UK’s CityFibre launches 5.5Gbit/s wholesale broadband service- 3 times faster than BT Openreach

CityFibre, the UK’s largest independent full fiber optic platform, has unveiled a new 5.5Gbit/s wholesale broadband internet service based on 10Gbit/s XGS-PON technology that has already been rolled out across 85% of the company’s network. CityFibre claims its new product is more than three times faster than the highest rate available service from its much larger rival, Openreach (the network access arm of BT). and available at a much lower wholesale cost, CityFibre’s 5.5Gb symmetrical product will enable partners to offer a range of Multi-Gig speed tiers to customers, improving margins whilst providing a valuable customer retention tool for the long term.

Highlights:

- CityFibre’s new 5500/5500Mbps service offers >3x faster downloads, >45x faster uploads than BT Openreach’s fastest full fibre service which is 1800/120Mbps and is delivered over its GPON network.

- CityFibre’s upgraded XGS-PON network provides numerous benefits over GPON technology, including network cost savings, reduced power consumption, improved performance, and enhanced efficiency.

- CityFibre’s launch of its new Multi-Gig products enables the UK to keep pace with countries including France, the Netherlands, New Zealand and the United States of America where consumers are already making the most of affordable Multi-Gig services.

Photo Credit: CityFibre

Greg Mesch, CEO of CityFibre, said: “The UK’s full fibre future is here, thanks to CityFibre’s powerful, 10Gb XGS-PON network. Our ISP partners are already connecting customers with speeds over 2Gb and exceeding expectations when it comes to quality and reliability, but our next generation of full fibre will set a new standard for what’s possible.

“CityFibre started out to challenge the incumbents and bring choice and competition to the UK market. This is another huge step-forward, giving ISPs more power and flexibility than ever before and bringing affordable Multi-Gig speeds and an unrivalled experience to millions of UK consumers.”

Even faster multi-gig services will be launched in 2026 the company promises.

CityFibre’s network now passes more than 4.3 million premises, which the company says means it is more than halfway along its journey towards its “rollout milestone” of 8 million premises. Actual service take-up, however, has reached just 518,000, an increase of around 181,000 customers on its previous total. During the year covered by the earnings statement, CityFibre announced a partnership with Sky that will see the UK’s second-largest broadband provider launch services on CityFibre’s network later this year.

References:

https://cityfibre.com/news/cityfibre-unveils-new-5-5gb-wholesale-product-its-fastest-ever

Nokia and CityFibre sign 10 year agreement to build 10Gb/second UK broadband network

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications fiber growth accelerates in Q1 2025

AT&T grows fiber revenue 19%, 261K net fiber adds and 29.5M locations passed by its fiber optic network

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

STELLAR Broadband offers 10 Gigabit Symmetrical Fiber Internet Access in Hudsonville, Michigan

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

Dell’Oro Group just completed its 1Q-2025 Radio Access Network (RAN) report. Initial findings suggest that after two years of steep declines, market conditions improved in the quarter. Preliminary estimates show that worldwide RAN revenue, excluding services, stabilized year-over-year, resulting in the first growth quarter since 1Q-2023. Author Stefan Pongratz attributes the improved conditions to favorable regional mix and easy comparisons (investments were very low same quarter lasts year), rather than a change to the fundamentals that shape the RAN market.

Pongratz believes the long-term trajectory has not changed. “While it is exciting that RAN came in as expected and the full year outlook remains on track, the message we have communicated for some time now has not changed. The RAN market is still growth-challenged as regional 5G coverage imbalances, slower data traffic growth, and monetization challenges continue to weigh on the broader growth prospects,” he added.

Vendor rankings haven’t changed much in several years, as per this table:

Additional highlights from the 1Q 2025 RAN report:

– Strong growth in North America was enough to offset declines in CALA, China, and MEA.

– The picture is less favorable outside of North America. RAN, excluding North America, recorded a fifth consecutive quarter of declines.

– Revenue rankings did not change in 1Q 2025. The top 5 RAN suppliers (4-Quarter Trailing) based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

– The top 5 RAN (4-Quarter Trailing) suppliers based on revenues outside of China are Ericsson, Nokia, Huawei, Samsung, and ZTE.

– The short-term outlook is mostly unchanged, with total RAN expected to remain stable in 2025 and RAN outside of China growing at a modest pace.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected]

………………………………………………………………………………………………………………………………………………………………………………..

Separately, Pongrantz says “there is great skepticism about AI’s ability to reverse the flat revenue trajectory that has defined network operators throughout the 4G and 5G cycles.”

The 3GPP AI/ML activities and roadmap are mostly aligned with the broader efficiency aspects of the AI RAN vision, primarily focused on automation, management data analytics (MDA), SON/MDT, and over-the-air (OTA) related work (CSI, beam management, mobility, and positioning).

Current AI/ML activities align well with the AI-RAN Alliance’s vision to elevate the RAN’s potential with more automation, improved efficiencies, and new monetization opportunities. The AI-RAN Alliance envisions three key development areas: 1) AI and RAN – improving asset utilization by using a common shared infrastructure for both RAN and AI workloads, 2) AI on RAN – enabling AI applications on the RAN, 3) AI for RAN – optimizing and enhancing RAN performance. Or from an operator standpoint, AI offers the potential to boost revenue or reduce capex and opex.

While operators generally don’t consider AI the end destination, they believe more openness, virtualization, and intelligence will play essential roles in the broader RAN automation journey.

Operators are not revising their topline growth or mobile data traffic projections upward as a result of AI growing in and around the RAN. Disappointing 4G/5G returns and the failure to reverse the flattish carrier revenue trajectory is helping to explain the increased focus on what can be controlled — AI RAN is currently all about improving the performance/efficiency and reducing opex.

Since the typical gains demonstrated so far are in the 10% to 30% range for specific features, the AI RAN business case will hinge crucially on the cost and power envelope—the risk appetite for growing capex/opex is limited.

The AI-RAN business case using new hardware is difficult to justify for single-purpose tenancy. However, if the operators can use the resources for both RAN and non-RAN workloads and/or the accelerated computing cost comes down (NVIDIA recently announced ARC-Compact, an AI-RAN solution designed for D-RAN), the TAM could expand. For now, the AI service provider vision, where carriers sell unused capacity at scale, remains somewhat far-fetched, and as a result, multi-purpose tenancy is expected to account for a small share of the broader AI RAN market over the near term.

In short, improving something already done by 10% to 30% is not overly exciting. However, suppose AI embedded in the radio signal processing can realize more significant gains or help unlock new revenue opportunities by improving site utilization and providing telcos with an opportunity to sell unused RAN capacity. In that case, there are reasons to be excited. But since the latter is a lower-likelihood play, the base case expectation is that AI RAN will produce tangible value-add, and the excitement level is moderate — or as the Swedes would say, it is lagom.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Editor’s Note:

ITU-R WP 5D is working on aspects related to AI in the Radio Access Network (RAN) as part of its IMT-2030 (6G) recommendations. IMT-2030 is expected to consider an appropriate AI-native new air interface that uses to the extent practicable, and proved demonstrated actionable AI to enhance the performance of radio interface functions such as symbol detection/decoding, channel estimation etc. An appropriate AI-native radio network would enable automated and intelligent networking services such as intelligent data perception, supply of on-demand capability etc. Radio networks that support applicable AI services would be fundamental to the design of IMT technologies to serve various AI applications, and the proposed directions include on-demand uplink/sidelink-centric, deep edge, and distributed machine learning.

