Point Topic: Global Broadband Subscribers in Q2 2025: 5G FWA, DSL, satellite and FTTP

Overview:

Global broadband subscribers surpassed 1.53 billion in Q2 2025, marking a 1.1% growth. Broadband subscriptions[1] declined in 24 countries[2], compared to 22 in Q1 2025. In some of these markets consumers are migrating to mobile broadband, others are experiencing economic headwinds or are already highly saturated. Some are still in the midst of conflict. Globally, the growth in Q2 2025 has increased slightly, compared to the same quarter of 2024.

Notes:

[1] Whenever Point Topic refers to ‘broadband’ in this report, they mean fixed broadband. Also, ‘subscriptions’ and ‘connections’ are used interchangeably.

[2] It is possible there will be restatements in the coming quarter/s and single period data should be viewed in that light. Decline in some markets can be due to changes in methodology used by national regulatory authorities.

Key Points:

-

In terms of growth, India remained at the top of the largest 20 fixed broadband markets with a 6.7% quarterly growth rate.

-

The share of FTTH/B in the total fixed broadband subscriptions increased further and stood at 72.68%. Broadband connections based on other technologies saw their market shares shrink again, with an exception of satellite and fixed wireless access (FWA).

-

Year-on-year, FTTH/B connections grew by 7.2%. Satellite and FWA saw an even higher annual growth (41.6% and 31% respectively).

-

Legacy copper subscriptions declined by 12.1% y-o-y, while FTTx lines (mainly VDSL) went down by 6%, with Spain becoming one of the first countries in the world and the first major European economy to shut down its copper network completely.

-

5G FWA take-up accelerated, especially in India and the US, as a result of aggressive investments by Reliance, Bharti Airtel, T-Mobile, Verizon and AT&T.

In Q2 2025, the global fixed broadband subscriber figure grew by 1.1%, exceeding 1.53 billion. In line with seasonal trends, the growth rate was slower than in the previous quarter but it was slightly higher than in the respective quarter of 2024 (Figure 1. above and Table 1. below).

Table 1. Global broadband subscribers and quarterly growth rates. Source – Point Topic

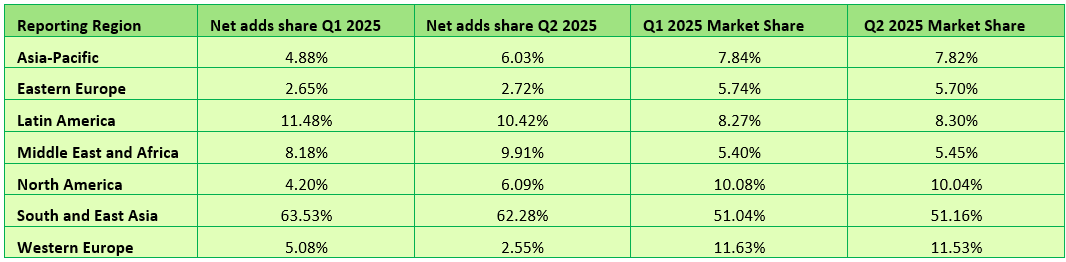

South and East Asia continues to claim the largest share of net adds in global fixed broadband subscribers, though it dropped slightly quarter-on-quarter from 63.5% to 62.3%. This was largely due to the slower quarterly growth in China, the largest broadband market of the region[3], which is inevitable due to the increasing market saturation (Table 2. below).

Other regions saw their net adds shares expand, with an exception of Latin America and Western Europe. In Western Europe, whose net adds share halved, most of the Scandinavian countries, the UK and some others saw a decline in fixed broadband subscribers, as the extent of migration to gigabit capable technologies was not sufficient to offset the decline in copper based subscriptions.

For the largest twenty broadband markets, once again all except the UK saw fixed broadband subscriber growth in Q2 2025 (Figure 5). The UK saw a -0.05% decline (compared to -0.3% in the previous quarter), as the FTTP growth was not sufficient to offset the decline in DSL, FTTx and cable broadband connections. For several quarters now India is at the top of this cohort, with a 6.7% growth, continuing to show huge growth potential due to the low fixed broadband penetration (16% of households) and the fast growing economy. Along with Canada, India also saw the largest increase in quarterly growth, compared to Q1 2025.

Globally, healthy quarterly FTTH/B growth rates were spread around the world, with the less advanced economies and more youthful fibre markets generally exhibiting higher growth. In the last 12 months to the end of Q2 2025, the number of DSL lines saw another decline (-12.1%), while FTTH/B connections grew by 7.2%. The decline in FTTx was -6%, while cable (HFC) broadband subscribers dropped by -0.9%.

The decline in copper and FTTx (mainly VDSL) is not surprising. When it comes to cable/HFC, it is not immune to competition from other technologies either. The US is a good example, being the largest cable market globally. There the decline has continued as major players such as Comcast, Charter, Cox, Altice and others are losing customers. Competition from telcos who are rapidly expanding their fibre footprints (AT&T, Verizon, Frontier, Lumen, Consolidated Communications) and offering symmetric bandwidth, superior upload speeds and lower latency is partly to blame. At the same time, cable broadband prices have risen steadily due to promotional offer expirations, ‘network fees’, and equipment costs. Finally, 5G FWA home broadband from T-Mobile, Verizon and AT&T has exploded, with their customer numbers jumping year-on-year by 31%, 34% and 194% respectively.

Globally, wireless broadband (FWA, 5G FWA and LTE fixed) connections also continued to grow – they went up by 31% year-on-year, largely impacted by an explosive growth of 5G FWA in India (332% year-on-year) as well as the US (39%). In India, Reliance and Bharti Airtel are marching ahead with 5G FWA rollouts, capitalising on the huge potential of the enormous broadband hungry market.

Point Topic expects this trend to continue due to the fact that FWA networks are easier to scale after the initial investment, FWA broadband services being generally cheaper for consumers than the alternatives, easy to self-install, and being ‘good enough’ for streaming, remote work, and average household use, as well as the demand for connectivity in remote and underserved areas. Having said that, this applies primarily to the more advanced FWA, especially 5G based. They are also seeing a decline in subscriptions based on older FWA variants in some markets.

References:

Point Topic: FTTP broadband subs to reach 1.12bn by 2030 in 29 largest markets

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

Point Topic Comprehensive Report: Global Fixed Broadband Connections at 1.377B as of Q1-2023

Point Topic: Global Broadband Tariff Benchmark Report- 2Q-2022

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share

Cable broadband subscriber growth slows while FTTx and FWA gain ground

Nvidia pays $1 billion for a stake in Nokia to collaborate on AI networking solutions

This is not only astonishing but unheard of: the world’s largest and most popular fabless semiconductor company –Nvidia– taking a $1 billion stake in a telco/reinvented data center connectivity company-Nokia.

Indeed, GPU king Nvidia will pay $1 billion for a stake of 2.9% in Nokia as part of a deal focused on AI and data centers, the Finnish telecom equipment maker said on Tuesday as its shares hit their highest level in nearly a decade on hope for AI to lift their business revenue and profits. The nonexclusive partnership and the investment will make Nvidia the second-largest shareholder in Nokia. Nokia said it will issue 166,389,351 new shares for Nvidia, which the U.S. company will subscribe to at $6.01 per share.

Nokia said the companies will collaborate on artificial intelligence networking solutions and explore opportunities to include its data center communications products in Nvidia’s future AI infrastructure plans. Nokia and its Swedish rival Ericsson both make networking equipment for connectivity inside (intra-) data centers and between (inter-) data centers and have been benefiting from increased AI use.

Summary:

- NVIDIA and Nokia to establish a strategic partnership to enable accelerated development and deployment of next generation AI native mobile networks and AI networking infrastructure.

- NVIDIA introduces NVIDIA Arc Aerial RAN Computer, a 6G-ready telecommunications computing platform.

- Nokia to expand its global access portfolio with new AI-RAN product based on NVIDIA platform.

- T-Mobile U.S. is working with Nokia and NVIDIA to integrate AI-RAN technologies into its 6G development process.

- Collaboration enables new AI services and improved consumer experiences to support explosive growth in mobile AI traffic.

- Dell Technologies provides PowerEdge servers to power new AI-RAN solution.

- Partnership marks turning point for the industry, paving the way to AI-native 6G by taking AI-RAN to innovation and commercialization at a global scale.

In some respects, this new partnership competes with Nvidia’s own data center connectivity solutions from its Mellanox Technologies division, which it acquired for $6.9 billion in 2019. Meanwhile, Nokia now claims to have worked on a redesign to ensure its RAN software is compatible with Nvidia’s compute unified device architecture (CUDA) platform, meaning it can run on Nvidia’s GPUs. Nvidia has also modified its hardware offer, creating capacity cards that will slot directly into Nokia’s existing AirScale baseband units at mobile sites.

Having dethroned Intel several years ago, Nvidia now has a near-monopoly in supplying GPU chips for data centers and has partnered with companies ranging from OpenAI to Microsoft. AMD is a distant second but is gaining ground in the data center GPU space as is ARM Ltd with its RISC CPU cores. Capital expenditure on data center infrastructure is expected to exceed $1.7 trillion by 2030, consulting firm McKinsey, largely because of the expansion of AI.

Nvidia CEO Jensen Huang said the deal would help make the U.S. the center of the next revolution in 6G. “Thank you for helping the United States bring telecommunication technology back to America,” Huang said in a speech in Washington, addressing Nokia CEO Justin Hotard (x-Intel). “The key thing here is it’s American technology delivering the base capability, which is the accelerated computing stack from Nvidia, now purpose-built for mobile,” Hotard told Reuters in an interview. “Jensen and I have been talking for a little bit and I love the pace at which Nvidia moves,” Hotard said. “It’s a pace that I aspire for us to move at Nokia.” He expects the new equipment to start contributing to revenue from 2027 as it goes into commercial deployment, first with 5G, followed by 6G after 2030.

Nvidia has been on a spending spree in recent weeks. The company in September pledged to invest $5 billion in beleaguered chip maker Intel. The investment pairs the world’s most valuable company, which has been a darling of the AI boom, with a chip maker that has almost completely fallen out of the AI conversation.

Later that month, Nvidia said it planned to invest up to $100 billion in OpenAI over an unspecified period that will likely span at least a few years. The partnership includes plans for an enormous data-center build-out and will allow OpenAI to build and deploy at least 10 gigawatts of Nvidia systems.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Tech Details:

Nokia uses Marvell Physical Layer (1) baseband chips for many of its products. Among other things, this ensured Nokia had a single software stack for all its virtual and purpose-built RAN products. Pallavi Mahajan, Nokia’s recently joined chief technology and AI officer recently told Light Reading that their software could easily adapt to run on Nvidia’s GPUs: “We built a hardware abstraction layer so that whether you are on Marvell, whether you are on any of the x86 servers or whether you are on GPUs, the abstraction takes away from that complexity, and the software is still the same.”

Fully independent software has been something of a Holy Grail for the entire industry. It would have ramifications for the whole market and its economics. Yet Nokia has conceivably been able to minimize the effort required to put its Layer 1 and specific higher-layer functions on a GPU. “There are going to be pieces of the software that are going to leverage on the accelerated compute,” said Mahajan. “That’s where we will bring in the CUDA integration pieces. But it’s not the entire software,” she added. The appeal of Nvidia as an alternative was largely to be found in “the programmability pieces that you don’t have on any other general merchant silicon,” said Mahajan. “There’s also this entire ecosystem, the CUDA ecosystem, that comes in.” One of Nvidia’s most eye-catching recent moves is the decision to “open source” Aerial, its own CUDA-based RAN software framework, so that other developers can tinker, she says. “What it now enables is the entire ecosystem to go out and contribute.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Quotes:

“Telecommunications is a critical national infrastructure — the digital nervous system of our economy and security,” said Jensen Huang, founder and CEO of NVIDIA. “Built on NVIDIA CUDA and AI, AI-RAN will revolutionize telecommunications — a generational platform shift that empowers the United States to regain global leadership in this vital infrastructure technology. Together with Nokia and America’s telecom ecosystem, we’re igniting this revolution, equipping operators to build intelligent, adaptive networks that will define the next generation of global connectivity.”

“The next leap in telecom isn’t just from 5G to 6G — it’s a fundamental redesign of the network to deliver AI-powered connectivity, capable of processing intelligence from the data center all the way to the edge. Our partnership with NVIDIA, and their investment in Nokia, will accelerate AI-RAN innovation to put an AI data center into everyone’s pocket,” said Justin Hotard, President and CEO of Nokia. “We’re proud to drive this industry transformation with NVIDIA, Dell Technologies, and T-Mobile U.S., our first AI-RAN deployments in T-Mobile’s network will ensure America leads in the advanced connectivity that AI needs.”

……………………………………………………………………………………………………………………………………………………………………………………

Editor’s Notes:

1. In more advanced 5G networks, Physical Layer functions have demanded the support of custom silicon, or “accelerators.” A technique known as “lookaside,” favored by Ericsson and Samsung, uses an accelerator for only a single problematic Layer 1 task – forward error correction – and keeps everything else on the CPU. Nokia prefers the “inline” approach, which puts the whole of Layer 1 on the accelerator.

2. The huge AI-RAN push that Nvidia started with the formation of the AI-RAN Alliance in early 2024 has not met with an enthusiastic telco response so far. Results from Nokia as well as Ericsson show wireless network operators are spending less on 5G rollouts than they were in the early 2020s. Telco numbers indicate the appetite for smartphone and other mobile data services has not produced any sales growth. As companies prioritize efficiency above all else, baseband units that include Marvell and Nvidia cards may seem too expensive.

……………………………………………………………………………………………………………………………………………………………………………………….

Other Opinions and Quotes:

Nvidia chips are likely to be more expensive, said Mads Rosendal, analyst at Danske Bank Credit Research, but the proposed partnership would be mutually beneficial, given Nvidia’s large share in the U.S. data center market.

“This is a strong endorsement of Nokia’s capabilities,” said PP Foresight analyst Paolo Pescatore. “Next-generation networks, such as 6G, will play a significant role in enabling new AI-powered experiences,” he added.

Iain Morris, International Editor, Light Reading: “Layer 1 control software runs on ARM RISC CPU cores in both Marvell and Nvidia technologies. The bigger differences tend to be in the hardware acceleration “kernels,” or central components, which have some unique demands. Yet Nokia has been working to put as much as it possibly can into a bucket of common software. Regardless, if Nvidia is effectively paying for all this with its $1 billion investment, the risks for Nokia may be small………….Nokia’s customers will in future have an AI-RAN choice that limits or even shrinks the floorspace for Marvell. The development also points to more subtle changes in Nokia’s thinking. The message earlier this year was that Nokia did not require a GPU to implement AI for RAN, whereby machine-generated algorithms help to improve network performance and efficiency. Marvell had that covered because it had incorporated AI and machine-learning technologies into the baseband chips used by Nokia.”

“If you start doing inline, you typically get much more locked into the hardware,” said Per Narvinger, the president of Ericsson’s mobile networks business group, on a recent analyst call. During its own trials with Nvidia, Ericsson said it was effectively able to redeploy virtual RAN software written for Intel’s x86 CPUs on the Grace CPU with minimal changes, leaving the GPU only as a possible option for the FEC accelerator. Putting the entire Layer 1 on a GPU would mean “you probably also get more tightly into that specific implementation,” said Narvinger. “Where does it really benefit from having that kind of parallel compute system?”

………………………………………………………………………………………………………………………………………………….

Separately, Nokia and Nvidia will partner with T-Mobile U.S. to develop and test AI RAN technologies for developing 6G, Nokia said in its press release. Trials are expected to begin in 2026, focused on field validation of performance and efficiency gains for customers.

References:

https://nvidianews.nvidia.com/news/nvidia-nokia-ai-telecommunications

https://www.reuters.com/world/europe/nvidia-make-1-billion-investment-finlands-nokia-2025-10-28/

https://www.lightreading.com/5g/nvidia-takes-1b-stake-in-nokia-which-promises-5g-and-6g-overhaul

https://www.wsj.com/business/telecom/nvidia-takes-1-billion-stake-in-nokia-69f75bb6

Analysis: Cisco, HPE/Juniper, and Nvidia network equipment for AI data centers

Nvidia’s networking solutions give it an edge over competitive AI chip makers

Telecom sessions at Nvidia’s 2025 AI developers GTC: March 17–21 in San Jose, CA

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

FT: Nvidia invested $1bn in AI start-ups in 2024

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Highlights of Nokia’s Smart Factory in Oulu, Finland for 5G and 6G innovation

Nokia & Deutsche Bahn deploy world’s first 1900 MHz 5G radio network meeting FRMCS requirements

Will the wave of AI generated user-to/from-network traffic increase spectacularly as Cisco and Nokia predict?

Indosat Ooredoo Hutchison and Nokia use AI to reduce energy demand and emissions

Verizon partners with Nokia to deploy large private 5G network in the UK

Verizon’s commercial agreement with Eaton Fiber to accelerate fiber/mobile convergence

Verizon has announced a commercial fiber agreement with Eaton Fiber LLC [1.], an affiliate of Tillman Global Holdings, that will enable Verizon to sell fiber-based services outside its current wireline footprint and beyond the areas it will gain via its pending acquisition of Frontier Communications. It’s another important step to accelerate Verizon’s broadband and mobility convergence strategy, which has also been embraced by AT&T and T-MobileUS.

Note 1. “Eaton Fiber is a wholesale-only FTTP network provider powering ISPs with fast, frictionless access to future-ready fiber. Our open-access platform makes it easy for ISPs to expand across key U.S. markets—without building or managing the network. Our open-access platform makes it easy for ISPs to expand across key U.S. markets – without building or managing the network. You bring the service. We deliver the speed,” Eaton Fiber states on its website.

…………………………………………………………………………………………………………………………………………………………………………………………………………

Eaton Fiber will fund and build the network and take care of network maintenance and installation, while Verizon will be responsible for sales and marketing and end-user customer service. The agreement will expand Verizon’s premium broadband offering, complementing the company’s ongoing fiber builds and planned acquisition of Frontier. The agreement is expected to bring ultra-fast, high-capacity fiber service to homes and customers in markets outside of Verizon’s and Frontier’s current fiber-to-the-home footprint.

Image Credit: Eaton Fiber

“Our strategy is clear: lead the market in premium mobility and broadband convergence, and fiber is the foundation of that leadership,” said Sowmyanarayan Sampath, Executive Vice President for Verizon and CEO for Verizon Consumer. “This agreement allows us to rapidly enter new markets, accelerate deployment speed and ensure we maintain the necessary flexibility to capture growth opportunities across the country.”

“We are pleased to partner with a world-class provider in Verizon,” Sanjiv Ahuja, Founder, Chairman, and CEO of Tillman Global Holdings. “Marking a significant expansion of Tillman’s fiber deployments, this announcement underscores our shared commitment to expanding next-generation infrastructure nationwide.”

Missing from the press release: Verizon did not say where Eaton Fiber has built networks, where it intends to build, or how many homes and businesses Verizon eventually will be able to serve off of Eaton’s platform. Verizon also neglected to say when it will start to offer services via Eaton Fiber’s networks. It’s also not clear if Verizon is considered an anchor tenant or will represent one of multiple tenants that will sell services over Eaton Fiber’s network.

Tillman Fiber, builds and operates symmetrical gigabit-capable services over fiber-to-the-premises networks. The company was founded in 2021, and its backers include Tillman Global Holdings and Northleaf Capital Partners. In July, Tillman Fiber launched fiber networks serving parts of Northport, Kissimmee and Deltona and Hernando County in Florida. T-MobileUS is offering services on that network as part of a broader fiber Internet strategy that’s also underpinned by partnerships and acquisitions of Lumos, Metronet and US Internet.

Both Tillman Fiber and Eaton Fiber note on their respective websites that their fiber networks use an open access model that sells wholesale access to other Internet service providers (ISPs).

……………………………………………………………………………………………………………………………………………………………………………………

New Street Research David Barden remarked in a research note (registration required) that Eaton Fiber has not yet revealed its leadership. But given that Verizon referenced Frontier in today’s announcement, he wondered if Veronica Bloodworth, a former AT&T exec who has been serving as Frontier’s EVP and chief network officer since 2021, or Vishal Dixit, Frontier’s EVP of strategy and wholesale, “could be on a short list.” Barden also suggested that today’s announcement with Eaton Fiber is more about intent rather than specifics. “Given that this agreement was seen as worthy of a press release, especially within a month of Dan Schulman taking over the reins of the company, this release is also very likely about ambition as well,” Barden wrote.

………………………………………………………………………………………………………………………………………………………………………………………

Verizon’s new agreement with Eaton Fiber is proceeding as the company approaches the finalization of its $20 billion acquisition of Frontier Communications.

The integration of Frontier’s assets is expected to boost Verizon’s fiber network, increasing its reach to serve about 25 million premises throughout 31 states and Washington, D.C.. In addition to constructing 500,000 new FiOS locations this year, Verizon has set a strategic goal of achieving over 30 million fiber passings by 2028 and is exploring an eventual expansion to 35-40 million homes and businesses.

References:

https://www.verizon.com/about/news/verizon-expanding-broadband-new-strategic-fiber-agreement

https://www.lightreading.com/broadband/verizon-taps-into-eaton-fiber-to-broaden-fiber-reach

https://www.verizon.com/about/news/verizon-acquisition-starry

Verizon to buy Frontier Communications

Reuters: US Department of Energy forms $1 billion AI supercomputer partnership with AMD

The U.S. Department of Energy has formed a $1 billion partnership with Advanced Micro Devices (AMD) to construct two supercomputers that will tackle large scientific problems ranging from nuclear power to cancer treatments to national security, U.S. Energy Secretary Chris Wright and AMD CEO Lisa Su told Reuters.

The U.S. is building the two machines to ensure the country has enough supercomputers to run increasingly complex experiments that require harnessing enormous amounts of data-crunching capability. The machines can accelerate the process of making scientific discoveries in areas the U.S. is focused on.

U.S. Energy Secretary Wright said the systems would “supercharge” advances in nuclear power, fusion energy, technologies for defense and national security, and the development of drugs. Scientists and companies are trying to replicate nuclear fusion, the reaction that fuels the sun, by jamming light atoms in a plasma gas under intense heat and pressure to release massive amounts of energy. “We’ve made great progress, but plasmas are unstable, and we need to recreate the center of the sun on Earth,” Wright told Reuters.

The second, more advanced computer called Discovery will be based around AMD’s MI430 series of AI chips that are tuned for high-performance computing.

184K global tech layoffs in 2025 to date; ~27.3% related to AI replacing workers

As of October, over 184,000 global tech jobs were cut in 2025, according to a report from Silicon Valley Business Journal. 50,184 were directly related to the implementation of artificial intelligence (AI) and automation tools by businesses. Silicon Valley’s AI boom has been pummeling headcounts across major companies in the region — and globally. U.S. companies accounted for about 123,000 of the layoffs.

These are the 10 tech companies with the most significant mass layoffs since January 2025:

- Intel: 33,900 layoffs. The company has cited the need to reduce costs and restructure its organization after years of technical and financial setbacks.

- Microsoft: 19,215 layoffs. The tech giant has conducted multiple rounds of cuts throughout the year across various departments as it prioritizes AI investments.

- TCS: 12,000 layoffs. As a major IT firm, Tata Consultancy Services’ cuts largely affected mid-level and senior positions, which are becoming redundant due to AI and evolving client demands.

- Accenture: 11,000 layoffs. The consulting company reduced its headcount as it shifts toward greater automation and AI-driven services.

- Panasonic: 10,000 layoffs. The Japanese manufacturer announced these job cuts as part of a strategy to improve efficiency and focus on core business areas.

- IBM: 9,000 layoffs as part of a restructuring effort to shift some roles to India and align the workforce with areas like AI and hybrid cloud. The layoffs were reportedly concentrated in certain teams, including the Cloud Classic division, and impacted locations such as Raleigh, New York, Dallas, and California.

- Amazon: 5,555 layoffs. Cuts have impacted various areas, including the Amazon Web Services (AWS) cloud unit and the consumer retail business.

- Salesforce: 5,000 layoffs. Many of these cuts impacted the customer service division, where AI agents now handle a significant portion of client interactions.

- STMicro: 5,000 cuts in the next three years, including 2,800 job cuts announced earlier this year, its chief executive said on Wednesday. Around 2,000 employees will leave the Franco-Italian chipmaker due to attrition, bringing the total count with voluntary departures to 5,000, Jean-Marc Chery said at a June 4th event in Paris, hosted by BNP Paribas.

- Meta: 3,720 layoffs. The company has made multiple rounds of cuts targeting “low-performers” and positions within its AI and virtual reality divisions. More details below.

……………………………………………………………………………………………………………………………………………………………………..

Image Credit: simplehappyart via Getty Images

……………………………………………………………………………………………………………………………………………………………………..

In a direct contradiction in August, Cisco announced layoffs of 221 employees in the San Francisco Bay Area, affecting roles in Milpitas and San Francisco. This occurred despite strong financial results and the CEO’s previous statement that the company would not cut jobs in favor of AI. The cuts, which included software engineering roles, are part of the company’s broader strategy to streamline operations & focus on AI.

About two-thirds of all job cuts — roughly 123,000 positions — came from U.S.-based companies, with the remainder spread across mainly Ireland, India and Japan. The report compiles data from WARN notices, TrueUp, TechCrunch and Layoffs.fyi through Oct. 21st.

- Shift to AI and automation: Many companies are restructuring their workforce to focus on AI-centric growth and are automating tasks previously done by human workers, particularly in customer service and quality assurance.

- Economic headwinds: Ongoing economic uncertainty, inflation, and higher interest rates are prompting tech companies to cut costs and streamline operations.

- Market corrections: Following a period of rapid over-hiring, many tech companies are now “right-sizing” their staff to become leaner and more efficient.

References:

Report: Broadcom Announces Further Job Cuts as Global Tech Layoffs Approach 185,000 in 2025

Tech layoffs continue unabated: pink slip season in hard-hit SF Bay Area

HPE cost reduction campaign with more layoffs; 250 AI PoC trials or deployments

High Tech Layoffs Explained: The End of the Free Money Party

Massive layoffs and cost cutting will decimate Intel’s already tiny 5G network business

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Cloud Computing Giants Growth Slows; Recession Looms, Layoffs Begin

AT&T’s convergence strategy is working as per its 3Q 2025 earnings report

AT&T reported a 1.6% increase in third-quarter revenue to $30.7 billion, driven by its convergence strategy which combines wireless and fiber services. This strategy attracted profitable customers, as evidenced by 405,000 postpaid phone net additions and 550,000 new subscribers for AT&T’s advanced broadband services, including Fiber and Internet Air. The growth in these areas offset a decline in business wireline revenue.

“We have the key building blocks in place to give our customers the best connectivity experience in the industry and we’re winning the race to lead in convergence,” said John Stankey, AT&T Chairman and CEO.

“We continue to add highly-profitable customers that are choosing AT&T for all their connectivity needs on the country’s fastest and largest wireless and fiber networks. It’s clear our differentiated investment-led strategy is working, and we remain on track to achieve all of our 2025 consolidated financial guidance.”

Here are a few AT&T 3Q 2025 highlights:

- Postpaid Phone Subscribers: Gained 405,000 net additions.

- AT&T Fiber: Added 288,000 new subscribers.

- AT&T Internet Air: Added 270,000 new subscribers, marking a strong quarter for broadband net additions overall.

- Total Revenue increased 1.6% year-on-year to $30.7 billion.

- Mobility Revenue grew 3.1% year-over-year, supported by higher equipment sales and subscriber additions.

- Latin America Revenues were up 7.1% year on year to USD 1.10 billion amid subscriber and ARPU growth, higher equipment sales and the favourable effects of foreign exchange rates.

- Consumer Wireline Revenue increased 4.1%, led by an 8.2% rise in broadband revenue and strong fiber growth.

- Business Wireline Revenue declined 7.8%, mainly due to reductions in legacy services, though this was partially offset by growth in fiber and advanced connectivity services.

- The strategy is working because customers who bundle fiber and wireless services have lower churn and higher lifetime values, according to AT&T CEO John Stankey.

- More than 41% of AT&T Fiber households also have an AT&T Mobility service, which shows the success of this strategy.

- The company is on track to achieve its consolidated financial guidance for the year.

Stankey on AT&T’s competitive advantage (from Earnings Call transcript):

“We offer fast and reliable connectivity for 5G and fiber at attractive price points. More people are choosing AT&T for both wireless and home internet services. Today, more than 41% of AT&T Fiber households also choose AT&T for wireless. And the pace of this convergence trend within our customer base continues to grow. These customers remain our most valuable, with the lowest churn profile and highest lifetime values.

Our success with convergence also extends to fixed wireless. More than half of our Internet Air subscribers also choose AT&T for their wireless service. Similar to fiber, these customers exhibit lower churn and drive higher lifetime values than customers with stand-alone services.

The EchoStar spectrum we agreed to acquire will improve our 5G wireless performance in a cost-efficient manner, while allowing us to grow Internet Air at a faster pace. We’re already making great progress, delivering on our commitment to deploy this valuable spectrum for the benefit of American consumers and businesses.

We started deploying the 3.45 GHz spectrum that we have agreed to acquire from EchoStar under a short-term spectrum manager lease. Based on our current rate and pace, we expect these mid-band licenses will be deployed in cell sites covering nearly two-thirds of the US population by mid-November.

This should position us to further expand the availability of Internet Air 5G FWA) in our sales channels in 2026. Our ability to move this quickly reflects the great work of our teams and the FCC’s pro-investment and supportive policy environment. We’re also making great progress in preparing to close our transaction with Lumen. Most of the senior leadership team has been identified, and we now expect to close this transaction in the early part of 2026.

As I’ve said before, where we have fiber, we win with both fiber and 5G, and we plan to win even more as our investments in these assets bring advanced connectivity to more Americans. The supportive (FCC) policy environment is also making it easier for us to transition away from outdated legacy infrastructure and invest in the AI-ready connectivity that Americans want and need.

The bottom line is that we now have the right building blocks in place to realize our scaled fiber and fixed wireless ambitions, complete our wireless modernization, and successfully transition away from legacy infrastructure. As we complete our key investments, acquisitions, and transformation initiatives, we expect to increase our fiber and convergence penetration rates and see a majority of incremental revenue growth originate from converged customer relationships.”

Outlook & Financial Guidance:

AT&T reiterated its guidance for the 2025 financial year, with service revenue growth in the low single-digit range and mobility service revenue growth of 3 percent or better. It still foresees consumer fibre broadband revenue growth in the mid-to-high teens. Annual adjusted EBITDA growth should be 3 percent or better. Mobility EBITDA growth will be about 3 percent. Business wireline EBITDA will decline at a low double-digit rate and EBITDA growth for consumer wireline is still forecast in the low to mid-teen range. FY capital investment will be in the USD 22 billion to USD 22.5 billion range. AT&T predicts free cash flow in the low-to-mid USD 16 billion range. It continues to forecast FY adjusted EPS of USD 1.97 to USD 2.07.

AT&T reiterated its long-term financial guidance of service revenue growth in the low-single-digit range annually from 2026-2027, adjusted EBITDA growth of 3 percent or better annually, and adjusted EPS accelerating to double-digit percentage growth in 2027. AT&T foresees capital investment in the range USD 23 billion to USD 24 billion annually from 2026-2027. It predicts free cash flow of USD 18 billion or more in 2026 and USD 19 billion or more in 2027.

References:

https://about.att.com/story/2025/3q-earnings.html

https://www.telecompaper.com/news/att-says-convergence-boosts-q3-revenue-and-profitability–1551778

AT&T deploys nationwide 5G SA while Verizon lags and T-Mobile leads

AT&T to buy spectrum licenses from EchoStar for $23 billion

AT&T grows fiber revenue 19%, 261K net fiber adds and 29.5M locations passed by its fiber optic network

Analysts weigh in: AT&T in talks to buy Lumen’s consumer fiber unit – Bloomberg

T-Mobile’s new CEO Srini Gopalan faces fierce competition from AT&T, Verizon and MVNOs

AT&T sets 1.6 Tbps long distance speed record on its white box based fiber optic network

AT&T and Verizon cut jobs another 6% last year; AI investments continue to increase

Omdia: How telcos will evolve in the AI era

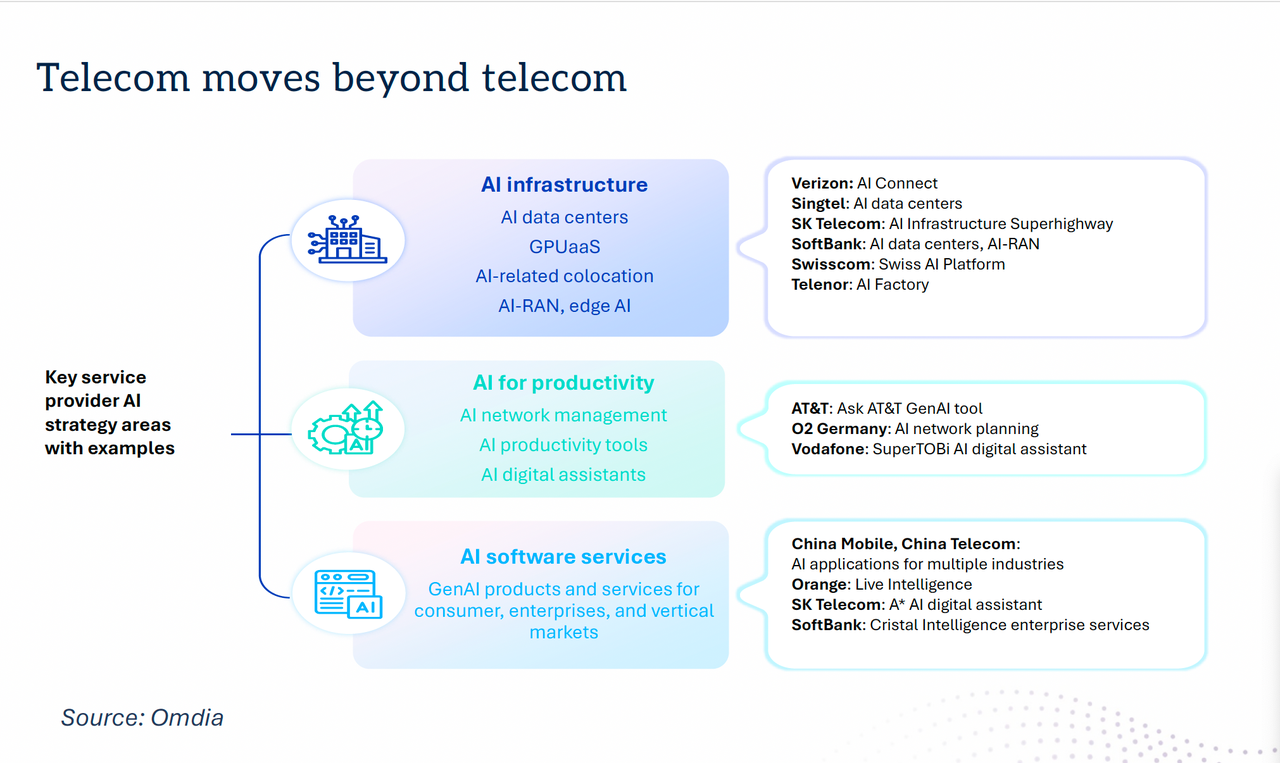

Dario Talmesio, research director, service provider, strategy and regulation at market research firm Omdia (owned by Informa) sees positive signs for network operators.

“After many years of plumbing, now telecom operators are starting to see some of the benefits of their network and beyond network strategies. Furthermore, the investor community is now appreciating telecom investments, after many years of poor valuation, he said during his analyst keynote presentation at Network X, a conference organized by Light Reading and Informa in Paris, France last week.

“What has changed in the telecoms industry over the past few years is the fact that we are no longer in a market that is in contraction,” he said. Although telcos are generally not seeing double-digit percentage increases in revenue or profit, “it’s a reliable business … a business that is able to provide cash to investors.”

Omdia forecasts that global telecoms revenue will have a CAGR of 2.8% in the 2025-2030 timeframe. In addition, the industry has delivered two consecutive years of record free cash flow, above 17% of sales.

However, Omdia found that telcos have reduced capex, which is trending towards 15% of revenues. Opex fell by -0.2% in 2024 and is broadly flatlining. There was a 2.2% decline in global labor opex following the challenging trend in 2023, when labor opex increased by 4% despite notable layoffs.

“Overall, the positive momentum is continuing, but of course there is more work to be done on the efficiency side,” Talmesio said. He added that it is also still too early to say what impact AI investments will have over the longer term. “All the work that has been done so far is still largely preparatory, with visible results expected to materialize in the near(ish) future,” he added. His Network X keynote presentation addressed the following questions:

- How will telcos evolve their operating structures and shift their business focuses in the next 5 years?

- AI, cloud and more to supercharge efficiencies and operating models?

- How will big tech co-opetition evolve and impact traditional telcos?

Customer care was seen as the area first impacted by AI, building on existing GenAI implementations. In contrast, network operations are expected to ultimately see the most significant impact of agentic AI.

Talmesio said many of the building blocks are in place for telecoms services and future revenue generation, with several markets reaching 60% to 70% fiber coverage, and some even approaching 100%.

Network operators are now moving beyond monetizing pure data access and are able to charge more for different gigabit speeds, home gaming, more intelligent home routers and additional WiFi access points, smart home services such as energy, security and multi-room video, and more.

While noting that connectivity remains the most important revenue driver, when contributions from various telecoms-adjacent services are added up “it becomes a significant number,” Talmesio said.

Mobile networks are another important building block. While acknowledging that 5G has been something of a disappointment in the first five years of the deployment cycle, “this is really changing” as more operators deploy 5G standalone (5G SA core) networks, Omdia observed.

Talmesio said: “At the end of June, there were only 66 telecom operators launching or commercially using 5G SA. But those 66 operators are those operators that carry the majority of the world’s 5G subscribers. And with 5G SA, we have improved latency and more devices among other factors. Monetization is still in its infancy, perhaps, but then you can see some really positive progress in 5G Advanced, where as of June, we had 13 commercial networks available with some good monetization examples, including uplink.”

“Telecom is moving beyond telecoms,” with a number of new AI strategies in place. For example, telcos are increasingly providing AI infrastructure in their data centers, offering GPU as-a-service, AI-related colocation, AI-RAN and edge AI functionality.

Dario Talmesio, Omdia

……………………………………………………………………………………………………………………………………………………

AI is also being used for network management, with AI productivity tools and AI digital assistants, as well as AI software services including GenAI products and services for consumer, enterprises and vertical markets.

“There is an additional boost for telecom operators to move beyond connectivity, which is the sovereignty agenda,” Talmesio noted. While sovereignty in the past was largely applied to data residency, “in reality, there are more and more aspects of sovereignty that are in many ways facilitating telecom operators in retaining or entering business areas that probably ten years ago were unthinkable for them.” These include cloud and data center infrastructure, sovereign AI, cyberdefense and quantum safety, satellite communication, data protection and critical communications.

“The telecom business is definitely improving,” Talmesio concluded, noting that the market is now also being viewed more favorably by investors. “In many ways, the glass is maybe still half full, but there’s more water being poured into the telecom industry.”

References:

https://networkxevent.com/speakers/dario-talmesio/

https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/pushing-telcos-ai-envelope-on-capital-decisions

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Omdia: Huawei increases global RAN market share due to China hegemony

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Omdia: Cable network operators deploy PONs

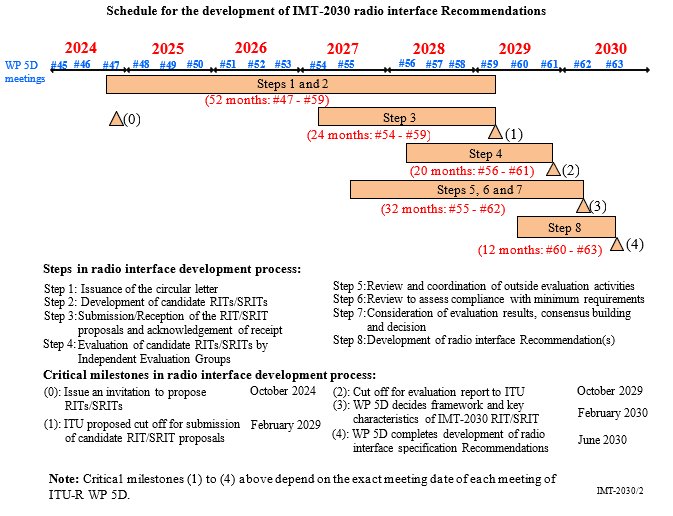

ITU-R WP 5D Timeline for submission, evaluation process & consensus building for IMT-2030 (6G) RITs/SRITs

The ITU-R WP 5D schedule described below applies to the first invitation for IMT 2030 candidate RITs [1] or SRITs [2]

[1] RIT =Radio Interface Technology [2] SRITs =Set of RITs. That terminology was used for IMT 2020 and the IMT 2150 recommendation

Submission of proposals may begin at 54th meeting of Working Party (WP) 5D, currently planned for February 2027. The final deadline for submissions is 1600 hours UTC, 12 calendar days prior to the start of the 59th meeting of WP 5D in February 2029.

The evaluation of the proposed RITs/SRITs by the independent evaluation groups and the consensus-building process will be performed throughout this time period and thereafter. Subsequent calendar schedules will be decided according to the submissions of proposals.

References:

https://www.itu.int/dms_pub/itu-r/oth/0a/06/R0A060000C80001PDFE.pdf

https://www.itu.int/rec/R-REC-M.2150/en

ITU-R WP5D IMT 2030 Submission & Evaluation Guidelines vs 6G specs in 3GPP Release 20 & 21

Highlights of 3GPP Stage 1 Workshop on IMT 2030 (6G) Use Cases

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

Verizon’s 6G Innovation Forum joins a crowded list of 6G efforts that may conflict with 3GPP and ITU-R IMT-2030 work

Ericsson and e& (UAE) sign MoU for 6G collaboration vs ITU-R IMT-2030 framework

ITU-R WP5D invites IMT-2030 RIT/SRIT contributions

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

Should Peak Data Rates be specified for 5G (IMT 2020) and 6G (IMT 2030) networks?

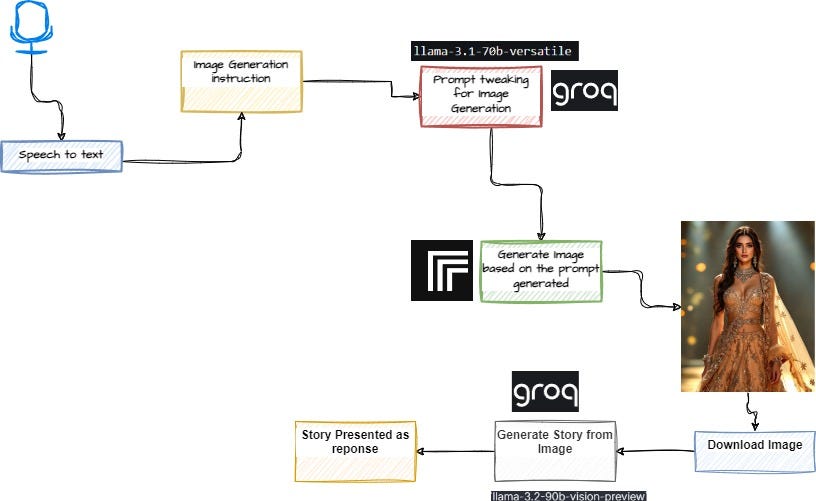

IBM and Groq Partner to Accelerate Enterprise AI Inference Capabilities

IBM and Groq [1.] today announced a strategic market and technology partnership designed to give clients immediate access to Groq’s inference technology — GroqCloud, on watsonx Orchestrate – providing clients high-speed AI inference capabilities at a cost that helps accelerate agentic AI deployment. As part of the partnership, Groq and IBM plan to integrate and enhance RedHat open source vLLM technology with Groq’s LPU architecture. IBM Granite models are also planned to be supported on GroqCloud for IBM clients.

………………………………………………………………………………………………………………………………………………….

Note 1. Groq is a privately held company founded by Jonathan Ross in 2016. As a startup, its ownership is distributed among its founders, employees, and a variety of venture capital and institutional investors including BlackRock Private Equity Partners. Groq developed the LPU and GroqCloud to make compute faster and more affordable. The company says it is trusted by over two million developers and teams worldwide and is a core part of the American AI Stack.

NOTE that Grok, a conversational AI assistant developed by Elon Musk’s xAI is a completely different entity.

………………………………………………………………………………………………………………………………………………….

Enterprises moving AI agents from pilot to production still face challenges with speed, cost, and reliability, especially in mission-critical sectors like healthcare, finance, government, retail, and manufacturing. This partnership combines Groq’s inference speed, cost efficiency, and access to the latest open-source models with IBM’s agentic AI orchestration to deliver the infrastructure needed to help enterprises scale.

Powered by its custom LPU, GroqCloud delivers over 5X faster and more cost-efficient inference than traditional GPU systems. The result is consistently low latency and dependable performance, even as workloads scale globally. This is especially powerful for agentic AI in regulated industries.

For example, IBM’s healthcare clients receive thousands of complex patient questions simultaneously. With Groq, IBM’s AI agents can analyze information in real-time and deliver accurate answers immediately to enhance customer experiences and allow organizations to make faster, smarter decisions.

This technology is also being applied in non-regulated industries. IBM clients across retail and consumer packaged goods are using Groq for HR agents to help enhance automation of HR processes and increase employee productivity.

“Many large enterprise organizations have a range of options with AI inferencing when they’re experimenting, but when they want to go into production, they must ensure complex workflows can be deployed successfully to ensure high-quality experiences,” said Rob Thomas, SVP, Software and Chief Commercial Officer at IBM. “Our partnership with Groq underscores IBM’s commitment to providing clients with the most advanced technologies to achieve AI deployment and drive business value.”

“With Groq’s speed and IBM’s enterprise expertise, we’re making agentic AI real for business. Together, we’re enabling organizations to unlock the full potential of AI-driven responses with the performance needed to scale,” said Jonathan Ross, CEO & Founder at Groq. “Beyond speed and resilience, this partnership is about transforming how enterprises work with AI, moving from experimentation to enterprise-wide adoption with confidence, and opening the door to new patterns where AI can act instantly and learn continuously.”

IBM will offer access to GroqCloud’s capabilities starting immediately and the joint teams will focus on delivering the following capabilities to IBM clients, including:

- High speed and high-performance inference that unlocks the full potential of AI models and agentic AI, powering use cases such as customer care, employee support and productivity enhancement.

- Security and privacy-focused AI deployment designed to support the most stringent regulatory and security requirements, enabling effective execution of complex workflows.

- Seamless integration with IBM’s agentic product, watsonx Orchestrate, providing clients flexibility to adopt purpose-built agentic patterns tailored to diverse use cases.

The partnership also plans to integrate and enhance RedHat open source vLLM technology with Groq’s LPU architecture to offer different approaches to common AI challenges developers face during inference. The solution is expected to enable watsonx to leverage capabilities in a familiar way and let customers stay in their preferred tools while accelerating inference with GroqCloud. This integration will address key AI developer needs, including inference orchestration, load balancing, and hardware acceleration, ultimately streamlining the inference process.

Together, IBM and Groq provide enhanced access to the full potential of enterprise AI, one that is fast, intelligent, and built for real-world impact.

References:

FT: Scale of AI private company valuations dwarfs dot-com boom

AI adoption to accelerate growth in the $215 billion Data Center market

Big tech spending on AI data centers and infrastructure vs the fiber optic buildout during the dot-com boom (& bust)

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Can the debt fueling the new wave of AI infrastructure buildouts ever be repaid?

OneLayer Raises $28M Series A funding to transform private 5G networks with enhanced security

Private network security startup OneLayer has scored $28 million in series A funding led by Maor Investments with participation from McRock Capital, Chevron Technology Ventures and existing investors Viola Ventures, Grove Ventures and Koch Disruptive Technologies. The Series A round brings total funding to more than $43 million.

The Boston, MA headquartered firm says they are the leader in private LTE/5G OT management and Zero Trust security. The security startup’s major rivals include Fortinet, Juniper Networks and Trend Micro.

“Private 5G represents a massive market opportunity, with enterprise demand far outpacing the industry’s ability to deliver simple, secure solutions,” said Ido Hart, Partner at Maor. “OneLayer solves this by translating cellular networks into enterprise IT language, eliminating the need for specialized cellular expertise. At its core, OneLayer is building the essential infrastructure layer that will make private 5G as ubiquitous as WiFi or any LAN.”

OneLayer’s mission is to secure and manage all private cellular network devices with enterprise-grade capabilities while eliminating the need for specialized cellular expertise. The company’s platform transforms private cellular environments from operational silos into integrated enterprise networks, providing complete device visibility, security, and control through familiar IT management tools.

The funding round was highly competitive and oversubscribed, reflecting strong investor confidence in OneLayer’s vision and proven momentum. OneLayer has demonstrated significant market traction across multiple verticals, including utilities, manufacturing, mining, airports, and critical infrastructure, with proven deployments spanning across North America, Europe and Latin America. This includes major expansions at leading fortune 100 manufacturers, with enterprises scaling from initial deployments to comprehensive multi-site deployments spanning numerous facilities.

“Enterprises are deploying private cellular networks at unprecedented scale, but they’re struggling with device visibility, security gaps, and operational complexity that didn’t exist with traditional IT infrastructure,” said Dave Mor, CEO and Co-Founder of OneLayer. “The demand for solutions that bridge this gap is explosive, customers need to manage thousands of cellular-connected devices with the same confidence and control they have over their existing IT assets. Private LTE/5G is fast becoming a dominant enterprise network. Organizations need to manage and secure it within their current network setup. We established OneLayer to bridge this gap and create one layer of security and one layer of asset management across all organization networks.” Mor added.

“OneLayer enables secure private 5G for industrial automation and autonomy – the foundation Industrial AI needs to scale,” said Scott MacDonald, Co-founder & Managing Partner of McRock Capital. “Private cellular networks represent the next wave of digital transformation, but connectivity without security is a house of cards. OneLayer provides the missing layer of trust that enterprises need to adopt private 5G with confidence.”

“OneLayer’s software platform holds promise to improve private cellular network reliability and integration for industrial companies, offering better visibility, cost efficiency and security,” said Jim Gable, Vice President of Innovation within Chevron’s Technology, Projects and Execution division and President of Technology Ventures at Chevron. “This is the latest investment from our Core Venture Fund, which focuses on high-growth startups and breakthrough technologies that have the potential to improve Chevron’s core businesses, as well as create new opportunities for growth. We welcome OneLayer to the portfolio.”

“Since coming out of stealth mode in 2022, OneLayer has gone from strength to strength, raising more than $43 million to date,” SNS Telecom & IT 5G research director, Asad Khan, told Fierce.

OneLayer’s platform has proven essential for organizations deploying private LTE and 5G networks at scale. Notable deployments include:

- Southern Linc’s regional LTE network spanning 122,000 square miles across Alabama, Georgia, and southeastern Mississippi, supporting diverse devices from grid control systems to mission-critical push-to-talk services.

- Evergy’s private LTE network, built to eventually cover their 1.7 million customers in Kansas and Missouri; currently supporting thousands of devices, including Internet of Things (IoT) sensors, smart meters, OT and other cellular devices.

- Latin America mining operations where OneLayer enabled automated processes, improved operational efficiency, and secure deployment of new production sites through comprehensive device discovery, classification, and network segmentation.

OneLayer’s comprehensive partner ecosystem spans the entire private cellular value chain, from cellular leaders Nokia and Ericsson to leading cellular router manufacturers Digi, Cradlepoint, and Multitech; CMDBs ServiceNow and SolarWinds; channel partners and integrators World Wide Technology (WWT), Burns & McDonnell (B&M), Anterix, and Future Technologies; and leading cybersecurity vendors such as Palo Alto Networks, Fortinet, Checkpoint, Claroty, and more.

Adding to the strong revenues from its expanding customer base, the company will use the Series A funding to:

- Accelerate go-to-market initiatives in response to surging enterprise demand

- Expand product capabilities to provide customers a platform that solves their critical operational pains

- Scale geographic expansion beyond North America following successful entry into Latin American markets, and further expand European operations

OneLayer’s growth reflects the broader market transformation as private cellular networks evolve from carrier-grade infrastructure to enterprise-managed networks. With partnerships across major 5G vendors and proven success in critical verticals and leading enterprises, OneLayer has become the defacto solution for managing and securing the rapidly expanding private cellular market.

About OneLayer

OneLayer provides advanced asset management, operational intelligence, and Zero Trust security for private LTE and 5G networks. Its technology empowers enterprises to manage their cellular networks seamlessly without the need for cellular expertise. For more information, visit www.onelayer.com. Media Contact: [email protected]

References: