cognitive computing:This can involve using techniques such as machine learning and artificial intelligence to improve the ability of networks to learn from data and make decisions autonomously.

-

Block-chain solutions:This can involve using techniques such as distributed ledgers and smart contracts to improve the security and transparency of networks.

-

Unconventional hardware and software design and implementation:This can involve using techniques such as open source software, software-defined networking, and network function virtualization to improve the flexibility and scalability of networks.

| Issue 1 – Editorial Volume 5 (2024), Issue 1 Enhancing user experience in home networks with machine learning-based classification Adaptive HELLO protocol for vehicular networks On the extraction of RF fingerprints from LSTM hidden-state values for robust open-set detection Unsupervised representation learning for BGP anomaly detection using graph auto-encoders A framework for automating environmental vulnerability analysis of network services Automated Wi-Fi intrusion detection tool on 802.11 networks Optimizing IoT security via TPM integration: An energy efficiency case study for node authentication |

Huawei is back – net profits more than doubled in 2023!

China’s Huawei Technologies said its net profit more than doubled last year, marking a stunning comeback for the company years after U.S. export controls cut it off from advanced technology.

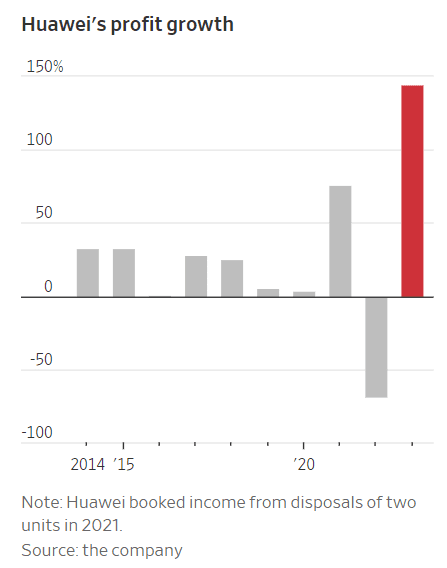

The tech giant on Friday said profit rose to 87 billion yuan, or $12 billion, a rise of more than 140% from the same period a year ago. It is the largest jump in profit for the company since it started reporting comparable figures in 2006. Revenue rose 10% to $99 billion.

It’s Huawei’s highest revenue number, and its first year of topline growth, in four years. Operating cash flow of RMB69.8 billion ($9.7 billion), up fourfold from 2022 and also the highest in four years.

In a statement, Huawei downplayed the figures, with current rotating chairman Ken Hu describing them as “in line with forecast.”

It’s a long way from the imposition of U.S. technology transfer sanctions five years ago, when Huawei executives acknowledged the company was fighting for its survival.

Huawei said growth was driven by higher sales in its consumer electronics and cloud computing offerings.

Last September, Huawei surprised U.S. authorities by releasing a new smartphone, the Mate 60 Pro, with 5G-like capabilities, running on its homegrown chips. Five years after the U.S. restricted sales of the most powerful chips and the Android operating system to Huawei, the telecom equipment and mobile phone maker has shown strong resilience.

Huawei’s core ICT infrastructure unit, comprising the legacy carrier network business and enterprise network sales, remains the biggest source of revenue. It grew 2.3% to RMB362 billion ($50.1 billion), while the cloud business was another of the big growth drivers, gaining 22%.

The company has diversified into new business lines such as cloud computing, enterprise software and automobile systems and retooled its products.

Huawei co-built Aito, one of China’s most popular EVs. There’s also the newly formed smart auto components units business, which more than doubled revenue to RMB4.7 billion ($650 million).

“We’ve been through a lot over the past few years. But through one challenge after another, we’ve managed to grow,” said Ken Hu, Huawei’s rotating chairman.

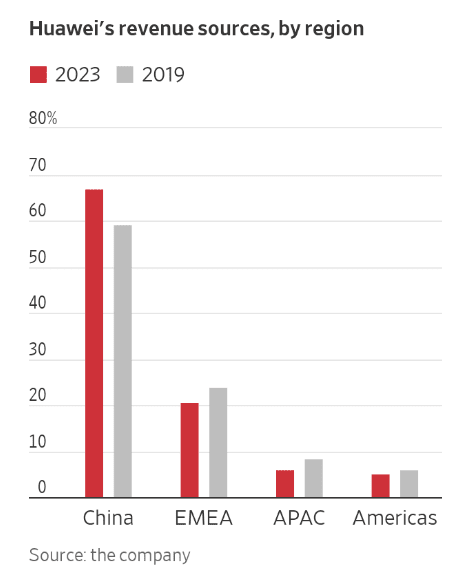

Last year nearly 70% of Huawei’s revenue came from China as its overseas presence shrunk. Five years ago, China formed about 60% of its revenue, while the rest came from Europe and emerging markets. Huawei doesn’t break out U.S. sales figures.

