Author: Alan Weissberger

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector are a $1.5B opportunity

SNS Telecom & IT says that private 5G in the global Defense Sector is a $1.5 Billion opportunity. The market research firm’s latest report indicates that cumulative spending on private 5G networks in the defense sector will reach $1.5 Billion between 2024 and 2027.

Private 5G and 4G LTE cellular networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – are rapidly gaining popularity across a diverse range of vertical industries. The defense industry is no exception to this trend, with private cellular network solutions in the sector extending from permanent 5G networks at military bases and training facilities to satellite-backhauled portable cellular systems for warfighters at the tactical edge.

Alongside their use of specialized, proprietary communication systems, armed forces around the world are increasingly turning to adapted COTS (Commercial-off-the-Shelf) network solutions – especially those built on 3GPP specs – to reduce costs, expedite deployment timelines and support increasingly complex application scenarios. The U.S. DOD (Department of Defense) has recently published its strategy for deploying Open RAN-compliant private 5G networks at military installations in the United States and overseas territories.

- Supported by over $650 Million in funding over the past three years, several U.S. Army, Navy, Marine Corps and Air Force bases already host on-premise 5G infrastructure for both experimental and operational use. 5G private networks have been deployed at over 14 U.S. military bases to date.

- The Spanish Army and Navy have awarded multiple contracts – collectively worth $15 Million – to mobile operator Telefónica to supply standalone private 5G networks for army brigades on the move, armored systems and helicopter maintenance parks, naval bases, ships and marine infantry units.

- The Norwegian Armed Forces are utilizing a combination of defense-specific network slices and tactical private 5G networks to support their future mobile communications needs while the South Korean military is leveraging private 5G installations for smart naval base operations, runway safety management and XR (Extended Reality)-based training, including small unit tactics and firearm disassembly/assembly-related education.

-

The Jordanian Armed Forces and Ministry of Interior are jointly investing over $10 Million to deploy a hybrid TETRA-LTE communications system to support both narrowband voice and broadband data applications.

-

As part of the Qatar MoD’s (Ministry of Defense) LTE-5G program, the Signals Corps of the Gulf country’s armed forces has deployed a nationwide wireless network for mission-critical communications.

-

The ADF (Australian Defence Force) relies on private LTE and 5G-ready networks to support wireless broadband communications for live and synthetic military training environments.

-

The South Korean military is leveraging private 5G installations for smart naval base operations, runway safety management and XR (Extended Reality)-based training, including small unit tactics and firearm disassembly/assembly-related education.

-

The Japanese Ministry of Defense plans to deploy local 5G networks across JSDF (Japan Self-Defense Forces) military installations to digitize rear-area operations, such as base security, and reduce the burden on personnel.

-

The Brazilian Army and state-level military police forces have installed private LTE infrastructure in strategic locations to facilitate high-availability and reliable broadband communications.

- Other examples range from the ZNV (Deployable Cellular Networks) program of the Bundeswehr (German Armed Forces) to the ADF’s (Australian Defence Force) private LTE and 5G-ready networks for live and synthetic military training environments.

SNS Telecom & IT’s “Private 5G/4G Cellular Networks for Defense: 2024 – 2030” report predicts that global spending on private 5G and 4G LTE network infrastructure in the defense sector will grow at a CAGR of 21% over the next three years, collectively accounting for nearly $1.5 Billion between 2024 and 2027.

……………………………………………………………………………………………………………………………………….

Military bases hosting fixed and transportable (rapidly deployable) private 5G network assets include but are not limited to Naval Air Station Whidbey Island (Washington), Naval Base Guam, Joint Base Pearl Harbor-Hickam (Hawaii), Fort Carson (Colorado), Marine Corps Base Camp Pendleton (California), Marine Corps Air Station Miramar (California), Nellis Air Force Base (Nevada), Fort Hood (Texas), Fort Bliss (Texas), Joint Base San Antonio (Texas), Marine Corps Logistics Base Albany (Georgia), Tyndall Air Force Base (Florida), Camp Grayling (Michigan) and Fort Bragg (North Carolina), explained SNS Telecom & IT 5G research director, Asad Khan said in an email to Fierce Network. “We definitely expect more rollouts, particularly Open RAN-compliant networks in line with the DOD’s recently published private 5G deployment strategy,” Khan added.

For more information, please visit: https://www.snstelecom.com/defense

About SNS Telecom & IT:

SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 6G, 5G, LTE, Open RAN, vRAN (Virtualized RAN), small cells, mobile core, xHaul (Fronthaul, Midhaul & Backhaul) transport, network automation, mobile operator services, FWA (Fixed Wireless Access), neutral host networks, private 4G/5G cellular networks, public safety broadband, critical communications, MCX (Mission-Critical PTT, Video & Data), IIoT (Industrial IoT), V2X (Vehicle-to-Everything) communications and vertical applications.

References:

https://www.snstelecom.com/defense

FRMCS-Ready 5G/LTE Networks a $1.2 Billion Opportunity, Says SNS Telecom & IT

https://www.fierce-network.com/wireless/private-network-thats-lieutenant-network-you-soldier

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

For several years, many telecom analysts said it was inevitable that network operators would move telco workloads, especially their 5G SA core network software, into the giant data centers operated by Amazon Web Services (AWS), Google Cloud and Microsoft Azure. For example:

- In June 2021, AT&T made an agreement with Microsoft to run its 5G SA core network in the Azure public cloud platform. However, that 5G SA network is still not commercially available!

- In July 2023, India’s Tech Mahindra and Microsoft announced they’d collaborate to enable cloud-powered 5G SA core network for telecom operators worldwide. So far we don’t know of any takers?

- Dish Network outsourced its entire 5G infrastructure (including 5G SA core network) to run on the AWS public cloud platform which went live in February 2022. See Figure 1. below

- In May 2024, O2 Telefónica in Germany and Nokia announced the deployment of 5G standalone core software on Amazon Web Services (AWS).

