Dell’Oro Group

RAN growth slowed in 4Q-2021, but full year revenues rose to ~$40B – $45B; Open RAN market highlights

- Global RAN rankings did not change with Huawei, Ericsson, Nokia, ZTE, and Samsung leading the full year 2021 market.

- Ericsson, Nokia, Huawei, and Samsung lead outside of China while Huawei and ZTE continue to dominate the Chinese RAN market.

- RAN revenue shares are changing with Ericsson and Samsung gaining share outside of China.

- Huawei and Nokia’s RAN revenue shares declined outside of China.

- Relative near-term projections have been revised upward – total RAN revenues are now projected to grow 5 percent in 2022.

Open RAN Market – Highlights

- While 5G offers superior performance over 4G, both will coexist comfortably into the 2030s as the bedrock of next-generation mobile networks. There are three perspectives that help to underline this point. Firstly, unlike voice-oriented 2G and 3G (which were primarily circuit-switched networks with varying attempts to accommodate packet-switching principles), 4G is a fully packet-switched network optimized for data services. 5G builds on this packet switching capability. Therefore, 4G and 5G networks can coexist for a long while because the transition from 4G to 5G does not imply or require a paradigm shift in the philosophy of the underlying technology. 5G is expected to dominate the OPEN RAN market with $22B TAM in 2030 with a growth rate of 52% as compared to a 4G growth rate of 31% between 2022 and 2030

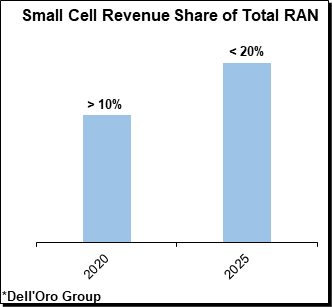

- Within OPEN RAN radio unit (RU), Small cells and macrocells are likely to contribute $7.5B and $2.4B TAM by 2030 respectively. It is going to be a huge growth of 46% from the current market size of $327M for such cells in the OPEN RAN market

- The sub-6GHz frequency band is going to lead the market with a 70% share for OPEN RAN although the mmWave frequency band will have a higher CAGR of 67% as compared to 37% CAGR of Sub-6GHz. Most focus has been on the 3.5 GHz range (i.e., 3.3-3.8 GHz) to support initial 5G launches, followed by mmWave awards in the 26 GHz and 28 GHz bands. In the longer term, about 6GHz of total bandwidth is expected for each country across two to three different bands

- Enterprises are adopting network technologies such as private 5G networks and small cells at a rapid rate to meet business-critical requirements. That’s why public OPEN RAN is expected to have the majority share of round ~95% as compared to the small market for the private segment

- At present, it is relatively easy for greenfield service providers to adopt 5G open RAN interfaces and architectures and it is extremely difficult for brownfield operators who have already widely deployed 4G. One of the main challenges for brownfield operators is the lack of interoperability available when using legacy RAN interfaces with an open RAN solution. Still, Mobile network operators (MNOs) throughout the world, including many brownfield networks, are now trialling and deploying Open RAN and this trend is expected to grow with time to have a larger share of brownfield deployments

- Asia Pacific is expected to dominate the OPEN RAN market with nearly 35% share in 2030. OPEN RAN market in the Asia Pacific is expected to reach USD 11.5 billion by 2030, growing at a CAGR of 34% between 2022 and 2030. Japan is going to drive this market in the Asia Pacific although China will emerge as a leader in this region by 2030. North America and Europe are expected to have a higher growth rate of more than 45% although their share will be around 31% and 26% respectively in 2030

References:

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

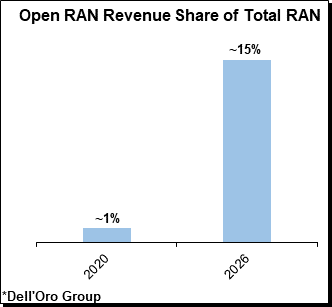

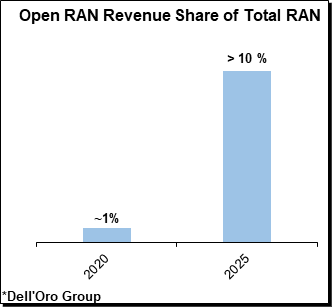

Dell’Oro Group recently published the January 2022 edition of its Open RAN report. Preliminary findings suggest that total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G (this author disagrees).

- The Asia Pacific region is dominating the Open RAN market in this initial phase and is expected to play a leading role throughout the forecast period, accounting for more than 40 percent of total 2021-2026 revenues.

- Risks around the Open RAN projections remain broadly balanced, though it is worth noting that risks to the downside have increased slightly since the last forecast update.

- The shift towards Virtualized RAN (vRAN) is progressing at a slightly slower pace than Open RAN. Still, total vRAN projections remain mostly unchanged, with vRAN on track to account for 5 percent to 10 percent of the RAN market by 2026.

-Market.jpg)

The global open radio access network (O-RAN) market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Amongst the market in these regions, the market in the Asia Pacific generated the largest revenue of $70 Million in the year 2020 and is further expected to hit $8200 Million by the end of 2028. The market in the region is further segmented by country into Japan, South Korea, India, and the Rest of Asia Pacific. Amongst the market in these countries, the market in India is expected to grow with the highest CAGR of 102% during the forecast period, while the market in Japan is projected to garner the second-largest revenue of $1900 Million by the end of 2028. Additionally, in the year 2020, the market in Japan registered a revenue of $60 Million.