Revenue from its telecommunication equipment and enterprise technology business grew 2%. Sales at its consumer business group, encompassing products such as smartphones, laptops and smart wearables, rose 17%.

Huawei was the world’s largest providers of telecom equipment and among the biggest smartphone makers globally, but U.S. sanctions beginning in 2019 crushed its smartphone business and forced it to spin off its budget Honor handset brand.

U.S. authorities also blocked American carriers from buying from the Chinese company and asked allies not to use Huawei’s telecom equipment, calling the company a national security threat. Huawei said then that restricting it from doing business in the U.S. wouldn’t improve national security and would limit the country’s 5G development.

But the past few months have indicated a reversal of Huawei’s fortunes. Since the launch of the Mate 60 series, Huawei has begun to chip away at Apple’s high-end smartphone market share in China.

On Friday, Huawei said the Mate 60 Series and HarmonyOS, its own operating system for mobile phones and other smart devices, had “received wide acclaim.” The company said its consumer unit grew by “overcoming major technical barriers and diving deep into the industry’s most challenging issues.”

Huawei didn’t provide sales numbers for the phones. Ming-Chi Kuo, a supply chain analyst at TF International Securities, last September predicted that Huawei would likely deliver at least 12 million Mate 60 handsets by August.

The company said cloud computing revenue rose 22% last year. Huawei, China’s second-largest cloud computing provider, had outpaced the growth of market leader Alibaba Group and smaller rival Tencent Holdings. Last year, the company launched new cloud-based artificial-intelligence offerings for business use that are now deployed in banks and mines.

Analysts say Huawei is also set to benefit from China’s localization policy, as the company expands its offerings in areas such as semiconductors, where Beijing is seeking more self-sufficiency.

Huawei has managed to deliver AI chips that developers say match the capabilities of some of Nvidia’s top processors. Nvidia named Huawei as one of its competitors in its annual report in February.

In 2023, Huawei spent $23 billion on research and development, about 23% of its total revenue.

References:

https://www.lightreading.com/5g/huawei-profit-soars-as-it-returns-to-growth

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Kuwait stc/Huawei deploy 5G Redcap FWA in Kuwait; Huawei’s 5G core wins

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei launches new network products at HNS 2023 in Mexico

Huawei and Ericsson renew global patent cross-licensing agreement

GSMA: China’s 5G market set to top 1 billion this year

China’s state sponsored 5G market is expected to add almost US$260 billion to its gross domestic product in 2030, with its 5G connections accounting for nearly a third of the worldwide total according to a recent GSMA report.

The report forecasts that more than half of Chinese mobile connections will be 5G by the end of 2024. 5G’s contribution to GDP in China is expected to reach almost $260 billion in 2030, which is 23% of the overall annual economic impact of mobile in China. Also by 2030, 5G connections in China will account for nearly a third of the global total, with 5G adoption in China reaching almost 90%, making it one of the leading markets globally.

The mobile industry contributed to 5.5% of China’s GDP last year, and in each of the coming years through 2030, nearly a quarter of that contribution will come from 5G – the highest echelon of current cellular technology – per the results of a study issued on Tuesday by the Group System for Mobile communications Association (GSMA).

Overall, the mobile market’s contribution to the Chinese economy will reach around US$1.1 trillion in 2030, GSMA said. Mats Granryd, Director General of the GSMA, said:

“It is great to see China, the world’s largest 5G market, commit so enthusiastically to the GSMA’s Open Gateway initiative to help drive the growth and maturity of the technology. As China surpasses 1 billion 5G connections this year, we expect to see further investment and potential in evolutions such as 5G-Advanced, 5G New Calling and 5G RedCap to improve user experience and unlock new revenue streams for operators.”

Photo credit: Shutterstock

GSMA’s Mobile Economy China 2024 report said the country’s entire mobile sector has so far provided a total of nearly 8 million jobs directly and indirectly, and generated US$110 billion in tax revenue in 2023 alone. According to that report:

- There are now 1.28 billion unique mobile subscribers in China – a penetration rate of 88%

- Mobile’s overall contribution to the Chinese economy in 2023 reached $970 billion, or 5.5% of GDP

- 5G is expected to reach 1.6bn connections in 2030, representing a third of the world’s total, and forecast to contribute $260 billion to China’s GDP

- An additional 290 million people in China now use mobile internet compared to eight years ago (2015), closing the country’s Usage Gap from 43% to just 16%

- Mobile data traffic in China is expected to quadruple by the end of the decade

China has the world’s most mobile phone users by a wide margin. As of the end of last year, there were 122.5 mobile phones for every 100 people, according to figures from the National Bureau of Statistics. The number of 5G base stations was nearly 3.38 million – a surge of 46% from a year earlier.