Figure 1. DISH 5G Cloud Architecture

……………………………………………………………………………………………………………………..

However, the expected big move to telco public cloud did not happen in 2024! “No operators have core applications in the public cloud,” David Hennessy, the chief technology officer of the UK’s Three, told Light Reading earlier this year. 5G networks are spread across the geographies they serve. Hosting all functions in a single place just isn’t possible. Even the core, the domain allowing for the most centralization, is increasingly distributed across multiple facilities at the network “edge.” As a result, network operators are not using public cloud platforms for their 5G SA core or mission critical applications.

T-Mobile-US (the “un carrier”) has deployed its own 5G SA network. Cisco and Nokia are the primary vendors that built T-Mobile’s 5G SA core network. Some European network operators are resistant to use of the public cloud for telco-specific workloads. Those include the UK’s BT, which previously invested time and effort in building its own telco cloud with Canonical, a UK software company. Germany’s Deutsche Telekom has something similar called T-CaaS. Orange also has built a homegrown cloud based 5G SA network. Spain’s Telefónica is still not fully convinced by the other benefits of the public cloud providers. Automation is currently more advanced when both the core network software and infrastructure come from Ericsson than it is when Telefónica takes the core from Nokia and the infrastructure from AWS, according to Cayetano Carbajo, the operator’s director for core networks.

Carbajo is clearly disturbed by the lack of infrastructure standardization in a world of multiple different cloud offerings. Various telcos are working on this through an initiative called Sylva, overseen by the Linux Foundation. The fruit of it should be the ability for Telefónica to move network applications from one cloud to another without having to make big changes. Yet public cloud service providers are not even listed as sponsors on the Sylva website.

The alternative is to keep the 5G core on premises or in a private cloud. The latter might be used by other workloads, but – as the designation implies – it would not be shared with other companies. In general, 5G network operators have distributed their previously centralized workloads around a nationwide network, bringing resources into closer proximity with end-user devices. That results in lower latency as well as other service improvements.

For example, BT hosts its control plane functions at eight UK sites and its user plane software at 16 sites. Replicating this in the traditional public cloud, which relies on a smaller number of giant facilities, would be difficult if not impossible to do. As a result, IBM-owned Red Hat and Broadcom-owned VMware, the best-known cloud-computing players in this area, now propose to bring their software into a telco’s facilities. Microsoft calls it the “hybrid” cloud.

There was a bad omen for public cloud advocates in June when Microsoft revealed it was cutting telecom jobs and abandoning Affirmed Networks and Metaswitch, core network software developers it bought in high-profile deals several years ago. Clearly, Microsoft is retreating from the development of network applications.

References:

https://www.lightreading.com/cloud/2024-in-review-a-bad-year-for-public-cloud-in-telecom

Public cloud economics aren’t adding up for some telcos

The public cloud has failed to crack telecom

Telefónica still not fully sold on public cloud after AWS move

Telenor has a go at public cloud but needs AWS to help

Latest Ericsson Mobility Report talks up 5G SA networks (?) and FWA (!)

Building and Operating a Cloud Native 5G SA Core Network

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

https://aws.amazon.com/blogs/industries/telco-meets-aws-cloud-deploying-dishs-5g-network-in-aws-cloud/

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://www.lightreading.com/cloud/the-public-cloud-has-failed-to-crack-telecom

Beyon partners with Ericsson to build energy-efficient wireless networks in Bahrain

Bahrain based Beyon announced it has renewed its sustainability Memorandum of Understanding (MoU) with Ericsson to expand their joint sustainability initiatives and circular economy practices for building energy-efficient networks in Bahrain.

The MoU renewal was signed by Beyon Chief Communications & Sustainability Officer Shaikh Bader bin Rashid Al Khalifa and Vice President and Head of Gulf Council Countries at Ericsson Middle East and Africa, Nicolas Blixell.

The companies also announced the successful outcomes of their sustainability collaboration, signed in early 2024, for accelerating the journey to a Net Zero future for both companies and managing Waste from Electronic and Electrical Equipment (WEEE).

Key achievements during the year include the initiation of ‘Ericsson Product Take-Back Programme’, which addresses the issue of e-waste and enables recycling of end-of-life electronic and electrical equipment in a responsible and sustainable way.

Software such as Cell Sleep Mode and Artificial Intelligence (AI)-powered MIMO Sleep Mode were also implemented on pilot sites, leading to a 22% average reduction in energy consumption where the features were activated.

Another 18% percent energy reduction was apparently achieved through the deployment of the single-antenna footprint Interleaved AIR 3218, compared to AIR 3227, to provide “5G Massive MIMO while addressing space constraints on rooftops and towers.”

“Our partnership with Ericsson demonstrates the substantial progress that can be made through focused sustainability initiatives,” said Shaikh Bader bin Rashid Al Khalifa, Beyon Chief Communications & Sustainability Officer. “The outcomes reflect our commitment to energy efficiency and our goal to reduce our environmental footprint through innovative technologies and circular economy practices. Ultimately these efforts fall in line with the Kingdom of Bahrain’s vision to achieve its sustainable development goals of 2030.”

Nicolas Blixell, Vice President and Head of Gulf Council Countries at Ericsson Middle East and Africa added: “The results of our collaboration with Beyon highlight the role of technologies in achieving sustainability goals. By leveraging our expertise and technologies, we have been able to deliver measurable energy savings and support Beyon in their journey towards Net Zero.”

Earlier this year, Three and Ericsson claimed to have improved energy efficiency by up to 70% at selected sites through AI, data analytics and a ‘Micro Sleep’ feature. The deployment of ‘next-generation AI-powered hardware and software solutions’ from Ericsson is part of a network modernisation initiative Three had been engaged in over the previous 18 months, we were told at the time.

Ericsson and Beyon share a longstanding relationship, through its telecom arm Batelco, with this sustainability collaboration marking another milestone in their efforts to enhance network efficiency and environmental performance across Beyon’s operations.

References:

Are cloud AI startups a serious threat to hyperscalers?

Introduction:

Cloud AI startups include Elon Musk’s xAI, OpenAI, Vultr, Prosimo, Alcion, Run:ai, among others. They all are now or planning to build their own AI compute servers and data center infrastructure. Are they a serious threat to legacy cloud service providers who are also building their own AI compute servers?

- xAI built a supercomputer it calls Colossus—with 100,000 of Nvidia’s Hopper AI chips—in Memphis, TN in 19 days vs the four months it normally takes. The xAI supercomputer is designed to drive cutting-edge AI research, from machine learning to neural networks with a plan to use Colossus to train large language models (like OpenAI’s GPT-series) and extend the framework into areas including autonomous machines, robotics and scientific simulations. It’s mission statement says: “xAI is a company working on building artificial intelligence to accelerate human scientific discovery. We are guided by our mission to advance our collective understanding of the universe.”

- Open AI lab’s policy chief Chris Lehane told the FT that his company will build digital infrastructure to train and run its systems. In an interview with the FT, Lehane said “chips, data and energy” will be the crucial factors in helping his company win the AI race and achieve its stated goal of developing advanced general intelligence (AGI), AI which can match or surpass the capability of the human brain. Lehane said the company would build clusters of data centers in the US mid west and south west, but did not going into further detail about the plan. DCD has contacted the company to ask for more information on its data center buildout.

Elon Musk’s xAI built a supercomputer in Memphis that it calls Colossus, with 100,000 Nvidia AI chips. Photo: Karen Pulfer Focht/Reuters

As noted in our companion post, Cloud AI startup Vultr raised $333 million in a financing round this week from Advanced Micro Devices (AMD) and hedge fund LuminArx Capital Management and is now valued at $3.5 billion

Threats from Cloud AI Startups include:

- Specialization in AI: Many cloud AI startups are highly specialized in AI and ML solutions, focusing on specific needs such as deep learning, natural language processing, or AI-driven analytics. They can offer cutting-edge solutions that cater to AI-first applications, which might be more agile and innovative compared to the generalist services offered by hyperscalers.

- Flexibility and Innovation: Startups can innovate rapidly and respond to the needs of niche markets. For example, they might create more specialized and fine-tuned AI models or offer unique tools that address specific customer needs. Their focus on AI might allow them to provide highly optimized services for machine learning, automation, or data science, potentially making them appealing to companies with AI-centric needs.

- Cost Efficiency: Startups often have lower operational overheads, allowing them to provide more flexible pricing or cost-effective solutions tailored to smaller businesses or startups. They may disrupt the cost structure of larger cloud providers by offering more competitive prices for AI workloads.

- Partnerships with Legacy Providers: Some AI startups focus on augmenting the services of hyperscalers, partnering with them to integrate advanced AI capabilities. However, in doing so, they still create competition by offering specialized services that could, over time, encroach on the more general cloud offerings of these providers.

Challenges to Overcome:

- Scale and Infrastructure: Hyperscalers have massive infrastructure investments that enable them to offer unparalleled performance, reliability, and global reach. AI startups will need to overcome significant challenges in terms of scaling infrastructure and ensuring that their services are available and reliable on a global scale.

- Ecosystem and Integration: As mentioned, many large enterprises rely on the vast ecosystem of services that hyperscalers provide. Startups will need to provide solutions that are highly compatible with existing tools, or offer a compelling reason for companies to shift their infrastructure to smaller providers.

- Market Penetration and Trust: Hyperscalers are trusted by major enterprises, and their brands are synonymous with stability and security. Startups need to gain this trust, which can take years, especially in industries where regulatory compliance and reliability are top priorities.

Conclusions:

Cloud AI startups will likely carve out a niche in the rapidly growing AI space, but they are not yet a direct existential threat to hyperscalers. While they could challenge hyperscalers’ dominance in specific AI-related areas (e.g., AI model development, hyper-specialized cloud services), the larger cloud providers have the infrastructure, resources, and customer relationships to maintain their market positions. Over time, however, AI startups could impact how traditional cloud services evolve, pushing hyperscalers to innovate and tailor their offerings more toward AI-centric solutions.

Cloud AI startups could pose some level of threat to hyperscalers (like Amazon Web Services, Microsoft Azure, and Google Cloud) and legacy cloud service providers, but the impact will take some time to be significant. These cloud AI startups might force hyperscalers to accelerate their own AI development but are unlikely to fully replace them in the short to medium term.

References:

ChatGPT search

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Ciena CEO sees huge increase in AI generated network traffic growth while others expect a slowdown

Lumen Technologies to connect Prometheus Hyperscale’s energy efficient AI data centers

https://www.datacenterdynamics.com/en/news/openai-could-build-its-own-data-centers-in-the-us-report/

AI cloud start-up Vultr valued at $3.5B; Hyperscalers gorge on Nvidia GPUs while AI semiconductor market booms

Over the past two years, AI model builders OpenAI, Anthropic and Elon Musk’s xAI have raised nearly $40bn between them. Other sizeable investment rounds this week alone included $500mn for Perplexity, an AI-powered search engine, and $333mn for Vultr, part of a new band of companies running specialized cloud data centers to support AI.

Cloud AI startup Vultr raised $333 million in a financing round this week from Advanced Micro Devices (AMD) and hedge fund LuminArx Capital Management. That’s a sign of the super hot demand for AI infrastructure. West Palm Beach, Fla.-based Vultr said it is now valued at $3.5 billion and plans to use the financing to acquire more graphics processing units (GPUs) which process AI models. The funding is Vultr’s first injection of outside capital. That’s unusually high for a company that had not previously raised external equity capital. The average valuation for companies receiving first-time financing is $51mn, according to PitchBook.

