Electromagnetic Signal and Information Theory (ESIT): From Fundamentals to Standardization-Part II.

Part I of this two part article may be accessed here:

From ESIT Theory to Standardization:

In addition to fundamental research, several technologies originating from ESIT are currently being considering by standardization bodies (aka SDOs). This is especially true for Reconfigurable Intelligent Surfaces (RIS).

RIS relates to a new type of system node that is made with surfaces which may have reflection, refraction, and absorption properties through many small antennas or metamaterials elements which can be adapted to a specific radio channel environment.

The European Telecommunications Standards Institute (ETSI) Industry Specification Group (ISG) on RIS was officially launched on September 30, 2021 for a two-year duration. It was recently renewed for two more years.

ETSI ISG RIS set out to explore RIS and its applications across the wide spectrum of use cases and deployments to identify any specification needs that may be required, thus paving the way for future standardization of the technology.

This ISG identifies and describes RIS related use cases and deployment scenarios, specifies requirements and identifies technology challenges in several areas including fixed and mobile wireless access, fronthaul and backhaul, sensing and positioning, energy and EMF exposure limits, security and privacy.

After two years of work, ETSI ISG RIS has completed and published reports from three work items (WIs), following a consensus-based and contribution-driven working format. The contributions and discussions from ISG members and participants in this first phase of the ISG have been focused on studies related to RIS fundamental, potential, and maturity. The ETSI ISG RIS supports and encourages other standards developing organizations (SDOs) to use the group reports as baseline text for further study or their own specifications

Here’s the list of group reports approved and published by the ETSI ISG RIS as of September 2023:

GR RIS 001: Use Cases, Deployment Scenarios and Requirements

The scope of the report is on the identification and definition of relevant use cases with corresponding general key-performance-indicators (KPIs), deployment scenarios wherein RIS technology will play a role and potential requirements for each identified use case with the aim of promoting interoperability with existing and upcoming wireless technologies and networks. Aspects around system/link performance, spectrum, coexistence, and security are analyzed as part of the report.

GR RIS 002: Technological Challenges, Architecture and Impact on Standardization

The scope of the report is on the technological challenges to deploy RIS as a new network entity, the potential impacts on internal architecture, framework and the required interfaces of RIS, the potential impacts on architecture, framework and the required interfaces of RIS-integrated network, and the potential recommendations and specification impacts to standardization to support RIS as a network entity.

GR RIS 003: Communication Models, Channel Models, Channel Estimation and Evaluation Methodology

The scope of the report is on communication models that strike a suitable trade-off between electromagnetic accuracy and simplicity for performance evaluation and optimization; channel models that include path-loss and multipath propagation effects, as well as the impact of interference for application to different frequency bands; channel estimation, including reference scenarios, estimation methods, and system designs; and key performance indicators and evaluation methodology of RIS for application to wireless communications, including the coexistence between different network operators, and for fairly comparing different transmission techniques, communication protocols, and network deployments.

Further information on the ISG RIS terms of reference, work program, planned group reports, and other documentation are available through the ISG portal.

Editor’s Note: A study item related to RIS has been proposed by the industry in Release 18 (2022) and will be discussed for future plans in Release 19. The results have not yet been released.

Conclusions:

In conclusion, although ESIT may appear a pure theoretical subject, it is an essential tool for modeling, understanding, analyzing, and optimizing emerging communications technologies.

While implementation may be premature at this time, ESIT will surely be used to guide essential technology specifications in standards development organizations (SDO’s).

………………………………………………………………………………………………………………………………..

References:

Electromagnetic Signal and Information Theory: From Fundamentals to Standardization-Part I.

https://www.etsi.org/committee/1966-ris

https://www.etsi.org/committee-activity/activity-report-ris

https://portal.etsi.org/tb.aspx?tbid=900&SubTB=900#/50611-work-programme

ETSI releases first Report on Reconfigurable Intelligent Surfaces communication and channel models

Electromagnetic Signal & Information Theory (ESIT): From Fundamentals to Standardization-Part I.

by Marco Di Renzo, Université Paris-Saclay, CNRS, CentraleSupélec, Laboratoire des Signaux et Systèmes, 3 Rue Joliot-Curie, 91192 Gif-sur-Yvette, France,,,,,,,,,,,,,,,,AND

Marco Donald Migliore, University of Cassino and Southern Lazio, Cassino Viale dell’Università, 03043 Cassino FR, Italy

Edited by Boya Di and Alan J Weissberger

…………………………………………………………………………………………………………………………

Introduction:

The notion of communications channel capacity* as well as the methods, algorithms, and protocols to achieve it have been fundamental questions that have driven the design of wireless communications and will continue to do so.

* Channel capacity is the highest rate at which communications can be made with only a small number of transmission errors.

Communication and information are inherently physical phenomena. Most of the literature, however, abstracts the physics of wave propagation, often treating the generation, transmission, and manipulation of electromagnetic waves as pure mathematical operators.

While mathematical abstractions and engineering approximations are necessary to design advanced or complex communications systems and to gain so-called “engineering insights,” much is lost in understanding the true and physically consistent fundamental limits of wireless communications. The disciplines of information and communications theory, wave propagation, and signal processing are all inter-related and are consistent with the fundamental laws of physics and electromagnetism [1].

…………………………………………………………………………………………………………………

Electromagnetic field theory provides the physics of radio communications, while information theory approaches the problem from a purely mathematical point of view. While there is a law of conservation of energy in physics, there is no such law in information theory. In information theory, when reference is made (as it frequently is) to terms like energy, power, noise, or antennas, it is by no means guaranteed that their use is consistent with the physics of the communication system.

………………………………………………………………………………………………………………….

Emerging communication paradigms and technologies are pushing the boundaries of wave and information manipulation far beyond what was thinkable a few years ago. Among the technologies under evaluation for being integrated in future telecommunication standards, Reconfigurable Intelligent Surfaces (RIS) [2] have been under intense research during the last few years. It is interesting to note that these two technologies put forth a vision of information generation and processing that is not digital-oriented anymore but is analog-oriented and entails the processing of electromagnetic waves either through the scattering objects available in the network or at the end points of communication links.

Editor’s Note: In the past few years, various evaluation and field tests have been delivered to explore the applicability of RIS in future telecommunication standards. For example, ZTE Corporation had conducted outdoor and indoor trials that the deployment of RIS can increase the RSRP by 15 to 35 dB depending on the detail test setup in 2022. NTT Docomo has also performed communication tests based on transparent dynamic meta-surfaces in 2020.

Reconfigurable Intelligent Surfaces:

The basic premise of reconfigurable intelligent surfaces (RIS) is to be able to modify the scattering from objects coated with this technology as one desires. However, modeling such a device as a simple diagonal matrix is neither capacity achieving from a pure information-theoretic standpoint, i.e., assuming that the model being utilized is correct [4], nor strictly correct from an electromagnetic standpoint [5]. Also, the use of such devices just for channel shaping is known not to be capacity achieving [6].

The relationship between information theory and the physics of wave propagation is essential. Understanding these relationships entails a redefinition of the Physical layer in communication systems, which goes beyond the concept of manipulation of bits. The interplay between information theory and physics of wave propagation can only be captured by embedding the wave propagation into the physical layer – a concept known as the “deep physical layer” [10], where electromagnetic field processing is performed using specialized devices.

Electromagnetic Signal and Information Theory (ESIT) Explained:

In order to extend the mathematical notions of information/communication theory and statistical signal processing to incorporate the notion of physics of wave propagation, the term electromagnetic signal and information theory (ESIT) has recently emerged.

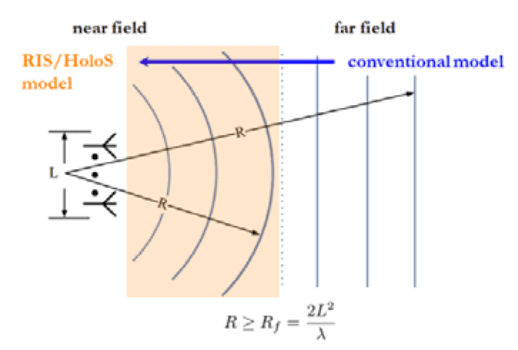

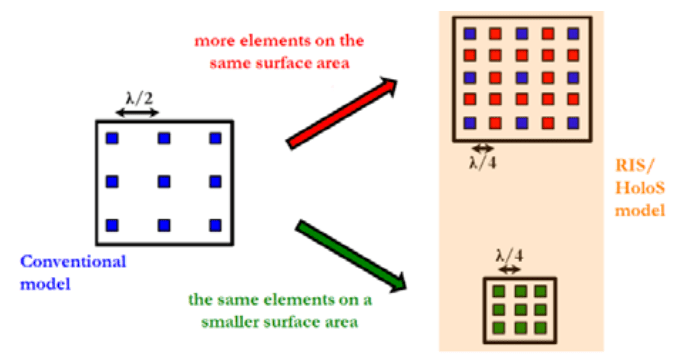

ESIT is a broad research field that is concerned with the mathematical treatment and information processing of electromagnetic fields governing the transmission and processing of messages through communication systems. One of the main objectives of ESIT is, for example, the development of communication models that are electromagnetically consistent and that overcome current assumptions in wireless communications, including considering scalar fields, assuming far-field planar wave fronts, and ignoring electromagnetic coupling, as illustrated in the following two figures:

Fig. 1 From far-field planar-wavefronts to near-field spherical wavefronts

Fig. 2 From mutual coupling-free designs to mutual coupling-aware optimization

………………………………………………………………………………………………………………………..

ESIT makes it possible to quantify the ultimate performance limits of wireless communications, by considering realistic electromagnetic models.

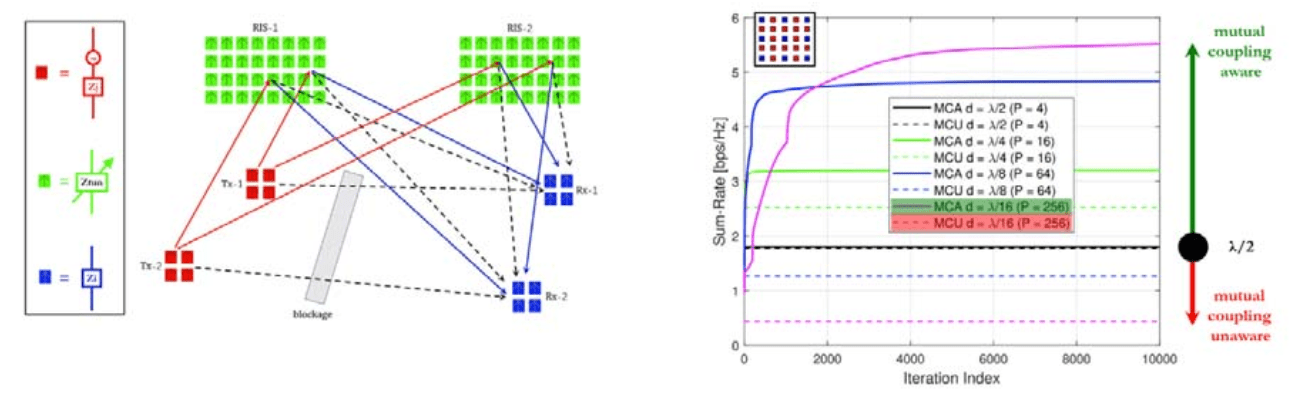

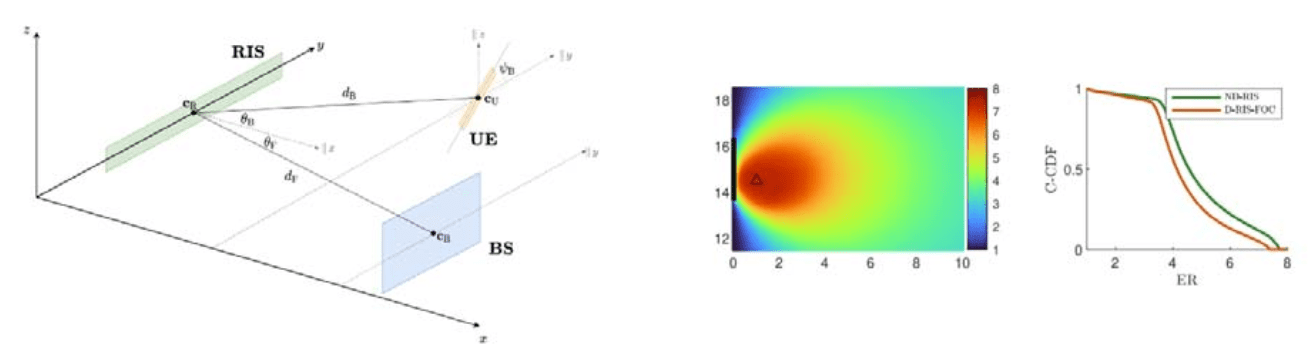

Fig. 3. and Fig. 4. show the great benefits of exploiting the mutual coupling at the design stage and the increased number of communication models that can be transmitted in near-field multiple antenna communication channels.

Recent results on the impact of mutual coupling and the fundamental performance limits in the near-field communications can be found in [13] and [14], respectively.

Fig. 3 ESIT: Mutual coupling aware design [11]

Fig. 4 ESIT: Multi-mode communications in line-of-sight [4]

Editor’s Note: Modelling the influence of the near-far field and coupling effects naturally builds up a bridge between the real-world practice and theoretical analysis.

……………………………………………………………………………………………………………………….

Part II to follow: “From ESIT Theory to Standardization” by ETSI

………………………………………………………………………………………………………………………..

References:

[1] M. Franceschetti. Wave Theory of Information. Cambridge University Press, 2018.

[2] M. Di Renzo et al., “Smart Radio Environments Empowered by Reconfigurable Intelligent Surfaces: How It Works, State of Research, and The Road Ahead,” in IEEE Journal on Selected Areas in Communications, vol. 38, no. 11, pp. 2450-2525, Nov. 2020.

[3] C. Huang et al., “Holographic MIMO Surfaces for 6G Wireless Networks: Opportunities, Challenges, and Trends,” in IEEE Wireless Communications, vol. 27, no. 5, pp. 118-125, October 2020.

[4] G. Bartoli et al., “Spatial Multiplexing in Near Field MIMO Channels with Reconfigurable Intelligent Surfaces”, IET Signal Processing, 2023 (https://arxiv.org/abs/2212.11057).

[5] M. Di Renzo, F. H. Danufane and S. Tretyakov, “Communication Models for Reconfigurable Intelligent Surfaces: From Surface Electromagnetics to Wireless Networks Optimization,” in Proceedings of the IEEE, vol. 110, no. 9, pp. 1164-1209, Sept. 2022.

[6] R. Karasik et al., “Adaptive Coding and Channel Shaping Through Reconfigurable Intelligent Surfaces: An Information-Theoretic Analysis,” in IEEE Transactions on Communications, vol. 69, no. 11, pp. 7320- 7334, Nov. 2021.

[7] D. Dardari and N. Decarli, “Holographic Communication Using Intelligent Surfaces”, IEEE Commun. Mag. 59(6): 35-41 (2021).

[8] M. Di Renzo, D. Dardari, and N. Decarli, “LoS MIMO-Arrays vs. LoS MIMO-Surfaces”, IEEE EuCAP 2023 (https://arxiv.org/abs/2210.08616).

[9] M. Di Renzo, V. Galdi, and G. Castaldi, “Modeling the Mutual Coupling of Reconfigurable Metasurfaces”, IEEE EuCAP 2023 (https://arxiv.org/abs/2210.08619).

[10] M. D. Migliore, “The World Beneath the Physical Layer: An Introduction to the Deep Physical Layer”, IEEE Access 9: 77106-77126 (2021).

[11] Andrea Abrardo, Davide Dardari, Marco Di Renzo, Xuewen Qian, “MIMO Interference Channels Assisted by Reconfigurable Intelligent Surfaces: Mutual Coupling Aware Sum-Rate Optimization Based on a Mutual Impedance Channel Model”, IEEE Wirel. Commun. Lett. 10(12): 2624-2628 (2021).

[12] https://portal.etsi.org/tb.aspx?tbid=900&SubTB=900#/

[13] A. Abrardo, A. Toccafondi, and M. Di Renzo, “Analysis and Optimization of Reconfigurable Intelligent Surfaces Based on -Parameters Multiport Network Theory”, arXiv:2308.16856.

[14] J. C. Ruiz-Sicilia, M. Di Renzo, M. D. Migliore, M. Debbah, and H. V. Poor, “On the Degrees of Freedom and Eigenfunctions of Line-of-Sight Holographic MIMO Communications”, arXiv:2308.08009.

