IEEE ComSocSV/SCU SoE New Event (free): Inside a Telecom Chip Start-up and its 4G+5G Base Station SoC

Date & Time: May 30th, 2:30pm to 5pm

Venue: Santa Clara University – SCDI 1308

Register at: https://events.vtools.ieee.org/m/421628

Agenda/Timeline:

⦁ 2:30pm-3pm Registration & Networking

⦁ 3pm Opening Remarks

⦁ 3:05pm-4pm Presentation

⦁ 4pm-4:30pm Panel Discussion/Conversation

⦁ 4:30pm-4:50pm Audience Q & A

⦁ 4:50pm-4:55pm Closing Remarks & Acknowledgements

Abstract:

As 5G evolves for both public and private networks, edge demands will impact the fluidity and constructs of 5G infrastructure. Mobile network operators (public 5G) and enterprises (private 5G) are confronted with a daunting fundamental challenge:

How to deploy a wireless infrastructure that can effortlessly scale across all future upgrades (e.g. 5G Advanced) and demands, without incurring the traditional capital and operating expense of a system redesign and rip-and-replace costs?

This talk will cover the starting point of all wireless infrastructure – the 4G+5G baseband System on a Chip (SoC). We will discuss: how a”soft modem” can scale with evolving infrastructural demands across small cells and macro cells, new application use cases, emerging megatrends (such as 5G non-terrestrial networks), market fundamentals impacting 5G deployments, and personal insights into the starting and evolution of a 5G semiconductor startup company in the era of AI.

Five years in the making, EdgeQ emerged in 2018 as one of the very few semiconductor startups [1.] focusing on 5G wireless infrastructure. Led by executives from Qualcomm, Intel, and Broadcom, EdgeQ is pioneering converged connectivity and AI that is fully software-customizable and programmable. The company has raised multiple financing rounds, backed by world-renowned investors across all major continents. See below for awards EdgeQ has received.

Note 1. There’s been a significant decline in funding for semiconductor startups over the past 10 years due to a maturing industry, high capital requirements, and fewer exits. In 2021, chip startups globally raised $8.3 billion in 263 deals, but in 2023, U.S. startups have only raised $262 million in 17 deals. There have been EVEN FEWER semiconductor startups focusing on wireless telecommunications as EdgeQ has done.

Speakers and Panelists:

- Adil Kidwai, Head of Product Management, EdgeQ

- Edward Wu, Head of Marketing & Market Development, EdgeQ

Moderator: Alan J Weissberger, IEEE Techblog Content Manager, SCU SoE Scholar in Residence, IEEE GCN North American Correspondent

………………………………………………………………………………….

EdgeQ Awards:

2023 GLOMO Award Winner

CTO Choice Award for Outstanding Mobile Technology

Best Digital Technology Breakthrough for Companies with Under $10M Annual Global Revenue

2022 Mobile Breakthrough Award Winner Small Cell Technology Innovation of the Year

……………………………………………………………………………………………………………………………

Addendum:

Video recording is at https://www.youtube.com/watch?v=-v42TnNjIfM

“Qualcomm will be a tough competitor if they seriously enter into the wireless infrastructure market. They make good modems,” Adil said.

…………………………………………………………………………………………………………………

References:

https://www.edgeq.io/edgeq-debuts-worlds-first/

https://www.edgeq.io/static/Tech_Pcie_Explosion-f48f32134ee6e58752aab6683a63abf4.mp4

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

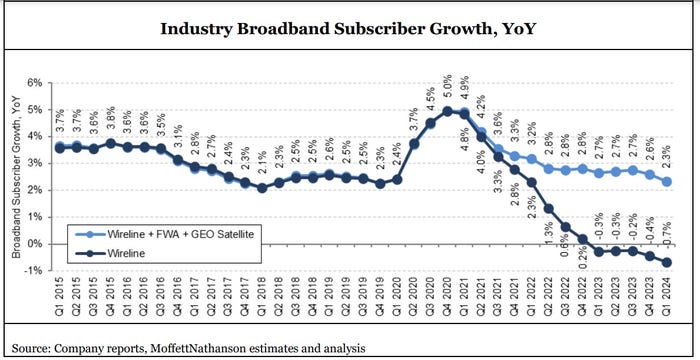

The pace of U.S. broadband subscriber growth slowed considerably in the first quarter of 2024 as fiber, fixed wireless access (FWA) and cable broadband service providers collectively turned in results that were worse than what they posted in the year-ago period.

Total industry net additions, including or excluding FWA and geosynchronous (GEO) satellite broadband providers, decelerated noticeably in Q1 2024. The total market’s growth rate decreased to just 2.3% year-over-year, the slowest since the COVID-19 pandemic, analysts at MoffettNathanson estimated in its latest broadband industry trends report (paid subscription required). When FWA and GEO satellite categories were excluded, the growth rate was much worse: -0.7%.

The overall number of U.S. broadband market subscribers decelerated by 299,000 net adds versus the year-ago quarter. “That was the most abrupt since Q2 2022,” said MoffettNathanson analyst Craig Moffett. “The bottom line is that penetration of home broadband stalled, and perhaps even declined in the quarter, particularly if one adjusts for the growth in homes passed in rural areas under RDOF [Rural Digital Opportunity Fund] subsidies and unsubsidized edgeouts,” Moffett wrote.

Here’s a breakdown of U.S. broadband subscribers by access type:

- Fixed Wireless Access (FWA) providers added 879,000 subs in Q1 2024, down from a gain of 925,000 in the year-ago period.

- Fiber net adds also slowed – from 487,000 in Q1 2024 versus a gain of 517,000 in the year-ago quarter.

- DSL losses of 560,000 in Q1 were similar to a year-ago loss of 571,000.

- MSO/cable network operators shed 169,000 broadband subs in Q1, much worse than a year-ago gain of about 71,000 subs.

“The culprit for cable’s weaker broadband net additions was a slower market growth rate,” though lower new household formation and cessation of ACP enrollments in the quarter also played a role, Moffett noted.

……………………………………………………………………………………………………………..

According to Statista, the total number of broadband subscribers in the U.S. stood at 114.7 million at the end of 2023, This was an increase of over four million subscribers compared to the previous year.

Source: Statista

…………………………………………………………………………………………………………………………

In March 2024, Leitman Research found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 96% of the market – acquired about 3,520,000 net additional broadband Internet subscribers in 2023, similar to a pro forma gain of 3,530,000 subscribers in 2022.

Leitman Research findings for 2023:

- The top cable companies lost about 65,000 subscribers in 2023 – compared to about 530,000 net adds in 2022

- The top wireline phone companies lost about 80,000 total broadband subscribers in 2023 – compared to about 180,000 net losses in 2022

- Wireline Telcos had about 1.97 million net adds via fiber in 2023, offset by about 2.05 million non-fiber net losses

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,665,000 subscribers in 2023 – compared to about 3,185,000 net adds in 2022

- Fixed wireless services accounted for 104% of the total net broadband additions in 2023, compared to 90% of the net adds in 2022, and 20% of the net adds in 2021

“Top broadband providers added about 3.5 million subscribers in 2023, similar to the number of broadband adds in 2022,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Over the past four years, top providers added about 15.9 million broadband subscribers, compared to about 10.2 million net broadband adds in the prior four (pre-pandemic) years.”

………………………………………………………………………………………………………..

References:

https://www.lightreading.com/broadband/us-broadband-subscriber-pace-slows-across-the-board

https://www.statista.com/statistics/217938/number-of-us-broadband-internet-subscribers/

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Verizon’s 2023 broadband net additions led by FWA at 375K

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Hubble Network Makes Earth-to-Space Bluetooth Satellite Connection; Life360 Global Location Tracking Network

U.S. startup Hubble Network has claimed Bluetooth-based satellite communications is possible after transmitting data from standard Bluetooth devices to its new satellite constellation, launched in March. The firm, with a $20 million funding round behind it, reckons it will extend Bluetooth transmissions from 10 meters to hundreds of kilometers. It wants to “connect a billion devices” on the “world’s first truly global, cost-efficient, and low-power network,” the company said in a press release.

“We’ve disproved thousands of skeptics,” claims Hubble Network co-founder and chief executive officer Alex Haro of his company’s milestone achievement. “By showcasing that we can send signals directly from Bluetooth chips and receive them in space 600km [around 370 miles] away, we’ve opened a new realm of possibilities.”

Hubble Network has successfully proven the core concept on which the company was founded: that a Bluetooth connection, typically thought of as exclusively for short-range wireless connectivity, can be made between a device on Earth and an orbiting satellite.

“We’ve disproved thousands of skeptics,” claims Hubble Network co-founder and chief executive officer Alex Haro of his company’s milestone achievement. “By showcasing that we can send signals directly from Bluetooth chips and receive them in space 600km [around 370 miles] away, we’ve opened a new realm of possibilities.”

“Our innovative approach allows existing Bluetooth-enabled devices to be retrofitted to transmit data to the Hubble Network without any hardware modifications,” explains co-founder and chief technology officer, “ushering in a new era of connectivity.”

Two satellites, granted, is a somewhat limited constellation. Following its first successful Earth-to-space Bluetooth link, the company has stated that it will focus on increasing the number of satellites in orbit in order to boost capacity and increase coverage — and has opened a waitlist for those interested in experimenting with its official developer’s kit.

Separately, Life360, a family connection and safety company, has announced a signed non-binding letter of intent with Hubble Network to become the exclusive consumer application of their groundbreaking satellite Bluetooth technology. Through this strategic partnership, Life360 will leverage Hubble’s global satellite infrastructure and Life360’s global network of over 66 million smartphones to introduce “Find with Life360,” a global location-tracking network. Hubble’s breakthrough achievement of connecting Bluetooth devices to a satellite tracking network avoids previous limitations of Bluetooth location-tracking devices. Find with Life360 has the potential to herald a new era in location tracking and surpass the finding network capabilities of Apple and Google.

References:

AT&T deal with AST SpaceMobile to provide wireless service from space

AT&T and satellite network provider AST SpaceMobile are teaming up to provide wireless service from space — a challenge to Elon Musk’s SpaceX, which struck a similar deal two years ago with T-Mobile US. AT&T and AST SpaceMobile formalized the partnership following an earlier testing period. They said on Wednesday that their agreement to build a space-based broadband network will run through 2030.

AT&T head of network Chris Sambar will join the AST SpaceMobile board, deepening a relationship that dates back to at least 2018. Sambar said in an interview that his team is confident in AST SpaceMobile’s technology, as demonstrated by the performance of the BlueWalker 3 test satellite. The relationship is moving from “loose partner to a strategic partner,” he said.

Wireless providers are in a race to offer connections for the world’s estimated 5 billion mobile phones when those devices are in remote areas beyond the reach of cell towers. For consumers, these services hold the promise of connectivity along rural roads and in places likes national parks. The service is typically marketed as a supplement to standard wireless coverage.

The new satellite network will work with ordinary mobile phones, offering a level of convenience that’s lacking in current call-via-satellite services, which require the assistance of bulky specialized equipment.

“Space-based direct-to-mobile technology is designed to provide customers connectivity by complementing and integrating with our existing mobile network,” said Jeff McElfresh, Chief Operating Officer, AT&T. “This agreement is the next step in our industry leadership to use emerging satellite technologies to provide services to consumers and in locations where connectivity was not previously feasible.”

“Working together with AT&T has paved the way to unlock the potential of space-based cellular broadband directly to everyday smartphones. We are thrilled to solidify our collaboration through this landmark agreement,” said Abel Avellan, AST SpaceMobile Founder, Chairman, and CEO. “We aim to bring seamless, reliable service to consumers and businesses across the continental U.S., transforming the way people connect and access information.”

AST SpaceMobile this summer will send five satellites to Cape Canaveral, Florida, for launch into low Earth orbit. AT&T’s Sambar didn’t say when service to customers might begin. “This will be a full data service, unlike anything you can get today from a low-Earth orbit constellation,” Sambar said.

T-Mobile is working with the low-Earth orbiting Starlink service from Musk’s Space Exploration Technologies Corp. The mobile carrier earlier said that its calling-via-satellite service could begin this year.

SpaceX has roughly 6,000 satellites aloft in low-Earth orbit — far more than any other company. The trajectory, with satellites circling near the Earth’s surface, allows communications signals to travel quickly between spacecraft and a terrestrial user.

SpaceX in January launched its first set of satellites capable of offering mobile phone service. The service “will allow for mobile phone connectivity anywhere on Earth,” Musk said in a post on X, the social network formerly known as Twitter, though he added that technical limitations mean “it is not meaningfully competitive with existing terrestrial cellular networks.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About AST SpaceMobile

AST SpaceMobile, Inc. is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio, and designed for both commercial and government applications. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. For more information, follow AST SpaceMobile on YouTube, X (formerly Twitter), LinkedIn and Facebook. Watch this video for an overview of the SpaceMobile mission.

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

An IEEE Communications Resource Designed for Telecom Engineers

by Danielle Novello, IEEE Associate Marketing Manager (edited by Alan J. Weissberger)

IEEE DiscoveryPoint for Communications is a machine-learning-powered, all-in-one platform specifically designed for engineers in the telecommunications industry.

Engineers designing communications products need access to the most up-to-date information—the latest research, lists of parts and components, and technical standards to help ensure that their design will work correctly and integrate seamlessly with other elements in the system. However, tracking down resources across multiple websites can be very time-consuming, the material might not be relevant or the sources could be questionable.

The IEEE DiscoveryPoint for Communications platform aims to solve those problems by providing one-stop access to searchable, curated content from trusted sources on just about any telecommunications topic. The platform library contains:

- More than 1.4 million full-text research documents.

- 14,000 technical standards.

- 7,500 online courses.

- 1,300 ebook titles.

- 18.4 million parts and components data from manufacturers and distributors.

- 1,300 industry and product news sources, blogs, and white papers.

The documents in our library are sourced from reputable publishers, including AT&T, the IEEE Xplore Digital Library, River Publishers, and John Wiley & Sons, Inc, ensuring the highest quality and reliability of the content.

IEEE standards are also included in the library. The IEEE Standards Association has developed more than 900 communications related standards, including the popular IEEE 802.11 WiFi and IEEE 802.3 Ethernet standards.

With a single query users can find answers to technical questions by referencing relevant content from multiple high-quality sources, including full-text IEEE publications and standards. IEEE DiscoveryPoint returns only the most applicable information to user search queries and then organizes the results in resource-specific channels, making it easier to browse different content types cohesively. It can also help accelerate project workflow with time-saving tools such as custom dashboards, alerts, saved searches, bookmarks, and collaboration tools to work through projects in less time and avoid duplicative queries.

“There’s nothing on the market right now that fully supports the design engineer’s workflow and delivers all the information needed in one place,” says Mark Barragry, senior product manager for corporate markets at IEEE Global Products and Marketing.

In designing IEEE DiscoveryPoint, Barragry comments, “We reconstructed the work process of a product design engineer and put together a set of resources that meet all the information needs they would have during a standard product-development cycle.” Barragry adds that design engineers who tested the platform before launch said they liked that it came from IEEE, a trusted source.

The subscription-based product’s intuitive search engine saves users time by zeroing in on key concepts related to the topic they’re searching for. To get started, the user types a word, phrase, concept, the name of an author or company, or another term into the search bar. The search engine’s ranking algorithm analyzes the documents’ full text and metadata to find relevant material.

The results are organized into curated channels and categorized by resource types, such as research papers, standards, books, or industry news. For each search result, a machine-learning feature examines the document and generates a short summary of key points highlighted in the document. This solution allows time-strapped engineers to find relevant information more efficiently.

In one testimonial about IEEE DiscoveryPoint, a director of technology development said, “I really appreciated the thought that went into this product. It’s an unmet need for people like me.”

Subscription prices depend on the size of the organization and the number of engineers and technical professionals using it. Contact us to learn more.

References:

https://discoverypoint.ieee.org/

https://innovate.ieee.org/introducing-ieee-discoverypoint-for-communications/

Practical Applications of IEEE DiscoveryPoint for Communications (IDPC)

e& UAE sets new world record with fastest 5G speed of 30.5Gbps

e& UAE network operator today announced registering the world’s fastest recorded speed of 30.5Gbps on its live 5G network, marking a significant milestone in its evolution towards 5G-Advanced. This global achievement was unveiled during a demonstration held at SAMENA Leaders’ Summit 2024, showcasing the successful aggregation of multiple carriers across high-band and mid-band spectrums (1600 MHz in mmWave and 300MHz in C-band), with network speeds reaching 30.5Gbps. This achievement underscores e& UAE’s commitment to delivering unparalleled user experiences, ensuring seamless connectivity to meet the increasing demand for a broad spectrum of digital services.

Khalid Murshed, Chief Technology and Information Officer of e& UAE, said, “We are thrilled to announce e& UAE’s achievement of the world’s fastest 5G network speed. With this accomplishment, we are poised to unleash the boundless potential of 5G technology, empowering innovative services and applications that will transform the fabric of society and the economy. “Aligned with the UAE’s ambitious digital agenda, e& UAE’s continuous investment in its network and technologies underscores its commitment to delivering premium digital services. By adopting the latest 5G solutions, we are providing our customers with premium digital experiences today but also paving the way for the 6G era by 2030 in line with the UAE’s recently unveiled 6G Roadmap by TDRA.”

As the demand for advanced network capabilities continues to surge, e& UAE is poised to revolutionize the landscape of connectivity in the UAE. This vision integrates state-of-the-art technologies and innovative services, including network slicing, private 5G network, RedCap, mobile VPN, and premium Fixed Wireless Access (FWA) leased lines, offering a superior experience for consumers, home, and enterprise customers alike. e& UAE has also harnessed the power of AI to deliver seamless and personalized experiences to every customer.

AI technologies will spearhead intelligent energy-saving and smart network planning initiatives, driving environmental responsibility and technological excellence to new heights. This monumental achievement solidifies e& UAE’s position as a trailblazer in the telecommunications industry, reaffirming its dedication to pushing the boundaries of innovation and delivering connectivity solutions for the digital era.

References:

https://www.wam.ae/en/article/b34rucp-uae-sets-new-world-record-with-fastest-speed

UAE network operator “etisalat by e&” achieves 5G mmWave distance milestone

UAE’s “etisalat by e&” announces first software defined quantum satellite network

du (UAE) deploys Microchip’s TimeProvider 4100 Grandmaster clock for advanced 5G network services

Nokia and du (UAE) complete 5G-Advanced RedCap trial; future of RedCap?

Part-2: Unleashing Network Potentials: Current State and Future Possibilities with AI/ML

By Vinay Tripathi with Ajay Lotan Thakur

Introduction

In the dynamic realm of networking, AI/ML has emerged as a transformative force to reshape the networking world by making it more secure, reliable, efficient and optimized. In this blog we will dive into characteristics, possibilities, use cases and challenges of AI/ML in the networking.

About AI and ML

Definitions of AL/ML

AI and ML are often used interchangeably, but there are some key differences between the two.

- AI is the ability of machines to perform tasks that would normally require human intelligence, such as understanding natural language, recognizing objects, and making decisions.

- ML is a subfield of AI that allows machines to learn from data and improve their performance over time.

- DL = Uses neural networks for complex structured models and greater insights.

Types of AI/ML

AI/ML encompass a wide range of techniques and algorithms that can be used to solve a variety of problems. In the context of networks, AI/ML technologies can be broadly categorized into the following types:

Key Points:

- AI/ML taxonomy is continuously evolving due to industry growth and various methodologies and algorithms.

- The choice of AI/ML algorithm significantly influences business outcomes, including training time, prediction accuracy, and resource usage.

- The selection of algorithms depends on the type and volume of available data for a specific use case.

Popular ML Types:

- Supervised/Unsupervised: When available data is simple or significant pre-processing has resulted in high data quality:

- Neural Networks and Deep Learning: When you have substantial amounts of unstructured/structured data or unclear features these may offer superior accuracy over Classical ML methods

- AutoML: When you need to streamline machine learning model development, especially with limited expertise, time, or resources.

- NLP: When tasks involve text or language data and require automation, understanding, or generation of natural language content.

- Reinforcement learning: Suitable when you need to train agents to make sequential decisions in dynamic environments, optimizing for long-term rewards, and when there is a need for autonomous decision-making, such as in robotics, game playing, or autonomous systems.

Figure-1: Hierarchy of AI, ML and DL

Applications of AI/ML

AI and ML technologies provide a diverse array of applications in networks, encompassing security, engineering, capacity planning, and operations. These technologies have the capability to augment network security, optimize network design and performance, forecast traffic demand, and automate network tasks. This leads to enhanced efficiency, reliability, and overall network performance. Here are some specific examples:

Network Security

- Intrusion Detection System (IDS): AI-powered IDS can detect and respond to cyberattacks in real-time, providing a more robust defense against threats.

- Thread Detection and Prevention (TDP): AI can analyze network traffic to identify and prevent threats before they can cause damage.

- Anomaly Detection: AI can detect deviations from normal network behavior, indicating potential security incidents.

Network Engineering

- Quality of Service (QoS): AI can optimize network resources to ensure consistent and reliable performance for critical applications.

- Routing and Traffic Management: AI can optimize routing decisions and manage traffic flow to avoid congestion and improve network performance.

- Optimized Traffic Flow: AI can analyze traffic patterns and make real-time adjustments to optimize traffic flow, reducing latency and improving overall network performance.

- Load Balancing: AI can distribute traffic across multiple servers or network links to balance the load and prevent bottlenecks.

Network Capacity Planning

- Improved Capacity Forecasting: AI can analyze historical data and predict future traffic demand, enabling network operators to plan for future capacity needs.

- Efficient Uses of Resources: AI can identify and allocate network resources more efficiently, reducing costs and improving network performance.

Network Maintenance, Troubleshooting, Operations and Monitoring

- Real-time Monitoring: AI can continuously monitor network performance and identify potential issues before they cause outages or disruptions.

- Quicker Resolutions of Vendor/Hardware Issues: AI can diagnose and resolve vendor and hardware issues more quickly, minimizing downtime.

- Faster Root Cause Analysis: AI can analyze large amounts of data to identify the root cause of network issues, enabling faster resolution.

- Quick Mitigations of Network Issues: AI can automatically implement mitigations for network issues, reducing the impact on users and applications.

AI/ML Based Network in Action

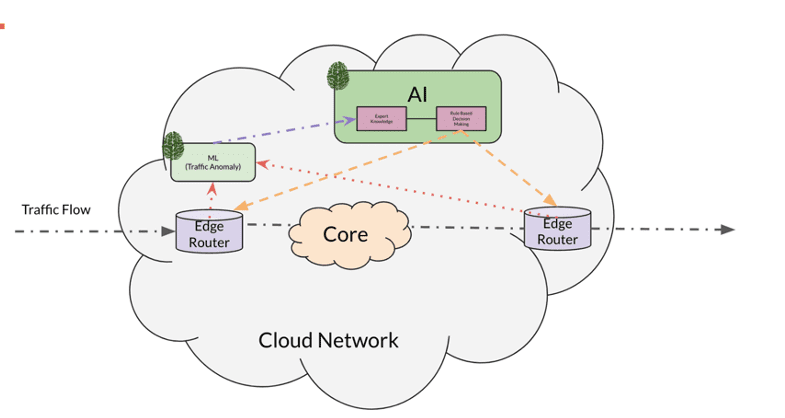

The seamless integration of AI/ML components at various levels of the network (edge, core, management, etc.) enhances its reliability, efficiency, and security by optimizing performance and safeguarding against vulnerabilities.

The diagram illustrates a practical application of AI/ML within one of the extensive networks.

Figure-2: AI/ML in action in a cloud network

Trends in AI/ML

AI/ML are revolutionizing the field of networks. These technologies are being used to improve the performance, security, and reliability of networks.

Here are some of the key trends in AI/ML for networks:

- Simplify and scale data operations.

AI/ML can be used to automate and simplify many of the tasks involved in managing and analyzing network data. This can free up network administrators to focus on more strategic tasks.

- Increase accuracy of forecasts.

AI/ML can be used to predict network traffic patterns, identify potential problems, and plan for future capacity needs. This can help organizations to avoid costly downtime and improve the quality of service for their users.

- Decrease time to market.

AI/ML can be used to automate the process of designing, deploying, and managing new network services. This can help organizations to bring new products and services to market faster.

- Enable insights on otherwise unusable data

AI/ML can be used to extract insights from network data that would otherwise be too complex or voluminous to analyze manually. This can help organizations to identify security threats, optimize network performance, and improve customer experience.

Figure-3: Trends in ML

AI/ML Use Cases

The introduction of AI/ML use cases in network functions has revolutionized the field of networking. AI/ML technologies are being leveraged to enhance network security, optimize network design and performance, anticipate traffic demand, and automate network tasks. This integration leads to improved efficiency, reliability, and overall network performance.

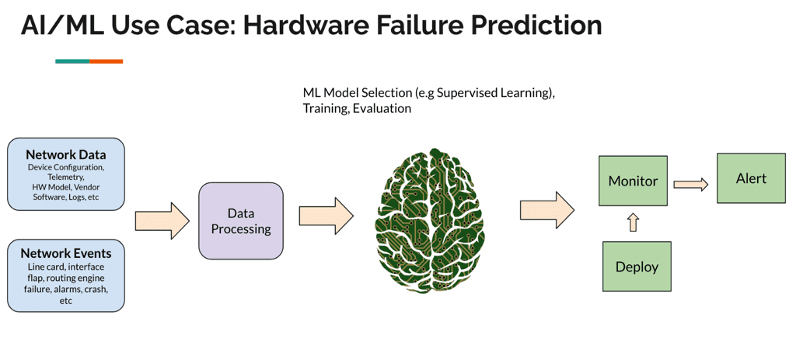

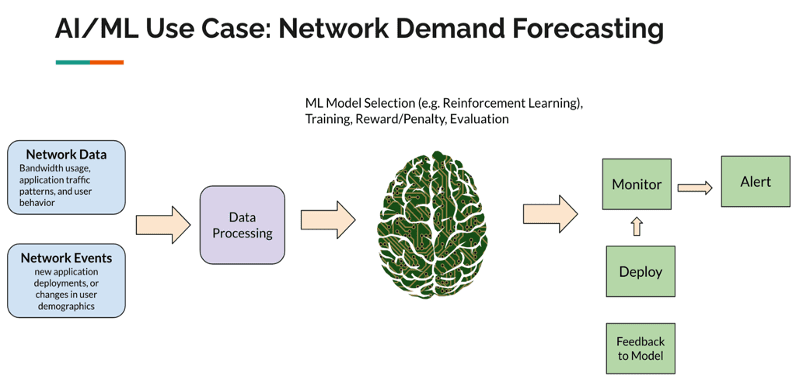

Examples of the popular use cases of AI/ML in large networks.

Figure-4: AI/ML Use Case: Hardware Failure Prediction

Figure-5: AI/ML Use Case: Network Demand Forecasting

ML vs Non-ML Networks

The comparison of ML-based and non-ML-based networks provides valuable insights into the advantages and limitations of each approach. By examining the key aspects such as scalability, flexibility, accuracy, and security, organizations can make informed decisions about the most suitable solution for their specific networking needs. This comparison can guide network engineers, architects, and decision-makers in selecting the optimal approach to meet their performance, efficiency, and security requirements.