“China continues to set the pace for cutting-edge 5G technology standards,”the GSMA said, adding the country’s operators are “leading the way in the transition to 5G-advanced and 5G reduced capability networks. This is anticipated to kick-start a new round of 5G investment in 2024 and beyond.”

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

5G Americas/Omdia: 2023 global 5G connections reach 1.76 billion

5G connections accelerated in 2023, reaching 1.76 billion globally by end-December, following the addition of 700 million connections in the 12-month period, according to a report from 5G Americas, with data provided by Omdia.

Of course, most of those connections were 5G NSA, which does not offer any 3GPP defined 5G features (including 5G Security and Network Slicing). According to a Dell’Oro Group report, 12 new 5G SA core networks were deployed in 2023, down from 18 in 2022. The report also notes that AT&T, Verizon, British Telecom EE, Deutsche Telekom, and other Mobile Network Operators (MNOs) did not deploy 5G SA networks in 2023.

Chris Pearson, President of 5G Americas, said, “The wireless telecommunications industry stands at the cusp of a new era, driven by innovation, collaboration, and a shared vision for a connected future. With Fixed Wireless Access (FWA) continuing to drive consumer broadband demand, new technology milestones are advancing unparalleled connectivity experiences worldwide.”

North America emerged as a leader in 5G adoption, with connections in the region comprising 29% of all North American connections by the end of 2023. Notably, the region experienced a staggering 64% year-over-year growth in 5G connections, adding 77 million new connections to its network. By the end of 2023, North American 5G connections totaled 197 million.

–>This author believes that most of the new 5G connections in the U.S. were FWA from Verizon and T-Mobile.

Latin America also witnessed substantial progress in both 4G LTE and 5G connections, with LTE connections reaching 582 million by the close of 2023, adding 40 million new connections year over year. Moreover, the region embraced the 5G revolution, with 39 million 5G connections established by year-end, setting the stage for further expansion in the years to come.

“4G LTE is still the strongest technology across the region,” said Jose Otero, Vice President of Latin America, and the Caribbean for 5G Americas. “Although various factors, including 5G handset mass market availability and completion of spectrum auctions will see an increase in 5G coverage, and subscriber growth in the coming year.”

Looking ahead, Omdia forecasts paint a picture of the telecommunications landscape we can expect to see throughout this decade. Global 5G connections are projected to skyrocket to 7.9 billion by 2028, with North America forecasted to boast an impressive 700 million 5G connections by the same year.

Omdia principal analyst Kristin Paulin points out, “With this forecast, 5G will reach the global milestone of accounting for more than half of all connections by 2028. For North America, as an early leader, 5G will be more than 80% of connections.”

Additionally, 5G data traffic is expected to be 76% of all technology data traffic as it reaches a staggering 2.6 billion TB (or 2600 EB), with all technology data traffic reaching 3.4 billion TB (or 3400 EB) by 2028, reflecting the exponential growth trajectory of 5G connectivity.

While 5G technology continues to dominate headlines, the Internet of Things (IoT) ecosystem remains a vital component of the digital revolution. Currently, global IoT subscriptions stand at 3.1 billion, complemented by 6.6 billion smartphone subscriptions. Forecasts suggest that IoT subscriptions will reach 4.5 billion, while smartphone subscriptions will surge to 7.4 billion by 2026, highlighting the evolving nature of connectivity and the interconnectedness of our digital world.

Globally, the number of deployed 5G networks shows strength compared to 4G LTE deployments, and in the case of North America almost matches 4G LTE networks deployed. Currently, there are 314 commercial 5G networks worldwide, and this number is anticipated to grow to 450 by 2025, reflecting significant investments in 5G infrastructure worldwide.

The number of 5G and 4G LTE network deployments as of March 18, 2024, are summarized below:

5G:

- Global: 314

- North America: 17

- Latin America and Caribbean: 39

4G LTE:

- Global: 714

- North America: 18

- Latin America and Caribbean: 135

Visit www.5GAmericas.org for more information, statistical charts, and a list of LTE and 5G deployments by operator and region. Subscriber and forecast data is provided by Omdia and deployment data by 5G Americas and TeleGeography (GlobalComm).