……………………………………………………………………………………………………………………

About Marco Di Renzo, PhD:

Marco Di Renzo (Fellow, IEEE) received the Laurea (cum laude) and Ph.D. degrees in electrical engineering from the University of L’Aquila, Italy, in 2003 and 2007, respectively, and the Habilitation à Diriger des Recherches (Doctor of Science) degree from University Paris-Sud (currently Paris-Saclay University), France, in 2013. Currently, he is a CNRS Research Director (Professor) and the Head of the Intelligent Physical Communications group in the Laboratory of Signals and Systems (L2S) at Paris-Saclay University – CNRS and CentraleSupelec, Paris, France. Also, he is an elected member of the L2S Board Council and a member of the L2S Management Committee. At Paris-Saclay University, he serves as the Coordinator of the Communications and Networks Research Area of the Laboratory of Excellence DigiCosme, as a Member of the Admission and Evaluation Committee of the Ph.D. School on Information and Communication Technologies, and as a Member of the Evaluation Committee of the Graduate School in Computer Science. He is a Founding Member and the Academic Vice Chair of the Industry Specification Group (ISG) on Reconfigurable Intelligent Surfaces (RIS) within the European Telecommunications Standards Institute (ETSI), where he serves as the Rapporteur for the work item on communication models, channel models, and evaluation methodologies. He is a Fellow of the IEEE, IET, and AAIA; an Ordinary Member of the European Academy of Sciences and Arts, an Ordinary Member of the Academia Europa; and a Highly Cited Researcher. Also, he holds the 2023 France-Nokia Chair of Excellence in ICT, and was a Fulbright Fellow at City University of New York, USA, a Nokia Foundation Visiting Professor, and a Royal Academy of Engineering Distinguished Visiting Fellow. His recent research awards include the 2021 EURASIP Best Paper Award, the 2022 IEEE COMSOC Outstanding Paper Award, the 2022 Michel Monpetit Prize conferred by the French Academy of Sciences, the 2023 EURASIP Best Paper Award, the 2023 IEEE ICC Best Paper Award (wireless), the 2023 IEEE COMSOC Fred W. Ellersick Prize, the 2023 IEEE COMSOC Heinrich Hertz Award, and the 2023 IEEE VTS James Evans Avant Garde Award. He served as the Editor-in-Chief of IEEE Communications Letters during the period 2019-2023, and he is now serving in the Advisory Board.

About Marco Donald Migliore, PhD.:

Marco Donald Migliore (Senior Member, IEEE) received the Laurea degree (Hons.) and the Ph.D. degree in electronic engineering from the University of Naples, Naples, Italy. He was a Visiting Professor with The University of California at San Diego, La Jolla, CA, USA, in 2007, 2008, and 2017; the University of Rennes I, Rennes, France, in 2014 and 2016; the Centria Research Center, Ylivieska, Finland, in 2017; the University of Brasilia, Brazil, in 2018; and the Harbin Technical University, China, in 2019. He was a Speaker with the Summer Research Lecture Series of the UCSD CALIT2 Advanced Network Science, in 2008. He is currently a Full Professor with the University of Cassino and Southern Lazio, Cassino, Italy, where he is also the Head of the Microwave Laboratory and the Director of studies of the ITC Courses. He is also a member of the ELEDIA@UniCAS Research Laboratory, the ICEMmB – National Interuniversity Research Center on the Interactions between Electromagnetic Fields and Biosystems, where he is the Leader of the 5G Group, the Italian Electromagnetic Society (SIEM), and the National Interuniversity Consortium for Telecommunication (CNIT). His current research interests include connections between electromagnetism and information theory, analysis, synthesis and characterization of antennas in complex environments, antennas and propagation for 5G, ad hoc wireless networks, compressed sensing as applied to electromagnetic problems, and energetic applications of microwaves. He serves as a referee for many scientific journals and has served as an Associate Editor for IEEE Transactions on Antennas and Propagation.

Vodafone and Amazon’s Project Kuiper to extend 4G/5G in Africa and Europe

- Vodafone and Vodacom plan to use Project Kuiper’s low Earth orbit (LEO) satellite constellation to extend the reach of their 4G/5G networks.

- Companies plan to participate in beta testing of Project Kuiper service in 2024.

Vodafone and Project Kuiper, Amazon’s low Earth orbit satellite (LEO) communications initiative, today announced a strategic collaboration through which Vodafone and Vodacom plan to use Project Kuiper’s network to extend the reach of 4G/5G services to more of their customers in Europe and Africa.

Vodafone and Vodacom plan to use Project Kuiper’s high-bandwidth, low-latency satellite network to bring the benefits of 4G/5G connectivity to areas that may otherwise be challenging and prohibitively expensive to serve via traditional fibre or microwave solutions. Project Kuiper will connect geographically dispersed cellular antennas back to the companies’ core telecom networks. This means Vodafone and Vodacom will be able offer 4G/5G services in more locations without the time and expense of building out fibre-based or fixed wireless links back to the core networks.

As part of the collaboration, Amazon plans to partner with Vodafone to roll out Project Kuiper’s high-speed broadband services to unserved and underserved communities around the world. The companies are also exploring additional enterprise-specific offerings to provide businesses with comprehensive global connectivity solutions, such as backup service for unexpected events and extending connectivity to remote infrastructure.

Margherita Della Valle, Vodafone Group Chief Executive, said: “Vodafone’s work with Project Kuiper will provide mobile connectivity to many of the estimated 40% of the global population without internet access, supporting remote communities, their schools and businesses, the emergency services, and disaster relief. These connections will be complemented further through our own work on direct-to-smartphone satellite services.”

“Amazon is building Project Kuiper to provide fast, affordable broadband to tens of millions of customers in unserved and underserved communities, and our flexible network means we can connect places that have traditionally been difficult to reach,” said Dave Limp, Amazon’s senior vice president for devices and services. “Teaming with a leading international service provider like Vodafone allows us to make a bigger impact faster in closing the digital divide in Europe and Africa. Together we’ll explore how we can help our customers get the most value from expanded connectivity, particularly in areas like residential broadband, agriculture, education, healthcare, transportation, and financial services.”

“At Vodacom, our purpose is to connect for a better future, and we work every day to bring more people in Africa online,” said Shameel Joosub, CEO of Vodacom Group. “Collaborating with Project Kuiper gives us an exciting new path to scale our efforts, using Amazon’s satellite constellation to quickly reach more customers across the African continent.”

Vodafone, Vodacom and Project Kuiper will begin deploying services in Africa and Europe as Amazon’s production satellites come online. Amazon is preparing to test two prototype satellites in the coming months before starting to deploy production satellites in 2024. Amazon expects to begin beta testing Project Kuiper services with select customers by the end of 2024, and Vodafone and Vodacom plan to participate in that testing through this collaboration.

Vodafone’s Margherita Della Valle with Amazon’s David Lamp

……………………………………………………………………………………………………….

References:

ZTE sees demand for fixed broadband and smart home solutions while 5G lags

According to a senior executive, ZTE Corp has seen “tremendous” opportunities due to the increased demand for high-speed internet and smart home solutions globally following the COVID-19 pandemic. That’s despite a slower-than-expected development of 5G outside of China.

“Deployment of 5G technology in overseas markets has been slower than what we previously thought and investments in the field have also lagged behind,” said Chen Zhiping, vice-president of ZTE Corp.

“However, we have seen rapid growth of two sectors in our business – fixed broadband and home network solutions – internationally, especially in the Latin American market.”

The COVID-19 pandemic has pushed up demand for these two types of businesses, as people who were confined to their homes became more reliant on high-speed internet connections and home automation, she said.

“We are actively promoting these two areas of business in Latin America. Besides, the Asia-Pacific region is also where we put great focus on, such as Indonesia, Malaysia and Thailand, as the region has a huge demand for network convergence, network modernization and digitalization,” Chen said.

The Asia-Pacific region is a market from which the company generates most of its overseas revenue, she added.

ZTE posted 60.7 billion yuan ($8.36 billion) in operating revenue in the first half of the year, up 1.5 percent from the year-ago period, according to its interim results announced on Aug 18. Of the total, 17.6 billion yuan, or 29 percent, came from international markets.

Net profit grew 19.9 percent on a yearly basis to 5.47 billion yuan.

“Exploring the domestic market is far from enough for a technology company, whether it is research and development or marketing. We have been committed to the international markets and promoting the globalization of research and development, supply chain and collaboration all along,” she said.

Chen acknowledged that factors such as geopolitical tensions, economic slowdown and a deteriorating business environment in some countries have posed serious challenges to ZTE‘s operations in overseas markets. She stressed that the company had established a sound system of management as well as risk identification and control to deal with potential risks.

On November 225, 2022, the Federal Communications Commission (FCC) voted unanimously to ban U.S. sales of new Chinese telecommunications equipment and devices produced by Huawei and ZTE—as well as to restrict the use of other Chinese-made video surveillance equipment—over national security concerns. The Chinese companies have denied the allegations.

According to a report by German market intelligence platform Statista, the global ICT market is expected to reach $6 trillion in 2023, up from $5.5 trillion last year. China would rank third in global market share with over 11%, following the United States and European Union (EU).

References:

https://www.chinadaily.com.cn/a/202309/02/WS64f26e23a310d2dce4bb384f.html

Vodafone Idea (Vi) to launch 5G services “soon;” Awards optical network equipment contract to ZTE

FCC bans Huawei, ZTE, China based connected camera and 2-way radio makers

EdgeCore Digital Infrastructure and Zayo bring fiber connectivity to Santa Clara data center

EdgeCore Digital Infrastructure, a wholesale data center developer, owner and operator, today announced its partnership with Zayo, a leading global communications infrastructure provider, to connect EdgeCore’s Silicon Valley data center campus in Santa Clara, CA to Zayo’s global network, providing customers with resilient, diverse routes for current use and future expansion.

Editor’s Note: The main reason for so many wholesale data centers/colocation facilities in Santa Clara (CoreSight, Digital Realty, Cologix, Cyxtera, NTT, Tata, etc) is cheaper electricity rates. That makes a huge difference as the IT equipment in the data centers consume a tremendous amount of power. Dark fiber access is abundant with multiple providers offering fiber ring access to regional carrier hotels / MMRs.

……………………………………………………………………………………..

“We are pleased to bring Zayo on-net in our Silicon Valley data centers,” said Clint Heiden, Chief Commercial Officer, EdgeCore. “The scale of EdgeCore’s campus is made more valuable for customers with the addition of Zayo’s future-proofed network and global reach.”

Through Zayo’s expansive, Tier-1 fiber network—including over 200 IP points of presence (PoPs) across the United States—customers at EdgeCore’s Silicon Valley campus will have access to fast, diverse, and reliable connectivity with guaranteed bandwidth to support their business needs. Zayo’s future-ready network infrastructure accommodates EdgeCore customers’ evolving needs for scale, rapid deployment of additional bandwidth, cloud connectivity, customer end-point connectivity, and more.

“Zayo is excited to be a part of EdgeCore’s expansion and provide the connectivity their customers need to be successful in today’s digital business era,” said Derek Gillespie, Chief Sales Officer, Enterprise at Zayo. “As customer bandwidth demands increase with the rapid growth of technologies like AI, partnerships like this will be hugely important in providing the supporting infrastructure. We look forward to staying at the forefront of this trend and continuing to connect what’s next with EdgeCore.”

In January, EdgeCore announced the groundbreaking of its Silicon Valley data center campus. Upon completion, the LEED-designed campus will support 72 MW of critical load across 540,000 square feet of space. In April, EdgeCore also announced the expansion of its Phoenix data center campus in Mesa, Arizona, for which Zayo also provides connectivity. Both companies look forward to building on their partnership in future EdgeCore markets.

About EdgeCore Digital Infrastructure

EdgeCore Digital Infrastructure serves the world’s largest cloud, internet, and technology companies with both ready-for-occupancy and build-to-suit data center capacity supported by best-in-class service-delivery capabilities. Privately held and supported by committed equity to fund an initial aggregate amount of over USD $4 billion in development, EdgeCore supports customer requirements by proactively investing in land, power, and vertical development in key data center locations, with buildings that highlight density engineering and meet key performance specifications, safety metrics, and sustainability objectives. EdgeCore has four markets with power and shovel ready campuses, operational data center buildings, and the ability to expand investment into new markets. For more information, please visit edgecore.com.

About Zayo

For more than 15 years, Zayo has empowered some of the world’s largest and most innovative companies to connect what’s next for their business. Zayo’s future-ready network spans over 16.5 million fiber miles and 141,000 route miles. Zayo’s tailored connectivity and edge solutions enable carriers, cloud providers, data centers, schools, and enterprises to deliver exceptional experiences, from core to cloud to edge. Discover how Zayo connects what’s next at www.zayo.com and follow us on LinkedIn and Twitter.

SOURCE EdgeCore Digital Infrastructure

………………………………………………………………………………………………..

References:

TDC NET with Ericsson launch first 5G Standalone network in Denmark

Danish digital infrastructure provider TDC NET, together with Ericsson, have launched the first 5G Standalone (5G SA) network in Denmark. The transition to high-performance 5G SA technology will enhance the regional 5G ecosystem, accelerate innovation across industries, and unlock exciting possibilities for consumers.

In September 2020, TDC NET went live with the first non-standalone (NSA) 5G network in Denmark, which worked alongside the existing 4G infrastructure provided by Ericsson.

Ericsson press release states: “This milestone signifies a monumental leap forward in connectivity, enabling transformative advancements and placing Denmark at the forefront of technological progress.”

“A 5G Standalone network provides lower latency, higher efficiency, better spectrum utilization, more reliable connectivity, and lower device battery consumption than other networks. It unlocks more use cases for consumers, critical IoT, enterprises and industrial automation. 5G SA also facilitates network slicing benefits for multiple customer segments, offering an infrastructure for businesses to enable, for instance, smart manufacturing and IoT-driven innovation, while giving consumers better and more consistent service experience. It is also a big step forward for communications service providers as it enables a more flexible approach to service creation and provision for subscribers.”

–>Those are all nice features but do any of them represent a monumental leap forward? 5G SA, aka true 5G (vs fake 5G=5G NSA=4G infrastructure/core with a 5G NR RAN) has yet to prove that in its limited global deployments. Where are the new 5G SA revenue streams?

Jakob Dirksen CTO of TDC NET, says: “We were the first to introduce 5G in Denmark and now we are taking the next big step by switching on 5G Standalone. This will offer consumers, enterprises and industries enhanced efficiency, safety, and a range of opportunities across everything from self-driving cars, remote work, healthcare, as well as mission-critical operations by authorities. In addition, 5G Standalone will also enable energy efficiency improvements thanks to more data being transmitted with the same amount of energy and faster access to content.”

One of the key benefits of 5G SA will be improved speed capabilities. Over a 5G SA network, TDC NET and Ericsson have already achieved an impressive 7Gbps downlink peak throughput in a live site environment that has been equipped with Ericsson Radio System products supporting millimeter wave and mid-band spectrum. Enabling New Radio Dual Connectivity (NR-DC) mode through Ericsson’s 5G Core and high modulation scheme have been key to this achievement.

A 5G trial at the Tour de France 2022 in Copenhagen, Denmark used Ericsson Massive MIMO radios on 5G TDD (time division duplex) spectrum. It delivered up to 13 times more data with the same energy consumption compared to LTE FDD (frequency division duplex).

Niclas Backlund, Country Manager for Ericsson Denmark, says: “With the 5G Standalone network, we are now able to accelerate the Danish 5G ecosystem and provide a world-class mobile network with a range of new opportunities for consumers and businesses by enabling slicing, and thereby providing service differentiation. By modernizing legacy networks and then upgrading to 5G, communication service providers can lower operating costs thanks to greater energy efficiency and thus reduce total cost of ownership. And, at the same time, they can future-proof their networks for anticipated higher capacity needs and offer customers value through new services and capabilities.”

In addition, 5G SA uses a dedicated 5G core network, which means that data transmission requires less signaling than with 5G NSA. This is because 5G SA devices do not need to switch between the 4G and 5G core networks, which can reduce latency and improve performance.

The 5G Standalone deployment in TDC´s commercial network is expected to contribute to the service provider’s roadmap towards Net Zero emissions target by 2030, says Ericsson. Also, the 5G SA network was said to signal major overall progress in TDC NET’s technological transformation as it adopts cloud-native software architecture, leading to fast and reliable service innovation for subscribers with service providers using TDC NET’s 5G network, while maintaining improved efficiency and network performance.

References:

Ericsson and Vodafone enable Irish rugby team to use Private 5G SA network for 2023 Rugby World Cup

BT and Ericsson wideband FDD trial over live 5G SA network in the UK

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Bouygues Telecom picks Ericsson for cloud native 5G SA core network

Ericsson powers Singtel 5G SA core network; lightest and smallest Massive MIMO radio

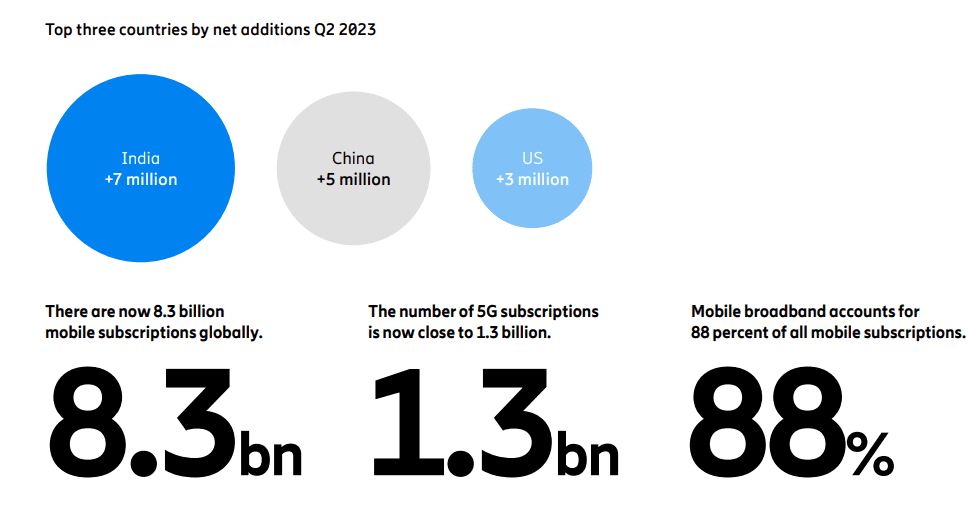

Ericsson: Global 5G subscriptions close to 1.3 billion in Q2-2023

According to Ericsson’s Mobility Report update, approximately 260 communications service providers (CSPs) have launched commercial 5G services. About 35 CSPs have launched 5G standalone (SA) networks. The Q2-2023 additions bring the global number of 5G subscriptions close to 1.3 billion.

India continues to lead the world in 5G subscription growth rate with more than seven million of the 175 million global subscriptions added between April and June (the second financial quarter – Q2) 2023 accounted for in the country.

China had the second highest country growth rate with more than five million 5G additions during Q2.

The United States was in third place with more than three million 5G subscription additions.

The four-page August 31 update is an addendum to the full edition of the Ericsson Mobility Report, published in June 2023. It focuses on recent updates to the quarterly subscription and traffic data sections.

Other information in the Q2-2023 update includes:

- In Q2 2023, the number of mobile subscriptions totalled 8.3 billion, with a net addition of 40 million subscriptions during the quarter. The number of unique mobile subscribers is 6.1 billion.

- Global mobile subscription penetration was 105 percent.

- The number of mobile broadband subscriptions grew by about 100 million in the quarter, totalling 7.4 billion, a year-on-year increase of five percent. Mobile broadband now accounts for 88 percent of all mobile subscriptions.

- Mobile data traffic grew by 33 percent between Q2 2022 and Q2 2023.

- 4G subscriptions increased by 11 million, totalling about 5.2 billion and representing 62 percent of all mobile subscriptions.

- WCDMA/HSPA subscriptions declined by 85 million and GSM/EDGE-only subscriptions dropped by 59 million during the quarter. Other technologies fell by about two million.

References:

https://www.ericsson.com/en/news/2023/8/emr-q2-2023-update

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/june-2023

Ericsson Mobility Report: 5G monetization depends on network performance

Ericsson Mobility Report: 5G subscriptions in Q2 2022 are 690 million (vs. 8.3 billion total mobile users)

June 2022 Ericsson Mobility Report: 5G subscriptions increased by 70 million in Q1-2022 to reach 620 million

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

5G network slicing [1.] use cases are still few and far between, mainly because so few 5G telcos have deployed the 5G SA core network which is mandatory for ALL 3GPP defined 5G features and functions, such as network slicing and 5G security.

ABI’s 5G network slicing and cloud packet core market data report found that growing ecosystem complexity and ongoing challenges with cloud-native tooling adoption have placed increased pressure on new service innovation, like 5G network slicing. ABI expects the 5G network slicing market to be worth US$19.5bn in value by 2028. Considering existing market activities, a growing force behind 5G slicing uptake is enhanced mobile broadband (eMBB) and fixed wireless access (FWA). To that end, there is growing market activity and commercial engagements from network equipment vendors (NEVs) Ericsson, Huawei, Nokia, and ZTE, among other vendors. ABI regards these market engagements as representing a good foundation for the industry to match 5G slicing technology to high-value use cases, such as enhanced machine-type communication and ultra-reliable low-latency communications.

Note 1. A network slice provides specified network capabilities and characteristics – or multiple, isolated virtual networks – to fit a user’s needs. Although multiple network slices run on a single physical network, network slice users are sometimes (depending upon the access level of the individual) authenticated for only one network level, enabling data and security isolation and a much higher degree of security. Individuals can be sanctioned for more than network level. Each slice spans multiple connected components that form a network, components that include physical computing, storage and networking infrastructure. These are virtualized, and protocols are set in place to create a specific network slice for each user or application. This means that varying types of 5G traffic, such as video streaming, industrial automation and mission-critical applications, all can be accommodated on the same network, yet each has its own dedicated resources and performance guarantees.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

“5G Slicing continues to promise new value creation in the industry. However, as reflected in multiple ABI Research’s market intelligence reports, a solid software and cloud-native foundation must be in place for that promise to materialize. That, in turn, is a prerequisite for a wider diffusion of 5G core adoption, an architecture that provides native support for 5G slicing,” explains Don Alusha, Senior Analyst at ABI Research.

Image Credit: Viavi Solutions

From a network architecture perspective, ABI said two modalities are emerging to deploy 5G slicing. The first one is to share the whole infrastructure spanning radio access network (RAN), core, physical devices and physical servers. This, said the analyst, constitutes a unified resource pool, the basis of which can be used to instantiate multiple logical connectivity transmissions.

A second approach is to provide hardware-based logical slices by slicing the physical equipment. The analyst cautions that this is a time-consuming, resource-intensive endeavor, but said it may be the best option for mission-critical services. It requires slicing the physical transmission network and oftentimes a dedicated user plane.

“Horizontal integration for cross-domain interoperability is critical going forward. Equally important is vertical integration for 5G slicing lifecycle management of multi-vendor deployments. There is ongoing market activity for the 5G core network penetration and maturity of 5G slice management functions. To that end, enterprises will seek to create and reserve slices statically and on-demand. They also want to efficiently integrate with cloud providers through open and programmable Application Program Interfaces (APIs) to enable hybrid cloud/cellular slice adoption. NEVs and other suppliers (e.g., Amdocs, Netcracker, etc.) offer solutions enabling CSPs to create fully automated and programmatic slicing capability over access, transport, and core network domains,” Alusha concludes.

These findings are from ABI Research’s 5G Network Slicing and Cloud Packet Core market data report. This report is part of the company’s 5G Core & Edge Networks research service, which includes research, data, and analyst insights. Market Data spreadsheets comprise deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight into where opportunities lie.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

T-Mobile US, the only U.S. carrier that has deployed 5G SA core network, has recently shared details of what it claims is “first use of 5G network slicing for remote video production on a commercial network,” which took place during Red Bull’s cliff diving event in Boston, MA. This customized slice gave the broadcast team supercharged wireless uplink speeds so they could easily and quickly transfer high-resolution content from cameras and a video drone circling the event to the Red Bull production team in near real-time over T-Mobile 5G. The uplink speed was up to 276 Mbps!

T-Mobile says they can also use network slicing for specific application types for enterprise customers across the U.S. Earlier this month they launched a first-of-its-kind network slicing beta for developers who are working to supercharge their video calling applications with the power of 5G SA. With a customized network slice, developers can sign up to test video calling applications that require consistent uplink and downlink speeds along with increased reliability. In the weeks since, we’ve seen tremendous interest from the developer community with dozens of companies large and small signing up to join the likes of Dialpad, Google, Webex by Cisco, Zoom and more.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Vodafone recently worked with Ericsson to provision network slices optimized for cloud gaming. In January, Samsung and KDDI announced the successful demonstration of Service Level Agreements (SLA) assurance network slicing in a field trial conducted in Tokyo, Japan. Yet there’s hardly a flood of real-world use cases (see References below).

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.abiresearch.com/market-research/product/market-data/MD-SLIC/

https://www.computerweekly.com/news/366550353/5G-network-slicing-value-hits-19bn-but-growth-stalls

https://www.t-mobile.com/news/network/its-time-to-unleash-network-slicing

https://www.viavisolutions.com/en-us/5g-network-slicing

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

GSA 5G SA Core Network Update Report

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Japan network operator KDDI announced today that it has signed an agreement with SpaceX to introduce satellite-to-cellular service in Japan. Leveraging SpaceX’s Starlink low earth orbit (LEO) satellites and KDDI’s extensive national wireless spectrum, this partnership aims to enhance cellular connectivity in areas, including remote islands and mountains that have been traditionally hard to reach using conventional 4G and 5G networks.

The partnership is slated to introduce SMS text services as the initial step, starting as early as 2024. At a later date, voice and data services will follow suit. The company also announced the service will work with almost all existing smartphones on the KDDI network.

The service is planned to be provided based on the establishment of radio-related laws and regulations in Japan.

Source: SpaceX

…………………………………………………………………………………………………………………………………

SpaceX first announced plans to provide cellular connectivity with T-Mobile in the US last year. At the time Elon Musk invited other companies to join them, and while there were no immediate takers, KDDI is now the third company to sign a deal.

Earlier this year New Zealand’s telecommunications company, One NZ (formerly known as Vodafone), announced it has signed an agreement with SpaceX to offer mobile coverage across the country, eliminating cellular dead zones.

KDDI and SpaceX also invite carries worldwide to join the ecosystem of mobile network operators bringing next generation satellite enabled connectivity to their customers.

■About KDDI:

KDDI’s au network enables our customer’s daily lives and helps them share unforgettable moments. We are proud of providing 99.9% “population coverage” to the people of Japan. Unfortunately, only a small portion of the Japanese land mass is habitable and often it is difficult to use traditional technologies to provide coverage from coast to coast. Our extensive network continues to grow in coverage as we deploy more fiber and satellite backhauled base stations. In addition to our continued efforts, we will provide “connecting the unconnected” experience, by enabling smartphones to connect to satellites.

■About Starlink by SpaceX:

Starlink delivers high-speed, low-latency internet to users all over the world. As the world’s first and largest satellite constellation using a low Earth orbit, Starlink delivers broadband internet capable of supporting streaming, online gaming, video calls and more. Starlink is engineered and operated by SpaceX. As the world’s leading provider of launch services, SpaceX is leveraging its deep experience with both spacecraft and on-orbit operations to deploy the world’s most advanced broadband internet system, as well as a Direct to Cell constellation of satellites to provide connectivity directly to unmodified LTE cell phones.

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2023/08/30/6937.html

KDDI teams up with SpaceX to bring Starlink-powered cellular service to Japan

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

Global spending on public cloud services is projected to reach $1.35 trillion in 2027, according to IT market research firm IDC. Although annual cloud spending growth is expected to slow slightly over the 2023-2027 forecast period, the market is forecast to achieve a five-year compound annual growth rate (CAGR) of 19.9%.

IDC forecasts that the U.S. will be the largest geographic public cloud market and will reach $697 billion in 2027. Western Europe is predicted to be in second place with $273 billion, followed by China at $117 billion in 2027.

Eileen Smith, program VP for data & analytics at IDC, said cloud is dominating spending in the tech sector across infrastructure, platforms and applications. She wrote:

“Cloud now dominates tech spending across infrastructure, platforms, and applications. Most organizations have adopted the public cloud as a cost-effective platform for hosting enterprise applications and for developing and deploying customer-facing solutions. Looking forward, the cloud model remains incredibly well positioned to serve customer needs for innovation in application development and deployment, including as data, artificial intelligence/machine learning (AI/ML), and edge needs continue to define the forefront of innovation.”

Of the 28 industries* covered in the IDC Spending Guide, the three largest in 2027 – Banking, Software and Information Services, and Telecommunications – will together represent $326 billion in public cloud services spending.

IDC forecasts that software-as-a-service (SaaS) applications to be the largest cloud computing category, garnering about 40% of all public cloud spending. Next largest is infrastructure as a service (IaaS) with a CAGR of 23.5%, followed by platform as a service (PaaS) with a five-year CAGR of 27.2%. SaaS – system infrastructure software (SIS) is forecast to be the smallest category of cloud spending, cornering about 15% of the market.

…………………………………………………………………………………………………………………….

References:

https://www.idc.com/getdoc.jsp?containerId=prUS51179523

https://www.idc.com/getdoc.jsp?containerId=IDC_P33214

IDC: Public Cloud software at 2/3 of all enterprise applications revenue in 2026; SaaS is essential!

https://techblog.comsoc.org/2022/02/09/gartner-accelerated-move-to-public-cloud-to-overtake-traditional-it-spending-in-2025/

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?