Inside AT&T’s newly expanded $8 billion cost-reduction program and huge layoffs

As its stock price (“T”) trades at 30+ year lows, AT&T is under severe pressure to cut costs. Its wireless subscriber growth is slowing, new fiber take rates are lower, debt has increased by $6 billion to $143.3 billion, while the company faces a potentially costly ($B+) lead cable cleanup.

AT&T recently announced they will cut another $2 billion in expenses over the next three years, even after reaching a $6 billion cost reduction plan early. Largely through what AT&T called “surplussings,” rounds of layoffs have been conducted on a department level on nearly a monthly basis to reduce costs.

The Dallas-based company’s employment has shrunk this decade from a peak of 281,000 to less than 160,000 through the first half of this year. Since the beginning of 2021, AT&T has cut 74,130 employees, including through divestitures, or 32% of its total staff through June 30th.

The company added fewer customers than analysts’ expected in the second quarter of 2023. In the three months ended June 30th, AT&T added 326,000 mobile phone subscribers. AT&T has been offering free phones in order to fuel customer growth for several quarters. The appeal of those promotions may be wearing out. The company cautioned last month that the pace of subscriber gains had slowed due to competition from rivals and cable TV companies.

AT&T raised rates on its premium mobile plan to help boost revenue and is in the process of restructuring operations by reducing 350 offices across the U.S. to nine core locations with the main hubs in Dallas and Atlanta. The telco has told 60,000 managers that they need to show up in person to one of these locations, and some will face relocation decisions or be fired.

Chief executive John Stankey recently informed employees in an email about the departure of HR chief Angela Santone. She is one of only three female top executives at AT&T. During her tenure, Santone developed an internal “culture of connection” program. The idea was to echo one of Stankey’s themes of “connectivity,” the new simplified mission for the company as it returned to its telecommunications roots after a $100 billion ill-fated attempt to transform the company into a media rival of Walt Disney Co. and Netflix Inc.

“On behalf of AT&T’s leadership, I’d like to thank her for her support and commitment to driving these initiatives during a very challenging and important time of transition,” Stankey wrote in the email, which was confirmed by Bloomberg. AT&T declined to comment on Santone’s departure.

……………………………………………………………………………………………………………………

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Everyone agrees that Generative AI has great promise and potential. Martin Casado of Andreessen Horowitz recently wrote in the Wall Street Journal that the technology has “finally become transformative:”

“Generative AI can bring real economic benefits to large industries with established and expensive workloads. Large language models could save costs by performing tasks such as summarizing discovery documents without replacing attorneys, to take one example. And there are plenty of similar jobs spread across fields like medicine, computer programming, design and entertainment….. This all means opportunity for the new class of generative AI startups to evolve along with users, while incumbents focus on applying the technology to their existing cash-cow business lines.”

A new investment wave caused by generative AI is starting to loom among cloud service providers, raising questions about whether Big Tech’s spending cutbacks and layoffs will prove to be short lived. Pressed to say when they would see a revenue lift from AI, the big U.S. cloud companies (Microsoft, Alphabet/Google, Meta/FB and Amazon) all referred to existing services that rely heavily on investments made in the past. These range from the AWS’s machine learning services for cloud customers to AI-enhanced tools that Google and Meta offer to their advertising customers.

Microsoft offered only a cautious prediction of when AI would result in higher revenue. Amy Hood, chief financial officer, told investors during an earnings call last week that the revenue impact would be “gradual,” as the features are launched and start to catch on with customers. The caution failed to match high expectations ahead of the company’s earnings, wiping 7% off its stock price (MSFT ticker symbol) over the following week.

When it comes to the newer generative AI wave, predictions were few and far between. Amazon CEO Andy Jassy said on Thursday that the technology was in its “very early stages” and that the industry was only “a few steps into a marathon”. Many customers of Amazon’s cloud arm, AWS, see the technology as transformative, Jassy noted that “most companies are still figuring out how they want to approach it, they are figuring out how to train models.” He insisted that every part of Amazon’s business was working on generative AI initiatives and the technology was “going to be at the heart of what we do.”

There are a number of large language models that power generative AI, and many of the AI companies that make them have forged partnerships with big cloud service providers. As business technology leaders make their picks among them, they are weighing the risks and benefits of using one cloud provider’s AI ecosystem. They say it is an important decision that could have long-term consequences, including how much they spend and whether they are willing to sink deeper into one cloud provider’s set of software, tools, and services.

To date, AI large language model makers like OpenAI, Anthropic, and Cohere have led the charge in developing proprietary large language models that companies are using to boost efficiency in areas like accounting and writing code, or adding to their own products with tools like custom chatbots. Partnerships between model makers and major cloud companies include OpenAI and Microsoft Azure, Anthropic and Cohere with Google Cloud, and the machine-learning startup Hugging Face with Amazon Web Services. Databricks, a data storage and management company, agreed to buy the generative AI startup MosaicML in June.

If a company chooses a single AI ecosystem, it could risk “vendor lock-in” within that provider’s platform and set of services, said Ram Chakravarti, chief technology officer of Houston-based BMC Software. This paradigm is a recurring one, where a business’s IT system, software and data all sit within one digital platform, and it could become more pronounced as companies look for help in using generative AI. Companies say the problem with vendor lock-in, especially among cloud providers, is that they have difficulty moving their data to other platforms, lose negotiating power with other vendors, and must rely on one provider to keep its services online and secure.

Cloud providers, partly in response to complaints of lock-in, now offer tools to help customers move data between their own and competitors’ platforms. Businesses have increasingly signed up with more than one cloud provider to reduce their reliance on any single vendor. That is the strategy companies could end up taking with generative AI, where by using a “multiple generative AI approach,” they can avoid getting too entrenched in a particular platform. To be sure, many chief information officers have said they willingly accept such risks for the convenience, and potentially lower cost, of working with a single technology vendor or cloud provider.

A significant challenge in incorporating generative AI is that the technology is changing so quickly, analysts have said, forcing CIOs to not only keep up with the pace of innovation, but also sift through potential data privacy and cybersecurity risks.

A company using its cloud provider’s premade tools and services, plus guardrails for protecting company data and reducing inaccurate outputs, can more quickly implement generative AI off-the-shelf, said Adnan Masood, chief AI architect at digital technology and IT services firm UST. “It has privacy, it has security, it has all the compliance elements in there. At that point, people don’t really have to worry so much about the logistics of things, but rather are focused on utilizing the model.”

For other companies, it is a conservative approach to use generative AI with a large cloud platform they already trust to hold sensitive company data, said Jon Turow, a partner at Madrona Venture Group. “It’s a very natural start to a conversation to say, ‘Hey, would you also like to apply AI inside my four walls?’”

End Quotes:

“Right now, the evidence is a little bit scarce about what the effect on revenue will be across the tech industry,” said James Tierney of Alliance Bernstein.

Brent Thill, an analyst at Jefferies, summed up the mood among investors: “The hype is here, the revenue is not. Behind the scenes, the whole industry is scrambling to figure out the business model [for generative AI]: how are we going to price it? How are we going to sell it?”

………………………………………………………………………………………………………………

References:

https://www.ft.com/content/56706c31-e760-44e1-a507-2c8175a170e8

https://www.wsj.com/articles/companies-weigh-growing-power-of-cloud-providers-amid-ai-boom-478c454a

https://www.techtarget.com/searchenterpriseai/definition/generative-AI?Offer=abt_pubpro_AI-Insider

Global Telco AI Alliance to progress generative AI for telcos

Curmudgeon/Sperandeo: Impact of Generative AI on Jobs and Workers

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Qualcomm CEO: AI will become pervasive, at the edge, and run on Snapdragon SoC devices

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

MTN Consulting’s Mid Year Update:

There are three different types of network operators: telecom operators (telcos), webscale network operators (webscalers), and carrier-neutral operators (CNNOs). In 2022, these three groups accounted for $4.1 trillion (T) in revenues, $559 billion (B) in capex, and 8.87 million employees. The report provides 2011-22 actuals and projections through 2027, and includes projections from past forecasts for reference.

Review of the 3 Market Segments:

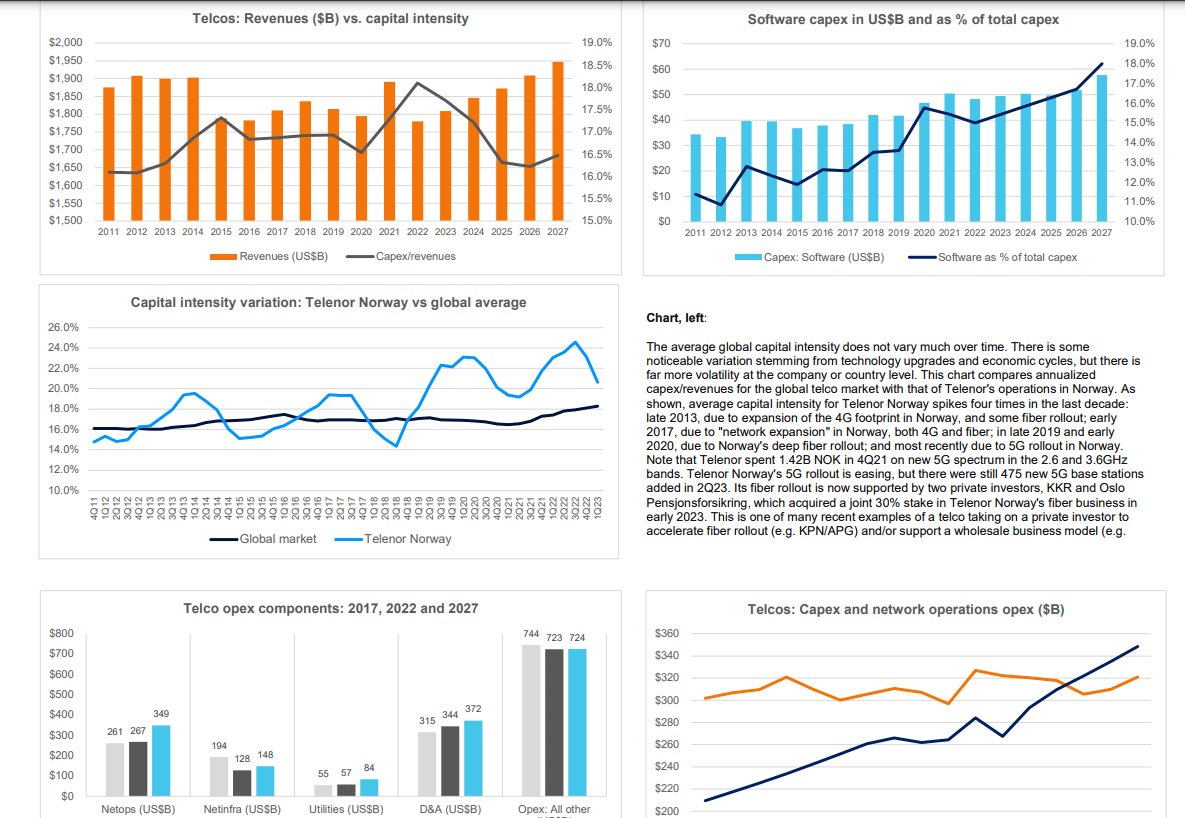

1. Telco: Telecom is essentially a zero-growth industry. Specific countries and companies do grow from time to time, in part from market share shifts, the different timing of growth cycles, or M&A. But global telco revenues have hovered in a narrow range ($1.7-$1.9 trillion) since 2011, and this will likely remain true through 2027. In 2022, revenues were $1.78T, and will grow an average annual rate of 1.8% to reach $1.95T by 2027.

Capex continues to vary with technology upgrade cycles (e.g. 5G) and government actions (e.g. newly issued spectrum, or rural fiber subsidies). In 2022, capex totaled $322B, or 18.1% of revenues; that’s an all-time high capital intensity, for coverage timeframe (2011-present). Capex will decline slightly through 2025, though, and then rise modestly again to reach $321B in 2027, which would be a 16.5% capital intensity. US capex surged in 2022, but will drop dramatically in 2023; we already expected this, though, so the current forecast is not significantly different. Software capex is growing more slowly than expected, and now likely to remain under 20% of total capex for the forecast period.

Headcount in telecom is declining faster than expected, and now likely to fall below 4.2 million in 2027, from just under 4.6 million in 2022. Labor costs per head will revert to a growth trajectory in 2023, as telcos develop a more IT/software-centric workforce.

2. Webscalers: growth from webscale has lifted the overall network operator market over the last decade. Webscalers surged during COVID, by all measures – revenues, capex, employment. Demand for data center chips and related gear also surged. Now, parts of the sector are cutting back slightly.

In 2022, revenues were $2.23 trillion, up just 4% YoY, far less than the average growth of 12% per year from 2011-22. We expect revenues to grow at a ~6% CAGR through 2027. Webscale capex was $203B in 2022, a healthy increase from 2021; due in part to generative AI interest, capex will grow again in 2023 and 2024, dip for a couple years of capacity absorption, and then end 2027 at around $231B. A larger portion of this capex will be for Network/IT/software investments: around 46%, from 44% in 2022. R&D spending by webscalers will remain high but fall from the record-breaking level of 2022 (12.0% of revenues), to about 10% in 2027. As topline growth gets harder for webscalers, they will become more cost conscious and short-term oriented.

3. CNNOs: the carrier-neutral sector remains tiny, with just $95B in 2022 revenues, but will grow to about $132B by 2027. Webscalers and telcos alike will both rely more on CNNOs over time for expansion of their data center, tower and fiber footprints.

Telcos will continue to spin out portions of their infrastructure to third-parties – both traditional CNNOs, and joint ventures like Gigapower, the AT&T-Blackrock partnership. Total CNNO capex for 2022 was $34B, and will grow to about $45B by 2027; a large chunk of the CNNO sector’s expansion will be inorganic, though, via acquisition of existing assets from other sectors. By 2027, the CNNO sector will have under its management approximately 3.7 million cell towers (2022: 3.3M), 1,607 data centers (2022: 1,224), and 1.1M route miles of fiber (2022: 960K).

Source: MTN Consulting

……………………………………………………………………………………………………………………………………………………………

Market drivers, constraints and risk factors:

This forecast represents only a modest revision from the edition published in December 2022. Most of the realities facing the operator market today were anticipated by our last forecast. For instance, we already expected that service revenues were not growing for telcos, and that 5G device sales distorted the market; an MTN Consulting report published in 2Q23 confirmed this fact, and supports a more cautious outlook for telco spending. We also thought that open RAN was overhyped, and was not likely to change the capex calculus for most established mobile operators. The 2023 dip in US telco capex was baked into our old forecast. The one big sector-specific change from the last forecast to this one is, the recent spike in interest in generative AI. This is a plus for the webscale market’s capex outlook, even if new revenue models are unclear and government regulations will slow adoption.

What about the macroeconomic climate? Wars, economic growth, inflation, interest rates, climate change, etc. Russia’s war on Ukraine remains ongoing, but hasn’t expanded to new countries. China has not invaded Taiwan as of yet, although this is a serious risk over the 5-year forecast horizon. Global economic growth is weaker than historic averages – about 3% this year and next, per the IMF – but inflation is easing, and the IMF’s GDP growth outlook improved slightly from April to July 2023. Interest rates continue to rise; the US federal funds rate has risen from 3.83% to 5.08% between 12/22 and 7/23, and further increases seem likely. Rising interest rates were already assumed to modestly depress 2023-24 capex, though.

Climate change is the one macro area that is quite a bit different than 8 months ago. The news gets worse each week. Government action continues to be gradual and consensus is hard to achieve. Increasingly the pressure will be on private companies to make voluntary, verifiable changes in how they operate. This doesn’t impact the forecast directly, but will impact how operators spend their tech budgets, as we have discussed in separate reports. Energy, sustainability and climate change will continue to be key themes in MTN Consulting research.

References:

Nokia will manufacture broadband network electronics in U.S. for BEAD program

Nokia has become the first telecom company to announce the manufacturing of fiber-optic broadband network electronics products and optical modules in the U.S. for use in the Broadband Equity, Access and Deployment (BEAD) program.

Using thin strands of glass to transmit data with light, fiber-optic networks have become the backbone of today’s digital economy and are used to connect everything to fast, reliable gigabit data services. Seventy percent of fiber broadband lines in North America are powered by Nokia. Now, partnering with Sanmina Corporation, Nokia will manufacture in the U.S. several fiber-optic broadband products at Sanmina’s state-of-the-art manufacturing facility located in Pleasant Prairie, Kenosha County, Wisconsin, bringing up to 200 new jobs to the state.

By manufacturing fiber-optic technology in the U.S., Nokia will be able to supply its products and services to critical projects like BEAD that are focused on narrowing the digital divide, helping to further contribute to the nation’s economic growth and job creation. Having access to technology that is built in the U.S. is an important requirement for states and infrastructure players seeking to participate in BEAD and the $42.45bn of available funding allocated for broadband rollouts to unserved and underserved communities.

Pekka Lundmark, President and CEO of Nokia, said: “At Nokia, we create technology that helps the world act together. We are committed to connecting people and communities. However, many Americans still lack adequate connectivity, leaving them at a disadvantage when it comes to accessing work, education and healthcare. Programs like BEAD can change this. By bringing the manufacturing of our fiber-optic broadband access products to the U.S., BEAD participants will be able to work with us to bridge the digital divide. We look forward to bringing more Americans online.”

Vice President of the United States, Kamala Harris, said: “President Biden and I are delivering on our promise to strengthen our economy by investing in working people, expanding domestic manufacturing, empowering small business owners, and rebuilding our nation’s infrastructure—today’s announcement is a direct result of this work. Our investments in broadband infrastructure are creating jobs in Wisconsin and across the nation, and increasing access to reliable, high-speed internet so everyone in America has the tools they need to thrive in the 21st century.”

U.S. Secretary of Commerce, Gina Raimondo, said: “President Biden promised to bring high-speed internet to every corner of America, and to do it with American workers and American-made equipment. This announcement is proof that he’s delivering on that promise. When we invest in American manufacturing and American jobs, there’s no limit to what we can achieve. Thanks to the President’s leadership, we’re going to connect everyone in America and create a strong and equitable economy that’s built for the future.”

Jure Sola, Chairman and CEO of Sanmina, said: “Sanmina has been manufacturing in the U.S. for more than forty years and we are excited to partner with Nokia to support their efforts to build robust and resilient high-tech fiber broadband networks that will connect people and societies. By continuing to invest in domestic manufacturing, Nokia and Sanmina will be able to help create a sustainable future for the industry, one that drives job growth and ensures the fiber products produced embody the quality and excellence associated with American manufacturing.”

Nokia fiber-optic broadband products manufactured in the U.S. will include:

- Optical Line Termination card for a modular Access Node

- A small form factor OLT

- OLT optical modules

- An “outdoor-hardened” Optical Network Terminal (ONT)

Resources and additional information

- Seven out of ten fiber broadband connections in North America are made through Nokia equipment.

- Nokia is the top supplier of fiber-optic broadband technology for service providers in the U.S.

- Nokia is the number one vendor for XGS-PON technology globally and in the U.S. market. XGS-PON can deliver up to 10 Gbps (Gigabits-per-second) broadband speeds to end-users. With 10 Gbps, you can download a 4K movie in less than 30 seconds or stream around 1,700 movies simultaneously.

- Nokia was the first to deploy 1, 10 and 25 Gigabit fiber-optic broadband networks in the U.S. with the Electric Power Board (EPB) in Chattanooga, Tennessee.

- Website: More about funding opportunities and Nokia broadband solutions

- Infograph: Why Fiber Broadband is Essential

- Article: U.S. Broadband Infrastructure Funding explained

- Video: Explaining the limitless speeds for fiber broadband

- https://www.nokia.com/about-us/news/releases/2023/08/03/nokia-first-to-announce-manufacturing-of-broadband-network-electronics-products-for-bead-program-in-us/

……………………………………………………………………………………………………………………..

August 16, 2023 Addendum:

Nokia announced today its partnership with Fabrinet to become the first telecom vendor to manufacture fiber broadband optical modules in the U.S. for use in the Broadband Equity, Access and Deployment (BEAD) program.

Starting in 2024, Nokia’s next generation, multi-rate optical modules for Optical Line Terminals (OLTs) will be produced at Fabrinet’s state-of-the- art manufacturing facility located in Santa Clara, California, bringing high-tech innovation and additional jobs to the country.

This news builds on Nokia’s recent announcement that they will produce fiber-optic broadband network electronic products in Kenosha, Wisconsin – expanding Nokia’s list of products and solutions for networks rollouts using BEAD or other funding to help bridge the digital divide.

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro Group predicts the broadband equipment market will surpass $120 billion in cumulative spending between 2022 and 2027. The market research firm says sales of PON equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will show a 0.2% Compounded Annual Growth Rate (CAGR) from 2022 to 2027. Service providers continue to expand their fiber and DOCSIS 3.1/4.0 networks, while also increasing the reliability and sustainability of their broadband access networks.

“After three consecutive years of tremendous broadband network expansions and upgrades, 2023 is expected to show a return to normalized levels of spending,” said Jeff Heynen, Vice President of Broadband Access and Home Networking research at Dell’Oro Group. “After 2023, spending is expected to increase through 2026 and 2027, driven by 25 Gbps and 50 Gbps PON, Fixed Wireless CPE, as well as DAA and DOCSIS 4.0 deployments.”

Labor markets are “still being challenged” and a number of fiber based network operators (AT&T, Altice USA, Frontier) have reduced their expansion plans and homes passed targets. “To close out 2022 we did see a significant uptake in equipment purchases, and what happened there was supply chains appeased. A lot of orders that had been on the books for a long time have been fulfilled.”

Network equipment vendors are working through that inventory they had built up while taking on “additional equipment purchases.

Additional highlights from the Broadband Access & Home Networking 5-Year July 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.8 B in 2022 to $13.3 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs) is expected to reach $1.6 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.7 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

- Revenue for Residential Wi-Fi Routers will surpass $5.2 B in 2027, owing to massive shipments of Wi-Fi 7 units.

“Which isn’t going to float to manufacturers until you know, late 2024, really into 2025,” he said. “I think in the interim, XGS-PON in the European market is certainly going to catch up. We’re also seeing considerable growth in XGS-PON deployments now in China.”

In Dell’Oro’s five-year forecast published in January, Heynen expected fixed wireless subscriber growth, particularly in North America, would “start to moderate” beginning in 2024, due to factors like “capacity issues and fiber expansion.”

Heynen has increased his revenue predictions for the fixed wireless CPE market – which he previously tipped would hit $2.2 billion in five years – and now predicts subscriber growth to continue into 2025.

“Part of that is because of the net reduction in homes passed for fiber,” he said. “In the meantime, fixed wireless will be able to cover more ground while the operators who are building out fiber kind of extend their overall deployment plans.”

Further, operators like T-Mobile and Verizon “are seeing fixed wireless as a way to secure broadband subscribers away from cable operators. The U.S. market is really dynamic in terms of how services can be marketed.”

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

https://www.fiercetelecom.com/telecom/broadband-equipment-market-eclipse-120b-2027-delloro

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Futuriom and Dell’Oro weigh in on SD-WAN and SASE market: single vendor solutions prevail

Openreach deploys Adtran’s FSP 3000 open optical transport system

Adtran today announced that Openreach, the UK’s largest wholesale broadband network, has deployed its FSP 3000 open optical transport technology to enable its new Optical Spectrum Access 100G Single enterprise service.

Openreach’s new product offers a dedicated fiber link that empowers more UK businesses to harness point-to-point 100Gbit/s data transport. The solution also brings efficiency benefits that reduce capital and operational expenditure. The latest collaboration builds on more than a decade of successful partnership between Adtran and Openreach.

“Corporate cloud applications and other data-intensive tasks such as data center backhaul are fueling a growing demand for bandwidth. Adtran’s scalable optical technology enables us to offer a managed, high-speed service that satisfies that demand at a highly competitive price point,” said Simon Williams, head of optical products at Openreach.

“With no filters or amplifiers required, our Optical Spectrum Access 100G Single service offers secure and always-on optical services that can transport enormous amounts of data. We’re also making dedicated, uncomplicated and customizable access available in a slimmed-down package that’s even easier to manage.”

Adtran’s FSP 3000 technology is helping Openreach deliver managed 100G connectivity to UK businesses. (Photo: Business Wire)

Openreach’s Optical Spectrum Access 100G Single offers a choice of point-to-point Ethernet links at 100Gbit/s or 10 separate channels at 10Gbit/s. Built on Adtran’s scalable, open FSP 3000 optical transport technology, the service empowers Openreach to meet the growing demand for data-intensive cloud-based applications. Engineered for operational simplicity, Adtran’s compact and highly efficient FSP 3000 platform offers a dedicated fiber link ensuring low latency, consistent service quality and unparalleled network reliability for Openreach’s customers.

“Our FSP 3000 technology gives Openreach a powerful optical transport solution that efficiently delivers high-bandwidth services for enterprise customers. Using the Optical Spectrum Access 100G Single service, businesses can now smoothly manage substantial data transfers, even during peak operational hours,” commented Stuart Broome, GM of EMEA sales at Adtran. “We have a great track record of partnering with Openreach to advance digital transformation across the UK. It’s a relationship based on trust and a shared dedication to deliver for customers. Together, we’re providing extra capacity and value for more businesses.”

About Adtran:

ADTRAN Holdings, Inc. (NASDAQ: ADTN and FSE: QH9) is the parent company of Adtran, Inc., a leading global provider of open, disaggregated networking and communications solutions that enable voice, data, video and internet communications across any network infrastructure. From the cloud edge to the subscriber edge, Adtran empowers communications service providers around the world to manage and scale services that connect people, places and things. Adtran solutions are used by service providers, private enterprises, government organizations and millions of individual users worldwide. ADTRAN Holdings, Inc. is also the largest shareholder of Adtran Networks SE, formerly ADVA Optical Networking SE. Find more at Adtran, LinkedIn and Twitter.

References:

BT’s CEO: Openreach Fiber Network is an “unstoppable machine” reaching 9.6M UK premises now; 25M by end of 2026

Adtran showcases coherent innovation at OFC 2023: FSP 3000 open line system & coherent 100ZR

Openreach on benefit of FTTP in UK; Full Fiber rollouts increasing

Analysts: Combined ADTRAN & ADVA will be a “niche player”

UScellular’s Home Internet/FWA now has >100K customers

UScellular now has more than 100,000 Home Internet/Fixed Wireless Access (FWA) customers and it anticipates even more growth over the coming years.

In 2022, fixed wireless services accounted for 90% of home broadband net additions, according to Leichtman Research Group. In the U.S., Verizon is by far the leader in 4G/5G FWA ending 2022 with 1.452 million fixed wireless home internet customers. The telco added 384K, 393K, 379K, and 342K in the last four quarters. It now has 2.229 million FWA internet subscribers.

In a press release on Tuesday, UScellular Chief Marketing Officer Eric Jagher said they knew rural areas in particular would see great benefit from having a FWA solution.

“We continue to enhance our Home Internet experience for customers, and the growth and positive response we’ve received to this service has us excited for the future. As we celebrate this milestone, we look forward to further updating the service so we can soon surpass hundreds of thousands of Home Internet customers,” Jagher stated.

As UScellular continues to build out its 5G mid-band network, more customers will be able to realize the fast, dependable connectivity that Home Internet provides. Earlier this year, UScellular launched its 5G mid-band network in parts of 10 states and expects to cover 1 million households by the end of the year and 3 million households by the end of 2024. This network can deliver speeds up to 10x faster than its 4G LTE network and low-band 5G.

UScellular initially offered Home Internet on its 4G LTE network and has upgraded the service with low-band, mid-band and mmWave 5G in select markets across the country. Most customers today can access 5G speeds on the service, which has led to a doubling of the customer base over the last 18 months. The company currently offers self-install, plug-and-play internal antennas and routers and a professionally installed external antenna in certain areas. Later this year, the company expects to have additional self-install options available to help meet the evolving needs of customers.

Additionally, UScellular offers a free Internet Setup Coach for all new customers. Experts from Asurion are available via phone to help customers with router placement for the best speeds and getting all essential devices – like computers, TVs and doorbells – connected to their home’s Wi-Fi network.

As UScellular looks to further enhance and expand its Home Internet service especially in rural areas, funding from the National Telecommunications and Information Administration’s Broadband Equity Access and Deployment (BEAD) program will be important. Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States.

Indeed, UScellular has made it clear that it wants to use funds from the BEAD program to build more towers and serve more rural areas with FWA while increasing its 5G mobile coverage.

The telco this week reiterated the importance of that BEAD funding. “Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States,” the company stated.

About UScellular:

UScellular is the fourth-largest full-service wireless carrier in the United States, providing national network coverage and industry-leading innovations designed to help customers stay connected to the things that matter most. The Chicago-based carrier provides a strong, reliable network supported by the latest technology and offers a wide range of communication services that enhance consumers’ lives, increase the competitiveness of local businesses and improve the efficiency of government operations. Through its After School Access Project, the company has pledged to provide hotspots and service to help up to 50,000 youth connect to reliable internet. Additionally, UScellular has price protected all of its plans, promising not to increase prices through at least the end of 2024. To learn more about UScellular, visit one of its retail stores or www.uscellular.com. To get the latest news, visit newsroom.uscellular.com.

References:

For more information about UScellular’s efforts:

https://newsroom.uscellular.com/connecting-us/

https://www.fiercewireless.com/5g/uscellular-marks-100000-fwa-customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

GSA 5G SA Core Network Update Report

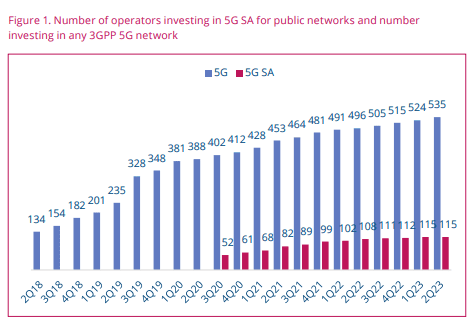

GSA is tracking the emergence of the 5G SA core network, including the availability of chipsets and devices for customers, plus the testing and deployment of 5G SA networks by public mobile network operators as well as private network operators.

5G SA networks can be deployed in a variety of scenarios: as an overlay for a public 5G non-SA network, as a greenfield 5G deployment for a public network operator without a separate LTE network, or as a private network deployment for an enterprise, utility, education, government or other organization requiring its own private campus network.

GSA has identified 115 operators in 52 countries and territories worldwide that have been investing (?) in public 5G SA networks in the form of trials, planned or actual deployments (see Figure 1.). This equates to 21.4% of the 535 operators known to be investing in 5G licenses, trials or deployments of any type.

At least 36 operators in 25 countries and territories are now understood to have launched or deployed public 5G SA networks, two of which have only soft-launched their 5G SA networks.

NOTE: Incredibly, that’s a DECREASE from GSA’s June 5G SA report which stated “GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.”

Also, 19 cellular network operators have been catalogued as deploying or piloting 5G SA for public networks, and 29 as planning to deploy or evaluating, testing or trialing the technology.

Several organizations are testing, piloting or deploying 5G SA technologies for private networks. As of May 2024, 66 (just over 13% of total cellular private networks) organizations are known to be working with 5G SA core networks. These organizations include manufacturers, academic institutions, commercial research institutes, construction, communications and IT services, rail and aviation industries.

The number of 5G SA devices as a percentage of all 5G devices announced has been steadily increasing. They accounted for 35.6% of 5G devices in December 2019, 49.7% in December 2020 and 54.6% in December 2021 and a large increase to 81.8% in December 2022. As of June 2023, they account for 85.8%.

Software upgrades are almost always needed to enable 5G SA capability for existing 5G devices. There is a range of form factors to cater for different users, including modules for equipment manufacturers and vendors; customer-premises equipment (CPE), routers and gateways for enterprise or industrial customers or their systems integrators; CPE for home and business broadband; phones; and battery-operated hot spots for portable services.

Smartphones make up over half (59.0%) of the announced 5G devices with stated 5G SA support (1,034 phones), followed by fixed wireless access CPE (246) and modules (220).

Spectrum Support in 5G SA Devices:

Selected sub-6 GHz frequencies are increasingly well supported in 5G SA devices. The pattern of most-supported bands in sub-6 GHz 5G SA devices largely matches the pattern for most-supported bands across all 5G devices, with C-band, 2.6 GHz, 2 GHz, 1.8 GHz and 700 MHz.

Sub-6 GHz support by band, announced 5G SA devices, most-supported bands by most devices. Support for millimeter wave is not yet common.

Chipsets are being developed to support this capability — GSA has currently only catalogued eight chipsets specifically supporting 5G SA in millimeter-wave spectrum (eight mobile processors and platforms). 320 393 397 421 449 519 739 741 743 817 846 979 1,025 1,115 1,183 1,257 1,309 1,444 1,465 n48 n25 n66 n71 n12 n2 n20 n40 n79 n38 n7 n8 n5 n3 n28 n77 n1 n41 n78 We can expect support for spectrum bands above 6 GHz to increase in the future, as these bands are being promoted as an option for deployment of private 5G networks by regulators in various countries, as well as being promoted as capacity bands for high-traffic locations in public networks.

Summary:

The market is seeing the emergence of a strong 5G SA ecosystem with chipsets, devices of many types and users of public as well as private networks. We can expect to see the market go from strength to strength.

–>This author opines the 5G SA market is going from nowhere to no place!

As it does, GSA will continue to track its evolution and will be looking out for important new trends as they emerge.

Topics likely to become more important in the coming year in this context include 5G carrier aggregation in SA networks, ultrareliable low-latency communications (can’t be accomplished till 3GPP Release 16 URLLC in the RAN spec has been completed and performance tested) capabilities to support machine-to-machine connections in 5G SA systems, increasing support for millimeter-wave connections, network slicing in 5G networks and the introduction of VoNR in 5G SA networks.

……………………………………………………………………………………………………………………..

References:

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

5G SA networks (real 5G) remain conspicuous by their absence

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

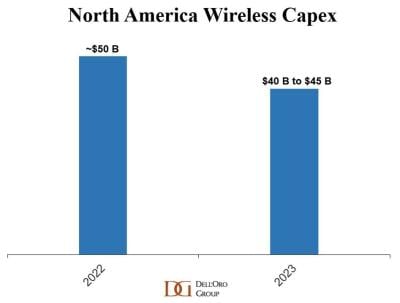

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

IEEE President Elect: IEEE Overview, 2024 Priorities and Strategic Plan

by Tom Coughlin, IEEE President Elect (edited by Alan J Weissberger)

IEEE at a Glance:

- 420,000 members in 190+ countries

- Sponsors 2,000+ conferences in 96 countries annually

- 5 million+ documents in the IEEE Xplore® digital library, with 15 million+ downloads each month

- Publishes approximately 200 transactions, journals, and magazines; IEEE is 3 out of the top 5 publications on AI, Automation and Control Systems, and Computer Science HW and SW

- Leader in tech patents granted

- 1,076 active standards (including IEEE 802.3 Ethernet and IEEE 802.11 WiFi)

- 900+ standards under development

- 46 Societies and Technical Councils

- IEEE members have won 21 Nobel Prizes

- Lots of volunteer opportunities!

Technical Expertise that is Broad and Deep:

IEEE is the most-cited publisher in new patents from top patenting organizations!

A study of the top 50 patenting organizations ranks IEEE #1 again:

- Nearly 3x more citations than any other publisher

- Patent referencing to IEEE increased 864% since 1997

- Analyzed by discipline, IEEE is the #1 most referenced publisher in AI, Blockchain, Computing, Cybersecurity, IoT, Power Systems, Semiconductors, Telecom and more

- The importance of sci-tech literature in patents is rising IEEE research is increasingly valuable to innovators

IEEE Priorities for 2024:

- Increasing outreach to younger IEEE members

- Increase engagement with industry groups

- Increasing our outreach to the broader public

- Make investments in new products and services

- Improve the communications and coordination between standards activities and the technical societies

Strengthening IEEE’s Value to Industry:

This will require serious work at the local section level as well as by various IEEE Organizational Units. Goals and objectives:

- Get members from industry involved in your local section leadership

- Work with your local companies

- Participate in local trade shows (exhibits, talks)

- Recognize local companies for their activities

- Getting IEEE engaged with industry is an important element in retaining and attracting younger members (one of our 2024 IEEE Priorities)

- IEEE organizational units must be part of this effort!

Note: IEEE will need to create a new strategic plan out to 2030.