In summary:

- ITU-R WP5D recognizes AI as one of the key technology trends for IMT-2030 (6G).

- This includes “native AI,” which encompasses both AI-enabled air interface design and radio network for AI services.

- AI is expected to play a crucial role in enhancing the capabilities and performance of 6G networks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.2160-0-202311-I!!PDF-E.pdf

McKinsey: AI infrastructure opportunity for telcos? AI developments in the telecom sector

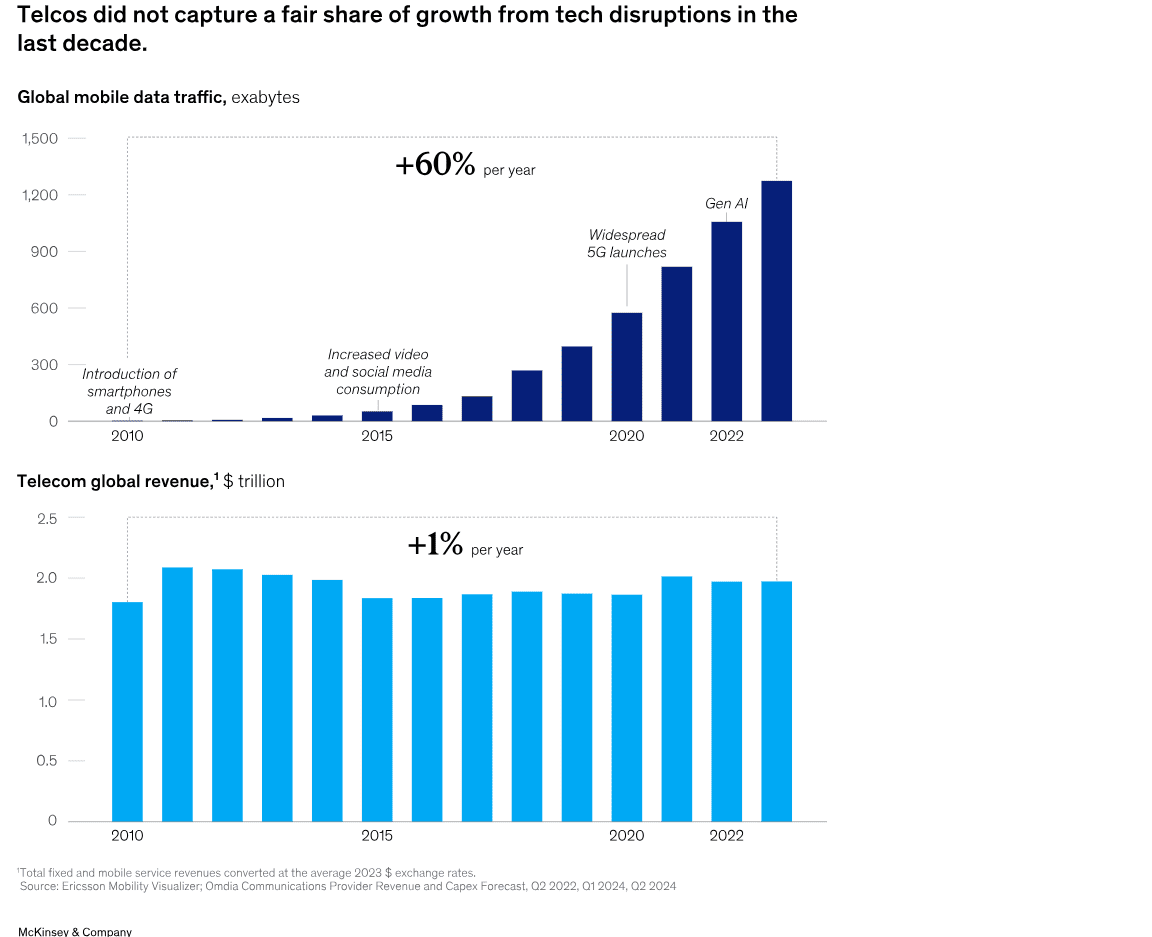

A new report from McKinsey & Company offers a wide range of options for telecom network operators looking to enter the market for AI services. One high-level conclusion is that strategy inertia and decision paralysis might be the most dangerous threats. That’s largely based on telco’s failure to monetize past emerging technologies like smartphones and mobile apps, cloud networking, 5G-SA (the true 5G), etc. For example, global mobile data traffic rose 60% per year from 2010 to 2023, while the global telecom industry’s revenues rose just 1% during that same time period.

“Operators could provide the backbone for today’s AI economy to reignite growth. But success will hinge on effectively navigating complex market dynamics, uncertain demand, and rising competition….Not every path will suit every telco; some may be too risky for certain operators right now. However, the most significant risk may come from inaction, as telcos face the possibility of missing out on their fair share of growth from this latest technological disruption.”

McKinsey predicts that global data center demand could rise as high as 298 gigawatts by 2030, from just 55 gigawatts in 2023. Fiber connections to AI infused data centers could generate up to $50 billion globally in sales to fiber facilities based carriers.

Pathways to growth -Exploring four strategic options:

- Connecting new data centers with fiber

- Enabling high-performance cloud access with intelligent network services

- Turning unused space and power into revenue

- Building a new GPU as a Service business.

“Our research suggests that the addressable GPUaaS [GPU-as-a-service] market addressed by telcos could range from $35 billion to $70 billion by 2030 globally.” Verizon’s AI Connect service (described below), Indosat Ooredoo Hutchinson (IOH), Singtel and Softbank in Asia have launched their own GPUaaS offerings.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Recent AI developments in the telecom sector include:

- The AI-RAN Alliance, which promises to allow wireless network operators to add AI to their radio access networks (RANs) and then sell AI computing capabilities to enterprises and other customers at the network edge. Nvidia is leading this industrial initiative. Telecom operators in the alliance include T-Mobile and SoftBank, as well as Boost Mobile, Globe, Indosat Ooredoo Hutchison, Korea Telecom, LG UPlus, SK Telecom and Turkcell.

- Verizon’s new AI Connect product, which includes Vultr’s GPU-as-a-service (GPUaaS) offering. GPU-as-a-service is a cloud computing model that allows businesses to rent access to powerful graphics processing units (GPUs) for AI and machine learning workloads without having to purchase and maintain that expensive hardware themselves. Verizon also has agreements with Google Cloud and Meta to provide network infrastructure for their AI workloads, demonstrating a focus on supporting the broader AI economy.

- Orange views AI as a critical growth driver. They are developing “AI factories” (data centers optimized for AI workloads) and providing an “AI platform layer” called Live Intelligence to help enterprises build generative AI systems. They also offer a generative AI assistant for contact centers in partnership with Microsoft.

- Lumen Technologies continues to build fiber connections intended to carry AI traffic.

- British Telecom (BT) has launched intelligent network services and is working with partners like Fortinet to integrate AI for enhanced security and network management.

- Telus (Canada) has built its own AI platform called “Fuel iX” to boost employee productivity and generate new revenue. They are also commercializing Fuel iX and building sovereign AI infrastructure.

- Telefónica: Their “Next Best Action AI Brain” uses an in-house Kernel platform to revolutionize customer interactions with precise, contextually relevant recommendations.

- Bharti Airtel (India): Launched India’s first anti-spam network, an AI-powered system that processes billions of calls and messages daily to identify and block spammers.

- e& (formerly Etisalat in UAE): Has launched the “Autonomous Store Experience (EASE),” which uses smart gates, AI-powered cameras, robotics, and smart shelves for a frictionless shopping experience.

- SK Telecom (Korea): Unveiled a strategy to implement an “AI Infrastructure Superhighway” and is actively involved in AI-RAN (AI in Radio Access Networks) development, including their AITRAS solution.

- Vodafone: Sees AI as a transformative force, with initiatives in network optimization, customer experience (e.g., their TOBi chatbot handling over 45 million interactions per month), and even supporting neurodiverse staff.

- Deutsche Telekom: Deploys AI across various facets of its operations

……………………………………………………………………………………………………………………………………………………………………..

A recent report from DCD indicates that new AI models that can reason may require massive, expensive data centers, and such data centers may be out of reach for even the largest telecom operators. Across optical data center interconnects, data centers are already communicating with each other for multi-cluster training runs. “What we see is that, in the largest data centers in the world, there’s actually a data center and another data center and another data center,” he says. “Then the interesting discussion becomes – do I need 100 meters? Do I need 500 meters? Do I need a kilometer interconnect between data centers?”

……………………………………………………………………………………………………………………………………………………………………..

References:

https://www.datacenterdynamics.com/en/analysis/nvidias-networking-vision-for-training-and-inference/

https://opentools.ai/news/inaction-on-ai-a-critical-misstep-for-telecos-says-mckinsey

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Telecom and AI Status in the EU

Major technology companies form AI-Enabled Information and Communication Technology (ICT) Workforce Consortium

AI RAN Alliance selects Alex Choi as Chairman

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

Deutsche Telekom and Google Cloud partner on “RAN Guardian” AI agent

NEC’s new AI technology for robotics & RAN optimization designed to improve performance

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Amdocs and NVIDIA to Accelerate Adoption of Generative AI for $1.7 Trillion Telecom Industry

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

OpenAI partners with G42 to build giant data center for Stargate UAE project

OpenAI, the maker of ChatGPT, said it was partnering with United Arab Emirates firm G42 and others to build a huge artificial-intelligence data center in Abu Dhabi, UAE. It will be the company’s first large-scale project outside the U.S. OpenAI and G42 said Thursday the data center would have a capacity of 1 gigawatt (1 GW) [1], putting it among the most powerful in the world. OpenAI and G42 didn’t disclose a cost for the huge data center, although similar projects planned in the U.S. run well over $10 billion.

………………………………………………………………………………………………………………………………………………………………………..

Note 1. 1 GW of continuous power is enough to run roughly one million top‑end Nvidia GPUs once cooling and power‑conversion overheads are included. That’s roughly the annual electricity used by a city the size of San Francisco or Washington.

“Think of 1MW as the backbone for a mid‑sized national‑language model serving an entire country,” Mohammed Soliman, director of the strategic technologies and cybersecurity programme at the Washington-based Middle East Institute think tank, told The National.

………………………………………………………………………………………………………………………………………………………………………..

The project, called Stargate UAE, is part of a broader push by the U.A.E. to become one of the world’s biggest funders of AI companies and infrastructure—and a hub for AI jobs. The Stargate project is led by G42, an AI firm controlled by Sheikh Tahnoon bin Zayed al Nahyan, the U.A.E. national-security adviser and brother of the president. As part of the deal, an enhanced version of ChatGPT would be available for free nationwide, OpenAI said.

The first 200-megawatt chunk of the data center is due to be completed by the end of 2026, while the remainder of the project hasn’t been finalized. The buildings’ construction will be funded by G42, and the data center will be operated by OpenAI and tech company Oracle, G42 said. Other partners include global tech investor, AI/GPU chip maker Nvidia and network-equipment company Cisco.

Data centers are grouped into three sizes: small, measuring up to about 1,000 square feet (93 square metres), medium, around 10,000 sqft to 50,000 sqft, and large, which are more than 50,000 sqft, according to Data Centre World. On a monthly basis, they are estimated to consume as much as 36,000kWh, 2,000MW and 10MW, respectively.

UAE has at least 17 data centers, according to data compiled by industry tracker DataCentres.com. AFP

The data-center project is the fruit of months of negotiations between the Gulf petrostate and the Trump administration that culminated in a deal last week to allow the U.A.E. to import up to 500,000 AI chips a year, people familiar with the deal have said.

That accord overturned Biden administration restrictions that limited access to cutting-edge AI chips to only the closest of U.S. allies, given concerns that the technology could fall into the hands of adversaries, particularly China.

To convince the Trump administration it was a reliable partner, the U.A.E. embarked on a multipronged charm offensive. Officials from the country publicly committed to investing more than $1.4 trillion in the U.S., used $2 billion of cryptocurrency from Trump’s World Liberty Financial to invest in a crypto company, and hosted the CEOs of the top U.S. tech companies for chats in a royal palace in Abu Dhabi.

As part of the U.S.-U.A.E agreement, the Gulf state “will fund the build-out of AI infrastructure in the U.S. at least as large and powerful as that in the UAE,” David Sacks, the Trump administration’s AI czar, said earlier this week on social media.

U.A.E. fund MGX is already an investor in Stargate, the planned $100 billion network of U.S. data centers being pushed by OpenAI and SoftBank.

Similar accords with other U.S. tech companies are expected in the future, as U.A.E. leaders seek to find other tenants for their planned 5-gigawatt data-center cluster. The project was revealed last week during Trump’s visit to the region, where local leaders showed the U.S. president a large model of the project.

The U.A.E. is betting U.S. tech giants will want servers running near users in Africa and India, slightly shaving off the time it takes to transmit data there.

Stargate U.A.E. comes amid a busy week for OpenAI. On Wednesday, a developer said it secured $11.6 billion in funding to push ahead with an expansion of a data center planned for OpenAI in Texas. OpenAI also announced it was purchasing former Apple designer Jony Ive’s startup for $6.5 billion.

References:

https://www.wsj.com/tech/open-ai-abu-dhabi-data-center-1c3e384d?mod=ai_lead_pos6

https://www.thenationalnews.com/future/technology/2025/05/24/stargate-uae-ai-g42/

Wedbush: Middle East (Saudi Arabia and UAE) to be next center of AI infrastructure boom

Cisco to join Stargate UAE consortium as a preferred tech partner

Cisco to join Stargate UAE consortium as a preferred tech partner

Cisco Systems Inc. today announced the signing of a Memorandum of Understanding (MoU) to join the Stargate UAE consortium as a preferred technology partner. The strategic MoU, signed by Cisco’s Chair and Chief Executive Officer Chuck Robbins together with other consortium partners, G42, OpenAI, Oracle, NVIDIA and SoftBank Group, envisions the construction of an AI data center in Abu Dhabi with a target capacity of 1 GW, with an initial 200 MW capacity to be delivered in 2026.

Photo Credit: Cisco

As a partner in this initiative, Cisco will provide advanced networking, security and observability solutions to accelerate the deployment of next-generation AI compute clusters.

“With the right infrastructure in place, AI can transform data into insights that empower every organization to innovate faster, tackle complex challenges, and deliver tangible outcomes,” said Chuck Robbins, Cisco Chair and CEO. “Cisco is proud to join this consortium to harness the power of AI and deliver the infrastructure that will enable tomorrow’s breakthroughs.”

Today’s announcement follows Robbins’ recent visit to Bahrain, Saudi Arabia, Qatar, and the UAE where Cisco announced a series of strategic initiatives across all phases of the AI transformation in the region. These new initiatives employ Cisco’s trusted technology across the region’s AI infrastructure buildouts, leveraging the company’s deep expertise in networking and security together with longstanding regional partnerships. By fostering the development of secure, AI-powered digital infrastructure and collaborating with key Cisco partners, the company is delivering world-class, trusted technology to the region.

More information on Cisco’s recent announcements in the Middle East is here.

“AI is the most transformative force of our time,” said Nvidia CEO Jensen Huang in a press release Thursday. “With Stargate UAE, we are building the AI infrastructure to power the country’s bold vision – to empower its people, grow its economy, and shape its future.”

The Stargate project, in collaboration with Emirati firm G42, will span 10 square miles and include a 5-gigawatt capacity. As part of the deal, OpenAI and Oracle are slated to manage a 1-gigawatt compute cluster built by G42. The project will include chips from Nvidia, while Cisco Systems will provide connectivity infrastructure.

The companies said an initial 200-megawatt AI cluster should launch next year.

References:

https://www.prnewswire.com/news-releases/cisco-joins-stargate-uae-initiative-302463388.html

https://www.cnbc.com/2025/05/22/stargate-uae-openai-nvidia-oracle.html

More information on Cisco’s recent announcements in the Middle East is here.

Wedbush: Middle East (Saudi Arabia and UAE) to be next center of AI infrastructure boom

España hit with major telecom blackout after power outage April 28th

Spain has suffered its second major telecom outage in two months. A widespread mobile network outage early Tuesday morning May 20th left millions without phone or internet access. The outage, which affected all major operators including Movistar, Orange, Vodafone, Digimobil and O2, began around 2:00 AM CET and worsened by 5:00 AM, disrupting services in major cities such as Madrid, Barcelona, Seville, Valencia, Bilbao and Malaga. Users suffered a complete loss of signal, inability to make calls, receive texts or use mobile data.

Local news site Corriere della Sera had reported that telecom networks across the country were experiencing issues, with the emergency number 112 not working in several areas of the country, including Andalusia, Navarra, and the Basque Country. The outage affected both consumers and enterprises across Spain and took down the “112” Spanish emergency number across multiple communities. Telefonica said it had re-established communications across the country early this afternoon (more below).

The current outage follows a wide-ranging power disruption that affected millions in Spain, Portugal and parts of France on April 28th. That 10-hour-plus electricity outage led to a loss of cellular coverage and mobile data for users. The power failure resulted in mass outages for telco services, with both communications and infrastructure impacted, causing operators to kickstart emergency backup generators to keep services running.

“I can tell you it was much more painful to be without any connectivity for 7 hours – this is what happened – than to be without any electricity for 11 hours,” Oleg Volpin, president of Telefonica Global stated at the recent FutureNet World show in London.

Services were largely restored by the afternoon as landlines and fixed internet services were also reportedly down. “All service has been re-established except for a case or two where teams are working,” Sergio Sanchez, Telefonica’s operations director, said in a video posted online.

References:

https://www.fierce-network.com/wireless/2nd-major-cellular-disruption-weeks-hits-spain

https://www.earthdata.nasa.gov/news/worldview-image-archive/power-outage-spain

Telefónica and Nokia partner to boost use of 5G SA network APIs

Telefónica launches 5G SA in >700 towns and cities in Spain

Wedbush: Middle East (Saudi Arabia and UAE) to be next center of AI infrastructure boom

The next major area of penetration for the AI revolution appears to be the Middle East, Wedbush analysts say in a research note. Analyst Dan Ives said the rapid expansion of artificial intelligence infrastructure in the Middle East marks a “watershed moment” for U.S. tech companies, driven by major developments in Saudi Arabia and the United Arab Emirates. President Trump was recently there to negotiate a deal to have the U.S. tech sector make data centers, supercomputers, software, and overall infrastructure for a massive AI buildout in Saudi Arabia and the U.A.E in the coming years, the analysts say. Saudi Arabia is now due to get 18,000 Nvidia chips for a massive data center while the U.A.E. has Trump’s support to guild the largest data center outside of the U.S., two factors that should start an era of new growth for the U.S. tech sector and be a game-changer for the industry, the analysts say.

“We believe the market opportunity in Saudi Arabia and UAE alone could over time add another $1 trillion to the broader global AI market in the coming year,” Wedbush said. “No Nvidia chips for China… red carpet rollout for the Kingdom,” the firm wrote, contrasting Middle East expansion with chip export restrictions affecting Beijing. Ives called the momentum in the region “a bullish indicator that further shows the U.S. tech’s lead in this 4th Industrial Revolution.” He said that Nvidia CEO Jensen Huang was “the Godfather of AI” and this author totally agrees. Without Nvidia [1.] AI-GPT chips there would be no AI compute servers in the massive data centers now being built.

Wedbush believes Saudi Arabia, the UAE, and Qatar are now on the “priority list” for U.S. tech, with regional demand for AI chips, software, robotics, and data centers expected to surge over the next decade. ……………………………………………………………………………………………………………………………………………………………………………………………

Note 1. Nvidia should see its trend of strong revenue growth continue, but consensus estimates may not fully account for the recent H20 export restriction, Raymond James’ Srini Pajjuri and Grant Li say in a research note. The analysts expect revenue growth between $4 billion and $5 billion during the past six quarters to continue on strong ramps for its Blackwell chip, but they note that the restrictions on the H20 chips present a roughly $4 billion headwind, leaving them to expect limited sequential growth in 2Q. “That said, we fully expect management to sound bullish on 2H given the strong hyperscale capex trends and recent AI diffusion rule changes,” say the analysts. Nvidia is scheduled to report 1QFY26 results on May 28th.

…………………………………………………………………………………………………………………………………………………………………………………………….

Last week, Saudi Arabia unveiled a series of blockbuster AI partnerships with US chip makers, cloud infrastructure providers, and software developers this week, signaling its ambition to become a global AI hub.

Leveraging its $940 billion Public Investment Fund (PIF) and strategic location, Saudi Arabia is forming partnerships to create sovereign AI infrastructure including advanced data centers and Arabic large language models. Google, Oracle, and Salesforce are deepening AI and cloud commitments in Saudi Arabia that will support Vision 2030, a 15-year program to diversify the country’s economy. Within that, the $100 billion Project Transcendence aims to put the kingdom among the top 15 countries in AI by 2030.

The deals include a $20 billion commitment from Saudi firm DataVolt for AI data centers and energy infrastructure in the US and an $80 billion joint investment by Google, DataVolt, Oracle, Salesforce, AMD, and Uber in technologies across both nations, according to a White House fact sheet.

References:

https://finance.yahoo.com/news/wedbush-ives-sees-ai-boom-123710639.html

https://www.wsj.com/tech/tech-media-telecom-roundup-market-talk-87c22df6

US companies are helping Saudi Arabia to build an AI powerhouse

Ericsson and ACES partner to revolutionize indoor 5G connectivity in Saudi Arabia

Ericsson and e& (UAE) sign MoU for 6G collaboration vs ITU-R IMT-2030 framework

e& UAE sets new world record with fastest 5G speed of 30.5Gbps

ITU World Radiocommunication Conference 2023 opens in Dubai, UAE

Charter and Cox Communications in $34.5B merger

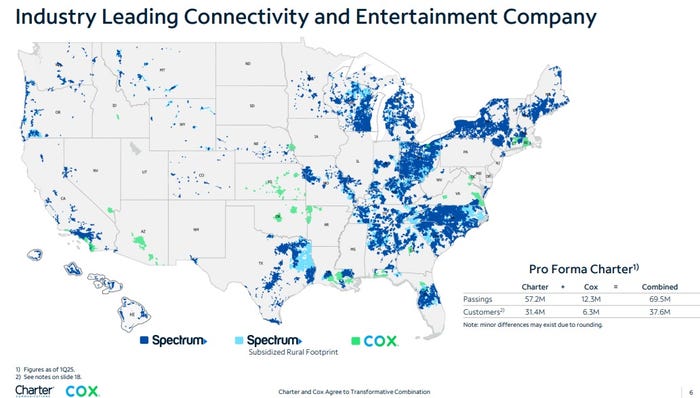

Two of the biggest cable network providers – Charter Communications and Cox Communications – today announced that they have entered into a definitive agreement to combine their businesses in a transformative transaction. The new entity will compete with Comcast for industry leadership in mobile and broadband communications services, seamless video entertainment, and high-quality customer service.

The proposed transaction values Cox Communications at an enterprise value of approximately $34.5 billion1 based on, and at parity with, Charter’s recent enterprise value to 2025 estimated Adjusted EBITDA trading multiple. Within a year after the Charter-Cox deal closes, the combined company, which will be headquartered in Stamford, Conn., plans to change its name to Cox Communications. Spectrum will be the consumer-facing brand name.

Note 1. Comprised of $21.9 billion of equity and $12.6 billion of net debt and other obligations.

Cable internet service, once a reliable engine of high-octane growth that added millions of subscribers a year, is now a grind for the industry’s two heavyweights, Charter and Comcast. Selling a broadband connection remains their main way to reap profits from the internet economy, from streaming to gaming, but that’s not happening now as net broadband losses prevail.

Cable’s pay-TV business is all but dead as video streaming continues to eat away at cable providers’ video packages. So much so that Comcast’s Xfinity brand offers streaming TV packages such as Xfinity StreamSaver, NOW StreamSaver, and Xfinity Stream.

Meanwhile, mobile carriers like Verizon and T-Mobile have heightened the threat with home broadband service beamed over the air. Wireless companies have racked up millions of customers with the offerings, which use 5G technology to provide internet speeds that are competitive with fixed cable lines at lower prices. The pressures of this new landscape have come into focus in recent months: Charter lost 60,000 internet customers in the March quarter, while rival Comcast reported an acceleration in broadband customer losses.

“We have AT&T, Verizon, T-Mobile in 100% of our footprint. We have satellite everywhere we operate,” Charter chief Chris Winfrey said. “It’s significant.”

The deal with Cox gives the combined company more heft in competing for customers, negotiating with programmers and making network investments. It also expands the merged company’s enterprise offerings. Charter has 31.4 million customers while Cox has 6.3 million customers. The companies expect $500 million in annual cost savings within three years of the deal closing.

Source: Charter-Cox merger presentation, May 16, 2025

“Charter’s board and I are excited about this transaction and very supportive of Alex stepping into the board Chairman role,” said Eric Zinterhofer, Chairman of Charter’s Board of Directors. “The combination of Cox Communications with Charter is an excellent outcome for our collective shareholders, customers, employees and the industry.”

Photo: Jeff Roberson/Associated Press

“We’re honored that the Cox family has entrusted us with its impressive legacy and are excited by the opportunity to benefit from the terrific operating history and community leadership of Cox,” said Chris Winfrey, President and CEO of Charter. “Cox and Charter have been innovators in connectivity and entertainment services – with decades of work and hundreds of billions of dollars invested to build, upgrade, and expand our complementary regional networks to provide high-quality internet, video, voice and mobile services. This combination will augment our ability to innovate and provide high-quality, competitively priced products, delivered with outstanding customer service, to millions of homes and businesses. We will continue to deliver high-value products that save American families money, and we’ll onshore jobs from overseas to create new, good-paying careers for U.S. employees that come with great benefits, career training and advancement, and retirement and ownership opportunities.”

Cox is a major player in the internet and pay-TV business, but is still dwarfed by Charter and Comcast. The Atlanta-based family business has opted to stay private for the past two decades as other cable and wireless companies swelled through ever-bigger acquisitions. Cox is the longest continuous cable network operator in the industry, having acquired its first cable television franchise in 1962. “Our family has always believed that investing for the long-term and staying committed to the best interests of our customers, employees and communities is the best recipe for success,” said Alex Taylor, Chairman and CEO of Cox Enterprises. “In Charter, we’ve found the right partner at the right time and in the right position to take this commitment to a higher level than ever before, delivering an incredible outcome for our customers, employees, suppliers and the local communities we serve.”

Cox will eventually launch a range of products under the Spectrum brand, including Spectrum’s Advanced WiFi, Spectrum Mobile, the Spectrum TV app and Xumo, a streaming platform operated by a joint venture of Charter and Comcast.

Cox launched the Xumo Stream Box last fall. Cox also operates Cox Mobile, a mobile service based on an MVNO agreement with Verizon. Charter’s Spectrum Mobile service is also based on a Verizon MVNO. New Street’s Chaplin presumes that Cox’s mobile business will move over the Charter MVNO on Verizon and get better overall terms.

It’s not immediately clear how Cox’s network upgrade plans will change following the combination. Cox recently announced it would deploy a virtual cable modem termination system (vCMTS) from Vecima. Charter has tapped Harmonic as its initial vCMTS partner for a multi-tiered hybrid fiber/coax (HFC) upgrade.

“You really do need scale in this business,” said Andrew Cole, executive chairman of Glow Services, a telecom-focused software company, and board member of European cable company Liberty Global. Liberty Global, like Charter, is part of cable mogul John Malone’s communications empire. “The coming-together of cable in its entirety over time will happen because that’s the only way they can compete against these giants, which are the telcos,” Cole added.

Details of the Merger:

Charter will acquire Cox Communications’ commercial fiber and managed IT and cloud businesses, and Cox Enterprises will contribute Cox Communications’ residential cable business to Charter Holdings, an existing subsidiary partnership of Charter. Cox’s assets have been valued using Cox’s 2025 estimated Adjusted EBITDA, multiplied by Charter’s total enterprise value to 2025 estimated Adjusted EBITDA trading multiple of 6.44x, based on:

- Wall Street consensus for Charter’s 2025 Adjusted EBITDA, and

- Charter’s (NASDAQ: CHTR) 60-day Volume Weighted Average Price of $353.64, as of 4/25/25.

As consideration in the transaction, Cox Enterprises will receive:

- $4 billion in cash,

- $6 billion notional amount of convertible preferred units in Charter’s existing partnership, which pay a 6.875% coupon, and which are convertible into Charter partnership units, which are then exchangeable for Charter common shares, and

- Approximately 33.6 million common units in Charter’s existing partnership, with an implied value of $11.9 billion1, and which are exchangeable for Charter common shares.

Based on Charter’s share count as of March 31, 2025, at the closing, Cox Enterprises will own approximately 23% of the combined entity’s fully diluted shares outstanding, on an as-converted, as-exchanged basis, and pro forma for the closing of the Liberty Broadband merger. The transaction is subject to customary closing conditions, including the receipt of regulatory and Charter shareholder approvals. The combined entity will assume Cox’s approximately $12 billion in outstanding debt.

Within a year after the closing, the combined company will change its name to Cox Communications. Spectrum will become the consumer-facing brand within the communities Cox serves. The combined company will remain headquartered in Stamford, CT, and will maintain a significant presence on Cox’s Atlanta, GA campus following the closing.

Governance:

Following the closing, Mr. Winfrey will continue in his current role as President & CEO, and board member. Mr. Taylor will join the board as Chairman, and Mr. Zinterhofer will become the lead independent director on Charter’s board. Cox will have the right to nominate an additional two board members to Charter’s 13-member board. Advance/Newhouse, another storied cable innovator, which contributed its operations to Charter’s partnership in 2016, will retain its two board nominees.

It is expected that Charter’s combination with Cox will be completed contemporaneously with the previously announced Liberty Broadband merger. As a result, Liberty Broadband will cease to be a direct shareholder in Charter and will no longer designate directors for election to the Charter Board. Accordingly, the three current Liberty Broadband nominees on Charter’s board will resign at closing. Liberty Broadband shareholders will receive direct interests in Charter as a result of the Liberty Broadband merger.

Upon closing, Charter, Cox Enterprises and Advance/Newhouse will enter into an amended and restated stockholders agreement, which will provide for preemptive rights over certain issuances, voting caps and required participation in Charter common share repurchases at specified acquisition caps, and transfer restrictions among other shareholder governance matters.

Community Leadership:

The Cox family of businesses was founded 127 years ago on the promise of “building a better future for the next generation.” Both Cox and Charter want to see that intent reinforced in this new partnership. The Cox family’s commitment to supporting its communities through the philanthropic work of the James M. Cox Foundation will be continued by Charter’s $50 million grant to establish a separate foundation that will encourage community leadership and support where the combined company does business. Additionally, Charter will make an initial $5 million investment to establish an employee relief fund that mirrors the Cox Employee Relief Fund, which Cox and the Cox family created in 2005 to help employees through times of hardships such as natural disasters or other unexpected life challenges.

Strategic and Customer Objectives:

Following the closing, the combined company’s industry-leading products will launch across Cox’s approximately 12 million passings and 6 million existing customers, under the Spectrum brand – including Spectrum’s Advanced WiFi, Spectrum Mobile with Mobile Speed Boost, the Spectrum TV App, Seamless Entertainment and Xumo – and which, when coupled with Spectrum’s transparent and customer-focused pricing and packaging structure, will provide Cox customers with enhanced flexibility and convenience, as well as the choice to pay less for new Spectrum bundled services or to keep their current plans.

The new combination will create a best-in-class customer service model. That model will integrate Cox’s rich service history with Charter’s 100% U.S.-based, employee-focused service and sales model and industry-leading customer commitments. Charter customers will benefit from Cox Business’ well-known industry leadership in business telecommunications, including Segra and RapidScale.

Charter and Cox employees will benefit from investments in employee-focused technology and AI tools and an expansion of Charter’s self-progression career advancement model for promotions and standardized pay increases.

Specific benefits from the combination include:

- The combined company will bring together the best products and practices of each company to benefit all of the combined company’s customers and employees.

- The combined company will be better positioned to aggressively compete in an expanding and dynamic marketplace that includes:

- Larger, national broadband companies with wireline and wireless capabilities,

- Regional wireline and mobile competitors,

- Global video distribution providers and platforms, and satellite broadband companies.

- The combined company also will be better positioned for continued and expanded investment and innovation:

- In mobile, given the increased footprint;

- In video, where Big Tech currently leverages global scale in content and distribution;

- In advertising, where the transaction will expand opportunities for advertisers large and small, national, regional, and local, bringing new competition in an area now dominated by Big Tech;

- In the business sector, where the combined company will have additional coverage, yet still remain a regional player competing against larger, national competitors;

- And through greater product innovation in areas including AI tools and small cell deployment of licensed, shared licensed and unlicensed spectrum, bringing new and advanced services and capabilities to consumers and businesses.

- Cox customers will gain access to Charter’s simple and transparent pricing and packaging structure, including no annual contracts for any residential services, which means customers are free to change service providers at any time, with no risk of early termination fees.

- Cox customers also will benefit from Charter’s industry-first Customer Service Commitments, which include:

- Charter’s 100% U.S.-based customer service team available 24/7.

- Charter has committed to fixing service disruptions quickly, including same-day technician dispatch when requested before 5:00 pm; if not, the next day.

- Charter provides customers credits for outages that last longer than two hours.

- This proposed transaction puts America first by returning jobs from overseas and creating new, good-paying customer service and sales careers.

- The combined company will adopt Charter’s sales and service workforce model, which will fully return Cox’s customer service function to the U.S.

- All employees will earn a starting wage of at least $20 per hour and will gain access to Charter’s industry-leading benefits, which include:

- Comprehensive medical, dental, and vision coverage for all full-time and part-time employees; Charter has absorbed the full premium cost increase for the last 12 years.

- Market-leading retirement benefits, including a 401(k) plan with a company match up to 6% of their eligible pay, with an additional 3% contribution available for most employees.

- Free or discounted Spectrum Mobile, TV and Internet service.

- Multiple opportunities for upward advancement and to build careers, including through tuition-free undergraduate degree and certificate programs via flexible online learning; self-progression programs with standardized pay raises, and formal development programs, such as the Broadband Field Technician Apprenticeship program.

- Employee Stock Purchase Plan, which provides frontline employees the ability to purchase stock and receive a matching grant of Charter Restricted Stock Units (RSUs) up to 1 for 1 based on years of service, offering employees another meaningful incentive to grow their careers with Charter.

- The combined company will expand Charter’s award-winning local Spectrum News stations in the Cox footprint, bringing hyper-local, unbiased news coverage to more communities. The combined company will not own any national programming.

- The combined company will retain its industry leadership in protecting the security of U.S. communications networks from foreign threats.

End Note:

Adding to the near-term uncertainty for internet service providers like Charter, the Trump administration put Biden’s $42.5 billion broadband-construction program on hold. The Broadband Equity, Access, and Deployment (BEAD) Program, is a key component of the “Internet for All” initiative, aiming to expand high-speed internet access across the United States. The program, funded by the Bipartisan Infrastructure Law, allocates grants to states and territories to deploy or upgrade broadband networks, ensuring reliable, affordable, high-speed internet service for all.The Commerce Department has frozen grants to state authorities that were set to start awarding contracts this year while it reviews the program’s criteria.

References:

https://www.lightreading.com/cable-technology/cablepalooza-charter-and-cox-strike-34-5b-merger

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Cox Communications commits to symmetrical 10-Gig; many upgrade paths are possible

T‑Mobile and EQT close JV to acquire FTTH network provider Lumos

FCC to investigate Dish Network’s compliance with federal requirements to build a nationwide 5G network

In a letter to Charlie Ergen, the chairman and co-founder of network operator EchoStar, Federal Communications Commission (FCC) chairman Brendan Carr wrote that the agency’s staff would investigate the company’s compliance with requirements to build a nationwide 5G network as per the terms of its federal spectrum licenses. EchoStar owns both Dish Network and Boost Mobile’s wireless service. Dish has said its 5G network covers more than 268 million people and has met all of its regulatory requirements.

In 2019, the U.S. government set several construction milestones for Dish Network to maintain cellular licenses worth billions of dollars. The company agreed to meet specific buildout obligations in connection with a number of spectrum licenses across several different bands. In particular, the FCC agreed to relax some of EchoStar’s then-existing buildout obligations in exchange for EchoStar’s commitment to put its licensed spectrum to work deploying a nationwide 5G broadband network. EchoStar promised—among other things—that its network would cover, by June 14, 2025, at least 70% of the population within each of its licensed geographic areas for its AWS-4 and 700 MHz licenses, and at least 75% of the population within each of its licensed geographic areas for its H Block and 600 MHz licenses.

“The FCC structured the buildout obligations to prevent spectrum warehousing and to ensure that Americans would gain broader access to high-speed wireless services, including in underserved and rural areas.”

Ergen said that the company has worked collaboratively with FCC leaders since it launched its first pay-TV satellite more than 30 years ago. He added that EchoStar’s network creates American jobs and furthers a critical Trump administration priority of ensuring “the United States is at the forefront of wireless leadership and that our infrastructure is free of Chinese vendors.” Full text of his statement is below.

Ergen is reportedly working to pivot his satellite TV business from a declining pay-TV model to a “direct-to-device” business that connects smartphones from space, among other services. Carr laid out plans for the agency to seek public comment on how mobile-satellite services could use some spectrum that EchoStar currently holds. EchoStar is among a group of satellite companies that already hold licenses to provide mobile-device links, though they lack the dense network of modern satellites that Starlink has at its disposal.

SpaceX said in an April letter that EchoStar’s spectrum in the 2 Gigahertz band “remains ripe for sharing among next-generation satellite systems.” The company urged the commission to launch a new rule-making process to add new competitors to the band. EchoStar has accused SpaceX of a spectrum land grab.

Separately, Dish Network has spent years wiring thousands of cellphone towers to help Boost become a wireless operator that could rival AT&T, Verizon and T-Mobile, but the project has been slow-going. Boost’s subscriber base has shrunk in the five years since Ergen bought the brand from Sprint so it is not at all competitive with its big three U.S. cellular rivals.

Dish Network under FCC microscope, Art by Midjourney for Fierce Network

……………………………………………………………………………………………………………………………………………………………….

Charlie Ergen’s Statement in Response to FCC Letter:

“We have worked collaboratively with FCC leaders since we launched our first DBS satellite more than 30 years ago. Today, we are proud to have invested tens of billions to deploy the world’s largest 5G Open RAN network – primarily using American vendors – across 24,000 5G sites, to offer broadband service to over 268 million people nationwide. Through this deployment, which is possible thanks to scores of tower climbers, engineers, and partners, we have met or exceeded all of the commitments we have entered into with the FCC to date. And our work is not yet finished as we continue to deploy and invest in our network. Not only does our network create American jobs and a competitive alternative to incumbent wireless carriers, it also furthers another critical Trump Administration priority: deploying Open RAN to ensure the United States is at the forefront of wireless leadership and that our infrastructure is free of Chinese vendors. Thanks to our nationwide pricing model and agreements with partner carriers, Boost Mobile is available at affordable prices to Americans across the country – including in rural and hard to reach communities. Indeed, our new buildout deadlines – which are consistent with FCC practice under the past two Administrations where the Wireless Bureau granted hundreds of buildout extensions – came with additional, substantial pro-competitive commitments that EchoStar has fulfilled. As we continue to invest in and expand our terrestrial network deployment, we are also working to provide Open RAN direct-to-device satellite technology, bringing additional connectivity to all Americans in the U.S. and around the world.

EchoStar worked tirelessly to establish 3GPP NTN standard for D2D. With D2D 3GPP standards now complete, EchoStar has the global capability in terms of expertise, spectrum, and ITU priority to bring this to fruition. We are now testing new S-band services in both North America and Europe, and this year we launched a LEO satellite with several more planned in the coming months. We look forward to continuing this important work to help the Administration and FCC continue to deliver for the American people.”

References:

https://prod-i.a.dj.com/public/resources/documents/Carr-Ergen-letter.pdf

https://www.fierce-network.com/wireless/fcc-questions-echostar-about-how-its-using-5g-spectrum

https://www.tipranks.com/news/the-fly/echostar-confirms-fcc-letter-to-company-ergen-makes-statement

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network to FCC on its “game changing” OpenRAN deployment

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

Sources: AI is Getting Smarter, but Hallucinations Are Getting Worse

Recent reports suggest that AI hallucinations—instances where AI generates false or misleading information—are becoming more frequent and present growing challenges for businesses and consumers alike who rely on these technologies. More than two years after the arrival of ChatGPT, tech companies, office workers and everyday consumers are using A.I. bots for an increasingly wide array of tasks. But there is still no way of ensuring that these systems produce accurate information.

A groundbreaking study featured in the PHARE (Pervasive Hallucination Assessment in Robust Evaluation) dataset has revealed that AI hallucinations are not only persistent but potentially increasing in frequency across leading language models. The research, published on Hugging Face, evaluated multiple large language models (LLMs) including GPT-4, Claude, and Llama models across various knowledge domains.

“We’re seeing a concerning trend where even as these models advance in capability, their propensity to hallucinate remains stubbornly present,” notes the PHARE analysis. The comprehensive benchmark tested models across 37 knowledge categories, revealing that hallucination rates varied significantly by domain, with some models demonstrating hallucination rates exceeding 30% in specialized fields.

Hallucinations are when AI bots produce fabricated information and present it as fact. Photo Credit: More SOPA Images/LightRocket via Getty Images

Today’s A.I. bots are based on complex mathematical systems that learn their skills by analyzing enormous amounts of digital data. These systems use mathematical probabilities to guess the best response, not a strict set of rules defined by human engineers. So they make a certain number of mistakes. “Despite our best efforts, they will always hallucinate,” said Amr Awadallah, the chief executive of Vectara, a start-up that builds A.I. tools for businesses, and a former Google executive.

“That will never go away,” he said. These AI bots do not — and cannot — decide what is true and what is false. Sometimes, they just make stuff up, a phenomenon some A.I. researchers call hallucinations. On one test, the hallucination rates of newer A.I. systems were as high as 79%.

Amr Awadallah, the chief executive of Vectara, which builds A.I. tools for businesses, believes A.I. “hallucinations” will persist.Credit…Photo credit: Cayce Clifford for The New York Times

AI companies like OpenAI, Google, and DeepSeek have introduced reasoning models designed to improve logical thinking, but these models have shown higher hallucination rates compared to previous versions. For more than two years, those companies steadily improved their A.I. systems and reduced the frequency of these errors. But with the use of new reasoning systems, errors are rising. The latest OpenAI systems hallucinate at a higher rate than the company’s previous system, according to the company’s own tests.

For example, OpenAI’s latest models (o3 and o4-mini) have hallucination rates ranging from 33% to 79%, depending on the type of question asked. This is significantly higher than earlier models, which had lower error rates. Experts are still investigating why this is happening. Some believe that the complex reasoning processes in newer AI models may introduce more opportunities for errors.

Others suggest that the way these models are trained might be amplifying inaccuracies. For several years, this phenomenon has raised concerns about the reliability of these systems. Though they are useful in some situations — like writing term papers, summarizing office documents and generating computer code — their mistakes can cause problems. Despite efforts to reduce hallucinations, AI researchers acknowledge that hallucinations may never fully disappear. This raises concerns for applications where accuracy is critical, such as legal, medical, and customer service AI systems.

The A.I. bots tied to search engines like Google and Bing sometimes generate search results that are laughably wrong. If you ask them for a good marathon on the West Coast, they might suggest a race in Philadelphia. If they tell you the number of households in Illinois, they might cite a source that does not include that information. Those hallucinations may not be a big problem for many people, but it is a serious issue for anyone using the technology with court documents, medical information or sensitive business data.

“You spend a lot of time trying to figure out which responses are factual and which aren’t,” said Pratik Verma, co-founder and chief executive of Okahu, a company that helps businesses navigate the hallucination problem. “Not dealing with these errors properly basically eliminates the value of A.I. systems, which are supposed to automate tasks for you.”

For more than two years, companies like OpenAI and Google steadily improved their A.I. systems and reduced the frequency of these errors. But with the use of new reasoning systems, errors are rising. The latest OpenAI systems hallucinate at a higher rate than the company’s previous system, according to the company’s own tests.

The company found that o3 — its most powerful system — hallucinated 33% of the time when running its PersonQA benchmark test, which involves answering questions about public figures. That is more than twice the hallucination rate of OpenAI’s previous reasoning system, called o1. The new o4-mini hallucinated at an even higher rate: 48 percent.

When running another test called SimpleQA, which asks more general questions, the hallucination rates for o3 and o4-mini were 51% and 79%. The previous system, o1, hallucinated 44% of the time.

In a paper detailing the tests, OpenAI said more research was needed to understand the cause of these results. Because A.I. systems learn from more data than people can wrap their heads around, technologists struggle to determine why they behave in the ways they do.

“Hallucinations are not inherently more prevalent in reasoning models, though we are actively working to reduce the higher rates of hallucination we saw in o3 and o4-mini,” a company spokeswoman, Gaby Raila, said. “We’ll continue our research on hallucinations across all models to improve accuracy and reliability.”

Tests by independent companies and researchers indicate that hallucination rates are also rising for reasoning models from companies such as Google and DeepSeek.

Since late 2023, Mr. Awadallah’s company, Vectara, has tracked how often chatbots veer from the truth. The company asks these systems to perform a straightforward task that is readily verified: Summarize specific news articles. Even then, chatbots persistently invent information. Vectara’s original research estimated that in this situation chatbots made up information at least 3% of the time and sometimes as much as 27%.

In the year and a half since, companies such as OpenAI and Google pushed those numbers down into the 1 or 2% range. Others, such as the San Francisco start-up Anthropic, hovered around 4%. But hallucination rates on this test have risen with reasoning systems. DeepSeek’s reasoning system, R1, hallucinated 14.3% of the time. OpenAI’s o3 climbed to 6.8%.

Sarah Schwettmann, co-founder of Transluce, said that o3’s hallucination rate may make it less useful than it otherwise would be. Kian Katanforoosh, a Stanford adjunct professor and CEO of the upskilling startup Workera, told TechCrunch that his team is already testing o3 in their coding workflows, and that they’ve found it to be a step above the competition. However, Katanforoosh says that o3 tends to hallucinate broken website links. The model will supply a link that, when clicked, doesn’t work.

AI companies are now leaning more heavily on a technique that scientists call reinforcement learning. With this process, a system can learn behavior through trial and error. It is working well in certain areas, like math and computer programming. But it is falling short in other areas.

“The way these systems are trained, they will start focusing on one task — and start forgetting about others,” said Laura Perez-Beltrachini, a researcher at the University of Edinburgh who is among a team closely examining the hallucination problem.

Another issue is that reasoning models are designed to spend time “thinking” through complex problems before settling on an answer. As they try to tackle a problem step by step, they run the risk of hallucinating at each step. The errors can compound as they spend more time thinking.

“What the system says it is thinking is not necessarily what it is thinking,” said Aryo Pradipta Gema, an A.I. researcher at the University of Edinburgh and a fellow at Anthropic.

New research highlighted by TechCrunch indicates that user behavior may exacerbate the problem. When users request shorter answers from AI chatbots, hallucination rates actually increase rather than decrease. “The pressure to be concise seems to force these models to cut corners on accuracy,” the TechCrunch article explains, challenging the common assumption that brevity leads to greater precision.

References:

https://www.nytimes.com/2025/05/05/technology/ai-hallucinations-chatgpt-google.html

The Confidence Paradox: Why AI Hallucinations Are Getting Worse, Not Better

https://www.forbes.com/sites/conormurray/2025/05/06/why-ai-hallucinations-are-worse-than-ever/

https://techcrunch.com/2025/04/18/openais-new-reasoning-ai-models-hallucinate-more/