Vultr said its AI cloud service, in which it leases GPU access to customers, will soon become the biggest part of its business. Earlier this month, Vultr announced plans to build its first “super-compute” cluster with thousands of AMD GPUs at its Chicago-area data center. Vultr said its cloud platform serves hundreds of thousands of businesses, including Activision Blizzard, the Microsoft-owned videogame company, and Indian telecommunications giant Bharti Airtel. Vultr’s customers also use its decade-old cloud platform for their core IT systems, said Chief Executive J.J. Kardwell. Like most cloud platform providers, Vultr isn’t using just one GPU supplier. It offers Nvidia and AMD GPUs to customers, and plans to keep doing so, Kardwell said. “There are different parts of the market that value each of them,” he added.

Vultr’s plan to expand its network of data centers, currently in 32 locations, is a bet that customers will seek greater proximity to their computing infrastructure as they move from training to “inference” — industry parlance for using models to perform calculations and make decisions.

Vultr runs a cloud computing platform on which customers can run applications and store data remotely © Vultr

……………………………………………………………………………………………………………………………………………………………………………………………..

The 10 biggest cloud companies — dubbed hyperscalers — are on track to allocate $326bn to capital expenditure in 2025, according to analysts at Morgan Stanley. While most depend heavily on chips made by Nvidia, large companies including Google, Amazon and Facebook are designing their own customized silicon to perform specialized tasks. Away from the tech mega-caps, emerging “neo-cloud” companies such as Vultr, CoreWeave, Lambda Labs and Nebius have raised billions of dollars of debt and equity in the past year in a bet on the expanding power and computing needs of AI models.

AI chip market leader Nvidia, which alongside other investors, provided more than $400 million to AI cloud provider CoreWeave [1.] in 2023. CoreWeave last year also secured $2.3 billion in debt financing by using its Nvidia GPUs as collateral.

Note 1. CoreWeave is a New Jersey-based company that got its start in cryptocurrency mining.

The race to train sophisticated AI models has inspired the commissioning of increasingly large “supercomputers” (aka AI Clusters) that link up hundreds of thousands of high-performance GPU chips. Elon Musk’s start-up xAI built its Colossus supercomputer in just three months and has pledged to increase it tenfold. Meanwhile, Amazon is building a GPU cluster alongside Anthropic, developer of the Claude AI models. The ecommerce group has invested $8bn in Anthropic.

Hyperscalers are big buyers of Nvidia GPUs:

Analysts at market research firm Omdia (an Informa company) estimate that Microsoft bought 485,000 of Nvidia’s “Hopper” chips this year. With demand outstripping supply of Nvidia’s most advanced graphics processing units for much of the past two years, Microsoft’s chip hoard has given it an edge in the race to build the next generation of AI systems.

This year, Big Tech companies have spent tens of billions of dollars on data centers running Nvidia’s latest GPU chips, which have become the hottest commodity in Silicon Valley since the debut of ChatGPT two years ago kick-started an unprecedented surge of investment in AI.

- Microsoft’s Azure cloud infrastructure was used to train OpenAI’s latest o1 model, as they race against a resurgent Google, start-ups such as Anthropic and Elon Musk’s xAI, and rivals in China for dominance of the next generation of computing. Omdia estimates

- ByteDance and Tencent each ordered about 230,000 of Nvidia’s chips this year, including the H20 model, a less powerful version of Hopper that was modified to meet U.S. export controls for Chinese customers.

- Meta bought 224,000 Hopper chips.

- Amazon and Google, which along with Meta are stepping up deployment of their own custom AI chips as an alternative to Nvidia’s, bought 196,000 and 169,000 Hopper chips, respectively, the analysts said. Omdia analyses companies’ publicly disclosed capital spending, server shipments and supply chain intelligence to calculate its estimates.

The top 10 buyers of data center infrastructure — which now include relative newcomers xAI and CoreWeave — make up 60% of global investment in computing power. Vlad Galabov, director of cloud and data center research at Omdia, said some 43% cent of spending on compute servers went to Nvidia in 2024. “Nvidia GPUs claimed a tremendously high share of the server capex,” he said.

What’s telling is that the biggest buyers of Nvidia GPUs are the hyperscalers who design their own compute servers and outsource the detailed implementation and manufacturing to Taiwan and China ODMs! U.S. compute server makers Dell and HPE are not even in the ball park!

What about #2 GPU maker AMD?

Dave McCarthy, a research vice president in cloud and edge services at research firm International Data Corp (IDC). “For AMD to be able to get good billing with an up-and-coming cloud provider like Vultr will help them get more visibility in the market.” AMD has also invested in cloud providers such as TensorWave, which also offers an AI cloud service. In August, AMD bought the data-center equipment designer ZT Systems for nearly $5 billion. Microsoft, Meta Platforms and Oracle have said they use AMD’s GPUs. A spokesperson for Amazon’s cloud unit said the company works closely with AMD and is “actively looking at offering AMD’s AI chips.”

Promising AI Chip Startups:

Nuvia: Founded by former Apple engineers, Nuvia is focused on creating high-performance processors tailored for AI workloads. Their chips are designed to deliver superior performance while maintaining energy efficiency, making them ideal for data centers and edge computing.

SambaNova Systems: This startup is revolutionizing AI with its DataScale platform, which integrates hardware and software to optimize AI workloads. Their unique architecture allows for faster training and inference, catering to enterprises looking to leverage AI for business intelligence.

Graphcore: Known for its Intelligence Processing Unit (IPU), Graphcore is making waves in the AI chip market. The IPU is designed specifically for machine learning tasks, providing significant speed and efficiency improvements over traditional GPUs.

Market for AI semiconductors:

- IDC estimates it will reach $193.3 billion by the end of 2027 from an estimated $117.5 billion this year. Nvidia commands about 95% of the market for AI chips, according to IDC.