About 5G Americas: The Voice of 5G and Beyond for the Americas

5G Americas is an industry trade organization composed of leading telecommunications service providers and manufacturers.

The organization’s mission is to facilitate and advocate for the advancement of 5G and beyond toward 6G throughout the Americas. 5G Americas is invested in developing a connected wireless community while leading 5G development for all the Americas. 5G Americas is headquartered in Bellevue, Washington. More information is available at 5G Americas’ website.

5G Americas’ Board of Governors Members include Airspan Networks Inc., Antel, AT&T, Ciena, Cisco, Crown Castle, Ericsson, Liberty Latin America, Mavenir, Nokia, Qualcomm Incorporated, Rogers Communications, Samsung, T-Mobile US, Inc., Telefónica, and WOM.

…………………………………………………………………………………………………………………….

References:

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

GSMA Intelligence: 5G connections to double over the next two years; 30 countries to launch 5G in 2023

Bundenetzagentur: 5G was 28.5% of broadband speed measurements in Germany (Oct 2022 thru Sept 2023)

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

HKT is first to deploy 50G PON technology in Hong Kong

HKT [1.] has become the first telecommunication service provider in Hong Kong to adopt the latest 50G PON technology, as the telco prepares to ramp up the delivery of applications that require ultra-high-speed broadband Internet connections for both home and commercial customers.

Note 1. HKT Limited is a company incorporated in the Cayman Islands with limited liability.

50G fiber based broadband offers a significant step up in speed, with a specification download speed of up to 50Gbps. Paired with the latest Wi-Fi 7 technology, the remarkable increase in bandwidth supports smooth simultaneous multi-device connectivity of all kinds for users both at home and in a commercial setting. Latency also improves by a substantial 27% on average compared to that of a 10G fiber network. [The above latency is only applicable to designated servers. Network latency in other areas will vary depending on the operational load of individual servers as well as network traffic.]

Bruce Lam, CEO, Consumer, HKT, said, “NETVIGATOR has always been at the forefront of the market. We are delighted to become the first telecommunication service provider in Hong Kong to adopt 50G PON technology. With the development of smart homes, demand for high-speed multi-device connections has been increasing to cater for activities such as 8K video streaming, large video file transfer and sharing at home, online gaming and even real-time financial market monitoring and trading. We will continue to explore cutting-edge technologies to meet our customers’ future connectivity needs.”

Steve Ng, Managing Director, Commercial Group, HKT, said, “HKT Enterprise Solutions has consistently provided diverse digital solutions for our commercial customers. As AI and cloud applications become ubiquitous, enterprise customers’ demand for bandwidth, speed and low latency have continued to elevate.

For example, employees need to use cloud services, collaboration tools, and AI solutions within the office environment. Schools are actively implementing e-learning and remote teaching. Large-scale events such as exhibitions and concerts generate high demands for live streaming or AR/VR experience solutions. Through this latest technology, we are preparing ourselves for the network needs of different customers.”

By applying the innovative 50G PON technology HKT is able to further enhance the performance of its existing fiber network with ease. Currently, HKT’s 10G fiber broadband network covers over 2.4 million households across 50,000 residential buildings, as well as 8,000 commercial buildings in Hong Kong.

About HKT:

HKT is a technology, media, and telecommunication leader with more than 150 years of history in Hong Kong. As the city’s true 5G provider, HKT connects businesses and people locally and globally.

Our end-to-end enterprise solutions make us a market leading digital transformation partner of choice for businesses, whereas our comprehensive connectivity and smart living offerings enrich people’s lives and cater for their diverse needs for work, entertainment, education, well-being, and even a sustainable low-carbon lifestyle. Together with our digital ventures which support digital economy development and help connect Hong Kong to the world as an international financial centre, HKT endeavours to contribute to smart city development and help our community tech forward.

For more information, please visit www.hkt.com.

References:

Ooredoo Qatar is first operator in the world to deploy 50G PON

Türk Telekom and ZTE trial 50G PON, but commercial deployment is not imminent

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

ZTE, along with China Mobile’s Yunnan Branch, have created an accurate 3D model of the lineside infrastructure along the KunchuDali railway in China and used it to improve network performance. The companies introduced 5G-Advanced digital twin technology to build two core capabilities of digital site twinning and wireless channel twinning.

KunchuDali high-speed railway involves a large number of network planning challenges such as cross-bridge coverage, tunnel coverage, mountain-splitting area shielding, and abundant vegetation. It forms a vital segment of the China-Myanmar International Railway and the Trans-Asian Railway west line, connecting the key cities of Kunming, Chuxiong, Dali, and Lijiang in Yunnan Province. Serving as the backbone of the region’s transportation infrastructure, this route facilitates the daily movement of approximately 61,000 passengers, earning its reputation as the “golden tourism route.”

However, the railway’s construction and operation face formidable obstacles due to the rugged terrain characterized by fluctuating mountain ranges, perilous topography, and dense vegetation. Notably, a significant portion of the route traverses areas with a high concentration of bridges and tunnels, accounting for 64% of its total length. Moreover, many construction sites are situated in abnormal mountain zones, posing challenges to the efficiency and quality of surveying efforts.

China Mobile’s Yunnan Branch and ZTE introduced the 5G-Advanced digital twin technology to build two core capabilities of digital site twinning and wireless channel twinning. The 3D site twinning is achieved through UAV automatic flight control acquisition, thus implementing inspection survey of engineering parameters and AI identification of antenna assets, and guaranteeing engineering implementation quality with high efficiency and high quality.

- In June 2022, China Mobile unveiled a 6G network architecture which creates a virtual twin through digital means to realize a digital twin network architecture (DTN) with network closed-loop control and full lifecycle management; The service defines the end-to-end system to realize the full service system architecture (HSBA); In the group network, the Distributed Autonomous Network (DAN) with distributed, autonomous and self-contained features is implemented, which supports on-demand customization, plug and play and flexible deployment.

- ZTE’s RAN digital twin leverages digital twin, big data and artificial intelligence technologies, drastically enhancing network deployment and operation efficiency by minimizing resources and time needed for trial-and-error procedures of radio network deployment and optimization, making them more versatile, flexible and autonomous.

In addition, channel twinning is built in mountainous areas to achieve coverage prediction and optimization. The optimization elements required for mountainous areas, namely the azimuth, downtilt, power, and beam weights of antennas, are twinned and optimized beforehand. In this way, with the first-in-place construction of the pre-planning, the construction quality of the high-speed railway network is guaranteed faster and better, and the optimization period is shortened. Before the Spring Festival of 2024, the KunchuDali high-speed railway fully achieved the target of high-quality lines, with a coverage rate of 98.5% and a 5G download rate of more than 300Mbps. Compared with traditional planning and optimization methods, the KunchuDali high-speed railway saved more than RMB1.6 million and shortened the optimization period for nearly one month.

During the Spring Festival, China Mobile’s Yunnan Branch ensured an excellent internet experience for users with its high-quality high-speed railway network. The implementation of digital twin technology for high-speed railways enables efficient site surveys and coverage optimization to achieve higher efficiency and quality. This advancement fosters the deep integration of various industries with digital twin technology, paving the way for new industries, ecosystems, and operational modes. Furthermore, it lays a solid digital foundation for the future evolution towards 6G.

………………………………………………………………………………………………………………………………………………………….

According to Gartner, global digital twin revenues are expected to reach $183 billion by 2031. And when it comes to adoption, railway operators are at the forefront, using these virtual models to improve real-time asset management, reduce delays, and improve journey times.

In the UK, Transport for London (TfL) in 2022 announced plans to roll out a digital twin of the London Underground network so it can virtually monitor tracks and tunnels. Network Rail also offers a catalogue of training simulations built on digital twin technology.

According to an article in Mobility Innovators, bullet train operator JR East has deployed digital twins to monitor tracks, bridges and tunnels to enable predictive maintenance, while Hong Kong’s MTR (Mass Transit Railway) uses them to improve scheduling.

UAV automatic flight control acquisition implements 3D site twinning along the KunchuDali railway. Photo Credit: ZTE

……………………………………………………………………………………………………………………………………………………………………………………………………………..

ABOUT ZTE:

ZTE helps to connect the world with continuous innovation for a better future. The company provides innovative technologies and integrated solutions, and its portfolio spans all series of wireless, wireline, devices and professional telecommunications services. Serving over a quarter of the global population, ZTE is dedicated to creating a digital and intelligent ecosystem, and enabling connectivity and trust everywhere. ZTE is listed on both the Hong Kong and Shenzhen Stock Exchanges. www.zte.com.cn/global

……………………………………………………………………………………………………………………………………………………………………………………………………………..

https://www.zte.com.cn/global/about/news/china-mobile-zte-revolutionize-high-speed-railway-with-5g-a-digital-twin.html

https://www.zte.com.cn/global/solutions_latest/5g-advanced/digital_twin.html

https://www.telecoms.com/5g-6g/china-mobile-zte-use-digital-twin-to-improve-lineside-5g

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

What is 5G Advanced and is it ready for deployment any time soon?

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services