The market in North America generated a revenue of $50 Million in the year 2020 and is further expected to touch $7000 Million by the end of 2028. The market in the region is further segmented by country into the United States and Canada. Out of these, the market in the United States is expected to display the highest market share by the end of 2028, whereas the market in Canada is projected to grow with the highest CAGR of 137% during the forecast period.

Key companies covered in the Open Radio Access Network (O-RAN) Market Research Report are: Metaswitch Networks, Mavenir, NTT DOCOMO, INC., Sterlite Technologies Limited, Huawei Technologies Co., Ltd., Radisys Corporation, Casa Systems, VIAVI Solutions Inc., Parallel Wireless, Inc., NXP Semiconductors, and other key market players.

Reference:

https://www.kennethresearch.com/report-details/open-radio-access-network-o-ran-market/10352259

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The latest Heavy Reading Open RAN Operator Survey indicates a positive outlook with real signs of momentum over the past year. Network operators and the wider RAN ecosystem are making steady progress, according to the survey results.

The first question in the survey was designed to help understand how operator sentiment toward open RAN has changed over the past year, in light of better knowledge of the technology, experience from trials, the increased maturity of solutions and changes in the policy environment. The figure below shows just over half (54%) of survey respondents say their company has not changed the pace of its planned open RAN rollout in the past year. There has been movement in the other half, split between those accelerating their plans (20%) and those slowing down (27%). This volatility essentially cancels out, and the overall finding is therefore that operators as a group are working at a steady, measured pace toward open RAN.

A steady outlook is a positive outlook at this stage of the market because it recognizes that open RAN is a major change in RAN architecture and is a long-term, multiyear exercise. After several years of inflated expectations, it is encouraging to see a measured perspective on open RAN coming to the fore.

n=82 Source: Heavy Reading

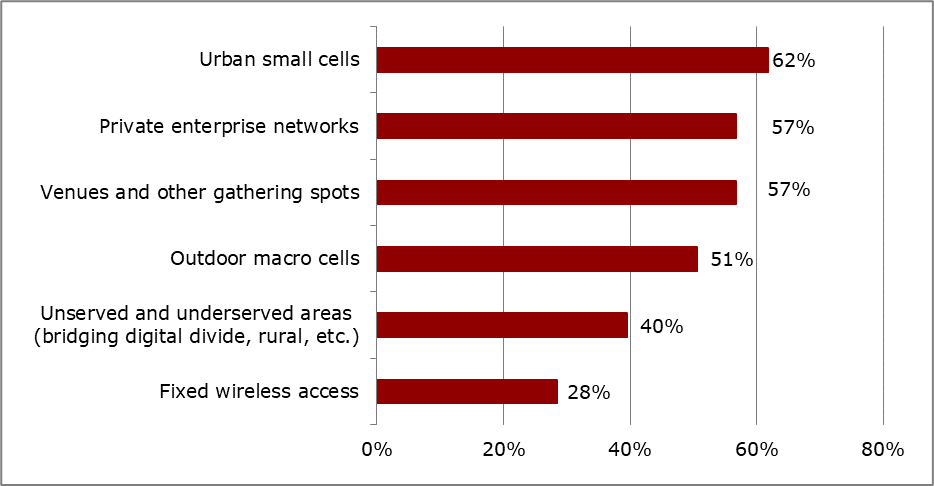

Another area of interest that helps gauge sentiment toward open RAN development relates to operators’ preferred use cases. The figure below reveals that operator intentions for how they will use open RAN are varied. Asked to select their top three use cases, 81 respondents representing 39 operators placed a total of 294 votes for an average of 3.6 per respondent, showing that there is no single open RAN use case or deployment scenario that stands out. Urban small cells (62%), private enterprise networks (57%) and venues and other gathering spots (also 57%) lead the responses.

n=81 Source: Heavy Reading

A positive way to interpret this finding is that open RAN is being pursued across a broad base of mobile communication scenarios. Once these models solidify and become “product ready,” then the market might see widespread adoption. Over time, open RAN could become the predominant mode of operation.

A less positive analysis, but one nevertheless worth considering, is that open RAN is a technology still in search of a solution. That is, the industry has committed to open RAN, and now it needs to find ways to make it work. Pursuing a diversity of use cases will help identify which are most promising and warrant investment and deployment at a wider scale.

It is notable that operator preferences for open RAN use cases have not changed much since Heavy Reading’s first survey in 2018; the same three use cases also led at that time. This reinforces the key message that open RAN progress is steady and consistent.

To download a copy of the 2021 Heavy Reading Open RAN Operator Survey, click here.

— Gabriel Brown, Principal Analyst, Heavy Reading

Reference:

https://www.lightreading.com/open-ran-steady-as-she-goes-/a/d-id/774765?

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

The slow uptake of 5G Standalone (SA) networks is decreasing the growth for the overall Mobile Core Network (MCN), which also includes IMS Core and 4G Core (EPC). Dell’Oro Group [1.] forecasts worldwide MCN 5-year growth will be at a 3% compounded annual growth rate (CAGR).

- 5G MCN, IMS Core, and Multi-Access Network Computing (MEC) will have positive growth rates for the forecast period while 4G MCN will experience negative growth.

- By 2026, 99% of the revenue for network functions will be from cloud native Container-based CNFs.

Via email, Dave wrote: The journey for network virtualization started in 2015 with ETSI NFV. We went from Physical Network Functions (PNFs) to Virtual Network Functions (VNFs) to cloud-ready VNFs, to Cloud- Native VNFs (CNF), to Container-Based Cloud-Native VNFs. Container-Based (CNF) enable microservices.