- Bank of America analysts forecast the market for AI chips will be worth $276 billion by 2027.

References:

https://www.ft.com/content/946069f6-e03b-44ff-816a-5e2c778c67db

https://www.restack.io/p/ai-chips-answer-top-ai-chip-startups-2024-cat-ai

Market Outlook for Disaggregated Cell Site Gateways (DCSG)

A Disaggregated Cell Site Gateways (DCSG) is a white-box cell site gateway or router based on an open and disaggregated architecture for existing 2G/3G/4G and 5G networks. It permits network operators to choose different software applications from various vendors, essentially separating the hardware from the software functionality, providing greater flexibility and choice compared to traditional, vendor-locked cell site gateways, particularly important for the evolving demands of 5G networks.

After a two-year lull, the DCSG market regained momentum in 2023, driven by contracts across North America, Asia, and Africa. Market leaders like Ciena and IP Infusion now dominate Network Operating System (NOS) software, while Taiwanese ODMs Edgecore Networks Corporation and UfiSpace lead in white box hardware. The Edgecore CSR430 supports LTE and 5G mobile xHaul networks. It incorporates advanced features like precise timing synchronization, eCPRI fronthaul capabilities, and advanced telemetry to address the scalability demands of mobile operators rolling-out 5G.

DCSGs are growing in importance along with the worldwide expansion and densification of 5G networks, which require more capacity while offering more services. This means operators need to deploy ever more sites, gateways and radios, which, in turn, provides a real incentive for operators to deploy cost-effective white-box DCSG solutions.

According to global research firm Omdia, DCSGs are expected to grow rapidly to some 25% of new CSGs in 2024. Telecom Infra Project (TIP) says over 27,000 Disaggregated Cell Site Gateways have been deployed globally.

TÉRAL RESEARCH forecasts DCSG sales to exceed $500M by 2029, fueled by 5G deployment and open RAN growth. Despite challenges in breaking into established vendor markets, the push for vendor-neutral, cost-efficient solutions keeps disaggregation high on CSPs’ agendas.

References:

https://teralresearch.com/report/december-2024-disaggregated-cell-site-gateways-dcsg-337

https://www.ceragon.com/disaggregated-cell-site-gateways

https://www.adtran.com/en/innovation/telecom-infra-project/disaggregated-cell-site-gateways

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

New Zealand telco One NZ has commercially launched its Satellite TXT service to eligible phone customers [1.] enabling them to communicate via Starlin/SpaceX’s network of Low Earth orbit (LEO) satellites at no extra cost as long as they have a clear line of sight to the sky. The initial TXT service will take longer to send and receive TXT messages. In many cases, TXT messages will take 3 minutes. However, at times it may take 10 minutes or longer, especially during the first few months. As the service matures and more satellites are launched, we expect delivery times to improve. The type of eligible phone you are using, where you are in New Zealand and whether a satellite is currently overhead will all have an impact on whether your TXT is sent or received and how long it takes.

Note 1. There are only four handsets that can currently use of Satellite TXT: Samsung’s Galaxy Z Flip6, Z Fold6, and S24 Ultra, plus the OPPO Find X8 Pro. One NZ said the handset line-up will expand during the course of next year (2025).

“We have lift-off! I’m incredibly proud that One NZ is the first telecommunications company globally to launch a nationwide Starlink Direct to Mobile service, and One NZ customers are among the first in the world to begin using this groundbreaking technology,” exclaimed Joe Goddard, experience and commercial director at One NZ. He said coverage is available across the whole of New Zealand including the 40% of the landmass that isn’t covered by terrestrial networks – plus approximately 20 km out to sea. “Right from the start we’ve said we would keep customers updated with our progress to launch in 2024 and as the technology develops. Today is a significant milestone in that journey,” he added.

April 2023’s partnership with Starlink coincided with the beginning of a new era for One NZ, which up until that point had operated under the Vodafone brand. At the time, One NZ tempered expectations by making it clear the service wouldn’t launch until late 2024.

SpaceX in October finally received permission to begin testing Starlink’s direct-to-cell capabilities with One NZ. Later that same month, One NZ reported that its network engineers in Christchurch were successfully sending and receiving text messages over the network. “We continue to test the capabilities of One NZ Satellite TXT, and this is an initial service that will get better. For example, text messages will take longer to send but will get quicker over time,” said Goddard. He also went to some lengths to point out that Satellite TXT “is not a replacement for existing emergency tools, and instead adds another communications option.”

One NZ offered a few tips to help their customers use the service:

- To TXT via satellite, you need a clear line of sight to the sky. Unlike other satellite services, you don’t need to hold your phone up towards the sky.

- Keeping your TXT short will help. You can also prepare your TXT and press send as soon as you see the One NZ SpaceX banner appear on-screen.

- To check if your TXT has been delivered, check the time stamp next to your TXT. On a Samsung or OPPO, tap on the message.

- Remember to charge your phone or take a battery pack if you are out adventuring.

One NZ vs T-Mobile Direct to Cell Service:

New Zealand’s terrain – as varied and at times challenging as it is – can be covered by far fewer LEO satellites than the U.S. where T-Mobile has announced Direct to Cell service using Starlink LEO satellites. T-Mobile was granted FCC approval for the service in November, and is now signing up customers to test the US Starlink beta program “early next year.”

References:

https://one.nz/why-choose-us/spacex/

https://www.telecoms.com/satellite/one-nz-claims-direct-to-cell-bragging-rights-over-t-mobile-us

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

U.S. Weighs Ban on Chinese made TP-Link router and China Telecom

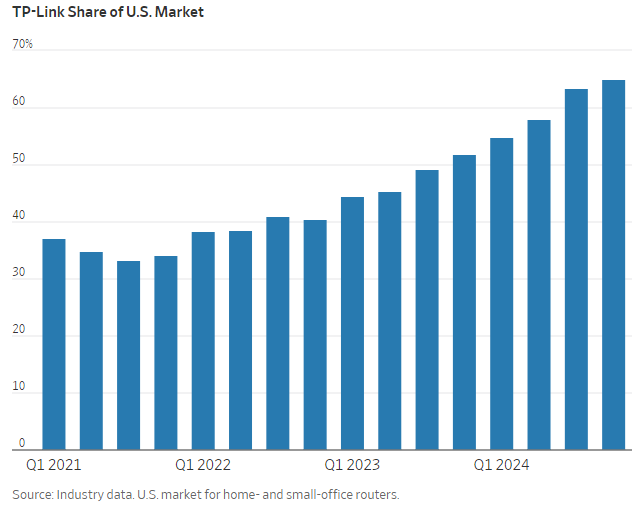

Today, the Wall Street Journal (WSJ) reported that the U.S. is considering banning the sale of China made TP-Link internet routers over concerns the home networking devices pose a security risk. Government authorities may ban the popular routers which have been linked to Chinese cyberattacks. TP-Link has roughly 65% of the U.S. market for routers for homes and small businesses. It is also the top choice on Amazon.com, and powers internet communications for the Defense Department and other federal government agencies.

Investigators at the U.S. Commerce, Defense and Justice departments have opened their own probes into the company, and authorities could ban the sale of TP-Link routers in the U.S. next year, according to people familiar with the matter. An office of the Commerce Department has subpoenaed TP-Link, some of the people said. If its routers are banned from the U.S., it would mark the biggest extraction of Chinese telecom equipment from the country since the Trump administration in 2019 ordered Huawei Technologies ripped out of American infrastructure.

TP-Link routers are routinely shipped to customers with security flaws, which the company often fails to address, according to people familiar with the matter. While routers often have bugs, regardless of their manufacturer, TP-Link doesn’t engage with security researchers concerned about them, the WSJ said. However, TP-Link told CBS MoneyWatch that the company’s “security practices are fully in line with industry security standards in the U.S.”

TP-Link router. Photo: Meghan Petersen/WSJ

…………………………………………………………………………………………………………………………………………………………………………………………………………

TP-Link has also joined with more than 300 internet providers in the U.S. to be the router that is mailed to new homes that sign up for their services. Federal contracting documents show TP-Link routers supply everything from the National Aeronautics and Space Administration to the Defense Department and Drug Enforcement Administration, and the routers are sold at online military exchanges. The company’s market dominance has been achieved in part through lower prices. Its routers are cheaper than competitors, often by more than half, according to market data.

TP-Link sells in the U.S. through a business unit based in California. According to business records, TP-Link co-founder Zhao Jianjun is the chief executive of the California operation and he and his brother still ultimately control all global TP-Link entities. A spokeswoman for that unit said TP-Link assesses potential security risks and takes action to address known vulnerabilities.

“We welcome any opportunities to engage with the U.S. government to demonstrate that our security practices are fully in line with industry security standards, and to demonstrate our ongoing commitment to the U.S. market, U.S. consumers, and addressing U.S. national security risks,” the spokeswoman said.

Asked to comment about potential actions against TP-Link, Liu Pengyu, a spokesman for the Chinese Embassy in Washington, said the U.S. was using the guise of national security to “suppress Chinese companies.” He added that Beijing would “resolutely defend” the lawful rights and interests of Chinese firms.

TP-Link’s U.S. growth took off during the pandemic, when people were sent home to work and needed reliable internet. The company climbed from around 20% of the U.S. market for home and small-business routers in 2019 to around 65% this year. It took an additional 5% of the market in just the third quarter of this year, according to industry data. The TP-Link spokeswoman disputed the industry data but said the company’s market share has grown in the U.S.

An analysis from Microsoft published in October found that a Chinese hacking entity maintains a large network of compromised network devices mostly comprising thousands of TP-Link routers. The network has been used by numerous Chinese actors to launch cyberattacks. These actors have gone after Western targets including think tanks, government organizations, nongovernment organizations and Defense Department suppliers.

The Defense Department earlier this year opened an investigation into national-security vulnerabilities in Chinese routers, according to people familiar with the matter. The House Select Committee on the Chinese Communist Party in August urged the Commerce Secretary to investigate TP-Link because it presents an “unusual degree of vulnerabilities.” The House of Representatives in September passed legislation that called for a study of the national-security risks posed by routers with ties to foreign adversaries, on which the Senate has yet to act.

………………………………………………………………………………………………………………………………………………………………………………………………

Separately, the U.S. Commerce Department is moving to further crack down on China Telecom’s U.S. unit over concerns it could exploit access to American data through their U.S. cloud and internet businesses by providing it to Beijing, a source told Reuters. The source confirmed a New York Times report that the department last week sent China Telecom Americas a preliminary determination that its presence in U.S. networks and cloud services poses U.S. national security risks and gave the company 30 days to respond.

Previously, the FCC moved to shrink China Telecom’s presence in the U.S. In October 2021, nine months into Mr. Biden’s term, the Commission revoked all licenses for China Telecom Americas to provide ordinary phone services in the United States, saying it was “subject to exploitation, influence and control by the Chinese government.” That left in place China Telecom’s network nodes on U.S. telecom networks and carrier neutral data centers with the power to “peer in” to internet and phone traffic. That ability would be stripped under the Commerce Department order, assuming that the Trump administration went along. China Telecom Americas did not respond to messages left at its office in Herndon, Va.

“We’ve been taking a hard look at where Chinese technologies are in the United States and asking ourselves the question of, is this an acceptable level of risk?” Anne Neuberger, the deputy national security adviser for cyber and emerging technologies, said in an interview on Monday. “For a number of years, these companies have operated networks and cloud service businesses in the U.S., which involved network equipment that’s co-located with our internet infrastructure. And while in the past we may have viewed this as an acceptable level of risk, that is no longer the case.”

The F.C.C. action to block China Telecom from most of its business in the United States did not prevent Volt Typhoon — China’s placement of malicious code in the electric grid and water and gas pipeline networks — or Salt Typhoon, the surveillance effort that was uncovered over the summer. Taken together, officials say, they amount to the most significant assault on American critical infrastructure in the digital age.

Speaking last week at the Paley Center for Media in Manhattan, Gen. Timothy D. Haugh, the director of the National Security Agency and commander of U.S. Cyber Command, said, “If I look at today, the PRC is not deterred,” using the initials for the People’s Republic of China. He declined to say whether his forces were conducting offensive operations against China in retaliation for any of its recent incursions into American networks.

On Sunday, President-elect Donald J. Trump’s incoming national security adviser, Representative Mike Waltz, a Florida Republican, suggested on CBS’s “Face the Nation” that the new administration would be much more tempted to use offensive cyber-actions against China. “We need to start going on offense and start imposing, I think, higher costs and consequences to private actors and nation-state actors that continue to steal our data, that continue to spy on us and that, even worse, with the Volt Typhoon penetration, that are literally putting cyber time bombs on our infrastructure, our water systems, our grids, even our ports,” he said.

Officials have said they do not believe that the Chinese hackers have been ousted from the networks of at least eight telecommunications firms, including the nation’s two largest, Verizon and AT&T. That suggests that China’s hackers retain the capability to escalate.

Since Microsoft first alerted the telecommunications firms over the summer that they had found evidence of hackers deep in their systems, the Biden administration has struggled to come up with a response. It created a task force inside the White House, and the issue is considered so serious that the group meets almost daily. Chief executives of the affected firms have been summoned to the Situation Room to come up with a joint plan of action.

https://www.cbsnews.com/news/tp-link-router-china-us-ban/

https://www.nytimes.com/2024/12/16/us/politics/biden-administration-retaliation-china-hack.html

Aftermath of Salt Typhoon cyberattack: How to secure U.S. telecom networks?

WSJ: T-Mobile hacked by cyber-espionage group linked to Chinese Intelligence agency

China backed Volt Typhoon has “pre-positioned” malware to disrupt U.S. critical infrastructure networks “on a scale greater than ever before”

FBI and MI5 Chiefs Issue Joint Warning: Chinese Cyber Espionage on Tech & Telecom Firms

Quantum Technologies Update: U.S. vs China now and in the future

5G network slicing progress report with a look ahead to 2025

The “true” version of 5G is 5G standalone (SA), which eliminates the need for a 4G anchor network and supports all 3GPP defined 5G functions, like 5G Security, Voice over 5G New Radio (VoNR) and network slicing. As we’ve noted for years, 5G SA has proven difficult to deploy, partially because there are no standards for implementation – only 3GPP 5G Architecture specs (rubber stamped as ETSI standards, but never submitted to the ITU for consideration as one or more ITU-T recommendations).

Network slicing is only possible with a 5G SA core network. Operators which have deployd 5G SA are using and planning to use 5G network slices for a variety of use cases, including: a priority slice for first responders, support financial or mission-critical applications, or offer broadcasters a dedicated fast 5G layer to transfer video from cameras to production teams at sporting or other live events.

Image Credit: SDx Central

……………………………………………………………………………………………………………….

In the U.S., T-Mobile is the only major carrier offering 5G SA and has been moving forward with network slicing deployments. Verizon said recently that its 5G network slicing public safety field demonstration in Phoenix, Arizona, is operational but still in trials. AT&T has tested prioritized access to its network, but so far has not yet provided a 5G SA network to support network slicing . That’s despite outsourcing development to Microsoft Azure cloud platform in June 2021.

T-Mobile recently launched “T-Priority,” a network slice for first responders supported by the network operator’s 5G SA core network. The wireless telco told regulators at the end of 2023:

“Network slicing involves creating customized, software-defined, virtual networks – or ‘slices’ – that are each logically separated and individually optimized to meet the specific needs of each application. Within a slice, network functions are defined in software and customized to the use case supported by that slice. For example, network slicing allows providers to use a single 5G network to deliver high-intensity network resources to support a small number of robots on a factory floor, while at the same time delivering low-intensity network resources to a very large number of meter-reading sensors on a utility network.”

Overseas, BT, Orange Belgium, Singtel, China Telecom, Reliance Jio, and Telia Finland have deployed network slicing, among other 5G carriers. Singtel’s app-based network slicing is designed to improve the performance of consumer and enterprise applications.

Nokia recently said it tested a network slicing application with network operator Liberty Global and Belgian shipping company Seafar. Nokia said the shipping company could use its API platform to purchase an ultra-low latency slice of Liberty Global’s Telenet 5G standalone network to maneuver Seafar’s ships through ports without having to slow down.

“Slicing will be critical to enabling enterprise cases and providing network solutions for many use cases for which a stand-alone purpose-built network is not feasible,” Nokia stated in a February meeting between CEO Pekka Lundmark and a variety of top FCC officials, including FCC Chairwoman Jessica Rosenworcel.

The GSMA, which is NOT a standards development organization, launched its “Open Gateway” campaign last year. Earlier this year the group said that 47 mobile operators representing 239 mobile networks and 65% of wireless connections around the world have signed up. Currently, GSMA and its partners are developing a wide range of APIs for text messaging, location information, billing, quality of service – and network slicing among other applications.

Several analysts believe that network slicing will see more growth next year:

“There will be definitely more rollouts of network slicing capabilities as 5G SA networks mature, and as 5G NSA networks move to SA in the next few years,” AvidThink principal analyst Roy Chua said in an email. “Using a network slice for privacy/security/isolation or for ensuring QoS (live broadcasts, sporting events, emergency and disaster support) will likely continue.”

Lead analyst at Techsponential Avi Greengart agreed that more network slicing deployments will happen in the coming year as more operators upgrade to 5G SA. “Network slicing has been a long-touted feature of 5G, and we’re starting to see it used for large venues (ex: sports stadiums) and public safety,” he told Fierce Network. Greengart warned that slicing is not a panacea for private networks or Wi-Fi.

“I do think that network slicing will be operator specific,” noted neXt Curve executive analyst Leonard Lee. “There is still the open question of what the generally monetizable services will be and the scenarios that make them viable. This, each operator will be answering for themselves on their own timeline. For outside observers, it will be like watching a kettle boil,” he said, adding a note of caution.

References:

https://www.lightreading.com/network-automation/2025-preview-network-slicing-gets-real

https://www.fierce-network.com/wireless/network-slicing-slides-more-vigorously-2025

https://www.sdxcentral.com/5g/definitions/key-elements-5g-network/5g-network-slicing/

FCC Draft Net Neutrality Order reclassifies broadband access; leaves 5G network slicing unresolved

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Lumen Technologies to connect Prometheus Hyperscale’s energy efficient AI data centers

The need for more cloud computing capacity and AI applications has been driving huge investments in data centers. Those investments have led to a steady demand for fiber capacity between data centers and more optical networking innovation inside data centers. Here’s the latest example of that:

Prometheus Hyperscale has chosen Lumen Technologies to connect its energy-efficient data centers to meet growing AI data demands. Lumen network services will help Prometheus with the rapid growth in AI, big data, and cloud computing as they address the critical environmental challenges faced by the AI industry.

Rendering of Prometheus Hyperscale flagship Data Center in Evanston, Wyoming:

……………………………………………………………………………….

Prometheus Hyperscale, known for pioneering sustainability in the hyperscale data center industry, is deploying a Lumen Private Connectivity Fabric℠ solution, including new network routes built with Lumen next generation wavelength services and Dedicated Internet Access (DIA) [1.] services with Distributed Denial of Service (DDoS) protection layered on top.

Note 1. Dedicated Internet Access (DIA) is a premium internet service that provides a business with a private, high-speed connection to the internet.

This expanded network will enable high-density compute in Prometheus facilities to deliver scalable and efficient data center solutions while maintaining their commitment to renewable energy and carbon neutrality. Lumen networking technology will provide the low-latency, high-performance infrastructure critical to meet the demands of AI workloads, from training to inference, across Prometheus’ flagship facility in Wyoming and four future data centers in the western U.S.

“What Prometheus Hyperscale is doing in the data center industry is unique and innovative, and we want to innovate alongside of them,” said Ashley Haynes-Gaspar, Lumen EVP and chief revenue officer. “We’re proud to partner with Prometheus Hyperscale in supporting the next generation of sustainable AI infrastructure. Our Private Connectivity Fabric solution was designed with scalability and security to drive AI innovation while aligning with Prometheus’ ambitious sustainability goals.”

Prometheus, founded as Wyoming Hyperscale in 2020, turned to Lumen networking solutions prior to the launch of its first development site in Aspen, WY. This facility integrates renewable energy sources, sustainable cooling systems, and AI-driven energy optimization, allowing for minimal environmental impact while delivering the computational power AI-driven enterprises demand. The partnership with Lumen reinforces Prometheus’ dedication to both technological innovation and environmental responsibility.

“AI is reshaping industries, but it must be done responsibly,” said Trevor Neilson, president of Prometheus Hyperscale. “By joining forces with Lumen, we’re able to offer our customers best-in-class connectivity to AI workloads while staying true to our mission of building the most sustainable data centers on the planet. Lumen’s network expertise is the perfect complement to our vision.”

Prometheus’ data center campus in Evanston, Wyoming will be one of the biggest data centers in the world with facilities expected to come online in late 2026. Future data centers in Pueblo, Colorado; Fort Morgan, Colorado; Phoenix, Arizona; and Tucson, Arizona, will follow and be strategically designed to leverage clean energy resources and innovative technology.

About Prometheus Hyperscale:

Prometheus Hyperscale, founded by Trenton Thornock, is revolutionizing data center infrastructure by developing sustainable, energy-efficient hyperscale data centers. Leveraging unique, cutting-edge technology and working alongside strategic partners, Prometheus is building next-generation, liquid-cooled hyperscale data centers powered by cleaner energy. With a focus on innovation, scalability, and environmental stewardship, Prometheus Hyperscale is redefining the data center industry for a sustainable future. This announcement follows recent news of Bernard Looney, former CEO of bp, being appointed Chairman of the Board.

To learn more visit: www.prometheushyperscale.com

About Lumen Technologies:

Lumen uses the scale of their network to help companies realize AI’s full potential. From metro connectivity to long-haul data transport to edge cloud, security, managed service, and digital platform capabilities, Lumenn meets its customers’ needs today and is ready for tomorrow’s requirements.

In October, Lumen CTO Dave Ward told Light Reading that a “fundamentally different order of magnitude” of compute power, graphics processing units (GPUs) and bandwidth is required to support AI workloads. “It is the largest expansion of the Internet in our lifetime,” Ward said.

Lumen is constructing 130,000 fiber route miles to support Meta and other customers seeking to interconnect AI-enabled data centers. According to a story by Kelsey Ziser, the fiber conduits in this buildout would contain anywhere from 144 to more than 500 fibers to connect multi-gigawatt data centers.

REFERENCES:

https://www.lightreading.com/data-centers/2024-in-review-data-center-shifts

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Superclusters of Nvidia GPU/AI chips combined with end-to-end network platforms to create next generation data centers

Initiatives and Analysis: Nokia focuses on data centers as its top growth market

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Deutsche Telekom with AWS and VMware demonstrate a global enterprise network for seamless connectivity across geographically distributed data centers