European Commission’s Digital Networks Act to restructure European telecom regulations with indefinite duration spectrum licenses

The European Commission’s forthcoming Digital Networks Act (DNA) aims to restructure the regulatory framework for the telecommunications sector in Europe to stimulate investment. The act indicates the European Commission is avoiding a mandatory levy system or new enforceable duties specifically targeting major tech firms. Instead, the proposal advocates for a voluntary cooperation framework where the largest online providers would engage in discussions moderated by the Body of European Regulators for Electronic Communications (BEREC), which comprises national telecom regulators.

A key component of this revamp, outlined in a draft document reviewed by Reuters, includes the potential allocation of lucrative radio spectrum licenses to telecom providers for an indefinite duration. The proposed legislation, scheduled for presentation by EU tech chief Henna Virkkunen on January 20th, suggests that licenses without time limits could foster a more functional secondary market for spectrum trading and leasing.

To prevent spectrum hoarding, EU regulators have suggested implementing “use-it-or-share-it or lose-it” conditions and specific roll-out obligations, ensuring the resource remains actively utilized and accessible to efficient competitors. The document said: “Spectrum usage rights shall be in principle granted for an unlimited duration….Sufficiently long duration of rights of use of radio spectrum should increase investment predictability to contribute to faster network roll-out and better services, as well as stability to support radio spectrum trading and leasing.”

The draft Digital Networks Act also addresses market dominance by suggesting that companies identified as having significant market power in one specific market could also be designated as such in closely related markets. This designation would subject them to stringent obligations, including enhanced transparency, non-discrimination requirements, and potentially price controls, cost accounting, or accounting separation.

This cooperative approach aligns with the Commission’s prior stance on “network fees.” A July 2025 policy analysis concluded that mandating large online platforms to pay network fees was not a viable mechanism for financing 5G and broadband infrastructure deployment. Nonetheless, the reported DNA draft introduces measures that could significantly impact telecom operators and national regulators. These include addressing spectrum license durations, sales conditions, and a proposed pricing methodology intended to guide national regulators during spectrum auctions—a sensitive area for member states given the substantial revenues generated by these auctions. Furthermore, the text is expected to provide EU-level guidance on fiber infrastructure rollout. A noted element is flexibility regarding the 2030 objective for replacing legacy copper networks; governments may be granted deadline extensions if they can demonstrate a lack of readiness.

Advocates for stronger EU harmonization argue that a unified market is essential for creating viable pan-European investment models, particularly for high-capacity fixed networks and future mobile technologies. Industry groups have consistently called for longer, more predictable spectrum licensing and consistent award conditions across the EU, arguing that national divergences impede deployment and escalate costs.

Critics of increased centralization caution that the DNA could facilitate a transfer of powers away from national regulators and governments.

The Reuters reporting suggests some national regulators may perceive the Commission’s planned interventions in spectrum policy and rollout guidance as a “power grab,” as spectrum management has traditionally remained a core national competence within the existing EU framework. Civil society organizations have raised concerns that attempts to restructure telecom market rules might compromise net neutrality principles or encourage commercial agreements that influence traffic management practices.

The DNA proposal is set against the backdrop of recent major EU digital legislation, including the Digital Services Act (DSA) and Digital Markets Act (DMA). To avoid repeating US criticism that EU rules disproportionately target US-based tech companies, the DNA appears designed to place the largest platforms within a cooperative, rather than compulsory, regime, while focusing binding measures on the connectivity sector’s regulatory architecture.

For large online services, the voluntary framework presents questions regarding incentives and enforcement. While a “best practices” code moderated by regulators can facilitate technical dialogue on issues like network resilience and traffic management, it inherently lacks hard obligations or penalties for non-compliance. Upon official publication, the Commission’s proposal will enter the EU’s ordinary legislative procedure. Core points of contention—including the balance between EU coordination and national discretion on spectrum, and the scope of any obligations placed on large digital firms—will be negotiated by member states in the Council and the European Parliament in the coming months.

If the reported draft details are confirmed, the Digital Networks Act signifies a strategic pivot: moving away from compelling Big Tech to directly finance networks and towards reshaping the existing telecom rulebook, spectrum practices, and infrastructure targets to unlock investment. The legislative negotiations will determine whether this combination is sufficient to accelerate infrastructure deployment without reigniting net neutrality disputes or national sovereignty arguments.

A July 2025 joint statement by consumer and civil society groups urged the Commission to preserve robust net neutrality within the DNA and voiced concerns regarding proposals linked to the “fair share” debate, including ideas for dispute-resolution systems between telecom operators and online services. Hence, Europe’s commitment to the principle of net neutrality is reaffirmed, mandating equal treatment for all Internet traffic by operators, a stance maintained despite industry calls for a less restrictive regulatory environment.

References:

https://eutoday.net/digital-networks-act-draft/

StrandConsult Analysis: European Commission second 5G Cybersecurity Toolbox report

European Commission DESI report reveals broadband network status is lagging

EU Commissioner outlines strategic direction for European Satellite Communications System

European Union plan for LEO satellite internet system

India’s COAI joins 4 European telcos in demanding OTT players pay to use their networks

57% of European homes can now get FTTH/B internet access; >50% growth forecast over next 5 years

Dell’Oro: Fixed Wireless Access revenues +10% in 2025 & will continue to grow 10% annually through 2029

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Total FWA subscriptions, which include residential, SMB, and large enterprises, are expected to grow steadily, surpassing 191 million by 2029.

- 5G Sub-6GHz and mmWave units will dominate the global residential CPE market.

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE (Residential and Enterprise) and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional forecasts for FWA subscriptions, including for both residential and enterprise markets, with the enterprise subscriptions segmented by SMB and Large Enterprise. To purchase this report, please contact us by email at [email protected].

………………………………………………………………………………………………………………………………………………………………………

Independent Analysis via Perplexity.ai:

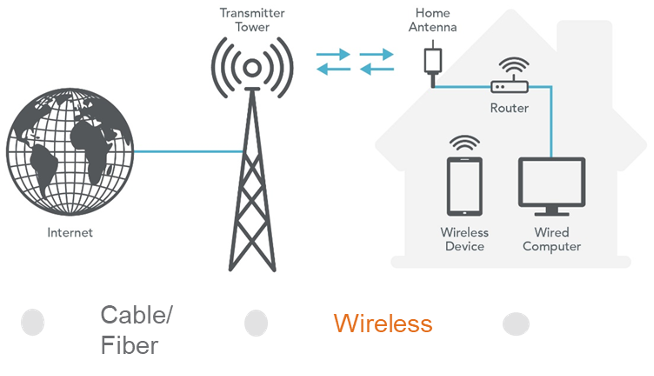

Fixed Wireless Access Schematic Diagrams

……………………………………………………………………………………………………………………………………………………………

Demand-side drivers:

-

Rising demand for high‑speed home and enterprise broadband, including video streaming, gaming, and cloud/SaaS, in areas poorly served by DSL or legacy cable.

-

Customer appetite for quick‑install, no‑truck‑roll broadband that can be activated using wireless CPE instead of waiting for fiber construction.

-

Growing need for reliable connectivity for remote work, distance learning, and SME digitization, especially in suburban and rural regions.

Supply-side / operator economics:

-

Ability to leverage existing 4G LTE macro grids and sub‑6 GHz spectrum, with incremental capex mainly in CPE and software rather than full new access builds.

-

Refarming of LTE spectrum and overlay of 5G NR on the same bands allows operators to run both mobile broadband and FWA on a common RAN/core.

-

Attractive ROI relative to fiber in low‑density areas, since one macro site at sub‑6 GHz can cover large rural or ex‑urban footprints.

Technology and spectrum factors (4G & sub‑6 GHz 5G):

-

4G LTE coverage ubiquity: years of investment mean LTE already reaches most urban, suburban, and many rural markets, making LTE‑FWA immediately deployable.

-

Sub‑6 GHz 5G propagation: better penetration through buildings and walls than higher bands, enabling more reliable indoor FWA without extensive outdoor CPE alignment.

-

Massive MIMO and beamforming on sub‑6 GHz bands increase sector capacity and improve non‑line‑of‑sight performance, which is critical for FWA quality at cell edge.

Competitive and regulatory drivers:

-

Mobile operators using FWA to attack cable and DSL bases; in several markets FWA contributes a high share of net broadband additions, pressuring incumbents on price and speed.

-

Government rural‑broadband programs and subsidies (e.g., U.S. RDOF‑type initiatives) encourage use of FWA as a cost‑effective tool to close the digital divide.

-

Regulatory allocation of additional mid‑band and sub‑6 GHz spectrum (e.g., 3–4 GHz bands) increases usable capacity and supports scaling FWA to millions of homes.

Market growth indicators:

-

FWA market value is growing at double‑digit CAGRs, with 4G still a large share today but 5G FWA projected to dominate new subscriptions by the late 2020s.

-

Sub‑6 GHz FWA gateways and CPE are a rapidly expanding device segment, driven by operator deployments targeting residential and SME broadband.

…………………………………………………………………………………………………………………………………………………………………….

References:

https://www.delloro.com/news/fwa-infrastructure-and-cpe-spending-will-remain-above-10-billion-annually-through-2029/

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Ookla: FWA Speed Test Results for big 3 U.S. Carriers & Wireless Connectivity Performance at Busy Airports

Point Topic: Global Broadband Subscribers in Q2 2025: 5G FWA, DSL, satellite and FTTP

Aviat Networks and Intracom Telecom partner to deliver 5G mmWave FWA in North America

T-Mobile’s growth trajectory increases: 5G FWA, Metronet acquisition and MVNO deals with Charter & Comcast

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

China ITU filing to put ~200K satellites in low earth orbit while FCC authorizes 7.5K additional Starlink LEO satellites

- Purpose: The planned systems are intended to provide global broadband connectivity, data relay, and positioning services, directly competing with U.S. efforts like SpaceX’s Starlink network.

- Filing Entities: The primary filings were submitted by the state-backed Institute of Radio Spectrum Utilization and Technological Innovation, along with other commercial and state-owned companies like China Mobile and Shanghai Spacecom.

- Status: These filings are an initial step in a long international regulatory process and serve as a claim to limited spectrum and orbital slots. They do not guarantee all satellites will ultimately be built or launched. The actual deployment will be a gradual process over many years.

- Context: The move is part of an escalating “space race” to dominate the LEO environment. Early filings are crucial for securing priority access to orbital resources and avoiding signal interference. The sheer scale of the Chinese proposal would, if realized, dwarf most other planned constellations.

- Regulations: Under ITU rules, operators must deploy a certain percentage of the satellites within seven years of the initial filing to retain their rights.

- Shanghai Yuanxin (Qianfan), currently China’s most advanced LEO satellite operator, has submitted a regulatory request for an additional 1,296 satellites.

- Telecommunications giant China Mobile is planning two separate constellations totaling 2,664 satellites.

- ChinaSat, the established state-owned satellite provider, is focusing on a 24-satellite medium-Earth orbit (MEO) system.

- GalaxySpace, a private satellite manufacturer based in Beijing, has applied for 187 satellites, and China Telecom has applied for 12.

Image Credit: Klaus Ohlenschlaeger/Alamy Stock Photo

“This gives SpaceX what they need for the next couple of years of operation. They’re launching a bit over 3,000 satellites a year, so 7,500 satellites being authorized is potentially enough for SpaceX to do what they want to do until late 2027,” said Tim Farrar, satellite analyst and president at TMF Associates.

SpaceX has plans for a larger D2D satellite constellation that would use the AWS-4 and H-block spectrum it is acquiring from EchoStar. It is awaiting FCC approval for the US$17 billion deal, but the spectrum is not expected to be transferred until the end of November 2027.

The FCC noted that the changes will allow the Starlink system to serve more customers and deliver “gigabit speed service.” Along with permission for another tranche of satellites, the FCC has set new parameters for frequency use and lower orbit altitudes. The modified authorizations will also apply to new satellites to be launched.

Starlink’s LEO satellite network competitors are Amazon Leo, OneWeb and AST Space Mobile.

………………………………………………………………………………………………………………………………………………………..

References:

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Amazon Leo (formerly Project Kuiper) unveils satellite broadband for enterprises; Competitive analysis with Starlink

NBN selects Amazon Project Kuiper over Starlink for LEO satellite internet service in Australia

GEO satellite internet from HughesNet and Viasat can’t compete with LEO Starlink in speed or latency

Amazon launches first Project Kuiper satellites in direct competition with SpaceX/Starlink

Vodafone and Amazon’s Project Kuiper to extend 4G/5G in Africa and Europe

New Linux Foundation white paper: How to integrate AI applications with telecom networks using standardized CAMARA APIs and the Model Context Protocol (MCP)

The Linux Foundation’s CAMARA project [1.] released a significant white paper, “In Concert: Bridging AI Systems & Network Infrastructure through MCP: How to Build Network-Aware Intelligent Applications.” The open source software organization says, “Telco network capabilities exposed through APIs provide a large benefit for customers. By simplifying telco network complexity with APIs and making the APIs available across telco networks and countries, CAMARA enables easy and seamless access.”

Note 1. CAMARA is an open source project within the Linux Foundation to define, develop and test the APIs. CAMARA works in close collaboration with the GSMA Operator Platform Group to align API requirements and publish API definitions. Harmonization of APIs is achieved through fast and agile created working code with developer-friendly documentation. API definitions and reference implementations are free to use (Apache2.0 license).

…………………………………………………………………………………………………………………………………………………………….

The white paper outlines how the Model Context Protocol (MCP) and CAMARA’s network APIs can provide AI systems with real-time network intelligence, enabling the development of more efficient and network-aware applications. This is seen as a critical step toward future autonomous networks that can manage and fix their own data discrepancies.

CAMARA facilitates the development of operator-agnostic network APIs, adhering to a “write once” paradigm to mitigate fragmentation and provide uniform access to essential network capabilities, including Quality on Demand (QoD), Device Location, Edge Discovery, and fraud prevention signals. The new technical paper details an architecture where an MCP server functions as an abstraction layer, translating CAMARA APIs into MCP-compliant “tools” that AI applications can seamlessly discover and invoke. This integration bridges the historical operational gap between AI systems and the underlying communication networks that power modern digital services. By leveraging MCP integration, AI agents can dynamically access the latest API capabilities upon release, circumventing the need for continuous code refactoring and ensuring immediate utilization of emerging network functionalities without implementation bottlenecks.

“AI agents increasingly shape the digital experiences people rely on every day, yet they operate disconnected from network capabilities – intelligence, control, and real-time source of truth,” said Herbert Damker, CAMARA TSC Chair and Lead Architect, Infrastructure Cloud at Deutsche Telekom. “CAMARA and MCP bring AI and network infrastructure into concert, securely and consistently across operators.”

The paper includes practical example scenarios for “network-aware” intelligent applications/agents, including:

- Intelligent video streaming with AI-powered quality optimization

- Banking fraud prevention using network-verified security context

- Local/edge-optimized AI deployment informed by network and edge resource conditions

In addition to the architecture and use cases, the paper outlines CAMARA’s objectives for supporting MCP, which include covering areas such as security guidelines; standardized MCP tooling for CAMARA APIs; and quality requirements and success factors needed for production-grade implementations. The white paper is available for download on the CAMARA website.

Collaboration with the Agentic AI Foundation

The release of this work aligns with a major ecosystem milestone: MCP now lives under the Linux Foundation’s newly formed Agentic AI Foundation (AAIF), a sister initiative that provides neutral, open governance for key agentic AI building blocks. The Linux Foundation announced AAIF on December 9, 2025, with founding project contributions including Anthropic’s MCP, Block’s goose, and OpenAI’s AGENTS.md. AAIF’s launch emphasizes MCP’s role as a broadly adopted standard for connecting AI models to tools, data, and applications, with more than 10,000 published MCP servers cited by the Linux Foundation and Anthropic.

“With MCP now under the Linux Foundation’s Agentic AI Foundation, developers can invest with confidence in an open, vendor-neutral standard,” said Arpit Joshipura, general manager, Networking, Edge and IoT at the Linux Foundation. “CAMARA’s work demonstrates how MCP can unlock powerful new classes of network-aware AI applications.”

“The Agentic AI Foundation calls for trustworthy infrastructure. CAMARA answers that call. As AI shifts from conversation to orchestration, agentic workflows demand synchronization with reality,” said Nick Venezia, CEO and Founder, Centillion.AI, CAMARA End User Council Representative to the TSC. “We provide the contextual lens that allows AI to verify rather than infer, moving from guessing to knowing.“

References:

https://camaraproject.org/news/

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Linux Foundation creates standards for voice technology with many partners

LF Networking 5G Super Blue Print project gets 7 new members

OCP – Linux Foundation Partnership Accelerates Megatrend of Open Software running on Open Hardware

Private 5G networks move to include automation, autonomous systems, edge computing & AI operations

A new report from PrivateLTEand5G.com analyzes the rapid evolution and expansion of global private cellular networks. The market research firm states that organizations worldwide shifted decisively from Private 5G feasibility trials to large-scale, operationally-integrated deployments. The defining theme is no longer just connectivity, but intelligent automation, with private 5G – often in 5G Standalone (SA) configurations – powering sophisticated applications including autonomous vehicle fleets, AI-driven quality control, remote machinery operation, and comprehensive digital twins.

“The year 2025 marked a significant acceleration in the private cellular network market,” said Ashish Jain, Co-founder of KAIROS Pulse and PrivateLTEand5G.com. “Private network deployments are increasingly focused on enabling intelligent automation rather than simply providing connectivity. We’re seeing autonomous haulage systems in complex mining environments, AI-powered video analytics for safety, and private networks actively replacing legacy systems like Wi-Fi, DECT, and pagers in mission-critical healthcare and utilities operations.”

The report documents 70+ verified private network deployments across tens of countries, providing the granular intelligence your organization needs to navigate this rapidly evolving landscape in 2026. Industry-specific insights on key private cellular use cases:

- Manufacturing & Industrial: Smart factories deploying 5G for AI-driven quality control, digital twins, and autonomous logistics

- Ports & Logistics: Real-time cargo tracking, autonomous vehicle coordination, and crane digitalization at the world’s busiest terminals

- Transportation Infrastructure: Airports, railways, and smart mobility deploying mission-critical connectivity

- Healthcare & Education: Private networks enabling telemedicine, campus safety, and immersive learning

- Energy & Mining: Remote operations, predictive maintenance, and worker safety in extreme environments

Featured deployments span dozens of countries and showcase groundbreaking implementations such as:

- •Autonomous Operations: Aker BP’s fully autonomous private 5G on North Sea oil platforms; Air New Zealand’s drone-based automated inventory management

- AI-Driven Manufacturing: BMW’s Debrecen facility with AI quality control and 1,000 industrial robots; Hyundai’s RedCap wireless vehicle inspection technology

- Mission-Critical Replacement: Austria’s Gesundheit Burgenland replacing pagers and DECT across five hospitals; Memphis utility’s CBRS network modernizing grid operations

- Broadcast Innovation: BT’s multiple network slicing deployment for Emirates Sail Grand Prix; T-Mobile’s dedicated 5G for MLB All-Star Game

- Transportation Transformation: Deutsche Bahn’s first commercial 5G railway network; Maersk’s fleet-wide LTE across 450 ships

“While industrial sectors like manufacturing, mining, and logistics continue to lead adoption, the use cases have evolved substantially,” Jain noted. “The rise of Neutral Host networks is solving connectivity challenges for public-facing venues like stadiums and airports, while advanced 5G features like network slicing enable demanding applications such as live 4K broadcast production.”

The report emphasizes that the availability of dedicated spectrum – from CBRS in the United States to licensed bands in Europe and Asia – remains a critical enabler, providing the deterministic reliability required for autonomous and mission-critical systems being deployed.

The complete report is available for download at PrivateLTEand5G.com. The company says “it offers essential insights for enterprise technology leaders, telecom operators, system integrators, and innovation teams planning private cellular network strategies.”

………………………………………………………………………………………………………………………………………………………………………………………………………………..

Here’s what Google Gemini has to say about recent Private 5G network developments:

- Intelligent Automation & AI Operations: The focus has moved beyond simple connectivity. Private 5G, often in Standalone (SA) configurations, is now the backbone for sophisticated applications like autonomous vehicle fleets, remote-controlled machinery, and AI-driven quality control in industries such as manufacturing and mining. AI and Machine Learning (ML) are also being used for predictive maintenance and real-time network orchestration.

- Edge Computing Integration: To support the massive data generated by IoT devices and AI applications, data processing is moving closer to the source (the edge) to reduce latency and improve efficiency. This synergy is crucial for real-time decision-making in critical operations.

- 5G-Advanced Features (3GPP Release 18): Commercialization of 5G-Advanced is underway and introduces critical industrial features, including:

- URLLC (Ultra-Reliable, Low-Latency Communications): Essential for replacing wired connections in mission-critical control systems (achieving millisecond response times).

- 5G RedCap (Reduced Capability): A cost-efficient technology for lower-power IoT and industrial sensors, bridging the gap between basic IoT needs and full 5G capabilities.

- Network Slicing: This allows enterprises to create multiple virtual networks on a single physical infrastructure, each tailored with specific performance parameters (e.g., bandwidth, latency) for different applications.

- Open RAN and Virtualization: The adoption of Open Radio Access Network (Open RAN) and virtualized RAN solutions is increasing, reducing infrastructure costs, preventing vendor lock-in, and allowing for greater vendor diversity.

- Hybrid Networks: Enterprises are increasingly combining private 5G with existing Wi-Fi 6/7 networks and public cellular coverage (neutral host systems) to provide seamless indoor and outdoor connectivity across large campuses and remote areas.

- Enhanced Security: Private 5G inherently offers better security than public networks through dedicated, isolated environments and SIM-based authentication. New solutions from companies like Palo Alto Networks and Trend Micro are focusing on extending security visibility across both IT and operational technology (OT) domains.

- Market Growth: The private 5G market is experiencing rapid acceleration, projected to grow at a CAGR of over 40% through the rest of the decade.

- Key Industries: Manufacturing, logistics, mining, utilities, and healthcare are leading the adoption, leveraging private 5G for use cases such as factory automation, connected robotics, remote patient monitoring, and autonomous vehicles.

- Regional Markets:

- North America: Dominates the market in spending and innovation, driven by spectrum access like CBRS (Citizens Broadband Radio Service).

- Asia-Pacific: The fastest-growing region, with China leading in large-scale deployments due to state-funded initiatives.

- Europe: Seeing significant interest, with countries like Germany, the UK, and Sweden allocating dedicated local spectrum for industrial use.

- Simplified Deployment: To overcome the complexity and skill shortages associated with deployments, vendors are offering “network-in-a-box” solutions and “5G-as-a-service” (5GaaS) models, which shift costs from capital expenditures (CapEx) to operational expenditures (OpEx).

………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.privatelteand5g.com/reports/private-cellular-network-deployments-report-2026/

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector are a $1.5B opportunity

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

OneLayer Raises $28M Series A funding to transform private 5G networks with enhanced security

Verizon partners with Nokia to deploy large private 5G network in the UK

HPE Aruba Launches “Cloud Native” Private 5G Network with 4G/5G Small Cell Radios

Tata Consultancy Services: Critical role of Gen AI in 5G; 5G private networks and enterprise use cases

Keysight Technologies Demonstrates 3GPP Rel-19 NR-NTN Connectivity in Band n252

Keysight Technologies, Inc. has demonstrated the first end-to-end New Radio Non-Terrestrial Network (NR-NTN) connection in 3GPP band n252 under Release 19 specifications, achieved in collaboration with Samsung Electronics using Samsung’s next-generation commercial NR modem chipset (part number not stated). The live trial, conducted at CES 2026 in Las Vegas, validated satellite-to-satellite (SAT-to-SAT) mobility and cross-vendor interoperability, establishing a key milestone for direct-to-cell (D2C) satellite communications and NTN commercialization.

The successful validation of band n252 marks the first public confirmation of this spectrum band in an operational NTN system. Band n252 is expected to be a foundational component for upcoming low Earth orbit (LEO) constellations targeting global broadband and IoT coverage. This result demonstrates tangible progress toward large-scale NTN integration supporting ubiquitous, standards-based connectivity for consumers, connected vehicles, IoT devices, and critical communications.

Together with earlier demonstrations in bands n255 and n256, Keysight and Samsung have now validated all major NR-NTN FR1 frequency bands end-to-end. This consolidation enables ecosystem participants—including modem vendors, satellite network operators, and device manufacturers—to analyze cross-band mobility, inter-satellite handovers, and radio performance under consistent, controlled NTN emulation conditions.

The demonstration leveraged Keysight’s NTN Network Emulator Solutions to replicate multi-orbit LEO scenarios, emulate SAT-to-SAT mobility, and execute complete end-to-end routing while supporting live user traffic over the NTN link. When paired with Samsung’s chipset, the setup verified standards compliance, user throughput performance, and multi-vendor interoperability, providing a high-fidelity validation environment that accelerates system testing and time-to-market for NR-NTN deployments targeted for global scaling in 2026.

This integration underscores the readiness of 3GPP Release 19-compliant NTN technologies to transition from proof-of-concept trials to operational field testing, supporting the broader industry goal of realizing seamless terrestrial–non-terrestrial 5G networks within the Rel-19 framework and paving the way for future 6G NTN evolution.

For network operators, device OEMs, and satellite providers, this consolidation of NTN FR1 coverage provides a reference environment to evaluate cross‑band handovers, inter‑satellite mobility, and multi‑vendor interoperability before field deployment. By moving live NR‑NTN testing with commercial‑grade silicon into an emulated LEO constellation environment, the solution is positioned to reduce integration risk, compress trial timelines, and accelerate commercialization of direct‑to‑cell NTN services anticipated to scale from 2026.

Peng Cao, Vice President and General Manager of Keysight’s Wireless Test Group, Keysight, said:

“Together with Samsung’s System LSI Business, we are demonstrating the live NTN connection in 3GPP band n252 using commercial-grade modem silicon with true SAT-to-SAT mobility. With n252, n255, and n256 now validated across NTN, the ecosystem is clearly accelerating toward bringing direct-to-cell satellite connectivity to mass-market devices. Keysight’s NTN emulation environment enables chipset and device makers a controlled way to prove multi-satellite mobility, interoperability, and user-level performance, helping the industry move from concept to commercialization.”

Resources:

About Keysight Technologies:

At Keysight (NYSE: KEYS), we inspire and empower innovators to bring world-changing technologies to life. As an S&P 500 company, we’re delivering market-leading design, emulation, and test solutions to help engineers develop and deploy faster, with less risk, throughout the entire product life cycle. We’re a global innovation partner enabling customers in communications, industrial automation, aerospace and defense, automotive, semiconductor, and general electronics markets to accelerate innovation to connect and secure the world. Learn more at Keysight Newsroom and www.keysight.com.

………………………………………………………………………………………………………………………………………….

References:

https://www.telecoms.com/satellite/samsung-and-keysight-show-off-continuous-ntn-connectivity

Telecom operators investing in Agentic AI while Self Organizing Network AI market set for rapid growth

Telecom companies are planning to use Agentic AI [1.] for customer experience and network automation. A recent RADCOM survey shows 71% of network operators plan to deploy agentic AI in 2026, while 14% have already begun, prioritizing areas that directly influence trust and customer satisfaction: security and fraud prevention (57%) and customer service and support (56%). The top use cases are automated customer complaint resolution and autonomous fault resolution.

Operators are betting on agentic AI to remove friction before customers feel it, with the highest-value use cases reflecting this shift, including:

- 57% – automated customer complaint resolution

- 54% – autonomous fault resolution before it impacts service

- 52% – predicting experience to prevent churn

This technology is shifting networks from simply detecting issues to preventing them before customers notice. In contact centers, 2026 is expected to see a rise in human and AI agent collaboration to improve efficiency and customer service.

Note 1. Agentic AI refers to autonomous artificial intelligence systems that can perceive, reason, plan, and act independently to achieve complex goals with minimal human intervention, going beyond simple command-response to manage multi-step tasks, use various tools, and adapt to new information for proactive automation in dynamic environments. These intelligent agents function like digital coworkers, coordinating internally and with other systems to execute sophisticated workflows.

……………………………………………………………………………………………………………………………………………………………………………………………

ResearchAndMarkets.com has just published a “Self-Organizing Network Artificial Intelligence (AI) Global Market Report 2025.” The market research firm says that the self-organizing network AI [2.] is forecast to expand from $5.19 billion in 2024 to $6.18 billion in 2025, at a CAGR of 19.2%. This surge is driven by the integration of machine learning and AI in telecom networks, smart network management investment, and the growing demand for features like self-healing and self-optimization, as well as predictive maintenance technologies.driven by the expansion of 5G, increasing automation demands, and AI integration for network optimization. Opportunities include AI-driven RRM and predictive maintenance. Asia-Pacific emerges as the fast-growing region, boosting telecom innovations amid global trade shifts.

Note 2. Self-organizing network AI leverages software, hardware, and services to dynamically optimize and manage telecom networks, applicable across various network types and deployment modes. The market encompasses a broad range of solutions, from network optimization software to AI-driven planning products, underscoring its expansive potential.

Looking further ahead, the market is expected to reach $12.32 billion by 2029, with a CAGR of 18.8%. Key drivers during this period include heightened demand for automation, increased 5G deployments, and growing network densification, accompanied by rising data traffic and subscriber numbers. Trends such as AI-driven network automation advancements, machine learning integration for real-time optimization, and the rise of generative AI for analytics are reshaping the landscape.

The expansion of 5G networks plays a pivotal role in propelling this growth. These networks, characterized by high-speed data and ultra-low latency, significantly enhance the capabilities of self-organizing network AI. The integration facilitates real-time data processing, supporting automation, optimization, and predictive maintenance, thereby improving service quality and user experience. A notable development in 2023 saw UK outdoor 5G coverage rise to 85-93%, reflecting growing demand and technological advancement.

Huawei Technologies and other major tech companies, are pioneering innovative solutions like AI-driven radio resource management (RRM), which optimizes network performance and enhances user experience. These solutions rely on AI and machine learning for dynamic spectrum and network resource management. For instance, Huawei’s AI Core Network, introduced at MWC 2025, marks a substantial leap in intelligent telecommunications, integrating AI into core systems for seamless connectivity and real-time decision-making.

Strategic acquisitions are also shaping the market, exemplified by Amdocs Limited acquiring TEOCO Corporation in 2023 to bolster its network optimization and analytics capabilities. This acquisition aims to enhance end-to-end network intelligence and operational efficiency.

Leading players in the market include Huawei, Cisco Systems Inc., Qualcomm Incorporated, and many others, driving innovation and competition. Europe held the largest market share in 2024, with Asia-Pacific poised to be the fastest-growing region through the forecast period.

References:

Operator Priorities for 2026 and Beyond: Data, Automation, Customer Experience

https://uk.finance.yahoo.com/news/self-organizing-network-artificial-intelligence-105400706.html

Ericsson integrates agentic AI into its NetCloud platform for self healing and autonomous 5G private network

Agentic AI and the Future of Communications for Autonomous Vehicles (V2X)

IDC Report: Telecom Operators Turn to AI to Boost EBITDA Margins

Omdia: How telcos will evolve in the AI era

Palo Alto Networks and Google Cloud expand partnership with advanced AI infrastructure and cloud security

Arm Holdings unveils “Physical AI” business unit to focus on robotics and automotive

- Cloud and AI: Focused on data center and AI infrastructure solutions.

- Edge: Encompassing mobile devices, personal computing, and related technologies.

- Physical AI: Integrating its automotive business with robotics initiatives.

- Market Opportunity: Acknowledged the significant growth potential in robotics, from industrial automation to humanoid robots, driven by AI advancements.

- Synergy with Automotive: Combined robotics and automotive within the unit due to shared technical needs, such as power efficiency, safety, and sensor technology.

- Strategic Reorganization: Positioned Physical AI as a third core business line, alongside Cloud & AI and Edge (mobile/PC), to better focus resources and expertise.

- Customer Demand: Responding to existing customers (like automakers and robotics firms such as Boston Dynamics) who are integrating more AI into physical devices.

- Enhancing Real-World Impact: Aims to deliver solutions that fundamentally improve labor, productivity, and potentially GDP, moving AI from data centers to physical interactions

2026 Consumer Electronics Show Preview: smartphones, AI in devices/appliances and advanced semiconductor chips

Marvell shrinking share of the RAN custom silicon market & acquisition of XConn Technologies for AI data center connectivity

Groq and Nvidia in non-exclusive AI Inference technology licensing agreement; top Groq execs joining Nvidia

The Internet of Things (IoT) explained along with ARM’s role in making it happen!

Marvell shrinking share of the RAN custom silicon market & acquisition of XConn Technologies for AI data center connectivity

Samsung and Nokia currently use Marvell’s OCTEON Fusion baseband processors and OCTEON Data Processing Units (DPUs) in their 5G Radio Access Network (RAN) equipment.

- OCTEON Fusion Processors: Samsung uses these baseband processors in its 5G base stations, particularly for massive MIMO (Multiple-Input Multiple-Output) deployments that require significant compute power for complex beamforming algorithms.

- OCTEON and OCTEON Fusion Families: Samsung has leveraged multiple generations of these processors for baseband and transport processing solutions.

- Customized OCTEON Silicon: Nokia uses customized Marvell OCTEON silicon across key applications, including multi-RAT (Radio Access Technology) RAN and transport.

- OCTEON Fusion Processors: These are used for baseband processing in Nokia’s 5G products.

- OCTEON TX2 and OCTEON 10 Families: These infrastructure processors are used for demanding tasks like packet processing, security, and edge inferencing within Nokia’s 5G infrastructure.

- OCTEON 10 Fusion: Nokia is working with the latest generation of this 5nm baseband platform, which supports use cases from radio units (RU) to distributed units (DU) for both traditional and Open RAN architectures.

……………………………………………………………………………………………………………………………………………………………………………….

Meanwhile, the total global RAN market has been declining for years as network operators slash investment in network equipment and cut jobs. According to Omdia (owned by Informa):

- Global RAN equipment sales fell from $45 billion in 2022 to $40 billion in 2023 and just $35 billion in 2024. Nokia’s mobile networks business group suffered an operating loss of €64 million (US$75 million) on sales of €5.3 billion ($6.2 billion) for the first nine months of 2025.

- For its 2023 fiscal year (ending in January 2023), Marvell’s carrier division made almost $1.1 billion in revenues, more than 18% of total company sales. Two years later, annual revenues had slumped to just $338.2 million, less than 6% of turnover.

- Marvell’s carrier sales have also recently improved in fiscal 2026, rising 88% year-over-year for the first nine months, to $436.3 billion. However, that’s still half as much as Marvell made during the first nine months of fiscal 2024, and interest in the RAN has seemingly evaporated.

- Samsung’s share of the shrinking RAN market has declined. Amid contraction of the entire addressable market, revenues generated by Samsung Networks fell from 5.39 trillion South Korean won ($3.74 billion) in 2022 to just KRW2.82 trillion ($1.95 billion) in 2024. For the first nine months of 2025, Samsung reported network sales of KRW2.1 trillion ($1.46 billion). But it has also lost market share, which dipped from 6.1% in 2023 to 4.8% in 2024, according to Omdia.

- Ericsson has two development tracks – one for purpose-built RAN products based partly on its own custom RAN silicon and the other for an Intel-based virtual RAN. In contrast to Samsung, the purpose-built RAN silicon portfolio today accounts for nearly all of the company’s sales.

- Ericsson’s senior managers increasingly talk about virtualization as a means of developing one set of software for multiple hardware platforms. The hope is that software originally designed for use with Intel’s processors could be redeployed on CPUs from AMD or licensees from ARM Ltd. with minimal coding changes. Such optionality combined with the narrowing of the performance gap between CPUs and purpose built RAN silicon would make it hard for Ericsson to justify investment in its own custom silicon.

…………………………………………………………………………………………………………………………………………………………………………….

Today, Marvell announced it will acquire XConn Technologies for $540 million to boost AI/data center connectivity. In late 2025, the company announced the acquisition of Celestial AI for up to $5.5 billion to expand its optical interconnects for next-gen data centers, solidifying its position in infrastructure semiconductors.

Adding XConn’s PCIe and CXL switching technology (see illustrations below), fills gaps in Marvell’s silicon portfolio and enables the company to expand into higher-speed interconnects (like PCIe Gen 6).

XConn Technologies XC 50256 chip: 256 lanes with total 2,048GB/s switching capacity

…………………………………………………………………………………………………………………………………….

XC50256 CXL 2.0 Switch Chip

……………………………………………………………………………………………………………………………………………………………

As AI workloads scale, data center system design is evolving from single-rack deployments to larger, multi-rack configurations. These next-generation platforms increasingly require a high-bandwidth, ultra-low latency scale-up fabric such as UALink to efficiently connect large numbers of XPUs and enable more flexible resource sharing across the system.

UALink is a new open industry standard purpose-built for scale-up connectivity, enabling efficient, high-speed communication so multiple accelerators can operate together as a single, larger system. UALink builds on decades of PCIe ecosystem innovation and incorporates proven high-speed I/O techniques to meet the bandwidth, latency, and reach requirements of next-generation accelerated infrastructure.

Together, Marvell and XConn will bring together a significantly larger, integrated team to fully address the rapidly emerging opportunity in UALink switching as well as comprehensively support the growing list of customers and partners who want to work with Marvell in evolving their next generation AI platforms.

About Marvell:

To deliver the data infrastructure technology that connects the world, we’re building solutions on the most powerful foundation: our partnerships with our customers. Trusted by the world’s leading technology companies for over 30 years, we move, store, process and secure the world’s data with semiconductor solutions designed for our customers’ current needs and future ambitions. Through a process of deep collaboration and transparency, we’re ultimately changing the way tomorrow’s enterprise, cloud and carrier architectures transform—for the better.

About XConn Technologies:

XConn is the innovation leader in next-generation interconnect technology for high-performance computing and AI applications. The company is the industry’s first to deliver a hybrid switch supporting both CXL and PCIe on a single chip. Privately funded, XConn is setting the benchmark for data center interconnect with scalability, flexibility, and performance. For more information visit: https://www.xconn-tech.com

……………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/fragile-samsung-deal-with-marvell-shows-challenge-for-ran-chipmakers

RAN silicon rethink – from purpose built products & ASICs to general purpose processors or GPUs for vRAN & AI RAN

Dell’Oro: Analysis of the Nokia-NVIDIA-partnership on AI RAN

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Analysis: Nokia and Marvell partnership to develop 5G RAN silicon technology + other Nokia moves

Samsung and Marvell develop SoC for Massive MIMO and Advanced Radios

China gaining on U.S. in AI technology arms race- silicon, models and research

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

2026 Consumer Electronics Show Preview: smartphones, AI in devices/appliances and advanced semiconductor chips

The 2026 Consumer Electronics Show (CES) in Las Vegas, NV, in the first week of January each year, is one of the largest and most significant tech trade shows in the world. It’s attended by all the major, established tech companies, as well as numerous up-and-coming companies from around the world. The show floor officially opens on Tuesday, January 6th, for four days, but companies have already started making announcements. LG’s CLOiD is a laundry-folding, milk-fetching home robot, SwitchBot’s AI-powered Obboto lamp looks like a desktop version of the Las Vegas Sphere, the wooden Mui Board adds sleep tracking, and Clicks’ new Communicator is a smartphone alternative that reminds us of a classic BlackBerry. Watch for more smartphone announcements from the likes of Samsung, LG, and Motorola – infused with AI, of course.

-

Samsung Galaxy Z TriFold: Samsung is expected to use CES 2026 to bring its first tri-folding smartphone, the Galaxy Z TriFold, to the US market and provide hands-on demonstrations. This device folds into a large 10-inch, tablet-sized display using two hinges.

- New Motorola Foldable: Motorola is anticipated to unveil a new book-style foldable phone, distinct from its existing clamshell Razr models. Physical invites sent to the media suggest it may feature a unique wood finish.

- AI Integration: Artificial intelligence will be a dominant theme, integrated into new laptops and home appliances, and is expected to be a core feature of the new foldable phones, enhancing user experiences and functionality. Samsung has framed its entire CES presence around a “unified AI approach” across its devices.

- Advanced Display Concepts: Beyond immediate product launches, Samsung Display is likely to showcase experimental and futuristic display panels, which often preview technologies that will appear in consumer devices in the coming years, such as wider aspect ratio foldables and potentially holographic displays.

- Smart Glasses and Wearables: Though not strictly phones, AI-powered smart glasses and other wearables are expected to have a significant presence at the show, building on their modest comeback in 2025.

Photo credit: James Martin/CNET

Major smartphone manufacturers like Apple typically host their own separate launch events and do not make major announcements at CES. The focus at CES is generally on innovative form factors, new technologies, and general tech trends rather than mainstream flagship phone releases.

………………………………………………………………………………………………………………………………………………………………………………

- AI Accelerators: Updates are anticipated on the next-generation Instinct MI400 series, designed to compete with Nvidia in the AI training segment.

- Consumer CPUs/APUs: Expect showcases of the new Ryzen AI 400 “Gorgon Point” APUs for laptops and a refresh of Zen 5 X3D desktop CPUs (specifically the Ryzen7 9850X3D and

Ryzen 9 9950X3D).

- Data Center/Server: AMD may provide updates on its next-generation Zen 6 “Venice” EPYC CPUs for the data center market.

- GPUs: No new consumer discrete GPU launches (Radeon RX 9000 series) are expected at this show, with the focus remaining on existing RDNA 4 models and integrated graphics.

- Consumer Processors: Intel will highlight its upcoming “Panther Lake” (Core Ultra Series 3) chips, its first processors using the highly anticipated 18A manufacturing process. These chips will power new laptops and PCs demonstrated by partners like Dell, HP, Lenovo, and Samsung.

- GPUs: Details are expected on the “Crescent Island” Xe3 discrete GPU, positioned as a cost-effective option for inference workloads, and potentially the mid-tier Arc B770 “Battlemage” GPU.

- AI Hardware: The focus will likely be on next-generation AI accelerators beyond the current Blackwell architecture, data center roadmaps, and the company’s push into “physical AI” systems like robotics and self-driving cars.

- Consumer GPUs: No new high-end consumer GPU launches (RTX 50 series) are expected at CES, as these are typically reserved for separate events like Nvidia’s GTC conference.

- PC Processors: The company is expected to showcase laptops featuring its Snapdragon X2 Elite and X2 Elite Extreme chips, emphasizing their performance and power efficiency for AI PCs.

- Samsung Electronics is hosting “The First Look” event to unveil its vision for AI-driven customer experiences across its device ecosystem.

- Visual Semiconductor will showcase its “glasses-free 3D” (GF3D) display technology for both large home displays and smartphones.

- The overall theme of CES 2026 across all companies is the pervasive integration of AI into consumer and industrial devices, from wearables and robots to enterprise machines

………………………………………………………………………………………………………………………………………………………………………………

References:

https://spectrum.ieee.org/ces-2026-preview

https://www.cnet.com/tech/ces-2026-preview-expectations/