…………………………………………………………………………………………………………………

Separately, the Global mobile Suppliers Association (GSA) recently wrote that only 99 operators in 50 countries are investing in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks.

The GSA said at least 20 network operators (Dell’Oro says 13) in 16 countries or territories are believed to have launched public 5G SA networks. Another five have deployed the technology, but not yet launched commercial services or have only soft-launched them. So only 20.6% of the 481 5G network operators (investing in 5G licenses, trials or deployments of any type) have deployed 5G and that percentage is lower if you go by Dell’Oro’s 13 5G SA network operators.

From GSA’s The Power of Standalone 5G – published 19th January 2022:

Importantly, the 5G standalone core is cloud-native and is designed as a service-based architecture, virtualizing all software network functions using edge computing and providing the full range of 5G features. Some of these are needed in the enterprise space for advanced uses such as smart factory automation, smart city applications, remote control of critical infrastructure and autonomous vehicle operation. However, 5G standalone does mean additional investment and can bring complexity in running multiple cores in the network.

This will be a potential source of new revenue for service providers, as digital transformation — with 5G standalone as a cornerstone — will enable them to deliver reliable low-latency communications and massive Internet of things (IoT) connectivity to customers in different industry sectors. The low latency and much higher capacity needed by those emerging service areas will only be feasible with standalone 5G and packet core network architecture.

In addition, the service-based architecture opens up the ability to slice the 5G network into customized virtual pieces that can be tailored to the needs of individual enterprises, while maximizing the network’s operational efficiency. Advanced uses for 5G NR aren’t backward- compatible with LTE infrastructure, so all operators will eventually need to get to standalone 5G.

Standalone 5G metrics:

- Volume: Gbps per month

- Speed: Mbps (peak), Mbps (guaranteed)

- Location: Network Slice, service per location

- Latency per service or location (dependent on URLLC in the 5G RAN and 5G Core)

- Reliability or packet loss

- Number of devices per square km

- Dynamic service-level agreements per location

- Full end-to-end encryption and authentication

Source: CCS Insight

……………………………………………………………………………………………………………….

Note 1. Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

………………………………………………………………………………………………………………….

Feb 8, 2022 Update from Dave Bolan of Dell’Oro Group:

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

References:

Slow Uptake for 5G Standalone Drags on Mobile Core Network Growth, According to Dell’Oro Group

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

T-Mobile US: 5G SA Core network to be deployed 3Q-2020; cites 5G coverage advantage

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

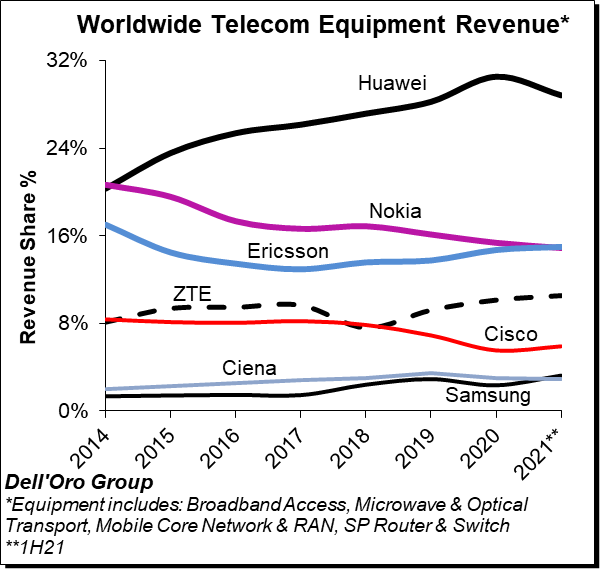

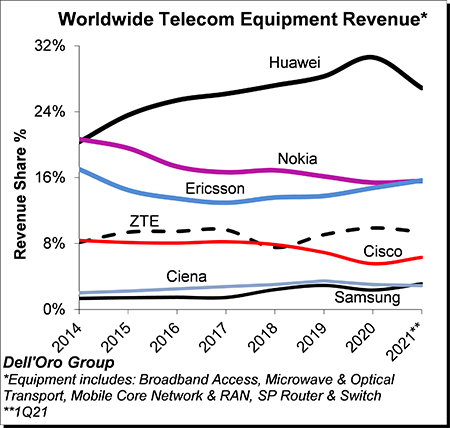

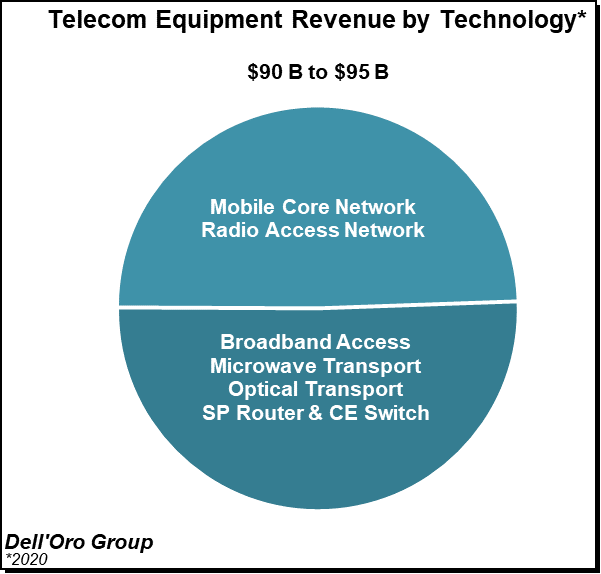

Dell’Oro: 3Q21 Total Telecom Equipment Market up 6% year-over-year & 9% year-to-date

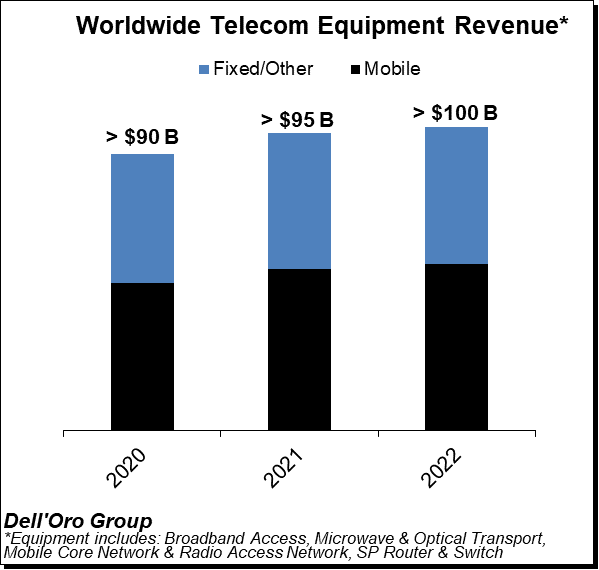

Dell’Oro Group just completed their 3Q21 reporting period for all the Telecommunications Infrastructure programs covered. Those include: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network (RAN), SP Router & Switch.

The data contained in these reports suggest that the positive trends that characterized the broader telecom equipment market in the first half of 2021 extended into the third quarter, propelling the overall telecom equipment market to a sixth consecutive quarter of year-over-year (Y/Y) growth in revenues.

Preliminary estimates suggest the overall telecom equipment market advanced 6% Y/Y in the quarter and 9% Y/Y year-to-date (YTD). The growth in the quarter was underpinned by healthy demand for both wireless and wireline equipment.

While the majority of the suppliers were able to navigate the supply chain situation fairly well in the first half, supply chain disruptions had a greater impact in the third quarter, though clearly this was not enough to derail the positive momentum that has characterized the market over the past six quarters.

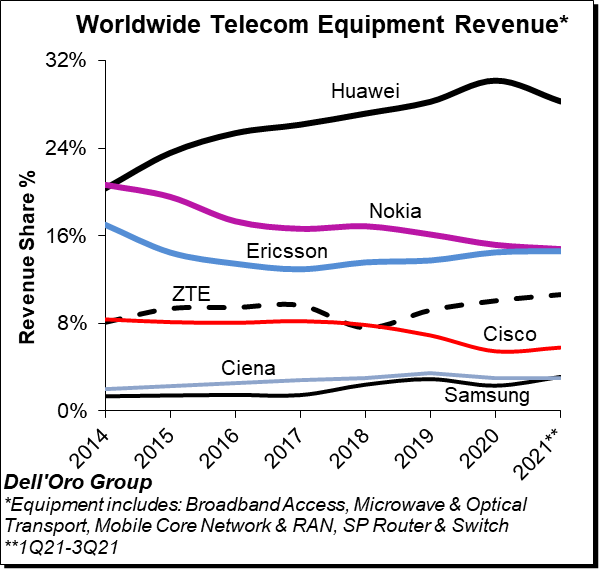

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1Q21-3Q21, with the top seven vendors comprising around ~80% of the total market.

Ongoing efforts by the US government to curb the rise of Huawei is starting to show in the numbers, especially outside of China. At the same time, Huawei continued to dominate the global market, still nearly as large as Ericsson and Nokia combined.

Overall, we believe ZTE and Samsung are trending upward while Huawei is losing some ground YTD relative to 2020.

Additional key takeaways from the 3Q21 reporting period include:

- Positive market sentiment in the third quarter was driven by strong growth in RAN and Broadband Access, which was more than enough to offset weaker trends in Optical Transport.

- RAN and Broadband Access are also the strongest growth vehicles for the YTD period, fueled by surging demand for 5G, PON, and FWA CPEs.

- With the pandemic resurging and the visibility surrounding the supply chain weakening, the Dell’Oro analyst team is expecting near-term growth to decelerate – the overall telecom equipment market is now projected to advance 2% in 2022, down from 8% in 2021.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.

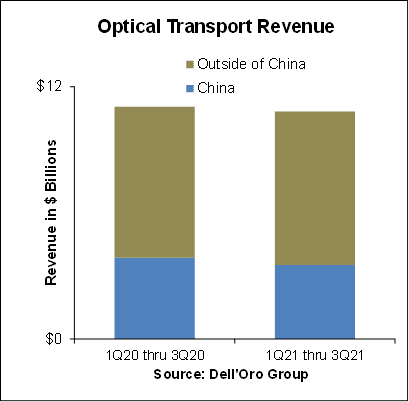

Dell’Oro: Optical Transport Market Down 2% in 1st 9 Months of 2021

According to a recently published report from Dell’Oro Group, the Optical Transport equipment market contracted 2 percent year-over-year in the first nine months of 2021 due to lower sales in China. Outside of China, however, the demand for optical equipment continued to increase, outpacing supply.

“Optical equipment revenue in China took a sharp turn for the worse in 3Q 2021,” said Jimmy Yu, Vice President at Dell’Oro Group. “As a result, optical revenue in China declined at a double-digit rate in the quarter, resulting in a 9 percent decline for the first nine months of 2021. At this rate, we are expecting a full year optical market contraction in the country. Something that has not occurred since 2012. Helping to offset some of this lower equipment revenue from China was the robust demand in North America, Europe, and Latin America.”

“We estimate that Optical Transport equipment revenue outside of China grew 6 percent year-over-year in the third quarter. However, we believe this growth rate could have been higher, closer to 10 percent, if it was not for component shortages and other supply issues plaguing the industry. So, fortunately while optical demand is hitting a rough patch in China, it seems to be accelerating in other parts of the world,” added Yu.

The optical transport market is predicted to reach $18 billion by 2025, primarily as a result of demand for WDM equipment, Dell’Oro reported in July 2021. In addition, Dell’Oro says the ZR pluggable optics market could exceed $500 million in annual sales by 2025.

In a 2Q-2021 report by market research firm Omdia, analysts noted that 5G investment, cloud service growth and demand for “infotainment-at-home” are among the drivers increasing demand in the optical networking market. “The twin dynamics of increasing optical capillarity and increasing end-point capacity continue to drive the optical core,” Omdia wrote in a note to clients.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Jimmy Yu, Vice President, Dell-Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Optical Transport Market Down 2 Percent in First Nine Months of 2021, According to Dell’Oro Group

Disaggregated DWDM Equipment Market Up 36 Percent in 2Q 2021, According to Dell’Oro Group

5-Year Forecast: Optical Transport Market Reaches $18 Billion by 2025

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Dell’Oro Group has completed its 1H2021 reports on “Telecommunications Infrastructure programs” including Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network (RAN), Service Provider Router & Switch markets. The data contained in these reports suggest that the positive trends that characterized the broader telecom equipment market extended into the second quarter, even if the pace of the growth slowed somewhat between the first and the second quarter.

Preliminary estimates suggest the overall telecom equipment market advanced 10% year-over-year (Y/Y) during 1H21 and 5% Y/Y in the quarter, down from 16% Y/Y in the first quarter. The growth in the first half was primarily driven by strong demand for both wireless and wireline equipment, lighter comparisons, and the weaker US Dollar (USD). Helping to explain the Y/Y growth deceleration between 1Q and 2Q is slower growth in China.

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1H21, with the top seven vendors comprising around ~81% of the total market.

Huawei is still the overall market leader by some margin, despite its sales and marketing challenges in many other parts of the world. Huawei’s market share slid below 30%, though that still almost double the share of its nearest rivals Ericsson and Nokia. Within the mix, Dell-Oro estimates Huawei and Nokia lost some ground between 2020 and 1H21 while Cisco, Ericson, Samsung, and ZTE recorded minor share gains over the same period.

Additional key takeaways from the 1H2021 reporting period include:

- Following the Y/Y decline in 1Q20, our analysis suggests the overall telecom equipment market recorded a fifth consecutive quarter of growth in the second quarter.

- The improved market sentiment in the first half was relatively broad-based, underpinned by single-digit growth in SP Routers and double-digit advancements in Broadband Access, Microwave Transport, Mobile Core Networks, and RAN.

- Aggregate 2Q21 revenues were in line with expectations, however, within the programs both Broadband Access and Microwave Transport were surprised on the upside while Optical Transport and SP Routers came in below expectations.

- From a regional perspective, China underperformed in the quarter, impacting the demand for both wireless and wireline-related infrastructure.

- Ongoing efforts by the US government to curb the rise of Huawei are starting to show in the numbers outside of China, not just for RAN but in other areas as well.

- Though Huawei is not able to procure custom ASICs for its telecom products, the supplier is assuring the analyst community its current inventory levels is not a concern over the near term for its infrastructure business.

- The majority of the vendors have through proactive measures been able to navigate the ongoing supply chain shortages and minimize the infrastructure impact. At the same time, the supply constraints appear more pronounced with higher volume residential and enterprise products including CPE and WLAN endpoints.

- Even with the unusual uncertainty surrounding the economy, the supply chains, and the pandemic, the Dell’Oro analyst team remains optimistic about the second half – the overall telecom equipment market is projected to advance 5% to 10% for the full-year 2021, unchanged from last quarter.

Two of the key telecom revenue drivers will be the RAN and Broadband Access markets, both of which have been growing at a strong pace this year so far: The RAN market is set to grow at between 10% and 15% this year, which means it could be worth as much as $40 billion, while the increasing number and size of investments in fibre broadband access networks around the world is driving growth in the Broadband Access market, which Dell’Oro reports was worth $3.6 billion during the second quarter alone.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.

Dell’Oro: Total RAN market to grow 10-15% in 2021; Microwave Transmission equipment grows 11% YoY

Dell’Oro Group has once again upgraded its forecast for the total RAN market, now projecting it to grow 10-15% this year. As expected, Huawei and ZTE are gaining market share in China, while Ericsson and Nokia are gaining everywhere else. Ericsson and Samsung increased their RAN revenue outside of China.

“The underlying long-term growth drivers have not changed and continue reflect the shift from 4G to 5G, new FWA (Fixed Wireless Access) and enterprise capex, and the transitions towards active antenna systems,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “At the same time, a string of indicators suggest this output acceleration is still largely driven by the shift from 4G to 5G, which continued at a torrid pace in the quarter (but only for the RAN; not for the 5G SA core network), even as LTE surprised on the upside,” continued Pongratz.

“With the improved outcome in Latin America, we estimate that four out of the six regions we track increased at a double-digit rate in the second quarter,” Stefan said via email. He was kind enough to send me these charts:

Additional highlights from Dell’Oro’s 2Q 2021 RAN report:

- RAN rankings did not change – Huawei and ZTE were the No.1 and No.2 suppliers in China while Ericsson and Nokia maintained their No.1 and No.2 positions outside of China.

- Revenue shares changed slightly – preliminary estimates suggest Ericsson and Samsung recorded revenue share gains outside of China, while Huawei and ZTE improved their positions in China.

- The combined share of the smaller RAN suppliers, excluding the top five vendors, improved by ~1% between 2020 and the first half of 2021, in part as a result of the ongoing Open RAN greenfield deployments in Japan and the U.S. “It’s all relative and it will take some time before open RAN moves the needle,” Pongrantz said.

- The RAN market remains on track for a fourth consecutive year of growth. The short-term outlook has been revised upward – total RAN is now projected to advance 10 to 15% in 2021.

………………………………………………………………………………………………………………………………………………..

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceiver, macro cell, small cell BTS shipments, and Open RAN for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, and LTE. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook.

- Segments: LTE, Sub 6 GHz 5G NR, Millimeter Wave 5G NR, Massive MIMO, Macro Cell, Small Cell, Open RAN

- Regions: North America, Europe, Middle East & Africa, Asia Pacific, China and CALA (Caribbean and Latin America)

To purchase this report, please contact: [email protected]

References:

2021 Outlook Upgraded for RAN Market, According to Dell’Oro Group

…………………………………………………………………………………………………………………………………..

Separately, Dell’Oro Group says that the demand for Microwave Transmission equipment grew 11% year-over-year in the first half of 2021, driven by LTE and 5G. In that period, microwave revenue from mobile backhaul application grew 16 percent.

“The Microwave Transmission market is recovering from the decline caused by the spread of COVID-19 as evidenced by the strong growth in the first half of 2021,” stated Jimmy Yu, Vice President at Dell’Oro Group. “Almost all of the vendors in this industry are benefiting from the improving mobile backhaul market, especially the top vendors. Since demand is rising, each vendor’s performance this year will come down to how well they navigate the supply issues created by the pandemic and semiconductor shortages,” added Yu.

Highlights from the 2Q 2021 Quarterly Report:

- All regions contributed to the positive market growth this quarter with the exception of Latin America. Latin America declined year-over-year for a ninth consecutive quarter, shrinking to its lowest quarterly revenue level that we have on record.

- The top three vendors in the quarter continued to be Huawei, Ericsson, and Nokia. In 2Q 2021, Huawei regained most of the market share lost in the previous quarter and returned to holding a 10 percentage point lead over Ericsson.

- E/V Band revenue growth remained positive for another consecutive quarter and held its double-digit year-over-year growth rate.

The Dell’Oro Group Microwave Transmission & Mobile Backhaul Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, ports/radio transceivers shipped, and average selling prices by capacities (low, high and E/V Band). The report tracks point-to-point TDM, Packet, and Hybrid Microwave as well as full indoor and full outdoor unit configurations.

The following markets are covered in the report:

- TDM, Packet, and Hybrid Microwave

- Microwave Transmission by Application: Mobile Backhaul and Verticals

- Split mount units, Full indoor units, and full outdoor units

- E/V Band systems

To purchase this report, please contact [email protected]

References:

5G and LTE Drive Mobile Backhaul Microwave Market 16 Percent in 1H 2021, According to Dell’Oro Group

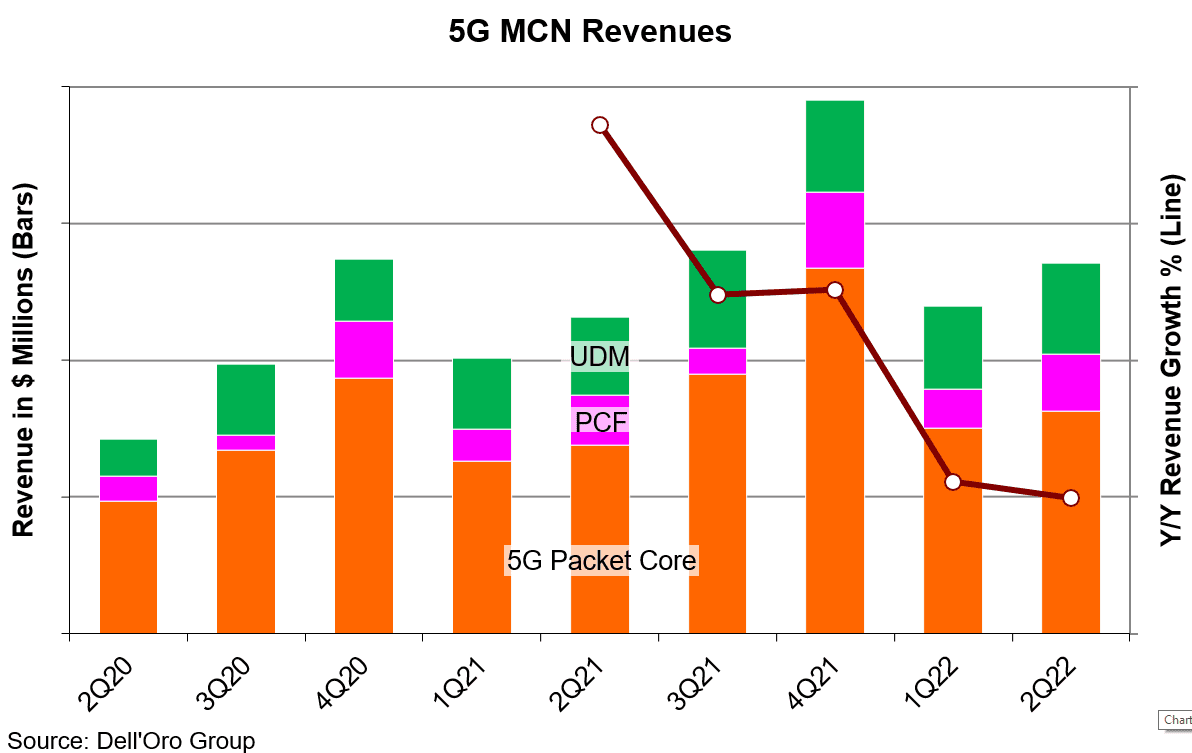

Dell’Oro: 5G SA indecisions slowing 5G Core network growth

Revenues for the Mobile Core Network (MCN) [1.] market slowed to 6% year-over-year growth in 2Q 2021 after four quarters of double-digit growth, according to a new report by Dell’Oro Group.

Communication Service Providers (CSPs) indecisions about moving forward with 5G Standalone (5G SA/core network are slowing 5G Core market growth (except in China). It is now expected to decelerate over the next four quarters dropping to 17% year-over-year in 2Q 2022.

Note 1. The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

With Network Function Virtualization (NFV) the 5G Core SBA is best served with Cloud-native Network Functions that disaggregates the hardware from the software and operates in a stateless function with the data separated from the control function among other things.

………………………………………………………………………………………………………………………………………………

“We attribute the slowdown to the slow uptake of 5G Standalone (SA) networks. CSPs need to make decisions about which direction to take for 5G SA deployments. CSPs have several options to mull over, with new choices that were not available during the switch from 3G to 4G,” stated David Bolan, Research Director at Dell’Oro Group. “One decision CSPs need to make is about the selection of Network Function Virtualization Infrastructure (NFVI). NFVI can be procured from a 5G core vendor, a third-party, the public cloud, or another platform like the Rakuten Communications Platform.”

Additional highlights from the 2Q 2021 Mobile Core Network Report:

• The Asia Pacific region accounted for 70% of the revenues for 5G Core as the Chinese SPs continue to build and Japanese SPs begin their buildouts.

• Top vendor ranking remains unchanged based on the four trailing quarters ending in 2Q 2021: Huawei, Ericsson, Nokia, ZTE, and Mavenir.

• 4G MCN (EPC) revenues are now in continual decline, but still represented 70% of the mix between 4G and 5G.

About the Report:

The Dell’Oro Group Mobile Core Network Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions.

To purchase this report, please contact at [email protected].

……………………………………………………………………………………………………………………………..

Closing Comments:

The slowdown in 5G SA/core network growth should come as no surprise to IEEE Techblog readers. We’ve pounded the table for a very long time, stating that in the absence of an ITU standard or 3GPP IMPLEMENTATION spec, the 5G SA/core network growth would be slow with many different versions implemented by CSPs. That will inhibit interoperability and portability of 5G endpoints which have 5G SA software.

Equally important is that ALL 5G services and features (e.g. network slicing, automation, MEC, etc) require a 5G Core network while almost all 5G deployments today are 5G NSA which has a 4G core (EPC) network.

References:

CSPs’ Indecisions Slow 5G Core Growth Except for China, According to Dell’Oro Group

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

RootMetrics touts 5G performance in Korea while users complain; No 5G SA in Korea!

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

T-Mobile Announces “World’s 1st Nationwide Standalone 5G Network” (without a standard)

Evaluating Gaps and Solutions to build Open 5G Core/SA networks

Dell’Oro Group: Telecom equipment market advances in 1Q-2021; Top 7 vendors control 80% of the market

Preliminary estimates from Dell’Oro Group suggests the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Switch – started the year on a high note, advancing 15% year-over-year (Y/Y) in the 1st quarter of 2021, reflecting positive activity in multiple segments and regions, lighter comparisons, and a weaker US Dollar (USD).

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1Q2021, with the top seven vendors comprising around ~80% of the total market. Not surprisingly, Huawei maintained its leading position. However, the gap between Nokia and Ericsson, which was around 5 percentage points back in 2015, continued to shrink and was essentially eliminated in the quarter. In addition, Samsung passed Ciena in the quarter to become the #6 supplier.

Excluding North America, we estimate Huawei’s revenue share was about 36% in the quarter, nearly the same as the combined share of Nokia, Ericsson, and ZTE.

Additional key takeaways from the 1Q2021 reporting period include:

- Following three consecutive years of growth between 2018 and 2020, preliminary readings suggest the positive momentum that characterized the overall telco market in much of 2020 extended into the first quarter, underpinned by double-digit growth on a Y/Y basis in both wireless and wireline technologies including Broadband Access, Microwave Transport, Mobile Core Network, RAN, and SP Router & Switch.

- In addition to easier comparisons due to poor market conditions in 1Q20 as a result of supply chain disruptions impacting some segments, positive developments in the North America and Asia Pacific regions, both of which recorded growth in excess of 15% Y/Y during the first quarter, helped to explain the output acceleration in the first quarter.

- Aggregate gains in the North America region were driven by double-digit expansion in Broadband Access, RAN, and SP Routers & Switch.

- The results in the quarter surprised on the upside by about 2%, underpinned by stronger than expected activity in multiple technology domains including Broadband Access, Microwave Transport, RAN, and SP Routers & Switch.

- The shift from 4G to 5G continued to accelerate at a torrid pace, impacting not just RAN investments but is also spurring operators to upgrade their core and transport networks.

- At a high level, the suppliers did not report any material impact from the ongoing supply chain shortages in the first quarter. At the same time, multiple vendors did indicate that the visibility going into the second half is more limited.

- Overall, the Dell’Oro analyst team is adjusting the aggregate forecast upward and now project the total telecom equipment market to advance 5% to 10% in 2021, up from 3% to 5% with the previous forecast.

………………………………………………………………………………………………………………………………………………….

- Cisco was the top-ranked vendor for market share, followed by Huawei, Nokia, and Juniper.

- The SP Router and Switch market is forecasted to grow at a mid-single-digit rate in 2021.

- The adoption of 400 Gbps technologies is expected to drive double-digit growth for the SP Core Router market in 2021.

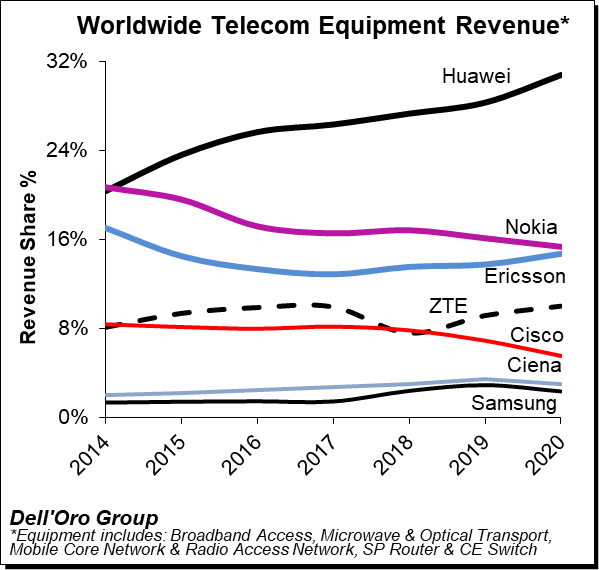

Dell’ Oro: Huawei still top telecom equipment supplier; optical transport market +1% in 2020

Huawei has increased its lead as the#1 global telecoms network equipment vendor, boosting its revenue share by a three percentage points last year, according to Dell’Oro Group. Nokia lost one percentage point of revenue share year-on-year, as did Cisco, the latter falling to 6%. Ericsson gained one percentage point to match Nokia at 15% of the market and ZTE also saw a 1% uptick to 10% of the global telecom market. (Please refer to chart below).

Dell’Oro Group’s preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES) – advanced 7% year-over-year (Y/Y) for the full year 2020, growing at the fastest pace since 2011.

The telecom and networking market research firm suggests revenue rankings remained stable between 2019 and 2020, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for 80% to 85% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets. While both Ericsson and Nokia improved their RAN positions outside of China, initial estimates suggest Huawei’s global telecom equipment market share, including China, improved by two to three percentage points for the full year 2020.

Dell’Oro now estimates the following revenue shares for the top seven suppliers:

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Additional key takeaways from the 4Q2020 reporting period:

- Preliminary estimates suggest that the positive momentum that has characterized the overall telecom market since 1Q-2020 extended into the fourth quarter, underpinned by strong growth in multiple wireless segments, including RAN and Mobile Core Networks, and modest growth in Broadband Access and CES.

- Helping to drive this output acceleration for the full year 2020 is faster growth in Mobile Core Networks and RAN, both of which increased above expectations.

- Covid-19 related supply chain disruptions that impacted some of the telco segments in the early part of the year had for the most part been alleviated towards the end of the year.

- Not surprisingly, network traffic surges resulting from shifting usage patterns impacted the telecom equipment market differently, resulting in strong demand for capacity upgrades with some technologies/regions while the pandemic did not lead to significant incremental capacity in other cases.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained around 3 to 4 percentage points of revenue share between 2019 and 2020, together comprising more than 40% of the global telecom equipment market.

- Even with the higher baseline, the Dell’Oro analyst team remains optimistic about 2021 and projects the overall telecom equipment market to advance 3% to 5%.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Carrier Ethernet Switch.

…………………………………………………………………………………………….

Last week, Dell’Oro Group reported that the optical transport equipment revenue increased 1% in 2020 reaching $16 billion. In this period, all regions grew with the exception of North America and Latin America.

“Between concerns on starting new optical builds during the start of the pandemic and aggressive plans on 5G deployments that required a larger share of a service provider’s capital budget, the spending on optical transport dramatically slowed by the end of 2020,” said Jimmy Yu, Vice President at Dell’Oro Group.

“It was a really dramatic drop in optical equipment purchases in the fourth quarter. While we anticipated a slowdown near the end of the year due to concerns around COVID-19, we were surprised by a 29 percent year-over-year decline in WDM purchases in North America as well as a 12 percent decline in China. That said, there was good growth in the other parts of the world, especially Japan,” continued Yu.

| Optical Transport Equipment Market | |

| Regions | Growth Rate in 2020 |

| North America | -6% |

| Europe, Middle East and Africa | 2% |

| China | 1% |

| Asia Pacific excluding China | 13% |

| Caribbean and Latin America | -14% |

| Worldwide | 1% |

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please email [email protected].

References: