Deutsche Telekom offers 5G mmWave for industrial customers in Germany on 5G SA network

Deutsche Telekom (DT) has successfully trialed 5G millimeter wave (mmWave) frequencies at 26 gigahertz (GHz) with industrial use cases and is now offering them commercially to industrial customers. For the customer Ger4tech Mechatronik Center, autonomous industrial machines and robots were networked with a router in the 5G campus environment of the Werner-von-Siemens Centre for Industry and Science in Berlin. In addition to the 5G standalone (SA) network in the industrial spectrum at 3.7 GHz, this router also supports mmWave spectrum for the first time. With low latency times of three to four milliseconds RTT (round trip time) and a data rate of over 4 gigabits per second in download and 2 gigabits in upload, mmWave has huge potential in data-intensive applications in the manufacturing industry. The 5G mmWave communications are enabled by Telit Cinterion, a global end-to-end IoT solutions provider.

5G mmWave is playing an increasingly important role in wireless communication technology and imaging, among others. It is characterized by short coverage range and high bandwidth and speeds. It has enormous potential for development within 5G campus networks and for applications in the field of autonomous vehicles and the manufacturing industry. The special ability of mmWave lies in its ability to transmit large amounts of data in real time. The frequency spectrum around 26 GHz is allocated exclusively to interested parties in Germany by the Federal Network Agency. It can currently only be used for local applications.

“It is important for our industrial customers in the age of artificial intelligence to be able to upload data from machines and thus make it available and analyzable in real time,” explains Klaus Werner, Managing Director Business Customers at Telekom Deutschland GmbH. “This is the only way for companies to introduce AI applications sensibly and efficiently and derive great benefits for their business,” he added.

“We’re enabling customers to access unparalleled levels of efficiency, productivity and innovation. Through the seamless integration of 5G mmWave into their operations, every device and process can achieve connectivity at an unprecedented scale,” said Marco Contento, VP of Product Management, Mobile Broadband at Telit Cinterion. “Collaboratively, we’re helping to pave the way for industries to streamline operations, anticipate maintenance needs, and a multitude of future possibilities.”

The 5G standalone campus network at the Werner-von-Siemens Centre operates separately from Telekom’s public mobile network. The entire infrastructure, from the antennas and active system technology to the core network, comes from Ericsson. Based on this network, a fleet of autonomously driving and operating robots works on various use cases at the center. The 5G standalone network is often sufficient to control the robots. The 5G millimeter waves come into play when the requirements for communication and data transmission increase, and therefore also when solving more complex tasks. For example, in a computer vision application: the robot picks up an order and checks whether the ordered goods are complete on the way to the next destination. If there is a discrepancy, it immediately reorders the goods.

In addition to these, many other scenarios are mapped in the Werner-von-Siemens Centre. Here, industry, research institutions (including TU Berlin and Fraunhofer), small and medium-sized enterprises and start-ups work on practical solutions for companies – including for autonomous production logistics and other challenges in industrial manufacturing.

In the UK, regulator Ofcom launched a new consultation in April and the sector is awaiting the details of when and in what form an auction will take place.

Additional Resources:

About Ger4Tech Mechatronik Center

About Telit Cinterion

……………………………………………………………………………………………………………………………………………………

References:

https://www.telecoms.com/5g-6g/deutsche-telekom-looking-to-flog-5g-mmwave-to-industrial-sector

Daryl Schoolar: 5G mmWave still in the doldrums!

Momentum builds for wireless telco- satellite operator engagements

Over the past two years, the wireless telco-satellite market has seen significant industry-wide growth, driven by the integration of Non-Terrestrial Networks (NTN) in 5G New Radio as part of 3GPP Release 17. GSMA Intelligence reports that 91 network operators, representing about 5 billion global connections (60% of the total mobile market), have partnered with satellite operators. Although the regulatory landscape and policy will influence the commercial launch of these services in various regions, the primary objective is to achieve ubiquitous connectivity through a blend of terrestrial and non-terrestrial networks.

Recent developments include:

- AT&T and AST SpaceMobile have signed a definitive agreement extending until 2030 to create the first fully space-based broadband network for mobile phones. This summer, AST SpaceMobile plans to deliver its first commercial satellites to Cape Canaveral for launch into low Earth orbit. These initial five satellites will help enable commercial service that was previously demonstrated with several key milestones. These industry first moments during 2023 include the first voice call, text and video call via space between everyday smartphones. The two companies have been on this path together since 2018. AT&T will continue to be a critical collaborator in this innovative connectivity solution. Chris Sambar, Head of Network for AT&T, will soon be appointed to AST SpaceMobile’s board of directors. AT&T will continue to work directly with AST SpaceMobile on developing, testing, and troubleshooting this technology to help make continental U.S. satellite coverage possible.

- SpaceX owned Starlink has officially launched its commercial satellite-based internet service in Indonesia and received approvals to offer the service in Malaysia and the Philippines. Starlink is already available in Southeast Asia in Malaysia and the Philippines. Indonesia, the world’s largest archipelago with more than 17,000 islands, faces an urban-rural connectivity divide where millions of people living in rural areas have limited or no access to internet services. Starlink secured VSAT and ISP business permits earlier in May, first targeting underdeveloped regions in remote locations.Jakarta Globe reported the service costs IDR750,000 ($46.95) per month, twice the average spent in the country on internet service. Customers need a VSAT (very small aperture terminal) device or signal receiver station to use the solution.Internet penetration in Indonesia neared 80% at the end of 2023, data from Indonesian Internet Service Providers Association showed. With about 277 million people, Indonesia has the fourth largest population in the world. The nation is made up of 17,000 islands, which creates challenges in deploying mobile and fixed-line internet nationwide.Starlink also in received approvals to offer the service in Malaysia and the Philippines. The company aims to enable SMS messaging directly from a network of low Earth orbit satellites this year followed by voice and data starting in 2025. In early January, parent SpaceX launched the first of six satellites to deliver mobile coverage.

- Space X filed a petition with the FCC stating that it “looks forward to launching commercial direct-to-cellular service in the United States this fall.” That will presumably be only for text messages, because the company has stated that ONLY text will available in 2024 via Starlink. Voice and data won’t be operational until 2025. Importantly, SpaceX did not identify the telco who would provide Direct-to Cell satellite service this fall.

In August 2022, T-Mobile and SpaceX announced their plans to expand cellular service in the US using low-orbit satellites. The service aims to provide direct-to-cell services in hard-to-reach and underserved areas such as national parks, uninhabited areas such as deserts and mountain ranges, and even territorial waters. Traditional land-based cell towers cannot cover most of these regions.

- SpaceX said that “supplemental coverage from space (“SCS”) will enable ubiquitous mobile coverage for consumers and first responders and will set a strong example for other countries to follow.” Furthermore, SpaceX said the “FCC should reconsider a single number in the SCS Order—namely, the one-size-fits-all aggregate out-of-band power flux-density (“PFD”) limit of -120 dBW/m2 /MHz that it adopted in the new Section 25.202(k) for all supplemental coverage operations regardless of frequency band.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AT&T, AST SpaceMobile draw closer to sat-to-phone launch

Starlink sat-service launches in Indonesia

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Harnessing the Power of 5G

Revolutionizing Telecom with Programmable Networks and APIs

By Ameer Shohail L with Ajay Lotan Thakur

Ameer Shohail is an experienced ICT Solutions Design Specialist and IEEE Senior Member at a Tier 1 telecom operator in the Middle East, specializing in advanced wireless technologies.

Ajay Lotan Thakur is a Senior IEEE Member, IEEE Techblog Editorial Board Member (who edits/adds to blog posts), BCS Fellow, TST Member of ONF’s open source Aether (Private 5G) Project, Cloud Software Architect at Intel Canada.

Abstract

The telecom industry is on the verge of a significant transformation driven by the convergence of 5G/Beyond 5G and programmable networks. This article explores the immense potential of these advancements, emphasizing the shift from rigid infrastructures to dynamic platforms that offer their capabilities as services. We delve into the importance of programmable networks, the Network as a Service (NaaS) model, and the critical role of APIs. The article highlights the Network Exposure Function (5G CORE – NEF) and its role in creating new revenue streams for CSPs and fostering a thriving digital ecosystem. The TM (TeleManagement) Forum’s emphasis on service lifecycle management and the collective effort towards a digitally interconnected future are key themes, inviting all stakeholders to embrace this transformative journey.

Introduction: The Paradigm Shift in Telecom

The telecom industry is undergoing a profound transformation from traditional infrastructures to more dynamic and flexible systems. This shift is essential to meet the increasing demands for faster, more reliable, and scalable network services. Innovation and collaboration are now crucial drivers of industry growth, enabling communication service providers (CSPs) to leverage cutting-edge technologies to enhance their offerings and stay competitive.

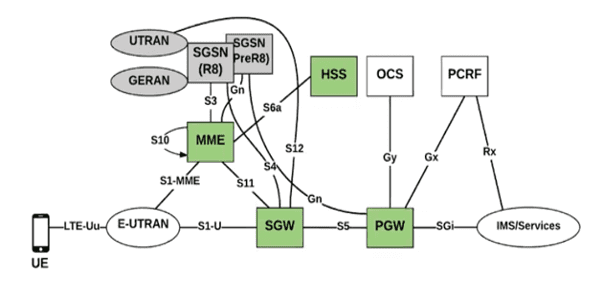

Figure1: EPS Architecture

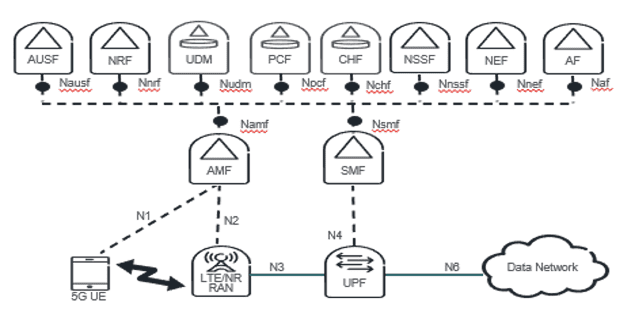

Figure2: 5GS Architecture

Programmable Networks and NaaS: The New Frontier

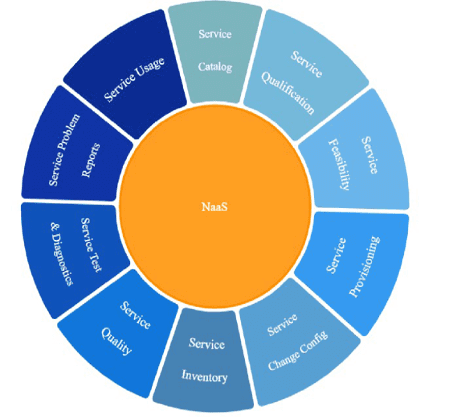

Programmable networks and Network as a Service (NaaS) represent the next frontier in telecom innovation. These technologies allow CSPs to offer network capabilities as customizable services, enhancing flexibility and efficiency. The TM Forum’s Open Digital Architecture (ODA) is central to this transformation, providing a standardized framework for the seamless integration of network services. By adopting ODA, CSPs can decouple network functions from the underlying hardware, enabling greater agility and innovation

Figure3: NaaS function wheel, depicting various NaaS functions offered to consumers, REF[1]

APIs: The Engine of Innovation

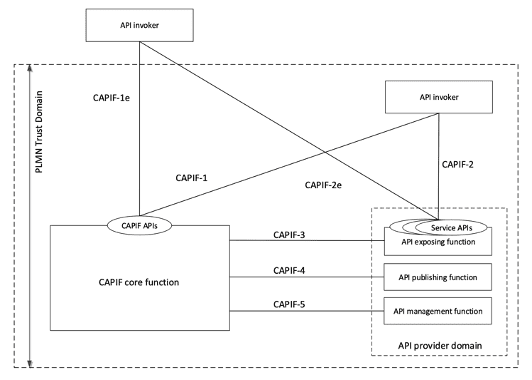

APIs are fundamental to the telecom industry’s transformation, empowering developers to create innovative services that leverage network capabilities. The Common API Framework (CAPIF) by 3GPP standardizes API usage across various network functions, ensuring smooth and secure communication. This framework acts as a universal language, facilitating collaboration and enhancing security across diverse applications and industries.

Figure4: Functional model for the CAPIF

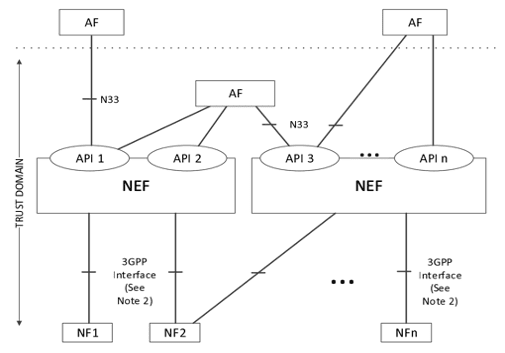

Network Exposure Function (NEF): Unlocking New Potential

3GPP 5G Core architecture

5GC (Figure2) is the new 3GPP standard for core networks defining how the core network should evolve to support the needs of 5G New Radio (NR) and the advanced use cases enabled by it. The figure below depicts NEF representation in the non-roaming architecture, using 5G reference point representation.

Figure5: Network Exposure Function in reference point representation REF[4]

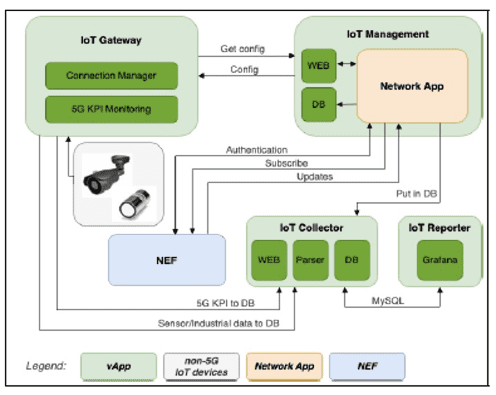

The Network Exposure Function (NEF) provides a secure, standardized method for exposing APIs, enabling CSPs to broaden their service offerings and explore new revenue streams. NEF is essential for fostering a thriving digital ecosystem, driving innovation, and economic growth in the telecom sector. Figure below depicts how NEF plays a role with the IoT ecosystem in enabling the communication exchange through API.

Figure6: Illustrates NEF and its role in enabling the network and external applications to exchange information, REF[5]

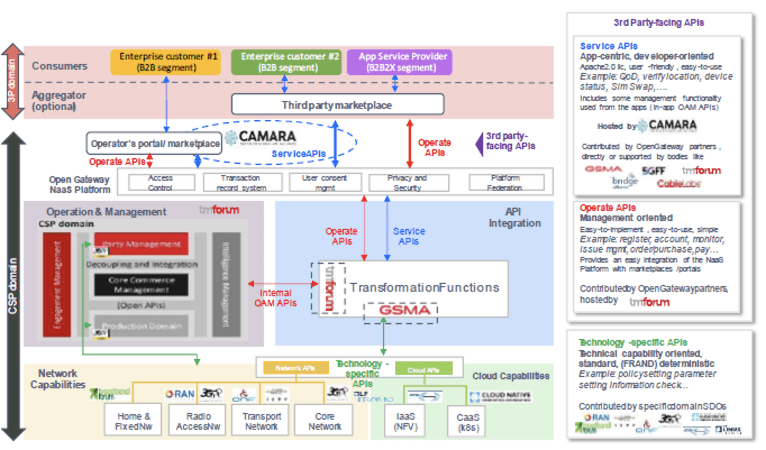

CAMARA Project: Accelerating Innovation through Standardized APIs

The CAMARA project, an open-source initiative hosted by the Linux Foundation, is pivotal in advancing the telecom industry’s move towards programmable networks and Network as a Service (NaaS). CAMARA aims to develop standardized APIs for network services, enabling seamless integration and interoperability across diverse network functions and applications.

This initiative promotes community-driven development and open-source principles, fostering collaboration among CSPs, technology vendors, and developers. Supported by leading industry players, CAMARA drives the adoption of robust, secure, and widely accepted APIs, facilitating new business models and revenue streams. By focusing on the needs of future technologies, CAMARA ensures that the telecom sector is well-equipped to leverage the unique capabilities of 5G, B5G, and beyond. REF[8]

Transition to a Service-Centric Model

The TM Forum’s focus on NaaS and service lifecycle management underscores the industry’s shift towards a service-centric model. This approach emphasizes managing the entire lifecycle of network services, from design and deployment to operation and optimization. By adopting a service-centric mindset, CSPs can deliver more personalized and efficient services, improving customer satisfaction and driving business growth. This approach also helps CSPs optimize operations and reduce costs by streamlining processes and improving resource utilization.

Figure7: Open Gateway NaaS Architecture and contributing stakeholders REF[7]

Conclusion

The telecom industry’s shift to programmable networks and NaaS marks a pivotal moment in its evolution. By embracing APIs, NEF, and service lifecycle management, CSPs can unlock new opportunities for innovation and growth. The collective efforts of industry stakeholders, supported by initiatives from TM Forum, GSMA, and CAMARA, will pave the way for a digitally interconnected future where collaboration and innovation are the norms. As the industry continues to evolve, embracing these advancements will be crucial for CSPs to stay competitive and meet the ever-growing demands of the digital age.

This journey is not just about technological advancement; it’s a collective endeavor towards a digitally interconnected future. It’s an invitation for all stakeholders, from telecom operators and technology providers to developers, to contribute to and reap the benefits of the expanding digital economy. Let’s embrace this transformative time, shaping the way we connect and interact in the digital world.

References

- IG1224 NaaS Transformation v12.0.0″: https://www.tmforum.org/resources/reference/ig1224-naas-transformation-v12-0-0/

- “Northbound exposure – how NEF and CAMARA can enable telecom’s platform play” by James Crawshaw, Practice Leader: https://omdia.tech.informa.com/om028769/northbound-exposure–how-nef-and-camara-can-enable-telecoms-platform-play

- ETSI TS 129 522 V16.4.0 (2020-08) – 5G; 5G System; Network Exposure Function Northbound APIs; Stage 3.

- 3GPP TS 23.501 version 15.3.0 Release 15; System Architecture for the 5G System

- “Common Framework for 5G Northbound APIs”: https://www.etsi.org/deliver/etsi_ts/123200_123299/123222/15.03.00_60/ts_123222v150300p.pdf

- “5G and B5G NEF exposure capabilities towards an Industrial IoT use case” : https://scholar.google.com/scholar?q=5G+and+B5G+NEF+exposure+capabilities+towards+an+Industrial+IoT+use+case&hl=en&as_sdt=0&as_vis=1&oi=scholart

- “The-Ecosystem-for-Open-Gateway-NaaS-API-development”: https://www.gsma.com/solutions-and-impact/gsma-open-gateway/gsma_resources/naas-ecosystem-whitepaper/

- https://camaraproject.org/; APIs enabling seamless access to Telco network capabilities

Ameer Shohail, Experienced ICT Solutions Design Specialist and IEEE Senior Member at a Tier 1 telecom operator in the Middle East, specializing in advanced wireless technologies

Nokia and Hong Kong Broadband Network Ltd deploy 25G PON

Nokia today announced that Hong Kong Broadband Network Ltd (HKBN), a leading telecom and technology solutions provider in Hong Kong, will deploy its 25G PON to provide customers with some of the fastest, most reliable broadband access speeds in the region. The 25G PON deployment will deliver 20Gb/s symmetrical broadband speeds essential for new applications and business services powering today’s digital economy.

Based on the Quillion chipset, Nokia’s 25G PON fiber broadband solution (more below) allows HKBN to reuse its existing fiber broadband equipment to immediately address demand for more capacity and enhanced broadband services.

William Yeung, HKBN Co-Owner, Executive Vice-chairman and Group CEO: “Since 2004, HKBN has been the market leader in introducing Hong Kong’s first fiber-to-the-home broadband service. With an unwavering commitment to innovation, we have joined forces with Nokia to achieve a groundbreaking upgrade, proudly providing customers with a revolutionary 25Gbps broadband speed that meets their ever-increasing demands for network connectivity. Looking ahead, we will continue to stay at the forefront of technological advancements, investing resources to expand network coverage and upgrade infrastructure. This will enable more households and businesses to benefit from our exceptional and high-quality services.”

Geert Heyninck, Vice President of Broadband Networks at Nokia: “Nokia’s technology enables HKBN to upgrade its existing fiber network quickly and efficiently, leveraging both passive and active assets. With Nokia’s technology and HKBN ‘s citywide network, we’re leading customers into a new era of seamless connectivity.”

Roland Montagne, Director and Principal Analyst for FTTH at IDATE: “The momentum behind 25G PON continues to build with the number of deployments growing substantially over the past year. Clearly the ability to quickly upgrade GPON and XGS-PON to deliver true 25Gbs without having to deploy additional network elements is attractive for large operators like HKBN that want to deliver 25G PON services to its customers.”

…………………………………………………………………………………………………….

Nokia recently deployed XGS-PON services with Baktelcom in Azerbaijan. That network can be upgraded in the future to 25G PON which would increase capacity and stay ahead of demand for higher bandwidth.

Nokia has also deployed with Global Fiber Peru a new subaquatic and future-proof Optical, IP and XGS-PON fiber broadband network in the Amazon rainforest, helping to reduce the digital divide. The extensive network connects over 400 communities to multi-gigabit broadband access that is critical in today’s digital economy.

About Nokia’s 25G PON Solution:

• Nokia’s 25G PON increases service agility with operational efficiency.

• The fiber access node supports multiple fiber technologies including GPON, XGS-PON, 25GS-PON and Point-to-Point Ethernet to deliver a wide range of services.

Resources and additional information:

…………………………………………………………………………………………………………………….

References:

https://x.com/nokia/status/1181473779320594433

Nokia’s launches symmetrical 25G PON modem

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

HPE Aruba Launches “Cloud Native” Private 5G Network with 4G/5G Small Cell Radios

HPE Aruba has launched an end-to-end private 5G network platform which is designed to help customers accelerate and simplify the deployment and management of private 5G networks, provide high levels of reliable wireless coverage across large campus and industrial environments, and open new, untapped use cases for private cellular. This integration follows HPE’s 2023 acquisition of private cellular technology provider Athonet.

Highlights:

- HPE Aruba Networking provides a comprehensive solution that removes the complexity of managing, deploying and purchasing enterprise private cellular networks.

- With this expansion of its secure edge-to-cloud portfolio, HPE Aruba Networking becomes the only global enterprise infrastructure vendor to provide comprehensive Wi-Fi and private 5G solutions.

- HPE Aruba Networking Enterprise Private 5G provides high levels of reliable wireless coverage across large campus and industrial environments, opening up new, untapped use cases for private cellular.

“Enterprise and industrial customers are increasingly seeking to deliver wireless coverage in demanding environments, including large outdoor areas, serving fast-moving clients, and providing deterministic access in dedicated spectrum,” said Stuart Strickland, wireless chief technology officer, HPE Aruba Networking.

“The complexity of conventional approaches to private cellular networks has held them back. Building on HPE Aruba’s networking history of wireless innovation and leadership, we have uniquely positioned ourselves to enable new applications for private cellular by integrating Athonet core cellular solutions with our traditional strengths in enterprise networking.”

With the debut of HPE Aruba Networking Enterprise Private 5G, enterprises can increase reliable, secure, high-performance connectivity with a fully integrated private 5G network that features:

- An end-to-end offering that includes a 4G/5G core, HPE ProLiant Gen11 servers, SIM/eSIM cards, 4G/5G small cells, and dashboard.

- New 4G/5G small cell radios from HPE that provide indoor/outdoor coverage, eliminating the need to integrate and use a separate management tool from a 3rd party vendor.

- Simplified cloud-native management and automation for subscriber management, deployment management, core monitoring and radio monitoring, with future plans for integration with HPE Aruba Networking Central.

- Expanded AI data capture and delivery for building AI data lakes and activating inference solutions.

- Interoperability with shared spectrum for private enterprise use: Citizens Broadband Radio Service (CBRS) spectrum in the US, and globally, where regulatory frameworks allow, beginning in 2025.

- Simplified configuration with pre-integrated, tested solution including everything needed to deploy an enterprise private 4G/5G network.

- Ability to deploy solutions in under 30 minutes with zero touch provisioning and configuration wizards that mask the 3GPP cellular complexity.

“HPE Aruba Networking Enterprise Private 5G is a significant step forward to solve for the complexity, cost, control, and management challenges associated with many private network deployments today,” said Patrick Filkins, Senior Research Manager, IoT and Telecommunications, IDC. “HPE Aruba Networking takes a grounded approach focusing on how to most efficiently integrate a private cellular network within an enterprise’s existing IT framework, streamlining network and device management through the use of familiar tools, as well as dynamically assigning and preserving device policy across 4G/5G, Wi-Fi, and wired LAN networks.”

“‘Many private network solutions are too complex, even for large enterprises with internal network expertise,” said Tom Rebbeck, Partner, Analysys Mason. “We expect customers to embrace solutions that can make private networks easier to deploy and manage.”

“For IronYun’s Vaidio Platform to be able to provide AI inferencing at the edge and drive accurate AI video search results, we needed an infrastructure that provided fast, available and reliable bandwidth without any complexity,” said Paul Sun, IronYun CEO. “We found it with HPE Aruba Networking, which provides us with all the components needed to deliver an end-to-end private 5G network for AI. HPE Aruba Networking’s private 5G network is the technical foundation for all Vaidio functions for real-time video analysis and AI inferencing that deliver AI insights to help improve security outcomes.”

“Private cellular, with its wide area, deterministic coverage, is the ideal fit for Disc Golf Network’s global live competition coverage of the Disc Golf Pro Tour,” said Baker Helton, DGPT Vice President of Business Administration. “The new HPE Aruba Networking Enterprise Private 5G offering will make it that much easier for companies to do what we’ve done and meet their requirements for pervasive coverage with an integrated offering using CBRS.”

5 Reasons to adopt HPE Aruba Networking Enterprise Private 5G

HPE completes acquisition of private 5G leader Athonet

HPE acquires private cellular network provider Athonet (Italy) to strengthen HPE Aruba’s networking portfolio

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Apparently, there’s no place to hide in any telecom or datacom market? We all know the RAN market has been in a severe decline, but recent Dell’Oro Group reports indicate that Optical Transport, Mobile Core Network and Cable CPE shipments have also declined sharply in the 1st Quarter of 2024.

Here are a few selected quotes from Dell’Oro analysts:

“The North American broadband market is in the midst of a fundamental shift in the competitive landscape, which is having a significant impact on broadband equipment purchases,” said Jeff Heynen, Vice President with Dell’Oro Group. “In particular, cable operators are trying to navigate mounting, but predictable, broadband subscriber losses with the need to invest in their networks to keep pace with further encroachment by fiber and fixed wireless providers,” explained Heynen.

Omdia, owned by the ADVA, expects cable access equipment spending to grow later in 2024 and peak in 2026 at just over $1 billion, then drop off to $700 million in 2029.

………………………………………………………………………………………………………

“Customer’s excess inventory of DWDM systems continued to be at the center stage of the Optical Transport market decline in the first quarter of 2024,” said Jimmy Yu, Vice President at Dell’Oro Group. “However, we think the steeper-than-expected drop in optical transport revenue in 1Q 2024 may have been driven by communication service providers becoming increasingly cautious about the macroeconomic conditions, causing them to delay projects into future quarters,” added Yu.

…………………………………………………………………………………………………..

“Inflation has impacted the ability of some Mobile Network Operators (MNOs) to raise capital, and it has also impacted subscribers when it comes to upgrading their phones to 5G. Many MNOs have lowered their CAPEX plans and announced that they have fewer than expected 5G subscribers on their networks; which limits MNOs’ growth plans. As a result, we are lowering our expectations for 2024 from a positive growth rate to a negative one,” by Research Director Dave Bolan.

- As of 1Q 2024, 51 MNOs have commercially deployed 5G SA (Stand Alone) eMBB networks with two additional MNOS launching in 1Q 2024.

References:

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

In a May 30th filing with the FCC, SpaceX wrote that it “looks forward to launching commercial direct-to-cellular service [1.] in the United States this fall.” That will presumably be only for text messages, because the company has stated that ONLY text will available in 2024. Voice and data won’t be operational until 2025.

Importantly, SpaceX did not identify the telco who would provide Direct-to Cell satellite service this fall.. Mike Dano of LightReading has suggested it might be T-Mobile US (more below), but there is nothing on the company’s news website to confirm that.

Note 1. “Direct to Cell works with existing LTE phones wherever you can see the sky. No changes to hardware, firmware or special apps are required, providing seamless access to text, voice and data,” according to the Starlink’s website. “Starlink satellites with Direct to Cell capabilities enable ubiquitous access to texting, calling, and browsing wherever you may be on land, lakes, or coastal waters. Direct to Cell will also connect IoT devices with common LTE standards.”

………………………………………………………………………………………………………………………….

SpaceX disclosed its commercial direct-to-cell launch plans in a filing with the FCC that urged the Commission to make changes to its initial supplemental coverage from space (SCS) ruling. SpaceX argued the FCC should create SCS rules that are specific to each band of spectrum used in such offerings

In its most recent FCC filing, SpaceX said that “supplemental coverage from space (“SCS”) will enable ubiquitous mobile coverage for consumers and first responders and will set a strong example for other countries to follow.”

Furthermore, SpaceX said the “FCC should reconsider a single number in the SCS Order—namely, the one-size-fits-all aggregate out-of-band power flux-density (“PFD”) limit of -120 dBW/m2 /MHz that it adopted in the new Section 25.202(k) for all supplemental coverage operations regardless of frequency band.

If the Commission decides to retain an aggregate limit, adopting band-specific limits that efficiently and transparently achieve the accepted ITU interference protection threshold for terrestrial networks of -6 dB interference-to-noise ratio (“I/N”) would better achieve the Commission’s goals of ensuring better service, broader coverage, and more choices for consumers.

By making this simple adjustment to the SCS Order, the Commission can potentially bring an order of magnitude better service to consumers who use supplemental coverage from space in higher frequencies, without causing any risk of harmful interference to terrestrial services in adjacent bands,” SpaceX added.

SOURCE: OFFICIAL SPACE X PHOTOS ON FLICKR, CC2.0

………………………………………………………………………………………………………..

SpaceX established a phone-to-satellite agreement with T-Mobile in 2022. That agreement called for the satellite launch vendor to add T-Mobile’s spectrum into its Starlink satellites. T-Mobile officials have suggested SpaceX’s satellite service might be included in its more expensive service plans for no extra charge, or through an extra fee on its other plans.

……………………………………………………………………………………………………………………….

Sidebar: SpaceX LEO Satellites in Orbit

SpaceX currently operates a constellation of more than 6,000 Starlink satellites. That web of satellites helps to keep Starlink’s services consistent for users on the ground. Each Starlink LEO satellite travels extremely fast such that it goes around the world every 90 minutes.

SpaceX has stated that it plans to have around 800 satellites capable of direct-to-cell connections in orbit within a few months.

According to one source, SpaceX has so far launched more than three dozen satellites that support those “direct-to-cell“ connections.

………………………………………………………………………………………………………………

References:

https://www.fcc.gov/ecfs/document/105311484428351/1

https://www.starlink.com/business/direct-to-cell

https://www.lightreading.com/satellite/spacex-says-t-mobile-s-direct-to-cell-service-launching-commercially-this-fall

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Telstra partners with Starlink for home phonetechblog.comsoc.org/…/spacex-launches-first-set-of-starlink-satellites-with-direct-to-cell-capabilities service and LEO satellite broadband services

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Musk’s SpaceX and T-Mobile plan to connect mobile phones to LEO satellites in 2023

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

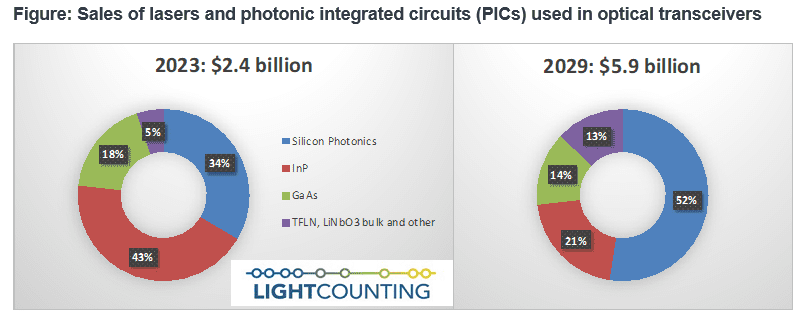

LightCounting: Silicon Photonics chip market to hit $3 billion in 2029

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile will buy almost all of regional carrier UScellular’s wireless operations including customers, stores and 30% of its spectrum assets [1.] in a deal valued at $4.4 billion, the company said on Tuesday. The announcement comes nearly ten months after UScellular and its parent company TDS disclosed that they were undertaking a strategic review of the mobile business, suggesting a possible sale.

Note 1. UScellular stated that it will retain around 70% of its spectrum assets following the T-Mobile deal “and will seek to opportunistically monetize these retained assets.”

The transaction, which is subject to the satisfaction of customary closing conditions and receipt of certain regulatory approvals, is expected to close in mid-2025.

T-Mobile’s 5G SA network will expand to provide millions of UScellular customers, particularly those in underserved rural areas, a superior connectivity experience, moving from a roaming experience outside of the UScellular coverage area to full nationwide access on the country’s largest and fastest 5G network. Additionally, UScellular customers will have the ability to fully participate in the T-Mobile’s industry-leading value-packed plans filled with benefits and perks, and best-in-class customer support with the opportunity to save UScellular customers hundreds of millions of dollars. T-Mobile customers will also get access to UScellular’s network in areas that previously had limited coverage and the benefit of enhanced performance throughout UScellular’s footprint from the addition of the acquired UScellular spectrum to T-Mobile’s network.

“With this deal T-Mobile can extend the superior Un-carrier value and experiences that we’re famous for to millions of UScellular customers and deliver them lower-priced, value-packed plans and better connectivity on our best-in-class nationwide 5G network,” said Mike Sievert, CEO of T-Mobile. “As customers from both companies will get more coverage and more capacity from our combined footprint, our competitors will be forced to keep up – and even more consumers will benefit. The Un-carrier is all about shaking up wireless for the good of consumers and this deal is another way for us to continue doing even more of that.”

“T-Mobile’s purchase and integration of UScellular’s wireless operations will provide best-in-class connectivity to rural Americans through enhanced nationwide coverage and service offerings at more compelling price points,” said Laurent Therivel, CEO of UScellular. “The transaction provides our customers access to better coverage and speeds, as well as unlimited texting in more than 215 countries, content offers, device upgrades and other T-Mobile benefits.”

Best-in-Class Network Experience

The combination of both companies’ spectrum and assets will provide UScellular customers a superior connected experience on T-Mobile’s industry-leading nationwide 5G network that offers best-in-class performance, coverage, and speed. Customers of both companies, particularly those in underserved rural areas, will receive access to faster and more reliable 5G service they would not otherwise have.

Value-Packed Plans

UScellular customers will have the option to stay on their current plans or move to an unlimited T-Mobile plan of their choosing with no switching costs, which include beloved Un-carrier benefits such as streaming and free international data roaming. If UScellular customers choose to switch to T-Mobile, they could save hundreds of millions of dollars combined annually. Some will also have access to plans with increased savings previously not available to them, including T-Mobile’s 5G Unlimited 55+ plans. All customers will be able to take advantage of T-Mobile’s award-winning customer service team, and have better, more accessible in-person and digital retail support.

More Choice and Increased Competition

This transaction will create a much-needed choice for wireless in areas with expensive and limited plans from AT&T and Verizon, and for those that have been limited to one or no options for home broadband connectivity. By tapping into the additional capacity and coverage created through the combined spectrum and wireless assets, T-Mobile will spur competition and expand its fast-growing home broadband offering and fixed wireless products to communities without competitive broadband options, further bridging the digital divide for hundreds of thousands of customers in UScellular’s footprint.

Proven Un-carrier Playbook

T-Mobile has a proven industry-leading track record of bringing companies together in the name of enhanced connectivity, choice, and value for consumers. The integrations of MetroPCS in 2013 and Sprint in 2020 have been noted as two of the most successful merger combinations in wireless history that resulted in competition-enhancing shifts benefiting millions of consumers. Leveraging its tried-and-true playbook for successful integrations, T-Mobile will continue to deliver exceptional value and experiences to more people across the country, while forcing others to follow suit, for the good of customers.

Transaction Details and Financial Profile

T-Mobile will pay approximately $4.4 billion for the assets being acquired from UScellular in the transaction in a combination of cash and up to $2.0 billion of debt to be assumed by T-Mobile through an exchange offer to be made to certain UScellular debtholders prior to closing. To the extent any debtholders do not participate in the exchange, their bonds will continue as obligations of UScellular and the cash portion of the purchase price will be correspondingly increased. Following the closing of the transaction, UScellular will retain ownership of its other spectrum as well as its towers, with T-Mobile entering into a long-term arrangement to lease space on at least 2,100 additional towers being retained.

T-Mobile does not expect the transaction to impact the company’s 2024 guidance or 2024 authorized shareholder return program. T-Mobile expects this transaction will yield approximately $1.0 billion in effective total opex and capex annual run rate cost synergies upon integration, with total cost to achieve the integration currently estimated at between $2.2 billion to $2.6 billion. The company plans to reinvest a portion of synergies toward enhancing consumer choice, quality and competition in the wireless industry.

References:

https://www.t-mobile.com/news/business/uscellular-acquisition-operations-assets

https://finance.yahoo.com/news/t-mobile-buy-uscellulars-wireless-114507766.html

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

Ghana’s Next-Gen Infrastructure Company to deploy shared 5G network

The Government of Ghana announced a partnership with seven tech companies to deploy a new shared infrastructure for affordable 5G mobile broadband services across Ghana. The seven partners are Ascend Digital, K-NET, Radisys, Nokia, and Tech Mahindra and two telcos – AT Ghana and Telecel Ghana.

The partners have established the Next-Gen Infrastructure Company (NGIC), which has been awarded a 5G license and is expected to launch 5G services across Ghana within the next six months, followed by expansion to other parts of Africa.

The company will be the first 5G Mobile Broadband Shared Infrastructure Entity to build a nationwide 4G/5G network. It will also work with the telcos to launch affordable 4G/5G-enabled FWA CPEs and smartphones in Ghana within this calendar year. Ghana’s largest telco, MTN Ghana, is missing from this all-important shared 5G infrastructure.

The partnership aims to enhance the lives of Ghanaians by introducing digital services in education, healthcare, and digital payment transactions through P2P (peer-to-peer), P2M (peer-to-merchant) and M2M (merchant-to-merchant) systems, thereby reducing -digital divide and promoting financial inclusion.

Additionally, the multiplayer partnership will support NGIC in the entire deployment of network infrastructure and associated services, as communications service providers (CSPs) are looking to address enterprise and consumer markets with enhanced digital services. To achieve this, Tech Mahindra will build a Cloud Native Core Network powered by leading OEM (original equipment manufacturer) platforms.

NGIC plans to adopt India’s successful model of affordable handsets, digital platforms, and localized content and applications. The goal is to replicate this high-speed mobile data model across Africa, beginning with Ghana.

Minister for Communications and Digitalization, Ursula Owusu-Ekuful said, “The creation of a shared 5G Mobile Broadband Infrastructure is critical for delivering affordable, high-speed data access to the people of Ghana and help achieve our Digital Ghana vision. The creation of NGIC as a neutral, shared platform, accessible to all mobile network operators and tower companies, will help to expand 5G services rapidly across the country. We are inspired by India’s digital infrastructure and low-cost mobile data usage and keen to replicate it in Ghana.”

Senior Vice President, of Middle East and Africa at Nokia, Mikko Lavanti said, “Ghana holds immense potential for mobile broadband growth on the back of an unmet demand for connectivity. Establishing an Open Access Network like NGIC will foster innovation and create numerous opportunities across various sectors. We are proud of our partnership with NGIC in helping Ghana realize its digital vision and unlock its full potential.”

CEO of Radisys, Arun Bhikshesvaran said, “Connectivity for all, through the use of open and disaggregated multi-access solutions, is a key component of Radisys’ initiatives to bridge the digital divide. By bringing Fixed Wireless Access alongside 4G and 5G cellular services to help drive economic growth and digital inclusion, Radisys looks forward to helping Ascend and NGIC build a disruptive and affordable shared broadband infrastructure across Ghana. In addition, our communications platform and digital applications will help create new digital experiences that empower the Ghanaian community and foster sustainable and inclusive development.”

Chief Technology Officer, Telecom & Global Business Head, Network Services, Tech Mahindra, Manish Mangal said, “Our partnership with Next Gen Infra Co. is based on a shared vision for digital connectivity and providing Network-as-a-Service to innovate and bring cost efficiency to the telecom market in Ghana and Africa. Echoing our promise to scale at speed, we aim to rapidly advance operations by building a Cloud Native Core Network with leading OEM platforms combined with Tech Mahindra’s automation platform, netOps.ai. Together with NGIC, we will support the complete network infrastructure deployment and introduce high-speed 4G/5G services in the region.”

CEO of Ascend Digital and Executive Director, of NGIC, Harkirit Singh said, “NGIC intends to launch its wholesale 4G/ 5G Network as a Service and make it available to all mobile network operators within the next six months. We have proven the strengths of our partners – Radisys, Nokia, and TechM, to scale the network and deliver affordable mobile broadband services to all Ghanaians. We intend to gradually expand to other parts of Africa as well. We will tap the capital markets and bring in strategic investors as and when required.”

COO of Telecel Ghana, Mohamad Ghaddar said, “NGIC’s neutral and ‘Network as a Service’ model creates a level-playing field for all telecom operators in Ghana. As an MNO our focus will be to enhance customer experience through innovative services, localized content, applications, and affordable devices. We are excited to be part of this venture and looking forward to working with NGIC in a shared vision of universal access to broadband and transforming Ghana into a Digital Economy”.

CEO of AT Ghana, Leo Skarlatos said, “This partnership will enable us to leverage a neutral, shared platform and scale up our services across Ghana. We are confident that our customers will experience the enhanced network quality and affordable services that they deserve. We look forward to working with NGIC and the MOCD, to contribute to the country’s digital transformation agenda.”

References:

https://citinewsroom.com/2024/05/ghana-govt-seven-others-partner-on-5g-shared-network/

https://www.deccanherald.com/business/companies/ghana-ties-up-with-reliance-jio-arm-others-for-building-4g-5g-telecom-infra-3040314