A comparison between ML-based and non-ML-based solutions is provided in the followingtable:

Figure-6: Comparison of ML and non-ML solutions

Reasons Not to Use AI/ML

While AI/ML technologies offer significant benefits for networks, there are certain scenarios where their application may not be suitable or feasible. Several factors, such as data availability, use case definition, cost considerations, the need for customized models, and the effectiveness of existing automation, can influence the decision to refrain from using AI/ML in networks. Understanding the limitations and potential drawbacks of AI/ML is crucial for organizations to make informed choices about the most appropriate approach for their specific networking needs.

- Not enough data sets to train the model:

- AI/ML models require large amounts of high-quality data to train effectively. In the context of networks, it may be challenging to collect and prepare sufficient data. Factors such as network size, traffic patterns, and security considerations can make data collection a complex and time-consuming process.

- The lack of adequate data can lead to models that are not well-generalized and may not perform well in real-world scenarios.

- Use case is not defined well:

- AI/ML models are designed to solve specific problems or achieve specific goals. If the use case for AI/ML in networks is not clearly defined, it can be difficult to develop a model that effectively addresses the desired outcomes.

- A poorly defined use case can lead to misalignment between the model’s capabilities and the actual requirements of the network.

- High cost is a problem:

- Implementing AI/ML solutions in networks can be expensive. Factors such as hardware requirements, software licenses, and the cost of hiring skilled professionals contribute to the overall cost.

- Organizations need to carefully evaluate the cost-benefit analysis before investing in AI/ML for their networks. In some cases, the cost of deploying and maintaining an AI/ML solution may outweigh the potential benefits.

- Customized AI/ML model is required:

- Off-the-shelf AI/ML solutions may not always be suitable for specific network scenarios. Organizations may require customized models that are tailored to their unique requirements.

- Developing customized AI/ML models requires specialized expertise and resources, which can further increase the cost and complexity of the project.

- Existing automation is already serving the requirement:

- Many networks already have existing automation solutions in place, such as network management systems (NMS) and configuration management tools. These solutions provide a range of automation capabilities that may already be sufficient for the organization’s needs.

- Implementing AI/ML in such scenarios may not offer significant additional benefits or may require a substantial investment to achieve incremental improvements.

AI/ML Challenges in Networks

AI/ML in networks has benefits but also challenges. Complexity arises from numerous interconnected components and interactions, which AI/ML further complicates. Data limitations and algorithmic bias are additional concerns. Regulatory compliance adds another layer of complexity. Some of the challenges are described in detail below:

Complexity

- As networks become increasingly complex, it can be difficult to troubleshoot issues that arise. This is due to the large number of interconnected components and the complex interactions between them.

- For example, a problem with a single router can have a cascading effect on the entire network, making it difficult to identify the root cause of the issue.

- Additionally, the use of AI and ML in networks can further increase complexity by introducing new layers of abstraction and decision-making.

Data Requirements

- AI and ML algorithms require large amounts of data to train and operate effectively. This can be a challenge for networks, as they may not have access to sufficient data to train their models.

- For example, a network security system may not have enough data on recent attacks to train a model to detect and prevent future attacks.

- Additionally, the data that is available may be biased or incomplete, which can lead to inaccurate or unfair models.

Algorithmic Bias

- AI and ML algorithms can be biased, which can lead to unfair or discriminatory outcomes. This is because the algorithms are trained on data that may contain biases, such as racial or gender bias.

- For example, a facial recognition system may be biased towards certain ethnicities, leading to false identifications or denials of service.

- It is important to address algorithmic bias in networks to ensure that AI and ML are used in a fair and responsible manner.

Regulatory Compliances

- Networks are subject to a variety of regulatory compliance requirements, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA).

- These regulations impose strict requirements on how data is collected, stored, and used.

- AI and ML can add additional complexity to compliance, as they can introduce new data processing and decision-making processes.

- Organizations need to carefully consider the regulatory implications of using AI and ML in networks to ensure that they are compliant with all applicable regulations.

Ethical Concerns

- The use of AI and ML in networks raises several ethical concerns, such as the misuse of data and job replacement.

- For example, AI-powered surveillance systems could be used to track and monitor people without their consent, raising concerns about privacy and civil liberties.

- Additionally, AI and ML could lead to job automation, which could displace workers and have a negative impact on the economy.

- It is important to consider the ethical implications of using AI and ML in networks to ensure that they are used in a responsible and ethical manner.

Networks: AI/ML Benefits

In today’s digital world, networks are becoming increasingly complex and interconnected. To manage and operate these networks effectively, organizations are turning to AI/ML. AI/ML can automate repetitive tasks, identify, and mitigate network threats, and optimize network performance. AI/ML can also help organizations to gain more insights from their network data, which can lead to better decision-making and improved business outcomes. Some of the top benefits are described below:

Lower Cost:

- Automated tasks: AI/ML can automate repetitive and time-consuming network tasks, such as configuration, monitoring, and troubleshooting. This can free up staff to focus on more strategic initiatives.

- Efficient customer support: AI/ML-powered chatbots and virtual assistants can provide 24/7 customer support, answering common questions and resolving simple issues. This can reduce the need for human customer support representatives, saving costs.

- Improved performance: AI/ML can be used to optimize network performance by identifying and resolving bottlenecks and inefficiencies. This can lead to reduced latency, improved throughput, and better overall network performance while minimizing the network operation cost.

Reduced Network Risk:

- Resilient network: AI/ML can be used to create more resilient networks that are better able to withstand outages and attacks. This can be done by predicting and preventing network failures, and by quickly identifying and resolving issues.

- Identify and mitigate threats: AI/ML can be used to detect and mitigate network threats, such as malware, DDoS attacks, and phishing attempts. This can help to protect sensitive data and systems from being compromised.

- Accurate network trends and forecast: AI/ML can be used to analyze network data to identify trends and forecast future needs. This information can be used to make informed decisions about network planning and investment.

- Network outage prediction: AI/ML can be used to predict network outages before they occur. This can help to prevent downtime and lost productivity.

More Revenue:

- Enhanced network and capacity planning: AI/ML can be used to optimize network and capacity planning, ensuring that the network has the resources it needs to meet current and future demands. This can help to avoid costly over-provisioning or under-provisioning of network resources.

- Faster time to market: AI/ML can help to accelerate time to market for new network services and applications. This can be done by automating the testing and deployment process, and by identifying and resolving potential issues early on.

- Better customer experience: AI/ML can be used to improve the customer experience by providing personalized and proactive support. This can lead to increased customer satisfaction and loyalty.

Networks: AI/ML Innovation Catalysts

The convergence of AI/ML with networks is revolutionizing various industries. Here are some key factors driving this transformation:

- Increase in Data/Compute and Storage:

- The proliferation of IoT devices has led to an exponential growth in data generation, fueling AI/ML innovation.

- High-performance computing (HPC) clusters and cloud platforms provide the necessary compute and storage resources for complex AI/ML models.

- Edge Computing:

- Edge computing brings AI/ML capabilities closer to data sources, enabling real-time decision-making.

- Edge devices, such as sensors and gateways, collect and process data locally, reducing latency and bandwidth requirements.

- Cloud Infrastructure:

- Cloud platforms offer scalable and elastic infrastructure for deploying and managing AI/ML workloads.

- Cloud-based AI/ML services provide pre-built tools and frameworks for developers, accelerating the development and deployment of AI/ML applications.

- Increase in Devices Running AI:

- Smartphones, smart home devices, and autonomous vehicles are increasingly equipped with AI capabilities.

- These devices generate vast amounts of data and use AI to perform tasks such as image recognition, natural language processing, and predictive analytics.

- Pre-trained Models:

- Pre-trained models, such as open-source BERT and ResNet, provide a starting point for developing custom AI models.

- These models have been trained on large datasets and can be fine-tuned for specific tasks, reducing the time and resources required for model development.

- Human and AI Cooperation:

- AI/ML is augmenting human capabilities, enabling collaboration between humans and machines.

- Human-AI teams can leverage their respective strengths to solve complex problems and make better decisions.

Conclusion

AI and ML are revolutionizing the field of networking, bringing efficiency, automation, and significant performance improvements. As networks continue to grow and complexity, traditional management methods are becoming increasingly ineffective. AI and ML offer a powerful solution by enabling networks to self-configure, self-optimize, and self-heal, leading to a more agile, resilient, and cost-effective network infrastructure. The use of AI and ML in networks is still in its early stages, but it has the potential to transform the way networks are designed, built, and operated. As AI and ML technologies continue to evolve, we can expect to see even more innovative applications that will further unleash the potential of networks.

References

- https://cloud.google.com/blog/products/infrastructure/google-network-infrastructure-investments

- https://www.cisco.com/c/en/us/solutions/collateral/executive-perspectives/ai-ml-overview-of-industry-trends.html

**** This blog post was written with the assistance of Google’s Gemini. The AI was used to generate initial draft, rephrasing, and brainstorming, which I then refined, edited, and expanded upon.

Part1: Unleashing Network Potentials: Current State and Future Possibilities with AI/ML

By Vinay Tripathi with Ajay Lotan Thakur

Introduction

We live in an era of rapid digitization and ubiquitous connectivity where networks touch every aspect of our lives. From the global telecommunication infrastructure enabling seamless voice and data communication to the diverse social media platforms facilitating instant global interactions, the way we collaborate, communicate, and access information is heavily dependent on the seamless operation of networks. However, as networks continue to evolve, expanding in size and complexity, managing, provisioning, and optimizing them efficiently poses significant challenges.

Introducing Artificial Intelligence (AI) and Machine Learning (ML), offering a transformative solution to simplify network provisioning, streamline operations, enhance network performance, and unlock valuable insights from the vast amounts of network data. AI and ML empower network administrators, architects, planners, engineers, and managers with a range of capabilities that significantly improve network efficiency and effectiveness.

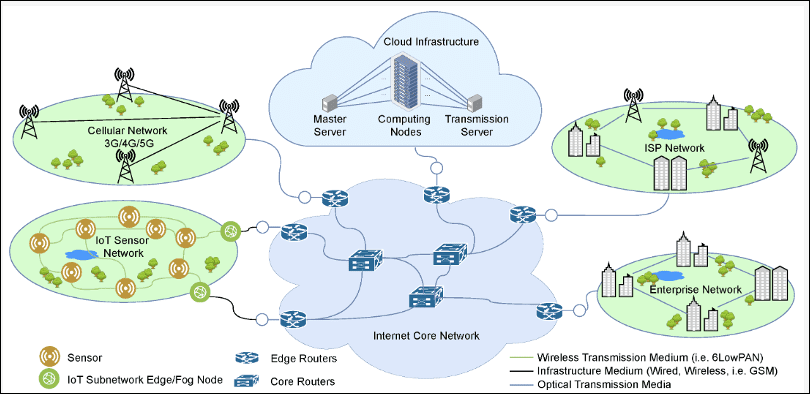

Type of Networks

Networks can be classified into various types based on their purpose, size, and geographical coverage. Some common types of networks include:

1. Core Networks:

- Form the backbone of the internet, connecting large geographical regions and major network providers.

- Characterized by high-speed data transmission, typically fiber optic cables, and redundant paths for reliability.

- Responsible for routing traffic between different parts of the internet and carrying large amounts of data.

2. Data Center Networks:

- Designed to support the infrastructure of data centers, where large amounts of data are processed and stored.

- Highly interconnected and optimized for low latency and high bandwidth to facilitate efficient communication between servers and storage systems.

- Often utilize specialized networking technologies such as Ethernet and InfiniBand.

3. Enterprise Networks:

- Connect devices and resources within an organization or company.

- Include local area networks (LANs) for devices within a building or campus and wide area networks (WANs) for connecting geographically dispersed sites.

- Provide secure and reliable connectivity for employees, customers, and partners.

4. Cellular Networks:

- Provide wireless connectivity for mobile devices such as smartphones, tablets, and IoT devices.

- Consists of cellular towers or base stations that communicate with mobile devices using radio waves.

- Offer various cellular technologies such as 2G, 3G, 4G, and 5G, each providing different levels of speed and capacity.

Here’s an example that demonstrates various types of networks:

Figure-1: Various types of Networks

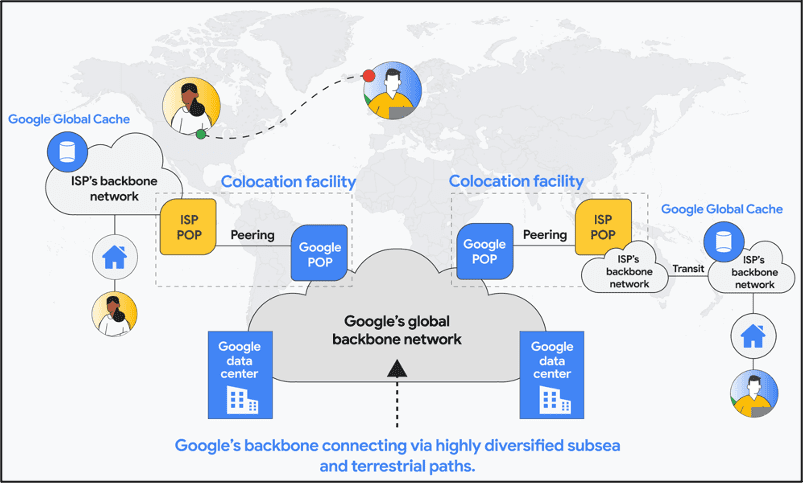

Figure-2: Google Network Infrastructure

Network Functions

Networks are designed to achieve specific goals, for example, edge networks can have very different routing and switching requirements when compared to core networks. However, there are some functions which are common to all networks.

- Engineering:Deals with design, optimization, provision and development of the network infrastructure and services. Engineering teams ensure the network operates efficiently, reliability and meets all the performance and scale requirements.

- Capacity Planning & Forecasting:Estimates future demand of network resources such as routers, switches, servers, storage and bandwidth. It helps in network planning and scaling by analyzing history consumptions and future demand.

- Implementation:Physically deploys the network components like routers, switches, servers, etc. It integrates the systems to the rest of the network and services based on the designs and plans developed by the engineering team.

- Monitoring:Another critical function of network infrastructure which provides vital insights to the current state of network infrastructure. Data collected from the systems can be used by other network functions to improve network performance, reliability, and security.

- Operation:A crucial function of the network which focuses on day-to-day management, maintenance and support of network infrastructure and services. It ensures the network operates smoothly, efficiently and with least disruptions.

- Security:Maintains confidentiality and integrity of information and systems. It uses firewall, intrusion detection systems and access control lists to keep the network secure.

Network Without AI/ML

Many large-scale network outages result from human manual errors or automated system malfunctions. Avoiding such issues is difficult when humans are involved in daily operational decision-making. Many network functions have been automated in recent years, but they still rely on predefined values or actions that require continuous system or service updates. Additionally, there are still many networks or functions that are not automated due to a lack of expertise, resources, or willingness. Even in automated networks, operators must perform manual operations in certain situations, such as tooling infrastructure failures or recoveries. Some scenarios where automated and/or manual operations are performed in a network include:

- Manual/automated security provisions:

- Manual security provisions involve tasks such as manually configuring firewalls, intrusion detection systems, and other security devices.

- Automated security provisions involve using software tools to automate security tasks, such as vulnerability scanning, patch management, and threat detection.

- Manual/automated configuration of network devices (switches, routers, etc.):

- Manual configuration involves manually configuring network devices, such as switches and routers, using command-line interfaces or web-based interfaces.

- Automated configuration involves using software tools to automate the configuration of network devices, which can save time and reduce errors.

- Manual/automated monitoring dashboard with predefined values:

- Manual monitoring involves manually monitoring network performance and security metrics using technologies such as Telemetry, SNMP, and syslog.

- Automated monitoring involves using software tools to automate the monitoring of network metrics and generate alerts when predefined thresholds are exceeded.

- Manual/automated troubleshooting of network issues:

- Manual troubleshooting involves manually diagnosing and resolving network issues, such as connectivity problems, performance issues, and security breaches.

- Automated troubleshooting involves using software tools to automate the diagnosis and resolution of network issues, which can reduce the time it takes to resolve problems.

- Manual/automated mitigation of network events:

- Manual mitigation involves manually responding to network events, such as security breaches, denial-of-service attacks, and natural disasters.

- Automated mitigation involves using software tools to automate the response to network events, which can help to minimize the impact of these events.

- Manual/automated capacity planning process:

- Manual capacity planning involves manually forecasting network traffic demand and planning for future capacity needs.

- Automated capacity planning involves using software tools to automate the forecasting of network traffic demand and the planning of future capacity needs, which can help to ensure that the network has sufficient capacity to meet future demand. Automated solutions can save time, reduce errors, and improve efficiency.

NextGen Network Requirements

Next-generation networks must meet diverse use cases and deliver exceptional customer experiences. Network applications and use cases constantly evolve, necessitating adjustments in network design, technologies, and operations. Continuous optimization is needed to unleash the network’s full potential. For example, existing data center networks require redesign and optimization to meet the demands of AI/ML applications. Critical requirements that must be fulfilled by next-generation networks are as follows:

- Increased performance, reliability, and security: Networks must handle massive data volumes and complex workloads with high performance and low latency. Reliability and security are paramount, ensuring uninterrupted operations and safeguarding sensitive information.

- Customer-centric focus: Delivering a seamless and delightful customer experience is crucial. Networks must facilitate seamless coordination across business functions, enabling personalized services and addressing customer needs effectively.

- Managing massive complexity: The convergence of 5G, Internet of Things (IoT), AI/ML loads and edge computing introduces unprecedented complexity. Networks need to be equipped with advanced orchestration and management capabilities to handle this complexity efficiently.

- Value beyond connectivity: Networks should not be limited to providing mere connectivity. They must deliver value-added services and capabilities such as real-time analytics, edge computing, and network slicing to meet diverse customer requirements.

- Improved service assurance and issue prediction: Networks must proactively monitor and analyze network performance to predict potential issues before they impact customers. Fault detection and self-healing mechanisms are essential to ensure uninterrupted service availability.

- Measuring and optimizing customer experience: Networks should have built-in capabilities to measure and analyze customer experience metrics such as latency, packet loss, and jitter. This data can be leveraged to optimize network performance and rectify areas of improvement.

- Understanding customer expectations: Networks must provide insights into customer expectations and evolving needs. This can be achieved through surveys, feedback mechanisms, and real-time monitoring of customer interactions.

- Increased efficiency and intelligence: Networks should incorporate AI and ML technologies to automate tasks, optimize resource allocation, and enhance overall network efficiency and intelligence.

Conclusions

Future networks need AI/ML integration to fulfill the next generation of requirements. AI/ML can make networks more efficient, secure, reliable, and scalable. AI/ML can effectively monitor and alert operators, utilizes resources efficiently, make network customer centric and faster delivery of services. In the next blog, we will discuss AI/ML use cases, benefits, limitations, and projections.

References

- https://www.mdpi.com/1424-8220/21/11/3898

- https://cloud.google.com/blog/products/infrastructure/google-network-infrastructure-investments

**** This blog post was written with the assistance of Google’s Gemini. The AI was used to generate initial draft, rephrasing, and brainstorming, which I then refined, edited, and expanded upon.

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

UScellular has added NetCloud Private Networks from Cradlepoint (part of Ericsson) to expand its portfolio of private cellular solutions. The company now offers Ericsson Private 5G and Ericsson’s Mission Critical Networks to its customers. By building on these capabilities, UScellular is able to support even more customers across varying areas of business.

Some existing private cellular network ecosystems are pulled together piece by piece from different providers, which requires additional training and agreements. This makes it difficult for enterprise IT teams to have seamless visibility across the entire network. NetCloud Private Networks is an end-to-end private cellular network solution that removes these complexities to simplify building and operating 5G private networks.

“With the addition of NetCloud Private Networks to our portfolio, we can better address business challenges for customers of all sizes to connect business, industry and mission critical applications,” said Kim Kerr, senior vice president, enterprise sales and operations for UScellular. “The agility, flexibility and scalability of NetCloud Private Networks helps improve coverage, security, mobility, and reliability for applications where Wi-Fi may not be enough.”

NetCloud Private Networks supports enterprises who need more scalable, reliable and secure connectivity than they are getting today with traditional Wi-Fi solutions. There is significant opportunity in warehouses, logistics facilities, outdoor storage yards, manufacturing and retail operations environments to provide more connectivity. This will alleviate manual work, improve safety, and provide increased visibility.

“UScellular is a leader in this space by showing how a public carrier enhances the value of private network solutions,” said Manish Tiwari, head of private cellular networks, Cradlepoint and Ericsson Enterprise Wireless Networks.

“By adding NetCloud Private Networks to their portfolio of Ericsson private networks solutions, UScellular unlocks new opportunities for organizations to have local network coverage and address their reliability and security challenges. With solutions available to cater to both OT and IT in industrial and business environments, their customers have a choice in adopting the right private network solution for their use-cases with secure, policy-based wireless connectivity at scale.”

………………………………………………………………………………………………………………………..

Separately, The Wall Street Journal reported Thursday that T-Mobile is seeking to buy $2 billion worth of UScellular and take over some operations and wireless spectrum licenses. A deal could be announced this month, according to people familiar with the matter.

Meanwhile, Verizon is considering a deal for some of the rest of the company which is 80% owned by Telephone & Data Systems (TDS). Last year, TDS put the wireless company’s operations up for sale, as it struggled with competition from national wireless telco rivals and cable-broadband providers.

Verizon is the biggest U.S. cellphone carrier by subscribers, while T-Mobile became the second largest soon after it bought rival Sprint. T-Mobile gained more customers this month after it completed its purchase of Mint Mobile, an upstart brand.

The rising value of wireless licenses is a driving force behind the deal. U.S. Cellular’s spectrum portfolio touches 30 states and covers about 51 million people, according to regulatory filings.

U.S. companies have spent more than $100 billion in recent years to secure airwaves to carry high-speed fifth-generation, or 5G, signals and are hunting for more. But the Federal Communications Commission has lacked the legal authority to auction new spectrum for more than a year. The drought has driven up the price of spectrum licenses at companies that already hold them.

The U.S. wireless business has also matured: Carriers have sold a smartphone subscription to most adults and many children, which leaves less room for expansion as the country’s population growth slows. AT&T and Verizon have meanwhile retreated from expensive bets on the media business to focus on their core cellphone and home-internet customers.

A once-crowded field of small, midsize and nationwide cellphone carriers in the U.S. is now split among Verizon, T-Mobile and AT&T, leaving few players left to take over. As one of the last pieces left on the board, U.S. Cellular has long been an attractive takeover target. For many years, the home of the Chicago White Sox has been UScellular field.

………………………………………………………………………………………………………………………..

About UScellular:

UScellular offers wireless service to more than four million mostly rural customers across 21 states from Oregon to North Carolina. It also owns more than 4,000 cellular towers that weren’t part of the latest sale talks. The company has a market value of about $3 billion.

UScellular provides a range of solutions from public/private hybrid networks, MVNO models, localized data (aka CUPS) and custom VPN approaches. Private 5G offers unparalleled reliability, security and speed, enabling seamless communication and automation. For more information:

https://business.uscellular.com/products/private-cellular-networks/

References:

https://www.wsj.com/business/telecom/t-mobile-verizon-in-talks-to-carve-up-u-s-cellular-46d1e5e6

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

Highlights of 3GPP Stage 1 Workshop on IMT 2030 (6G) Use Cases

This 3GPP May 8-10,2024 workshop held in Rotterdam, Nederlands brought the 3GPP community closer to the initiatives of regional and global research organizations, market partners (MRPs), operators’ associations and the ITU.

The workshop presented the opportunity for different communities to share their views on 6G/IMT2030 Use Cases. Those communities are Operators; Verticals; Regional Alliances and ITU.

The workshop was co-chaired by Mr. Jose Almodovar, SA1 Chair, and by Mr. Puneet Jain, SA Chair. It was supported by ETSI MCC, coordinated by Mr. Alain Sultan.

3GPP WG SA1 now has the task to define the 6G stage 1 requirements to be met by future 3GPP specifications.

Among the more important sessions were:

Day 1: Opening, Operators, Verticals

Speakers: Puneet Jain (Intel), SA Chair and Jose Almodovar (TNO), SA1 Chair

Operators:

- GSMA – GSMA Proposal on 6G – Speaker: Barbara Pareglio (GSMA)

- NGMN – NGMN’s 6G Vision – Speakers: Sparsh Singhal & Quan Zhao (NGMN)

Panel#1: “6G Drivers for Operators”

Panel#2 : “6G Drivers for Verticals”

Potential Drivers for 6G include:

•Security. Used in different contexts, both about network security and user data confidentiality (interesting to note that 5G Security is not widely deployed. It requires a 5G SA network few of which are commercially available).

• Maintaining continuity of service and robust security, especially crucial in times of crisis

• Identify all relevant new threat-factors for 6G, and develop mitigation solution (e.g. detection and protection against electromagnetic threats)

• Quantum-safe security mechanisms

• Network-design/performance: network optimization and automation (Intelligent Network management, Network Performance)

• Energy efficiency/saving/ sustainability

• AI-assisted air interface/ Radio Performance

• AI for improving positioning

• Enabling AI at the application level

• AI data management, model distribution for all AI-assisted “smart” areas (cities, industries, surgeries, robot control, manufacturing plant, rescue missions etc.

• AI as a Service (AIaaS)

• To implement a range of media’s personalization and customization (sport TV program, etc)

ITU & 3GPP:

- ITU-R – Update from ITU-R on IMT-2030 – Speaker: Uwe Loewenstein (ITU)

- 3GPP – 3GPP Intro & 6G Planning – Speaker: Puneet Jain (Intel), SA Chair

Panel#4: ITU & 3GPP synergies for 6G

Closing:

Speakers: Puneet Jain (Intel), SA Chair; Jose Almodovar (TNO), SA1 Chair; Alain Sultan (ETSI MCC), SA1 Secretary & 3GPP Work Plan Coordinator

…………………………………………………………………………………………………………..

References:

https://www.3gpp.org/component/content/article/stage1-imt2030-uc-ws?catid=67&Itemid=101

https://www.3gpp.org/ftp/workshop/2024-05-08_3GPP_Stage1_IMT2030_UC_WS/Docs

https://www.3gpp.org/ftp/workshop/2024-05-08_3GPP_Stage1_IMT2030_UC_WS

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

Juniper Research: Global 6G Connections to be 290M in 1st 2 years of service, but network interference problem looms large

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

New ETSI Reports: 1.] Use cases for THz communications & 2.] Frequency bands of interest in the sub-THz and THz range

SK Telecom, DOCOMO, NTT and Nokia develop 6G AI-native air interface

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

SK Telecom, Intel develop low-latency technology for 6G core network

ETSI Integrated Sensing and Communications ISG targets 6G

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs